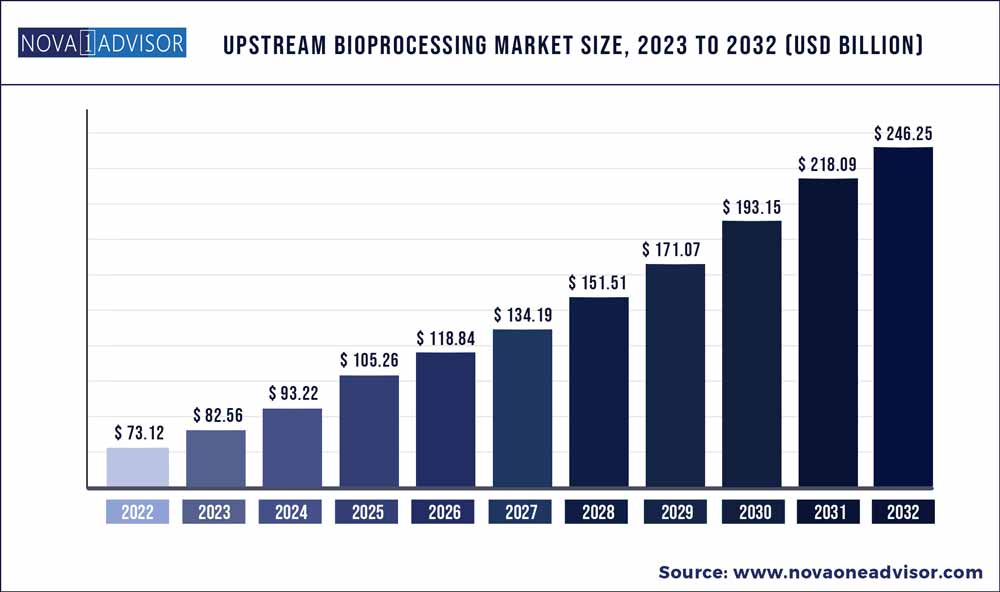

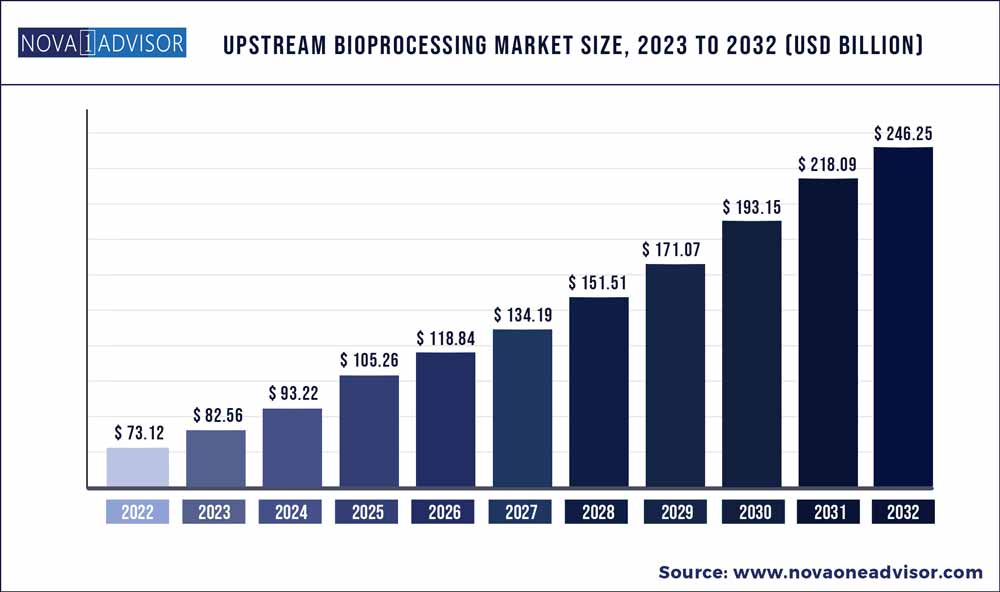

The global Upstream Bioprocessing market size was exhibited at USD 73.12 billion in 2022 and is projected to hit around USD 246.25 billion by 2032, growing at a CAGR of 12.91% during the forecast period 2023 to 2032.

Key Pointers:

- High availability of bioreactors and continuous launches of single-use bioreactors by the key market players can be attributed to the remarkable revenue share of the bioreactors segment

- Presence of well-established biopharmaceutical manufacturing firms capable of performing in-house bioproduction has led to the maximum revenue share of this segment

- Outsourced mode of upstream bioprocessing is anticipated to witness the fastest CAGR over the forecast period, owing to increase in investments and expansion of manufacturing capabilities through the integration of single-use systems in the plants by CMOs

- North America dominated the global upstream bioprocessing market as a result of the continuous innovations in biotechnology and rising preferences for biopharmaceuticals in the region. Moreover, the presence of substantial in-house biopharmaceutical manufacturers coupled with numerous investments in the U.S. biologics market has driven the growth

- Asia Pacific is poised to witness the fastest CAGR over the forecast period due to growing awareness about the rapid analytical methods that can be used for in-process control during the upstream workflows

Upstream Bioprocessing Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 82.56 Billion

|

|

Market Size by 2032

|

USD 246.25 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 12.91%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Product, workflow, use-type, mode

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

Thermo Fisher Scientific, Inc; GE Healthcare; Merck KGaA; Corning, Inc.; Sartorius AG; Eppendorf AG; Applikon Biotechnology; Lonza; PBS Biotech, Inc.; CellGenix GmbH; Boehringer Ingelheim; Samsung BioLogics; Patheon; CMC Biologics; JM BIOCONNECT; Danaher Corporation

|

The key factors that have driven the is the growing implementation of Process Analytical Technology (PAT) strategy as a mechanism to design, analyze, and optimize processes through timely measurements of critical process parameters.

Commercial success and wide acceptance of biopharmaceuticals have provided lucrative growth avenues to several in house as well as contract manufacturing biopharmaceutical companies. Furthermore, a confluence of factors, such as high demand for biosimilars and biologics, launch of improved cost-effective technologies, and growing acceptance of single-use systems have driven the revenue performance of the market.

Start-ups and new market entrants often face budget constraints while establishing new biomanufacturing plants. Thus, these entities expand their biotherapeutics portfolio by outsourcing the production process to contract services, thereby aiding in revenue growth for upstream bioprocessing services.

Continuous upstream bioprocessing has greatly benefited the bioprocessing industry. Rising implementation of methods, such as acoustic wave technology and continuous centrifugation, for clarification of bioreactor cultures tends to minimize the clarification burden. This, in turn, increases the cell-culture densities, consequently resulting in efficient upstream processes.

Ongoing advancements in cell line productivity with respect to protein expression and clone screening are expected to result in the fastest CAGR of cell culture products over the forecast period. Cell culture is considered as the most challenging and crucial step in upstream bioprocessing, and thus demands more attention with respect to technological intricacies, resulting in the largest share in the upstream bioprocessing market.

Factors such as multi-use systems incur one-time investment, are applicable for larger bioprocessing volumes and maintain the pH and oxygen accurately resulting in high usage rate of these systems. However, a paradigm shift from conventional stainless-steel bioreactors to single-use bioreactor systems has attributed to the lucrative growth of the single-use segment.

Key market players are adopting strategic initiatives, such as novel product developments, mutually beneficial partnerships, agreements, and geographical expansion to reinforce their market presence. For instance, in February 2019, Danaher Corporation signed an agreement to acquire the Biopharma business of GE Life Sciences. The acquisition broadened Danaher’s market presence with the addition of GE Biopharma’s cell culture media, single-use technologies, development instrumentation, and consumables to its existing portfolio.

Product Insights

Availability of a wide range of bioreactors/fermenters along with the high usage of bioreactors in large as well small-scale bioproduction marks the larger revenue share of the bioreactors. Moreover, the development of automated bioreactors for safe, cost-effective, and regulatory-compliant manufacturing of cell-based products for clinical applications has driven the segment growth.

Rising demand for high titer producing cell cultures can be attributed to the lucrative growth rate of cell culture products. High adoption of recombinant Chinese Hamster Ovary (CHO) cell line as a cost-effective option provided by the established companies fuels the segment growth. On the other hand, startup biotech companies outsource the entire CHO cell-based production process for more effective biomanufacturing in terms of time and yield.

The use of patented cell lines offers a high success rate in the cell cultivation process, because the use of patented cell lines have a proven track record concerning minimal regulatory risk and efficient commercial production. Aforementioned advantages positively impact the long-term value propositions for the companies operating in the upstream bioprocessing market.

Workflow Insights

Cell culture step is expected to maintain its dominance in terms of revenue share throughout the forecast period, due to the ongoing technological advancements in cell culture systems, such as, development of micro-bioreactors to facilitate small scale bioproduction.

The developments in biological data analysis and data management fields provide critical quality attributes related to cell cultivation. Constant improvements in the high throughput analytics and development of multi-bioreactor systems have driven the revenue in this segment.

Cell separation workflow accounted for the lowest penetration with respect to revenue share is expected to grow at a significant pace in the forthcoming years. Factors that can be attributed to the projected growth include implementation of flocculants to enhance the throughput in centrifugation and the advent of single-use tubular bowl centrifuges.

Use Type Insights

Multi-use products accounted for the largest share of the market for upstream bioprocessing in 2018 due to the high usage of conventional stainless-steel bioreactors for commercial biomanufacturing. Moreover, these systems impose lower environmental impact as compared to single-use systems and are associated with minimal leakage risk during the cell culture.

On the other hand, the cost-saving advantage of the single-use products is anticipated to drive the adoption of these systems with a notable growth rate. Disposable systems abolish the need for sterilization or cleaning steps, which in turn, reduces the additional expenses incurred during sterilization, process validation, assembly, and maintenance processes, which is mandatory in multi-use assemblies.

Furthermore, growing realization of single-use technology as an operational and economically beneficial trend among contract manufacturers has spurred the adoption of these products. Contract service providers are making significant investments for the expansion of service portfolio in upstream workflows and for capturing major share in the market for upstream bioprocessing.

Mode Insights

In-house segment captured the largest revenue share due to the presence of a substantial number of well-established firms that prefer in-house manufacturing. These firms consider outsourcing as a risk associated with the loss of strategic control over the process and limited management oversight. Moreover, such manufacturers have cross-functional teams for conducting advanced production techniques during biopharmaceutical production.

Furthermore, the inclusion of outsourcing activities as cost-saving efforts has increased the complexity pertaining to the planning and decision-making process for biopharmaceutical manufacturing. As a result, big pharma companies tend to adhere to their in-house facilities for biopharmaceutical manufacturing.

However, expansion of the contract manufacturing service portfolio has contributed to a considerable extent in making bioproduction more efficient and affordable. This is particularly witnessed among smaller and emerging entities that face budget constraints. These entities consider CMOs as a viable solution to address their resource and capital challenges.

Regional Insights

North America accounted for the largest upstream bioprocessing market share in 2022. Initiatives undertaken by U.S.-based public and private entities to provide higher profit margins by the virtue of the expansion of resources in the country has contributed to the largest revenue share of this region.

For instance, in February 2022, Jefferson (Philadelphia University + Thomas Jefferson University) announced the establishment of the Jefferson Institute for Bioprocessing to train industry professionals and engineering students for biologics manufacturing. Jefferson collaborated with the National Institute for Bioprocessing Research and Training to implement this initiative.

Asia Pacific is expected to witness the fastest growth throughout the forecast period owing to the increasing number of players entering the Asian biopharmaceutical market. Moreover, Asian countries are envisioned as a lucrative source of revenue, thus resulting in significant investments from global in the Asian economies to mark their business footprint and capture significant share.

Some of the prominent players in the Upstream Bioprocessing Market include:

- Thermo Fisher Scientific, Inc

- GE Healthcare

- Merck KGaA

- Corning, Inc.

- Sartorius AG

- Eppendorf AG

- Applikon Biotechnology

- Lonza

- PBS Biotech, Inc.

- CellGenix GmbH

- Boehringer Ingelheim

- Samsung BioLogics

- Patheon

- CMC Biologics

- JM BIOCONNECT

- Danaher Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Upstream Bioprocessing market.

By Product

- Bioreactors/Fermenters

- Cell Culture Products

- Filters

- Bioreactors Accessories

- Bags & Containers

- Others

By Workflow

- Media Preparation

- Cell Culture

- Cell Separation

By Use Type

By Mode

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)