UK Smart Home Security Camera Market Size and Growth

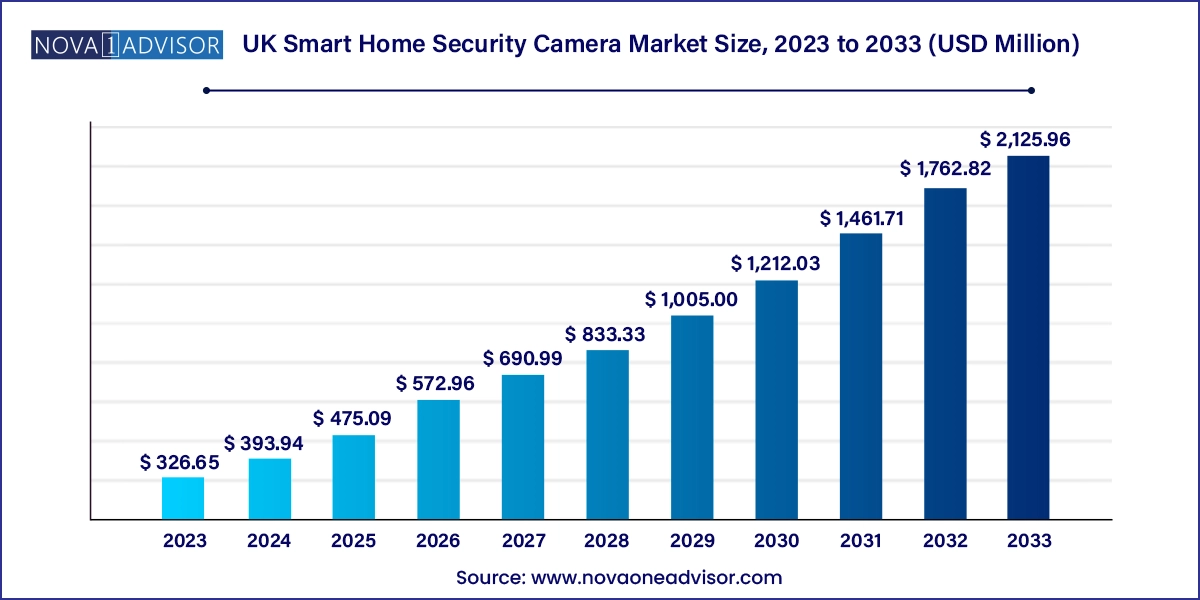

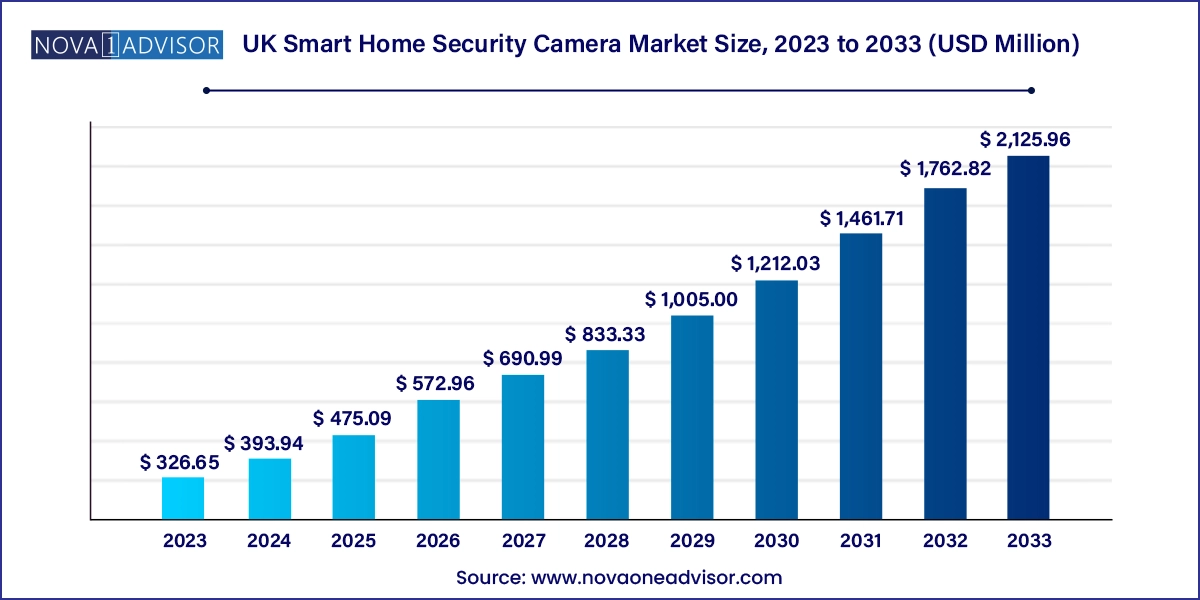

The UK smart home security camera market size was exhibited at USD 326.65 million in 2023 and is projected to hit around USD 2,125.96 million by 2033, growing at a CAGR of 20.6% during the forecast period 2024 to 2033.

UK Smart Home Security Camera Market Key Takeaways:

- In 2023, wired smart home security cameras market accounted for revenue share of 55.6%.

- Over the course of the projected period, wireless smart home security camera market is expected to grow at a CAGR of 20.5%.

- The indoor smart home security camera accounted for a share of 40.0% in 2023.

- Doorbell cameras are anticipated to grow at a CAGR of 20.8% over the forecast period.

Market Overview

The UK smart home security camera market is undergoing a robust transformation, propelled by a growing consumer demand for residential safety, smart living integration, and advanced surveillance capabilities. Aided by the rise of home automation technologies, the market has evolved from traditional closed-circuit television systems to intelligent, connected solutions that offer real-time monitoring, cloud storage, motion detection, and AI-powered alerts. As crime rates in urban areas prompt homeowners to seek proactive security solutions, smart security cameras have emerged as a central component of home protection systems across the United Kingdom.

British consumers today prioritize control, convenience, and peace of mind. From suburban family homes to urban flats, smart security systems are now being tailored to different living environments, integrating seamlessly with broader smart home ecosystems such as Amazon Alexa, Google Home, and Apple HomeKit. In cities like London, Manchester, and Birmingham, concerns around property theft, vandalism, and trespassing have led to a surge in demand for always-on, responsive surveillance tools. The rising penetration of high-speed internet and increasing smartphone usage also make it easier for users to manage and access live or recorded feeds on the go.

Beyond security, today’s smart cameras offer features such as facial recognition, package delivery monitoring, and remote two-way communication. Many also include heat sensors, AI detection of humans versus animals, and encrypted video storage, catering to a wide range of consumer concerns. Notably, many British households are adopting doorbell cameras as a first step toward full home surveillance, attracted by their affordability and functionality.

As UK homeowners increasingly transition from basic alarm systems to smart, connected surveillance, the market is witnessing a flood of both global and domestic players. Companies are responding with user-friendly mobile apps, flexible pricing models, and enhanced interoperability. Meanwhile, data privacy and compliance with regulations such as GDPR are shaping product development and consumer trust in the long run.

Major Trends in the Market

-

Rising Integration with Smart Home Ecosystems: Consumers prefer security cameras that sync with other smart devices like lighting systems, locks, and voice assistants.

-

Growth in DIY Installation and Subscription-Free Models: The demand for self-installed and cloud-free camera options is increasing, especially among renters and first-time buyers.

-

Adoption of AI and Facial Recognition: Cameras equipped with person detection, facial recognition, and behavioral analysis are on the rise, enhancing threat detection capabilities.

-

Cloud Storage with Enhanced Encryption: Growing preference for encrypted cloud storage and GDPR-compliant data handling practices is influencing consumer choices.

-

Increased Use of Doorbell Cameras: Affordable, compact, and easy-to-install, doorbell cameras are leading the charge in first-time smart security investments.

-

Push for Sustainability: Battery-operated, solar-powered, and energy-efficient models are gaining traction among eco-conscious UK consumers.

-

Real-time Mobile Alerts and Remote Access: The ability to access feeds from anywhere in the world through mobile apps is now a standard expectation.

-

Voice and Gesture-Controlled Cameras: Integration with AI assistants and gesture-activated features are enhancing the user experience.

Report Scope of UK Smart Home Security Camera Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 393.94 Million |

| Market Size by 2033 |

USD 2,125.96 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 20.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

UK |

| Key Companies Profiled |

Vivint Smart Home; ADT Inc.; SimpliSafe; Brinks Home Security; Skylinkhome; Samsung Electronics Co; Frontpoint Security Solution; Wyze Lab; Blink; Ring LLC |

Key Market Driver

High Adoption of Smart Homes in Urban UK Households

The rapid proliferation of smart homes in the UK is a significant driver of the smart home security camera market. With over 30% of UK households estimated to have at least one smart home device as of 2024, the environment is ripe for integration of surveillance systems. Rising disposable incomes, growing familiarity with IoT devices, and increased awareness of home safety have converged to create strong momentum for the adoption of smart cameras.

In major cities such as London, where dense housing makes property protection more urgent, smart cameras offer tailored security even in constrained spaces. Likewise, suburban families are increasingly investing in full home automation systems that include outdoor cameras, door sensors, and cloud-based security dashboards. Integration with smart locks and lighting systems is further enhancing the effectiveness and appeal of surveillance setups. As a result, security cameras are not being seen as standalone devices, but as key nodes within an interconnected network of smart technologies.

Key Market Restraint

Data Privacy Concerns and Regulatory Compliance

A prominent restraint affecting the UK smart home security camera market is the concern surrounding data privacy, storage, and regulatory compliance. The General Data Protection Regulation (GDPR), in effect across the UK and Europe, imposes strict rules on the collection, storage, and processing of personal video footage. This has raised concerns among consumers about how their data is handled by manufacturers and service providers.

Moreover, there have been cases where hackers have gained access to live feeds due to weak security protocols or unchanged default settings. These incidents undermine consumer confidence and make prospective buyers wary of installing always-on surveillance systems. Privacy-conscious households are also concerned about recording public footpaths or neighbors' properties, which could violate laws or spark disputes. As such, the market’s growth could be hampered by apprehensions about misuse, unauthorized data access, and inadequate transparency in vendor policies.

Key Market Opportunity

Expansion of AI-Enabled Features for Enhanced Home Intelligence

The integration of artificial intelligence presents a compelling growth opportunity for the UK smart home security camera market. As consumers seek more than passive monitoring, the evolution of AI-driven capabilities—such as real-time alerts, facial identification, object tracking, and behavioral pattern recognition—is transforming smart cameras into active participants in home security.

For example, AI-powered systems can distinguish between regular visitors and unfamiliar individuals, send alerts when packages are left at the doorstep, or detect suspicious movements during specific hours. In premium models, this intelligence extends to identifying license plates or setting up geofenced alerts. These advanced features add tangible value and elevate the perception of security, especially in urban environments. As AI technology becomes more affordable and accessible, manufacturers have the opportunity to differentiate their offerings and serve both tech-savvy early adopters and mainstream consumers looking for smart yet intuitive systems.

UK Smart Home Security Camera Market By Technology Insights

In 2023, wired smart home security cameras market accounted for revenue share of 55.6%. Particularly in larger properties or commercial environments. They are favored for their consistent power supply and uninterrupted connection, making them ideal for 24/7 surveillance. In certain high-value residential properties or multi-unit dwellings, wired systems are installed as part of broader integrated security solutions. However, the relatively complex installation and immobility limit their appeal among everyday consumers, contributing to slower growth compared to their wireless counterparts.

Over the course of the projected period, wireless smart home security camera market is expected to grow at a CAGR of 20.5%. primarily due to its flexibility, ease of installation, and seamless integration with smart home devices. Unlike wired systems, wireless cameras do not require complex installation procedures, making them an ideal choice for renters and those in smaller properties or historic buildings where wiring can be difficult. Leading brands like Ring and Arlo have capitalized on this by offering battery-powered models that support Wi-Fi connectivity, remote access, and rechargeable battery packs. With the majority of consumers preferring DIY installations and low-maintenance solutions, wireless cameras have become the first choice for new buyers across the UK.

UK Smart Home Security Camera Market By Application Insights

The indoor smart home security camera accounted for a share of 40.0% in 2023. driven by increasing concerns over burglary, package theft, and car-related crimes. Homeowners often prioritize surveillance of entry points, driveways, and garages to deter intrusions and capture video evidence. Modern outdoor cameras feature weatherproof casings, night vision, and motion-sensor lighting, making them highly effective for all-season protection. With many models offering 2K or 4K video resolution, wide-angle lenses, and AI-enhanced alerts, outdoor cameras are increasingly seen as essential for any comprehensive home security setup.

Doorbell cameras are the fastest-growing segment, gaining immense popularity among homeowners, apartment dwellers, and even small business owners. Devices like Ring, Eufy, and Google Nest doorbell cameras have revolutionized first-point-of-contact security, offering video recording, two-way audio, and integration with mobile alerts. They are especially valued in the UK for monitoring deliveries, deterring doorstep theft, and identifying visitors without opening the door. The affordability, simplicity, and compact design of doorbell cameras make them a preferred entry point into the smart surveillance ecosystem for many British consumers.

Country-Level Analysis

United Kingdom

As one of the most mature smart home markets in Europe, the United Kingdom is experiencing a steady rise in demand for smart home security cameras, particularly in urban and suburban areas. London, Manchester, Birmingham, and Glasgow are hotspots for adoption, fueled by high population densities and property crime awareness. Government crime data, combined with increased media coverage of doorstep thefts and intrusions, has encouraged homeowners to adopt advanced surveillance systems.

The UK market is also shaped by tech-savvy consumers who actively seek integration between security devices and broader smart home ecosystems. Compatibility with Amazon Alexa and Google Home has become a key purchasing criterion. Moreover, British consumers place high importance on privacy and data compliance, often scrutinizing vendor GDPR practices before committing to cloud-based subscriptions.

Seasonal campaigns, such as Black Friday and Boxing Day sales, have also played a role in driving demand, particularly through online channels. With a strong base of digitally literate buyers and growing awareness of home security threats, the UK is expected to remain one of the most promising markets for smart home security cameras in the coming decade.

Some of the prominent players in the UK smart home security camera market include:

- Vivint Smart Home, Inc.

- ADT Inc.

- SimpliSafe, Inc.

- Brinks Home Security

- Skylinkhome

- Samsung Electronics Co, Ltd.

- Frontpoint Security Solution, LLC

- Wyze Lab, Inc.

- Blink

- Ring LLC

UK Smart Home Security Camera Market Recent Developments

-

March 2024: Ring (an Amazon company) announced the launch of its next-gen battery-powered doorbell camera in the UK, featuring a wider 180° field of view and smart package detection—designed specifically for the growing e-commerce delivery culture.

-

January 2024: Arlo Technologies partnered with Currys UK to expand its product availability across physical retail stores and online channels, offering new bundles with no monthly cloud fees for budget-conscious consumers.

-

November 2023: Google Nest released its updated outdoor camera range in the UK, featuring AI-powered scene analysis and advanced face recognition, available as part of its Google One integration.

-

October 2023: Eufy, a brand by Anker Innovations, launched its Dual-Cam Doorbell in the UK, enabling simultaneous front-and-parcel view functionality, a feature that received significant attention due to rising parcel thefts.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the UK smart home security camera market

By Technology

By Application

- Doorbell Camera

- Indoor Camera

- Outdoor Camera