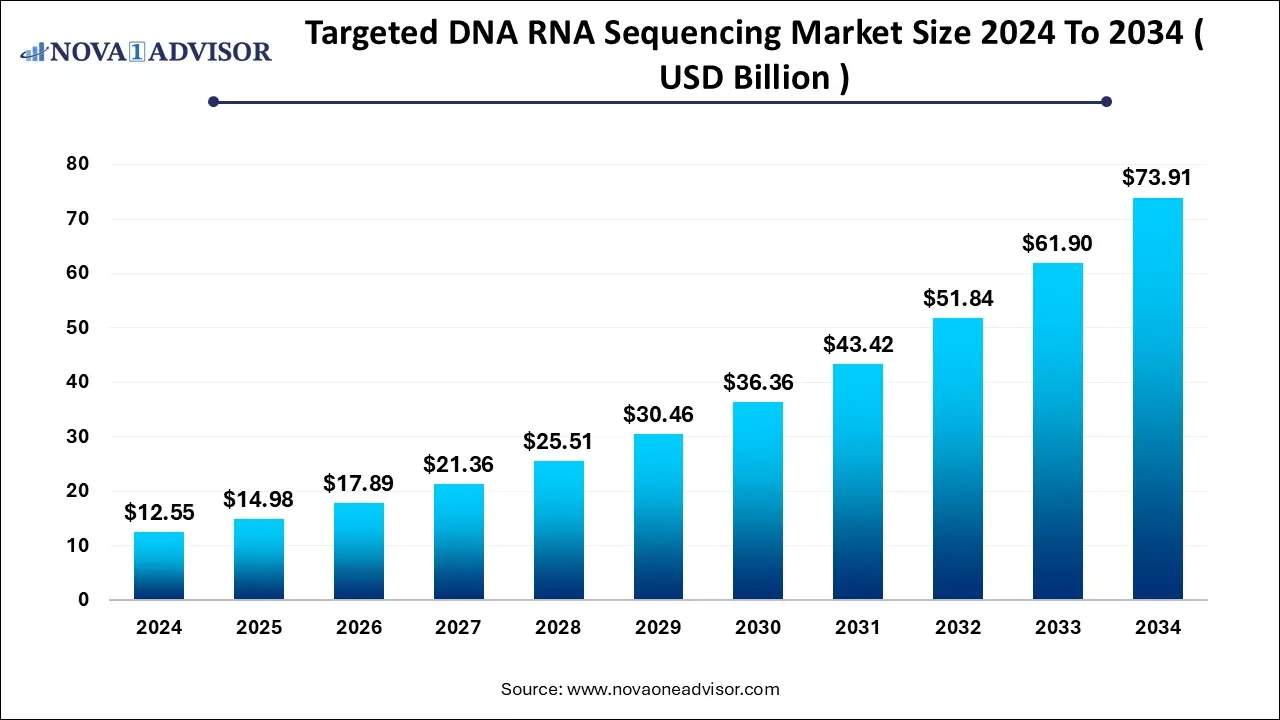

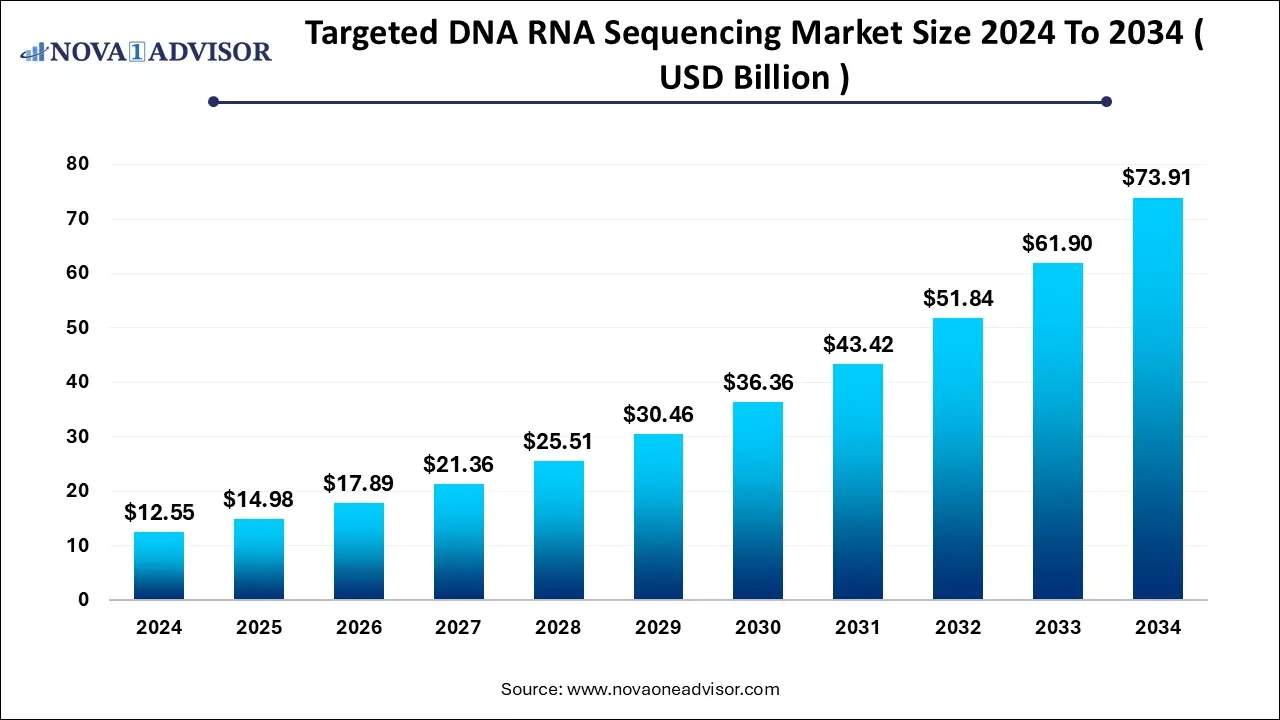

Targeted DNA RNA Sequencing Market Size and Forecast 2025 to 2034

The global targeted DNA RNA sequencing market size was valued at USD 12.55 billion in 2024 and is anticipated to reach around USD 73.91 billion by 2034, growing at a CAGR of 19.4% from 2025 to 2034. The targeted DNA RNA sequencing market growth can be linked to the rising cases of genetic disorders, reduced sequencing costs, focus on personalized medicine, and increased R&D activities. Widespread adoption of next-generation sequencing (NGS) technologies is expanding applications in biomarker identification, diagnostics and drug discovery.

Targeted DNA RNA Sequencing Market Key Takeaways

- North America targeted the DNA RNA sequencing market and accounted for largest revenue share of 43% in 2024

- Asia Pacific targeted DNA RNA sequencing market is anticipated to witness significant growth.

- The next generation sequencing (NGS) segment dominated the market in 2024.

- The others segment is projected to grow at a substantial rate over the forecast period.

- The sequencing segment dominated the market in 2024.

- The pre-sequencing segment is projected to grow at a substantial rate over the forecast period.

- Drug discovery dominated the market and accounted for a share of 43% in 2024.

- Plant and animal sciences are expected to register a CAGR of 19.9% during the forecast period.

- The DNA based targeted sequencing segment dominated the market in 2024.

- The RNA based targeted sequencing segment is projected to grow at a substantial rate over the forecast period.

- The academic research segment dominated in 2024 due to its vital role in driving scientific discoveries.

- The pharma and biotech entities segment is projected to grow at a CAGR of 20.2% over the forecast period.

Market Overview

The targeted DNA/RNA sequencing market is transforming modern genomics, offering powerful, focused alternatives to whole-genome sequencing. This technology enables researchers, clinicians, and pharmaceutical developers to concentrate on specific genes or genomic regions of interest—thereby enhancing efficiency, reducing costs, and accelerating clinical insights. The global market for targeted DNA/RNA sequencing has experienced exponential growth in recent years, underpinned by rising demand for precision medicine, increasing applications in oncology, and advancements in next-generation sequencing (NGS) platforms.

Unlike whole-genome or transcriptome sequencing, targeted sequencing allows for deeper coverage of selected regions, improving the sensitivity for detecting rare variants and mutations. This makes it highly valuable for applications such as cancer mutation profiling, rare disease detection, pharmacogenomics, and transcriptome analysis in developmental biology. The widespread adoption of NGS technologies by academic research centers, clinical laboratories, and biopharmaceutical companies is driving this segment's expansion across both developed and emerging economies.

In clinical oncology, targeted sequencing panels enable personalized therapy decisions by identifying actionable mutations. Inherited disease screening and carrier testing also benefit from the accuracy and resolution of gene-specific analysis. RNA-targeted sequencing, though a relatively newer entrant, is gaining traction for its role in understanding gene expression patterns, splicing events, and immune response pathways.

With the increasing convergence of bioinformatics, automation, and cloud computing, the market is witnessing rapid innovation in data analysis tools and workflow integration. Governments and private institutions are investing heavily in genomics research programs, fostering market expansion. However, challenges such as data complexity, regulatory hurdles, and the need for highly skilled personnel remain limiting factors.

As technology matures, and as global health priorities shift toward early diagnosis, personalized treatment, and population genomics, the targeted DNA/RNA sequencing market is positioned for long-term, high-value growth.

What is Targeted DNA RNA Sequencing?

The Targeted DNA and RNA Sequencing Market is a vital segment within the genomics landscape, which focuses on specific regions in the genome in order to provide precise insights into genetic variations and expression levels. Targeted DNA RNA sequencing can be defined as a genomic technique that works on specific RNA and DNA regions to get a detailed analysis of those regions instead of the entire genome. DNA sequencing works on the introns, exons and regulatory regions to detect genetic mutations whereas RNA studies gene expression and detects RNA events. This market deals with the diagnosis of various diseases, which can help identify specific genes.

Key Market Trends

- Integration of AI in Genomic Data Interpretation: Artificial intelligence and machine learning tools are increasingly being integrated to improve variant calling, annotation, and prediction of disease phenotypes.

- Miniaturization and Automation of Sample Preparation: The market is witnessing new workflow innovations, which are reducing hands-on time, increasing throughput and enabling point-of-care sequencing possibilities.

- Declining Sequencing Costs: The cost-per-megabase of NGS seems to have decreased, making high-throughput targeted sequencing more accessible to medium scale laboratories.

- Cloud-Based Bioinformatics Pipelines: Cloud solutions are now becoming a standard for data management, storage and real-time collaborative analysis, leading to efficient work.

- Shift Toward Multi-Gene Panels and Custom Assays: Researchers and clinicians all over the world increasingly prefer customizable gene panels over single-gene tests as it helps to capture broader genetic insights.

- Increased Use in Companion Diagnostics: Targeted sequencing is now being embedded in pharmaceutical trials and post-market treatment monitoring for companion diagnostics.

What is the Impact of AI in this field?

Artificial intelligence is now increasingly applied in the DNA RNA Sequencing field for analyzing vast amounts of sequencing data for identifying genetic variations as well as for interpreting genomic data for detection of functional elements and to predict the impact of variations on these elements. Artificial intelligence and machine learning tools are being heavily integrated in the field of RNA biology. These tools and system are used to predict RNA structures, interactions with proteins and small molecules, splicing and processing events as well as RNA modification sites. AI can also help uncover changes in RNA function and regulatory networks within the context of disease.

AI-powered tools can also give us an analysis of an individual’s unique genetic profile, thus enabling development of personalized treatment strategies. Deployment of AI algorithms and machine learning methodologies can also help to enhance sequencing efficiency by reducing time, costs and errors associated with DNA and RNA sequencing, further leading to more accurate variant identification, optimized experimental designs and data analysis workflows. AI models such as DeepCRISPR are already in the market, which are helping to improve the accuracy and efficacy of gene editing experiments by predicting the efficiency of guide RNAs for CRISPR-based genome editing.

Targeted DNA RNA Sequencing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 14.98 Billion |

| Market Size by 2034 |

USD 73.91 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 19.4% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, Workflow, Application, Type, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Illumina; F. Hoffman-La Roche Ltd.; QIAGEN; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Oxford Nanopore Technologies; PierianDx; Genomatix GmbH; DNASTAR, Inc.; Perkin Elmer, Inc. |

Key Market Driver

Rising Demand for Precision Oncology and Personalized Medicine

A primary driver for the targeted DNA/RNA sequencing market is the growing global emphasis on precision oncology and personalized healthcare. As clinicians seek to understand the molecular basis of diseases at an individual level, targeted sequencing is emerging as the gold standard for identifying relevant genetic mutations, fusions, and expression changes that influence diagnosis and therapy choices. In cancers such as breast, colorectal, and lung, targeted gene panels help oncologists identify actionable mutations like BRCA1/2, EGFR, ALK, and KRAS enabling more precise treatment selection.

In the UK’s National Health Service (NHS) and the U.S. FDA’s ongoing approvals of biomarker-based therapies, targeted sequencing plays a central role. The scalability, speed, and reliability of targeted NGS platforms offer clinicians a cost-effective solution to deliver data-driven care. This trend is further reinforced by payers increasingly recognizing the cost-saving potential of genetic stratification in therapy planning.

Key Market Restraint

Data Interpretation Complexity and Shortage of Skilled Professionals

Despite its promise, targeted DNA/RNA sequencing faces a significant barrier in the form of data interpretation challenges and limited availability of trained professionals. Sequencing platforms generate vast amounts of data, requiring sophisticated computational tools, pipelines, and experienced bioinformaticians for analysis, interpretation, and clinical reporting. Variants of uncertain significance (VUS), false positives, and issues related to alignment and annotation further complicate downstream workflows.

Many clinical and diagnostic labs, especially in developing markets, lack the infrastructure or expertise to process and act upon high-dimensional genomic data. Errors in variant classification or misinterpretation of gene fusions can lead to incorrect clinical decisions. While AI tools are emerging to address these gaps, there remains a strong dependency on human oversight, creating a bottleneck in the adoption and scale-up of targeted sequencing, especially in low-resource settings.

Key Market Opportunity

Expanding Use of RNA-Based Targeted Sequencing in Immuno-Oncology and Transcriptomics

A key opportunity lies in the growing utility of RNA-targeted sequencing, particularly in the areas of immuno-oncology, transcriptomics, and infection monitoring. RNA sequencing enables detailed insights into gene expression profiles, immune system responses, and post-transcriptional modifications. This has made it especially valuable in the development of cancer immunotherapies and biomarker discovery.

As research expands into neoantigen profiling and immune checkpoint pathways, RNA-targeted sequencing offers unparalleled advantages in analyzing tumor microenvironments and predicting response to immunotherapies. In infectious disease genomics, RNA-based tests have been pivotal in SARS-CoV-2 surveillance and monitoring of vaccine-induced immunity. The ability to detect alternatively spliced transcripts, fusion genes, and expression-level variations opens new frontiers for disease diagnostics and therapeutic development, driving investment from both academic and commercial stakeholders.

Targeted DNA RNA Sequencing Market By Product Insights

Which product dominated the market in 2024?

NGS-based targeted sequencing dominated the market in 2024. This dominance is due to its unmatched throughput, accuracy and flexibility in panel design. NGS platforms are widely adopted in clinical, academic and pharmaceutical environments. Their applications span from rare variant detection and exome sequencing to deep transcriptome profiling, making them a popular choice in the market.

Amplicon sequencing is seen to be the fastest-growing segment throughout the forecast period. This growth is due to its simplicity, cost-effectiveness and high sensitivity. This segment is particularly in oncology and inherited disease testing, as these methods are preferred for hotspot mutation analysis, even from low-input or degraded samples like FFPE tissues. With innovations in multiplex PCR and automation, amplicon sequencing has a strong edge in diagnostic workflows.

Targeted DNA RNA Sequencing Market By Workflow Insights

Which workflow segment dominated the market as of this year?

Sequencing led the market as of this year. Its dominance is because it forms the core of any targeted analysis. This segment includes sample loading, amplification and the actual base-pair readout process. Leading platforms are seen focusing on improving sequencing run times, error rates and instrument flexibility. High-throughput systems are also being deployed in biobanks, academic centers and pharmaceutical companies in order to support population-scale studies and drug target validation.

Data analysis is seen to be the fastest-growing segment. Its growth is spurred by increasing data volumes and the need for robust interpretation. Cloud-based tools, user-friendly dashboards and automated variant annotation platforms are making data interpretation more accessible to non-specialists. Startups are also entering the market with the help of AI-driven platforms and tools that reduce turnaround time from days to mere hours, providing clear clinical decision support.

Targeted DNA RNA Sequencing Market By Application Insights

Drug discovery dominated the market and accounted for a share of 43% in 2024. Accounting for the majority of targeted sequencing use across academic, institutional, and government labs. Targeted sequencing aids in understanding disease pathogenesis, genetic variation, and biomarker validation. Institutions such as the Broad Institute, NIH, and Cancer Research UK are heavily invested in using targeted panels for disease mechanism studies and therapeutic development.

Plant and animal sciences are expected to register a CAGR of 19.9% during the forecast period. This is due to the agriculture sector which makes it possible to determine genes associated with the desired characteristics in plants and animals. Additionally, in animal breeding, targeted sequencing assists in selecting animals with superior traits leading to improved livestock quality and productivity. Veterinary medicine is widely applied in targeted sequencing to identify diseases that affect animals and formulate individual treatment plans.

Targeted DNA RNA Sequencing Market By Type Insights

The DNA based targeted sequencing segment dominated the market in 2024. Driven by its broad applications in mutation detection, hereditary disease screening, and population studies. With well-established protocols and a wide range of commercially available panels, DNA-based sequencing is the default choice for laboratories entering the field of molecular diagnostics.

RNA-based targeted sequencing is growing rapidly, particularly in the context of gene expression profiling, transcript variant detection, and immune response monitoring. The rise of single-cell RNA sequencing and interest in mRNA therapeutics post-COVID-19 has also contributed to this segment's growth.

Targeted DNA RNA Sequencing Market By End Use Insights

Academic research institutions are the leading end-users, as they conduct exploratory studies in genomics, molecular biology, and evolutionary genetics. These institutions often serve as innovation hubs where novel panels and sequencing methodologies are tested, validated, and standardized.

Hospitals and clinics are the fastest-growing end-user group, particularly in the context of personalized medicine. Clinical diagnostic labs now routinely use targeted sequencing for oncology testing, hereditary cancer screening, and rare disease diagnosis. The integration of sequencing in clinical workflows has been aided by automation, regulatory clearances, and electronic health record (EHR) compatibility.

Targeted DNA RNA Sequencing Market By Regional Insights

North America targeted the DNA RNA sequencing market and accounted for largest revenue share of 43% in 2024 Driven by its well-established healthcare infrastructure, robust R&D ecosystem, and high adoption of next-generation sequencing (NGS) technologies. The region, led predominantly by the United States, is home to many of the world's leading genomics companies, academic institutions, and pharmaceutical giants that actively integrate targeted sequencing into diagnostics, therapeutics, and biomedical research. Institutions like the National Institutes of Health (NIH), Broad Institute, and Memorial Sloan Kettering Cancer Center routinely employ targeted panels for oncology, inherited disease screening, and immunogenomics.

Moreover, North America benefits from supportive regulatory frameworks (e.g., FDA’s approval process for NGS-based diagnostic kits), high insurance penetration, and national initiatives such as the All of Us Research Program and the Cancer Moonshot, which are accelerating the integration of genomics into public health. The presence of key players like Illumina, Thermo Fisher Scientific, and Agilent Technologies ensures ongoing innovation, investment, and accessibility. Clinical adoption is also surging in hospitals and cancer centers across the region, especially for companion diagnostics, precision oncology, and prenatal screening. High per capita healthcare expenditure and early technology adoption give North America a significant and sustained lead in this market.

Asia Pacific is emerging as the fastest-growing region in the targeted DNA/RNA sequencing market, owing to rising investments in genomic research, increasing healthcare access, and growing prevalence of chronic and genetic diseases. Countries like China, India, Japan, and South Korea are actively building capacity in molecular diagnostics, personalized medicine, and biopharmaceutical research. National programs such as China’s Precision Medicine Initiative and Japan’s Genome Medicine Implementation Project have created fertile ground for the expansion of targeted sequencing platforms across academic, clinical, and industrial settings.

In India, the rapid development of genomics startups and government initiatives like the GenomeIndia project are helping democratize access to genetic testing. Meanwhile, China's vast patient population, advanced infrastructure in tier-1 hospitals, and supportive government funding make it an epicenter for oncology and rare disease sequencing research. Additionally, the expansion of contract research organizations (CROs) and pharmaceutical outsourcing is increasing the deployment of targeted sequencing in drug discovery. The falling costs of NGS technology and growing collaborations between Asian biotech firms and global sequencing giants further contribute to the region’s exponential market trajectory. As clinical genomics adoption rises and bioinformatics capabilities strengthen, Asia Pacific is set to be the primary engine of market expansion in the coming decade.

Targeted DNA RNA Sequencing Market Top Key Companies:

The following are the leading companies in the targeted DNA RNA sequencing market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina

- F. Hoffman-La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

Targeted DNA RNA Sequencing Market Recent Developments

- In November 2025, Bionano Genomics, Inc. recently announced the publication of a study in Cancers from The University of Texas MD Anderson Cancer Center showing how optical genome mapping (OGM) can address key limitations of targeted RNA-sequencing (RNA-seq) panels in detecting therapeutically-relevant gene rearrangements in acute leukemias.

- In November 2025, a team from Roche, Broad Clinical Labs and Boston Children's Hospital broke the sequencing record a reference sample by completing it in less than four hours, testing Roche’s novel sequencing technology in a small group of NICU infants, the team delivered answers within the same work shift. Their results, published in the New England Journal of Medicine, highlight the potential of this technology to bring genetic answers to clinicians and their patients faster than ever before.

Targeted DNA RNA Sequencing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Targeted DNA RNA Sequencing market.

By Product

- NGS

- Method

- Exome Sequencing

- Enrichment Sequencing

- Amplicon Sequencing

- Others

- Application

- Cancer Gene Sequencing

- Inherited Disease Screening

- Drug Development

- Forensic Genomics

- 16S ribosomal RNA (rRNA) sequencing

- Others

By Workflow

- Pre-sequencing

- Sequencing

- Data Analysis

By Application

- Human Biomedical Research

- Plant & Animal Sciences

- Drug Discovery

- Others

By Type

- DNA Based Targeted Sequencing

- RNA Based Targeted Sequencing

By End Use

- Academic Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)