Tendon Repair Market Size and Trends

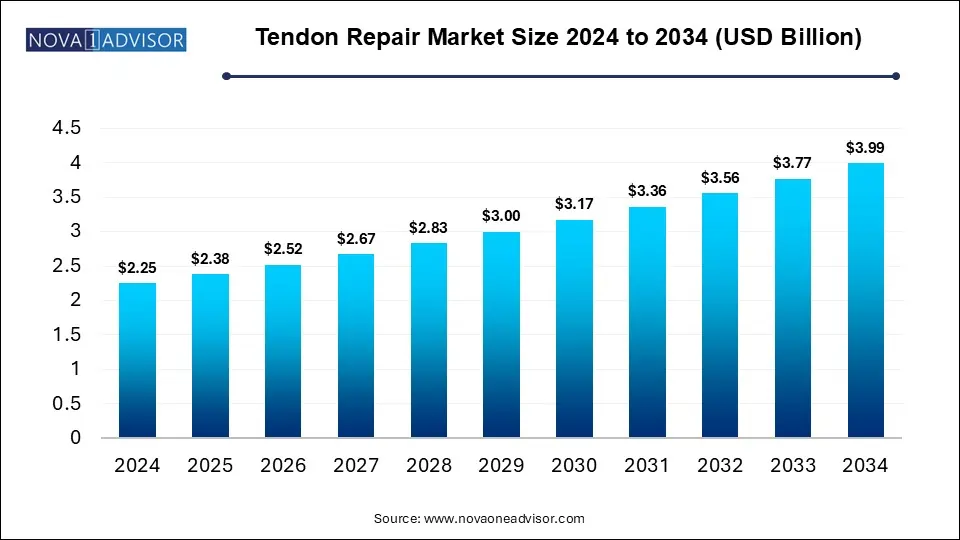

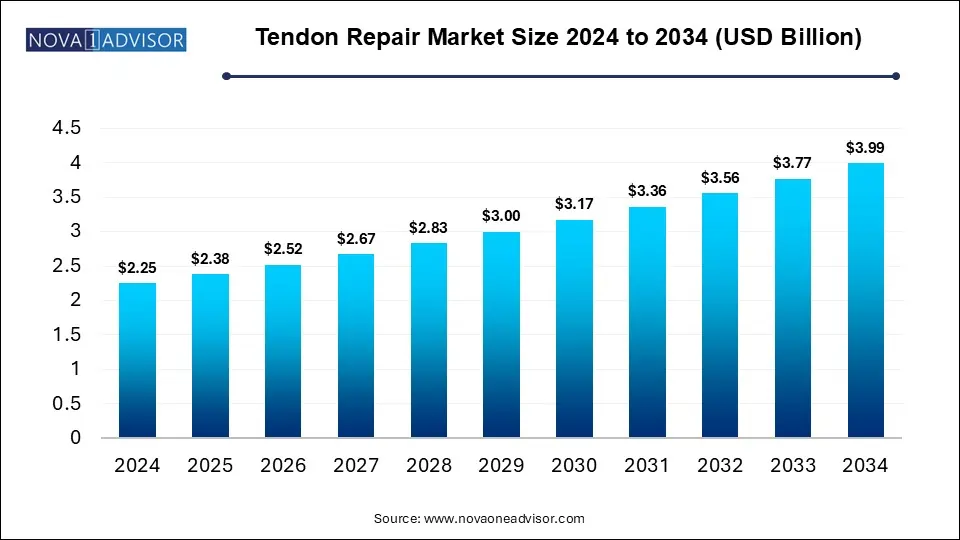

The global tendon repair market size is calculated at USD 2.25 billion in 2024, grows to USD 2.38 billion in 2025, and is projected to reach around USD 3.99 billion by 2034.at a CAGR of 5.9% from 2025 to 2034. The market is growing due to the rising incidence of sports injuries, aging populations, and increasing cases of tendon-related disorders. Advancements in surgical techniques and biological methods, such as stem cell therapy and tissue engineering, are also boosting demand in the market.

Key Takeaways

- North America dominated the tendon repair market in 2024.

- Asia-Pacific is anticipated to grow at the highest CAGR in the market during the forecast period.

- By Product type, the suture anchor devices segment held a dominant presence in the market in 2024.

- By Product type, the implants segment is anticipated to grow at the fastest CAGR in the market during the studied years.

- By application, the rotator cuff tendon repair segment accounted largest share in the market in 2024.

- By application, the foot and ankle tendon repair segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the hospitals and clinics segment was dominant in the market in 2024.

- By end user, the ambulatory surgical centers segment is projected to grow at the highest CAGR in the market during the studied years.

Tendon Repair: Outsourcing Expertise

Tendon repair is a surgical procedure to fix a torn or damaged tendon, restoring movement and strength to the affected area. The market is growing due to an increasing number of sports injuries, an aging population, advancements in surgical techniques, rising awareness about treatment options, and improved healthcare infrastructure. Additionally, the prevalence of chronic tendon disorders and the demand for minimally invasive procedures are boosting market expansion.

For Instance, As reported by Johns Hopkins Medicine, around 30 million people in the U.S. take part in organized sports each year. These activities lead to over 3.5 million sports-related injuries annually, with sprains and strains being the most common types of injuries among athletes.

Tendon Repair Market Trends

- In December 2023, Stryker launched a single-use suture anchor system called Citrefix. This system is designed for procedures involving tendon and ankle fixation. It is primarily composed of Citregen, a bioresorbable and elastomeric material that gradually breaks down in the body while supporting tissue healing.

- In May 2024, CoNextions Inc. successfully treated its first patient using the groundbreaking tendon repair implant, CoNextions TR. The company is now expanding the availability of this advanced system throughout the United States. Distribution is being handled by a trusted network of orthopedic partners who are dedicated to providing high-quality solutions for upper extremity surgeons.

How Can AI Revolutionize the Tendon Repair Market?

AI has the potential to transform the tendon repair market by enhancing surgical precision, improving diagnosis, and optimizing patient-specific treatment plans. Through advanced imaging analysis and predictive modeling, AI can assist surgeons in identifying the best repair techniques and predicting outcomes. It also enables real-time monitoring of recovery, allowing for timely interventions. Additionally, AI-driven robotics and smart implants could lead to more efficient procedures and faster healing. Overall, AI brings greater accuracy, personalized care, and improved patient outcomes to tendon repair.

Report Scope of Tendon Repair Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.38 Billion |

| Market Size by 2034 |

USD 3.99 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product Type, By Application, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Aevumed, Stryker Corporation, Smith & Nephew plc, CONMED Corporation, Johnson & Johnson, Alafair Biosciences, Inc., TendoMend, Arthrex Inc, BioPro Inc, Integra LifeSciences Holdings Corporation |

Market Dynamics

Driver

The rise in incidence of Sports and Physical Workout-related injuries

As more individuals engage in fitness activities, the number of injuries, such as sprains, fractures, and joint issues, increases. This surge boosts demand for sports medicines, orthopedic devices, and rehabilitation services. Additionally, raising awareness about injury prevention and recovery, along with advancements in treatment technologies, further supports the expansion of related healthcare and fitness markets.

- For Instance, In 2023, the National Safety Council reported an 8% rise in injuries linked to exercise and workout equipment, totaling 482,886 cases, up from 445,642 in 2022. Interestingly, the most affected age group was 15 to 24 years old, indicating that younger individuals are more susceptible to sports and fitness-related injuries.

Restraint

High Procedure Cost

High procedure costs significantly restrain the tendon repair market. Surgical tendon repair involves expensive implants, advanced technology, and specialist care, making it unaffordable for many patients, especially in low and middle-income countries. This cost barrier reduces treatment uptake, limits access to quality care, and slows overall tendon repair market growth.

Opportunity

Increase in investment in research and development

Increasing investment in research and development presents a strong opportunity for the tendon repair market by driving innovation in surgical technique, biologics, and regenerative therapies. R&D enables the development of advanced minimally invasive procedures and more effective healing solutions, improving patient outcomes and reducing recovery time. It also supports the discovery of cost-effective materials and methods, expanding accessibility. As technological breakthroughs emerge, they open new commercial avenues for partnership and enhance the tendon repair market growth.

For Instance, In January 2023, Zimmer Biomet acquired Embody, Inc., to expand its offerings in soft tissue healing. The deal brings in Embody’s collagen-based implants, including TAPESTRY and TAPESTRY RC, enhancing Zimmer Biomet’s capabilities in tendon and rotator cuff repair.

Segmental Insights

The Suture Anchor Devices Segment Dominated

By Product type, the suture anchor devices segment held a dominant presence in the market in 2024 due to their critical role in soft tissue fixation, particularly in orthopedic and sports injury surgeries. These devices offered strong fixation, minimally invasive application, and reduced recovery times, aligning with the growing demand for efficient surgical outcomes. Advancements in bioabsorbable and all-suture anchor technologies, also prevalence of joint disorders, and an aging population further fueled the adoption of these devices, securing their leading market position.

- For Instance, In December 2024, Stryker launched a new single-use suture anchor system called ‘Citrefix,’ designed specifically for tendon and ankle fixation procedures. The system is made from Citregen, a bioresorbable and flexible elastomeric material. This innovation aims to enhance surgical outcomes by providing a reliable and biocompatible solution for soft tissue attachment.

The Implants Segment: Fastest CAGR

By Product type, the implants segment is anticipated to grow at the fastest CAGR in the market during the studied years due to advancements in implant technology, including bioresorbable and synthetic materials that enhance healing and reduce complications. Increasing adoption of minimally invasive surgical techniques has further driven demand for such implants. Additionally, the rising incidence of sports injuries, age-related tendon disorders, and a growing number of orthopedic procedures globally contribute to boosting the tendon repair market.

The Rotator Cuff Tendon Repair Segment: Largest Shares

By application, the rotator cuff tendon repair segment accounted largest share in the market in 2024 due to its high injury prevalence, especially among athletes and older adults. The aging population and increased partnership in physical activities contributed to a rise in rotator cuff injuries. Research indicates that full-thickness rotator cuff tears occur in about 28% of adults younger than 60. This prevalence increases with age, affecting roughly 50% of individuals over 70 and up to 80% of those older than 80. Additionally, advancements in minimally invasive surgical techniques improved recovery outcomes, boosting demand. Occupational risks involving repetitive shoulder use also played a role, making rotator cuff repairs the most common and widely required tendon procedures.

- For Instance, In April 2023, an article published by Healio discusses expert opinions on treating rotator cuff tears. It notes that in some cases, a major tear caused by trauma can be effectively managed if treated early, before muscle atrophy sets in and while the tendon still retains its elasticity. Acting quickly and preserving the tendon’s condition can lead to better surgical results and a smoother recovery for the patient.

The Foot and Ankle Tendon Repair Segment: Fastest CAGR

By application, the foot and ankle tendon repair segment is expected to grow at the fastest CAGR in the market during the forecast period, due to the increasing prevalence of chronic conditions like diabetes and obesity, which heighten the risk of tendon injuries in these areas. Additionally, the complex biomechanics of the foot and ankle required more frequent medical interventions. Rising demand for specialized orthopedic care and growing investment in foot and ankle research are further propelling this segment's expansion in the tendon repair market.

The Hospitals and Clinics Segment: Dominated

By end user, the hospitals and clinics segment was dominant in the market in 2024, because of their advanced infrastructure, availability of skilled healthcare professionals, and ability to handle a high volume of surgical procedures. These facilities are often preferred for tendon repair surgeries because they offer comprehensive care, including diagnostics, surgery, and rehabilitation under one roof. Additionally, the rise in hospital admissions for sports and trauma-related injuries, along with favorable reimbursement policies, further strengthened the dominance in the market.

The Ambulatory Surgical Centers Segment: Highest CAGR

By end user, the ambulatory surgical centers segment is projected to grow at the highest CAGR in the market during the studied years, due to the increasing number of facilities offering cost-effective alternatives to hospitals. ASCs provide efficient =, same-day surgical procedures with shorter recovery times, attracting patients seeking convenience and affordability. Additionally, the rise in skilled healthcare professionals in private practices enhances the quality of care in ASCs, further driving the market growth.

Regional Insights

Advanced Healthcare Infrastructure Propels North America

North America dominated the tendon repair market in 2024 due to advanced healthcare infrastructure, rising cases of sports-related and age-related tendon injuries, and growing awareness about early treatment. Additionally, the region benefited from strong investment in research and the rapid adoption of technologically advanced surgical techniques.

- For Instance, The U.S. sees about 200,000 ACL injuries annually, a number expected to grow. Market expansion is further supported by the strong presence of key players like Arthrex, DePuy Synthes, and Smith & Nephew.

Rapid Economic Development Drive Asia-Pacific

Asia-Pacific is anticipated to grow at the highest CAGR in the market during the forecast period due to rapid economic development, urbanization, and rising disposable incomes. The region’s large population base, supportive government policies, and increasing foreign investment drive market expansion. Additionally, the fast adoption of technology and infrastructure development boosts growth across sectors, making it a key contributor to global market dynamics.

- For Instance, In March 2024, scientists at the Shanghai Institute of Ceramics developed an inorganic bioceramic scaffold to aid tendon-to-bone injury treatment. China's medical device market is mainly led by local manufacturers, with foreign companies holding about 25% of the market.

Some of The Prominent Players in The Tendon Repair Market Include:

- Integra Lifesciences Corporation

- Arthrex, Inc.

- Tendomend

- Depuy Synthes

- Conmed Corporation

- Stryker Corporation

- Biopro, Inc

- Parcus Medical, LLC

- Aevumed, Inc.

- Smith & Nephew

- Alafair Biosciences

Recent Developments in the Tendon Repair Market

- In June 2023, IPG, a top provider of surgical cost management solutions in the U.S., partnered with CoNextions Medical, known for its innovative tendon repair technologies like the CoNextions TR Tendon Repair System. This collaboration aims to enhance the quality and affordability of surgical care by lowering device costs and improving care delivery settings.

- In March 2023, Smith & Nephew introduced the UltraTRAC QUAD ACL Reconstruction Technique, which includes the Quadriceps Tendon Harvest Guide System. This new approach is designed to improve tendon visibility during surgery, making the procedure easier and more efficient for surgeons.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Implants

- Suture anchor device

- Grafts

- Others

By application

- Rotator cuff tendon repair

- Foot and ankle tendon repair

- Flexor and extensor tendon repair

- Others

By end-user

- Hospitals and Clinics

- Ambulatory Surgery Centers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)