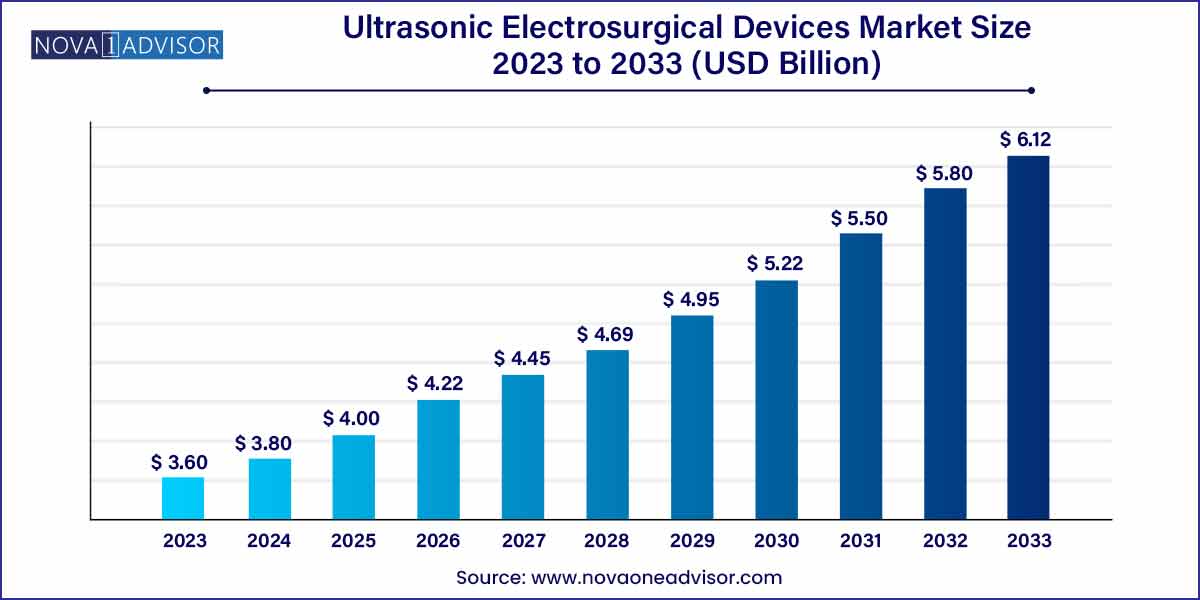

The global ultrasonic electrosurgical devices market size was exhibited at USD 3.60 billion in 2023 and is projected to hit around USD 6.12 billion by 2033, growing at a CAGR of 5.45% during the forecast period of 2024 to 2033.

Key Takeaways:

- The ultrasonic electrosurgical consumable segment accounted for the largest revenue share of 56.7% in 2023.

- The high-intensity focused ultrasonic (HIFU) ablators held the largest share of 40.0% in 2023.

- Cardiology held the largest share of 28.8% in 2023.

- The hospital segment captured the highest market share and will hold 48.5% of the market share in 2023.

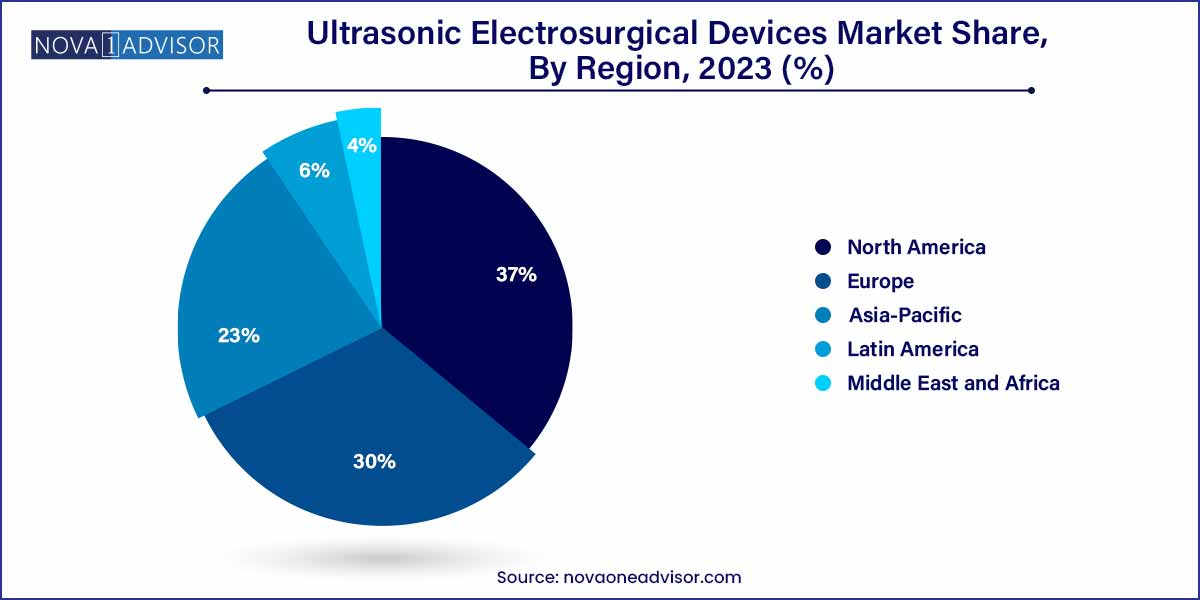

- North America accounted for the largest market share of 37.0% in 2023.

Market Overview

The ultrasonic electrosurgical devices market has rapidly evolved into a pivotal segment within the global surgical instruments landscape. Ultrasonic electrosurgical devices utilize high-frequency vibrations to cut, coagulate, and ablate tissues, offering a precision-based alternative to traditional surgical methods. These devices deliver superior surgical outcomes by minimizing blood loss, reducing thermal damage to surrounding tissues, and enhancing healing times. As a result, they have become indispensable tools across multiple medical specialties including general surgery, gynecology, cardiology, and urology.

The market's robust expansion is fueled by a rising preference for minimally invasive procedures, growing surgical volumes worldwide, and the pursuit of better patient outcomes. The integration of advanced technologies such as real-time imaging guidance, automation, and energy modulation has further improved device efficacy and safety profiles. Healthcare providers are increasingly favoring ultrasonic electrosurgical devices over conventional electrocautery due to their lower complication rates and the potential for outpatient procedures. Consequently, the ultrasonic electrosurgical devices market is poised for sustained growth across hospitals, ambulatory surgical centers, and specialty clinics globally.

Major Trends in the Market

-

Shift towards minimally invasive surgeries: Increasing adoption of laparoscopic and robotic-assisted surgeries is boosting demand for precision-based ultrasonic devices.

-

Technological advancements in focused ultrasound therapy: High-Intensity Focused Ultrasound (HIFU) and Magnetic Resonance-guided Focused Ultrasound Surgery (MRgFUS) are gaining prominence in non-invasive tumor ablation.

-

Rising applications in oncology: Ultrasonic electrosurgical devices are increasingly used for treating cancers, especially liver, prostate, and breast tumors.

-

Growing popularity of disposable consumables: To enhance procedural safety and reduce cross-contamination risks, hospitals are shifting towards single-use ultrasonic scalpel tips and probes.

-

Integration with robotic surgical systems: Robotic-assisted platforms are incorporating ultrasonic energy devices for complex surgeries, enhancing precision.

-

Expansion into emerging markets: Emerging economies are witnessing growing installations of ultrasonic electrosurgical devices owing to improving healthcare infrastructures.

-

Adoption of AI and IoT integration: Smart electrosurgical generators with remote monitoring and predictive maintenance capabilities are being introduced.

Ultrasonic Electrosurgical Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.60 Billion |

| Market Size by 2033 |

USD 6.12 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.45% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Type, Application, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Ethicon - Endo-Surgery; Olympus Corporation; Medtronic; Misonix Inc; BOWA-electronic GmbH; Söring GmbH; Advanced Instrumentations; Reach Surgical,;ITALIA MEDICA SRL.; SonaCare Medical; Miconvey. |

Product Insights

Generators dominated the product segment in 2024. Generators are the central component of ultrasonic electrosurgical systems, responsible for creating and controlling the ultrasonic energy delivered during procedures. Leading companies have introduced next-generation generators with enhanced safety features, customizable energy settings, and real-time feedback mechanisms. These developments make generators indispensable across a wide range of surgical specialties, solidifying their dominant market share.

Consumables are expected to be the fastest-growing product segment. Consumables such as ultrasonic scalpel tips, probes, and shears are witnessing increasing demand due to the shift toward single-use devices to prevent cross-contamination. Healthcare providers prefer disposable consumables for their convenience, sterility assurance, and regulatory compliance. Moreover, the growing number of surgical procedures worldwide naturally fuels the recurring demand for these essential consumables, driving rapid growth in this segment.

Type Insights

Ultrasonic Surgical Ablation Systems dominated the type segment in 2024. Ultrasonic surgical ablation systems, widely used across general surgery, urology, and gynecology, offer versatile solutions for cutting, coagulating, and dissecting tissues with minimal thermal damage. Their widespread adoption in hospitals and surgical centers for common procedures such as thyroidectomy, nephrectomy, and laparoscopic hysterectomy underlines their dominance.

High-intensity Focused Ultrasonic (HIFU) Ablators are projected to be the fastest-growing type. HIFU ablation technology is gaining traction in oncology and cardiology for its ability to deliver non-invasive, highly focused treatment to target tissues without incisions. With ongoing clinical research validating its efficacy and increasing regulatory clearances, HIFU technology is expanding its applications, from tumor ablation to treatment of atrial fibrillation, setting the stage for rapid market growth.

Application Insights

General Surgery dominated the application segment in 2024. The high volume of general surgical procedures, including appendectomies, hernia repairs, and gallbladder surgeries, has driven the demand for reliable, versatile ultrasonic devices. Surgeons increasingly prefer ultrasonic electrosurgical tools for their precision, reduced blood loss, and ability to perform tissue dissection and coagulation simultaneously.

Cardiology is anticipated to be the fastest-growing application segment. Cardiac surgeons and interventional cardiologists are increasingly leveraging ultrasonic electrosurgical tools for precise tissue ablation and vessel sealing during minimally invasive procedures. Additionally, the integration of HIFU technologies into cardiac rhythm management (e.g., atrial fibrillation ablation) is opening new frontiers, contributing to the rapid expansion of ultrasonic applications within cardiology.

End Use Insights

Hospitals dominated the end-use segment in 2024. Hospitals remain the primary users of ultrasonic electrosurgical devices due to their large surgical caseloads, availability of multidisciplinary surgical teams, and substantial capital budgets for acquiring advanced equipment. Hospitals also serve as centers for complex and high-risk surgeries, where precision instruments such as ultrasonic devices are indispensable.

Ambulatory Surgical Centers (ASCs) are expected to be the fastest-growing end-use segment. With healthcare systems pushing towards outpatient surgical care to control costs and improve patient convenience, ASCs are rapidly adopting advanced surgical technologies. Ultrasonic electrosurgical devices' suitability for minimally invasive and day-care surgeries makes them highly attractive to ASCs aiming for high throughput and excellent patient outcomes.

Regional Insights

North America dominated the ultrasonic electrosurgical devices market in 2024. A combination of advanced healthcare infrastructure, high surgical volumes, and a strong presence of leading manufacturers such as Ethicon (Johnson & Johnson) and Medtronic drives North America's leadership. The region benefits from early adoption of innovative surgical technologies, robust reimbursement systems, and a growing demand for minimally invasive procedures. Furthermore, ongoing investments in surgical robotics and energy-based surgical devices ensure that North America remains at the forefront of the market.

Asia-Pacific is anticipated to be the fastest-growing region. With a growing geriatric population, rising incidence of chronic diseases, and increasing healthcare spending, countries like China, India, and Japan are witnessing a surge in demand for advanced surgical interventions. Moreover, governments and private healthcare providers are investing in upgrading hospital infrastructures, thereby creating fertile ground for the adoption of ultrasonic electrosurgical technologies. Collaborations with local distributors, regional manufacturing hubs, and rising medical tourism further catalyze market growth in Asia-Pacific.

Some of the prominent players in the ultrasonic electrosurgical device market include:

- Ethicon - Endo-Surgery

- Olympus Corporation

- Medtronic

- Misonix Inc

- BOWA-electronic GmbH

- Söring GmbH

- Advanced Instrumentations

- Reach Surgical

- ITALIA MEDICA SRL.

- SonaCare Medical

- Miconvey

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global ultrasonic electrosurgical devices market.

Product

Type

- High-intensity Focused Ultrasonic (HIFU) Ablators

- Magnetic Resonance-guided Focused Ultrasonic (MRGFUS) Ablators

- Ultrasonic Surgical Ablation Systems

- Shock Wave Therapy Systems

Application

- Cardiology

- Gynecology

- General Surgery

- Urology

- Bariatric Surgery

- Others

End Use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)