Switzerland Healthcare & Medical Tourism Market Size and Trends

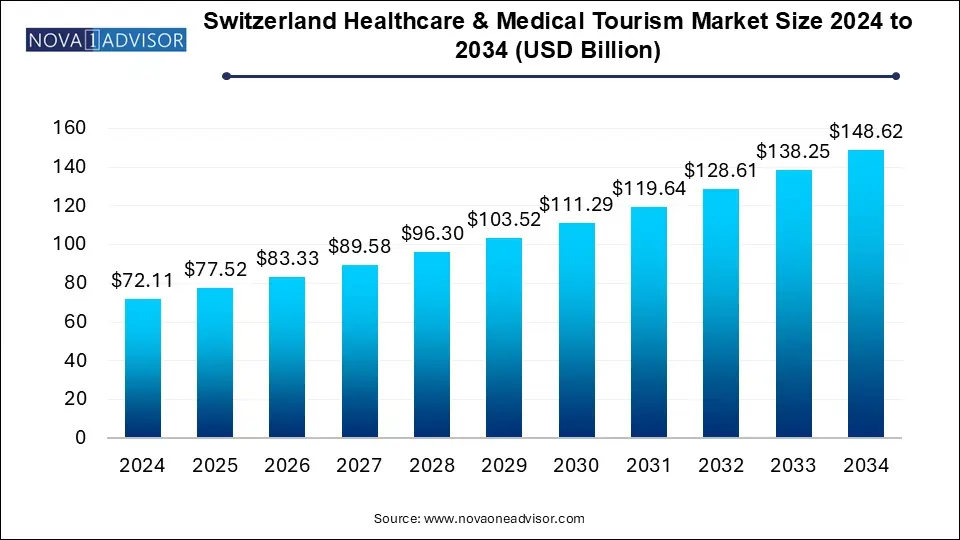

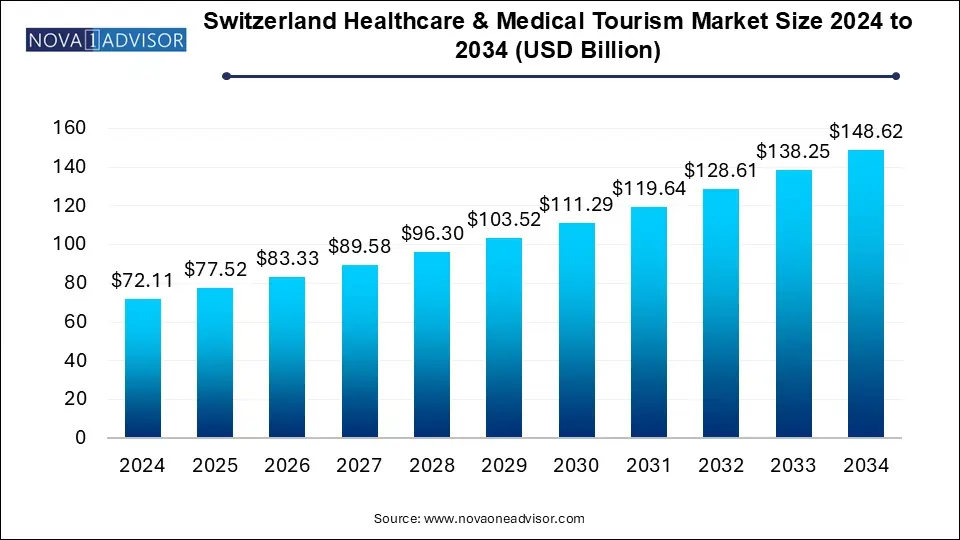

The Switzerland healthcare & medical tourism market size was exhibited at USD 72.11 billion in 2024 and is projected to hit around USD 148.62 billion by 2034, growing at a CAGR of 7.5% during the forecast period 2025 to 2034.

Switzerland Healthcare & Medical Tourism Market Key Takeaways:

- In terms of end-use, the public care segment held the largest revenue share of 73.7% in 2024.

- The private care segment is anticipated to grow at the fastest CAGR of 8.1% during the forecast period.

- In terms of service, the radiology segment held the largest revenue share of 25.0% in 2024.

- The cardiovascular treatment segment is anticipated to register the fastest CAGR of 8.8% over the forecast period.

Market Overview

Switzerland, a country synonymous with precision, quality, and luxury, has steadily evolved into one of the most sought-after destinations for healthcare and medical tourism. Its globally recognized healthcare system backed by cutting-edge technology, a highly skilled workforce, and exceptional infrastructure has positioned the country at the forefront of both curative and preventive medical care. Over the last decade, the Swiss medical tourism industry has flourished, attracting a growing number of affluent international patients seeking world-class care in a serene, private, and secure environment.

The Swiss healthcare system is a hybrid public-private model with universal coverage, offering a high standard of services across both ends of the spectrum. For international patients, private clinics and specialized institutions cater to everything from complex surgeries to wellness retreats. Switzerland’s clean environment, political stability, efficient transport networks, multilingual medical professionals, and short waiting times create an ideal blend of accessibility and comfort for medical travelers. Moreover, Swiss hospitality and wellness are seamlessly integrated into healthcare offerings, often combining post-treatment rehabilitation with luxury stays and holistic healing experiences.

Medical tourists from Russia, the Middle East, China, and European neighbors such as Germany and the United Kingdom frequently travel to Switzerland for procedures like cardiovascular treatments, orthopedic surgeries, oncology diagnostics, aesthetic surgeries, and fertility services. These patients are drawn not only by clinical expertise but also by the personalized, discreet service that Swiss providers are known for. The recent surge in interest for wellness-integrated medicine, anti-aging therapy, and regenerative treatments has added a new layer of dynamism to this market.

Even as global competition intensifies in the healthcare tourism sector, Switzerland’s commitment to quality over quantity—underscored by strict medical regulations and a patient-centric approach sets it apart. The government supports high regulatory standards while allowing private medical facilities to offer a luxury-driven experience, reinforcing Switzerland’s dual identity as a destination for both elite care and advanced medical treatment.

Major Trends in the Market

-

Rising Demand for Aesthetic and Anti-aging Treatments: Swiss clinics offering plastic surgery, cosmetic dermatology, and anti-aging cell therapies have become popular among global elites.

-

Integration of Wellness Tourism and Preventive Care: Medical facilities increasingly offer detox, nutrition counseling, and spa therapies alongside diagnostics and surgical interventions.

-

High Influx of Middle Eastern and Russian Patients: Political instability and lower healthcare standards in some regions are driving affluent patients to Switzerland for safety and privacy.

-

Growth in Fertility and IVF Services: As Europe’s regulations vary on reproductive treatment, Switzerland is becoming a preferred location for legal and ethical fertility solutions.

-

Digital Health and Teleconsultation Expansion: Swiss hospitals and clinics are leveraging telemedicine for pre- and post-treatment care to improve continuity for international patients.

-

Personalized Medicine and Genomics: Institutions like the University Hospital of Zurich are pioneering patient-specific treatment protocols, particularly in oncology and cardiology.

-

Post-Pandemic Focus on Immune Health and Longevity: Interest in immune diagnostics, stem cell therapy, and biologically personalized rejuvenation programs has surged post-COVID-19.

Report Scope of Switzerland Healthcare & Medical Tourism Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 77.52 Billion |

| Market Size by 2034 |

USD 148.62 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

End-use, Service |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Klinik Hirslanden; Swiss Medica XXI Century S.A.; Biologic Aesthetic Dentalcare; Berit Klinik; Clinique de Genolier; Clinique de Montchoisi; Hirslanden Clinique Cecil; Private Clinic Mentalva; Rehabilitation Clinic Zihlschlacht; Grand Resort Bad Ragaz; Clinica Sant’Anna; The Waldhotel; Swiss Medical Network; The Swiss Leading Hospital; Privatklinik Hohenegg AG; Klinik Im Park; Private Clinic Meiringen; Hirslanden Klinik Aarau; Pyramide am See Clinic; Salem-Spital; Schmerzklinik Basel; Klinik Beau-Site; Clinique La Colline; SW!SS REHA; Berit Klinik; BESAS Bern Hospital Center for Geriatric Medicine; cereneo Schweiz AG; CLINIC BAD RAGAZ; LEUKERBAD CLINIC; Clinique de Maisonneuve; Clinique Valmont; Hochgebirgsklinik Davos; Hof Weissbad AG; Klinik Schloss Mammern; Oberwaid AG; Rehaklinik Dussnang AG; Salina Rehabilitation Clinic |

Market Driver: Reputation for Excellence and Patient Confidentiality

Switzerland’s most prominent driver in the medical tourism sector is its unwavering reputation for clinical excellence and patient confidentiality. The country has long been known for its top-ranking hospitals, exemplary medical universities, and intensive research culture. Institutions such as University Hospital Zurich, Klinik Hirslanden, and Clinique Générale-Beaulieu are equipped with advanced robotic systems, imaging technology, and minimally invasive surgical tools, attracting patients seeking highly specialized or complex procedures.

Moreover, Swiss clinics are trusted for their commitment to discretion and privacy. High-profile patients, including celebrities, royalty, and political figures, favor Switzerland for its secure and anonymous treatment arrangements. Many clinics offer private entrances, personalized patient management, multilingual staff, and tailored treatment protocols. The professionalism and neutrality inherent in Swiss culture extend into the healthcare experience, reinforcing patient trust.

Market Restraint: High Cost of Treatment and Travel

Despite the prestige and quality associated with Swiss healthcare, its premium pricing is a key market restraint. Switzerland is consistently ranked as one of the most expensive countries globally, and its healthcare services are no exception. While the domestic population benefits from regulated insurance coverage, foreign patients often bear the full brunt of costs for consultations, diagnostics, surgeries, and recovery programs.

The high cost of accommodation, travel, and support services especially in peak tourism seasons can be prohibitive for middle-income international patients. While elite clients may not be deterred by cost, this restricts the broader growth potential of the market. In comparison, countries like Turkey, Thailand, and India offer similar procedures at a fraction of the price, albeit with differing quality standards. Unless Swiss providers innovate with flexible pricing, financing options, or international partnerships, affordability will remain a challenge.

Market Opportunity: Growth in Regenerative and Preventive Medicine

One of the most promising opportunities lies in Switzerland’s burgeoning role as a global hub for regenerative and preventive medicine. Swiss clinics have been pioneers in longevity science, cell-based therapy, and personalized healthcare programs aimed at early disease detection and biological rejuvenation. Institutions like Clinique La Prairie and Swiss Medica attract ultra-high-net-worth individuals with treatments including stem cell therapy, telomere diagnostics, mitochondrial optimization, and immune profiling.

With rising global awareness around preventive health—especially in the wake of the COVID-19 pandemic—international patients are increasingly willing to invest in proactive treatment strategies that go beyond curing disease. Switzerland’s reputation for scientific rigor, coupled with a luxurious hospitality framework, makes it uniquely positioned to lead this segment. Cross-disciplinary collaborations between biotech firms, research universities, and elite clinics are expected to fuel innovation in this field, unlocking a high-margin, low-competition market.

Switzerland Healthcare & Medical Tourism Market By End-use Insights

Private care dominates the Swiss healthcare and medical tourism market, catering to the affluent international clientele who demand exclusivity, comfort, and rapid access to medical services. Private hospitals and specialty clinics offer premium experiences with concierge services, private suites, multilingual staff, and personalized treatment schedules. These institutions focus on high-complexity areas like neurosurgery, oncology, orthopedic procedures, and regenerative medicine. Clinics such as Klinik Hirslanden and Clinique Générale-Beaulieu have invested heavily in robotics, AI diagnostics, and hybrid operating theaters to maintain leadership in this segment.

On the other hand, public care is the fastest-growing segment, driven by efforts to integrate international patients into university-affiliated hospitals and centers of excellence. Many public institutions, such as the University Hospital of Geneva, are offering international medical tourism programs with transparent pricing, fixed treatment packages, and English-language support. These public facilities provide an ideal balance of affordability and advanced care, particularly in cardiovascular surgery, cancer therapy, and transplant services. Public hospitals are increasingly partnering with government tourism and trade bodies to promote medical tourism services to broader markets.

Switzerland Healthcare & Medical Tourism Market By Service Insights

Aesthetic medicine dominates the Swiss medical tourism market, fueled by demand from high-net-worth individuals seeking facial rejuvenation, plastic surgery, anti-aging cell therapies, and dermatological enhancements. Switzerland is home to several globally renowned aesthetic clinics offering procedures like rhinoplasty, facelifts, liposuction, and hair transplantation, often integrated with post-operative wellness programs. The discretion and privacy available in the Swiss healthcare system attract international celebrities and professionals who seek discreet enhancements.

Fertility and gynecology treatments are emerging as the fastest-growing segment, driven by rising infertility rates, progressive regulations, and the high success rates of Swiss IVF programs. International patients—especially from countries with restrictive reproductive laws are turning to Switzerland for access to fertility preservation, egg donation (within legal limits), and hormone therapy. Specialized centers provide cutting-edge diagnostics, embryo freezing, and minimally invasive surgical interventions in combination with holistic care. This segment is expected to witness double-digit growth as awareness and accessibility expand.

Country-Level Analysis

Switzerland represents a unique healthcare ecosystem that combines clinical excellence with elite hospitality. The country boasts more than 280 hospitals and clinics, many of which cater specifically to international patients. The Swiss government supports stringent quality control and accreditation measures, and the country is consistently ranked among the best in terms of health outcomes, life expectancy, and patient satisfaction.

Major cities such as Zurich, Geneva, and Lausanne act as central hubs for medical tourism, offering a blend of world-class hospitals, luxury accommodation, and multilingual services. The Swiss franc’s strength and the high cost of operations may limit price competitiveness, but these are offset by the promise of top-tier service. Switzerland’s Schengen membership also facilitates visa access for many international patients, making travel logistics relatively straightforward.

Moreover, Switzerland’s positioning as a neutral and politically stable country enhances its appeal for patients from volatile regions. Hospitals are increasingly collaborating with diplomatic missions, international insurance providers, and concierge firms to streamline the patient journey. As global healthcare trends shift toward personalized and preventive care, Switzerland’s fusion of science, privacy, and luxury will remain a compelling draw for discerning medical travelers.

Some of the prominent players in the Switzerland healthcare & medical tourism market include:

- Klinik Hirslanden

- Swiss Medica XXI Century S.A.

- Biologic Aesthetic Dentalcare

- Berit Klinik

- Clinique de Genolier

- Clinique de Montchoisi

- Hirslanden Clinique Cecil

- Private Clinic Mentalva

- Rehabilitation Clinic Zihlschlacht

- Grand Resort Bad Ragaz

- Clinica Sant’Anna

- The Waldhotel

- Swiss Medical Network

- The Swiss Leading Hospital

- Privatklinik Hohenegg AG

- Klinik Im Park

- Private Clinic Meiringen

- Hirslanden Klinik Aarau

- Pyramide am See Clinic

- Salem-Spital

- Schmerzklinik Basel

- Klinik Beau-Site

- Clinique La Colline

- SW!SS REHA

- Berit Klinik

- BESAS Bern Hospital Center for Geriatric Medicine

- Cereneo Schweiz AG

- CLINIC BAD RAGAZ

- LEUKERBAD CLINIC

- Clinique de Maisonneuve

- Clinique Valmont

- Hochgebirgsklinik Davos

- Hof Weissbad AG

- Klinik Schloss Mammern

- Oberwaid AG

- Rehaklinik Dussnang AG

- Salina Rehabilitation Clinic

Recent Developments

-

In March 2025, Clinique La Prairie announced a strategic partnership with a biotech firm to enhance its longevity and cell therapy programs, incorporating AI-based health tracking and metabolic age assessments.

-

In January 2025, Swiss Medica launched a new regenerative therapy program combining stem cell infusion with genetic testing to tailor immune and anti-inflammatory responses.

-

In November 2024, Klinik Hirslanden opened a state-of-the-art robotic surgery center specializing in complex neurosurgical and spinal procedures, attracting patients from the Middle East and Central Asia.

-

In October 2024, the University Hospital of Zurich introduced a multilingual medical concierge program aimed at improving the patient journey for international patients seeking cancer and cardiovascular care.

-

In August 2024, the Swiss government approved tax incentives for luxury clinics investing in sustainable healthcare infrastructure, supporting eco-certified wellness and medical tourism facilities.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Switzerland healthcare & medical tourism market

By End-use

By Service

- Radiology

- Orthopedics

- Aesthetic Medicine

- Cardiovascular Treatment

- Pain Management

- Fertility And Gynecology Treatment

- Gastroenterology

- Dental Treatment

- Others