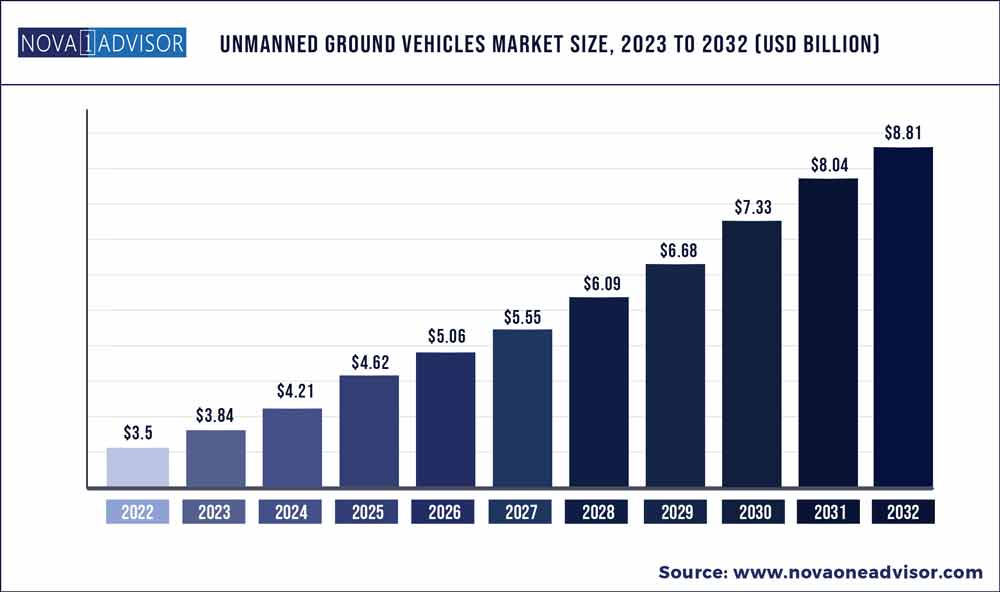

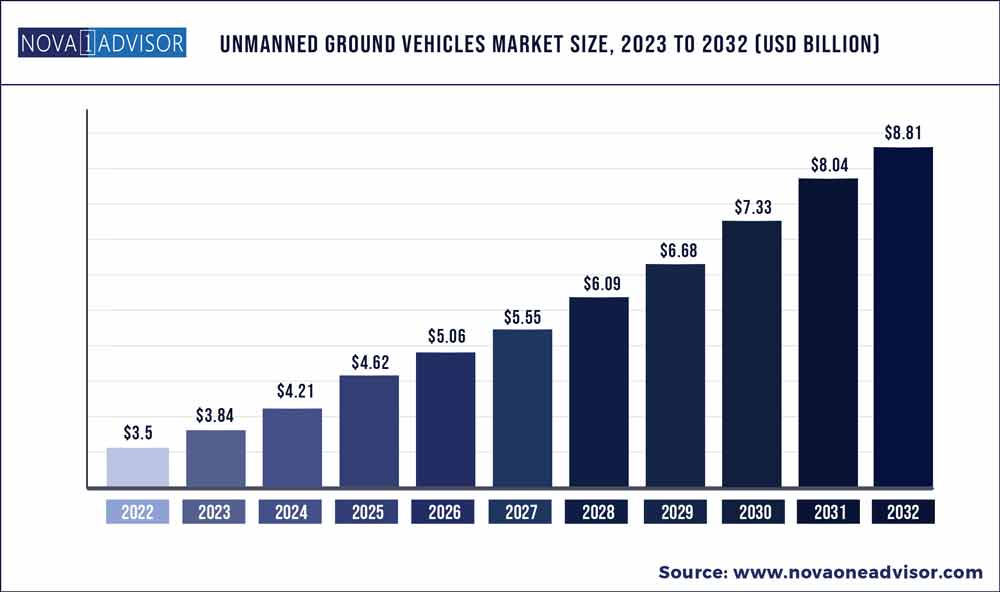

The global unmanned ground vehicles market size was exhibited at USD 3.5 billion in 2022 and is projected to hit around USD 8.81 billion by 2032, growing at a CAGR of 9.68% during the forecast period 2023 to 2032.

Key Pointers:

- By application, the defense segment held 69% market share in 2022.

- By size, the small segment accounted 59% market share in 2022.

- By mode of locomotion, the tracked segment hit 66% market share in 2022.

- By operation, the teleoperated segment has garnered 82% market share in 2022.

- Asia Pacific region is growing at a CAGR of 13.7 from 2023 to 2032.

- North America region generated highest revenue share of over 41.2% in 2022.

The growth of the market can be attributed to the rising demands for UGV systems in both commercial and military applications, coupled with advancements in UGV technologies, which in turn have lowered the cost of UGV ownership and increased their accessibility for civilian usage. Unmanned ground vehicles (UGVs) are robots that can operate over land, air, and water. It can perform tasks without any need for human operators. UGVs are also referred to as robotic platforms or remotely controlled vehicles. They are used in a variety of commercial, civilian, and military applications such as surveillance, an inspection of dams, nuclear power plants, hazardous chemical regions, bomb disposal in conflict zones, and search & rescue efforts during accidents or natural calamities.

The increasing use of robots in hazardous and dangerous environments such as biological, radiological, nuclear, and chemical threats are anticipated to drive the growth of the global UGV market. UGVs assist in countering the risk posed by explosive ordnance (EO), which includes landmines and improvised explosive devices, as a result, the demand for unmanned ground vehicles is expected to rise exponentially during the forecast period, thereby boosting the growth of the market.

The COVID-19 outbreak had a ripple effect on the global unmanned ground vehicle market. The pandemic led the UGV industry to face numerous challenges, including reductions in defense spending across several regions, logistic challenges, and disruptions in the supply chains of raw materials, among others. However, to withstand the drop in operating performance and revenue of the military sector, service providers and defense systems manufacturers had to limit expansion and R&D spending. Some of the difficulties seen in the unmanned ground vehicle market across the year included the poor production rate and the delay in purchase orders.

Unmanned Ground Vehicles Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 3.84 Billion

|

|

Market Size by 2032

|

USD 8.81 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 9.68%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Application, Mobility, Size, Mode of Operation, System

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

BAE Systems, QinetiQ, Rheinmetall AG, Teledyne FLIR, ECA Group, Lockheed Martin, General Dynamics, Leonardo S.p.A., Autonomous Solutions Inc., and Northrop Grumman

|

Unmanned Ground Vehicles Market Dynamics

Development of UGV payloads for combat operations

The use of UGVs in combat situations can be crutial. UGVs in cobat can be used for several tasks like providing a medical aid, weapons, surveillance, tracking, and actual combat by attaching a weapon system as a payload. This application area of UGV has wide scope and a rapid developments are taking place in this field. This application area holds fairly large amount of total UGV market as it covers few of the most important military operations. Hence, the rapid development in this application area is expected to drive the market for Unmanned Ground Vehicles.

Opportunity : Development of fully autonomous UGVs

Fully Autonomous UGVs is the latest innovation in the Unmanned ground vehicles market. Using AI & ML techniques, the fully autonomous UGVs are developed which are designed to operate without any human interference. Autonomous UGVs are designed accomplish any assigned task without any human help. Currently, these UGVs are used for applications like Intelligence, Surveillance & Reconnaissance (ISR) and security operations. With the advanced research being carried away, the widening of the application areas of fully autonomous UGVs will push the market upwards.

Challenges : Requirement for continuous and uninterrupted power supply in UGVs

UGVs are used for mission critical operations like Explosive Ordinance Disposal (EOD), Intelligence, Surveillance, & Reconnaissance (ISR), where the timely operation is crutial. These operations require uninterrupted and reliable power supply because of the high dependency of the whole operation on one UGV. So, there arises challenge for developing a highly reliable power supply solution with compact size.

Operation Insights

Based on the operation segment, the global market is segmented into teleoperated, autonomous, and tethered. During the forecast period, the autonomous segment is likely to exhibit a substantial CAGR of 8.3%. This can be attributed to their capability to make decisions without human intervention, including firing at a target. These robotic systems can replace human soldiers in a range of different hazardous tasks, such as patrolling vulnerable areas and barring access to Improvised Explosive Devices (IEDs), among others.

Teleoperated segment is expected to share the largest market share during the forecast period owing to its wide usage in numerous operations, including rescue and search, surveillance, and others. Additionally, the advantages of the teleoperated segment include enhanced situational awareness, head-aimed remote viewer, digital video feed, low latency, and others.

Mobility Insights

Based on the mobility segment, the market is divided into wheels, tracks, legs, and hybrid. The tracks segment was valued at over USD 1.29 billion million in 2022 and is expected to emerge as the dominant segment during the forecast period owing to the increasing defense spending along with the procurement of next-generation tracked UGVs from various countries. For instance, in May 2021, FLIR Systems Inc. received over USD 70 million in new orders for their innovative and advanced ground robots from the US Armed Services.

The hybrid segment is projected to grow at the fastest CAGR of 10.4% during the forecast period owing to their configuration ability for different roles, which include logistics support platform, observation, target acquisition, reconnaissance, and medical evacuation, among others.

Size Insights

On the basis of size, the global market has been fragmented into small, medium, large, and very large. The small-size segment witnessed a significant market share of over 23% in 2022. This growth is a result of UGVs being used more frequently for military purposes, such as Intelligence, Surveillance, and Reconnaissance (ISR) missions, combat operations, and search and rescue operations.

The large-size segment is projected to register the highest CAGR during the forecast period. This can be attributed to their ability to move bigger objects and operate around difficult terrains. These ground vehicles are used by civil security and military forces to analyze, detect, and defeat threats posed by Explosive Ordnance Disposal (EOD).

System Insights

The system segment is classified into payloads, navigation and control systems, power system, and others. Over the forecast period, the navigation and control segment is expected to witness a considerable CAGR of 8.0%. Simple image-based control techniques used by the system make it user-friendly and reduce operator workload. The navigation system uses a Global Navigation Satellite System (GNSS) receiver and real-time roll, pitch, and heading data to preserve accuracy in the case of a signal breakdown (tunnels, trees, buildings, and others). These factors are expected to drive growth further.

The payloads segment is expected to share a major market share during the forecast period owing to the improved performance of the vehicle by technological advancements in control, sensing, and computing-enabled advanced technologies.

Application Insights

Based on application segments, the market is differentiated into commercial, military, and government & law enforcement. The military segment accounted for the largest market share and is expected to continue its dominance during the forecast period. Using military unmanned ground vehicles for transportation improves logistical efficiency and enhances army movement. These vehicles help the military pick up casualties and carry battlefield equipment off the field. These factors are projected to fuel the segment growth further.

The commercial segment is projected to register the highest CAGR of over 11.1% during the forecast period. This growth can be attributed to the growing use of commercial applications, such as transportation, automotive sectors, healthcare sector, and others. These robots can also be benefitted from Artificial Intelligence (AI) and Machine Learning (ML) to adapt to the environment.

Regional Insights

North America accounted for the highest market share of over 41.2% in 2022 and is expected to retain its dominance during the forecast period. This can be attributed to factors including the growing defense budget and increasing investments in the procurement of next-generation military UGVs for numerous countries in the area, notably the U.S. For instance, in March 2021, the US Air Force successfully implemented four-legged unmanned ground vehicles, also known as robot dogs, in order to patrol the Tyndall Air Base. In order to protect civilians and secure facilities in the future, these technologies are anticipated to be implemented in civil airports.

The Asia Pacific is expected to witness the fastest CAGR of 13.7% during the forecast period. The continued development of UGVs for the military sectors in countries such as India, China, and Japan is a major factor in the rise in the region's market growth. Furthermore, the demand for UGVs is also growing due to factors such as the rapid growth of military forces, escalating political tensions between nearby nations, and the rise in terrorism.

Some of the prominent players in the Unmanned Ground Vehicles Market include:

- BAE Systems

- QinetiQ

- Rheinmetall AG

- Teledyne FLIR

- ECA Group

- Lockheed Martin

- General Dynamics

- Leonardo S.p.A.

- Autonomous Solutions Inc.

- Northrop Grumman

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Unmanned Ground Vehicles market.

By Application

By Mobility

- Wheeled

- Tracked

- Legged

- Hybrid

By Size

- Small

- Medium

- Large

- Very Large

- Extremely Large

By Mode of Operation

- Autonomous

- Teleoperated

- Tethered

By System

- Payloads

- Navigation System

- Controller System

- Power System

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)