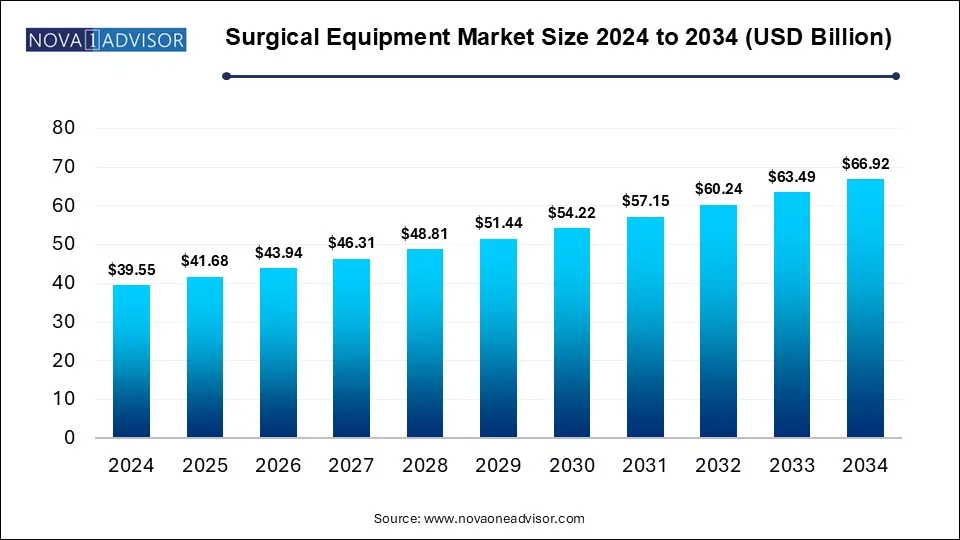

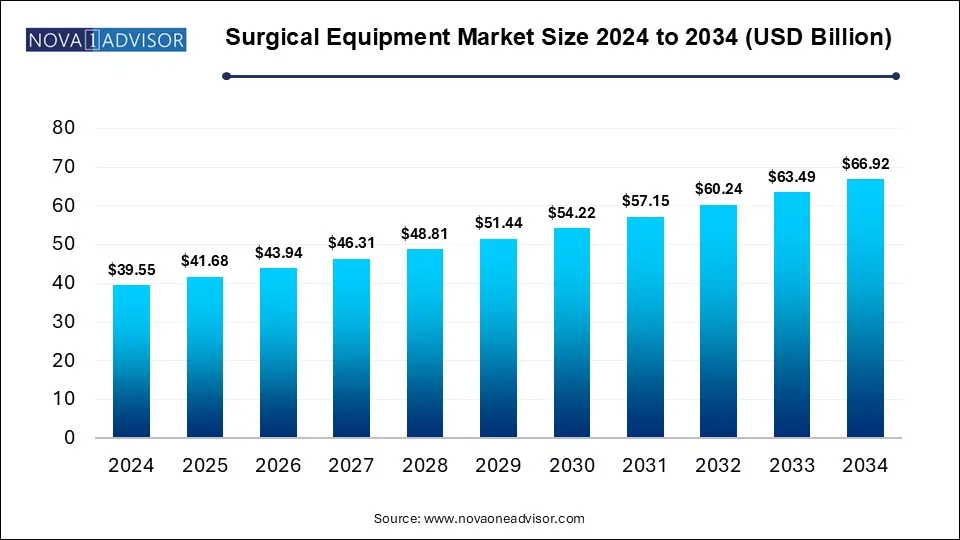

Surgical Equipment Market Size and Trends

The global surgical equipment market size is calculated at USD 39.55 billion in 2024, grows to USD 41.68 billion in 2025, and is projected to reach around USD 66.92 billion by 2034, growing at a CAGR of 5.4% from 2025 to 2034, The market is expanding rapidly due to increasing surgical procedures and technological advancements. Growing healthcare infrastructure in emerging economies is boosting demand.

Key Takeaways

- North America dominated the surgical equipment market in 2024.

- Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By product, the handheld surgical equipment segment held the major market share.

- By product, the electrosurgical devices segment is projected to grow at the fastest rate between 2025 and 2034.

- By category, the disposable surgical equipment segment contributed the biggest market share in 2024.

- By category, the reusable surgical equipment segment is expected to grow at the fastest rate in the market during the studied years.

- By application, the laparoscopy surgery segment held the highest share of the market in 2024.

- By application, the orthopedic surgery segment is expected to grow at the fastest rate in the market during the forecast period.

How is the Surgical Equipment Market Evolving?

Surgical equipment includes specialized instruments used by healthcare professionals to perform surgeries, ensuring precision, safety, and efficiency. These tools are essential for cutting, dissecting, grasping, and suturing tissues. The market is evolving through rapid technological innovation, with a strong focus on precision efficiency and minimally invasive procedures. Advancements such as robotic-assisted tools and smart instruments are transforming surgical practices. Growing demand for outpatient surgeries and improved healthcare access in developing regions are also driving change. The market is shifting towards integrated, user-friendly systems that enhance surgical outcomes and patient care.

- For Instance, According to a January 2024 article by WebMD LLC, open-heart surgery is the most frequently performed in the U.S., with around 400,000 procedures annually. This high volume of surgeries, both in developed and developing nations, is expected to significantly boost the demand for surgical equipment.

What are the Major Key Trends in the Surgical Equipment Market in 2025?

- In January 2024, Boston Scientific Corporation revealed its plans to acquire Axonics, Inc., a publicly listed medical technology firm known for creating and marketing innovative devices aimed at treating urinary and bowel disorders.

- In May 2024, Alcon, a well-known Swiss-American company in the field of eye care, acquired Belkin Vision, an Israeli company focused on glaucoma treatment, in a deal worth around US$ 335 million.

How AI is Fueling the Surgical Equipment Market?

Artificial intelligence is transforming the surgical equipment market by enhancing precision, reducing errors, and streamlining procedures. AI-powered surgical robots assist in complex operations, improving outcomes and minimizing invasiveness. Real-time data analysis and predictive algorithms support surgeons in decision-making, leading to more personalized patient care. As AI continues to integrate into surgical tools, it is reshaping the landscape of modern surgery, making procedures safer and more efficient.

Report Scope of Surgical Equipment Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 41.68 Billion |

| Market Size by 2034 |

USD 66.92 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Category, By Application, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Alcon, B. Braun Melsungen AG, Becton Dickinson and Company, Boston Scientific Corporation, CONMED Corporation, Integra LifeSciences, Intuitive Surgical Inc., Johnson & Johnson, Medtronic plc, Olympus Corporation, Smith & Nephew plc, Stryker Corporation, Zimmer Biomet |

Market Dynamics

Driver

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and diabetes is a major driver for the surgical equipment market. These conditions often require surgical intervention for diagnosis, treatment, or management, leading to a higher demand for advanced surgical tools. As global populations age and lifestyles change, the incidence of chronic illness continues to rise, pushing healthcare systems to invest in efficient and precise surgical equipment. This growing need for support, continuous innovation, and expansion within the surgical equipment drive the market growth.

- For Instance, According to the National Centers for Health Statistics estimates that approximately 2,001,140 new cancer cases will emerge in the United States in 2024. This significant number is expected to contribute to the rising demand for surgical equipment, as many cancer treatments involve surgical procedures.

Restraint

High Cost of Advanced Surgical Instruments and Robotic Systems

The high cost of advanced surgical instruments and robotic systems is a restraint for the surgical equipment market because it limits accessibility, especially for smaller hospitals and healthcare centers with tight budgets. These high expenses not only include the initial purchase but also maintenance, training, and integration costs. As a result, many facilities in developing regions or rural areas may delay or avoid adoption, slowing the overall market growth and widening the gap in surgical care.

Opportunity

Technological Advancement

Technological advancement presents a major opportunity for the surgical equipment market by enabling the development of more precise, efficient, and minimally invasive tools. Innovations such as robotic-assisted surgery, AI integration, and smart surgical instruments enhance surgical accuracy and patient outcomes. These advancements reduce recovery times and complications, making surgeries safer and more effective. As healthcare systems increasingly adopt cutting-edge technologies, demand for advanced surgical equipment is expected to grow, opening new avenues for market expansion and innovation.

- For Instance, In April 2024, Zimmer Biomet Holdings, Inc. made history by completing the first robotic-assisted shoulder replacement using its ROSA Shoulder System. This milestone reflects the company's commitment to innovation, enhancing surgical precision and efficiency, and paving the way for broader use of robotics in orthopedic procedures.

Segmental Insights

The Handheld Surgical Equipment Major Share

By product, the handheld surgical equipment segment held the major market share, due to wide application across various surgical procedures, ease of use, and cost-effectiveness. Instruments like forceps, scissors, scalpels, and retractors are essential in nearly all types of surgeries, from general to specialized fields. Their reliability, reusability, and familiarity among surgeons contribute to consistent demand. Additionally, advancements in designs and ergonomics continue to enhance their performance, furthering the surgical equipment market.

The Electrosurgical Devices Segment: Fastest Growing

By product, the electrosurgical devices segment is projected to grow at the fastest rate between 2025 and 2034, due to increasing demand for minimally invasive procedures, which offer faster recovery and reduced complications. These devices enable precise cutting and coagulation, improving surgical efficiency and safety. Technological advancements, such as the integration of AI and energy-based technologies, further enhance their performance. Additionally, rising chronic disease cases and expanding surgical volumes worldwide are boosting the adoption of electro-surgical tools across healthcare settings.

The Disposable Surgical Equipment Segment's Biggest Market Share

By category, the disposable surgical equipment segment contributed the biggest market share in 2024, due to growing concerns over infection control and cross-contamination. Hospitals and clinics increasingly prefer single-use instruments to ensure hygiene and patient safety. These products also reduce the need for sterilization, saving time and operational costs. Additionally, the rising volume of surgeries and strict regulatory guidelines on hospital-acquired infections have further driven the demand for disposable surgical tools, making them a dominant market.

The Reusable Surgical Equipment Segment: Fastest Growing

By category, the reusable surgical equipment segment is expected to grow at the fastest rate in the market during the studied years, due to its long-term ost-effectiveness and sustainability benefits. Healthcare facilities are increasingly investing in high-quality, durable instruments that can be sterilized and reused multiple times, reducing overall procurement costs. Advances in sterilization technologies and materials have improved the safety and lifespan of reusable tools. Additionally, the global push towards environmentally friendly medical practice supports the shift from disposable to reusable surgical equipment.

The Laparoscopy Surgery Segment Dominated

By application, the laparoscopy surgery segment held the highest share of the market in 2024. Laparoscopic surgeries offer benefits like smaller incisions, faster recovery, reduced pain, and lower risk of complications. These advantages have led to increased adoption across various specialties, including gynecology, urology, and general surgery. Moreover, advancements in laparoscopic tools and imaging technologies have improved precision and outcomes, further driving surgical equipment market dominance.

The Orthopedic Surgery Segment: Fastest Growing

By application, the orthopedic surgery segment is expected to grow at the fastest rate in the market during the forecast period, due to the increasing prevalence of bone and joint disorders, sports injuries, and age-related conditions like arthritis. Rising demand for joint replacement and spinal surgeries, along with advancements in Orthopedic surgical tools and techniques, are fueling this growth. Additionally, an aging global population and improved access to healthcare services are further boosting the need for orthopedic procedures.

Regional Insights

How is North America Contributing to the Expansion of the Surgical Equipment Market?

North America dominated the surgical equipment market in 2024 through advanced healthcare infrastructure, high surgical volumes, and strong adoption of cutting-edge technologies like robotic-assisted systems. The region benefits from increased healthcare spending, a growing elderly population, and a high prevalence of chronic diseases requiring surgical intervention. Additionally, the presence of leading medical device companies and supportive regulatory frameworks fosters innovation and accelerates the availability of advanced surgical tools in the market.

- For Instance, In November 2023, Cardinal Health introduced the SmartGown™ EDGE Breathable Surgical Gown with ASSIST™ Instrument Pockets in the U.S. This gown is specially designed to provide surgical teams with convenient and secure access to instruments during procedures. The launch of such innovative products is likely to boost the demand for surgical equipment across the region.

How is Asia-Pacific approaching the Surgical Equipment market in 2024?

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The region's expanding elderly population and the rising prevalence of chronic diseases such as cardiovascular conditions and diabetes are increasing the demand for surgical procedures. According to the World Economic Forum in September 2023, Japan’s aging population over 10% aged 80+ and one-third aged 65, is expected to boost demand for surgical equipment. Countries like China, India, and Japan are leading this growth due to their large patient populations and increasing healthcare expenditures. Advancements in medical technology, including minimally invasive surgical techniques and robotic-assisted surgeries, are also contributing to market expansion. Additionally, improvements in healthcare infrastructure and increased access to medical services are facilitating and increased access to medical services are facilitating the adoption of advanced surgical equipment market.

- For Instance, In January 2024, UK-based Surgical Instruments Group Holdings (SIGH) announced plans to set up a medical device manufacturing plant in Hyderabad. This growing focus on local production is expected to open new opportunities for surgical equipment providers in the Indian market.

Top Companies in the Surgical Equipment Market

- Alcon

- B. Braun Melsungen AG

- Becton Dickinson and Company

- Boston Scientific Corporation

- CONMED Corporation

- Integra LifeSciences

- Intuitive Surgical Inc.

- Johnson & Johnson

- Medtronic plc

- Olympus Corporation

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet

Recent Developments in the Surgical Equipment Market

- In September 2023, U.S.-based company PainTEQ launched a new Surgery-Ready Instrument Set, offering interventional pain specialists a safer and more affordable solution for performing procedures.

- In January 2025, JUNE MEDICAL entered into a strategic partnership with Aspen Surgical Products, Inc. to distribute its Galaxy II Retractor System throughout the U.S. Leveraging Aspen Surgical’s extensive sales network, the collaboration aims to expand the reach of the Galaxy II, a flexible surgical retractor widely used in specialties like orthopedics, gynecology, and more.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Surgical Sutures and Staplers

-

-

-

-

- Absorbable Suture

- Non-Absorable Suture

- Handheld Surgical Equipment

-

-

- Forceps and Spatulas

- Retractors

- Dilators

- Graspers

- Auxiliary Instruments

- Electrosurgical Devices

- Other Surgical Equipment

-

-

- Surgical Hernia Mesh

- Surgical Glue/Sealant and Hemostasis

- Powered Surgical Instruments

By Category

- Reusable Surgical Equipment

- Disposable Surgical Equipment

By Application

- Neurosurgery

- Plastic and Reconstructive Surgeries

- Wound Closure

- Urology

- Obstetrics and Gynecology

- Thoracic Surgery

- Microvascular

- Cardiovascular

- Orthopedic Surgery

- Laparoscopy

- Ophthalmic Application

- Veterinary Application

- Dental Application

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)