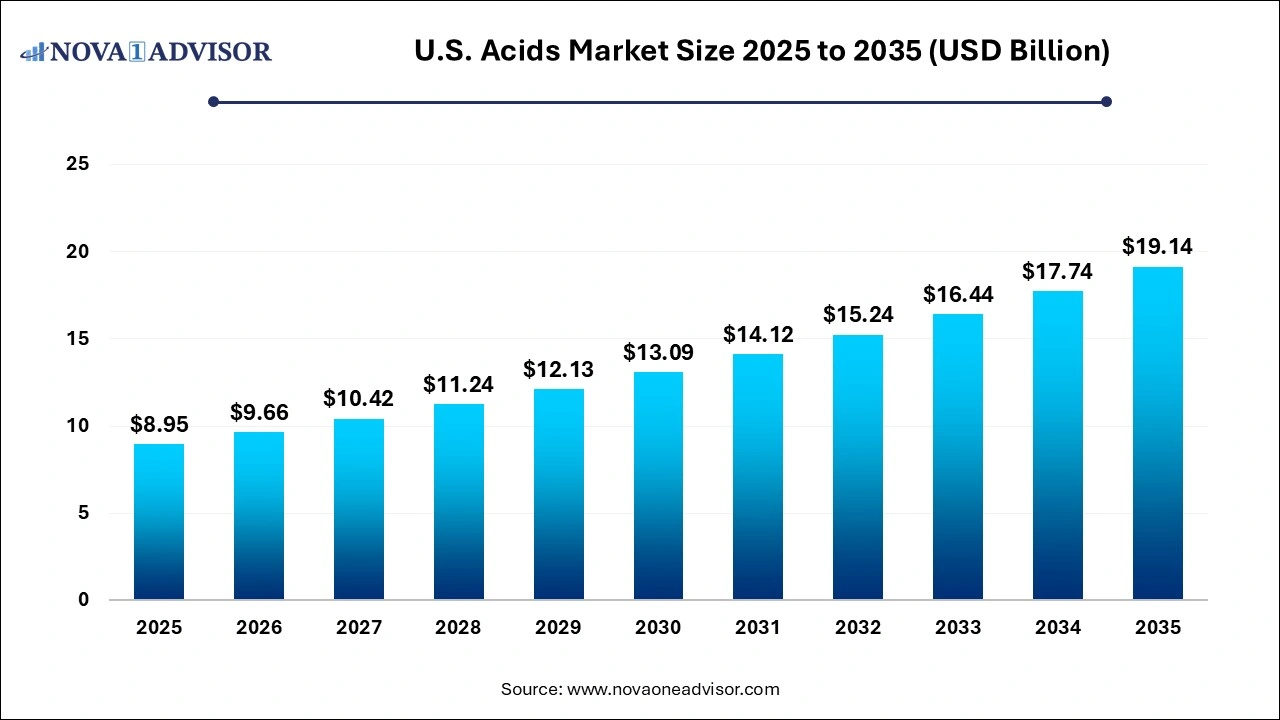

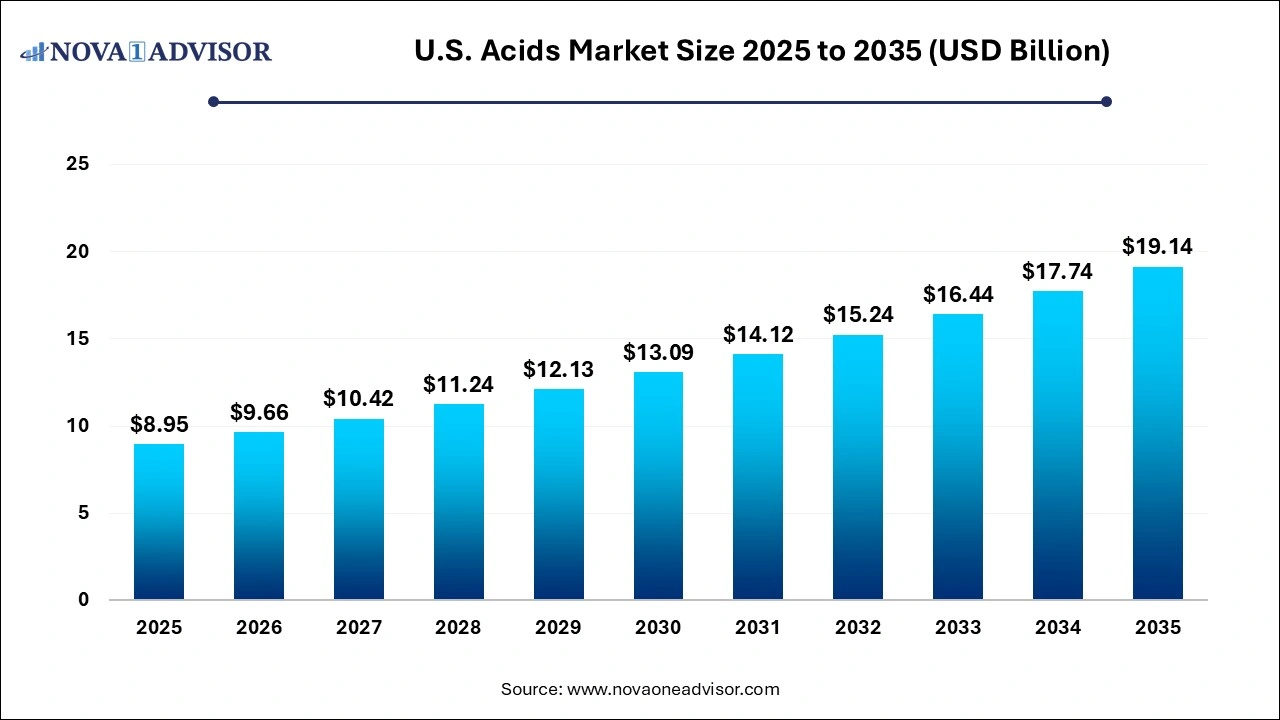

U.S. Acids Market Size and Trends 2026 to 2035

The U.S. acids market size was exhibited at USD 8.95 billion in 2025 and is projected to hit around USD 19.14 billion by 2035, growing at a CAGR of 7.9% during the forecast period 2026 to 2035.

U.S. Acids Market Key Takeaways:

- The organic segment accounted for the largest revenue share of 70.0%, in 2025.

- The inorganic type is anticipated to register the fastest CAGR of 7.8% over the forecast period.

U.S. Acids Market Overview

The U.S. acids market forms the backbone of numerous industrial, agricultural, and consumer-based sectors, playing a critical role in manufacturing, processing, and end-user applications. Encompassing a wide array of organic and inorganic acids, the market is robust, diverse, and dynamic, with demand spanning across food and beverage, pharmaceuticals, agriculture, metalworking, petroleum, and wastewater treatment industries. With increasing application scopes, innovations in green chemistry, and sustainability pressures, the acids market is witnessing a phase of strategic growth and transition.

Organic acids such as citric acid, acetic acid, lactic acid, and formic acid are being widely used in food preservation, cosmetic formulations, animal nutrition, and pharmaceuticals. These acids are increasingly derived from bio-based sources, especially as sustainability initiatives gain traction. In contrast, inorganic acids like sulfuric acid, hydrochloric acid, nitric acid, and phosphoric acid dominate heavy industries, including fertilizers, petroleum refining, water treatment, and metallurgy.

With stringent regulatory frameworks governing the use and disposal of chemical substances in the U.S., the acids market is shaped by compliance with Environmental Protection Agency (EPA), Food and Drug Administration (FDA), and Occupational Safety and Health Administration (OSHA) guidelines. Producers are increasingly turning toward circular production models, including acid recovery systems, to manage cost and sustainability targets.

Technological advancement, increased agricultural yield demands, pharmaceutical innovations, and the resurgence of domestic manufacturing are collectively driving market momentum. The integration of digital supply chain systems, smart logistics, and AI-based production optimization are transforming the acids value chain across the country.

Major Trends in the U.S. Acids Market

-

Increased Shift Toward Bio-Based Organic Acids: Sustainability goals are pushing producers to invest in organic acids derived from renewable resources, such as plant-based feedstocks and fermentation processes.

-

Adoption of Closed-Loop Acid Recovery Systems: Industries such as metalworking and pulp & paper are adopting acid regeneration technologies to reduce environmental impact and operational costs.

-

Rising Demand from the Pharmaceutical Sector: With the expansion of U.S. pharmaceutical manufacturing, acids used in drug synthesis and formulation are witnessing significant demand.

-

Surge in Acid Applications in Animal Nutrition: Organic acids such as formic and propionic acid are gaining traction as antibiotic alternatives in livestock feed.

-

Technological Advancements in Process Chemistry: Enhanced purification techniques, continuous production models, and green synthesis routes are reshaping acid production.

-

Growth of the Specialty Acids Segment: Niche applications of acids in electronics, semiconductors, and advanced materials are gaining market share.

-

Stringent Regulatory Oversight: Federal regulations surrounding the use of hazardous acids have led to innovations in handling, storage, and transport safety mechanisms.

Report Scope of U.S. Acids Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 9.66 Billion |

| Market Size by 2035 |

USD 19.14 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2036 |

| Segments Covered |

Type |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Akzo Nobel NV; Basic Chemical Solutions LLC; PVS Chemicals, Inc.; Navin Fluorine International Limited; Cargill Inc.; The Dow Chemical Company; BASF SE; Tate & Lyle Plc; AjinomotoCo., Inc.; Adisseo |

Market Driver – Expansion of the U.S. Agricultural and Food Processing Industry

A major driving force behind the U.S. acids market is the expansive growth of the agricultural and food processing sectors. Both organic and inorganic acids are critical to these industries—used for crop protection, food preservation, flavor enhancement, pH control, and pathogen suppression. For instance, citric acid is a ubiquitous additive in soft drinks, processed meats, and canned vegetables. Phosphoric acid is widely used in fertilizer production, a cornerstone of the U.S. agricultural economy.

According to the USDA, food processing remains a dominant contributor to the national manufacturing output, while the demand for efficient fertilizers continues to grow amidst efforts to enhance soil productivity. As the industry responds to climate change, shifting crop patterns, and evolving dietary habits, acids serve as indispensable agents for efficiency and quality control. Organic acids used in animal feed also support healthier livestock and align with trends toward antibiotic-free production systems. These cumulative factors strongly influence market growth.

Market Restraint – Environmental and Health Risks Associated with Inorganic Acids

Despite the significant utility of acids, particularly inorganic variants, the U.S. acids market is heavily impacted by environmental and occupational safety challenges. Inorganic acids such as sulfuric, nitric, and hydrochloric acid pose serious health risks if mishandled, including respiratory damage, chemical burns, and environmental hazards related to water and soil contamination.

The regulatory environment in the U.S. is becoming increasingly stringent, with agencies such as OSHA enforcing stringent Personal Protective Equipment (PPE) protocols, emissions caps, and hazard communication standards. These safety requirements can result in substantial compliance costs, especially for small-to-medium-sized enterprises (SMEs). Moreover, accidental spills or leaks during production, transport, or storage can result in severe legal and financial consequences. As such, the need for complex handling infrastructure and regulatory compliance limits market penetration for new entrants and creates operational bottlenecks in high-volume facilities.

Market Opportunity – Growth of Personalized and Nutraceutical Products in the U.S.

An emerging opportunity in the U.S. acids market is the growing demand from the nutraceutical and personalized health product industries. With increasing consumer awareness of preventive health, immunity-boosting products, and functional foods, organic acids are finding expanded usage in supplements, beverages, and therapeutic formulations. Lactic acid, malic acid, and citric acid are especially favored for their antimicrobial, antioxidant, and flavor-enhancing properties.

For example, citric acid is used extensively in vitamin C formulations, effervescent tablets, and hydration drinks. The trend toward plant-based and clean-label products is reinforcing the use of naturally derived acids. Moreover, dietary acids are increasingly being marketed for their roles in digestion, metabolic health, and weight management. With nutraceutical companies targeting U.S. consumers across multiple age and lifestyle demographics, the acids market is well-positioned to benefit from this evolving health-centric economy.

U.S. Acids Market By Type Insights

Organic acids dominated the U.S. acids market, led by their widespread applications in the food & beverages, pharmaceuticals, animal feed, and personal care sectors. Citric acid, lactic acid, and acetic acid remain staple ingredients in soft drinks, sauces, and processed foods due to their preservative and acidifying properties. Additionally, the use of organic acids in personal care—such as alpha hydroxy acids (AHAs) for exfoliation and pH control in skincare—has expanded significantly. With the surge in demand for vegan, non-GMO, and natural cosmetics, acids derived from plant or fermentation sources are increasingly preferred. In pharmaceuticals, lactic and succinic acids are used in drug formulation, contributing to their rising market share.

Food & beverages and pharmaceuticals emerged as the leading sub-segments in the organic acids market, owing to rising health awareness and changing consumer diets. The growing demand for shelf-stable, nutritious, and flavored foods has led to the incorporation of acids that can extend product life and enhance safety without synthetic preservatives. Meanwhile, in the pharmaceutical industry, organic acids serve as intermediates in API synthesis, solvent systems, and stabilizers in injectable formulations. U.S.-based pharmaceutical expansion under initiatives like Operation Warp Speed has indirectly boosted demand for high-purity acids, underlining their strategic value.

Inorganic acids are projected to grow at a steady pace, especially in metalworking, chemical manufacturing, and wastewater treatment applications. Sulfuric acid, the largest-volume inorganic acid, is used extensively in fertilizer production and petroleum refining. Hydrochloric acid remains essential in pH control, scale removal, and chemical synthesis. Nitric acid plays a pivotal role in the production of explosives, dyes, and ammonium nitrate. Wastewater treatment facilities across the U.S. are also adopting inorganic acids for neutralization and mineral precipitation. Increased federal funding toward infrastructure modernization is likely to amplify acid usage in this domain.

The wastewater treatment and agriculture segments are among the fastest-growing inorganic acid sub-markets, fueled by stringent environmental standards and the need to enhance agricultural productivity. Nitric and phosphoric acids are extensively used to manufacture ammonia-based fertilizers, while sulfuric acid is utilized in soil pH modification and nutrient release. In water treatment, hydrochloric and sulfuric acid are crucial for pH correction and scale inhibition in desalination and industrial effluent systems. With state and federal governments investing in water reuse and sanitation upgrades, acid consumption in this segment is expected to rise significantly.

Country-Level Analysis – United States

In the U.S., the acids market benefits from a mature industrial base, regulatory rigor, and strong interconnectivity between upstream chemical producers and downstream users. The presence of leading chemical hubs in states like Texas, Louisiana, California, and Ohio ensures a robust domestic supply of both organic and inorganic acids. The U.S. also hosts some of the largest fertilizer, pharmaceutical, and food processing companies, making it one of the most strategically significant acids markets globally.

The Biden administration’s push for domestic manufacturing, environmental sustainability, and healthcare resilience is indirectly boosting demand for acids across sectors. From green manufacturing policies to the expansion of bio-based feedstock incentives, federal support aligns with long-term growth. At the state level, investment in wastewater infrastructure, semiconductor fabrication, and clean energy is creating new application areas for acids. Import-export activities are highly regulated, with tariffs and safety compliance shaping the competitive landscape.

Some of the prominent players in the U.S. acids market include:

Recent Developments

-

April 2025 – Cargill Inc. announced a $30 million expansion of its Iowa fermentation facility to increase citric acid production using corn-based feedstock, citing growing demand in food and beverages.

-

February 2025 – BASF Corporation launched a new grade of high-purity lactic acid tailored for use in pharmaceuticals and nutraceuticals in the U.S. market.

-

January 2025 – Eastman Chemical Company unveiled an advanced recovery system for acetic acid used in textile and coatings applications, reducing production waste by 25%.

-

November 2024 – Univar Solutions Inc. signed an exclusive distribution agreement with a European specialty acid manufacturer to bring bio-based glycolic and malic acids to the U.S. personal care sector.

-

September 2024 – Dow Inc. began pilot production of nitric acid-based specialty chemicals for semiconductor etching processes at its Texas Innovation Campus.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. acids market

By Type

-

- Personal Care & Cosmetics

- Food & Beverages

- Pharmaceuticals

- Animal Feed

- Chemical Manufacturing

- Agriculture

- Consumer Goods

- Lubricants

- Others

-

- Agriculture

- Paints & coatings

- Textiles

- Petroleum

- Metalworking

- Wastewater treatment

- Chemical Manufacturing

- Pulp & paper

- Others