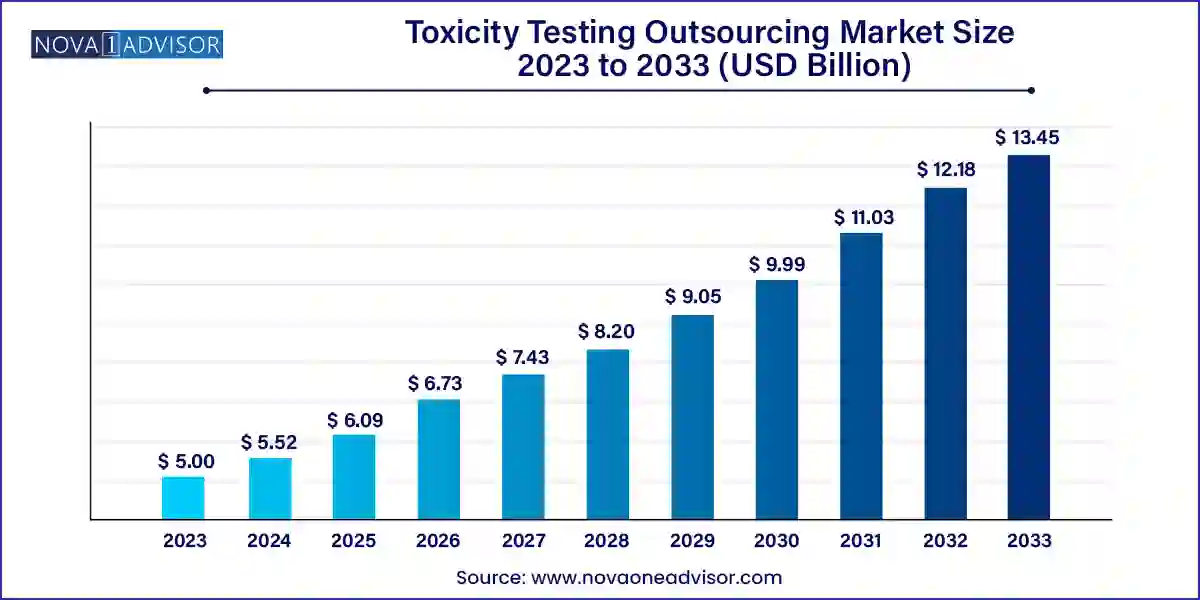

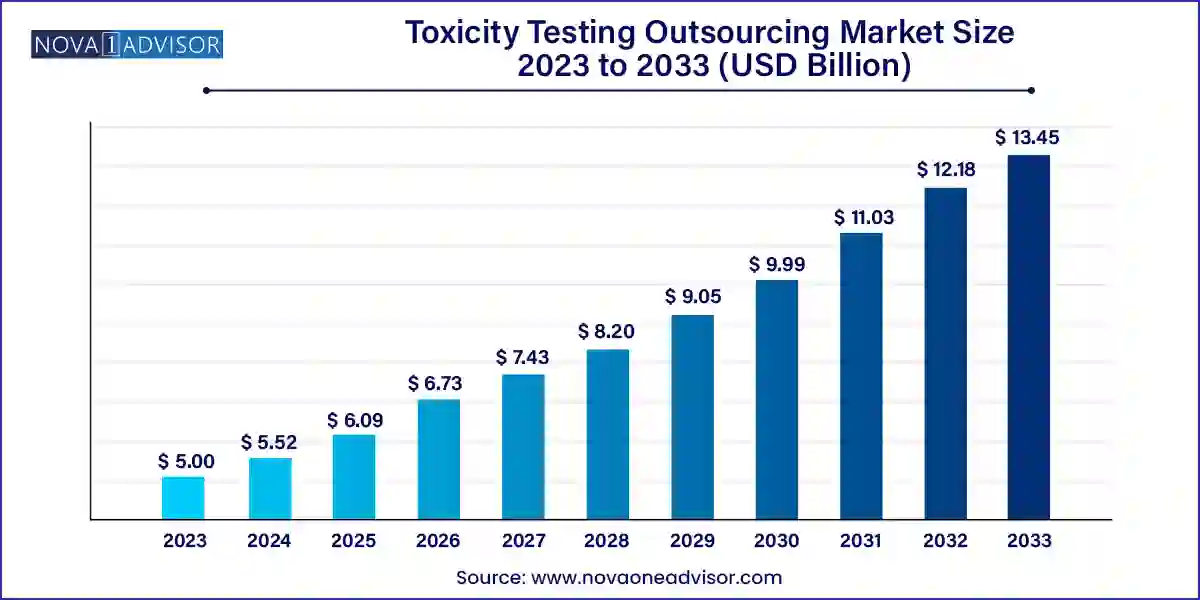

The global toxicity testing outsourcing market size was exhibited at USD 5.00 billion in 2023 and is projected to hit around USD 13.45 billion by 2033, growing at a CAGR of 10.4% during the forecast period 2024 to 2033.

Key Takeaways:

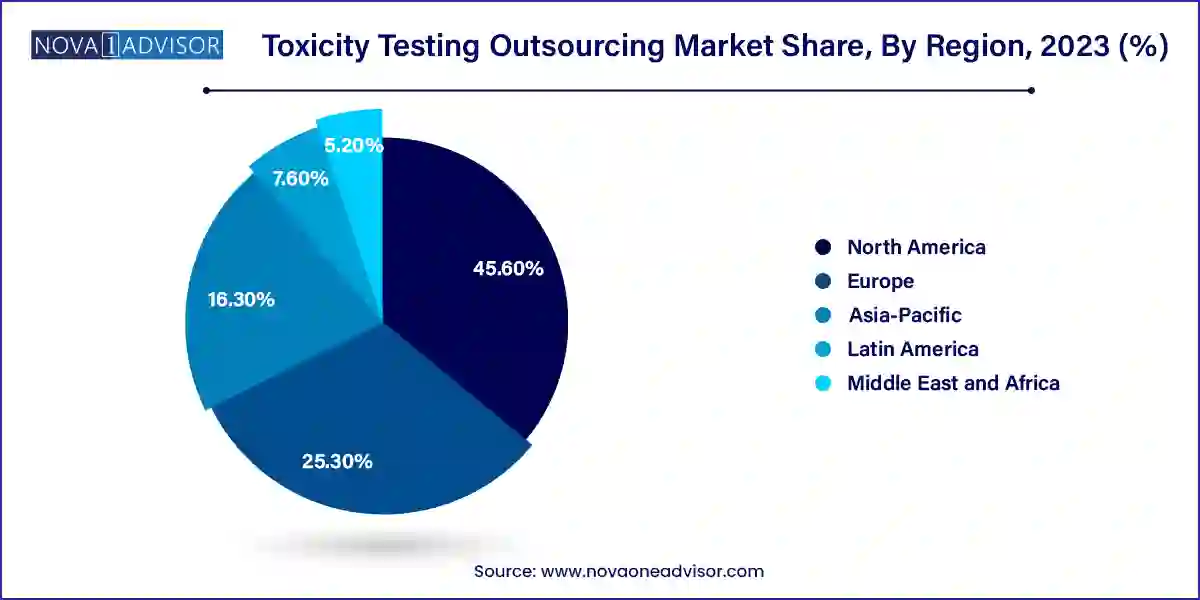

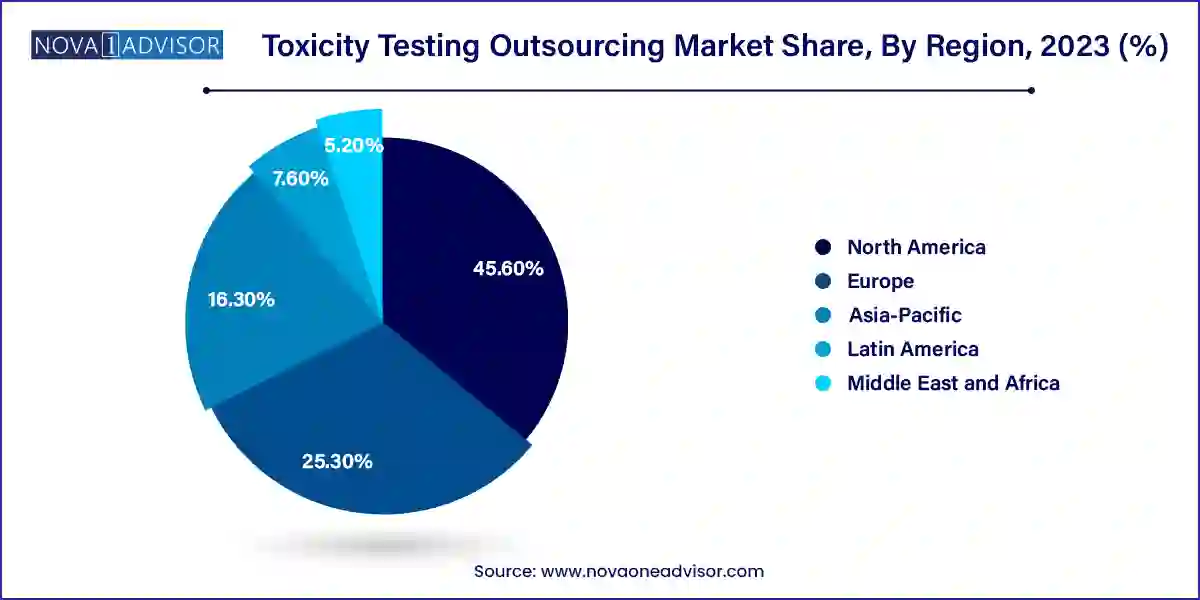

- North America dominated the market with a revenue share of 45.6% in 2023.

- Asia-Pacific region is expected to grow at a lucrative rate with a CAGR of 11.3% during the forecast period

- The method segment is subdivided into in-vivo and in-vitro. The in-vitro segment accounted for the largest share of 57.7% in 2023.

- The GLP segment dominated the market with a share of 80.6% in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

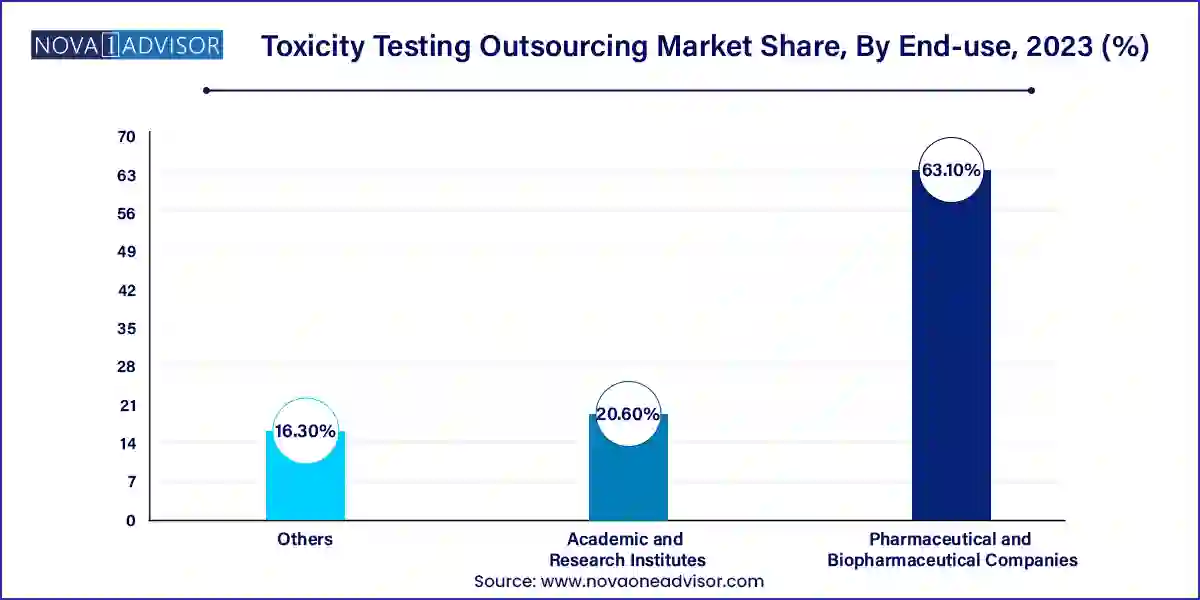

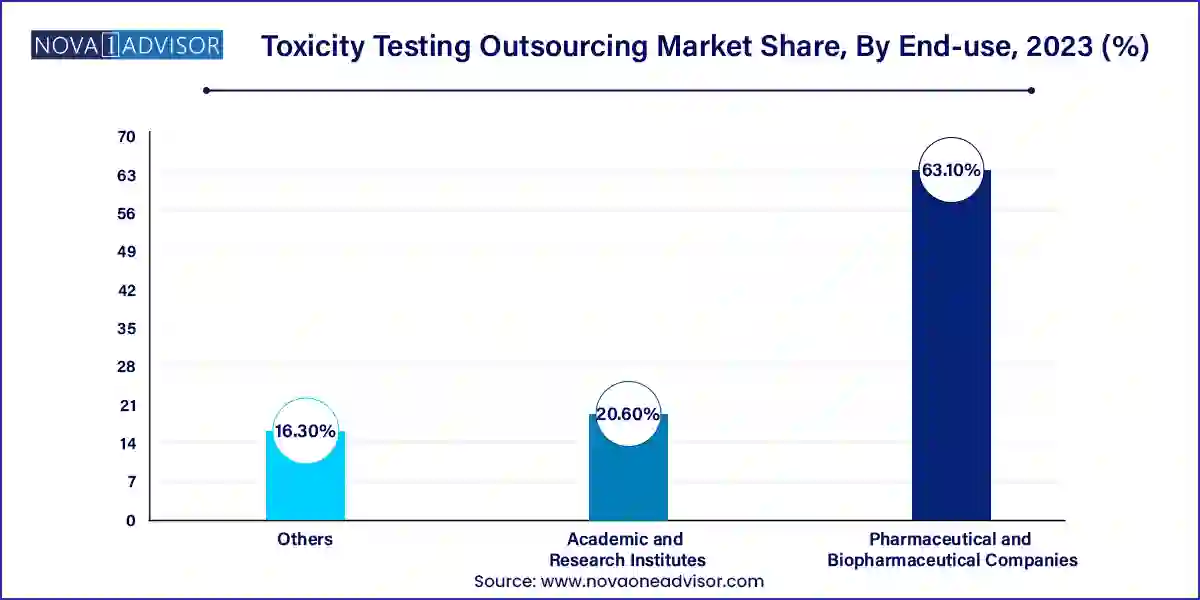

- The pharmaceutical and biopharmaceutical companies segment dominated the market and accounted for a revenue share of 63.1% in 2023.

Market Overview

The toxicity testing outsourcing market is gaining significant momentum as pharmaceutical, biopharmaceutical, chemical, and consumer product companies seek cost-effective, scalable, and compliant solutions for safety assessments. Toxicity testing is a critical step in drug and product development to evaluate the potential adverse effects of substances on biological systems. Given the regulatory rigor and ethical constraints surrounding these tests, outsourcing has become a strategic priority for organizations focused on innovation and market agility.

Outsourcing toxicity testing enables companies to leverage the expertise, infrastructure, and regulatory knowledge of specialized contract research organizations (CROs), reducing timelines, optimizing budgets, and ensuring global compliance. These services include a broad range of toxicity evaluations such as acute, sub-chronic, chronic, reproductive, developmental, genotoxicity, and carcinogenicity assessments, performed using both in vitro and in vivo methodologies.

The increased pace of drug development, the rise of biologics and personalized therapies, and evolving international regulatory requirements (like REACH in Europe or OECD guidelines globally) have further increased the demand for outsourcing toxicity studies. In parallel, growing ethical concerns and advocacy for animal-free testing models are pushing CROs to innovate and expand in vitro offerings using human cell lines, organ-on-chip platforms, and advanced imaging technologies.

Major Trends in the Market

-

Adoption of In Vitro and Alternative Testing Models

The market is seeing a shift toward non-animal testing methodologies, driven by ethics, regulatory pressure, and scientific advancements.

-

Rise of Genotoxicity and Immunotoxicity Testing in Biopharmaceuticals

Biologics and gene therapies have created new niches for specialized toxicity services tailored to these complex molecules.

-

Regulatory Harmonization Driving Global Outsourcing

Standardization of GLP and toxicity testing guidelines by organizations like OECD is facilitating cross-border outsourcing and global CRO growth.

-

Growth of Full-service and Niche CRO Partnerships

Companies are favoring end-to-end toxicology solutions or CROs with expertise in narrow therapeutic areas like oncology or neurology.

-

Integration of AI and Predictive Toxicology

AI-driven modeling, computational toxicology, and machine learning tools are being deployed for early-stage risk assessment and study optimization.

Report Scope of The Toxicity Testing Outsourcing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.52 Billion |

| Market Size by 2033 |

USD 13.45 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Method, GLP Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Euro fins Scientific, SGS SA, Charles River Laboratories, Thermo Fisher Scientific, Inc, Intertek Group plc, Catalent, Inc, ICON plc, Med pace, Labcorp Drug Development, and Wuxi AppTec. |

Market Driver: Rising Complexity of Drug Development Pipelines

One of the key drivers of the toxicity testing outsourcing market is the increasing complexity of modern therapeutics, especially with the surge in biologics, antibody-drug conjugates, cell and gene therapies, and RNA-based medicines. These novel therapies often require a more intricate battery of toxicity studies, including long-term safety evaluations, immune system effects, and reproductive toxicity.

Developing such therapies in-house demands specialized facilities, highly trained personnel, and dedicated regulatory teams—all of which increase operational costs and risk. Outsourcing toxicity testing allows innovators to de-risk their R&D programs, tap into cutting-edge techniques, and accelerate their preclinical timelines.

For example, a small biotech firm working on mRNA vaccines or CAR-T therapy might not have the in-house expertise to conduct comprehensive immunogenicity or cytokine release assays. Partnering with a CRO that specializes in immunotoxicology allows them to scale testing, meet IND submission requirements, and maintain compliance without building infrastructure from scratch.

Market Restraint: High Dependence on CROs and Data Confidentiality Concerns

Despite its advantages, one major restraint in outsourcing toxicity testing is the dependence on external providers and the risk of data security breaches or quality variability. Outsourcing critical data generation phases introduces vulnerabilities around intellectual property protection, confidentiality, and study integrity.

Furthermore, not all CROs operate at the same level of scientific rigor, and inconsistent Good Laboratory Practices (GLP) adherence, documentation errors, or deviations in methodology can lead to regulatory rejections or delays. This concern is especially acute in high-stakes therapeutic areas like oncology or rare diseases where precision data is paramount.

Additionally, geopolitical issues, such as data localization laws or cross-border compliance limitations, can complicate outsourcing to international providers. These factors can deter companies from outsourcing highly sensitive or novel projects and may lead to hybrid models where only standardized studies are outsourced.

An exciting opportunity in the market lies in the expansion of in vitro and predictive toxicology services. Regulatory agencies like the U.S. FDA, European Medicines Agency (EMA), and others are increasingly endorsing the use of alternative models for early toxicity screening to reduce animal usage, accelerate development, and cut costs.

Emerging technologies such as 3D tissue cultures, microfluidic organ-on-chip systems, and AI-powered simulation tools are transforming how toxicity is assessed. These systems can replicate human physiological responses more accurately than traditional animal models, offering better translational relevance.

CROs that invest in state-of-the-art in vitro testing facilities, high-throughput screening platforms, and toxicogenomic capabilities are poised to tap into a high-growth, innovation-driven segment. Startups and biopharma companies developing complex molecules increasingly seek predictive screening solutions to derisk candidates early and streamline their preclinical pipeline.

Segments:

Toxicity Testing Outsourcing Market By Method Insights

In vivo testing remains the dominant method in outsourced toxicity studies due to regulatory mandates for systemic toxicity, carcinogenicity, and reproductive toxicity evaluations, especially for new chemical entities (NCEs) and novel biologics. Despite ethical concerns, animal models remain a gold standard for assessing pharmacokinetics, metabolism, and multi-organ system effects.

Major regulatory agencies continue to require comprehensive in vivo studies for investigational new drug (IND) submissions. CROs with GLP-compliant animal testing facilities are key players, offering services including acute, sub-acute, and chronic toxicity studies across rodents and non-rodents.

In vitro testing is the fastest growing method segment, driven by advancements in cell-based assays, predictive modeling, and automation. These assays allow for rapid, scalable screening of compounds, especially during early discovery and lead optimization.

Use cases include cytotoxicity assays, hERG inhibition, Ames test, and hepatotoxicity assessments. The demand for non-animal models in cosmetics, food additives, and biologics development further fuels growth. As regulatory acceptance of in vitro models increases globally, this segment is poised for robust expansion.

Toxicity Testing Outsourcing Market By GLP Insights

GLP-compliant studies dominate the market as they are mandatory for data submission to regulatory bodies like the FDA, EMA, and PMDA. These studies are rigorously documented and validated, ensuring data integrity, reproducibility, and traceability.

CROs specializing in GLP studies provide high-quality services for safety pharmacology, carcinogenicity, and chronic dosing studies, making them integral to drug development and IND/NDA filings. Regulatory outsourcing demands are expanding this segment, particularly in North America and Europe.

Non-GLP studies are growing rapidly, especially in early-phase screening and academic research. They offer cost-effective options for hypothesis testing, compound prioritization, and mechanistic toxicology before committing to full-scale GLP programs.

Biotech startups often use non-GLP outsourcing to conduct proof-of-concept toxicity screens, reducing early-stage attrition. The demand for exploratory studies in nutraceuticals, agrochemicals, and cosmetic ingredients is further boosting this segment.

Toxicity Testing Outsourcing Market By End-use Insights

These companies are the primary clients of outsourced toxicity services, relying on CROs to manage preclinical safety evaluation across global pipelines. Big pharma, in particular, outsources large volumes of studies to manage risk, cut costs, and accelerate timelines.

They often engage in long-term strategic partnerships with full-service CROs to gain access to a spectrum of capabilities ranging from acute toxicity to genetic toxicology and carcinogenicity modeling.

Academic institutions and publicly funded research bodies are increasingly outsourcing complex toxicity assessments that they cannot perform in-house. This includes specialized immunotoxicology or neurotoxicity assessments and emerging in vitro modeling.

Collaborative consortia between universities and CROs for precompetitive toxicology data generation, especially in neglected diseases and pediatric drug development, are contributing to this segment’s growth.

Toxicity Testing Outsourcing Market By Regional Insights

North America dominates the global market due to its robust pharmaceutical R&D ecosystem, high regulatory scrutiny, and mature CRO industry. The U.S. is home to major players like Charles River Laboratories, Labcorp Drug Development, and ITR Laboratories, which support preclinical testing pipelines for global clients.

The FDA’s emphasis on comprehensive safety data, including reproductive and long-term toxicity, sustains demand for GLP outsourcing. Furthermore, North America is at the forefront of toxicogenomics, AI-enabled modeling, and organ-on-chip development, making it a hub for advanced in vitro solutions.

Asia-Pacific is the fastest-growing region, driven by outsourcing cost advantages, regulatory reforms, and expanding biopharmaceutical R&D. Countries like India, China, and South Korea are investing in preclinical infrastructure and attracting international sponsors seeking GLP and OECD-compliant services.

China’s commitment to biotech self-sufficiency and India’s large pool of scientific talent are attracting global partnerships and clinical outsourcing projects. Additionally, government-funded research hubs and biotech parks in the region are pushing academic demand for toxicity services.

Some of the prominent players in the Toxicity testing outsourcing market include:

- Euro fins Scientific

- SGS SA

- Charles River Laboratories

- Thermo Fisher Scientific, Inc.

- Intertek Group plc,

- Catalent, Inc.

- ICON plc.

- Med pace

- Labcorp Drug Development

- Wuxi AppTec

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global toxicity testing outsourcing market.

Method

GLP Type

End-use

- Pharmaceutical and Biopharmaceutical Companies

- Academic and Research Institutes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)