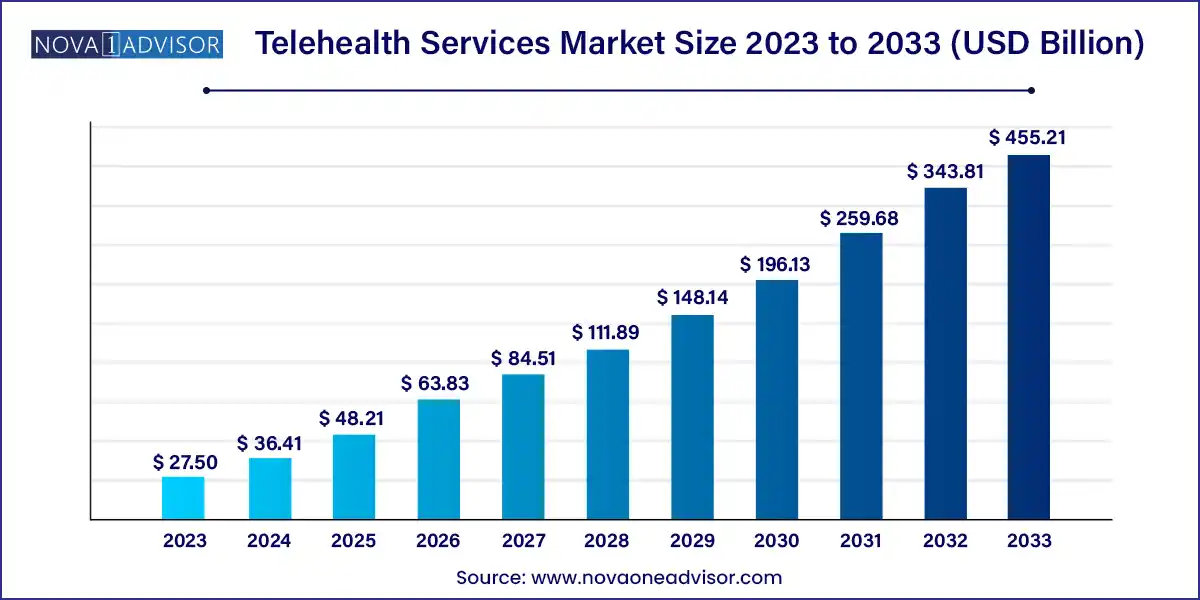

The global telehealth services market size was exhibited at USD 27.50 billion in 2023 and is projected to hit around USD 455.21 billion by 2033, growing at a CAGR of 32.4% during the forecast period 2024 to 2033.

Key Takeaways:

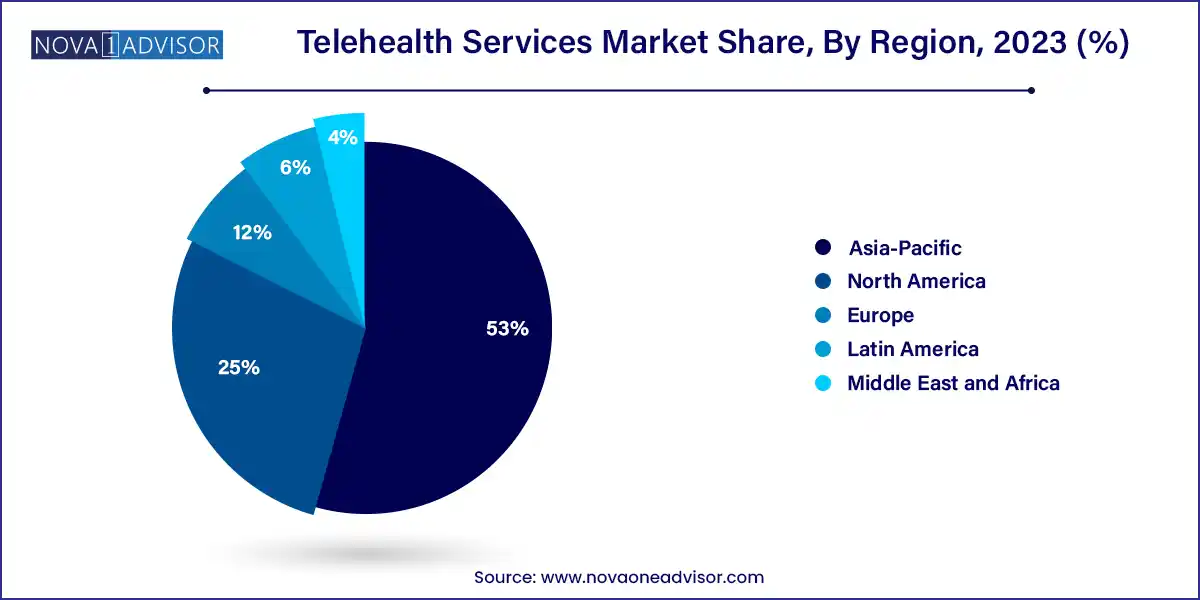

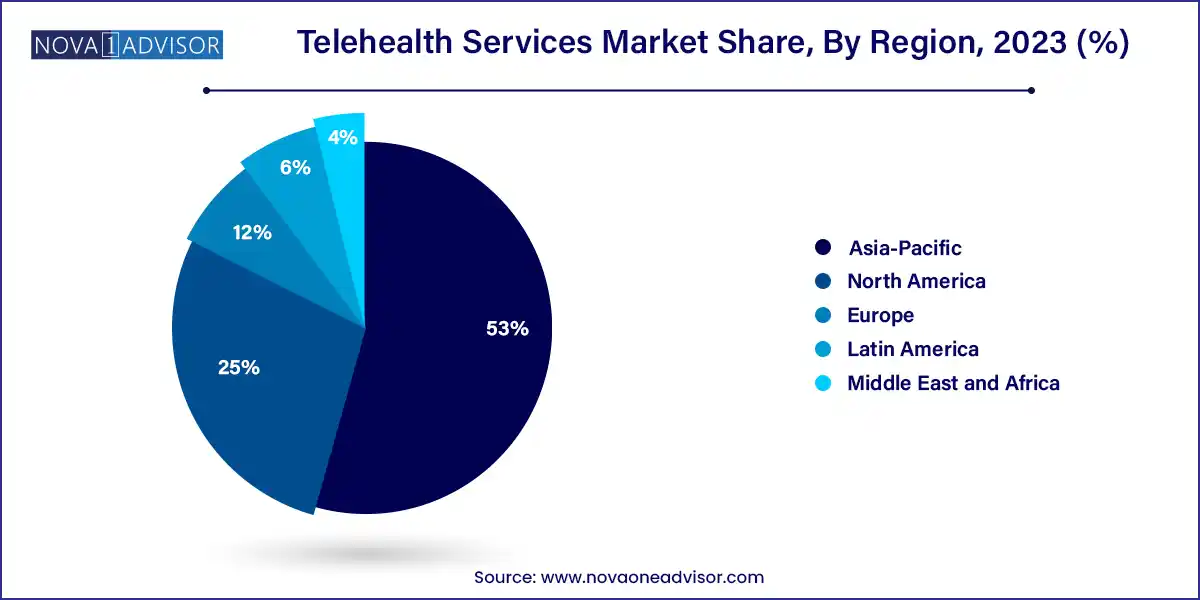

- In 2023, North America dominated the market and accounted for a revenue share of over 53.0%.

- In 2023, the real-time interactions segment dominated the market and accounted for a revenue share of over 25.0%

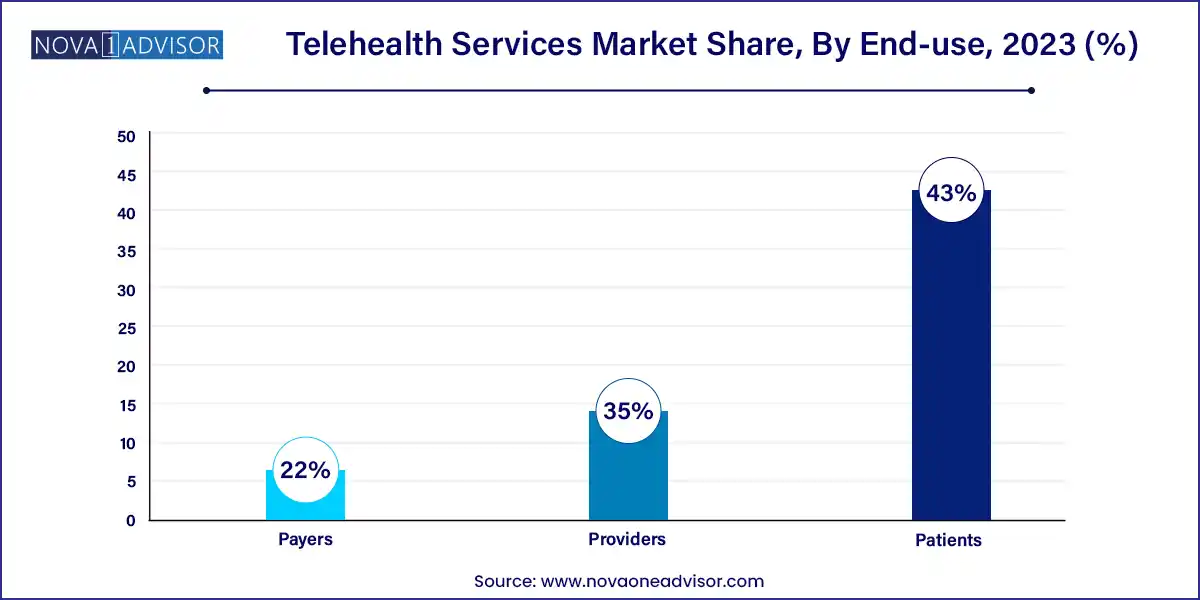

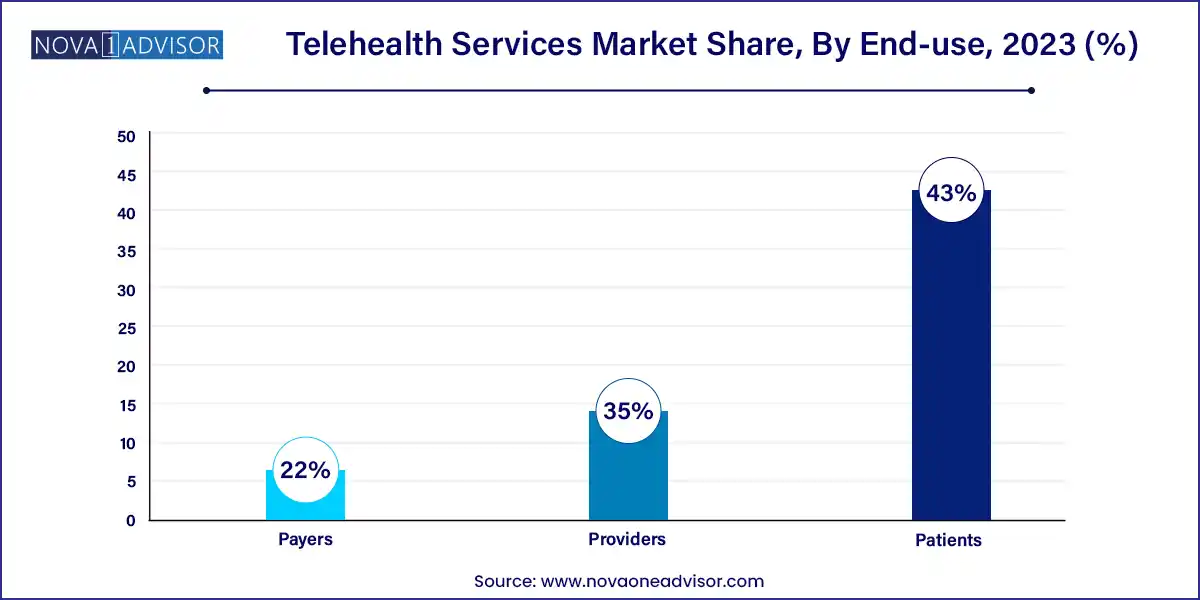

- In 2023, the patients segment dominated the market and accounted for a revenue share of over 43.0%.

- In 2023, tele-radiology segment dominated the market and accounted for a revenue share of over 20.0%.

Market Overview

The Telehealth Services Market has emerged as one of the most transformative domains in global healthcare delivery. Telehealth services encompass a broad array of remote healthcare interactions ranging from virtual consultations, real-time diagnostics, and chronic disease monitoring to mental health counseling and physician collaboration—all enabled by digital communication technologies. These services not only increase access to care but also improve healthcare efficiency, reduce costs, and enhance patient outcomes.

The COVID-19 pandemic significantly accelerated telehealth adoption worldwide. Governments, hospitals, and private healthcare providers rapidly embraced virtual platforms to maintain continuity of care while mitigating viral transmission. What began as a temporary shift has now evolved into a permanent reconfiguration of healthcare delivery models. Today, telehealth services are deeply embedded into the continuum of care, supported by maturing technology infrastructure, growing patient demand, and payer reimbursement reform.

With healthcare systems globally shifting toward patient-centric and value-based models, telehealth services are positioned at the forefront of this transformation. From primary care to specialized services such as cardiology and dermatology, telehealth offers scalable and equitable access to medical expertise, particularly in rural and underserved regions.

Major Trends in the Market

-

Explosion of Mental Health Teleconsultations: Tele-psychiatry and behavioral health services are experiencing record demand.

-

AI and Predictive Analytics in Remote Monitoring: Advanced algorithms are enhancing diagnostics and treatment adherence via telehealth.

-

Hybrid Care Ecosystems: Blended virtual and physical consultations are becoming the new norm for chronic care.

-

Multilingual and Localized Platforms: Expansion into emerging markets is being facilitated by culturally relevant and language-specific platforms.

-

Wearable and IoT Integration: Devices such as smartwatches and home diagnostic kits are enhancing remote care capabilities.

-

Interoperability with EHR Systems: Seamless data sharing across platforms is being prioritized for clinical continuity.

-

Expansion of Direct-to-Consumer (DTC) Telehealth: Companies are providing healthcare services directly to consumers via apps and online platforms.

-

Telehealth Reimbursement Integration: Insurers are increasingly offering plans that include virtual care as a core benefit.

Telehealth Services Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 36.41 Billion |

| Market Size by 2033 |

USD 455.21 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 32.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service Type, Delivery Mode, End-use, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Koninklijke Philips N.V.; Siemens Healthineers; Cerner Corporation; GE Healthcare; Medtronic PLC; Zoom; Doxy.me; Cisco Systems; Teladoc Health Inc.; American Well; Doctor on Demand; GlobalMed; MDLive; HealthTap, Inc.; PlushCare; Practo |

Market Driver: Demand for Cost-Effective and Accessible Healthcare

One of the strongest growth drivers of the telehealth services market is the escalating global demand for cost-effective and accessible healthcare, particularly for aging populations and chronic disease patients. With healthcare costs surging and provider shortages prevalent especially in rural and remote areas telehealth offers a pragmatic and sustainable alternative to traditional in-person visits.

Telehealth services enable timely access to specialists without the logistical burden of travel, reducing healthcare disparities. For instance, a diabetic patient in a remote village can now consult an endocrinologist via video call, transmit glucose readings, and adjust medications from home. Similarly, patients recovering from surgery can schedule follow-up consultations virtually, cutting down on hospital re-admissions.

This accessibility, combined with lower infrastructure and operational costs for providers, positions telehealth as a high-value component in modern healthcare delivery.

Market Restraint: Data Privacy and Technological Barriers

Despite its many benefits, the telehealth services market faces significant challenges in the form of data privacy concerns and unequal technology access. Handling sensitive health data digitally raises concerns about unauthorized access, data breaches, and lack of patient trust especially when services cross national borders with differing regulatory standards.

In addition, digital literacy and internet infrastructure gaps pose major barriers in low-income regions and among older populations. Not all patients own smartphones or understand how to use virtual platforms, leading to exclusion from telehealth services.

To mitigate these risks, companies must invest in robust cybersecurity frameworks, user-friendly interfaces, and targeted digital literacy programs especially in emerging markets.

Market Opportunity: Integration of Telehealth in Preventive and Home-Based Care

An emerging opportunity lies in the integration of telehealth services within preventive healthcare and home-based care models. Healthcare providers are increasingly using telehealth to proactively engage patients before conditions worsen, reducing the burden on emergency rooms and inpatient facilities.

Chronic disease management, remote cardiac monitoring, mental health therapy, and maternity care are increasingly delivered through telehealth platforms. Home-based services such as medication adherence checks, nutrition counseling, and physical therapy consultations are now routine in many markets.

This shift aligns with global trends toward personalized, preventive care, enabling providers to intervene earlier, improve outcomes, and reduce healthcare expenditures. As insurers expand reimbursement and employers adopt telehealth benefits, this sector is expected to witness robust and sustained growth.

Segments Insights

By Service Type Insights

Real-Time Interactions dominate the telehealth services segment, reflecting the widespread use of video and audio consultations in primary care, urgent care, and specialist visits. These services surged during the pandemic and have since become a staple in outpatient workflows across the world. They are particularly effective in managing episodic illnesses, mental health conditions, and follow-up care.

Remote Patient Monitoring is the fastest-growing segment, owing to the rising prevalence of chronic diseases and the integration of wearable technologies. Patients with hypertension, diabetes, or cardiac conditions are being monitored continuously using connected devices that transmit data to physicians. Combined with predictive analytics, RPM enhances clinical decision-making and reduces hospital admissions.

Other segments such as Store & Forward which involves transmitting diagnostic images or lab results asynchronously and Physician-to-Physician Contact for referrals and second opinions, also play crucial roles in creating a collaborative and comprehensive care network.

By Delivery Mode Insights

Cloud-based delivery dominates the telehealth services market, thanks to its scalability, ease of deployment, and cost-efficiency. Cloud platforms support real-time updates, remote access for both providers and patients, and seamless integration with mobile applications and EHRs. They are widely used by both startups and enterprise-level hospital networks.

Web-based platforms are also widely adopted, especially in regions where app usage is limited or regulatory bodies require browser-based compliance. These systems are particularly popular in corporate health services and insurance-led health portals.

On-premises and hybrid models find their place in large healthcare institutions and military-grade systems, where full control over data hosting and cybersecurity is paramount.

By End-use Insights

Providers account for the largest market share, utilizing telehealth to manage patient loads, expand service outreach, and reduce administrative burdens. Hospitals, physician networks, and urgent care clinics use telehealth for everything from triage to post-operative follow-ups.

Patients are the fastest-growing segment, driven by rising awareness, smartphone adoption, and preference for convenience. Direct-to-consumer models enable users to self-book appointments, store medical histories, and access a wide range of services including lifestyle counseling and remote diagnostics.

Payers (insurers) are also playing a significant role, especially in developed markets where they incentivize telehealth as a cost-control and preventive tool. Insurers increasingly partner with telehealth providers to offer bundled services or include them in coverage packages.

By Application Insights

Tele-psychiatry dominates in terms of application, as mental health concerns have escalated globally. Virtual therapy, medication management, and psychological assessments are widely delivered through secure telehealth platforms. The stigma-free, accessible nature of telehealth is making a significant impact in mental health care, especially among youth and working professionals.

Tele-radiology is a rapidly growing segment, enabling radiologists to interpret imaging studies remotely. This is especially valuable in rural hospitals and during night shifts when on-site staff may be unavailable.

Other rapidly expanding areas include tele-dermatology (enabled by high-quality image sharing), tele-cardiology (using remote ECGs and wearables), and tele-pathology, which is streamlining diagnostic processes through AI-enhanced digital microscopy.

By Regional Insights

North America remains the dominant region, led by the United States. Factors contributing to this dominance include a mature digital infrastructure, favorable reimbursement policies, extensive provider networks, and robust investment in telehealth innovation. Major players such as Teladoc Health and Amwell have transformed the U.S. market landscape. Canada, too, is rapidly integrating virtual care into public health systems.

Asia-Pacific is the fastest-growing region, driven by digital innovation, large underserved populations, and favorable government policies in countries like India, China, Japan, and Australia. Mobile-first strategies, multilingual interfaces, and the rise of low-cost teleconsultation startups are fueling explosive adoption. For example, India’s eSanjeevani and China’s Ping An Good Doctor platforms have reached tens of millions of users.

Some of the prominent players in the telehealth services market include:

- Koninklijke Philips N.V.

- Siemens Healthineers

- Cerner Corporation

- GE Healthcare

- Medtronic PLC

- Zoom

- Doxy.me

- Cisco Systems

- Teladoc Health Inc.

- American Well

- Doctor on Demand

- GlobalMed

- MDLive

- HealthTap, Inc.

- Practo

- PlushCare

Recent Developments

-

Teladoc Health (April 2025): Rolled out a unified virtual care ecosystem integrating primary care, mental health, and chronic disease management across 10 states in the U.S.

-

Doctolib (France, March 2025): Announced the expansion of its telehealth network into Central Europe with AI-powered appointment scheduling and physician-matching algorithms.

-

Practo (India, February 2025): Partnered with national public health agencies to digitize rural health records and facilitate telemedicine access via government health ID.

-

Babylon Health (UK, January 2025): Launched real-time monitoring for hypertension patients using smart blood pressure cuffs and AI-based care coaching.

-

Amwell (U.S., December 2024): Secured a multi-year contract with a large U.S. insurer to deliver integrated behavioral health services via its platform.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global telehealth services market.

Service Type

- Remote Patient Monitoring

- Real Time Interactions

- Store & Forward

- Video/ Audio Consultations

- Physician-to-physician Contact

- Appointment Scheduling

- Patient Medical Data Collections

- Other Telehealth Services

Delivery Mode

- Web-based

- Cloud-based

- Others

End-use

- Providers

- Payers

- Patients

Application

- Tele-radiology

- Tele-psychiatry

- Tele-cardiology

- Tele-dermatology

- Tele-pathology

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)