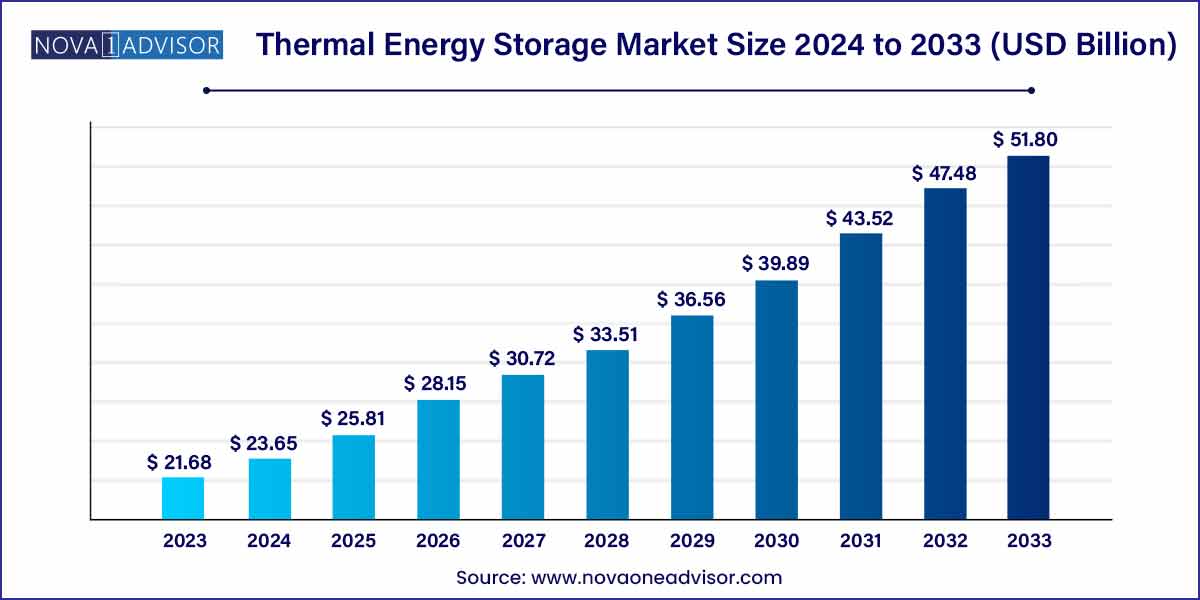

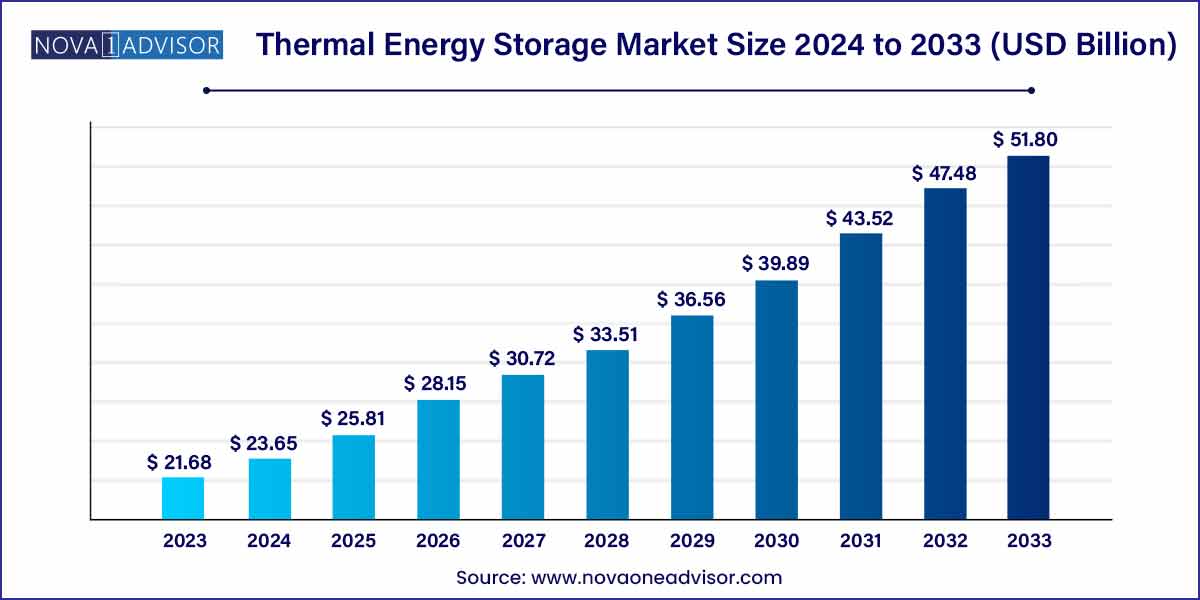

The global thermal energy storage market size was exhibited at USD 21.68 billion in 2023 and is projected to hit around USD 51.80 billion by 2033, growing at a CAGR of 9.1% during the forecast period of 2024 to 2033.

Key Takeaways:

- In 2023, Europe dominated the market with 38.0% of the total market share.

- By technology, the sensible storage segment has captured 84.8% of the total share in 2023.

- By storage material, the molten salt segment is growing at a CAGR of 9.3% during the forecast period.

- By application, the power generation segment has accounted market share of around 60% in 2023.

- By end user, the industrial segment accounted for 41% market share in 2023.

Thermal Energy Storage Market: Overview

In today's era of sustainable energy solutions, the Thermal Energy Storage (TES) market stands at the forefront, offering innovative approaches to storing and managing thermal energy. This comprehensive overview delves into the intricate landscape of the TES market, exploring its evolution, current trends, key players, and future prospects.

Growth Factors

Increasing demand for electricity due to the increased commercialization increased use of electricity during the peak hours and a demand for heating and cooling applications in the smart infrastructure are all leading to a growth in this market. The growth will be supplemented by many supportive government policies in the developed as well as the developing nations for renewable energy technologies. Many countries across the globe are making investments in renewables which is an important part which acts as a stimulus for the growth of this market in different economies.

Investments in solar and wind is creating jobs reducing emissions and fostering innovation. In order to reduce the carbon emissions in the energy sector to cap the global climate change it's the most important goal of many governments. It has led to an increase in the energy efficiency of the electric grids which are able to achieve reduced carbon dioxide emissions. By the year 2023 the Government of India it's targeting to install 175 gigawatts of renewable energy capacity. This energy will come from a wind, biopower solar and hydro power.

Similarly, the Spanish government is also aiming to add 157 gigawatts of renewable energy capacity by the year 2033. The use of thermal energy storage provides better reliability reduced investment, increase in the overall efficiency add reduction in the running costs and economic operations. A speedy growth of the decentralized renewable energy technologies will also drive the market.

Thermal Energy Storage Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 21.68 Billion |

| Market Size by 2033 |

USD 51.80 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.1% |

| Base Year |

2022 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Storage Material, Application, End User, and Geography |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BrightSource Energy Inc., SolarReserve LLC, Caldwell Energy, Cryogel, Steffes Corporation, Abengoa SA, Terrafore Technologies LLC, Ice Energy, Baltimore Aircoil Company |

Thermal Energy Storage Market Dynamics

The Thermal Energy Storage (TES) market is being propelled by several key drivers, underpinning its robust growth trajectory. Firstly, the increasing penetration of renewable energy sources, such as solar and wind, has spurred the demand for energy storage solutions to address the intermittency and variability inherent in these sources. TES systems offer a viable solution by enabling the efficient storage of excess energy during periods of high generation for later use during peak demand times or when renewable generation is low.

In addition to the drivers, several notable trends are shaping the Thermal Energy Storage market landscape. One prominent trend is the increasing emphasis on grid modernization and the integration of smart energy systems. As utilities strive to enhance grid flexibility, reliability, and resilience, TES systems are gaining traction as valuable assets for optimizing energy management, reducing peak demand, and supporting grid stability.

Thermal Energy Storage Market Restraint

One significant restraint hindering the widespread adoption of Thermal Energy Storage (TES) systems is the associated cost challenges. While TES technologies offer long-term benefits in terms of energy savings, grid stability, and emissions reduction, the upfront capital investment required for implementing these systems can be substantial. The cost of materials, equipment, installation, and maintenance often poses a barrier, particularly for smaller-scale projects and entities with limited budgets.

- Technical and Performance Limitations:

Another key restraint facing the Thermal Energy Storage market relates to technical and performance limitations inherent in current TES technologies. While advancements have been made in improving the efficiency, reliability, and scalability of TES systems, certain challenges remain unresolved. For instance, some TES technologies may exhibit limited thermal conductivity or cycling stability, impacting their overall performance and longevity.

Thermal Energy Storage Market Opportunity

- Integration with Renewable Energy Sources:

One of the most promising opportunities in the Thermal Energy Storage (TES) market lies in its integration with renewable energy sources, such as solar and wind. TES systems offer a viable solution to address the intermittency and variability associated with renewable energy generation by enabling the storage of excess energy during periods of high production for later use when energy demand is high or renewable generation is low.

- Emerging Applications and End-Use Sectors:

Another significant opportunity for the TES market lies in the exploration of emerging applications and end-use sectors beyond traditional HVAC and industrial processes. As technological advancements and market maturity continue to expand the capabilities of TES systems, new opportunities are emerging across various sectors, including district heating and cooling, thermal power generation, and transportation.

Thermal Energy Storage Market Challenges

- Technological Complexity and Performance Reliability:

One of the primary challenges facing the Thermal Energy Storage (TES) market is the inherent complexity of TES technologies and the critical need for performance reliability. While TES systems offer promising solutions for storing and managing thermal energy, the diverse range of technologies, materials, and system configurations available can present challenges in terms of selection, design, and implementation.

- Cost Competitiveness and Financial Viability:

Another key challenge hindering the widespread adoption of Thermal Energy Storage systems is the issue of cost competitiveness and financial viability. While TES technologies offer long-term benefits in terms of energy savings, grid stability, and emissions reduction, the upfront capital costs associated with implementing these systems can be prohibitive, particularly for smaller-scale projects or entities with limited budgets.

Segments Insight

Technology Insights

On the basis of technology, the sensible heat storage segment shall contribute largely to the growth of the market during the forecast period. Thermal energy storage which is in the form of sensible heat depends on the specific heat of a storage medium. The storage William it's captain storage tanks which have high thermal insulation. Molten salt is the most widely used commercial heat storage medium. It has a large number of industrial as well as commercial applications. Molten salt have excellent thermal properties.

In about 50% of the operational thermal energy projects molten salts are used till date. The sensible heat storage technology is extremely cost efficient.

Storage Material Insights

On the basis of the storage material, the molten salt segment is expected to grow well during the forecast period. Molten salts are commonly used as they have higher boiling points. Salt is pumped into her steam generator which boils water spins a turbine and generates electricity when there is a need for energy.

Application Insights

The power generation segment on the basis of application is expected to be the largest contributor during the forecast period. Storage of the thermal energy in concentrating solar power plants will be helpful in overcoming the intermittency of the solar resource as it will be able to provide power for extended periods of time. Energy can be captured during the sunshine hours and it can be stored for its delivery to facilitate the plant output during unfavorable weather conditions.

The working of the solar thermal power plant can be extended even when there is no solar radiation. It will reduce the need to burn fossil fuels. Energy storage will not only reduce the gap between supply and demand but it will also improve the reliability and the performance of the energy systems and play an extremely important role in conserving energy.

End-User Insights

The utility segment is expected to have the largest market share. This system makes use of chilled water technologies or ice for storing the thermal energy in tanks for the future use. The energy is stored in the tanks when it is not used during the off-peak hours. It helps in meeting the demand during the peak hours. Many customers are able to avail the power which is available on the time of the day pricing depending upon the peak hours. Energy is sold to the customers at a lower price during the off-peak hours.

The industrial segment is also expected to grow as there is an increase in the spending on infrastructure development. Increased use of large quantities of hot water in these industries will boost the segment growth. Thermal energy plans are utilized to generate electricity energy to meet the demand of the residential and commercial sectors. There is a use of home storage units to store the thermal energy to provide for the residential and commercial buildings as and when required.

Regional Insights

European countries are making attempts to meet the net zero carbon reduction targets. European nations are making efforts to shift from the coal fired power generation to the other enable energy generation sources are supporting the from coal fired power generation to renewable energy generation.

The North American region shall have the second largest revenue due to the positive outlook towards renewable based power generation. Increased research and development activities in the energy storage systems shall help in the growth of the market. In the developing nations like China India Japan Indonesia Malaysia and South Korea there is a rapid growth in population and organization. These developing nations have many fundamental infrastructure systems. Owing to these reasons the Asia Pacific region is expected to grow during the forecast period.

Key Market Developments

- In August 2022, a new prototype technology for thermal energy storage was introduced by the researchers at the National Renewable Energy Laboratory, U.S.This system uses silica sand as the storage medium. The cost effective storage medium can prove to be a new technology which can be installed in small modular structures in many nations to supply heat and electricity.

Some of the prominent players in the thermal energy storage market include:

- BrightSource Energy Inc.

- SolarReserve LLC

- Caldwell Energy

- Cryogel

- Steffes Corporation

- Abengoa SA

- Terrafore Technologies LLC

- Ice Energy

- Baltimore Aircoil Company

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global thermal energy storage market.

By Technology

- Latent

- Thermochemical

- Sensible

By Storage Material

- Molten salts

- Water

- Phase change materials

- Others

By Application

- Process Heating and Cooling

- Power Generation

- District Heating and Cooling

By End-User

- Utilities

- Residential & Commercial

- Industrial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)