U.S. Artificial Intelligence In Healthcare Market Size and Trends

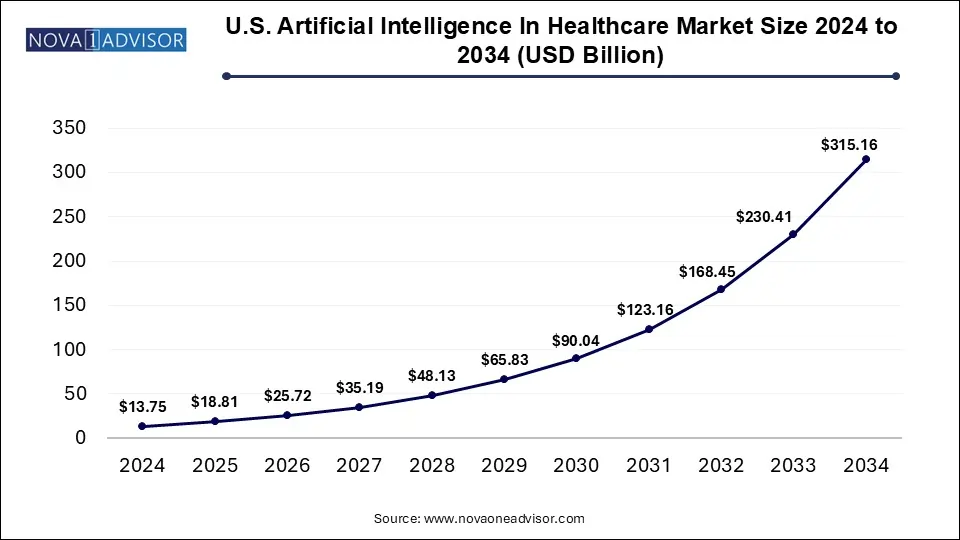

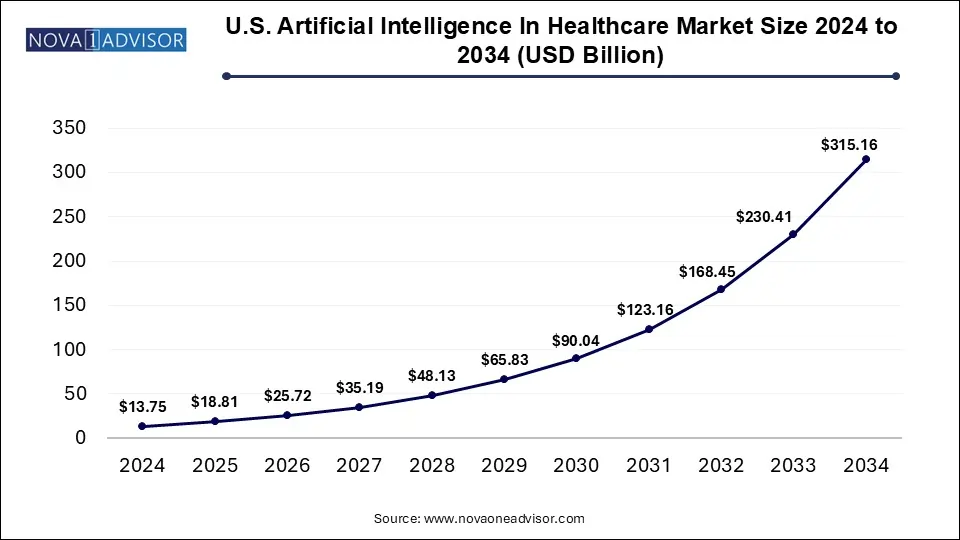

The U.S. artificial intelligence in healthcare market size was exhibited at USD 13.75 billion in 2024 and is projected to hit around USD 315.16 billion by 2034, growing at a CAGR of 36.78% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, the software solutions segment emerged as the leading component category, capturing the highest market share of 45%.

- Within the application segment, robot-assisted surgery stood out as the top contributor, accounting for 14% of the total market revenue in 2024.

- The machine learning segment led the technology landscape, representing the largest share at 36% in 2024.

- Among the end-use categories, pharmaceutical and biotechnology companies dominated, holding a substantial 31% share of the market in 2024.

Market Overview

The U.S. Artificial Intelligence (AI) in Healthcare market is experiencing a transformational shift, driven by increasing investments in AI-powered innovations, rising healthcare data volumes, and a pressing need for cost-effective clinical solutions. AI technologies ranging from machine learning to computer vision and natural language processing (NLP) are now interwoven into diagnostics, treatment planning, patient monitoring, operational management, and more. With its ability to automate repetitive tasks, identify complex patterns, and deliver predictive insights, AI is addressing the deep-rooted inefficiencies in the American healthcare system.

In a nation burdened by high healthcare expenditures, AI presents a pathway toward reducing costs while enhancing patient outcomes. The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer has necessitated timely diagnostics and intervention—areas where AI excels. Furthermore, AI has become instrumental in administrative processes, including hospital scheduling, medical billing, and clinical documentation, offering relief to healthcare staff plagued by burnout.

The pandemic has further accelerated digital health adoption. Telemedicine platforms, remote monitoring systems, and AI-integrated imaging tools saw a surge in demand, cementing AI’s place in modern healthcare workflows. With a robust ecosystem of technology providers, healthcare institutions, and supportive government initiatives, the U.S. is poised to dominate the global AI in healthcare landscape.

Major Trends in the Market

-

Shift from Rule-Based to Predictive AI: Healthcare providers are moving from deterministic models to AI systems capable of real-time decision-making using predictive analytics and deep learning.

-

Cloud-Based AI Platforms: The adoption of cloud infrastructure enables scalable, cost-efficient AI implementation for small and large hospitals alike.

-

Integration with Wearables and IoT: AI is enhancing the functionality of connected devices to provide continuous health monitoring and early warning systems.

-

AI in Radiology and Imaging Diagnostics: Algorithms are increasingly used for analyzing X-rays, MRIs, and CT scans with improved speed and precision.

-

Rise of Generative AI in Documentation: Tools like ambient scribing and AI note-taking assistants are transforming administrative workflows in hospitals.

-

AI for Drug Repurposing and Development: Pharma companies are using AI to identify alternative applications of existing molecules and shorten R&D timelines.

-

Personalized Virtual Health Assistants: AI chatbots and voice assistants are helping patients manage medications, book appointments, and monitor vitals.

-

NLP for Medical Records Mining: AI is unlocking unstructured data in EMRs to reveal actionable clinical and operational insights.

Report Scope of U.S. Artificial Intelligence In Healthcare Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 18.81 Billion |

| Market Size by 2034 |

USD 315.16 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 36.78% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Component, Application, Technology, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

IBM (Merative), Microsoft Corporation, NVIDIA Corporation, Intel Corporation, Google (Alphabet Inc.), Amazon Web Services, Inc., GE HealthCare, Oracle Health (formerly Cerner), Siemens Healthineers, Medtronic, Epic Systems Corporation, Philips Healthcare, Tempus, Aidoc, PathAI

|

Key Market Driver

Accelerated Adoption of AI-Powered Diagnostics and Imaging Tools

One of the primary drivers propelling the U.S. AI in healthcare market is the rapid adoption of AI-enhanced diagnostic tools. The integration of AI in medical imaging is streamlining the detection and classification of complex conditions such as tumors, vascular anomalies, and neurological disorders. For instance, Google's DeepMind AI demonstrated a higher accuracy than human radiologists in detecting breast cancer in a recent study conducted in collaboration with U.S. institutions.

Hospitals and diagnostic labs across the country are adopting AI-powered platforms that offer second-opinion diagnostics, image segmentation, and risk prediction. Notably, the U.S. Food and Drug Administration (FDA) has approved over 500 AI-based medical devices, a majority of which are imaging-related, reflecting a strong regulatory and innovation ecosystem. These solutions not only accelerate time-to-diagnosis but also improve consistency and reduce human error, thereby enhancing patient safety and clinical outcomes.

Key Market Restraint

Data Privacy and Regulatory Challenges

Despite the promising growth trajectory, the market is impeded by complex regulatory frameworks and concerns surrounding data privacy. The use of patient data in training machine learning models requires stringent compliance with HIPAA regulations, which often slow down AI development and deployment. Furthermore, achieving FDA clearance for AI-enabled medical tools can be time-consuming due to rigorous validation and interpretability standards.

Instances of algorithmic bias also raise ethical concerns, especially when models trained on unbalanced datasets deliver suboptimal results for minority populations. These limitations demand robust governance frameworks, transparency in model development, and clearer regulatory pathways to sustain market momentum and build trust among stakeholders.

Key Market Opportunity

Expansion of AI in Remote Patient Monitoring and Chronic Care Management

The growing demand for remote healthcare services, especially in the wake of the COVID-19 pandemic, presents a massive opportunity for AI in chronic disease management. According to the CDC, nearly 60% of American adults have at least one chronic condition, such as heart disease or diabetes. AI can continuously analyze data from wearable devices and home-monitoring tools to identify deteriorating health conditions and recommend early interventions.

Companies like Livongo (now part of Teladoc Health) and Omada Health are leveraging AI to provide personalized coaching, real-time alerts, and behavioral nudges for lifestyle management. With Medicare and private insurers increasingly reimbursing remote care, AI’s role in predictive monitoring and personalized disease management is set to expand rapidly, especially for aging populations and rural regions with limited healthcare access.

Segmental Analysis

Component Outlook

Software Solutions dominated the U.S. AI in healthcare market in 2024, driven by demand for AI platforms and APIs that accelerate diagnostics and operational efficiency.

The software segment includes AI platforms, machine learning frameworks, and application-specific solutions such as predictive analytics and computer-assisted diagnosis. Cloud-based AI tools in particular are gaining traction as they allow seamless integration across hospital IT systems. For instance, Amazon Web Services and Microsoft Azure are providing AI-as-a-Service tools tailored for healthcare providers. These solutions are scalable and easily deployable, making them ideal for healthcare institutions of all sizes. Furthermore, APIs are allowing hospitals to plug into powerful diagnostic and administrative AI models without developing in-house capabilities.

The fastest-growing segment within this category is cloud-based AI solutions, owing to reduced infrastructure costs, enhanced collaboration, and real-time scalability. Cloud AI has enabled startups and mid-sized healthcare providers to access cutting-edge capabilities such as NLP and image recognition without significant capital investment. As regulatory clarity improves and security protocols strengthen, cloud AI adoption is expected to skyrocket across hospitals, labs, and outpatient centers.

Hardware

The hardware segment was led by processors in 2024, owing to their central role in AI computations across imaging, signal processing, and robotic applications.

Processors such as GPUs (Graphics Processing Units) and ASICs (Application-Specific Integrated Circuits) are enabling high-speed data analysis in AI-driven healthcare applications. GPUs are widely used in deep learning applications in imaging diagnostics and robotic-assisted surgeries. Meanwhile, FPGA and ASIC technologies are seeing increased adoption for real-time AI inference at the edge, especially in wearables and point-of-care devices.

Among hardware components, GPU-based systems are expected to grow at the fastest pace due to their ability to handle parallel computations essential for high-performance medical imaging and deep learning workloads. Major technology companies such as NVIDIA and Intel are deeply entrenched in this segment, collaborating with healthcare firms to create AI-optimized chipsets that comply with medical safety standards.

Services

Deployment and integration services dominated the market in 2024, as healthcare institutions sought assistance to operationalize complex AI models.

AI implementation often requires extensive customization, interoperability with existing EMRs, and training of healthcare professionals. This has led to a surge in demand for deployment and integration services. These service providers also ensure regulatory compliance, data standardization, and maintenance across hospital IT environments.

Support & maintenance services are emerging as the fastest-growing segment, driven by the need for constant algorithm retraining, model updates, and cybersecurity oversight. Given the evolving nature of AI technologies, hospitals prefer long-term service partnerships with AI vendors to ensure that their systems remain compliant, updated, and efficient.

Application Outlook

Medical imaging & diagnostics was the leading application segment in 2024, accounting for the largest revenue share due to its transformative impact on radiology and pathology.

AI tools are extensively deployed in detecting anomalies from scans, classifying diseases, and recommending next steps in patient care. Platforms like Aidoc and Zebra Medical Vision have partnered with U.S. hospitals to provide real-time triage and workflow optimization in emergency and radiology departments.

Drug discovery and development is anticipated to be the fastest-growing application segment, fueled by partnerships between biotech firms and AI startups. AI is being used to simulate molecular interactions, predict therapeutic responses, and even identify biomarkers from omics data. For instance, NVIDIA and Schrödinger are collaborating on AI frameworks to expedite molecule screening, cutting down R&D time and costs significantly.

Technology Outlook

Machine learning dominated the technology landscape, particularly deep learning for imaging and supervised learning for structured data classification.

Machine learning underpins most modern AI use cases in healthcare, including patient risk prediction, tumor segmentation, and clinical decision support. Deep learning networks are widely used in ophthalmology, oncology, and cardiology to enhance diagnostic accuracy and speed.

However, Natural Language Processing (NLP) is the fastest-growing technology, especially with the rise of smart assistants, automated transcriptions, and real-time documentation tools. NLP engines extract insights from unstructured EMR notes, patient histories, and medical literature. Startups like Abridge and Suki are leveraging NLP to reduce physician workload by automatically generating visit summaries and billing codes, improving both accuracy and efficiency.

End Use Outlook

Hospitals and healthcare providers formed the largest end-user segment in 2024, owing to their role as primary implementers of AI across clinical, operational, and administrative domains.

From AI-assisted diagnostics to smart scheduling tools, hospitals are increasingly adopting AI to optimize patient outcomes, reduce readmissions, and streamline costs. Academic medical centers are also partnering with AI vendors to conduct pilot studies and clinical validations for AI models.

Pharmaceutical and biotechnology companies are emerging as the fastest-growing end users, given their aggressive pursuit of AI in drug discovery, toxicology prediction, and precision medicine. These firms are utilizing AI for biomarker identification, clinical trial matching, and regulatory document processing, thereby accelerating their drug pipelines and improving R&D productivity.

Country-Level Analysis – United States

In the United States, AI in healthcare is being embraced across both public and private sectors. Government initiatives such as the FDA’s Digital Health Innovation Action Plan and funding from agencies like NIH have laid the foundation for AI’s proliferation. Venture capital investments in health AI startups exceeded $5 billion in 2024, reflecting growing investor confidence.

On the state level, leading healthcare hubs like California, Massachusetts, and Texas are spearheading pilot programs and collaborations. For example, the Mayo Clinic in Minnesota and UCSF Health in California are integrating AI for diagnostics, radiology, and patient engagement. Meanwhile, large payers such as UnitedHealth Group are using AI to optimize claims management, detect fraud, and personalize member outreach.

Some of The Prominent Players in The U.S. Artificial Intelligence In Healthcare Market Include:

- IBM (Merative)

- Microsoft Corporation

- NVIDIA Corporation

- Intel Corporation

- Google (Alphabet Inc.)

- Amazon Web Services, Inc.

- GE HealthCare

- Oracle Health (formerly Cerner)

- Siemens Healthineers

- Medtronic

- Epic Systems Corporation

- Philips Healthcare

- Tempus

- Aidoc

- PathAI

Recent Developments

-

April 2025 – Microsoft expanded its partnership with Epic Systems to integrate Azure OpenAI’s generative capabilities into Epic’s electronic health records, enhancing clinical documentation.

-

March 2025 – NVIDIA launched a new AI computing platform, Clara Holoscan MGX, designed to streamline AI integration into medical devices, approved for U.S. market entry.

-

February 2025 – GE HealthCare announced the FDA clearance of its AI-powered ultrasound imaging software, SonicDL, promising real-time image reconstruction and diagnostics.

-

January 2025 – IBM Watson Health rebranded as Merative following its acquisition by Francisco Partners, with renewed focus on AI-powered analytics for population health and outcomes measurement.

-

December 2024 – Google Cloud signed a multi-year agreement with HCA Healthcare to build AI algorithms that assist with staffing optimization and patient flow management.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Artificial Intelligence In Healthcare Market

By Component

-

-

- Application Program Interface (API)

- Machine Learning Framework

-

-

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

-

-

- Adapter

- Interconnect

- Switch

-

- Deployment & Integration

- Support & Maintenance

- Others

By Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others

By Technology

-

- Deep learning

- Supervised

- Unsupervised

- Others

-

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

-

-

- Speech analytics

- Classification and categorization

- Computer Vision

- Context-Aware Computing

By End Use

- Hospitals & Healthcare providers

- Healthcare payers

- Pharmaceutical & Biotechnology Companies

- Patients

- Others