Surgical Retractors Market Size and Research

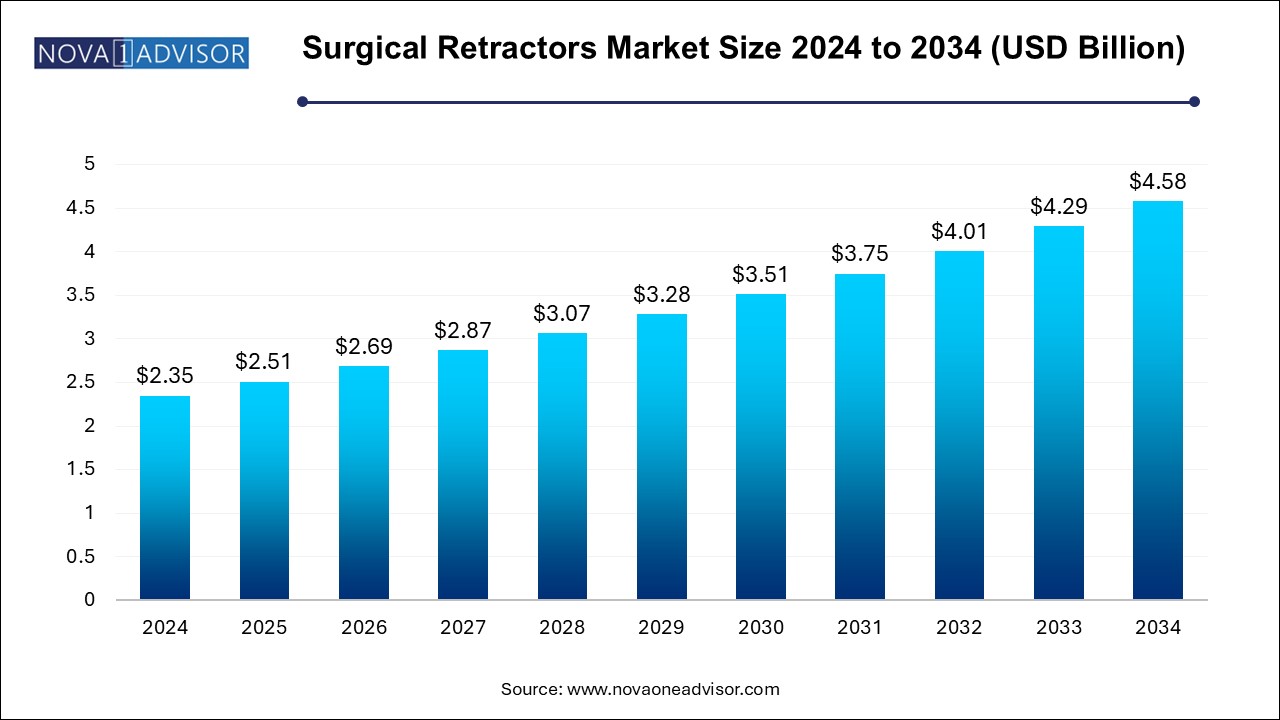

The surgical retractors market size was exhibited at USD 2.35 billion in 2024 and is projected to hit around USD 4.58 billion by 2034, growing at a CAGR of 6.9% during the forecast period 2025 to 2034.

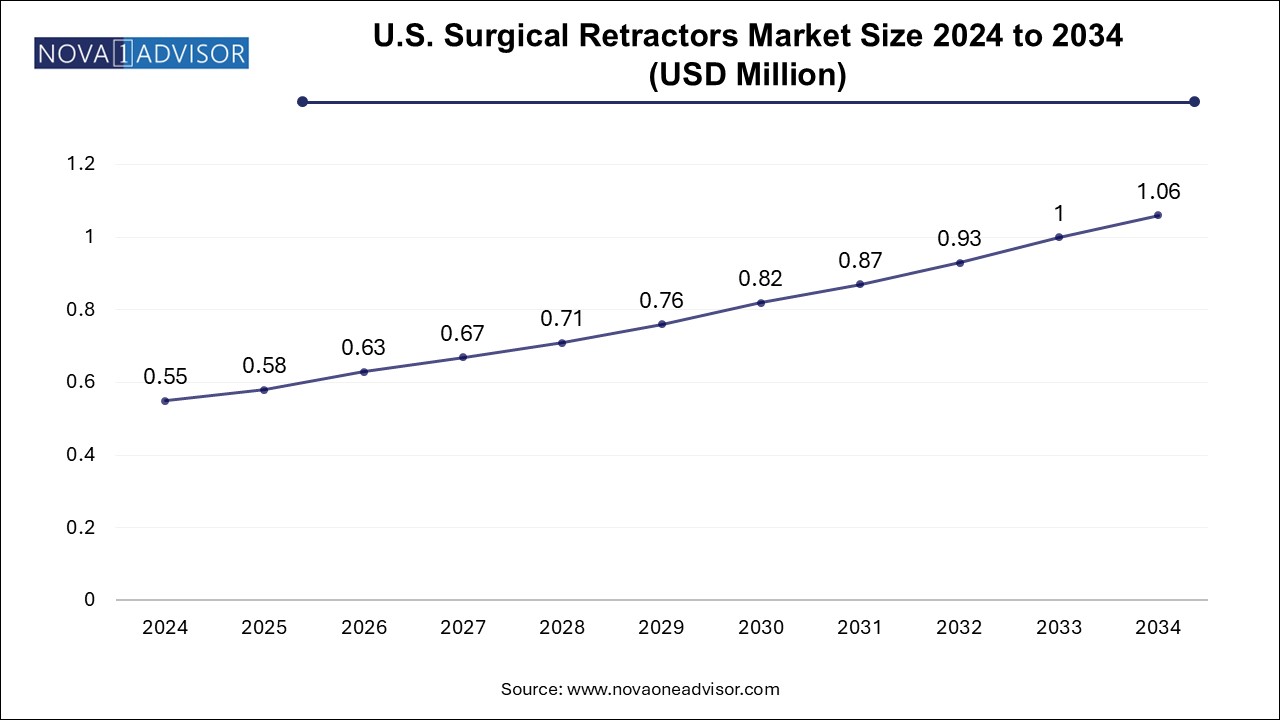

U.S. Surgical Retractors Market Size and Growth 2025 to 2034

The U.S. surgical retractors market size is evaluated at USD 0.550 million in 2024 and is projected to be worth around USD 1.06 million by 2034, growing at a CAGR of 6.14% from 2025 to 2034.

North America remains the largest market for surgical retractors, owing to its advanced healthcare infrastructure, high surgical volumes, and early adoption of new technologies. The U.S. accounts for the majority of the regional share, supported by a well-established network of hospitals, ASCs, and academic medical centers. Strong regulatory standards, favorable reimbursement frameworks, and the presence of key market players such as Medtronic, Stryker, and BD further reinforce regional leadership.

In addition, increasing investment in robotic surgery and minimally invasive procedures continues to drive the demand for specialty retractors. The U.S. market also benefits from consistent demand for cosmetic and elective surgeries, which often use small, custom retractors for facial and body contouring procedures.

Asia Pacific is the fastest-growing region in the surgical retractors market, attributed to rising healthcare expenditure, growing surgical infrastructure, and increasing awareness of modern surgical techniques. Countries like China, India, and South Korea are witnessing a surge in elective and trauma-related surgeries due to aging populations, urbanization, and expanding middle-class healthcare access.

Public-private partnerships in countries such as India and Indonesia are investing in hospital expansions and surgical center development. Medical tourism in Thailand, Malaysia, and Singapore further contributes to rising procedural volumes. Local manufacturers in Asia are also beginning to produce cost-effective retraction tools, making advanced surgical instruments more accessible to regional healthcare providers.

Market Overview

The surgical retractors market plays a crucial role in the broader surgical instruments ecosystem, facilitating clear visibility and access to internal structures during various medical procedures. Surgical retractors are tools used by surgeons to hold back tissues, organs, or incisions, providing a stable surgical field and allowing precise intervention. These devices are vital across numerous specialties, including neurosurgery, orthopedic, cardiovascular, reconstructive, and obstetric/gynecological procedures.

As surgical volumes rise globally—driven by an aging population, increasing prevalence of chronic diseases, and the rise of minimally invasive and robotic surgeries—the demand for efficient and ergonomic retraction tools has grown considerably. Advancements in materials, device design, and surgeon comfort are propelling innovation within the market. Moreover, hospitals and ambulatory surgical centers are investing in reusable and disposable retractors tailored for specialized and general procedures alike.

While traditional hand-held retractors remain prevalent in many surgical fields, there is a distinct shift toward self-retaining systems that reduce fatigue and optimize surgical efficiency. The integration of lighting elements and minimally invasive compatibility features further highlights the evolving role of surgical retractors in enhancing procedural outcomes. As healthcare systems focus more on operational precision, infection control, and cost-effectiveness, the surgical retractors market is poised for steady growth through 2034.

Major Trends in the Market

-

Growing Shift Toward Self-Retaining and Ergonomic Retractors for Surgeon Efficiency

-

Increased Adoption of Single-Use and Disposable Surgical Retractors for Infection Control

-

Integration of Fiber-Optic Lighting in Retractors for Improved Intraoperative Visibility

-

Rising Demand for Specialty-Specific Retractors, Particularly in Neurosurgery and Orthopedics

-

Surge in Outpatient and Day Surgery Volumes Driving Demand in Ambulatory Surgical Centers

-

Material Innovation, Including Lightweight Alloys and Radiolucent Polymers

-

Expanding Use of Retractors in Minimally Invasive and Robotic-Assisted Surgeries

-

Manufacturers Investing in Customizable and Modular Retraction Systems

-

Growing Importance of Sterility and Reprocessing Efficiency in Device Procurement

-

Expansion of Healthcare Access in Developing Markets Creating New Demand Channels

Report Scope of Surgical Retractors Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.51 Billion |

| Market Size by 2034 |

USD 4.58 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Product, Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Medtronic; Becton, Dickinson and Company (BD); Medical Devices Business Services, Inc.; Teleflex Incorporated; Medline Industries, Inc.; B. Braun Melsungen AG; Applied Medical Resources Corporation; Thompson Surgical; Innomed, Inc.; LiNA Medical ApS; Vivo Surgical Private Limited; BVI; CooperSurgical Inc.; Stryker; Terumo Corporation; June Medical Group; Mediflex Surgical Products; Chamfond Biotech Co., Ltd; Applied Medical Technology, Inc. (AMT); Microcure (Suzhou) Medical Technology Co., Ltd.; Boston Scientific Corporation; Coloplast |

Market Driver: Increasing Global Surgical Volume

A major driver for the surgical retractors market is the increasing global volume of surgical procedures, fueled by rising chronic disease incidence, trauma cases, and elective surgeries. According to the World Health Organization (WHO), over 300 million surgical procedures are performed annually worldwide—a figure projected to rise as access to healthcare services improves across emerging markets.

Conditions such as cardiovascular diseases, orthopedic disorders (like osteoarthritis and fractures), neurological complications, and cancers often require surgical intervention. With aging populations in developed nations and expanding insurance coverage in developing regions, hospitals and surgical centers are experiencing higher caseloads. Surgical retractors, being a fundamental component of the operating room (OR), see proportional demand growth. Their utility in ensuring procedural safety and anatomical access makes them indispensable across open and minimally invasive surgeries.

Market Restraint: Reprocessing Challenges and Cost Pressures

One of the key restraints in the surgical retractors market is the challenge of device reprocessing and associated cost pressures in hospital settings. Reusable retractors, although cost-effective in the long run, require rigorous sterilization procedures to meet infection control standards. Improper reprocessing can lead to cross-contamination and surgical site infections (SSIs), posing liability risks for hospitals and clinics.

Furthermore, the initial acquisition cost of high-quality self-retaining or specialty retractors can be significant, especially for smaller hospitals and low-budget surgical facilities. Budget constraints in public health systems often result in limited procurement or continued use of outdated tools. Additionally, cost-sensitive markets in developing regions often prioritize low-cost or general-purpose retractors over specialized models, which limits technological adoption.

Market Opportunity: Growth in Minimally Invasive and Outpatient Surgeries

A key opportunity for market growth lies in the rising adoption of minimally invasive surgeries (MIS) and outpatient surgical models. These procedures, which offer faster recovery, reduced blood loss, and shorter hospital stays, rely heavily on specialized retraction systems that provide precise access through smaller incisions. This trend is prompting manufacturers to design compact, radiolucent, and modular retractors optimized for laparoscopic, endoscopic, and robotic surgeries.

Ambulatory surgical centers (ASCs), which are growing rapidly across North America, Europe, and Asia Pacific, are embracing advanced surgical technologies to perform complex procedures outside of traditional hospital environments. These centers prefer single-use retractors that combine sterility with cost-efficiency. Moreover, the emphasis on patient turnover and efficient OR workflows in outpatient settings creates a receptive market for retractors that reduce procedure time and surgeon fatigue.

Surgical Retractors Market By Type Insights

The handheld retractors segment accounted for the largest revenue share of 54% in 2024. These instruments are preferred in emergency and trauma surgeries where setup time is critical. Recent improvements in handle ergonomics and blade versatility have enhanced the usability of hand-held retractors, making them essential for a variety of open procedures across developing regions.

Self-retaining retractors dominate the global surgical retractors market, owing to their superior functionality in maintaining consistent tissue separation without the need for an assistant. These retractors come equipped with mechanical locks, hinges, or spring-loaded arms that allow the surgeon to focus on the procedure without manual adjustment. Their widespread use in major surgeries such as orthopedic, abdominal, and cardiovascular operations underscores their clinical value.

Surgical Retractors Market By Product Insights

The orthopedic retractors dominated and is expected to grow at the fastest CAGR over the forecast period. driven by the rising prevalence of joint replacements, fracture repairs, and spinal surgeries. These retractors are specifically designed to handle dense tissues, large incisions, and bony structures. Devices like Hohmann, Bennett, and Taylor retractors are increasingly being tailored with titanium alloys and polymer coatings for better grip and sterility. The growth of orthopedic procedures among the elderly and sports-injury populations is fueling consistent demand in this segment.

Abdominal retractors hold the largest market share among product types, primarily due to the high volume of abdominal surgeries performed globally. These include procedures like cesarean sections, hernia repairs, appendectomies, and bowel resections. Abdominal retractors, such as the Balfour and Bookwalter systems, offer deep access and stable exposure of abdominal organs, making them indispensable in general and gynecological surgery.

Surgical Retractors Market By Application Insights

The Obstetrics and Gynecology (Ob/Gyn) segment dominated the surgical retractors market and accounted for the largest revenue share of 25.0% in 2024. Retractors in this space must be lightweight, minimally invasive, and often customized for delicate facial or soft-tissue applications. The global rise in cosmetic surgery volumes—particularly in Asia Pacific and Latin America—presents ample growth opportunities for specialized retractors tailored for aesthetic surgeries.

The neurosurgery segment is expected to witness a CAGR of 7.9% over the forecast period. due to the need for precision, minimal tissue damage, and stable exposure during intricate brain and spinal procedures. Neurosurgical retractors like Leyla or Greenberg systems are specifically designed to maintain tissue separation without causing trauma, while offering compatibility with microscopes and imaging tools. The high-value nature of neurosurgical retractors and the growing prevalence of neurodegenerative conditions support their market dominance.

Surgical Retractors Market By End-use Insights

The hospital’s segment dominated the market and accounted for the largest revenue share of 50.0% in 2024. These institutions require a wide array of retractors—ranging from general-purpose to highly specialized systems—for departments such as neurosurgery, cardiology, and obstetrics. The availability of high-budget procurement, trained personnel, and advanced sterilization facilities supports hospital dominance in this segment.

Meanwhile, ambulatory surgical centers (ASCs) are the fastest-growing end-use segment. These centers focus on cost-effective, high-throughput surgeries such as orthopedic, ENT, and gynecological procedures. ASCs prefer lightweight, easy-to-use retractors that are compatible with minimally invasive techniques and require minimal setup time. The increasing trend toward same-day surgeries, supported by advancements in anesthesia and post-op recovery, is expected to continue driving retractor demand in outpatient settings.

Some of the prominent players in the surgical retractors market include:

- Medtronic

- BD

- Medical Devices Business Services, Inc.

- Teleflex Incorporated

- Medline Industries, Inc.

- B. Braun Melsungen AG

- Applied Medical Resources Corporation

- Thompson Surgical

- Innomed, Inc.

- LiNA Medical ApS

- Vivo Surgical Private Limited

- BVI

- CooperSurgical Inc.

- Stryker

- Terumo Corporation

- June Medical Group

- Mediflex Surgical Products

- Chamfond Biotech Co., Ltd

- Applied Medical Technology, Inc. (AMT)

- Microcure (Suzhou) Medical Technology Co., Ltd.

- Boston Scientific Corporation

- Coloplast

Surgical Retractors Market Recent Developments

-

March 2025: Stryker Corporation announced the launch of its new self-retaining retractor line designed specifically for robotic-assisted orthopedic surgeries, integrating ergonomic handles and radiolucent material for intraoperative imaging.

-

February 2025: Medtronic plc revealed plans to invest in developing reusable retractor systems that are compatible with AI-assisted surgical navigation tools, aiming to improve precision in spinal and cranial surgeries.

-

January 2025: B. Braun Melsungen AG introduced a modular retractor kit for abdominal and vascular procedures, enhancing operating room efficiency and reducing instrument turnover time.

-

December 2024: Integra LifeSciences completed the acquisition of a niche German surgical instruments company specializing in neurosurgical retractors, strengthening its product portfolio in the premium surgical instruments space.

-

November 2024: Teleflex Incorporated expanded its single-use retractor product line for ambulatory surgical centers, focusing on infection control and reduced reprocessing burden.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the surgical retractors market

By Type

By Product

- Abdominal Retractor

- Finger Retractor

- Nerve Retractor

- Orthopedic Retractor

- Rectal Retractor

- Thoracic Retractor

- Ribbon Retractor

- Others

By Application

- Neurosurgery

- Wound Closure

- Reconstructive Surgery

- Cardiovascular

- Orthopedic

- Ob/Gyn

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Clinics

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)