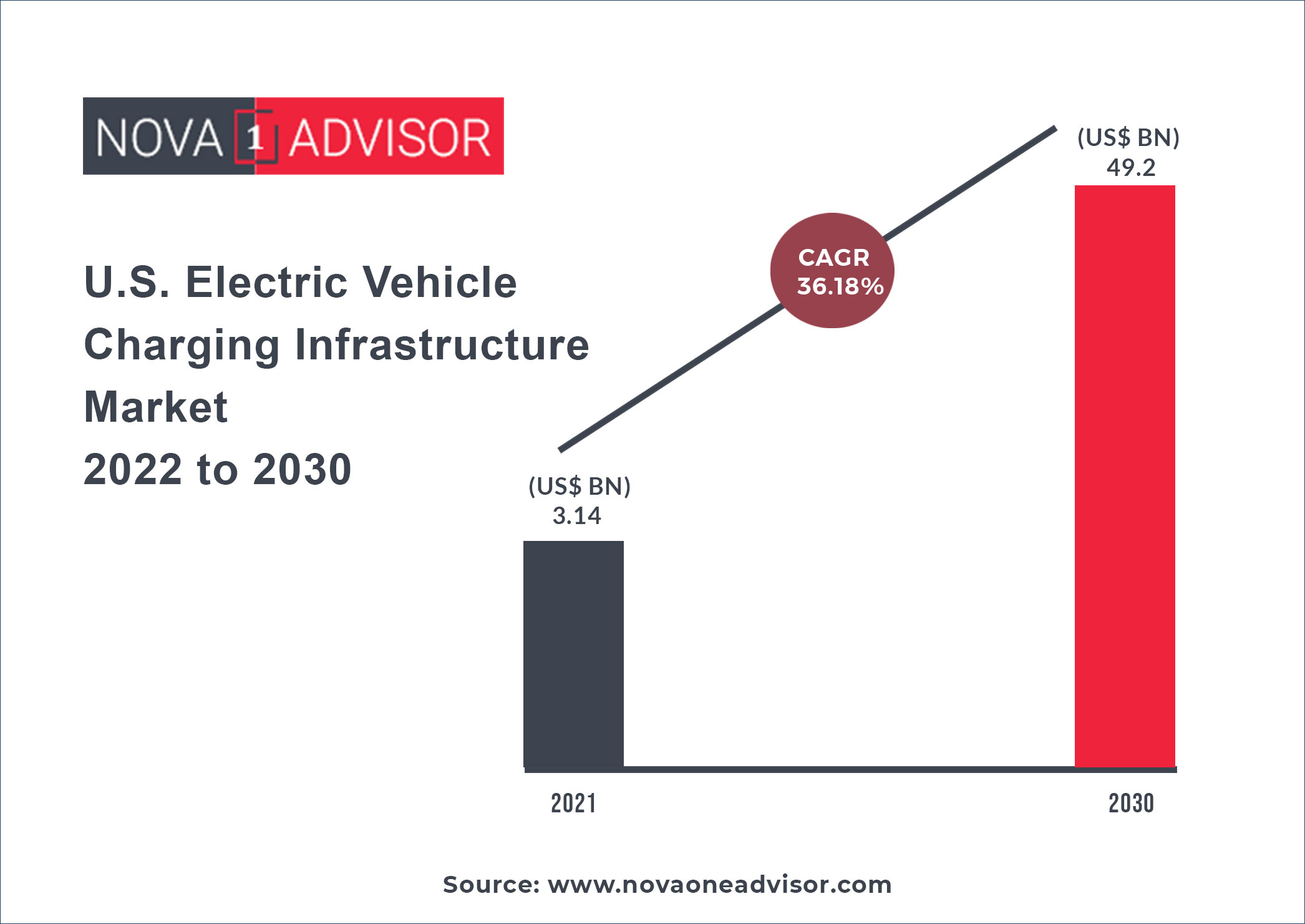

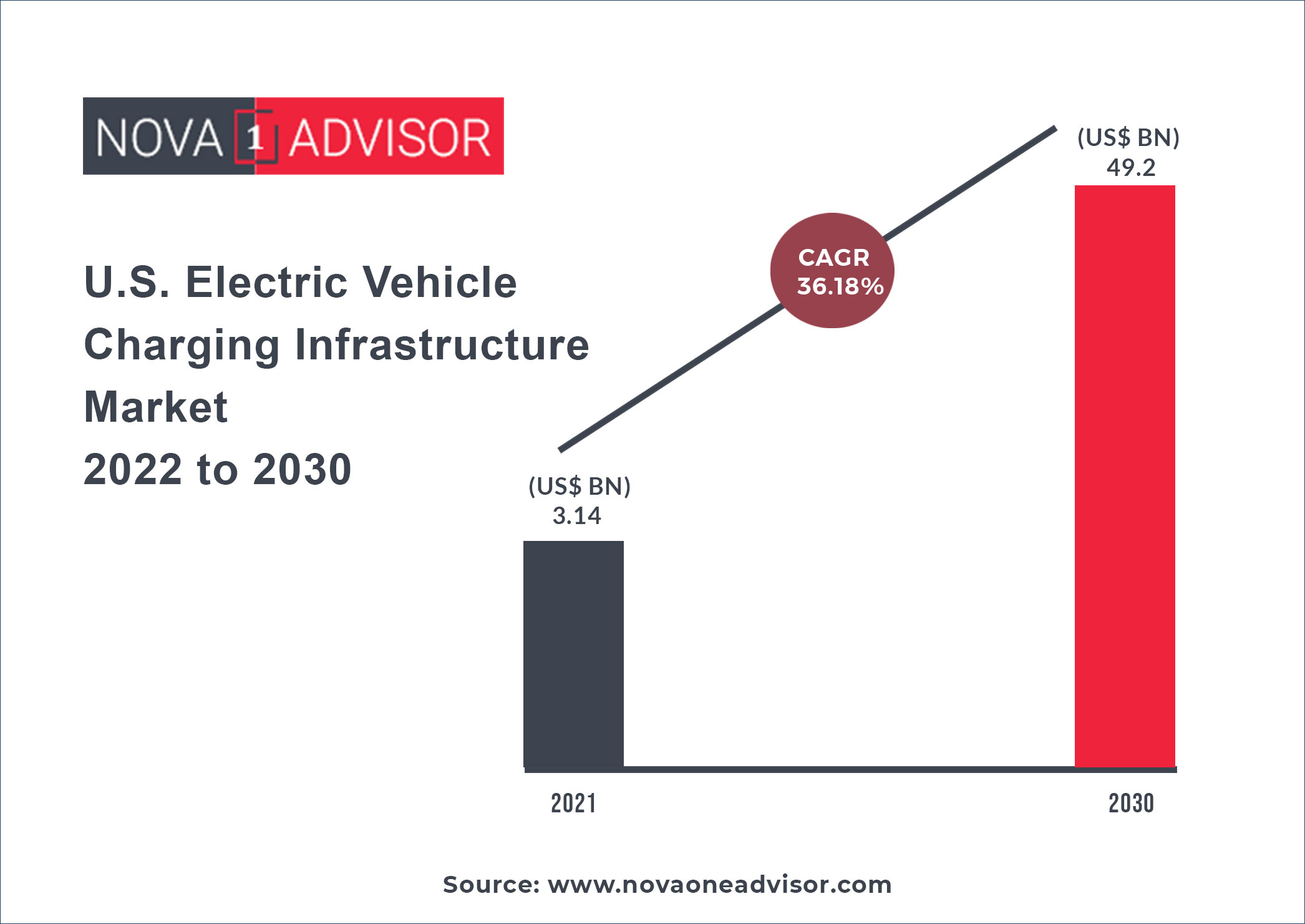

The U.S. Electric Vehicle Charging Infrastructure market size was valued at US$ 3.14 billion in 2021 and is expected to hit US$ 49.20 billion by 2030, growing at a compound annual growth rate (CAGR) of 36.18% from 2022 to 2030.

Growth Factors:

The market growth can be attributed to the growing initiatives taken by both public as well as private sectors to encourage the population to switch to Electric Vehicles (EVs). These initiatives have promoted the sale of electric vehicles and have also spread consumers’ awareness about the benefits of using these vehicles. Moreover, the development of technologies like portable charging stations, smart charging with load management, automated payment technology, and bi-directional charging is further expected to create new growth opportunities for the market during the forecast period.

Numerous electric vehicle charging station providers are focusing on developing new products that provide customers with better-charging infrastructures. For instance, in September 2021, SemaConnect Inc. announced the launch of the new Series 8 retail EV charging station. Series 8 is a level 2 charging station that features SemaConnect's slim design, an easy-to-use network platform, and interactive LED lights. Such initiatives are expected to create more growth opportunities for the market during the forecast period.

The U.S. is adopting aggressive emission reduction measures by implementing regulatory policies and regional initiatives to reduce atmospheric CO2 concentrations. Many metropolitan cities such as New York City, Los Angeles, and Houston, among others, have been facing air quality issues, which have caused respiratory diseases. Such conditions are making it difficult to survive in the existing environment. In 2016, the EPA approved new rules (National Emissions Ceilings (NEC) Directive) for its member states to cut down air pollution levels. All these factors together are propelling the need for an eco-friendly and low residual mode of transportation. Thus, promoting the adoption of electric vehicles, along with the increasing need for supporting electric vehicle charging infrastructure.

Many Original Equipment Manufacturers (OEMs) of electric vehicles, such as Tesla, Ford, and General Motors, offer a wide range of electric vehicles that have attracted many consumers, resulting in an increased market for electric vehicles. For instance, in June 2021, General Motors announced its plans to invest USD 35 billion to develop and increase its EV production capacity to more than one million by 2025. Moreover, in January 2022, General Motors said that it had planned to invest roughly USD 6.6 billion in its home state of Michigan by 2024 to increase its electric pickup truck production and build a new EV battery cell plant. Such investments are expected to boost the U.S. electric vehicle charging infrastructure market in the forecast period.

Technological advancements such as fast charging and increased vehicle range are anticipated to transform the U.S. automotive industry during the forecast period. The major trends driving the adoption of Electric Vehicles (EVs) are the emergence of self-driving vehicles and the growth of shared mobility. Both of these factors have a significant impact on U.S. EV vehicle sales. The growth of ride-hailing and ridesharing services will enable users to increase the utilization rate, which in turn will provide economical transportation facilities to commuters. The growing popularity of the mobility-as-a-service (MaaS) model is also anticipated to lead to increased adoption of electric vehicles. However, high costs of infrastructure and the initial setup are emerging as major factors hampering the market growth.

Costs incurred for research & development activities are highly significant since they require a dedicated workforce. Overall, the need for financial and human resources to develop innovative charging equipment is expected to restrain the market growth during the forecast period. Moreover, the outbreak of the COVID-19 pandemic has resulted in the slowdown of the automotive sector in numerous countries, which is expected to hinder market growth in the near future.

Report Scope of the U.S. Electric Vehicle Charging Infrastructure Market

|

Report Coverage

|

Details

|

|

Market Size in 2021

|

USD 3.14 Billion

|

|

Revenue Projection By 2030

|

USD 49.20 Billion

|

|

Growth Rate

|

CAGR of 36.18% from 2022 to 2030

|

|

Base Year

|

2021

|

|

Historical data

|

2017 - 2020

|

|

Forecast Period

|

2022 to 2030

|

|

Segments Covered

|

Charger type, connector, application

|

|

Companies Mentioned

|

ABB; bp pulse; Delta Electronics, Inc; Webasto Group; ChargePoint, Inc.; Leviton Manufacturing Co., Inc.; SemaConnect, Inc.; Tesla, Inc.; ClipperCreek, Inc.

|

COVID-19 Impact Analysis

The COVID-19 pandemic had an adverse impact on the automotive sector. Manufacturing activities, particularly of electric vehicle charging equipment providers, were halted partially or entirely due to the lockdown measures implemented by governments across various countries. This impacted the profitability of players in the market. Moreover, as electric vehicle manufacturing facilities remained closed due to the pandemic, a severe impact was also observed on the demand for electric vehicle charging infrastructure. Multiple industries faced significant challenges due to the shortage of raw materials.

Charger Type Insights

The fast charger segment led the market and accounted for 94.7% share of the global revenue in 2021. The growth of the segment is attributed to the rise in the number of consumers preferring electric vehicles for long-distance travel. Moreover, in February 2022, the federal government in the U.S. planned to provide USD 5 billion to its states for five years to build a nationwide network of fast chargers. This plan focuses on the Interstate Highway System, which directs states to build one charging station every 50 miles, which must be capable of charging at least four electric vehicles simultaneously at 150 kW.

On the other hand, the slow charger segment is anticipated to grow at a fast pace accounting for a high market volume by 2030. The demand for slow chargers is significantly driven by vehicle owners who prefer charging vehicles at home using a standard electricity outlet. The segment is expected to witness remarkable growth during the forecast period, attributed to the rise in the popularity of EVs and the inclination of users toward buying plug-in hybrid electric vehicles.

Application Insights

The commercial segment dominated the market and accounted for a 92.7% share of the global revenue in 2021. Favorable government initiatives to deploy charging stations on highway projects such as the Trans-Canada highway project and Norway to Italy Electric Highway are driving the growth of the segment. Several automotive companies are focusing on launching new EV charging projects that would help commercial customers to go electric. For instance, in December 2021, Ford, an automotive company, announced the launch of the new EV project called Ford Pro Charging to help its commercial customers switch to electric vehicles and offer the necessary hardware and software required for charging electric vehicles.

Residential application is the fastest-growing segment and is anticipated to exhibit a high revenue share by 2030. Electric vehicle chargers for residential spaces can also offer significant growth potential as they provide a cheaper and more convenient mode for charging electric vehicles as compared to commercial charging stations. Since users prefer charging their vehicles at home owing to ease and convenience, they opt for AC charging stations for EVs, as the cost of installation is reasonably low as compared to DC charging stations. Hence, DC charging stations have a lower adoption rate in the residential segment due to the significant costs involved in their installation.

Connector Insights

The Combined Charging System (CCS) segment dominated the market and accounted for a 47% share of the global revenue in 2021. The increasing electrification and support by major manufacturers and OEMs, including Daimler AG, Ford Motor Company, General Motor Company, and Volkswagen is driving the segment growth. A CCS connector supports slow and fast charging since it uses the Programmable Logic Controller (PLC) protocol that is a part of smart grid protocols. According to the U.S. Department of Energy (DOE), there are more than 5,000 CCS individual outlets as compared to the CHAdeMO outlets.

Easy integration with smart grid infrastructure and bi-directional charging capability is anticipated to drive the growth of the CHAdeMO segment during the forecast period. Moreover, research & development initiatives and investments by electric vehicle manufacturers such as Nissan Motor Co., Ltd. and Mitsubishi Motors Corporation for developing DC fast charging networks to support long-range travel is expected to drive the demand for CHAdeMO in the U.S. market.

Key Companies & Market Share Insights

In October 2020, Redwood Residential and Redwood Capital Group, a Chicago-based real estate company, announced the installation of an electric vehicle charging station of SemaConnect Inc. at Deer Park Crossing Apartments. Thus, the rising enhancements in electric vehicle chargers are propelling the market growth. Moreover, in August 2020, the Venture Port District announced the installation of five new SemaConnect Inc. charging stations for visitors to Venture Harbor. At the same time, the Series 6 charging stations are designed to replace the old pair of charging stations at Island Packers, which will be opened for all plug-in EV drivers at the harbor.

Acquisition and partnerships are undertaken by companies to expand their geographic presence in key markets. For instance, in November 2020, ChargePoint, Inc. announced its partnership with Volvo Car USA LLC to provide a seamless charging experience to Volvo car drivers. ChargePoint, Inc. will offer Home Flex home chargers to Volvo Car drivers owing to this partnership, which will enable drivers to charge their cars at home. Some prominent players in the U.S. electric vehicle charging infrastructure market include:

- ABB

- bp pulse

- Delta Electronics, Inc

- Webasto Group

- ChargePoint, Inc.

- Leviton Manufacturing Co., Inc.

- SemaConnect, Inc.

- Tesla, Inc.

- ClipperCreek, Inc.

Segments Covered in the Report

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects. Further, this research study investigates market size, production, consumption and its development trends at U.S. for the period of 2017 to 2030

- By Connector

- CHAdeMO

- Combined Charging System

- Others

- By Application

Key Points Covered in U.S. Electric Vehicle Charging Infrastructure Market Study:

- Growth of U.S. Electric Vehicle Charging Infrastructure in 2022

- Market Estimates and Forecasts (2017-2030)

- Brand Share and Market Share Analysis

- Key Drivers and Restraints Shaping Market Growth

- Segment-wise

- Competition Mapping and Benchmarking

- Recommendation on Key Winning Strategies

- COVID-19 Impact on Demand for U.S. Electric Vehicle Charging Infrastructure and How to Navigate

- Key Product Innovations and Regulatory Climate

- U.S. Electric Vehicle Charging Infrastructure Consumption Analysis

- U.S. Electric Vehicle Charging Infrastructure Production Analysis

- U.S. Electric Vehicle Charging Infrastructure and Management