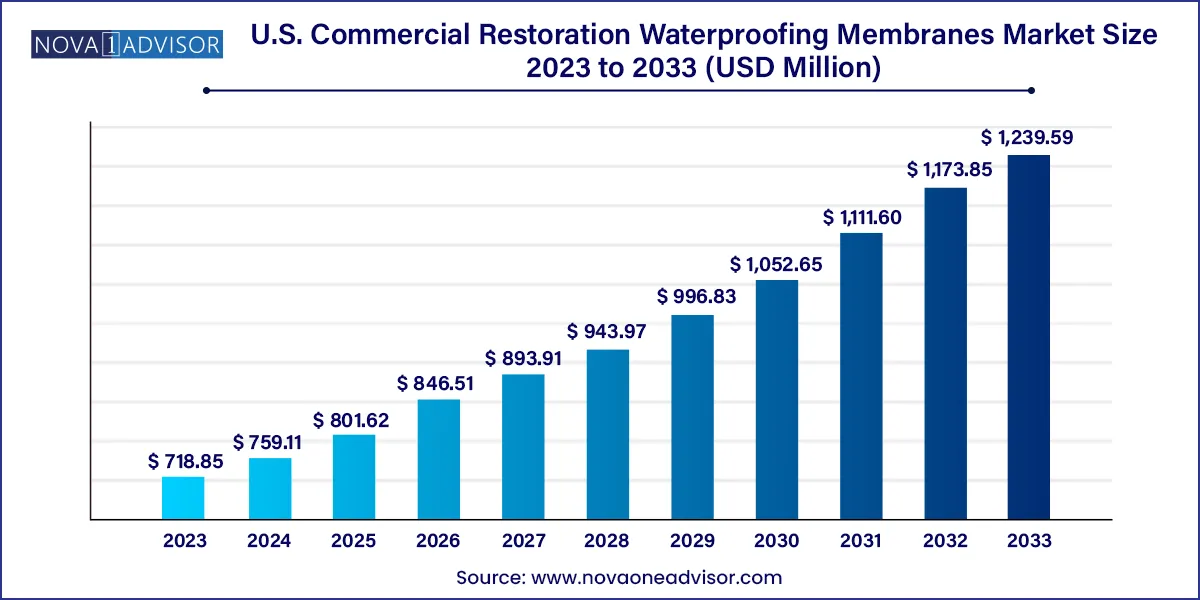

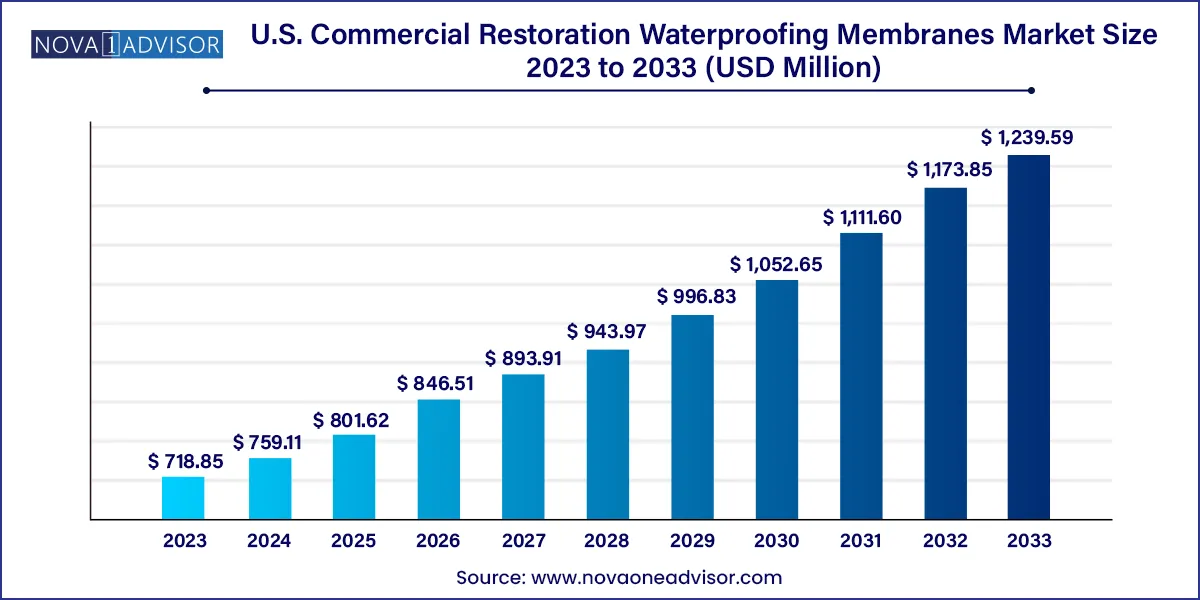

U.S. Commercial Restoration Waterproofing Membranes Market Size and Growth

The U.S. commercial restoration waterproofing membranes market size was exhibited at USD 718.85 million in 2023 and is projected to hit around USD 1,239.59 million by 2033, growing at a CAGR of 5.6% during the forecast period 2024 to 2033.

Key Takeaways:

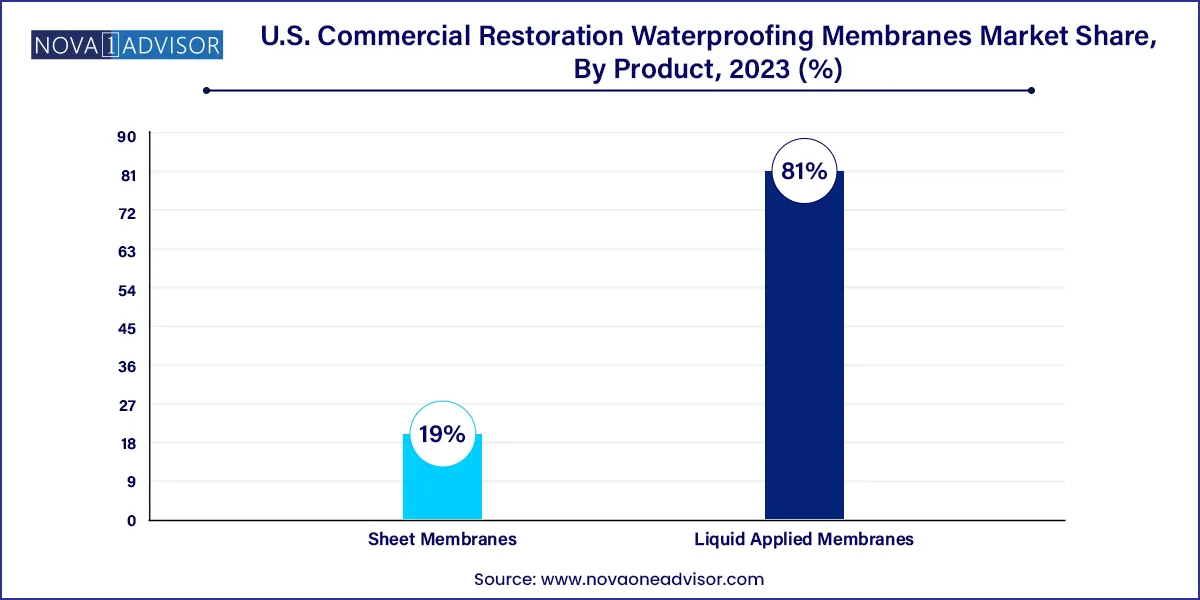

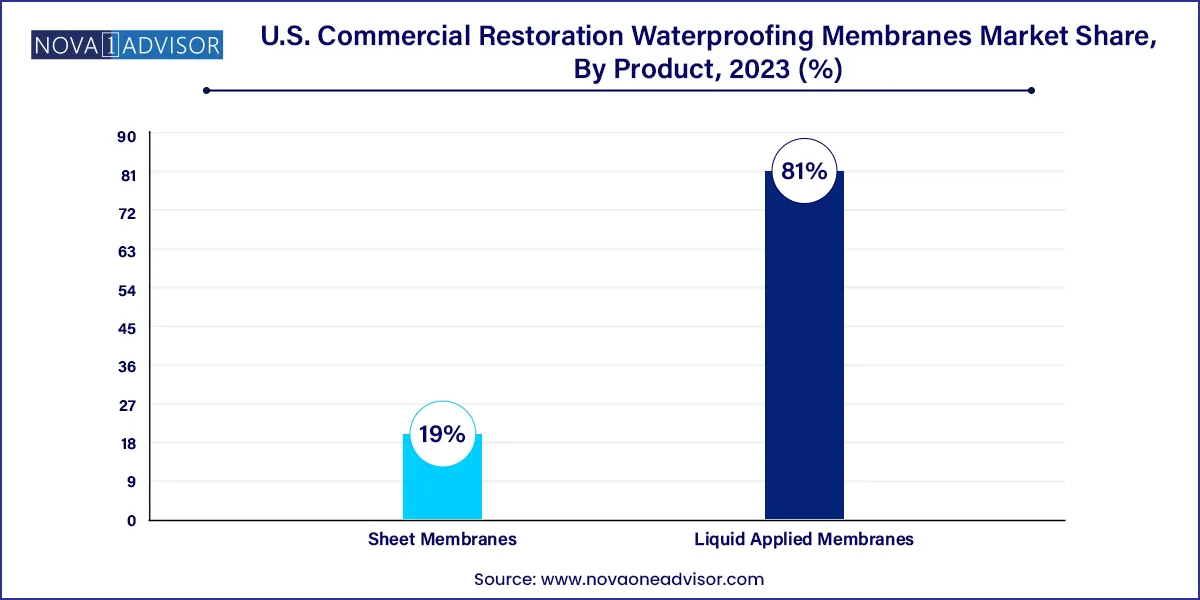

- Liquid applied membranes products led the U.S. commercial restoration waterproofing membranes market and accounted for about 81% share of the global revenue in 2023.

- Sheet membrane products are expected to expand at a CAGR of 5.5% over the forecast period.

- Roofing application led the market and accounted for about 30% share of the revenue in 2023.

Market Overview

The U.S. Commercial Restoration Waterproofing Membranes Market has grown into a vital segment of the building rehabilitation and maintenance industry. As commercial properties age and endure long-term exposure to weather elements, moisture infiltration becomes a critical threat to structural integrity and asset value. Waterproofing membranes serve as essential protective barriers that prevent water ingress into building components such as roofing, walls, basements, and foundations. These membranes not only ensure structural durability but also contribute to energy efficiency and interior air quality.

This market is heavily influenced by trends in commercial real estate, climate variability, sustainability regulations, and the evolving needs of building restoration projects. Restoration projects have surged due to the deferred maintenance of aging buildings, increasingly stringent codes on water damage prevention, and the need for retrofitting existing structures to meet modern performance standards. Membranes used in restoration offer flexibility, ease of installation, resistance to temperature fluctuations, and compatibility with diverse substrates key factors for their adoption in retrofitting applications.

Technological advancements and innovations in membrane chemistry, including self-healing materials and smart membranes with moisture-sensing capabilities, are further driving growth. Additionally, commercial property owners, building engineers, and contractors are shifting toward sustainable and low-VOC waterproofing solutions to comply with environmental mandates. The market comprises various stakeholders including membrane manufacturers, chemical formulators, commercial roofing contractors, and restoration specialists.

Report Scope of The U.S. Commercial Restoration Waterproofing Membranes Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 759.11 Million |

| Market Size by 2033 |

USD 1,239.59 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 5.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Sika AG; BASF SE; Kemper System America, Inc.; DuPont de Nemours, Inc.; GAF Materials Corporation; Johns Manville |

Market Driver: Aging Commercial Infrastructure and Deferred Maintenance

A primary driver for the market is the growing backlog of deferred maintenance and aging commercial infrastructure across the United States. Buildings constructed in the 1970s and 1980s, particularly in urban business districts, are approaching the end of their initial lifecycle, necessitating extensive restoration to prevent deterioration and maintain occupancy standards. Waterproofing membranes are among the first lines of defense in these restorations, playing a pivotal role in extending a structure’s lifespan.

Failure to address water ingress issues can result in mold growth, insulation damage, corrosion of metal reinforcements, and costly legal liabilities. Building owners, particularly those managing high-value commercial real estate, are increasingly investing in durable and tested waterproofing membrane systems to reduce long-term operational costs and improve asset resilience. The boom in adaptive reuse of historic buildings for commercial spaces is also fueling demand for advanced restoration-grade waterproofing solutions.

Market Restraint: High Installation Costs and Labor Dependency

One of the key restraints in the U.S. commercial restoration waterproofing membranes market is the high cost associated with membrane installation and the skilled labor required for proper application. Restoration projects typically involve irregular surfaces, complex building geometries, and accessibility challenges, increasing labor intensity and risk of application errors. Installation errors can compromise the entire system’s effectiveness, leading to callbacks, warranty claims, or complete system failure.

Moreover, certain membrane types especially sheet membranes require precise cutting, overlapping, and sealing, necessitating experienced applicators. Labor shortages in the skilled construction trades exacerbate the problem, leading to project delays and increased contractor fees. While liquid-applied membranes mitigate some of these issues, they still demand environmental controls and surface preparation to achieve optimal adhesion. Cost-sensitive building owners may hesitate to pursue full waterproofing system upgrades due to these upfront challenges.

Market Opportunity: Integration with Energy-Efficient Retrofit Projects

An exciting opportunity in the market lies in the alignment of waterproofing systems with broader energy-efficient building retrofits. Waterproofing membranes can contribute to better thermal insulation and moisture regulation, directly supporting green building goals. Commercial property owners seeking to comply with LEED, WELL, and ENERGY STAR certifications are increasingly integrating restoration-grade waterproofing into holistic sustainability upgrades.

Incorporating reflective or thermally insulating membranes on rooftops can reduce heat absorption and lower HVAC loads. Additionally, basement and foundation membranes with vapor barrier properties help maintain indoor humidity levels and reduce energy waste. As commercial retrofitting becomes a strategic investment driven by ESG objectives, waterproofing membranes are poised to gain higher priority in capital expenditure planning, particularly in urban commercial zones with older infrastructure stock.

U.S. Commercial Restoration Waterproofing Membranes Market By Product Insights

Liquid Applied Membranes dominate the U.S. commercial restoration waterproofing membranes market, largely due to their adaptability, ease of use, and seamless application over irregular surfaces. Among liquid options, polyurethane and bituminous variants are particularly popular. Polyurethane membranes are preferred for high-performance, elastomeric protection on rooftops and podium decks, while bituminous coatings offer time-tested durability for below-grade applications. Liquid membranes are valued for their ability to form monolithic barriers, reducing the likelihood of leaks caused by seams or weak joints, which are common challenges in restoration work.

Sheet Membranes, particularly EPDM and PVC, are among the fastest-growing segments, driven by their high tensile strength, UV resistance, and pre-engineered performance standards. Sheet systems are preferred for large-scale horizontal applications and settings where consistent thickness and pre-set quality assurance are critical. EPDM (ethylene propylene diene monomer) membranes, in particular, have gained favor in retrofits of flat commercial rooftops due to their excellent weathering characteristics. Sheet membranes are also increasingly supplied in self-adhering formats to reduce labor intensity and enhance application efficiency.

U.S. Commercial Restoration Waterproofing Membranes Market By Application Insights

Roofing is the leading application segment, representing the bulk of restoration waterproofing demand. Commercial roofs are exposed to heavy rainfall, UV radiation, thermal cycling, and mechanical damage, making them prime candidates for membrane retrofitting. Restoration-grade roofing membranes, especially liquid-applied types, are ideal for projects where tear-off is not feasible or where legacy systems require overlay. The commercial push toward cool roofs and energy conservation is also driving the uptake of reflective waterproofing membranes in restoration initiatives.

Landfills and Tunnels represent the fastest-growing application segment, largely due to federal and state infrastructure investment. While niche in comparison to roofing or wall waterproofing, these applications require highly specialized membranes with chemical resistance and durability under extreme conditions. Restoration projects involving aging transportation tunnels, stormwater channels, and municipal landfills are increasingly specifying multi-layered waterproofing membrane systems to mitigate leakage, groundwater infiltration, and structural erosion. As governments prioritize climate resilience and infrastructure rehabilitation, this segment is expected to grow significantly.

Country-Level Analysis

In the United States, the commercial restoration waterproofing membranes market is supported by a broad network of product manufacturers, certified contractors, engineering firms, and architectural consultants. Building codes and restoration requirements vary by jurisdiction but are becoming increasingly stringent regarding waterproofing as a preventative measure. Urban centers such as New York City, Los Angeles, and Chicago have robust restoration activity driven by aging commercial real estate, while climate-prone regions such as Florida and the Gulf Coast prioritize waterproofing to protect against hurricanes and high rainfall.

Federal incentives for energy efficiency retrofits and climate-resilient infrastructure upgrades further support the market’s development. Public-private partnerships, particularly for schools, transportation hubs, and municipal buildings, are helping accelerate waterproofing restoration projects. Additionally, national standards such as ASTM and organizations like the International Institute of Building Enclosure Consultants (IIBEC) guide best practices for membrane performance, material compatibility, and installation integrity across the country.

Some of the prominent players in the U.S. commercial restoration waterproofing membranes market include:

- Sika AG

- BASF SE

- Kemper System America, Inc.

- DuPont de Nemours, Inc.

- GAF Materials Corporation

- Johns Manville

- Alchimica

- Saint-Gobain Weber GmbH

- Isomat S.A.

- Covestro AG

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. commercial restoration waterproofing membranes market.

Product

-

- Cementitious

- Bituminous

- Polyurethane

- Acrylic

- Others

-

- Bituminous

- PVC

- EPDM

- Others

Application

- Roofing

- Walls

- Building Structures

- Landfills & Tunnels

- Others