Trauma Care Centers Market Size and Forecast 2025 to 2034

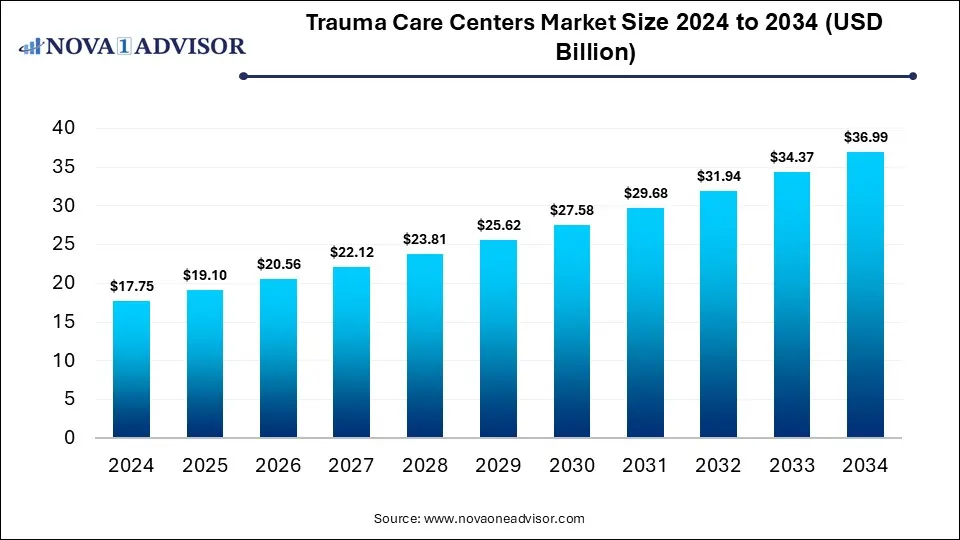

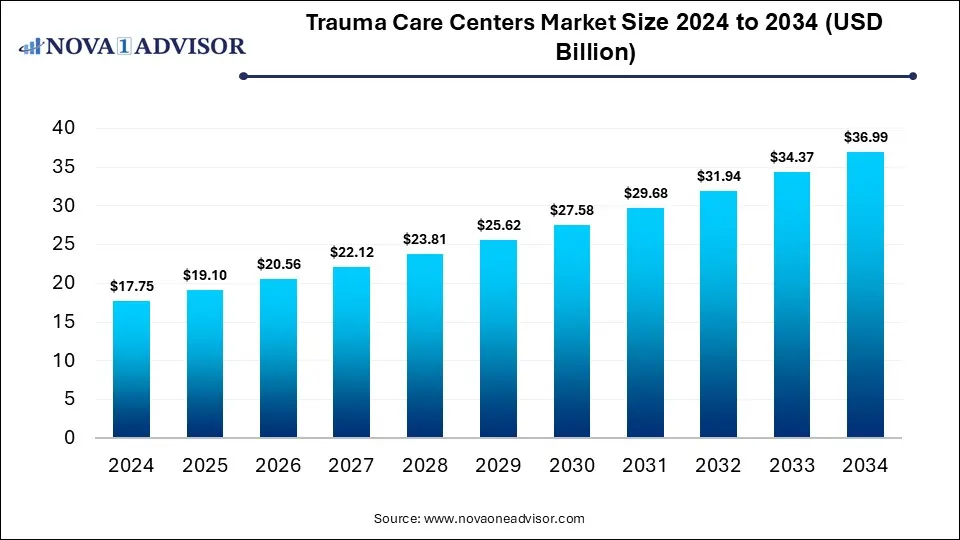

The global trauma care centers market size was estimated at USD 17.75 billion in 2024 and is expected to reach USD 36.99 billion by 2034, expanding at a CAGR of 7.62% during the forecast period of 2025 to 2034. The market growth is driven by the rising incidence of traumatic injuries, expanding emergency medical services, increasing government support, and growing demand for specialized care among aging and chronically ill populations.

Key Takeaways

- By region, North America dominated the trauma care centers market in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By facility type, the in-house segment led the market in 2024.

- By facility type, the standalone segment is expected to expand at a significant rate throughout the forecast period.

- By trauma type, the falls segment held the largest share of the market in 2024.

- By trauma type, the traffic-related injuries segment is expected to grow at the highest CAGR over the projection period.

- By service type, the outpatient segment contributed the largest market share in 2024.

- By service type, the inpatient segment is expected to grow at the fastest CAGR in the upcoming period.

Impact of AI on the Trauma Care Centers Market

AI is significantly transforming the trauma care centers market by enhancing diagnostic accuracy, speeding up patient triage, and optimizing treatment plans through data-driven insights. AI-powered tools enable real-time analysis of medical imaging and vital signs, allowing faster and more precise identification of injuries. Additionally, AI-driven predictive analytics help in resource allocation and patient outcome forecasting, improving overall trauma care efficiency. Integration of AI with telemedicine also expands access to expert trauma care in remote areas, further driving market growth and innovation.

Market Overview

The trauma care centers market encompasses specialized facilities that provide immediate and comprehensive medical treatment to patients suffering from severe injuries due to accidents, falls, or other traumatic events. These centers offer critical advantages such as rapid response, multidisciplinary care, and advanced technology integration, which improve patient outcomes and survival rates. The market is experiencing significant growth due to growing awareness about the importance of timely trauma care. Additionally, increasing aging population contributes to market expansion, as older adults are more susceptible to falls and other injuries, increasing the demand for trauma care.

- According to WHO, by 2030, 1 in 6 people globally will be aged 60 or older, rising from 1 billion in 2020 to 1.4 billion. By 2050, this population will double to 2.1 billion, with those aged 80+ expected to triple to 426 million.

What are the Major Trends in the Trauma Care Centers Market?

- Rise of Teletrauma Services: Telemedicine and teletrauma platforms are enabling remote consultation and real-time support, improving trauma care access, especially in rural and underserved regions.

- Growth of Standalone Trauma Centers: Standalone facilities focused solely on trauma care are expanding, offering specialized services and reducing pressure on traditional hospital emergency departments.

- Focus on Model-Informed Decision Making: The integration of predictive analytics and simulation models helps optimize resource allocation, improve clinical outcomes, and streamline trauma care processes.

- Expansion of Pediatric Trauma Care: There is a growing emphasis on establishing specialized pediatric trauma centers to address the unique needs of injured children with tailored care protocols.

- Partnerships & Collaborations: Collaborations between hospitals, technology providers, and research institutions facilitate the development and adoption of innovative trauma solutions, improving treatment protocols and patient outcomes. Joint ventures also help expand trauma care networks, increasing accessibility in underserved regions and streamlining emergency response systems.

Report Scope of Trauma Care Centers Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 19.10 Billion |

| Market Size by 2034 |

USD 36.99 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.62% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Facility Type, Trauma Type, Service Type and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Increasing Incidence of Traumatic Injuries

The increasing incidence of traumatic injuries, driven by factors such as rising road accidents, industrial hazards, and an aging population prone to falls, is a key factor driving the growth of the trauma care centers market. As more individuals suffer from severe injuries requiring immediate and specialized medical attention, the demand for well-equipped trauma centers continues to grow. This surge in trauma cases compels healthcare providers and governments to invest in expanding trauma care infrastructure and services. Consequently, the market is experiencing steady growth fueled by the urgent need to improve patient outcomes and reduce mortality rates associated with traumatic injuries.

According to a report published by the National Institutes of Health (NIH) in March 2025, each year, traumatic injuries cause nearly 6 million deaths and 40 million permanent disabilities, comparable to the combined toll of HIV/AIDS, malaria, tuberculosis, and COVID-19. Around 90% of these deaths occur in low- and middle-income countries, with up to 50% potentially preventable.

Ongoing Technological Advancements

Technological advancements are driving the growth of the trauma care centers market by improving diagnostic accuracy, treatment efficiency, and patient outcomes. Innovations such as AI-powered imaging, telemedicine, and advanced monitoring systems enable faster and more precise injury assessments, allowing for timely interventions. Additionally, the integration of data analytics and predictive modeling helps optimize resource allocation and personalize trauma care plans. These cutting-edge technologies enhance the overall quality of care while reducing costs and hospital stays, making trauma centers more effective and attractive to patients and healthcare providers alike.

Government Initiatives

Government initiatives also drive the growth of the market by funding the development and modernization of trauma infrastructure and emergency medical services. Regulatory frameworks and guidelines promote the establishment of standardized trauma care protocols, ensuring high-quality and timely treatment for trauma patients. Additionally, government-led awareness campaigns and training programs enhance public knowledge and preparedness for trauma emergencies. These initiatives not only improve patient outcomes but also encourage private sector participation, further expanding the market. Overall, strong policy backing accelerates the availability and accessibility of advanced trauma care facilities across regions.

- In April 2023, Taoiseach Leo Varadkar and Health Minister Stephen Donnelly officially opened Major Trauma Centres at Mater Misericordiae University Hospital, Dublin, and Cork University Hospital. Aligned with Ireland’s national trauma strategy, these centers will deliver advanced trauma care to the most severely injured patients in the Central and South Trauma Networks. Additional Trauma Units will be established to provide general trauma care across the country.

Restraints

Shortage of Skilled Trauma Professionals

The shortage of skilled trauma professionals, including specialized surgeons, nurses, and emergency responders, restraint the growth of the trauma care centers market. This talent gap leads to longer patient wait times, reduced quality of care, and increased pressure on existing medical staff, limiting the capacity of trauma centers to handle high patient volumes effectively. Training and retaining qualified trauma specialists require substantial time and investment, which many healthcare facilities struggle to meet. As a result, the lack of adequately trained personnel hampers the expansion and operational efficiency of trauma care centers, slowing overall market growth.

High Cost of Care and Reimbursement Issues

The high cost of trauma care, driven by expensive medical equipment, advanced technologies, and specialized personnel, poses a significant barrier to market growth. Many patients face financial challenges due to inadequate insurance coverage and complex reimbursement processes, which can limit access to timely trauma treatment. Additionally, healthcare providers often struggle with delayed or denied reimbursements from insurers, impacting their revenue streams and ability to invest in trauma care infrastructure. These financial constraints discourage expansion and modernization of trauma centers, ultimately restraining the overall growth of the market.

Opportunities

Expansion of Mobile Trauma Units and Ambulance Services

The expansion of mobile trauma units and advanced ambulance services creates significant opportunities by bringing critical care directly to the site of injury, reducing response times and improving survival rates. These mobile units are equipped with sophisticated medical technology, enabling emergency interventions that stabilize patients before they reach trauma centers. Growing investments in pre-hospital care infrastructure and integration with trauma centers enhance the overall trauma care ecosystem. This trend not only increases accessibility in remote and underserved areas but also drives demand for coordinated trauma services, fueling market growth.

- In November 2024, Rivers in the Desert launched The Healing Room, a mobile trauma unit providing grief support to underserved communities. Founded by Sharri Thomas after a personal tragedy, the unit offers peer support, case management, and creative healing services for those affected by trauma.

Demand for Specialized Care

The rising demand for specialized care in trauma treatment is creating immense opportunities in the trauma care centers market by driving the development of dedicated facilities equipped to handle complex injuries. Patients with severe or specific trauma types, such as pediatric, orthopedic, or neurological injuries, require tailored treatment approaches that specialized centers are uniquely positioned to provide. This demand encourages healthcare providers to invest in advanced technologies, skilled professionals, and multidisciplinary teams to deliver high-quality care. As a result, trauma centers offering specialized services are experiencing increased patient influx, fostering market growth and innovation.

Segment Outlook

Facility Type Insights

Why Did the In-House Segment Lead the Trauma Care Centers Market in 2024?

The in-house segment led the market in 2024 due to its ability to provide immediate, integrated, and continuous care within existing hospital infrastructure. In-house trauma units ensure faster response times, access to multidisciplinary medical teams, and availability of critical care resources such as operating rooms, ICUs, and diagnostic imaging, all under one roof. These facilities are better equipped to handle high patient volumes and complex trauma cases, making them more efficient and preferred for emergency interventions. Additionally, in-house centers benefit from greater funding, established protocols, and stronger affiliations with teaching hospitals and trauma networks, further reinforcing their market leadership.

The standalone segment is expected to grow at a significant rate during the projection period due to its flexibility in location and ability to serve underserved or remote areas where hospital-based trauma units are limited. Standalone centers can offer specialized trauma services without the infrastructure constraints of full hospitals, allowing quicker setup and scalability. They also provide focused, dedicated care that can reduce patient wait times and improve outcomes in emergency situations. Furthermore, increasing investments in outpatient and ambulatory care, along with advancements in telemedicine and mobile trauma units, support the rapid expansion of standalone facilities. The rising demand for accessible, cost-effective trauma care outside traditional hospital settings further supports segmental growth.

Trauma Care Centers Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Standalone |

7.99 |

8.63 |

9.33 |

10.09 |

10.9 |

11.79 |

12.74 |

13.77 |

14.88 |

16.09 |

17.39 |

| In-House |

9.76 |

10.47 |

11.23 |

12.03 |

12.91 |

13.83 |

14.84 |

15.91 |

17.06 |

18.28 |

19.6 |

Trauma Type Insights

How Does the Falls Segment Dominate the Market in 2024?

The falls segment dominated the trauma care centers market while holding the largest share in 2024. This is mainly due to the high prevalence of fall-related injuries, especially among the aging population who are more susceptible to fractures and severe trauma from even minor falls. Increased awareness and reporting of fall incidents, along with the growing elderly demographic globally, have significantly contributed to the demand for specialized trauma care. Falls often result in complex injuries requiring immediate and comprehensive treatment, which trauma centers are well-equipped to provide. Additionally, preventive programs and safety initiatives aimed at reducing fall risks have heightened the focus on trauma management and rehabilitation, further contributing to the segment’s dominance.

The traffic-related injuries segment is expected to expand at the highest CAGR in the coming years, owing to the increasing number of road accidents driven by rising vehicle ownership, urbanization, and high traffic density. According to the WHO, road traffic injuries are the leading cause of death for ages 5–29, causing around 1.19 million deaths annually. These injuries often involve severe trauma requiring urgent and specialized care, boosting the demand for advanced trauma centers. Additionally, government initiatives focused on improving emergency response systems and stricter traffic regulations are enhancing trauma care infrastructure. Advances in trauma treatment and growing public awareness about road safety also contribute to increased patient inflow, driving rapid growth of this segment.

Trauma Care Centers Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Falls |

5.32 |

5.69 |

6.09 |

6.5 |

6.95 |

7.43 |

7.94 |

8.49 |

9.07 |

9.69 |

10.35 |

| Traffic-Related Injuries |

4.44 |

4.74 |

5.06 |

5.4 |

5.76 |

6.15 |

6.57 |

7.01 |

7.47 |

7.97 |

8.51 |

| Stab/Wound/Cut |

1.77 |

1.95 |

2.14 |

2.35 |

2.57 |

2.82 |

3.09 |

3.38 |

3.7 |

4.06 |

4.44 |

| Burn Injury |

1.78 |

1.95 |

2.14 |

2.35 |

2.57 |

2.82 |

3.09 |

3.38 |

3.71 |

4.06 |

4.44 |

| Brain Injury |

2.66 |

2.88 |

3.12 |

3.37 |

3.67 |

3.97 |

4.3 |

4.66 |

5.05 |

5.46 |

5.92 |

| Other Injuries |

1.78 |

1.89 |

2.01 |

2.15 |

2.29 |

2.43 |

2.59 |

2.76 |

2.94 |

3.13 |

3.33 |

Service Type Insights

Why Did Outpatient Segment Contribute the Largest Market Share in 2024?

The outpatient segment held the largest share of the trauma care centers market in 2024. This is primarily due to the rising preference for minimally invasive treatments and faster recovery times that outpatient services offer. Outpatient trauma care allows patients to receive timely medical attention without prolonged hospital stays, reducing overall healthcare costs and improving patient convenience. Advances in medical technology and rehabilitation techniques have made it possible to treat many trauma cases effectively on an outpatient basis. Additionally, growing awareness of outpatient options and expanding facilities dedicated to outpatient trauma care have contributed to the segment’s market leadership.

The inpatient segment is expected to expand at the fastest CAGR throughout the forecast period due to the increasing severity and complexity of trauma cases that require intensive, round-the-clock medical care. Advances in surgical techniques and critical care have expanded the scope of inpatient trauma treatment, attracting more patients needing prolonged hospitalization. Additionally, rising incidences of severe injuries from accidents and falls, especially among the elderly, drive demand for comprehensive inpatient services. Growing investments in hospital infrastructure and trauma unit expansions further support segmental growth.

Trauma Care Centers Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Inpatient |

8.88 |

9.59 |

10.36 |

11.2 |

12.1 |

13.07 |

14.12 |

15.25 |

16.48 |

17.81 |

19.23 |

| Outpatient |

5.32 |

5.69 |

6.09 |

6.5 |

6.95 |

7.43 |

7.94 |

8.49 |

9.07 |

9.69 |

10.36 |

| Rehabilitation |

3.55 |

3.82 |

4.11 |

4.42 |

4.76 |

5.12 |

5.52 |

5.94 |

6.39 |

6.87 |

7.4 |

Regional Insights

What Made North America the Dominant Region in the Trauma Care Centers Market?

North America maintained dominance in the trauma care centers market by capturing the largest share in 2024. This is mainly due to its well-established healthcare infrastructure and advanced emergency medical services that ensure rapid and effective trauma response. The region benefits from substantial government funding, stringent regulatory frameworks, and widespread adoption of cutting-edge technologies in trauma care. Additionally, high awareness levels about trauma management and a growing prevalence of traumatic injuries, particularly from road accidents and falls, drive demand for trauma care. Strong presence of key market players and continuous innovations further reinforce North America’s leadership in the global market.

The U.S. is the major contributor to the North America trauma care centers market due to its advanced healthcare system, significant government investments, and widespread adoption of cutting-edge trauma care technologies. The country has a well-developed network of trauma centers, supported by robust emergency medical services and regulatory standards that emphasize timely and efficient trauma management. Additionally, the high incidence of traumatic injuries from road accidents, sports, and industrial activities fuels the demand for specialized trauma care facilities.

What Makes Asia Pacific the Fastest-Growing Market for Trauma Care Centers?

Asia Pacific is expected to experience the fastest growth in the coming years due to rapid urbanization, increasing road traffic accidents, and rising industrialization, which contribute to a higher incidence of traumatic injuries. The region is witnessing significant investments in healthcare infrastructure and emergency medical services to improve trauma care accessibility. Additionally, growing government initiatives, rising public awareness, and expanding healthcare coverage are driving demand for advanced trauma care facilities. Improving economic conditions and technological adoption further accelerate the development and modernization of trauma centers across Asia Pacific.

India is a major player in the Asia Pacific trauma care centers market due to its large population, rising number of road traffic accidents, and increasing prevalence of trauma-related injuries. The country is experiencing rapid urbanization and industrial growth, which have led to greater demand for advanced trauma care facilities. Increased awareness about trauma care and investments by private healthcare providers are further boosting India’s role in the market within the region. Additionally, government initiatives aimed at improving emergency healthcare infrastructure and expanding access to quality trauma services are driving market growth.

- On June 28, 2023, the Maharashtra government approved the establishment of a Trauma Care Centre at Wagholi as a special case. Aimed at enhancing highway medical facilities, the center was set to provide life-saving emergency care to accident victims during the golden hour.

Region-Wise Breakdown of the Trauma Care Centers Market

|

Region

|

Market Size (2024)

|

Projected CAGR (2025-2034)

|

Key Growth Factors

|

Key Challenges

|

Market Outlook

|

|

North America

|

USD 7.4 Bn

|

5.83%

|

Advanced healthcare infrastructure, high incidence of trauma cases, significant government funding

|

High healthcare costs, disparities in access to trauma care in rural areas

|

Dominant market with robust growth

|

|

Asia Pacific

|

USD 5.2 Bn

|

7.05%

|

Rapid urbanization, increasing healthcare investments, rising incidence of trauma cases

|

Limited healthcare infrastructure in rural areas, shortage of trained medical personnel

|

Fastest-growing region with significant potential

|

|

Europe

|

USD 4.1 Bn

|

10.0%

|

Well-established healthcare systems, emphasis on quality care, increasing trauma cases due to aging population

|

Economic constraints in certain countries, regulatory challenges

|

Stable market with moderate growth

|

|

Latin America

|

USD 1.4 Bn

|

5.2%

|

Improving healthcare access, government initiatives to enhance trauma care facilities

|

Political instability, economic challenges, limited healthcare resources

|

Developing market with steady growth

|

|

MEA

|

USD 0.9 Bn

|

3.4%

|

Increasing healthcare investments, development of trauma care infrastructure, aging population

|

Economic disparities, political instability in certain regions, limited access to advanced medical technologies

|

Emerging market with gradual growth

|

Value Chain Analysis of Trauma Care Centers Market

1. Research & Development (R&D)

This stage involves the innovation and development of advanced trauma care technologies, medical devices, and treatment protocols. R&D is crucial for improving patient outcomes by developing faster diagnostic tools, enhanced surgical equipment, and innovative therapeutic solutions tailored for trauma cases.

2. Manufacturing & Supply of Medical Equipment

Manufacturers produce critical medical devices such as imaging equipment, surgical instruments, trauma kits, and monitoring systems. Quality and reliability are vital at this stage, as trauma care requires precision equipment that can withstand emergency scenarios and deliver accurate results promptly.

3. Infrastructure Development & Facility Setup

This phase focuses on the establishment of trauma care centers, including the construction of emergency rooms, operating theaters, and intensive care units. The design and setup must ensure rapid patient access, seamless workflow for medical staff, and integration of necessary medical technologies to provide efficient trauma care services.

4. Healthcare Services & Patient Care

Trauma care centers provide immediate medical intervention, surgical procedures, rehabilitation, and follow-up care. This stage is the core of the value chain, emphasizing quick response, multidisciplinary teamwork, and specialized treatment to save lives and enhance recovery.

5. Training & Capacity Building

Continuous training of healthcare professionals, including doctors, nurses, and emergency responders, is essential to maintain high standards of trauma care. Capacity building also involves updating staff on the latest medical guidelines, technologies, and best practices to improve patient outcomes.

6. Distribution & Logistics

Efficient logistics ensure the timely supply of medical equipment, pharmaceuticals, and consumables to trauma centers. This stage also covers the management of supply chains to avoid shortages and delays, which are critical during emergency situations where every second counts.

7. Regulatory Compliance & Quality Assurance

Adhering to healthcare regulations, accreditation standards, and quality control measures ensures patient safety and operational excellence. Compliance at this stage involves regular audits, certifications, and monitoring to maintain the credibility and trustworthiness of trauma care facilities.

8. Post-Treatment Rehabilitation & Support Services

After initial medical intervention, trauma patients often require rehabilitation, psychological support, and outpatient care to recover fully. This stage focuses on holistic patient management, aiming to restore physical function, mental well-being, and social reintegration.

Major Players Operating in the Trauma Care Centers Market

1. University of Alabama Hospital

University of Alabama Hospital is a leading Level I trauma center known for its comprehensive emergency services and advanced trauma care protocols. It contributes by providing high-quality trauma treatment and participating in trauma research and education, improving patient outcomes regionally and nationally.

2. Banner University Medical Center Phoenix

Banner University Medical Center Phoenix offers specialized trauma services with a focus on rapid emergency response and multidisciplinary care teams. Its contribution lies in integrating cutting-edge technologies and trauma systems that enhance critical care delivery in the southwestern U.S.

3. St. Joseph’s Hospital and Medical Center

St. Joseph’s Hospital is a recognized Level I trauma center, which provides extensive trauma, surgical, and rehabilitation services. It plays a key role in advancing trauma care through community outreach, education, and participation in innovative treatment protocols.

4. Albany Medical Center

Albany Medical Center is a major trauma hub in upstate New York, equipped with a Level I trauma center designation. It contributes by offering specialized trauma and critical care services while fostering training programs to prepare future trauma care professionals.

5. Ascension St. John Hospital

Ascension St. John Hospital provides high-acuity trauma care and is equipped with advanced emergency and surgical facilities. Its focus on patient-centered care and community health initiatives supports trauma prevention and recovery efforts in its service area.

6. Bellevue Hospital Center

Bellevue Hospital Center, one of the oldest public hospitals in the U.S., operates a Level I trauma center with a broad range of emergency and trauma services. It contributes significantly by managing complex trauma cases and serving diverse urban populations with tailored trauma care solutions.

7. China Medical University Hospital

China Medical University Hospital is a key trauma care provider in Taiwan, offering comprehensive emergency and surgical trauma services. Its contribution includes integrating modern medical technologies and conducting trauma research that advances regional healthcare standards.

8. Klinikum Stuttgart

Klinikum Stuttgart is one of Germany’s largest hospitals with a dedicated trauma center that provides specialized care for severe injuries. The institution supports the trauma care market by participating in clinical research and implementing innovative treatment protocols aligned with European standards.

9. Kaiser Permanente

Kaiser Permanente operates a network of trauma centers known for coordinated care models that integrate prevention, treatment, and rehabilitation. Its contribution includes leveraging health IT systems and data analytics to optimize trauma care efficiency and patient outcomes across its facilities.

10. University Hospital Southampton NHS Foundation Trust

University Hospital Southampton offers advanced trauma and critical care services as a major trauma center in the UK. It plays a vital role by conducting research, training healthcare professionals, and implementing evidence-based trauma care practices to improve survival rates.

Recent Developments

- In June 2025, Apollo Children’s Hospital launched a centre of excellence for paediatric orthopaedics and trauma care, specializing in treating sports injuries and complex congenital conditions. The facility features a dedicated team of trauma specialists, orthopaedic surgeons, and rehabilitation experts to handle complex cases like clubfoot and hip dysplasia requiring surgery.

- In June 2025, NYC Health + Hospitals/Elmhurst was successfully re-verified as a Level I Trauma Center by the American College of Surgeons. This recognition confirms its ability to provide the highest level of trauma care, with 24/7 in-house trauma surgeons and immediate access to a full range of specialists. Elmhurst continues to serve as a regional leader in trauma services, rehabilitation, education, research, and injury prevention.

- In July 2024, ADP India announced the construction of a 6,500 sq. ft. trauma care center at Korlapahad toll plaza, Kethepally Mandal, Nalgonda district, in partnership with the health department. The center aims to provide immediate medical treatment to accident victims, significantly reducing response time and enhancing public safety. The foundation stone was laid in the presence of Minister Komatireddy Venkat Reddy, District Collector Narayana Reddy IAS, and ADP India’s senior leadership.

- In March 2023, Viz.ai announced the Viz Trauma Suite at TraumaCon 2023, a software designed to help trauma care providers meet new ACS standards. Its mobile viewer and communication platform aim to reduce response times and improve trauma patient care efficiency.

Segments Covered in the Report

By Facility Type

By Trauma Type

- Falls

- Traffic-Related Injuries

- Stab/Wound/Cut

- Burn Injury

- Brain Injury

- Other Injuries

By Service Type

- Inpatient

- Outpatient

- Rehabilitation

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa