Surgical Tables Market Size and Research

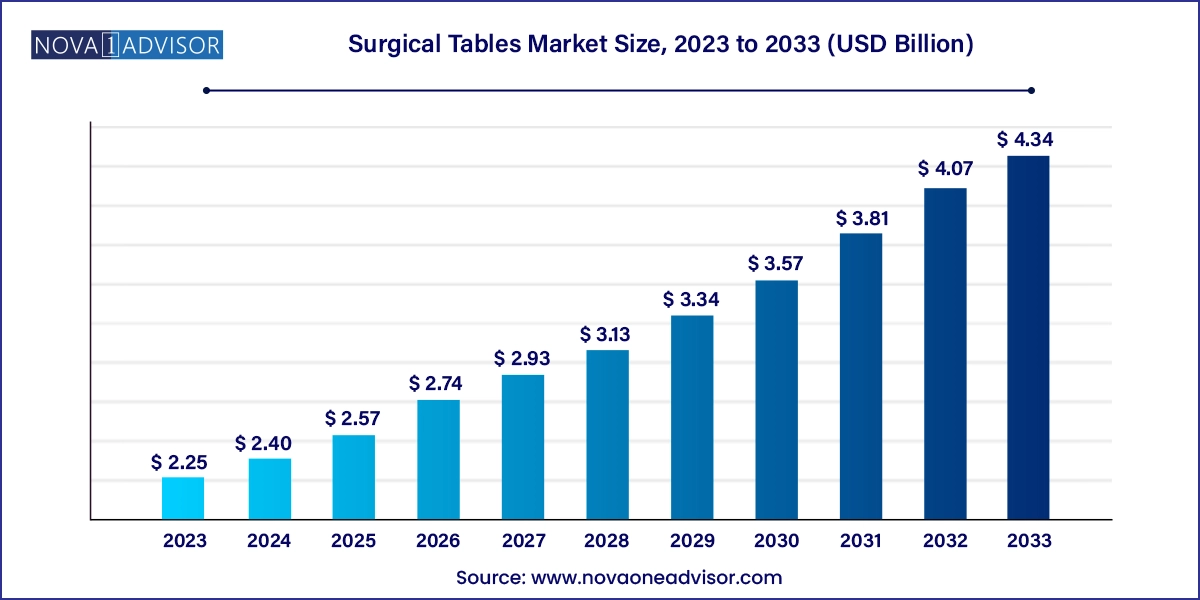

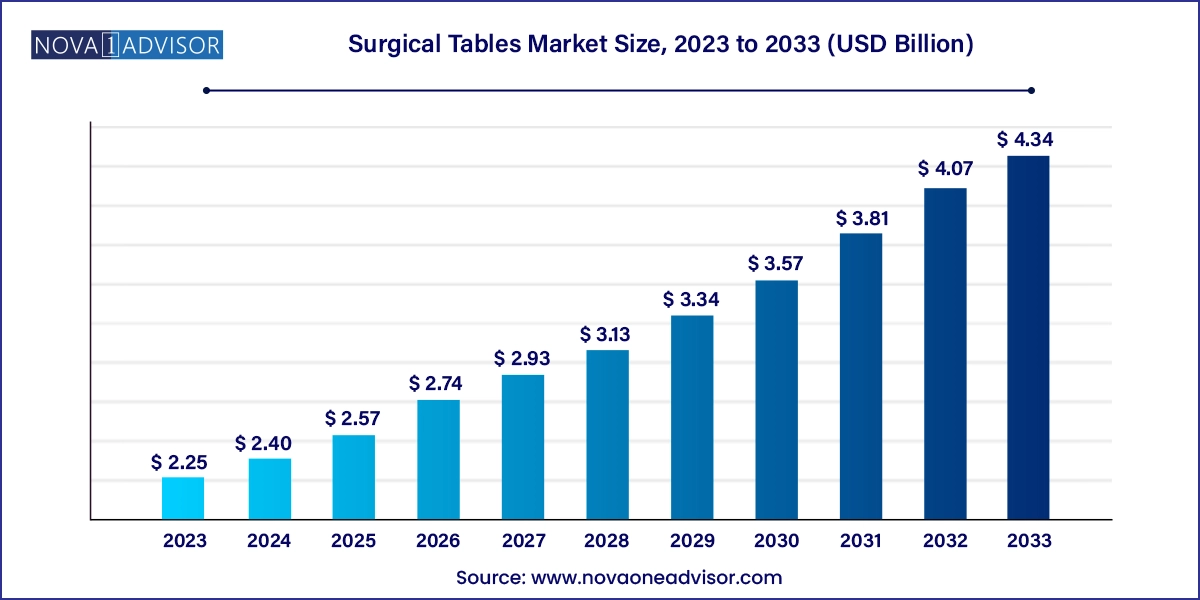

The global surgical tables market size was exhibited at USD 2.25 billion in 2023 and is projected to hit around USD 4.34 billion by 2033, growing at a CAGR of 6.8% during the forecast period 2024 to 2033.

Surgical Tables Market By Key Takeaways:

- North America dominated the market and accounted for the largest revenue share of 37.0% in 2023.

- The general surgical tables segment accounted for the largest revenue share of 30.7% in 2023.

- The metal segment accounted for the largest revenue share of 51.1% in 2023.

- The hospital segment held the majority of the revenue share of 38.1% in 2023

- The powered segment accounted for the largest revenue share of 68.0% in 2023.

Market Overview

The Surgical Tables Market represents a fundamental pillar of the global healthcare infrastructure, as these tables form the operational core of surgical environments across hospitals, ambulatory surgery centers (ASCs), and specialty clinics. Designed to support patients during a wide range of surgical procedures from general operations to highly specialized interventions surgical tables have evolved from static, mechanical platforms to sophisticated, powered systems with advanced mobility, radiolucency, and configurability.

As the volume of surgical procedures increases globally driven by aging populations, the growing burden of chronic illnesses, and enhanced healthcare access in emerging regions the demand for reliable, ergonomic, and multifunctional surgical tables is rising steadily. These devices must not only ensure patient safety and comfort but also allow surgeons and support staff optimal access, visibility, and operational flexibility.

Technology is playing a central role in reshaping this market. Surgical tables now integrate imaging compatibility, remote controls, and motorized features to enable seamless transitions during procedures. Furthermore, the growing trend of minimally invasive and outpatient surgeries is influencing table design toward lightweight, modular, and space-efficient configurations.

Major Trends in the Market

-

Rising Demand for Hybrid Operating Rooms: The integration of radiolucent tables with real-time imaging technologies is driving adoption in advanced surgical centers.

-

Preference for Powered and Multi-movement Tables: Surgeons and hospitals are favoring electric and hydraulic tables for precision, adjustability, and ergonomic benefits.

-

Specialty Tables Gaining Momentum: Procedures in neurosurgery, bariatrics, and orthopedics require tailored solutions, increasing demand for specialized surgical tables.

-

Growth of Ambulatory Surgical Centers (ASCs): ASCs require compact, multifunctional tables suitable for quick turnover and diverse procedure types.

-

Adoption of Modular Designs: Hospitals are investing in customizable tables with interchangeable components for multi-disciplinary use.

-

Focus on Infection Control and Cleanability: Antimicrobial coatings and seamless designs are being prioritized to comply with stricter hygiene protocols.

-

Increased Use of Lightweight Composite Materials: Composite materials enhance portability and maneuverability without compromising strength.

Surgical Tables Market Report Scope

Market Driver: Increasing Surgical Volume Globally

A primary driver of the surgical tables market is the growing global volume of surgical procedures, fueled by demographic changes, improved healthcare access, and the prevalence of chronic conditions. As populations age and non-communicable diseases (NCDs) such as cardiovascular disorders, cancers, and musculoskeletal issues rise, the number of surgical interventions—from bypasses to tumor removals and orthopedic implants is climbing.

According to the Lancet Commission, an estimated 313 million surgical procedures are performed annually worldwide, a figure projected to increase significantly. This rising load is placing pressure on healthcare facilities to equip operating rooms with modern, reliable surgical tables that can support both routine and complex procedures with precision.

Hospitals and ASCs alike are upgrading to powered and specialty surgical tables that enhance workflow, minimize surgical risks, and align with technological advancements in surgical instruments and intraoperative imaging.

Market Restraint: High Capital Costs and Maintenance Requirements

A critical restraint limiting wider adoption especially in cost-sensitive regions is the high capital cost associated with advanced surgical tables, particularly powered and specialty types. These tables often come with motorized controls, integrated imaging compatibility, and software-assisted positioning systems, which significantly raise upfront procurement costs.

In addition to high initial investment, the ongoing maintenance and servicing needs of powered surgical tables especially hydraulic and electro-mechanical models can be resource-intensive. Hospitals must also ensure availability of trained personnel for usage, cleaning, and compliance with biomedical equipment safety standards.

These challenges are more pronounced in low-income settings, where budgets for surgical infrastructure are constrained, and procurement tends to favor basic or refurbished models over modern high-spec options.

Market Opportunity: Expansion of Outpatient Surgeries and ASCs

A prominent opportunity within the surgical tables market stems from the rapid expansion of ambulatory surgical centers (ASCs) and the shift toward outpatient surgical procedures. Due to advancements in anesthesia, minimally invasive techniques, and post-operative care, many surgeries that once required hospital stays are now performed on a same-day basis.

ASCs are more cost-effective, patient-friendly, and efficient than traditional hospital ORs, but they require surgical tables that are versatile, mobile, and compatible with a variety of surgical specialties. This creates demand for multi-functional, space-saving, and quick-cleaning surgical tables that support high throughput.

Manufacturers that offer lightweight, easy-to-use surgical tables with modular attachments will be best positioned to serve this high-growth segment, particularly in North America and Asia, where ASC growth is strongest.

Segmental Analysis

By Product Type

General surgical tables dominate the market, as they are widely used for a broad range of procedures including general surgery, gynecology, and urology. These tables are the standard fixture in most hospitals due to their cost-effectiveness, adaptability, and compatibility with multiple surgical disciplines. The demand is especially robust in public hospitals and mid-tier private facilities where versatility and durability are key purchasing factors.

Specialty surgical tables are the fastest-growing segment, reflecting the increasing complexity and specialization of modern surgeries. Tables designed specifically for orthopedic, bariatric, neurosurgical, and laparoscopic procedures offer advanced positioning capabilities, integrated radiolucency, and load-bearing capacities tailored for specific surgical needs. For instance, bariatric tables must accommodate higher weight capacities with reinforced frames, while neurosurgical tables require micro-movements and head stabilization systems.

By Type

Powered surgical tables lead this segment, owing to their convenience, precision, and suitability for high-tech operating rooms. These tables typically use hydraulic or electric mechanisms to enable precise adjustments in height, tilt, and lateral movement. Powered tables significantly enhance ergonomics and workflow, especially during long or delicate procedures.

Non-powered surgical tables remain relevant, particularly in cost-sensitive or resource-limited settings. Although less flexible in movement and adjustment, these tables serve well for standard procedures and as backup or emergency-use equipment. Demand persists in secondary hospitals, field operations, and mobile surgical units.

By Material

Metal-based tables continue to dominate, especially stainless steel models that are renowned for their strength, corrosion resistance, and compliance with sterilization requirements. These materials offer long-term durability and are ideal for high-usage operating rooms.

Composite materials are emerging as the fastest-growing category, as they offer weight reduction, mobility, and radiolucency advantages. Carbon fiber-based tables, in particular, are increasingly used in interventional and hybrid OR settings due to their compatibility with fluoroscopy and CT scans.

By End-use

Hospitals are the leading end-use segment, accounting for the bulk of surgical table purchases. Their diverse procedural mix, round-the-clock operations, and higher budgets support the deployment of both general and specialty surgical tables. Tertiary hospitals and teaching institutions, in particular, are adopting advanced models with digital integration.

Ambulatory Surgery Centers (ASCs) are the fastest-growing end-use, reflecting the migration of surgical procedures from hospitals to outpatient settings. ASCs require compact, easy-to-maintain, and multifunctional tables that enable high patient turnover and meet accreditation standards. Specialty clinics and trauma centers are also contributing to demand, particularly for orthopedic and neurosurgical table variants.

Regional Analysis

North America dominates the surgical tables market, with the United States leading due to its advanced healthcare infrastructure, high surgical volumes, and early adoption of innovative operating room technologies. The prevalence of chronic diseases, high rates of bariatric and orthopedic surgeries, and rapid ASC expansion further bolster demand. U.S. hospitals are also at the forefront of integrating hybrid ORs with radiolucent and motorized surgical tables.

Asia-Pacific is the fastest-growing region, driven by expanding healthcare infrastructure in India, China, Indonesia, and Vietnam. Government investments, increasing surgical capabilities in rural areas, and medical tourism in countries like Thailand and Malaysia are propelling market growth. Additionally, a growing middle class and demand for better surgical outcomes are pushing private hospitals to adopt modern surgical equipment, including powered and specialty tables.

Some of the prominent players in the Surgical tables market include:

- Hill-Rom Holdings, Inc.

- Steris Plc.

- Stryker Corp.

- Getinge AB

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Mizuho Corporation (Mizuho OSI, Inc.)

- Skytron LLC

- Alvo Medical

- Allengers Medical Systems Ltd.

Recent Developments

-

Stryker Corporation (April 2025): Introduced a new line of modular orthopedic surgical tables with real-time motion assist and AI-guided alignment for precision orthopedic procedures.

-

Hillrom (a Baxter company) (March 2025): Announced integration of smart patient positioning sensors in powered surgical tables to improve intraoperative safety.

-

Getinge AB (February 2025): Launched an advanced radiolucent surgical table compatible with robotic-assisted surgery systems across Europe and North America.

-

Skytron (January 2025): Partnered with outpatient surgery chains in the U.S. to supply cost-efficient, compact surgical tables tailored for ASCs.

-

Mediland Enterprise Corporation (December 2024): Opened a new manufacturing and distribution hub in Southeast Asia to serve growing regional demand for surgical tables.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global surgical tables market.

Product Type

- General Surgical Tables

- Specialty Surgical Tables

-

- Bariatric Surgical Tables

- Laparoscopic Surgical Tables

- Neurosurgical Surgical Tables

- Orthopedic Surgical Tables

- Radiolucent Surgical Tables

- Pediatric Surgical Tables

Type

Material

End-use

- Hospital

- Ambulatory Surgery Centers

- Specialty Clinics & Trauma Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)