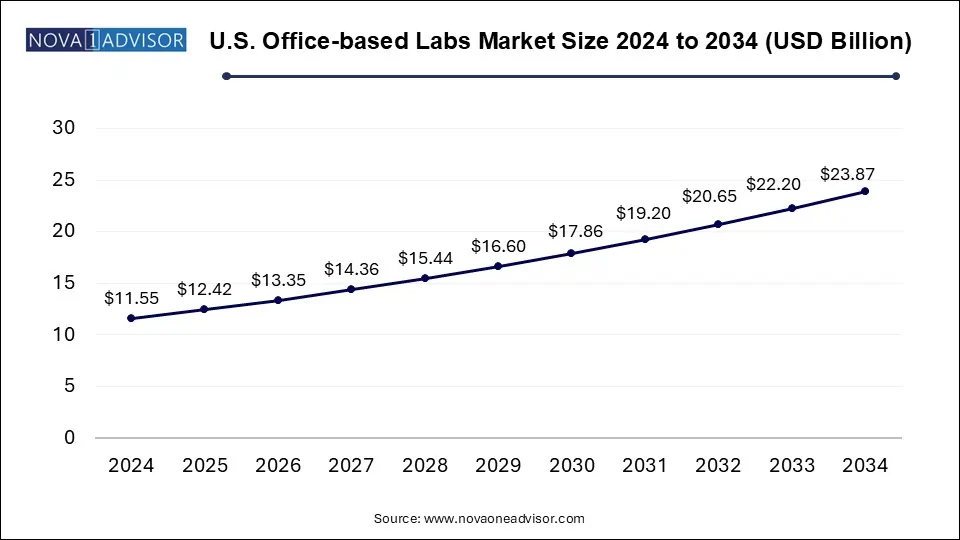

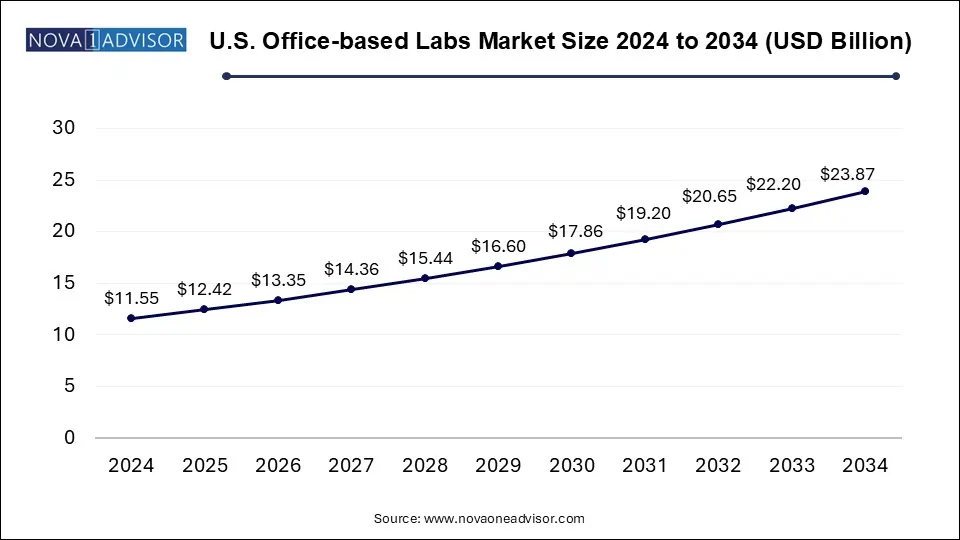

U.S. Office-based Labs Market Size and Growth

The U.S. office-based labs market size was exhibited at USD 11.65 billion in 2023 and is projected to hit around USD 24.10 billion by 2033, growing at a CAGR of 7.54% during the forecast period 2024 to 2033.

U.S. Office-based Labs Market Key Takeaways:

- The single specialty modality segment dominated the market in 2023 and accounted for a revenue share of 41.77%.

- The hybrid labs segment is expected to register the fastest CAGR during the forecast period.

- The interventional radiology segment is estimated to register the fastest CAGR over the forecast period.

- Based on specialists, the market has been further classified into vascular surgeons, interventional cardiologists, interventional radiologists, and others.

- The interventional radiologist segment is expected to grow at the fastest growth rate during the forecast period

Report Scope of U.S. Office-based Labs Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 12.53 Billion |

| Market Size by 2033 |

USD 24.10 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.54% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Modality, Services, Specialists |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG, Medtronic PLC, Boston Scientific Corporation, Abbott, Cardiovascular Systems, Inc., Envision Healthcare, Surgery Care Associate, Inc (SCA); Surgery Partners, National Cardiovascular Partners, Cardiovascular Collation; TH Medical |

The growing trend of surgical procedures being performed in outpatient settings and the rising incidence of various vascular diseases are among the major factors driving the demand for office-based labs (OBL) in the U.S. Additionally, high patient satisfaction with a focused and dedicated team of doctors is expected to boost the market growth.

The prevalence of these diseases has significantly increased over the past decade and is expected to continue growing at an exponential rate. The U.S. witnessed a growth of 13% in the number of individuals suffering from Peripheral Artery Disease (PAD) in the past decade. PAD increases the risk of stroke and heart attack and often lead to ischemic amputations. Thus, increasing the demand for vascular surgical procedures. Many service providers, such as National Cardiovascular Partners, Envision Healthcare, and Surgery Partners are/ providing office-based surgical solutions and services to patients at an affordable cost.

Furthermore, key manufacturers, such as Philips Healthcare and Siemens Healthineers, have been entering into partnerships with physicians to set up OBLs, equipping laboratories with required devices and providing complete solutions from start to end, which is expected to propel the market growth. The changing reimbursement policies for surgical procedures are boosting the scope of surgical procedures in office-based settings. In 2021, the Centers for Medicare and Medicaid Services proposed new standards for reimbursed procedures conducted in ASCs and broadened the scope of surgical procedures payable when performed in outpatient settings.

This policy change also positively affected peripheral vascular interventions. After changes were made in federal reimbursement policy, peripheral vascular interventions have been categorized under outpatient settings. This is comparatively less expensive than in inpatient settings. As compared to Hospital Outpatient (HO) settings, establishing an OBL is beneficial for physicians in terms of reimbursements. The operating cost of an ambulatory center is higher than that of an OBL due to high patient safety standards and stringent regulatory scenarios. In some states of the U.S., conversion of an ambulatory center requires a certificate of need, which is a time-consuming procedure. This is creating an opportunity for physicians to convert to OBL settings.

U.S. Office-based Labs Market By Modality Insights

Based on modality, the market is categorized into single specialty, multi-specialty, and hybrid labs. The single specialty modality segment dominated the market in 2023 and accounted for a revenue share of 41.77%. Single specialty centers are growing at a significant rate due to their investment-friendly model and importance in specified specialties, such as ophthalmology, urology, plastics, and gastroenterology. Single specialty clinics are more cost-efficient in comparison with multi-specialty hospitals that require many resources to support multiple service lines, leading to an increase in operational costs.

The hybrid labs segment is expected to register the fastest CAGR during the forecast period owing to technological advancements, an increase in reimbursement rates, and a rise in the number of minimally invasive procedures. In addition, improvements in technology, providing high-quality and convenient solutions for patients, are projected to support the growth of this segment. The hybrid lab operates as an OBL for a few days of the week and as an ASC on other days. Thus, hybrid labs increase the volume of procedures & reimbursement for providers and significantly enhance the efficiency and utilization of OBL/ASC.

U.S. Office-based Labs Market By Service Insights

Based on services, the OBLs market has been categorized into peripheral vascular intervention, endovascular intervention, cardiac, interventional radiology, venous, and others. The peripheral vascular intervention segment dominated the market in 2023 on account of the increased prevalence of PAD, favorable reimbursement, and technological advancements in minimally invasive vascular procedures.

Industry players are trying to strengthen their peripheral intervention product offerings to commercialize the growing opportunities in OBL settings. In March 2021, Cardiovascular Systems, Inc. acquired WavePoint Medical’s line of peripheral support catheters, which are used in peripheral vascular intervention. Under this acquisition agreement, WavePoint Medical would develop a specialty catheter portfolio used in complex percutaneous coronary intervention and chronic total occlusions for Cardiovascular Systems, Inc.

The interventional radiology segment is estimated to register the fastest CAGR over the forecast period. Interventional radiology is beginning to play a vital role in the adoption of value-based healthcare models. Interventional radiology helps diagnose and treat patients using the least invasive techniques that are less expensive, cause minimum pain, and need less recovery time in comparison with traditional surgery. It utilizes image-guided procedures, such as MRI, CT, and ultrasound, to guide minimally invasive procedures to diagnose and treat diseases in every organ system. According to Cardiovascular Disease Management Annual Symposium, around 12% of interventional radiologists performed office-based interventions in the U.S.

U.S. Office-based Labs Market By Specialist Insights

Based on specialists, the market has been further classified into vascular surgeons, interventional cardiologists, interventional radiologists, and others. The vascular surgeon segment dominated the market in 2023 owing to the advancements in medical technology, an increase in the demand for specialists, and a shift in preference from hospital settings to OBLs for better & more efficient care.

The interventional radiologist segment is expected to grow at the fastest growth rate during the forecast period on account of the increasing use of minimally invasive image-guided techniques for the diagnosis and treatment of diseases. Advancements in medical technology, increasing preference for better & efficient care, and patient demographics are factors expected to fuel the demand for vascular specialists.

Currently, there is a shortage of physicians for vascular surgery. According to the Society for Vascular Surgery, 100 million people in the U.S. are at risk of vascular disease. The office-based labs are the top preference of vascular surgeons, as performing surgeries at office-based facilities has financial benefits for them, with all the excess margin for surgical procedures going to the surgeon directly & indirectly. Moreover, interventional radiology reduces cost, recovery time, pain, and risk to patients.

U.S. Office-based Labs Market Recent Developments

- In July 2023, Siemens Healthineers announced the launch of a compact testing system -Atellica CI Analyzer, for addressing operational challenges in labs. The analyzer delivers workflow advancements to alleviate reporting burdens, attain more predictable turnaround times, and refocus staff attention on critical lab operations.

- In June 2023, Philips announced that it had entered into a strategic collaboration with Polarean to reinforce hyperpolarized Xenon MRI for respiratory illness in patients. This technology can be leveraged in office-based labs where clinicians require advanced imaging capabilities for respiratory assessment and disease management.

- In May 2023, Siemens Healthineers, along with CommonSpirit Health announced plans to acquire Block Imaging. This was aimed at providing more sustainable options and meeting the proliferating demand from U.S. hospitals, health systems, and other care sites, including office-based labs for multi-vendor imaging parts and services.

- In April 2023, Abbott announced the completion of the acquisition of Cardiovascular Systems, Inc. This acquisition was aimed at providing Abbott with a complementary solution for treating vascular diseases and enhancing the company’s vascular portfolio, thereby enabling them to more efficiently care for patients with peripheral and coronary artery diseases.

- In April 2023, Philips introduced the all-new Ultrasound Compact System 5000 series, a portable ultrasound solution with cutting-edge features, including AI-powered automation tools, purposed to bring quality ultrasound to patients. Office-based labs can also benefit from such advanced diagnostic technologies, as they focus on delivering medical care services in an outpatient setting.

- In November 2022, Boston Scientific Corporation announced plans to acquire Apollo Endosurgery, Inc. This acquisition was aimed at empowering Boston Scientific to expand its global capabilities in endoluminal surgery and progressively tap into the endobariatric market.

- In October 2022, GE Healthcare entered into a collaboration with Tribun Health to offer digital pathology solutions that enable healthcare providers to access a more all-inclusive view of patient records. This collaboration aimed to streamline and enhance pathology & diagnostic processes, which are critical components of healthcare services provided in diverse medical settings, including office-based labs.

- In April 2022, Medtronic announced a strategic collaboration with GE Healthcare to meet the escalating need for outpatient care in office-based labs (OBLs) and Ambulatory Surgery Centers (ASCs) applications. The objective of this deal was to deliver a full range of technologies and solutions, including products, equipment, and services, to back the growth of ASCs and OBLs and improve patient care in these settings.

Some of the prominent players in the U.S. office-based labs market include:

- Manufacturers

- Koninklijke Philips N.V

- GE Healthcare

- Siemens Healthineers AG

- Medtronic PLC

- Boston Scientific Corp.

- Abbott

- Cardiovascular Systems, Inc.

- Service Providers

- Envision Healthcare

- Surgery Care Associates, Inc. (SCA)

- Surgery Partners

- National Cardiovascular Partners

- Cardiovascular Coalition

- TH Medical

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. office-based labs market

Modality

- Single-specialty Labs

- Multi-specialty Labs

- Hybrid Labs

Service

- Peripheral Vascular Intervention

- Endovascular Interventions

- Cardiac,

- Interventional Radiology

- Venous

- Others

Specialist

- Vascular Surgeons

- Interventional Cardiologist

- Interventional Radiologists

- Others