Synthetic Biology Market Size and Research 2026 to 2035

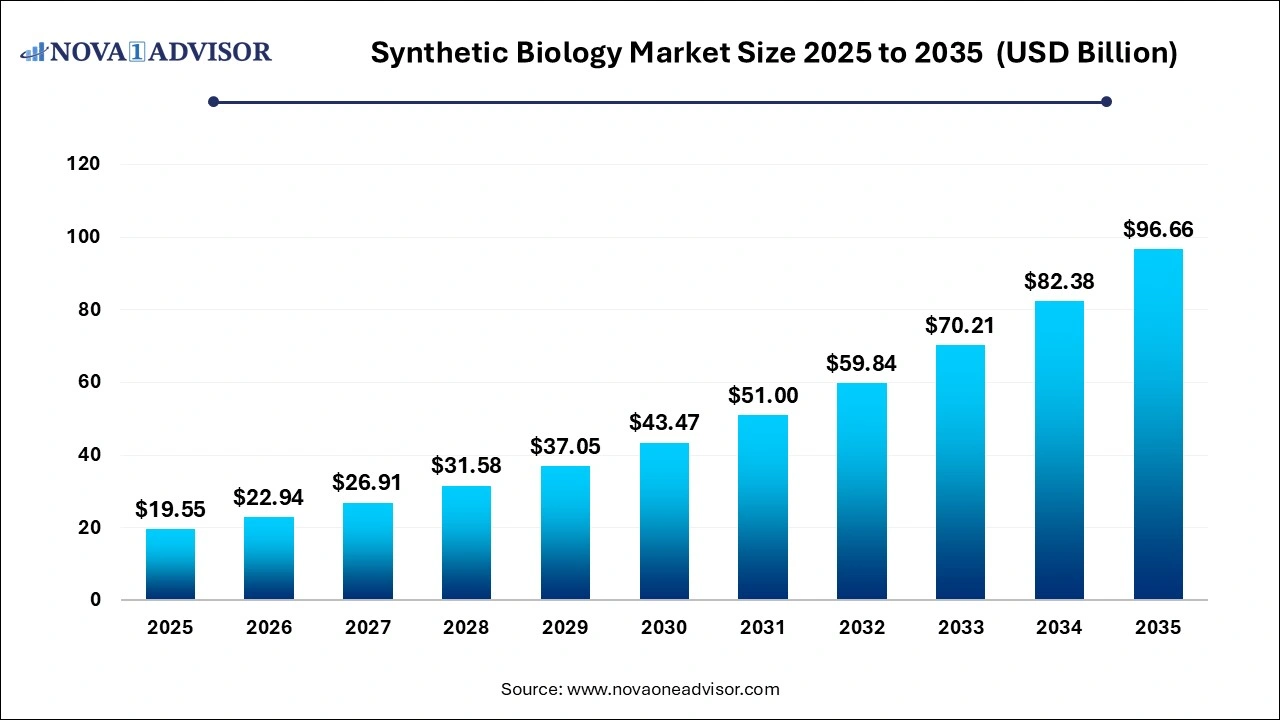

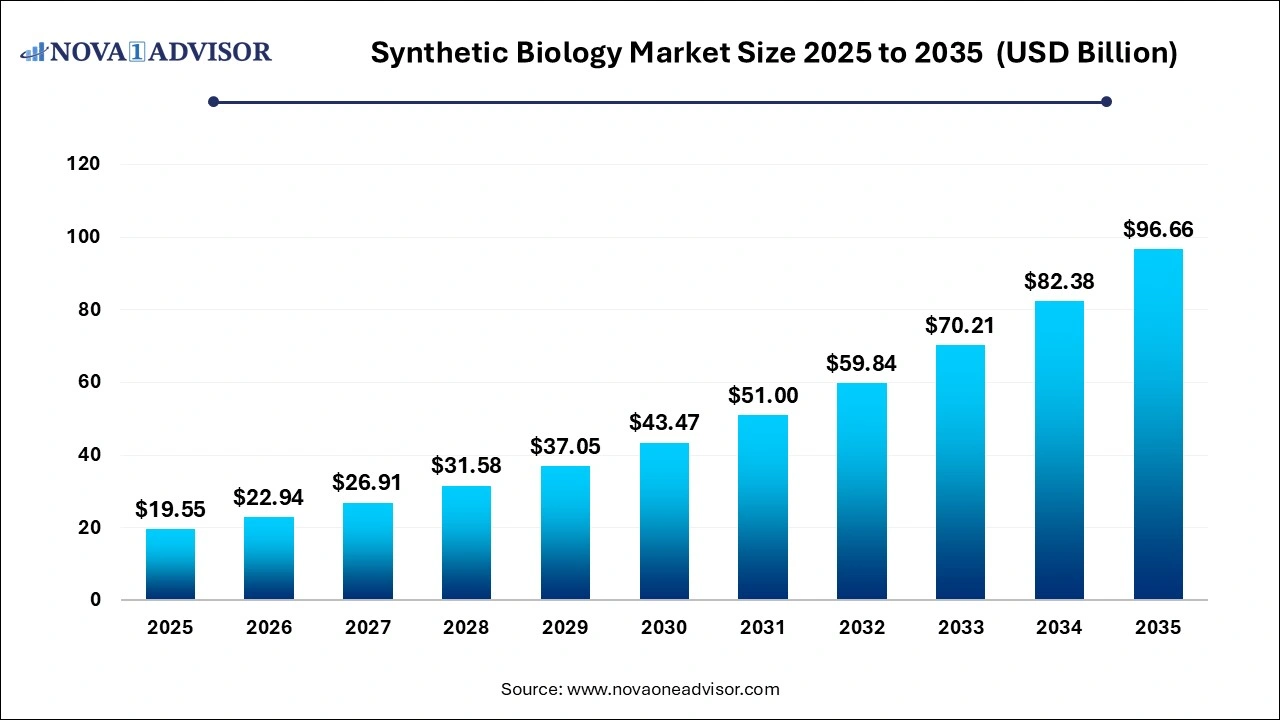

The synthetic biology market size was exhibited at USD 19.55 billion in 2025 and is projected to hit around USD 96.66 billion by 2035, growing at a CAGR of 17.33% during the forecast period 2026 to 2035. The market is growing due to increasing demand for engineered organisms in healthcare, agriculture, and industrial biotech. Advances in gene editing and automation are also accelerating innovation and commercial adoption.

Synthetic Biology Market Key Takeaways:

- North America dominated the synthetic biology market with the revenue shares in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the enzymes segment held the largest market share in 2025.

- By product, the cloning technologies kits segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the healthcare segment dominated the market with a major revenue share in 2025.

- By application, the non-healthcare segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the PCR segment held the highest market share in 2025.

- By technology, the genome editing technology segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end use, the biotechnology and pharmaceutical companies segment held the highest revenue shares in 2025.

- By end use, the academic and research institutes segment is expected to grow at the fastest CAGR in the market during the forecast period.

How Synthetic Biology Market Evolving?

Synthetic biology is the interdisciplinary field that designs and constructs new biological parts, systems, or organisms, or reprograms existing ones, to perform useful functions. The synthetic biology market is evolving through the integration of AI, machine learning, and high-throughput screening to accelerate biology design and optimization. Emerging sectors like biofuels, bioplastics, and personalized medicine are expanding commercial opportunities. Strategic partnerships, government funding, and increasing adoption of synthetic biology in research and industrial applications are driving growth. Additionally, improvements in DNA synthesis, cell-free systems, and biosafety measures are enabling faster development cycles, making the market more innovative, scalable, and resilient globally.

- For Instance, In January 2024, Rice University established the Rice Synthetic Biology Institute to promote collaborative research and advance the development of synthetic biology technologies for societal benefits.

What are the Key trends in the Synthetic Biology Market in 2024?

- In June 2024, Rice University partnered with the University of Texas MD Anderson Cancer Center to create advanced bioengineering solutions aimed at enhancing cancer research, diagnosis, and treatment.

- In March 2024, Pearl Bio entered a $1 billion partnership with Merck to develop biologic therapies using non-standard amino acids. The collaboration centers on advancing cancer treatments by utilizing Pearl’s proprietary GRO technology.

How Can AI Affect the Synthetic Biology Market?

AI is transforming the market by accelerating gene design, protein engineering, and metabolic pathway optimization through predictive modeling. It reduces trial-and-error in experiments, cutting development costs and timelines. AI-driven platforms also enhance data analysis from high-throughput screening, enabling precise modifications and scalable production. Moreover, the integration of AI with automation and robotics supports rapid prototyping of bio-based products, driving innovation in healthcare, agriculture, and industrial biotech, ultimately making synthetic biology more efficient and commercially viable.

Report Scope of Synthetic Biology Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 22.94 Billion |

| Market Size by 2035 |

USD 96.66 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 17.33% |

| Base Year |

2024 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, Technology, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Bota Biosciences Inc., Codexis, Inc., Creative Biogene, CREATIVE ENZYMES, Enbiotix, Inc., Illumina, Inc., Merck KGaA (Sigma-Aldrich Co. LLC), New England Biolabs, Eurofins Scientific, Novozymes, Pareto Bio, Inc., Scarab Genomics, LLC, Synthego, Synthetic Genomics Inc., Thermo Fisher Scientific, Inc. |

Synthetic Biology Market Dynamics

Driver

Rising demand for sustainable and Eco-friendly Bio-based Products

The push for eco-friendly alternatives is driving the synthetic biology market as companies explore engineered microbes and enzymes for waste reduction, carbon capture, and sustainable food production. Beyond replacing traditional materials, synthetic biology enables innovations like lab-grown meat, biodegradable textiles, and greener fertilizers. Supportive policies and corporate sustainability goals are further accelerating adoption. This shift positions synthetic biology as a critical tool for building circular economies, reducing dependence on finite resources, and creating environmentally responsible industrial solutions.

- For Instance, In April 2024, Australian cultured meat company Vow began selling its first commercially approved cultured product, Forged Parfait, made from Japanese quail cells in Singapore, following regulatory authorization.

Restraint

Biosafety and Biosecurity Concerns

Biosafety and biosecurity concerns are restraining the synthetic biology market as global agencies focus on preventing dual-use risks, where technologies could be exploited for harmful purposes. Increasing debates around ethical responsibility, secure data handling, and controlled access to genetic tools are adding regulatory complexity. Companies face delays due to stringent approval processes and higher compliance costs. Moreover, international variations in biosafety standards create barriers to global collaboration, slowing the pace of innovation and market expansion in synthetic biology.

Opportunity

Development of Personalized and Precision Medicine

Personalized and precision medicine offer a strong future opportunity in the synthetic biology market as they support the development of advanced diagnostic tools and targeted drug delivery systems. By engineering biosensors and programmable therapies, synthetic biology can enable early disease detection and real-time monitoring of patient responses. This approach not only improves treatment effectiveness but also reduces healthcare costs on preventive care and tailored health solutions. Synthetic biology is well-positioned to reshape modern medicine.

- For Instance, In September 2024, the Wyss Institute (Harvard), with MIT and the University of Edinburgh, unveiled a synthetic biology platform for binding-activated fluorescent biosensors. These nanosensors rapidly light up up to 100-fold when detecting specific proteins or biomarkers, enabling faster and more precise diagnostics.

Segmental Insights

How will the Enzymes Segment dominate the Synthetic Biology Market in 2025?

The enzymes segment dominated the market in 2025 as continuous innovation led to the creation of novel enzymes with unique catalytic properties. These enzymes are increasingly used in complex drug formulations, advanced diagnostics, and specialty chemicals. Growing investment in enzyme engineering has also expanded its role in niche applications such as rare disease therapies and biosensor development. This diversification beyond traditional industrial uses strengthened their market presence, making enzymes a central driver of synthetic biology’s commercial success.

The cloning technologies kits segment is set to witness the fastest growth as they enable researchers to explore advanced applications like pathway engineering, synthetic gene assembly, and creation of novel biomolecules. Their expanding use in agricultural biotech, vaccine development, and microbial engineering adds to their appeal. Additionally, the growing availability of cost-effective, ready-to-use kits tailored for high-throughput studies is boosting accessibility for both small labs and large institutions, positioning this segment for strong market momentum in the coming years.

Why Did the Healthcare Segment Dominate the Market in 2025?

The healthcare segment led the market in 2025 as hospitals and research institutes increasingly integrated biosensors, synthetic vaccines, and engineered biomaterials into clinical use. Rising adoption of synthetic biology for regenerative medicine, tissue engineering, and drug screening expanded its applications beyond conventional therapeutics. Moreover, growing collaborations between biotech firms and healthcare providers accelerated the commercialization of synthetic biology solutions, reinforcing healthcare’s position as the highest revenue-generating application segment during the year.

The non-healthcare segment is projected to expand at the fastest CAGR as synthetic biology is increasingly applied in sectors such as textiles, cosmetics, and industrial manufacturing. Engineered organisms are enabling the creation of novel dyes, fragrances, and specialty chemicals with improved performance and reduced environmental impact. Additionally, the rise of circular economy initiatives and corporate sustainability commitments is pushing industries to adopt bio-based alternatives, positioning synthetic biology as a transformative tool for innovation and growth outside traditional healthcare markets.

How does the PCR Segment Dominate the Synthetic Biology Market?

In 2025, the PCR segment dominated the market as it became central to high-throughput applications like pathway optimization, synthetic gene assembly, and microbial strain development. Its integration with digital platforms and miniaturized devices improved scalability and accessibility, expanding use beyond research labs into industrial and field settings. Moreover, the rising need for rapid, accurate analysis in agricultural biotech, environmental monitoring, and food safety reinforced PCR’s dominance, ensuring its position as the leading technology in the market.

The genome editing technology segment is projected to record the fastest growth as it moves beyond traditional research into real-world applications such as xenotransplantation, synthetic vaccines, and bioremediation. Growing collaborations between biotech firms and agricultural industries are enabling tailored genetic solutions for food security and climate resilience. At the same time, continuous innovation in delivery systems and multiplex editing is expanding its scope. These advancements are positioning genome editing as a transformative tool, fueling rapid adoption across multiple non-conventional sectors.

How will the Biotechnology and Pharmaceutical Companies Segment dominate the Market in 2025?

In 2025, the biotechnology and pharmaceutical companies segment dominated the synthetic biology market revenues as they increasingly integrated synthetic biology into biomanufacturing processes, enabling large-scale production of enzymes, antibodies, and cell-based products. These firms leveraged synthetic pathways to reduce costs, improve yields, and shorten development timelines. Moreover, the adoption of synthetic biology for precision diagnostics, biomarker discovery, and advanced clinical testing further strengthened their market position, ensuring they remained the primary beneficiaries of synthetic biology’s commercial applications.

The academic and research institute segment is projected to grow at the fastest CAGR as these institutions are becoming hubs for developing open-source tools, shared biorepositories, and community-driven innovation in synthetic biology. The rise of multidisciplinary research centers combining biology, engineering, and computational sciences is expanding capabilities. Furthermore, increased participation in global consortia and international projects is enhancing access to advanced technologies and infrastructure, positioning academia as a key driver of cutting-edge discoveries and future market advancements.

Regional Insights

How is North America contributing to the Expansion of the Synthetic Biology Market?

North America led the market in 2025 as the region witnessed rapid scaling of biomanufacturing facilities and strong integration of automation, AI, and robotics into biological research. Expanding applications in non-healthcare areas like sustainable materials, biofuels, and food technology further boosted market revenues. Moreover, a thriving start-up ecosystem supported by venture capital funding and active partnerships with global players positioned North America as a frontrunner in advancing synthetic biology commercialization and large-scale deployment.

How is Asia-Pacific Accelerating the Synthetic Biology Market?

Asia-Pacific is set to record the fastest CAGR in the market as countries in the region are prioritizing bioeconomy strategies and integrating synthetic biology into national development plans. Expanding cross-border collaborations, technology transfer initiatives, and the establishment of dedicated innovation clusters are strengthening regional capabilities. Moreover, rising demand for alternative proteins, eco-friendly materials, and precision agriculture solutions is creating new commercial opportunities, making the Asia-Pacific a dynamic hotspot for future synthetic biology advancements and market expansion.

Some of the prominent players in the synthetic biology market include:

Synthetic Biology Market Recent Developments

- In November 2024, Asymchem’s Center of Synthetic Biology Technology introduced STAR, an AI-powered platform designed to overcome major challenges in protein design. (Source: https://www.businesswire.com/)

- In March 2024, Strand Therapeutics created a new class of mRNA molecules that deliver immune signals within tumors, activating the body’s immune system to target and destroy the cancer cells. (Source: https://pharmatimes.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the synthetic biology market

By Product

- Oligonucleotide/Oligo Pools and Synthetic DNA

- Enzymes

- Cloning Technologies Kits

- Xeno-Nucleic Acids

- Chassis Organism

By Technology

- NGS Technology

- PCR Technology

- Genome Editing Technology

- Bioprocessing Technology

- Other Technologies

By Application

-

- Biotech Crops

- Specialty Chemicals

- Bio-fuels

- Others

By End Use

- Biotechnology and Pharmaceutical companies

- Academic and Research Institutes

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

-

Table 1: U.S. Synthetic Biology Market, by Product, 2024–2034

-

Table 2: U.S. Synthetic Biology Market, by Technology, 2024–2034

-

Table 3: U.S. Synthetic Biology Market, by Application, 2024–2034

-

Table 4: U.S. Synthetic Biology Market, by End Use, 2024–2034

-

Table 5: Canada Synthetic Biology Market, by Product, 2024–2034

-

Table 6: Canada Synthetic Biology Market, by Technology, 2024–2034

-

Table 7: Canada Synthetic Biology Market, by Application, 2024–2034

-

Table 8: Canada Synthetic Biology Market, by End Use, 2024–2034

-

Table 9: Mexico Synthetic Biology Market, by Product, 2024–2034

-

Table 10: Mexico Synthetic Biology Market, by Technology, 2024–2034

-

Table 11: Mexico Synthetic Biology Market, by Application, 2024–2034

-

Table 12: Mexico Synthetic Biology Market, by End Use, 2024–2034

-

Table 13: Germany Synthetic Biology Market, by Product, 2024–2034

-

Table 14: Germany Synthetic Biology Market, by Technology, 2024–2034

-

Table 15: Germany Synthetic Biology Market, by Application, 2024–2034

-

Table 16: Germany Synthetic Biology Market, by End Use, 2024–2034

-

Table 17: France Synthetic Biology Market, by Product, 2024–2034

-

Table 18: France Synthetic Biology Market, by Technology, 2024–2034

-

Table 19: France Synthetic Biology Market, by Application, 2024–2034

-

Table 20: France Synthetic Biology Market, by End Use, 2024–2034

-

Table 21: UK Synthetic Biology Market, by Product, 2024–2034

-

Table 22: UK Synthetic Biology Market, by Technology, 2024–2034

-

Table 23: UK Synthetic Biology Market, by Application, 2024–2034

-

Table 24: UK Synthetic Biology Market, by End Use, 2024–2034

-

Table 25: Italy Synthetic Biology Market, by Product, 2024–2034

-

Table 26: Italy Synthetic Biology Market, by Technology, 2024–2034

-

Table 27: Italy Synthetic Biology Market, by Application, 2024–2034

-

Table 28: Italy Synthetic Biology Market, by End Use, 2024–2034

-

Table 29: Rest of Europe Synthetic Biology Market, by Segments, 2024–2034

-

Table 30: China Synthetic Biology Market, by Product, 2024–2034

-

Table 31: China Synthetic Biology Market, by Technology, 2024–2034

-

Table 32: China Synthetic Biology Market, by Application, 2024–2034

-

Table 33: China Synthetic Biology Market, by End Use, 2024–2034

-

Table 34: Japan Synthetic Biology Market, by Product, 2024–2034

-

Table 35: Japan Synthetic Biology Market, by Technology, 2024–2034

-

Table 36: Japan Synthetic Biology Market, by Application, 2024–2034

-

Table 37: Japan Synthetic Biology Market, by End Use, 2024–2034

-

Table 38: South Korea Synthetic Biology Market, by Product, 2024–2034

-

Table 39: South Korea Synthetic Biology Market, by Technology, 2024–2034

-

Table 40: South Korea Synthetic Biology Market, by Application, 2024–2034

-

Table 41: South Korea Synthetic Biology Market, by End Use, 2024–2034

-

Table 42: India Synthetic Biology Market, by Product, 2024–2034

-

Table 43: India Synthetic Biology Market, by Technology, 2024–2034

-

Table 44: India Synthetic Biology Market, by Application, 2024–2034

-

Table 45: India Synthetic Biology Market, by End Use, 2024–2034

-

Table 46: Southeast Asia Synthetic Biology Market, by Segments, 2024–2034

-

Table 47: Rest of Asia Pacific Synthetic Biology Market, by Segments, 2024–2034

-

Table 48: Brazil Synthetic Biology Market, by Product, 2024–2034

-

Table 49: Brazil Synthetic Biology Market, by Technology, 2024–2034

-

Table 50: Brazil Synthetic Biology Market, by Application, 2024–2034

-

Table 51: Brazil Synthetic Biology Market, by End Use, 2024–2034

-

Table 52: Rest of Latin America Synthetic Biology Market, by Segments, 2024–2034

-

Table 53: GCC Countries Synthetic Biology Market, by Product, 2024–2034

-

Table 54: GCC Countries Synthetic Biology Market, by Technology, 2024–2034

-

Table 55: GCC Countries Synthetic Biology Market, by Application, 2024–2034

-

Table 56: GCC Countries Synthetic Biology Market, by End Use, 2024–2034

-

Table 57: Turkey Synthetic Biology Market, by Segments, 2024–2034

-

Table 58: Africa Synthetic Biology Market, by Segments, 2024–2034

-

Table 59: Rest of MEA Synthetic Biology Market, by Segments, 2024–2034

-

Figure 1: U.S. Synthetic Biology Market Share, by Product, 2024–2034

-

Figure 2: U.S. Synthetic Biology Market Share, by Technology, 2024–2034

-

Figure 3: U.S. Synthetic Biology Market Share, by Application, 2024–2034

-

Figure 4: U.S. Synthetic Biology Market Share, by End Use, 2024–2034

-

Figure 5: Canada Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 6: Mexico Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 7: Germany Synthetic Biology Market Share, by Product, 2024–2034

-

Figure 8: France Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 9: UK Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 10: Italy Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 11: China Synthetic Biology Market Share, by Product, 2024–2034

-

Figure 12: Japan Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 13: South Korea Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 14: India Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 15: Brazil Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 16: GCC Countries Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 17: Turkey Synthetic Biology Market Share, by Segments, 2024–2034

-

Figure 18: Africa Synthetic Biology Market Share, by Segments, 2024–2034