Surgical Instrument Tracking Systems Market Size Trends Analysis and Forecast till 2034

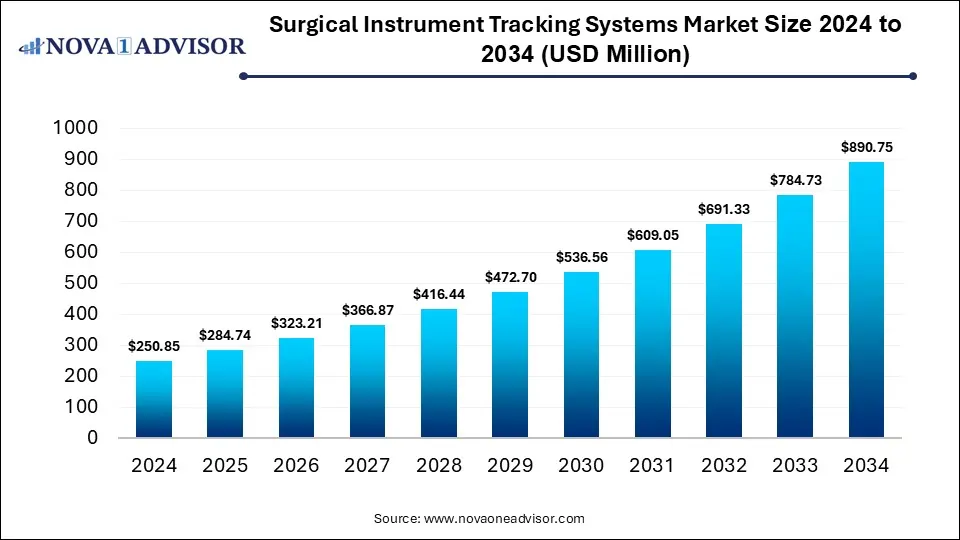

The global surgical instrument tracking systems market size was estimated at USD 250.85 million in 2024 and is expected to reach USD 890.75 million by 2034, expanding at a CAGR of 13.51% during the forecast period of 2025 to 2034. The growth of the market is driven by increasing regulatory mandates, rising surgical volumes, and the need for improved workflow efficiency and patient safety in operating rooms.

Surgical Instrument Tracking Systems Market Key Takeaways

- By region, North America dominated the surgical instrument tracking systems market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By product, the hardware segment led the market in 2024.

- By product, the service segment is expected to expand at a significant rate during the projection period.

- By technology, the barcode segment dominated the market in 2024.

- By technology, the RFID segment is expected to grow at the fastest CAGR in the upcoming period.

- By end use, the hospitals segment contributed the largest market share in 2024.

Impact of AI on the Surgical Instrument Tracking Systems Market

AI is significantly transforming the surgical instrument tracking systems market by enhancing accuracy, efficiency, and real-time decision-making in operating rooms. Through advanced data analytics and machine learning, AI can optimize instrument workflows, predict usage patterns, and reduce errors such as misplaced or unsterilized tools. It also enables intelligent automation in inventory management, helping hospitals reduce costs and ensure surgical readiness. Integration with computer vision and AI-powered scanning improves traceability and minimizes human error in instrument identification. Overall, AI is driving smarter, safer, and more efficient surgical environments, accelerating the adoption of tracking systems worldwide.

Market Overview

The surgical instrument tracking systems market involves technologies like RFID, barcodes, and software platforms used to monitor and manage surgical tools throughout their lifecycle, from sterilization to usage in operating rooms and storage. These systems offer critical benefits, including improved patient safety, enhanced surgical workflow efficiency, reduced risk of retained instruments, and better compliance with regulatory standards. They are widely applied in hospitals and ambulatory surgical centers to streamline inventory management, support real-time instrument traceability, and prevent delays or errors during procedures. The market is experiencing significant growth due to the rising number of surgical procedures and increasing emphasis on patient safety. Additionally, advancements in healthcare IT and the integration of AI and IoT technologies are further propelling the adoption of these systems globally.

What are the Major Trends in the Surgical Instrument Tracking Systems Market?

- Adoption of RFID Over Barcodes: Hospitals are increasingly shifting from traditional barcode systems to RFID technology due to its ability to track multiple instruments in real time without direct line-of-sight. RFID enhances speed, accuracy, and automation in instrument tracking, making it ideal for busy surgical environments.

- Integration of Artificial Intelligence (AI): AI and machine learning are being integrated to optimize instrument usage, predict maintenance needs, and automate inventory management. This results in improved operational efficiency, reduced human error, and better decision-making in surgical workflows.

- Need to Improve Operational Efficiency: Tracking systems automate inventory and processing workflows, significantly reducing manual labor, instrument turnaround times, and surgery delays. For example, implementing real-time location services (RTLS) in sterilization departments has directly enhanced efficiency and minimized disruptions in operating room schedules.

- Technological Advancements: Technological advancements like RFID, IoT, cloud computing, and AI enable real-time tracking, predictive maintenance, and automation of surgical instrument workflows, significantly improving operational efficiency. These innovations also ensure compliance with regulatory standards and enhance patient safety by minimizing errors and ensuring accurate sterilization and usage tracking.

Report Scope of Surgical Instrument Tracking Systems Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 284.74 Million |

| Market Size by 2034 |

USD 890.75 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 13.51% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Technology, End Use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Regulatory Compliance Requirements

Regulatory compliance requirements, such as the FDA’s Unique Device Identification (UDI) mandate, are driving the growth of the surgical instrument tracking systems market. These regulations require healthcare providers to ensure full traceability of surgical instruments throughout their lifecycle, including usage, sterilization, and storage. As a result, hospitals and surgical centers are increasingly adopting tracking systems to maintain detailed records, reduce the risk of retained surgical items, and improve accountability. Compliance not only helps avoid legal penalties but also supports patient safety and quality assurance initiatives. This growing emphasis on meeting regulatory standards is pushing healthcare institutions to invest in advanced tracking technologies, fueling market expansion.

Rising Number of Surgical Procedures

The rising number of surgical procedures globally is a major factor driving the demand for surgical instrument tracking systems. As surgical volumes increase, hospitals face greater pressure to efficiently manage, sterilize, and track thousands of instruments to avoid delays, errors, and infections. Tracking systems help streamline instrument workflows, ensure timely availability, and reduce the risk of misplaced or unsterilized tools during high surgical throughput. This is especially critical in large healthcare facilities and outpatient surgery centers where quick turnaround times are essential. As a result, the need for reliable, automated tracking solutions is growing in tandem with the surgical workload, ultimately driving market growth.

Focus on Patient Safety and Infection Control

The increasing focus on patient safety and infection control significantly drive the surgical instrument tracking systems market. Hospitals are under growing pressure to minimize surgical site infections (SSIs) and prevent the use of improperly sterilized or misplaced instruments. Tracking systems ensure that every surgical tool is properly cleaned, sterilized, and accounted for before use, reducing the risk of contamination and retained surgical items. By enhancing traceability and accountability, these systems support hospital accreditation, quality assurance, and better clinical outcomes. As patient safety becomes a top priority, healthcare providers are investing in advanced tracking technologies to meet strict infection control protocols and improve overall care quality.

- According to the WHO, over 300 million surgical procedures are performed worldwide each year. Surgical errors account for 10% of preventable patient harm, with most adverse events occurring before and after surgery. Healthcare-associated infections during surgery have a global rate of 0.14%, increasing by 0.06% annually, leading to longer hospital stays, disability, higher costs, and avoidable deaths. https://www.who.int/

Restraints

High Implementation Costs and Integration Challenges

High implementation costs and integration challenges are significant factors restraining the growth of the market. The initial investment required for software, RFID/barcode hardware, staff training, and infrastructure upgrades can be substantial, especially for small and mid-sized hospitals. Additionally, integrating these systems with existing hospital information systems (HIS), electronic health records (EHR), and sterilization workflows often requires technical expertise and customization, leading to delays and operational disruptions. Compatibility issues between different vendors’ systems can further complicate adoption. These financial and technical hurdles make some healthcare providers hesitant to implement tracking solutions despite their long-term benefits.

Data Security Concerns and Lack of Standardization

Data security concerns and lack of standardization are restraining the growth of the surgical instrument tracking systems market. As these systems increasingly rely on cloud connectivity and IoT integration, they become more vulnerable to cybersecurity threats, raising concerns about patient data breaches and unauthorized access to critical hospital information. Additionally, the lack of standardized protocols across different tracking technologies and healthcare systems leads to interoperability issues, complicating system integration and scalability. This inconsistency can result in data silos, reduced efficiency, and increased costs for healthcare providers. As a result, many institutions are cautious about adopting these systems until stronger data protection measures and industry-wide standards are in place.

Opportunities

Rise of Cloud-Based and SaaS Solutions

The rise of cloud-based and SaaS (Software as a Service) solutions is creating immense opportunities in the surgical instrument tracking systems market by offering scalable, cost-effective, and easily deployable options for healthcare providers. These solutions reduce the need for heavy upfront investments in IT infrastructure and allow hospitals to access real-time data and analytics from anywhere, improving instrument management and decision-making. Cloud platforms also facilitate seamless updates, remote support, and integration with other hospital systems, enhancing overall efficiency. Furthermore, SaaS models enable smaller hospitals and outpatient centers to adopt advanced tracking technologies without the burden of complex maintenance. This flexibility and accessibility are driving wider adoption and accelerating market growth.

Integration with Hospital Asset Management Systems

Integration with hospital asset management systems also opens up doors for market growth by enabling a unified platform for managing all critical medical equipment alongside surgical instruments. This seamless connectivity allows hospitals to optimize inventory control, reduce equipment downtime, and improve resource allocation by having comprehensive visibility into asset utilization and maintenance schedules. Combining surgical instrument tracking with broader asset management enhances operational efficiency, reduces costs, and supports regulatory compliance through better documentation. Additionally, integrated systems facilitate data sharing across departments, promoting coordinated care and faster decision-making.

What Macroeconomic Factors Influence the Growth of the Surgical Instrument Tracking Systems Market?

GDP growth generally drives the growth of the market by increasing healthcare spending and enabling hospitals to invest in advanced technologies. As economies expand, both public and private sectors allocate more resources to improve surgical efficiency and patient safety, boosting demand for tracking systems. However, in regions with slow or negative GDP growth, limited financial resources can restrain market growth due to budget constraints and delayed infrastructure upgrades.

Inflation rates typically restrain the growth of the market by increasing the costs of medical equipment, software, and operational expenses, making hospitals more cautious with investments. Higher inflation can also reduce healthcare budgets and limit purchasing power, especially in cost-sensitive regions. However, in some cases, moderate inflation may encourage healthcare providers to adopt efficiency-enhancing technologies like tracking systems to control overall costs.

Fiscal policy can drive the growth of the market when governments increase healthcare spending, provide subsidies, or offer tax incentives for adopting advanced medical technologies. Such supportive policies encourage hospitals and healthcare providers to invest in efficient tracking systems to improve surgical outcomes and reduce costs. Conversely, restrictive fiscal policies or budget cuts in healthcare can restrain market growth by limiting available funds for technology upgrades and infrastructure development.

Segment Outlook

Product Insights

How Does Hardware Segment Lead the Market in 2024?

The hardware segment led the surgical instrument tracking systems market in 2024 due to the widespread deployment of essential infrastructure like RFID readers, scanners, barcode printers, and tags across surgical environments. These physical components are critical for achieving precise, real-time traceability of instruments, especially through sterilization cycles, and ensure high durability and consistent performance in busy hospital settings. Mandatory compliance with regulatory traceability standards, such as those from the FDA and Joint Commission, further reinforced demand for certified hardware installations. Additionally, hardware’s ease of integration into existing operating room workflows and continual innovation, such as compact, wireless devices, have broader adoption among healthcare providers

The service segment is expected to grow at a significant rate over the forecast period. This is mainly due to the increasing complexity of surgical instrument tracking systems and the need for seamless integration within healthcare environments. As hospitals grapple with evolving regulatory requirements and strive for operational efficiency, they rely more on specialized service providers to tailor solutions, ensure system reliability, and train staff effectively. By offering customized implementation, technical support, and ongoing training, services help healthcare facilities overcome barriers to adoption and fully leverage the advantages of tracking technologies, making this segment a critical growth driver in the market.

Surgical Instrument Tracking Systems Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hardware |

130.44 |

146.07 |

163.54 |

183.07 |

204.89 |

229.26 |

256.48 |

286.86 |

320.78 |

358.62 |

400.84 |

| Software |

70.24 |

81.44 |

94.38 |

109.33 |

126.6 |

146.54 |

169.55 |

196.11 |

226.76 |

262.1 |

302.86 |

| Services |

50.17 |

57.23 |

65.29 |

74.47 |

84.95 |

96.9 |

110.53 |

126.07 |

143.8 |

164.01 |

187.06 |

Technology Insights

What Made Barcode the Dominant Segment in the Market in 2024?

The barcode segment dominated the surgical instrument tracking systems market with a major share in 2024. This is primarily due to its cost-effectiveness, widespread adoption, and ease of integration with existing hospital systems. Barcode technology is relatively inexpensive to implement compared to RFID, making it an attractive choice for healthcare facilities with budget constraints. It also requires minimal infrastructure changes and provides reliable tracking for sterilization, usage, and inventory management.

The technology's proven effectiveness in reducing surgical errors, enhancing operational efficiency, and ensuring compliance with regulatory standards further supported its dominance. Additionally, hospitals and surgical centers continue to prefer barcodes due to the availability of compatible scanners and software, contributing to its sustained market leadership.

The RFID segment is expected to grow at the fastest CAGR during the projection period, owing to its advanced capabilities in real-time tracking, automation, and data accuracy. Unlike barcodes, RFID does not require a line-of-sight scan, enabling faster and more efficient tracking of surgical instruments throughout their lifecycle. This technology significantly reduces manual errors, enhances workflow efficiency, and supports better compliance with sterilization and safety protocols.

As healthcare facilities increasingly prioritize patient safety, regulatory compliance, and operational efficiency, the adoption of RFID is rising, especially in high-volume or technologically advanced hospitals. Moreover, the decreasing cost of RFID solutions and integration with hospital information systems is making it a more viable and attractive option for long-term investment.

Surgical Instrument Tracking Systems Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Barcodes |

175.6 |

195.05 |

216.55 |

240.3 |

266.52 |

295.44 |

327.3 |

362.38 |

400.97 |

443.37 |

489.91 |

| RFID |

75.26 |

89.69 |

106.66 |

126.57 |

149.92 |

177.26 |

209.26 |

246.67 |

290.36 |

341.36 |

400.84 |

End Use Insights

Why Did Hospitals Hold the Largest Market Share in 2024?

The hospitals segment held the largest share of the surgical instrument tracking systems market in 2024 due to the high volume of surgical procedures performed and the growing emphasis on patient safety and infection control. Hospitals are under increasing pressure to comply with stringent regulatory standards, such as those set by the Joint Commission and FDA, which mandate proper sterilization and traceability of surgical instruments. Implementing tracking systems helps hospitals reduce errors, prevent instrument misplacement, and streamline inventory management.

Additionally, the push toward digital transformation in healthcare and the need for operational efficiency have driven both public and private hospitals to invest in advanced tracking technologies. Their large-scale operations and budgets also enable faster adoption of such systems compared to smaller healthcare facilities.

The others segment, including outpatient facilities and surgical centers, is expected to grow at a significant rate in the coming years. The segment growth is attributed to the rising number of minimally invasive and outpatient surgeries. These facilities are increasingly adopting advanced tracking technologies to improve instrument management, reduce surgical delays, and enhance patient safety. Growing patient preference for outpatient procedures, driven by cost-effectiveness and faster recovery times, is fueling demand for efficient instrument tracking solutions in these settings. Additionally, as outpatient centers and surgical facilities strive to comply with regulatory standards and improve operational efficiency, investments in tracking systems are becoming more widespread.

Surgical Instrument Tracking Systems Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hospitals |

220.75 |

250 |

283.13 |

320.64 |

363.14 |

411.25 |

465.73 |

527.44 |

597.31 |

676.44 |

766.04 |

| Others |

30.1 |

34.74 |

40.08 |

46.23 |

53.3 |

61.45 |

70.83 |

81.61 |

94.02 |

108.29 |

124.71 |

Real-World Examples of Surgical Instrument Tracking Systems

1. Berlin Charité Hospital, Germany

Challenge: Charité-Universitätsmedizin Berlin faced rising time and costs managing 300,000 surgical instruments manually. They needed a solution that could reliably track contaminated instruments before and during sterilization, without disrupting workflows or compromising instrument integrity.

Solution: In 2016, Charité implemented Xerafy’s autoclavable RFID tags, rigorously tested to withstand over 1,000 sterilization cycles involving heat, chemicals, and mechanical stress. The biocompatible tags were securely attached without affecting instrument balance, usability, or certification.

Result: The RFID system enabled seamless, end-to-end instrument tracking in the SPD department, significantly reducing labor time and improving documentation accuracy. Instrument performance and safety remained uncompromised, ensuring continued clinical confidence and regulatory compliance.

2. Copenhagen Rigshospitalet, Denmark

Challenge: Rigshospitalet Copenhagen performs 75,000 surgeries annually and faced significant labor costs from manual tracking of surgical instruments. They needed small, reliable RFID tags that could provide accurate reads on metal instruments without affecting their usability.

Solution: Using Xerafy’s durable UHF RFID tags, Rigshospitalet became the first hospital globally to pilot a single system for tracking surgical instruments throughout the entire lifecycle, from the operating room to cleaning and storage. The tags withstand over 1,000 autoclave cycles and allow rapid, accurate counting of up to 80 instruments at once.

Result: The RFID system saved an estimated 31,000 labor hours per year by eliminating manual tracking, optimizing workflows in sterile supply departments and surgical theaters, and improving patient care by freeing staff for more critical tasks. https://xerafy.com/

Regional Insights

What Made North America the Dominant Region in the Market?

In 2024, North America emerged as the dominant region in the surgical instrument tracking systems market due to the presence of a highly advanced healthcare infrastructure and strong regulatory frameworks promoting patient safety and equipment traceability. The region benefits from early adoption of cutting-edge technologies, including RFID and barcode-based tracking systems, driven by strict compliance requirements from bodies like the FDA. Major market players are also headquartered in North America, contributing to faster innovation and widespread implementation. Additionally, the growing number of surgical procedures, coupled with increasing awareness about preventing retained surgical instruments and improving operational efficiency, fueled demand for tracking solutions.

- According to the American College of Surgeons, approximately 15 million Americans undergo surgery each year. https://www.facs.org/

The U.S. is the major contributor to the North America surgical instrument tracking systems market, primarily due to its well-established healthcare infrastructure and stringent regulatory standards. The U.S. Food and Drug Administration (FDA) mandates the use of Unique Device Identification (UDI) systems, which has accelerated the adoption of advanced tracking technologies in hospitals and surgical centers. Additionally, the high volume of surgical procedures, strong focus on patient safety, and the presence of leading market players have further driven demand. The country's emphasis on reducing medical errors and improving surgical workflow efficiency continues to support market growth.

What Makes Asia Pacific the Fastest-Growing Market for Surgical Instrument Tracking Systems?

Asia Pacific is expected to experience rapid growth in the coming years due to the rapid expansion of healthcare infrastructure and rising investments in hospital modernization across countries like China, India, and Japan. Increasing awareness about patient safety, surgical efficiency, and the need to reduce instrument loss or misplacement are driving demand for advanced tracking technologies. Government initiatives aimed at improving healthcare quality, along with the growing number of surgical procedures in the region, are further contributing to market expansion. Additionally, the adoption of digital health technologies and rising medical tourism are encouraging hospitals to implement more efficient and traceable systems.

China is a major contributor to the Asia Pacific surgical instrument tracking systems market due to its rapidly growing healthcare sector and significant government investments in modernizing hospitals. The country is witnessing a surge in the number of surgeries performed, driven by an expanding population and increasing healthcare accessibility. Additionally, rising awareness about patient safety and regulatory efforts to improve surgical practices are encouraging the adoption of advanced tracking technologies.

Region-Wise Breakdown of the Surgical Instrument Tracking Systems Market

|

Region

|

Market Size (2024)

|

Projected CAGR (2025-2034)

|

Key Growth Factors

|

Key Challenges

|

Market Outlook

|

|

North America

|

USD 104.3 Bn

|

5.88%

|

Advanced healthcare infrastructure; high surgery volumes; adoption of digital tracking technologies

|

High cost of advanced tracking systems, data security concerns

|

Dominant market with consistent growth

|

|

Asia Pacific

|

USD 73.3 Bn

|

7.03%

|

Rapid urbanization; increasing healthcare IT investments; rising surgical procedures

|

Lack of skilled personnel; inadequate healthcare infrastructure in rural areas

|

Fastest-growing market

|

|

Europe

|

USD 58.6 Bn

|

9.93%

|

Well-developed healthcare systems; emphasis on patient safety and efficiency

|

Stringent regulations; budget limitations in some countries

|

Mature market with steady growth

|

|

Latin America

|

USD 20.2 Bn

|

4.71%

|

Government initiatives improving healthcare infrastructure; rising awareness of tracking benefits

|

Political instability; limited access to advanced tech

|

Developing market with gradual but steady growth

|

|

MEA

|

USD 12.9 Bn

|

3.33%

|

Increasing healthcare spending; growth in trauma and surgical care infrastructure

|

Economic disparities; political instability; low tech penetration

|

Emerging market with slow but promising growth potential

|

Surgical Instrument Tracking Systems Market Value Chain Analysis

1. Raw Material Sourcing and Component Manufacturing

This stage involves the procurement of essential materials such as RFID tags, barcode labels, sensors, and electronic components required to build tracking devices. Quality and durability are crucial at this phase to ensure that the components withstand sterilization processes and operate reliably in hospital environments.

2. System Development and Software Integration

Manufacturers and technology providers develop the tracking hardware and integrate it with sophisticated software platforms that enable real-time tracking, data analytics, and inventory management. This stage often involves collaboration between hardware engineers and software developers to create seamless, user-friendly solutions that can be customized for different hospital workflows.

3. Distribution and Supply Chain Management

Completed systems and components are distributed to healthcare facilities through specialized supply chains, which may include medical device distributors, technology vendors, and direct sales teams. Efficient logistics ensure timely delivery and installation, which is critical for hospitals that require minimal disruption during system rollout.

4. Implementation and Training

Once installed, hospitals undertake system integration with existing hospital information systems (HIS) and electronic health records (EHR), accompanied by staff training programs. This phase is vital for ensuring that clinical and sterilization teams can effectively use the technology, maximizing operational benefits and compliance.

5. After-Sales Support and Maintenance

Ongoing technical support, software updates, and maintenance services are essential to ensure system reliability and security. Providers often offer remote monitoring, troubleshooting, and upgrade options, helping hospitals keep their tracking systems optimized over time, which in turn builds customer loyalty and recurring revenue streams.

Surgical Instrument Tracking Systems Market Companies

1. Fortive

Fortive offers advanced RFID technology and automated tracking solutions that enhance surgical instrument visibility and management efficiency. Their solutions help hospitals reduce instrument loss and improve sterilization compliance through real-time data analytics and automation.

2. Spatrack Medical Limited

Spatrack Medical specializes in innovative surgical instrument tracking and asset management solutions designed to improve operational workflows and instrument traceability. Their user-friendly systems support efficient inventory management and compliance with stringent healthcare regulations.

3. Xerafy Singapore Pte Ltd.

Xerafy focuses on durable RFID tags specifically designed for the harsh sterilization environments of surgical instruments, enabling long-term tracking accuracy. Their technology helps hospitals maintain instrument integrity and reduces the risk of surgical delays due to missing tools.

4. Fingerprint Medical Limited

Fingerprint Medical develops real-time surgical instrument tracking systems that leverage RFID and software to optimize sterilization workflows and instrument utilization. Their solutions promote patient safety by ensuring instrument traceability and reducing the likelihood of retained surgical items.

5. Getinge AB

Getinge provides comprehensive instrument tracking and sterilization monitoring systems that ensure compliance with regulatory standards while improving surgical workflows. Their solutions are widely adopted for reducing infection risks and enhancing asset management in healthcare facilities.

6. B. Braun SE

B. Braun offers integrated surgical instrument tracking technologies that emphasize sterilization process control and traceability to boost patient safety. Their systems help hospitals efficiently manage instrument lifecycles, ensuring timely availability and regulatory compliance.

7. BD (Becton, Dickinson and Company)

BD contributes by integrating barcode and RFID tracking technologies into their broader medical device portfolio, enhancing surgical instrument traceability. Their solutions support healthcare providers in improving workflow efficiency and minimizing surgical errors.

8. Ternio Group LLC

Ternio Group focuses on blockchain-based tracking solutions that offer enhanced data security and transparency for surgical instrument management. Their technology ensures immutable records of instrument usage and sterilization, helping hospitals meet stringent compliance and patient safety standards.

9. ScanCARE Pty Ltd

ScanCARE delivers RFID and barcode-based surgical instrument tracking solutions that improve inventory control and workflow efficiency in hospitals. Their systems help healthcare providers reduce turnaround times and enhance compliance with sterilization protocols.

10. STERIS

STERIS offers RFID-enabled surgical instrument tracking systems that streamline sterilization, inventory management, and regulatory compliance. Their solutions are designed to reduce operating room delays and improve patient safety through accurate real-time instrument tracking.

11. 3M Healthcare

3M provides advanced barcode and RFID tracking technologies that ensure accurate instrument traceability and compliance with safety regulations. Their systems help healthcare facilities improve patient safety and streamline instrument lifecycle management.

12. Cardinal Health

Cardinal Health offers end-to-end tracking solutions combining hardware, software, and support services to optimize surgical instrument lifecycle management. They focus on reducing costs and enhancing instrument availability through analytics and real-time monitoring.

13. Medline Industries, Inc.

Medline integrates surgical instrument tracking into its broad portfolio of healthcare products, emphasizing ease of use and reliability. Their solutions support efficient sterilization tracking and inventory control to improve surgical workflow and reduce errors.

14. Omnicell, Inc.

Omnicell develops cloud-based tracking platforms that enable real-time visibility and analytics for surgical instrument management. Their SaaS solutions reduce manual processes and improve compliance with regulatory and safety standards.

15. SpaTrack Medical Limited

SpaTrack Medical specializes in cutting-edge RFID-based surgical instrument tracking, offering a unique system combining durable RFID pods, ultra-fast auto-scanners, and integrated software that dramatically reduces tray counting time from around one hour to just 12 seconds, while dramatically enhancing traceability and infection control.

Recent Developments

- In May 2025, Ascendco Health and Aesculap, Inc. extended their partnership for another ten years, continuing their joint mission to transform perioperative workflows. Combining Aesculap’s surgical and sterile processing expertise with Ascendco’s asset management technology, the collaboration delivers a comprehensive solution for surgical asset tracking, compliance, staffing, and real-time inventory. This long-term alliance aims to boost operational efficiency, reduce waste, and enhance patient care across health systems. https://www.prnewswire.com/

- In April 2024, Aesculap, Inc. launched the AESCULAP Aicon® RTLS, combining real-time location tracking with its Aicon® Sterile Container System to enhance efficiency in Sterile Processing Departments (SPD). Debuted at the HSPA Annual Conference, the system provides real-time visibility into the instrument reprocessing lifecycle, enabling better decision-making, reducing surgical delays, and minimizing errors. https://www.aesculapusa.com/

- In April 2023, NDI (Northern Digital Inc.) launched the Polaris Lyra®, a compact optical tracker designed for precise instrument tracking in confined clinical and surgical spaces. Succeeding the Polaris Vicra®, it offers high accuracy (up to 0.20 mm RMS), a fast measurement rate (125 Hz), and real-time visualization—ideal for navigated procedures using small, ergonomic instruments. Weighing under 1 kg and under 30 cm long, it’s easy to mount and integrate in tight surgical environments. https://www.surgicalroboticstechnology.com/

Segments Covered in the Report

By Product

- Hardware

- Software

- Services

By Technology

By End Use

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)