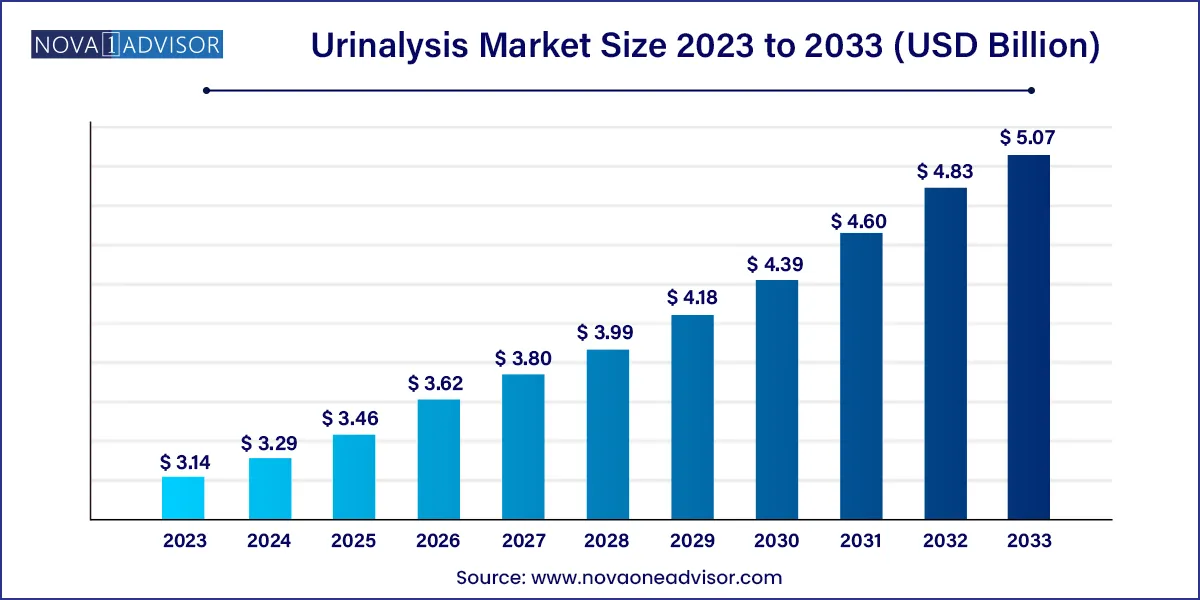

The global urinalysis market size was exhibited at USD 3.14 billion in 2023 and is projected to hit around USD 5.07 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2024 to 2033.

Key Takeaways:

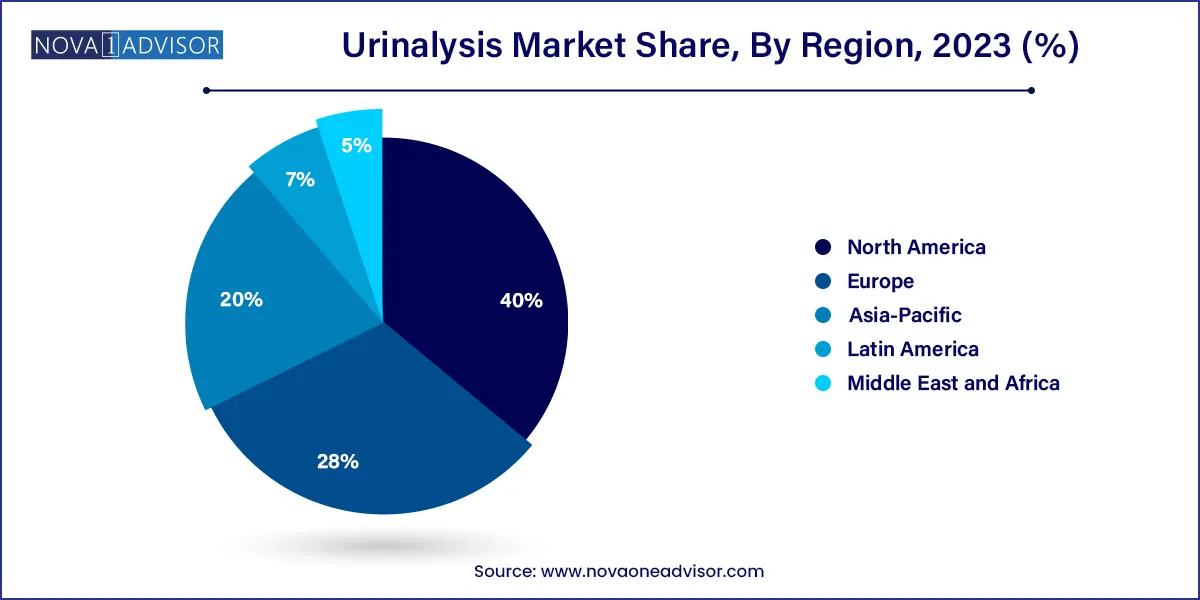

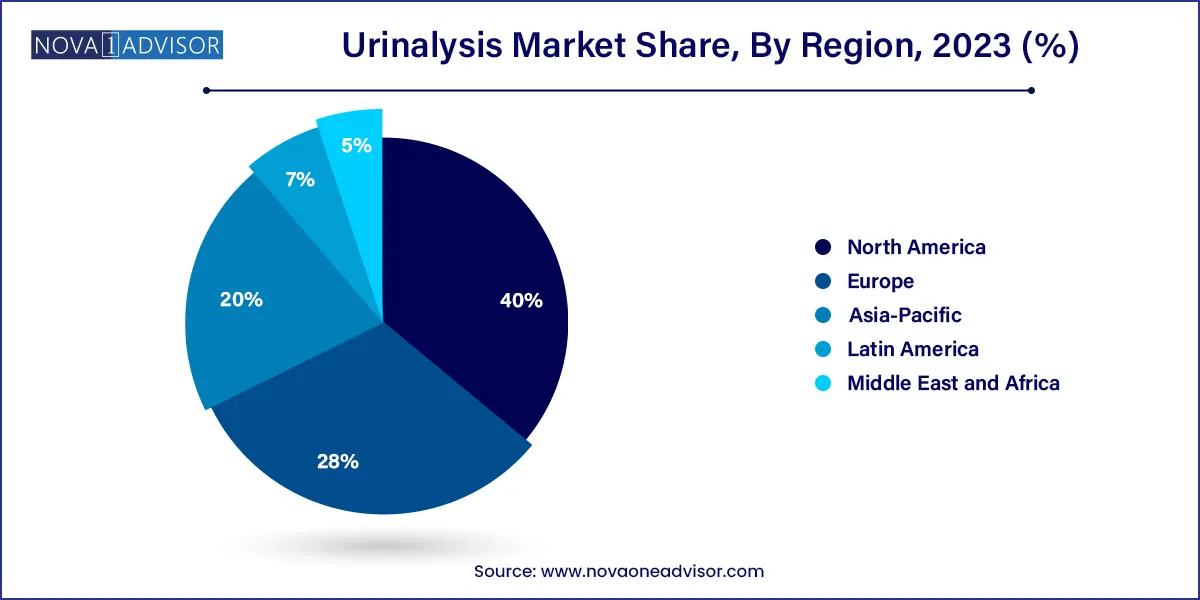

- North America dominated the market and accounted for the largest revenue share of 40.0% in 2023.

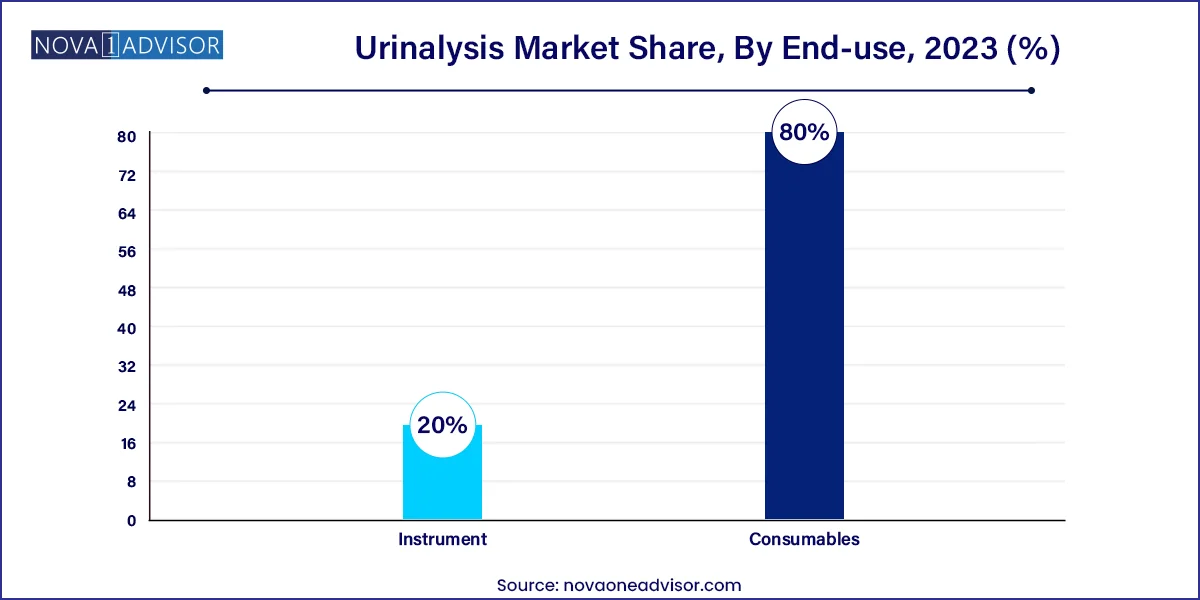

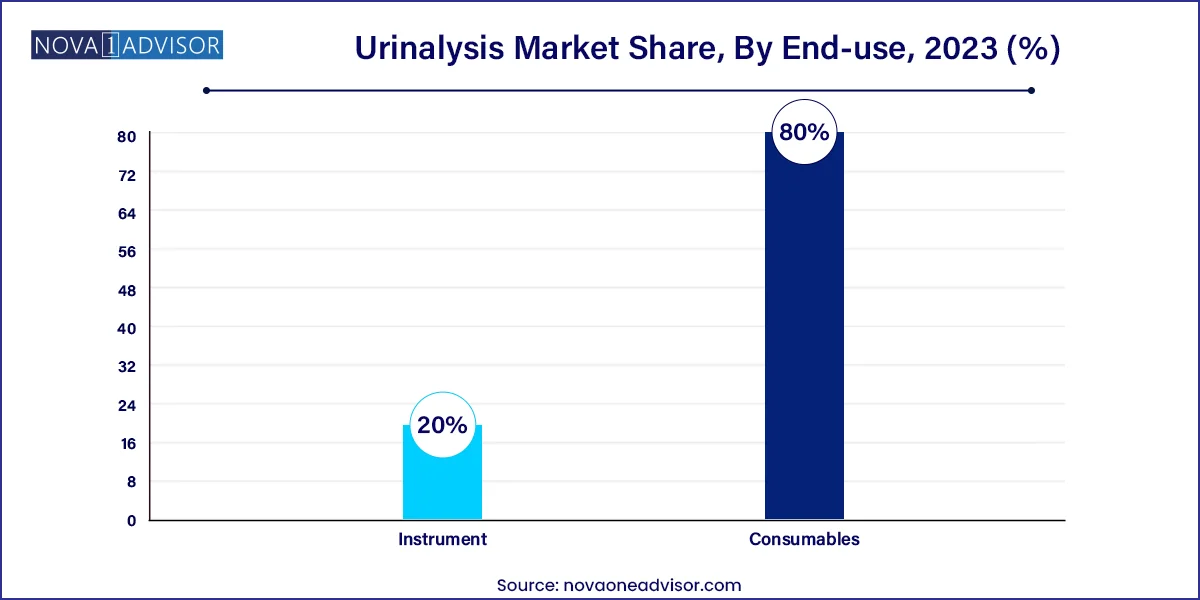

- The consumables segment held the dominant market share of 80.0% in terms of revenue in 2023.

- The urinary tract infection screening segment dominated the market and accounted for a revenue share of 25.06% in 2023, due to the rising incidence of UTIs worldwide.

- The clinical laboratories segment accounted for the highest revenue share of around 46.15% in 2023.

Market Overview

The urinalysis market is a dynamic and critical component of the broader in-vitro diagnostics (IVD) sector, essential for diagnosing and managing a wide spectrum of health conditions. Urinalysis involves the physical, chemical, and microscopic analysis of urine to detect the presence of disease, metabolic disorders, infections, and pregnancy. It plays a central role in primary care, emergency diagnostics, chronic disease management, and wellness screening.

The increasing burden of urinary tract infections (UTIs), diabetes, chronic kidney disease (CKD), and hypertension globally has propelled demand for urinalysis testing across healthcare settings. With a growing elderly population and a shift toward preventive and personalized medicine, urinalysis has evolved from a simple dipstick test to highly automated and sophisticated systems capable of delivering real-time, point-of-care diagnostics.

Advancements in urine analyzers automated biochemical, sediment, and flow cytometric systems have enabled faster, more accurate, and high-throughput analysis, particularly in hospitals and diagnostic laboratories. Simultaneously, the proliferation of at-home pregnancy kits, fertility testing products, and portable urinalysis devices has made testing accessible beyond clinical settings.

The urinalysis market is positioned at the intersection of chronic disease diagnostics, women's health, and digital health integration. As healthcare systems embrace decentralized diagnostics and value-based care, urinalysis will remain a frontline tool for both early disease detection and long-term patient monitoring.

Major Trends in the Market

-

Rising Automation in Urinalysis Laboratories: Fully automated analyzers reduce human error and boost throughput in high-volume testing environments.

-

Increased Use of Point-of-Care (POC) Devices: POC urinalysis is gaining traction in outpatient clinics, pharmacies, and remote care facilities.

-

Integration with Electronic Health Records (EHR): Digital urinalysis data is being directly transmitted into patient health systems to streamline reporting and continuity of care.

-

Miniaturization of Analyzers for Home Use: Companies are launching compact, smartphone-compatible urinalysis devices for chronic disease and pregnancy monitoring at home.

-

Growth in Multiparameter Dipsticks: Test strips capable of detecting multiple markers (e.g., glucose, protein, leukocytes) simultaneously are in high demand.

-

Rising Focus on Kidney and Liver Health Diagnostics: With increasing kidney disease and fatty liver prevalence, urinalysis is playing a bigger role in organ health screening.

-

Expansion in Emerging Markets: Growing healthcare access in Asia-Pacific, Latin America, and Africa is boosting adoption of both automated lab and disposable urinalysis kits.

Urinalysis Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.29 Billion |

| Market Size by 2033 |

USD 5.07 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Abbott; Sysmex Corporation; Siemens Healthcare GmbH; ACON Laboratories, Inc.; ARKRAY Inc.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; F. Hoffmann-La Roche Ltd.; Quidel Corporation; Bio-Rad Laboratories, Inc. |

Market Driver: Global Increase in Chronic and Infectious Diseases

A key driver of the urinalysis market is the rising incidence of chronic conditions and infectious diseases that require regular screening and monitoring through urine analysis. Urinalysis remains the gold standard for diagnosing urinary tract infections (UTIs), which affect nearly 150 million individuals worldwide each year. It is also crucial for monitoring diabetes through glucose and ketone testing and for detecting early signs of kidney dysfunction such as proteinuria and hematuria.

Moreover, as more people are diagnosed with hypertension, liver disorders, and metabolic syndromes, urinalysis is being utilized for broader preventive screening. With low cost, rapid results, and non-invasive collection, urinalysis is increasingly favored in both acute and routine diagnostic pathways. This trend is especially prominent in primary care settings, where urinalysis serves as a frontline diagnostic tool before advanced testing is prescribed.

Market Restraint: Accuracy Concerns in Point-of-Care and Home Settings

One significant restraint in the urinalysis market is the accuracy and reliability limitations of certain point-of-care and at-home testing kits. While convenient and cost-effective, these tests are prone to variability due to improper collection, operator error, and sample contamination. For instance, environmental factors or user technique may affect colorimetric interpretation of dipsticks, leading to false positives or negatives.

This is particularly concerning in pregnancy testing and chronic disease monitoring, where misdiagnosis can lead to either anxiety or missed treatment opportunities. Furthermore, regulatory challenges and product recalls related to quality control have raised concerns among clinicians and patients alike. While technological advancements are addressing these limitations, the gap between laboratory-grade accuracy and consumer-use simplicity remains a critical area for improvement and investment.

Market Opportunity: Growing Demand for Home-Based Diagnostics and Self-Monitoring

The urinalysis market is witnessing a significant opportunity with the rise of home diagnostics and self-monitoring technologies. Amidst the COVID-19 pandemic, consumers increasingly turned to home health tools, catalyzing interest in self-testing for chronic conditions, UTIs, and fertility. Companies are capitalizing on this trend by developing user-friendly urinalysis kits integrated with smartphone apps that guide users through the testing process and provide instant interpretations.

This evolution is particularly notable in pregnancy and fertility testing, where home-based urinalysis kits have become a mainstream consumer product. With the push toward remote patient monitoring, digital health integration, and teleconsultations, demand is growing for urinalysis solutions that can deliver reliable results without a lab visit. Innovations such as IoT-enabled urinalysis cups, AI-based strip reading apps, and mail-in urine test subscription services are transforming how consumers manage their health independently.

By Product Insights

Consumables dominate the product segment, driven by high-volume, recurring usage in clinical and home settings. Dipsticks are widely used for rapid, multiparameter testing, offering a cost-effective solution for detecting glucose, nitrites, protein, leukocytes, and more. Reagents and disposable cups are essential for both manual and automated systems, while pregnancy and fertility kits continue to expand among direct-to-consumer users. Their convenience, affordability, and ease of access in retail and online stores fuel their strong market hold.

However, urinalysis instruments are the fastest-growing segment, especially automated biochemical and sediment analyzers. Hospitals and diagnostic labs are upgrading from semi-automated to fully automated systems that combine biochemical and microscopic analysis in one platform. These systems support high-throughput labs, improve diagnostic precision, and reduce turnaround time. The demand for flow-cytometric urine analyzers is rising in tertiary care centers for detailed infection profiling and cellular assessment, particularly in nephrology and oncology departments.

By Application Insights

Disease screening is the largest application segment, covering diagnostics for UTIs, diabetes, kidney diseases, liver conditions, and more. Urinalysis is routinely performed during hospital admissions, outpatient diagnostics, and chronic disease check-ups. Its utility in identifying early signs of systemic illness through a simple urine sample keeps it central to preventive and general medicine. Disease screening is also expanding through corporate wellness programs and community health campaigns.

In contrast, pregnancy and fertility testing is the fastest-growing segment, driven by the surge in self-monitoring, fertility planning apps, and early pregnancy diagnostics. The market for digital ovulation and pregnancy kits is booming, with brands like Clearblue and First Response integrating Bluetooth connectivity and cycle tracking apps. Increasing awareness about reproductive health, later-age pregnancies, and hormone-based fertility interventions are also driving frequent urinalysis use at home, outside the clinical sphere.

By End-use Insights

Hospitals remain the dominant end-use segment, as urinalysis is a standard test performed in emergency, inpatient, and surgical departments. High test volumes, advanced analyzer installations, and integration with EHR systems support continuous urinalysis demand in this setting. In addition, complex cases involving kidney or liver dysfunction often require urinalysis to monitor patient progress and treatment response, reinforcing hospital reliance.

However, home care is the fastest-growing end-use segment, underpinned by trends in self-care, remote diagnostics, and decentralized healthcare. Pregnancy testing, chronic condition monitoring, and infection screening are increasingly performed at home using consumer kits and app-integrated tools. Telemedicine and subscription health services are also adopting urinalysis as part of their diagnostics portfolios. Home-based care is set to grow further with aging populations and post-COVID preferences for contactless healthcare delivery.

By Regional Insights

North America leads the global urinalysis market, owing to its advanced diagnostic infrastructure, high chronic disease prevalence, and widespread consumer adoption of home testing. The U.S. boasts one of the largest installed bases of automated urine analyzers, with laboratories frequently upgrading systems to support high throughput and digital data transfer. Reimbursement structures under Medicare and private insurance further support urinalysis use in disease management and prenatal care. Moreover, the region is a hub for innovation, with tech startups launching smart urine analyzers and mobile-linked test kits.

Asia-Pacific is the fastest-growing region, driven by rising healthcare access, increasing chronic disease incidence, and expanding middle-class populations. China, India, and Japan are seeing growing investments in hospital automation and diagnostic lab development. Meanwhile, the adoption of fertility kits and dipstick urinalysis in rural and semi-urban settings is widening the customer base. Governments in Asia are also launching national screening programs for kidney disease, diabetes, and maternal health, further supporting market penetration. Local manufacturers are producing cost-effective test kits to cater to the price-sensitive population, while global players are setting up regional production and distribution networks to meet rising demand.

Some of the prominent players in the Urinalysis market include:

- Abbott

- Sysmex Corporation

- Siemens Healthcare GmbH

- ACON Laboratories, Inc.

- ARKRAY Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- Quidel Corporation

- Bio-Rad Laboratories, Inc.

Recent Developments

-

April 2025 – Siemens Healthineers launched its CLINITEK Novus™ Enhanced Analyzer, an automated urinalysis platform with AI-driven sediment interpretation and EHR integration.

-

February 2025 – ACON Laboratories received FDA 510(k) clearance for its new On Call® Point-of-Care Urine Analyzer, optimized for outpatient and urgent care centers.

-

December 2024 – Healthy.io, an Israeli health tech firm, expanded partnerships with U.K. NHS trusts to roll out its app-based urinalysis kits for remote kidney screening.

-

November 2024 – Roche Diagnostics introduced its Urisys Smart POC urinalysis system for decentralized care environments in Europe and Asia.

-

September 2024 – Abbott launched a new generation of pregnancy and ovulation test kits under its Clearblue brand, featuring smart app sync and early detection accuracy enhancements.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global urinalysis market.

Product

-

- Biochemical urine analyzers

-

-

- Automated biochemical analyzers

- Semi-automated biochemical analyzers

-

- Automated urine sediment analyzers

-

-

- Microscopic urine analyzers

- Flow-cytometric urine analyzers

-

- Point-of-care urine analyzers

-

- Dipsticks

- Reagents

- Disposables

- Pregnancy and fertility kits

Application

-

- UTIs

- Diabetes

- Kidney disease

- Hypertension

- Liver disease

- Others

- Pregnancy and Fertility Testing

End-use

- Hospitals

- Clinical Laboratories

- Home Care

- Research and Academics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)