Suture Market Size and Growths

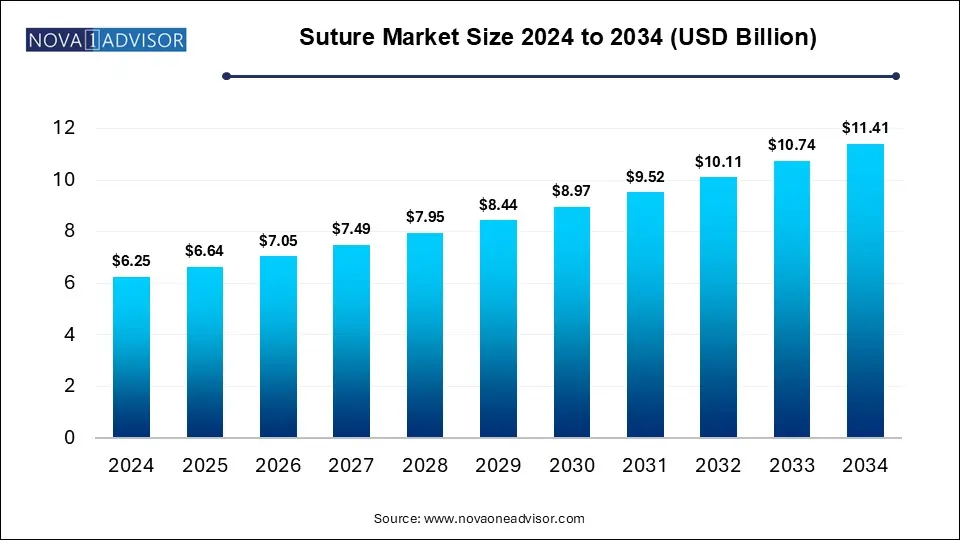

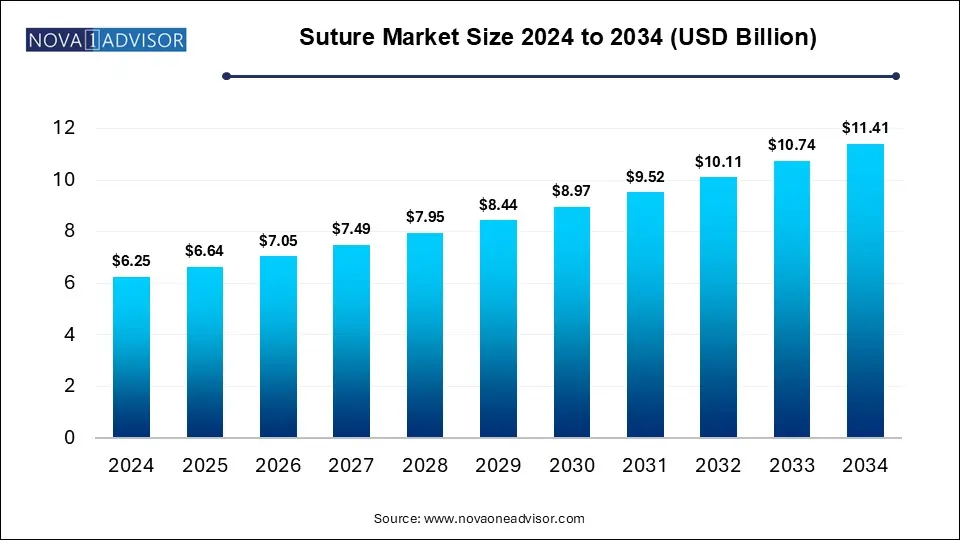

The Suture Market size was exhibited at USD 6.25 billion in 2024 and is projected to hit around USD 11.41 billion by 2034, growing at a CAGR of 6.2% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, surgical sutures accounted for the highest share, representing 65% of the total market.

- The acute wounds category led the suture market in 2024, contributing 72% of the overall market share.

- Hospitals and clinics emerged as the primary end-users in 2024, comprising 54% of the market.

- Institutional sales emerged as the leading distribution channel in 2024.

- Retail sales within the suture market are projected to register the highest compound annual growth rate (CAGR) of 6.62% during the forecast period.

- North America stood out as the dominant regional market in 2024, capturing a 40% share.

Market Overview

The global suture market plays a pivotal role in modern surgical and wound management procedures. It encompasses a wide range of products designed to close wounds and support tissue healing. Sutures remain an integral component in hospitals, ambulatory surgery centers, and various outpatient facilities across the world. The growing number of surgical procedures due to rising trauma cases, the prevalence of chronic diseases, and the aging population are propelling the market forward. Additionally, innovations in suture materials and techniques are further expanding their applications, making sutures indispensable tools in both conventional and minimally invasive surgeries.

Sutures are broadly categorized based on their absorption properties (absorbable vs. non-absorbable), material types (natural vs. synthetic), and specialized designs like barbed sutures, microsutures, and gut sutures. These products cater to a wide range of wound types and clinical scenarios, ranging from minor lacerations to major surgeries including cardiovascular and colorectal interventions. With healthcare systems emphasizing efficiency, cost-effectiveness, and faster healing times, advanced sutures with superior handling and bio-compatibility are gaining traction.

Major Trends in the Market

-

Adoption of Barbed Sutures: Increasing usage of barbed sutures, especially in minimally invasive procedures, for their self-anchoring ability and reduced knotting time.

-

Surge in Outpatient Surgeries: A global shift toward outpatient care and ambulatory surgery centers, fueling demand for suture kits suitable for quick and efficient use.

-

Rising Demand for Biodegradable Sutures: Escalated interest in absorbable and biodegradable sutures due to their reduced risk of complications and avoidance of follow-up removal procedures.

-

Technological Advancements: Development of antimicrobial sutures and sutures embedded with drug-eluting agents to prevent infections and promote healing.

-

Customization and Precision: Growing preference for microsutures and specialty sutures tailored for delicate and precision-intensive procedures.

Report Scope of Suture Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 6.64 Billion |

| Market Size by 2034 |

USD 11.41 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Wound Type, End-use, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Medtronic; Lotus Surgicals Pvt Ltd; Dolphin Sutures; CONMED Corporation; Teleflex Incorporated;Ethicon (Johnson & Johnson Services, Inc.); Smith Nephew; Integra LifeSciences Corporation; Peter Surgical; Healthium Medtech Limited; Medline Industries, LP.; Dynarex Corporation; Corza Medical; Advanced Medical Solutions Group plc; Riverpoint Medical; B. Braun SE; Atramat; DemeTECH Corporation |

Key Market Driver: Rising Number of Surgical Procedures

A primary driver of the suture market is the increasing volume of surgical procedures worldwide. The surge is attributable to several interrelated factors: a growing global population, increasing life expectancy, and the corresponding rise in age-related ailments. Chronic conditions such as cardiovascular diseases, diabetes, and obesity often necessitate surgical intervention, including bypass surgeries, orthopedic procedures, and wound repair. In developing regions, improving access to surgical care is further expanding patient pools. For instance, the proliferation of universal health coverage and government-sponsored healthcare initiatives in countries like India and Brazil has enabled more citizens to undergo timely medical procedures. Consequently, the rising number of surgeries across various specialties is directly boosting suture consumption.

Key Market Restraint: Risk of Surgical Site Infections (SSIs)

Despite advancements in suture materials and sterilization techniques, the risk of surgical site infections (SSIs) remains a considerable restraint. Sutures, being foreign materials introduced into the body, can potentially harbor bacteria, particularly in immunocompromised patients or those undergoing prolonged procedures. The development of SSIs can result in extended hospital stays, additional surgical interventions, and even increased mortality. These complications not only place financial strain on healthcare systems but also reduce the desirability of certain suture types, particularly those not coated with antimicrobial agents. Furthermore, stringent regulatory requirements to ensure sterility and safety add to the cost burden on manufacturers, potentially limiting product accessibility in price-sensitive markets.

Market Opportunity: Growth of Minimally Invasive Surgeries

The increasing adoption of minimally invasive surgical (MIS) techniques presents a significant opportunity for the suture market. MIS procedures are favored for their reduced trauma, faster recovery times, and lower risk of infection. However, they demand highly specialized suturing solutions, such as barbed sutures and microsutures, that are compatible with laparoscopic tools and narrow working spaces. The rapid rise in cosmetic, bariatric, gynecologic, and urologic MIS procedures, particularly in developed markets like the U.S., Japan, and Germany, is creating robust demand for these advanced sutures. In response, manufacturers are investing in R&D to design ergonomic, efficient, and cost-effective sutures tailored to MIS needs, opening new revenue streams and enhancing product portfolios.

Segmental Analysis

Product Outlook

Surgical sutures dominated the market in 2024, accounting for the largest revenue share due to their widespread use across all types of surgical interventions. Within this category, non-absorbable sutures are preferred in procedures requiring prolonged wound support, such as cardiovascular and orthopedic surgeries. However, the absorbable suture segment is anticipated to grow at the fastest rate, driven by its application in internal tissue closures where removal is not feasible. These include obstetric and gynecological surgeries, colorectal procedures, and plastic surgeries. The rising preference for patient comfort and reduced follow-up visits makes absorbable sutures an increasingly popular choice.

Among barbed sutures, bi-directional types are expected to register the fastest growth owing to their superior wound closure efficiency and ease of application. In cosmetic surgery, for example, bi-directional barbed sutures reduce procedural time and improve outcomes by evenly distributing tension across the wound. Gut sutures, primarily used in internal surgeries and veterinary procedures, maintain a steady demand, while microsutures are gaining traction for their role in ophthalmic and neurosurgical applications. Their ability to enable high-precision wound closure makes them ideal for sensitive and intricate operations.

Wound Type Outlook

Acute wounds held the dominant share of the suture market in 2024. Surgical and procedural wounds, particularly from cardiovascular and gastrointestinal surgeries, constitute the majority within this segment. The increasing incidence of lifestyle-related disorders has led to a higher frequency of surgical interventions. Obstetrics/gynecology and plastic/reconstructive surgeries also contribute significantly, especially in countries with robust cosmetic surgery trends like South Korea and Brazil. On the other hand, chronic wounds are projected to witness the fastest growth. The diabetic foot ulcer subsegment, in particular, is expanding rapidly due to the global diabetes epidemic. As healthcare providers enhance focus on wound management and prevention of complications, demand for advanced suturing solutions in chronic care settings is expected to surge.

End-use Outlook

Hospitals and clinics represented the largest end-use segment in 2024, driven by their capability to manage both routine and complex surgical procedures. These facilities are often the first point of care for trauma cases and provide a comprehensive range of surgeries. However, Ambulatory Surgery Centers (ASCs) are projected to emerge as the fastest-growing segment. Their cost-efficiency, short turnaround times, and patient convenience are making them increasingly popular for elective surgeries and minor procedures. Additionally, long-term care and rehabilitation facilities, while currently niche, are seeing incremental demand as populations age and post-surgical care needs grow.

Distribution Channel Outlook

Institutional sales dominated the market due to the high-volume procurement models of hospitals and large healthcare systems. These bulk purchasing practices often benefit from supplier contracts, logistics integration, and pricing negotiations. Conversely, retail sales are anticipated to grow rapidly as more patients seek wound closure products for home care or minor outpatient procedures. The expansion of online medical supply platforms and direct-to-consumer models is enhancing accessibility and boosting retail channel revenues.

Regional Analysis

North America dominated the global suture market in 2024, accounting for the largest revenue share, largely attributed to its advanced healthcare infrastructure, high surgical volumes, and early adoption of innovative suture technologies. The U.S., in particular, benefits from strong investment in research, the presence of leading manufacturers like Johnson & Johnson and Medtronic, and favorable reimbursement policies. Additionally, an aging population and increasing cases of chronic diseases requiring surgical intervention support market growth in the region.

Asia Pacific is the fastest-growing region in the suture market, driven by burgeoning healthcare expenditures, rapid urbanization, and a growing medical tourism sector. Countries such as India, China, and Thailand are witnessing increased surgical volumes due to improvements in healthcare access and infrastructure. In India, for example, government initiatives like Ayushman Bharat are facilitating affordable surgeries for millions. Moreover, regional manufacturers are making strides in producing cost-effective and high-quality sutures, increasing domestic supply and export potential.

Some of The Prominent Players in The Suture Market Include:

- Medtronic

- Lotus Surgicals Pvt Ltd

- Dolphin Sutures

- CONMED Corporation

- Teleflex Incorporated.

- Ethicon (Johnson & Johnson Services, Inc.)

- Smith + Nephew

- Integra LifeSciences Corporation

- Peter Surgical

- Healthium Medtech Limited

- Medline Industries, LP.

- Dynarex Corporation

- Corza Medical

- Advanced Medical Solutions Group plc

- Riverpoint Medical

- B. Braun SE

- Atramat

- DemeTECH Corporation

Recent Developments

-

In March 2025, Johnson & Johnson Ethicon announced the launch of a new range of barbed sutures designed for laparoscopic hysterectomies, which reduce closure time by nearly 40%.

-

February 2025 saw Medtronic expanding its suturing product line with absorbable antimicrobial sutures in the European market, aiming to reduce SSIs.

-

In January 2025, B. Braun entered into a strategic partnership with a Korean biotech firm to develop drug-eluting suture technologies for chronic wound care.

-

November 2024 marked the FDA approval for Teleflex’s next-generation micro suture system designed for neurovascular and ophthalmic applications.

-

October 2024, Smith & Nephew launched an educational campaign in Latin America to promote awareness of wound management practices and advanced suturing techniques among rural surgeons.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

-

- Absorbable

- Non-Absorbable

- Barbed Suture (only Absorbable)

-

- Uni-directional barbed suture

- Bi-directional barbed suture

By Wound Type

-

-

- Obstetrics / Gynecology

- Colorectal

- Cardiovascular

- Bariatric and Upper GI

- Plastic and Reconstructive Surgery

- Urology

- Hepato-pancreato-biliary (HPB)

- Dermatology

-

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

By End-use

- Hospitals and Clinics

- Ambulatory Surgery Center (ASC)

- Long-term Care Facilities

- Inpatient Rehabilitation Facility (IRF)

- Skilled Nursing Facility (SNF)

- Others

By Distribution Channel

- Institutional Sales

- Retail Sales

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)