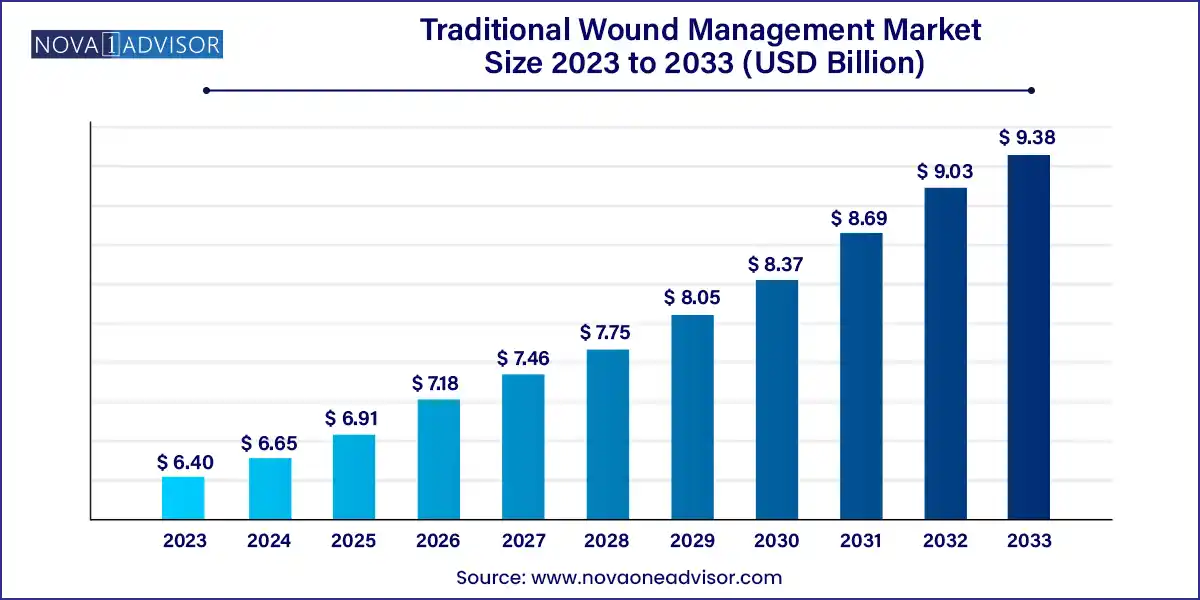

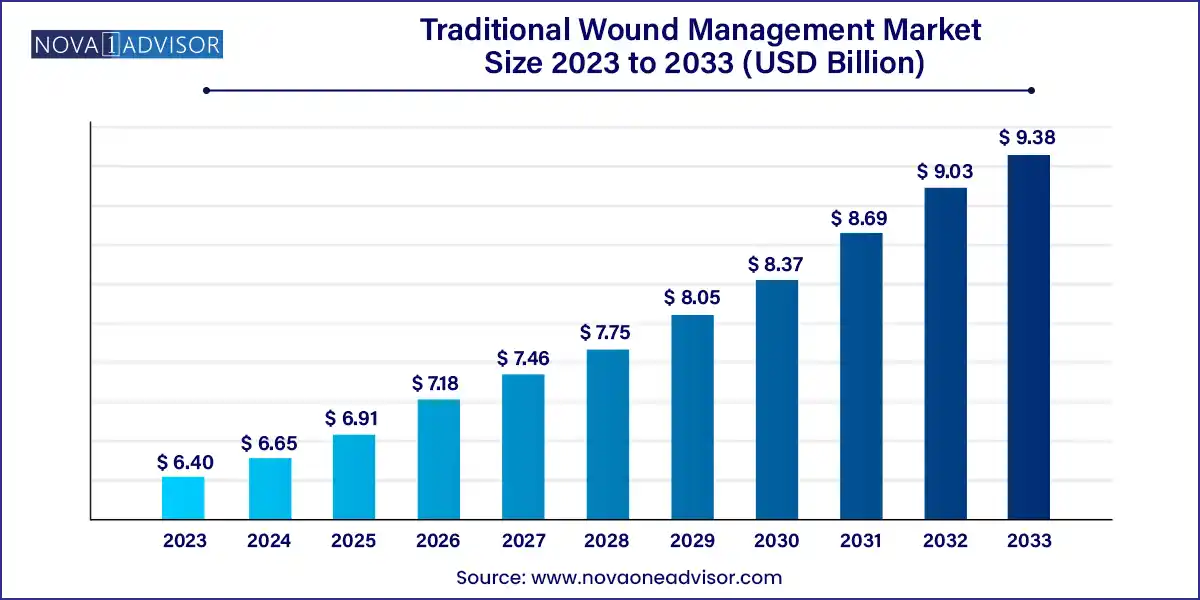

The global traditional wound management market size was exhibited at USD 6.40 billion in 2023 and is projected to hit around USD 9.38 billion by 2033, growing at a CAGR of 3.9% during the forecast period 2024 to 2033.

Key Takeaways:

- North America dominated the global industry in 2023 with a revenue share of more than 46.00%.

- The gauze segment accounted for the largest share of more than 48.90% of the overall revenue in 2023.

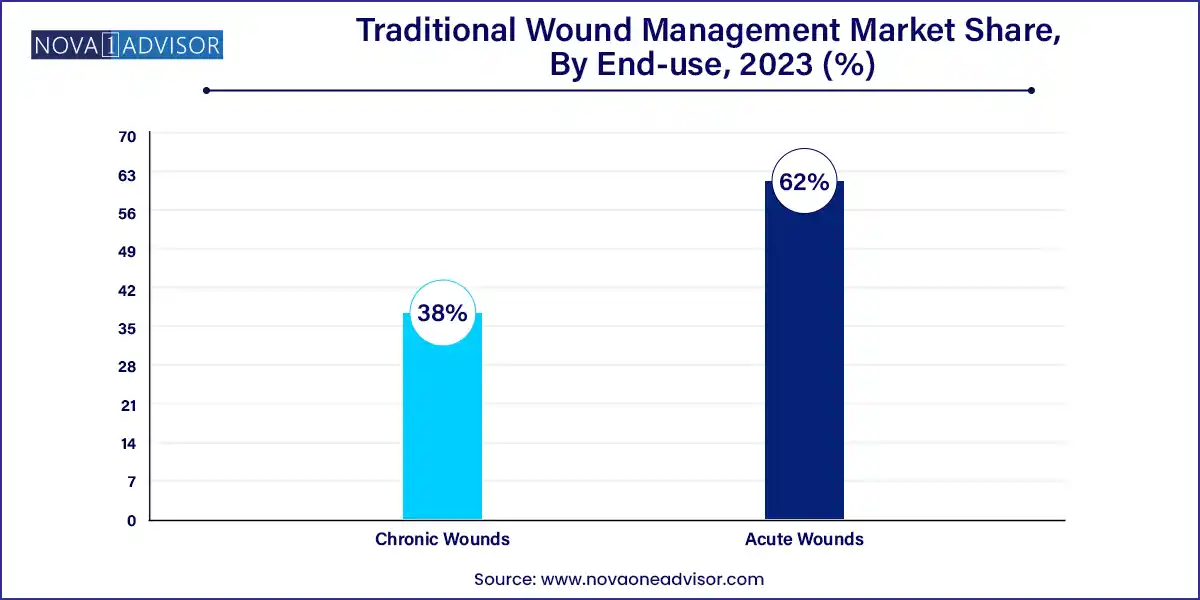

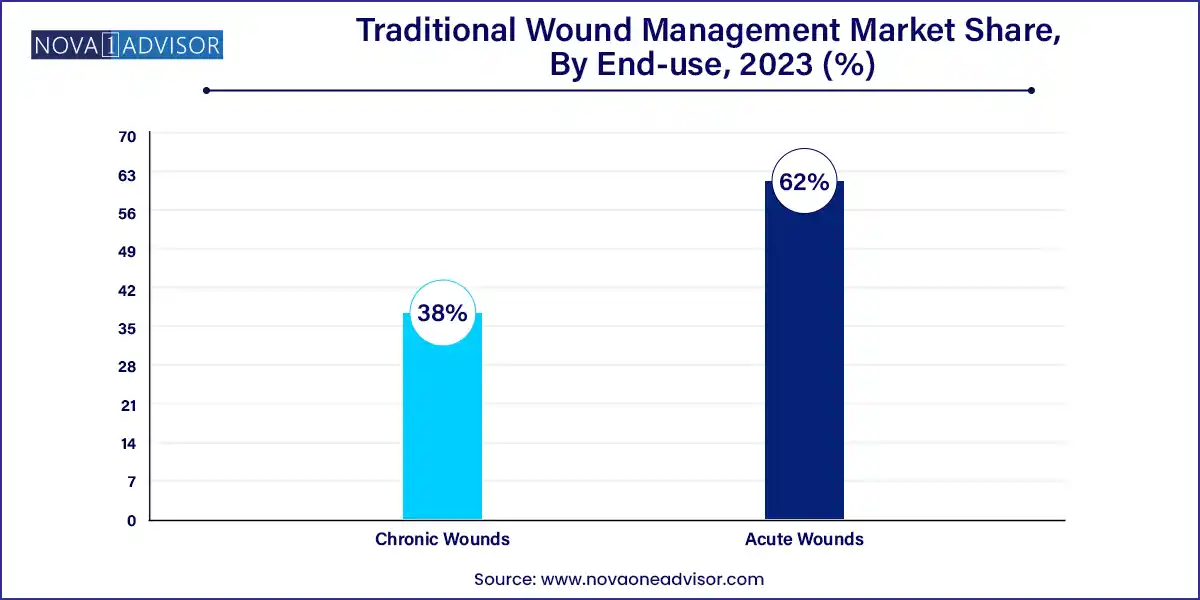

- The acute wounds segment held the largest share of around 62.0% of the overall revenue in 2023.

- The hospitals segment dominated the global industry in 2023 and accounted for the largest share of more than 45.00% of the overall revenue.

Market Overview

The Traditional Wound Management Market comprises basic wound care products such as gauze, cotton, bandages, and medical tapes that are widely used across medical and non-medical settings. Unlike advanced wound care therapies, which utilize hydrocolloids, foams, and negative pressure devices, traditional wound care focuses on the primary goals of wound protection, exudate absorption, and wound bed cleanliness. It is especially critical in low-resource settings and in the management of acute and less complex chronic wounds.

As global healthcare expenditure increases and access to care improves, the demand for basic wound care solutions remains robust. Particularly in emerging and developing economies, traditional wound care products serve as the first line of treatment for surgical wounds, traumatic injuries, and common skin ulcers. In regions where affordability and access to technology are limited, these products remain irreplaceable.

Despite the surge in demand for high-end products in advanced medical facilities, traditional wound management continues to dominate rural and peri-urban markets, emergency care, home healthcare, and natural disaster relief contexts. Furthermore, with increasing incidences of diabetes and obesity, the chronic wound burden particularly in diabetic foot ulcers and pressure sores is making wound care a central concern of primary healthcare.

Major Trends in the Market

-

Increased Demand for Cost-Effective Wound Care in Emerging Economies: Price-sensitive markets prefer traditional gauze, bandages, and cotton.

-

Growth of Home Healthcare Usage: More patients are managing minor wounds or post-surgical recovery at home, boosting sales of consumer-grade bandages and tapes.

-

Hybrid Wound Care Kits: Inclusion of antiseptics, gauze, and tapes in pre-assembled kits is rising, especially for rural outreach programs.

-

Eco-friendly and Biodegradable Materials: Environmental concerns are prompting manufacturers to explore cotton alternatives and compostable packaging.

-

Infection-Resistant Tapes and Gauze: Antimicrobial-impregnated traditional products are entering the market as a bridge between basic and advanced wound care.

-

Expansion of E-commerce Distribution Channels: Online availability of traditional wound care products is growing, especially in Asia and Latin America.

-

Public Health Campaigns and First-Aid Education: Governments and NGOs are promoting basic wound care literacy, increasing sales of traditional products.

-

Increased Incidence of Burns and Accidents: Road traffic accidents, occupational injuries, and household mishaps are driving acute wound treatment demand.

Traditional Wound Management Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.65 Billion |

| Market Size by 2033 |

USD 9.38 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

3M; ConvaTec Group PLC; DermaRite Industries LLC; DeRoyal Industries Inc.; Hollister Inc.; Integra LifeSciences Holdings Corp.; Coloplast A/S; Medtronic plc; Mölnlycke Health Care AB; Smith & Nephew plc.; B. Braun Melsungen AG; PAUL HARTMANN AG; Johnson & Johnson Pvt. Ltd. |

Market Driver: Rising Incidence of Chronic and Acute Wounds Globally

A major driver of the traditional wound management market is the rising global burden of acute injuries and chronic conditions, especially in aging populations. Chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, are increasing due to the rising prevalence of diabetes and mobility-reducing conditions. Acute wounds resulting from surgical procedures, accidents, and burns also remain common in both urban and rural populations.

In low- and middle-income countries, where access to sophisticated wound care products may be limited, traditional products remain the primary means of care. Moreover, natural disasters, conflict zones, and pandemic-driven constraints often push healthcare systems to rely on readily available, low-cost solutions such as gauze, cotton rolls, and adhesive tapes.

Market Restraint: Limited Healing Capabilities and Innovation Compared to Advanced Products

The biggest limitation of traditional wound care products lies in their limited ability to promote active wound healing. Unlike hydrocolloid dressings, silver-infused bandages, or negative pressure wound therapy, traditional gauze and bandages primarily serve protective functions without contributing to cellular regeneration or infection prevention.

Additionally, the market has experienced relatively low levels of product innovation. Traditional products often lack antimicrobial properties, moisture retention capabilities, or smart diagnostic features—factors that are increasingly being demanded by clinicians. In markets where advanced wound care is affordable and available, the preference naturally shifts away from traditional offerings, limiting growth in developed regions.

Market Opportunity: Integration of Traditional Products with Basic Antimicrobial Technologies

An exciting opportunity for market growth lies in enhancing traditional wound care products with antimicrobial and moisture-managing features while keeping them affordable. Products like gauze embedded with silver nanoparticles, iodine, or chlorhexidine can reduce bacterial load without the cost of advanced dressing systems.

Additionally, collaboration with public healthcare systems to supply pre-assembled wound kits to community health workers and emergency responders could substantially increase volume demand. In rural India or sub-Saharan Africa, for instance, NGOs and government health workers often rely on these products during outreach, childbirth, immunization days, and minor surgeries.

Investment in locally sourced raw materials, sustainable packaging, and public-private manufacturing partnerships can also open up new markets while aligning with UN Sustainable Development Goals.

Segments Insights:

By Product Insights

Gauze dominates the traditional wound care product segment, largely because of its versatility, affordability, and broad applicability across all types of wounds. Gauze is used to clean, cover, and pack wounds and is available in multiple formats including rolls, pads, and sponges. In both clinical and home settings, it remains the default choice for managing bleeding, exudates, and preventing infection. Gauze is also often used in combination with antiseptics or ointments to improve healing outcomes.

However, tapes are emerging as the fastest-growing product segment, especially adhesive medical tapes used to secure dressings, IV lines, and catheters. With the rise of ambulatory care and self-managed wound dressing, tapes that are hypoallergenic, breathable, and easy to remove are gaining significant popularity. Innovations such as paper tapes for pediatric use, waterproof tapes for post-surgical recovery, and antimicrobial tapes are increasingly being adopted in hospitals and home healthcare settings.

By Application Insights

Chronic wounds represent the dominant application segment, accounting for a large share of market demand, particularly in aging and diabetic populations. Diabetic foot ulcers, venous leg ulcers, and pressure sores require continuous care and often involve traditional gauze, bandages, and tapes as part of routine dressing changes. Hospitals and long-term care facilities use these products extensively for patients with restricted mobility.

Acute wounds are the fastest-growing application, particularly in the context of burns, surgical wounds, and trauma cases. Whether it’s a post-operative incision or a household injury, traditional wound products serve the essential need for basic first aid and wound closure. Rising rates of emergency room admissions and increased surgical procedures globally are further fueling this segment’s expansion.

By End-use Insights

Hospitals are the largest end-use sector, given the sheer volume of surgical procedures, inpatient wound management needs, and emergency cases. They routinely stock gauze, bandages, cotton pads, and tape in bulk, and use these across all departments—from general medicine to surgery, pediatrics, and emergency rooms.

Home healthcare is the fastest-growing end-use segment, fueled by the increasing preference for home recovery, especially in post-operative and elderly patients. Consumers are purchasing traditional wound care supplies directly from retail pharmacies or online channels for minor wounds, diabetic foot care, or post-discharge dressing needs. Telemedicine consultations often include recommendations for basic wound supplies that can be self-administered.

By Regional Insights

North America dominates the traditional wound management market, thanks to a well-established healthcare system, high incidence of chronic diseases, and widespread availability of medical-grade wound care products. The U.S. has a significant elderly population requiring long-term wound care, and reimbursement support for wound treatment encourages the adoption of both traditional and advanced products. Major healthcare product distributors ensure steady supply across clinics, hospitals, and home healthcare networks.

Asia-Pacific is the fastest-growing region, supported by its vast population, rapidly aging demographics, and improvements in healthcare infrastructure. Countries like India, China, Indonesia, and Vietnam are witnessing increased surgical volumes, traffic-related injuries, and non-communicable diseases all of which demand affordable wound care. Government initiatives promoting rural health outreach and first-aid training programs are also boosting product demand.

Some of the prominent players in the traditional wound management market include:

- 3M

- ConvaTec Group PLC

- DermaRite Industries LLC.

- DeRoyal Industries Inc.

- Hollister Incorporated

- Integra LifeSciences Holdings Corp.

- Coloplast A/S

- Medtronic plc.

- Mölnlycke Health Care AB

- Smith & Nephew plc.

- B. Braun Melsungen AG

- PAUL HARTMANN AG

- Johnson & Johnson Pvt. Ltd.

Recent Developments

-

3M Health Care (April 2025): Launched a new line of breathable antimicrobial gauze pads designed for developing countries under its global access initiative.

-

Smith & Nephew (March 2025): Expanded its traditional wound care manufacturing in Southeast Asia to support growing demand for cotton-based products in public hospitals.

-

Medline Industries (February 2025): Rolled out an e-commerce portal tailored for caregivers and home healthcare users, offering bundled wound care kits.

-

ConvaTec Group (January 2025): Announced a partnership with humanitarian NGOs to distribute gauze and bandage packs in disaster-affected regions in Latin America.

-

B. Braun (December 2024): Introduced eco-friendly packaging for its gauze and tape lines in compliance with the European Union’s Green Healthcare initiative.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global traditional wound management market.

Product

- Gauze

- Tape

- Bandages

- Cotton

Application

-

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

-

- Surgical & Traumatic Wounds

- Burns

End-use

- Hospitals

- Clinics

- Home Healthcare

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)