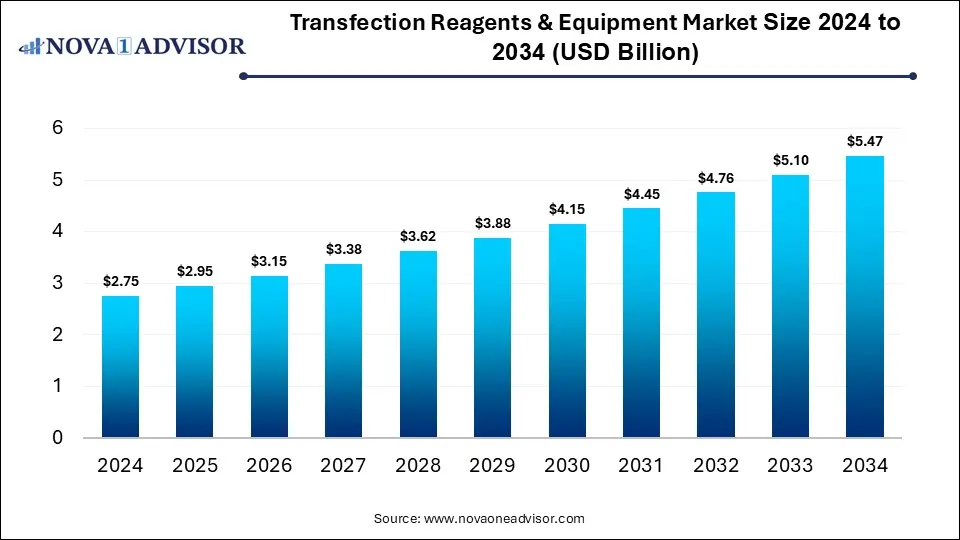

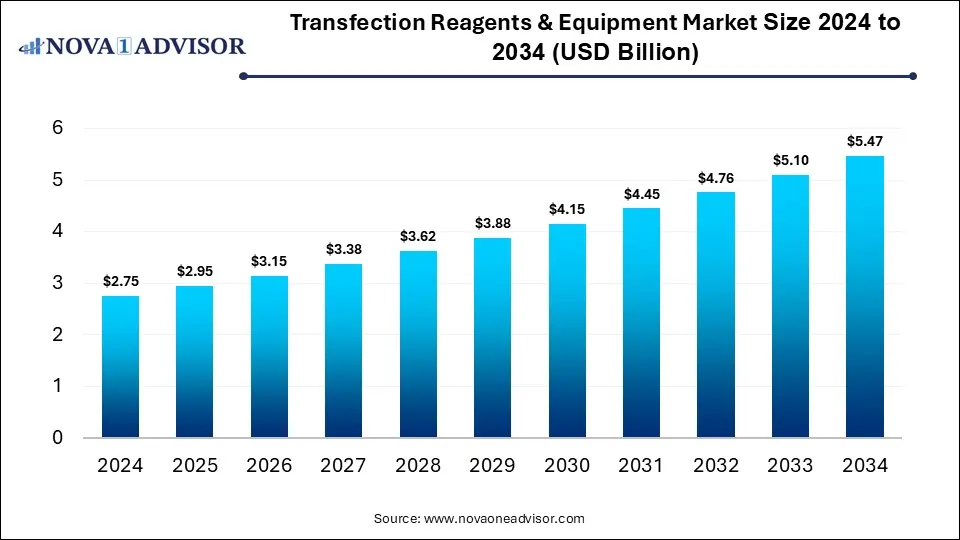

Transfection Reagents & Equipment Market Size and Growth 2025 to 2034

The global transfection reagents & equipment market size was valued at USD 2.75 billion in 2024 and is anticipated to reach around USD 5.47 billion by 2034, growing at a CAGR of 7.11% from 2025 to 2034. The growth of the transfection reagents & equipment market is driven by the advancements in genetic research, increased R&D investments, rise of personalized medicine and increasing prevalence of chronic diseases like cancer.

Transfection Reagents & Equipment Market Key Takeaways

- Based on the product, the reagents segment dominated the transfection reagents and equipment market, with the largest revenue share of 56% in 2024.

- The equipment segment is expected to experience expansion over the forecast period.

- The electroporation segment dominated the market in 2024.

- The particle bombardment segment is expected to be the fastest-growing segment during the forecast period.

- The gene expression studies segment accounted for the largest market revenue share in 2024.

- The biomedical research segment is expected to register the fastest CAGR over the forecast period.

- The pharmaceutical and biotechnological companies segment dominated in 2024.

- The academic and Research Institutes segment is expected to witness the fastest CAGR over the forecast period.

Market Overview

The global Transfection Reagents & Equipment Market has become a vital component of modern molecular biology, enabling researchers to study gene function, manipulate cellular processes, and develop next-generation therapeutics. Transfection is the process of introducing nucleic acids—such as DNA or RNA—into eukaryotic cells using chemical, physical, or biological methods. The reagents and equipment used for this procedure are essential for a wide range of applications, including gene expression studies, protein production, genome editing, and cancer research.

Over the past decade, the market has evolved rapidly, fueled by advances in gene therapy, cell-based assays, and synthetic biology. The rise of technologies like CRISPR-Cas9, RNA interference (RNAi), and the growing demand for recombinant protein therapeutics have significantly increased the utility and adoption of transfection tools. In both academic and commercial settings, transfection is used to explore gene function, develop disease models, and test new drug candidates.

The COVID-19 pandemic also had a catalytic impact on the market. Transfection played a central role in vaccine development platforms—particularly in the production of viral vectors and mRNA constructs for vaccines. This accelerated research in genetic engineering and biopharma, creating long-term demand for optimized transfection reagents and high-throughput equipment. Moreover, the post-pandemic world has witnessed greater investments in biotechnology infrastructure, especially in developing nations, thereby expanding the global transfection footprint.

From manual benchtop electroporators to fully automated systems and specialized nanoparticles, the market is diverse and highly competitive. Innovation is increasingly focused on achieving higher transfection efficiency, minimizing cytotoxicity, and enabling delivery into hard-to-transfect cell lines such as primary neurons or stem cells. As gene and cell therapies continue to mature, the transfection market will be foundational in translating basic biological discoveries into clinical breakthroughs.

Major Trends in the Market

-

Shift Toward Non-viral Delivery Methods: Due to safety and scalability issues associated with viral vectors, there's growing interest in non-viral techniques such as electroporation, liposomes, and nanoparticle-based transfection.

-

Customization for Hard-to-Transfect Cells: Vendors are developing cell-specific reagents and optimized protocols for challenging cell types like T cells, neurons, and stem cells.

-

Integration with High-throughput Systems: Automated transfection platforms that support 96- and 384-well plates are gaining popularity in large-scale screening environments.

-

CRISPR and Gene Editing Expansion: Transfection technologies are being refined to support more efficient delivery of gene-editing tools such as CRISPR-Cas9 complexes.

-

Advancements in Synthetic Polymers and Lipids: Novel biodegradable and low-toxicity transfection carriers are being developed to improve delivery precision and reduce cellular stress.

-

Growing Use in mRNA Therapeutics: With mRNA vaccines proving viable, transfection methods tailored for mRNA delivery are in high demand for both research and commercial applications.

-

Miniaturization and Portability: New portable electroporation systems and microfluidics-based devices are enabling point-of-use and remote lab applications.

Integration of artificial intelligence (AI) in transfection reagents and equipment market is enhancing the accuracy, efficiency, and reproducibility of gene delivery workflows. AI algorithms can be applied for analyzing huge datasets of transfection experiments for identifying optimal reagent-to-DNA ratios, incubation times, and other parameters related to specific cell types and vectors. Designing and testing of new transfection reagents with AI can potentially improve the efficiency and reduce toxicity of formulations. Automation of electroporation systems and robotic platforms with AI can maximize transfection efficiency and mitigate errors.

Transfection Reagents & Equipment Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 2.95 Billion |

| Market Size by 2034 |

USD 5.47 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.11% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, Method, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Promega Corporation; Lonza; QIAGEN; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Merck KGaA; OriGene Technologies, Inc.; MaxCyte; Polyplus |

Market Driver: Expansion of Gene Therapy and Cell-based Therapies

A major driver for the transfection reagents and equipment market is the expansion of gene and cell therapy research and commercialization. Gene therapies involve modifying or replacing defective genes to treat genetic disorders, while cell therapies—such as CAR-T treatments—use genetically engineered cells to combat diseases like cancer. Both approaches rely heavily on precise, efficient, and reproducible gene delivery technologies.

Transfection is a cornerstone of these advanced therapies, particularly in the production of engineered cell lines, preclinical testing, and biomanufacturing. For example, to produce CAR-T cells, T lymphocytes are transfected with chimeric antigen receptor constructs, allowing them to recognize and destroy cancer cells. The increasing number of FDA-approved gene therapies and growing clinical trial activity globally are boosting demand for high-efficiency, low-toxicity transfection systems.

As more biopharmaceutical companies enter this space, the need for scalable, GMP-compliant transfection solutions becomes paramount. Reagents optimized for clinical-grade cell production, automated electroporation systems, and closed-loop delivery platforms are increasingly becoming the norm. This driver is expected to gain further momentum as regulatory frameworks mature and reimbursement models for gene therapies are refined.

Market Restraint: Transfection Efficiency and Cytotoxicity Trade-offs

Despite advancements, a critical restraint in the transfection market remains the balance between high efficiency and low cytotoxicity. Transfection reagents and equipment must deliver genetic material effectively without triggering significant cellular stress or death. However, many commonly used methods—such as electroporation or certain chemical carriers—can compromise cell viability, particularly in sensitive or primary cell lines.

This becomes a major limitation in clinical research and therapeutic applications where maintaining cell integrity is crucial. Inefficient transfection can lead to poor reproducibility, skewed experimental results, and increased cost due to failed assays. Furthermore, optimizing transfection protocols often requires time-consuming trial-and-error approaches, limiting throughput and delaying workflows. For pharmaceutical and academic institutions working under tight timelines, these challenges can significantly hamper productivity and data reliability.

Manufacturers must therefore continuously innovate to create formulations that maximize uptake while minimizing toxicity, especially for use in GMP environments or human-derived samples.

Market Opportunity: Personalized Medicine and Functional Genomics

The emerging field of personalized medicine presents an enormous opportunity for the transfection market. Personalized or precision medicine aims to tailor treatment strategies to individual patients based on genetic, environmental, and lifestyle factors. Transfection plays a pivotal role in the functional genomics workflows required to identify disease-relevant genes, validate drug targets, and test therapeutic responses in patient-derived cells.

For instance, organoid models derived from patient biopsies are increasingly used to simulate disease environments in vitro. Transfecting these models with reporter genes, gene-editing tools, or fluorescent markers allows researchers to explore pathophysiology and assess therapeutic efficacy in a patient-specific context. Moreover, advancements in single-cell analysis and multi-omics approaches are boosting demand for ultra-precise gene delivery technologies.

As hospitals and research labs incorporate genomic testing into routine diagnostics, the downstream demand for transfection systems that support functional validation is set to grow significantly. Companies offering turnkey solutions for personalized drug screening and diagnostics stand to gain a competitive advantage.

Transfection Reagents & Equipment Market By Product Insights

Reagents dominate the market due to their wide applicability, lower cost, and critical role in nearly all transfection workflows. These include liposomes, polymers, nanoparticles, calcium phosphate, and dendrimer-based solutions tailored for various cell types and genetic materials. Chemical reagents are often the entry point for new users due to their ease of use and compatibility with standard lab protocols. Additionally, vendors provide ready-to-use kits with detailed protocols, reducing training overhead for research staff. Academic labs, in particular, rely heavily on these reagents for exploratory studies and routine experiments.

Meanwhile, Equipment is the fastest-growing product category. Electroporators, microinjection systems, and other physical delivery devices are essential for transfecting difficult cell types or achieving high transfection rates in therapeutic applications. Companies are launching compact, automated platforms designed for high-throughput use in pharmaceutical R&D. The demand for electroporation systems, in particular, has surged due to their utility in cell and gene therapy manufacturing, where chemical reagents may be too toxic or inefficient. With miniaturization and IoT integration on the rise, equipment will likely capture a larger market share over time.

Transfection Reagents & Equipment Market By Method Insights

Electroporation led the market in terms of method due to its versatility and superior transfection efficiency across a wide range of cell types. It uses controlled electrical pulses to permeabilize the cell membrane, allowing nucleic acids to enter the cytoplasm or nucleus. This method is especially valuable for transfecting difficult primary cells or large plasmids and is widely used in both academic research and clinical manufacturing. Its non-chemical nature also makes it suitable for applications requiring reduced biological variability or toxicity, such as vaccine production or CAR-T cell engineering.

On the other hand, Liposome-based transfection is the fastest-growing technique. Liposomes offer a safer, non-viral delivery method and have been refined over the years to enhance cellular uptake and endosomal escape. Their biocompatibility and ability to encapsulate a wide range of payloads—from plasmid DNA to siRNA and mRNA—make them ideal for many in vitro and in vivo applications. The success of lipid nanoparticle formulations in COVID-19 mRNA vaccines has further spotlighted this method, leading to increased investment and research in liposomal transfection.

Transfection Reagents & Equipment Market By Application Insights

Gene Expression Studies dominate the transfection applications landscape, driven by academic research and pharmaceutical efforts to understand gene function and regulatory pathways. Transfection enables researchers to overexpress or silence specific genes, providing insights into cellular mechanisms and disease pathology. This foundational application supports everything from developmental biology to drug screening. Universities and research institutions remain the largest contributors to this segment, and the rise of functional genomics and transcriptomics continues to expand its scope.

Therapeutic Delivery is emerging as the fastest-growing application. As gene and cell therapies move toward clinical and commercial implementation, transfection becomes a key step in delivering therapeutic payloads to target cells. Whether delivering mRNA to induce protein expression or plasmids for genome editing, efficient and scalable transfection platforms are essential. Biopharmaceutical companies are increasingly investing in GMP-grade transfection tools to support preclinical and clinical manufacturing, significantly driving growth in this segment.

Transfection Reagents & Equipment Market By End-use Insights

Academic and Research Institutes represent the largest end-users, reflecting the widespread use of transfection in basic science and preclinical research. These institutions rely heavily on reagents for gene function studies, CRISPR validation, and the creation of genetically modified cell lines. Government grants and public funding support the proliferation of these studies, making this segment a stable source of demand for transfection tools.

Pharmaceutical and Biotechnology Companies are the fastest-growing segment. The commercialization of gene-based therapies, vaccine development, and personalized medicine has driven pharmaceutical companies to adopt high-efficiency, scalable transfection technologies. With increasing regulatory scrutiny and demand for GMP-compliant manufacturing, these companies are prioritizing investment in both reagent optimization and equipment upgrades, particularly for clinical applications.

Transfection Reagents & Equipment Market By Regional Insights

North America, particularly the U.S., dominates the transfection market due to its robust biotechnology ecosystem, advanced academic research landscape, and high R&D expenditure. The presence of global biotech leaders such as Thermo Fisher Scientific, Lonza, and Bio-Rad in the region ensures continuous innovation and product development. Government support through the NIH and private venture capital funding have further accelerated the adoption of transfection technologies across academic and industrial domains. The region also leads in clinical trial activity for gene therapies, directly impacting demand for scalable, compliant transfection solutions.

U.S. Transfection Reagents & Equipment Market Trends

The U.S. is a major contributor to the market in North America, driven by factors such as strong presence of major pharmaceutical and biotechnology companies, increasing cases of genetic disorders, well-established healthcare infrastructure, and rising focus for personalized medicine approaches. Strategic alliances among market players, research organizations and academic institutes are bolstering the market growth. Additionally, increased government support through substantial funding for genetic research as well as development of advanced gene therapies are fuelling the demand for transfection technologies.

Asia-Pacific is the Fastest Growing Region

The Asia-Pacific region is experiencing the fastest growth, propelled by rising investments in biotechnology, expanding healthcare infrastructure, and increasing academic output. Countries like China, India, South Korea, and Singapore are rapidly developing their life sciences capabilities. Governments are offering incentives for biotech startups, and many pharmaceutical companies are outsourcing R&D to the region. Additionally, the growing prevalence of chronic diseases, large patient populations, and demand for affordable gene therapies are pushing research institutions and biomanufacturers in Asia-Pacific to adopt cutting-edge transfection tools.

China Transfection Reagents & Equipment Market

China is anticipated to witness significant growth in the market in Asia Pacific over the forecast period. The market growth can be linked to the rising cases of chronic diseases such as cancer and genetic disorders, large patient pool, rise in number of clinical trials for gene therapies, and innovative transfection product launches. The rise in investments in the biotechnology sector, particularly for cell and gene therapies is creating the need for advanced transfection technologies. Advancements in transfection equipment like automated systems as well as improved transfection reagents like lipid-based solutions are making transfection more accessible and effective. Furthermore, supportive government initiatives and cost-effectiveness of conducting clinical trials are driving the market expansion.

Transfection Reagents & Equipment Market Top Key Companies:

The following are the leading companies in the transfection reagent & equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Promega Corporation

- Lonza

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- OriGene Technologies, Inc.

- MaxCyte

- Polyplus

Transfection Reagents & Equipment Market Recent Developments

- In April 2025, Kytopen Corp. and Aldevron announced a joint marketing agreement to enhance workflow solutions for cell therapy manufacturers. The partnership will expedite cell therapy manufacturing by combining the Aldveron Nanoplasmid vector technology with Kytopen's Flowfect Tx GMP cellular engineering platform in CRISPR-mediated engineering of primary T Cells.

- In March 2025, Bharat Biotech International Limited (BBIL), inaugurated India’s only vertically integrated, purpose-built Cell & Gene Therapy (CGT) Infrastructure & Viral Vector Production Facility at Genome Valley. The new facility will expand its expertise from vaccine innovation to cutting-edge regenerative and personalized therapies to address scientific challenges such as immune system modulation, targeted gene expression, and long-term cell survival.

- In July 2024, STEMCELL Technologies commercially launched a breakthrough new technology, the CellPore Transfection System which will potentially advance cell engineering research and the development of novel cell therapies for curing diseases

- In April 2024, Asimov, the synthetic biology company, after achieving 10x improvement in lentiviral production announced the expansion of its LV Edge System by launching a completely stable cell line development service.

Transfection Reagents & Equipment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Transfection Reagents & Equipment market.

By Product

By Method

- Electroporation

- Liposomes

- Particle Bombardment

- Microinjection

- Adenoviral Vectors

- Calcium Phosphate

- DEAE-dextran

- Magnetic Beads

- Activated Dendrimers

- Laserfection

By Application

- Gene Expression Studies

- Protein Production

- Transgenic Models

- Therapeutic Delivery

- Cancer Research

- Biomedical Research

By End-use

- Academic And Research Institutes

- Pharmaceutical And Biotechnology Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)