U.S. Actinic Keratosis Treatment Market Size, Growth, Trends 2026 to 2035

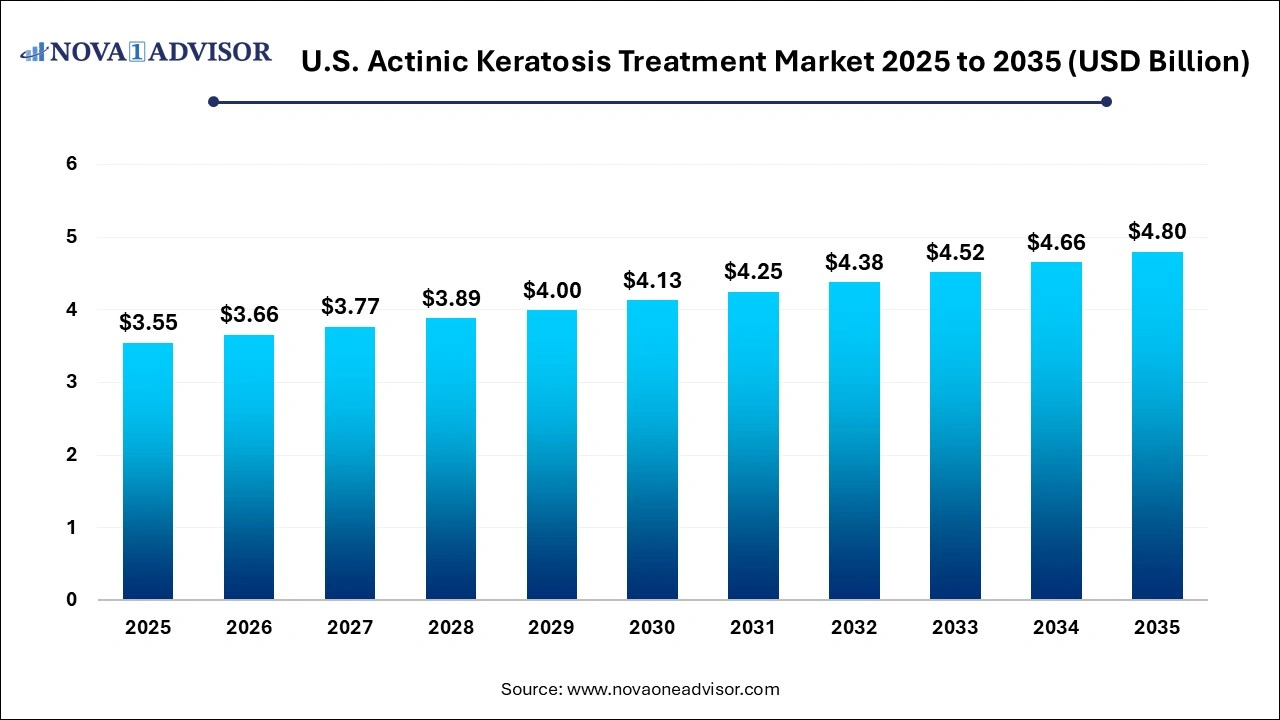

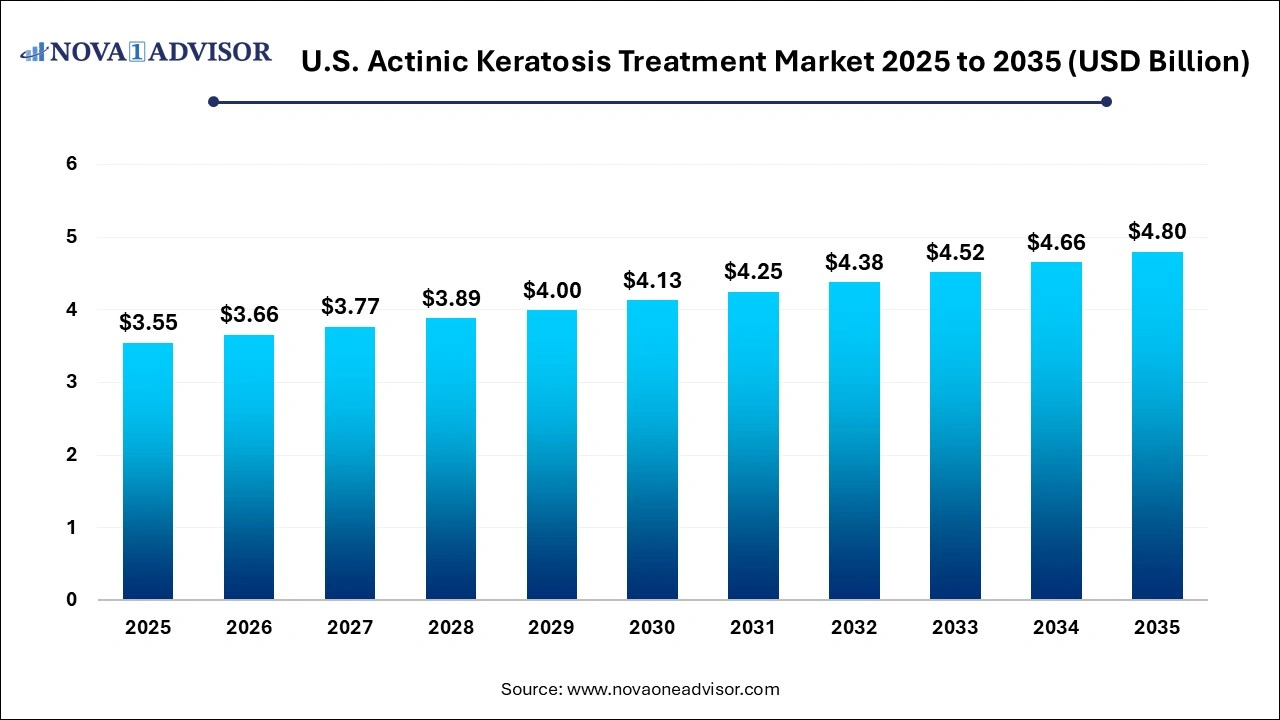

The U.S. actinic keratosis treatment market size was valued at USD 3.55 billion in 2025 and is projected to surpass around USD 4.80 billion by 2035, registering a CAGR of 3.06% over the forecast period of 2026 to 2035.

Key Takeaways:

- The surgery segment held the largest share of 77.35% in 2025 and is anticipated to continue leading during the projected period.

- However, the photodynamic therapy segment is projected to register the fastest growth rate over the forecast period.

- Based on topical/drugs segment, the nucleoside metabolic inhibitors dominated the market and is projected to hold a significant market share during the forecast period.

- The photo enhancers segment is anticipated to grow at the fastest rate throughout the forecast period.

- 5-fluorouracil was the leading segment in 2025 having a 32.28% share of AK drugs in the country.

U.S. Actinic Keratosis Treatment Market Overview

Actinic keratosis (AK), also referred to as solar keratosis, is a precancerous skin lesion caused primarily by prolonged exposure to ultraviolet (UV) radiation. It is one of the most prevalent dermatological conditions in the U.S., particularly among the aging population and individuals with fair skin types. As per estimates from the Skin Cancer Foundation, over 58 million Americans are affected by actinic keratosis annually, making it a significant public health concern. If untreated, AK can progress into squamous cell carcinoma (SCC), thus necessitating early detection and intervention.

The U.S. Actinic Keratosis Treatment Market is shaped by a combination of increasing disease burden, rising public awareness about skin cancer, and the development of more targeted and minimally invasive treatment modalities. While traditional therapies such as cryotherapy and surgical excision remain standard, the market is witnessing a strong shift toward topical drugs, photodynamic therapy (PDT), and immune-modulating therapies.

Pharmaceutical innovation is also fueling market expansion. Several products now offer improved selectivity, reduced recurrence rates, and better cosmetic outcomes, making them highly preferred by both dermatologists and patients. Furthermore, the growing number of dermatology clinics and the expansion of teledermatology services are enhancing treatment access, especially in rural and underserved areas.

Major Trends in the U.S. Actinic Keratosis Treatment Market

-

Rise in Non-Invasive Therapies: Topical agents and PDT are increasingly preferred over surgical options for cosmetic reasons and convenience.

-

Technological Advancement in PDT: New light sources like RhodoLED and advanced formulations such as Ameluz are gaining traction due to higher efficacy and shorter treatment cycles.

-

Increased FDA Approvals and Label Expansions: Regulatory momentum is strong, with recent approvals enhancing treatment access and innovation.

-

Shift Toward Combination Therapy: Dermatologists are employing dual-treatment modalities (e.g., cryotherapy + Imiquimod) for enhanced efficacy in severe cases.

-

Growth of Home-Based Care: OTC formulations and lower-risk therapies are driving demand for home-use products, especially among elderly patients.

-

Expansion of Indications for Existing Drugs: Some chemotherapeutics, like 5-fluorouracil, are now being repurposed or reformulated to expand therapeutic coverage in precancerous conditions.

-

Strong Focus on Photoprotection: Preventive care through education and sunscreen use is being integrated into AK management guidelines.

-

Patient Preference for Cosmetic Outcomes: Patients are increasingly seeking therapies that minimize scarring and pigment alteration, promoting demand for targeted drug classes.

U.S. Actinic Keratosis Treatment Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 3.66 Billion |

| Market Size by 2035 |

USD 4.80 Billion |

| Growth Rate From 2024 to 203 |

CAGR of 3.04% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Therapy, drug class, product, end-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Bausch Health Companies, Inc.; LEO Pharma A/S; Almirall, S.A; Biofrontera AG; GALDERMA; Sun Pharmaceutical Industries Ltd.; Novartis AG; Hill Dermaceuticals, Inc.; 3M; Viatris, Inc. |

Key Market Driver

Increasing Prevalence of Actinic Keratosis Due to UV Exposure and Aging Population

The surge in actinic keratosis cases in the U.S. is directly tied to an aging population and cumulative sun exposure. Individuals over 60 years of age, particularly those with outdoor lifestyles or occupational UV exposure, are at elevated risk. Additionally, the cultural trend of tanning and reduced use of sun protection among younger demographics has led to earlier onset of AK. This demographic shift is increasing the demand for both preventive screening and therapeutic interventions. As early diagnosis becomes more routine through regular dermatological check-ups, the volume of patients seeking effective treatment options is correspondingly rising, thereby fueling market expansion.

Key Market Restraint

Adverse Effects and Cosmetic Concerns Associated with Treatments

While effective, many of the standard treatments for actinic keratosis come with limitations that hinder wider adoption. Topical therapies like 5-fluorouracil and Imiquimod often cause significant skin irritation, inflammation, and prolonged erythema, leading to reduced compliance among patients. Surgical methods, though curative, frequently result in scarring or pigmentation changes, which are unacceptable to many patients, especially for facial or exposed areas. Even photodynamic therapy, though minimally invasive, can lead to photosensitivity reactions. These drawbacks affect patient adherence and limit repeat treatment cycles, particularly among elderly or cosmetically sensitive populations.

Key Market Opportunity

Development of Next-Generation Topical and Photoenhancer Therapies

An exciting frontier in the actinic keratosis treatment market is the development of next-generation topical drugs and photoenhancers that provide higher efficacy with reduced side effects. Innovations in nanoparticle-based delivery systems, selective immune response modulators, and low-dose formulations are showing promise in ongoing trials. For example, second-generation photodynamic therapy drugs are being developed with improved tissue penetration and lower phototoxicity. These advances not only expand the patient pool by catering to those who avoid conventional therapies due to adverse effects, but also open new revenue streams for pharmaceutical manufacturers via proprietary delivery technologies and novel molecules.

U.S. Actinic Keratosis Treatment Market By Therapy Insights

Topical/Drugs dominated the therapy segment due to their non-invasive nature and wide applicability across mild to moderate lesions. Products such as 5-fluorouracil, Imiquimod, and Diclofenac are often first-line treatments due to their ease of use, proven efficacy, and lower cost. These therapies are particularly preferred in outpatient settings and for elderly patients who seek home-based treatment. Imiquimod, for example, has shown efficacy not just in lesion clearance but also in stimulating an immune response, thus reducing recurrence rates. The availability of multiple branded and generic formulations enhances accessibility and patient compliance.

Photodynamic Therapy is emerging as the fastest-growing therapy segment. It offers a unique advantage by targeting dysplastic cells selectively while preserving healthy skin. Recent advancements like the introduction of Ameluz in combination with RhodoLED light have enhanced treatment precision and outcomes. In January 2024, Biofrontera Inc. reported positive results from its Phase III study involving this combination, demonstrating superior lesion clearance compared to conventional PDT methods. The increasing adoption of PDT in dermatology clinics, along with its growing use in combination with topical agents, underscores its growth trajectory in the market.

Segmental Insights

By Drug Class Insights

Nucleoside metabolic inhibitors, led by 5-fluorouracil, dominated the drug class segment. These drugs are widely accepted due to their ability to disrupt DNA synthesis in precancerous cells, making them highly effective for widespread lesions. 5-fluorouracil is often prescribed under brand names like Carac, Tolak, and Fluoroplex, and remains a go-to solution in dermatological practice for AK. Its versatility in treating both visible and subclinical lesions enhances its clinical value, especially in field cancerization scenarios where broad treatment is necessary.

Immune response modifiers are the fastest-growing drug class. Imiquimod-based therapies such as Aldara and Zyclara have shown growing acceptance among dermatologists for their dual action in lesion destruction and immune system activation. These agents are preferred for patients with recurrent AK or those resistant to nucleoside inhibitors. The ability to modulate local immune responses and reduce the likelihood of progression to squamous cell carcinoma makes this class highly valuable. Moreover, the growing interest in immune-based therapies across dermatology and oncology is contributing to increased R&D investments in this segment.

By Product Insights

5-fluorouracil products such as Carac and Tolak remained the market leaders among individual formulations. These products are well-established in clinical protocols and are supported by a substantial body of efficacy and safety data. Carac, a low-concentration fluorouracil cream, is specifically formulated to reduce side effects while maintaining lesion clearance, making it suitable for facial use. Tolak, on the other hand, is appreciated for its shorter treatment duration. Their consistent prescription rates across hospitals and private clinics reflect their dominant market position.

Tirbanibulin, under the brand name Klisyri, is gaining rapid momentum as the fastest-growing product. Approved by the FDA in 2020, it offers a five-day treatment regimen, significantly shorter than most alternatives. Its novel mechanism—targeting tubulin polymerization and Src kinase pathways—presents a new therapeutic avenue in AK management. Though relatively new, it is receiving positive adoption feedback due to minimal irritation, shorter downtime, and promising efficacy in moderate AK. With increasing physician familiarity and ongoing post-market studies, its market share is expected to expand significantly in the coming years.

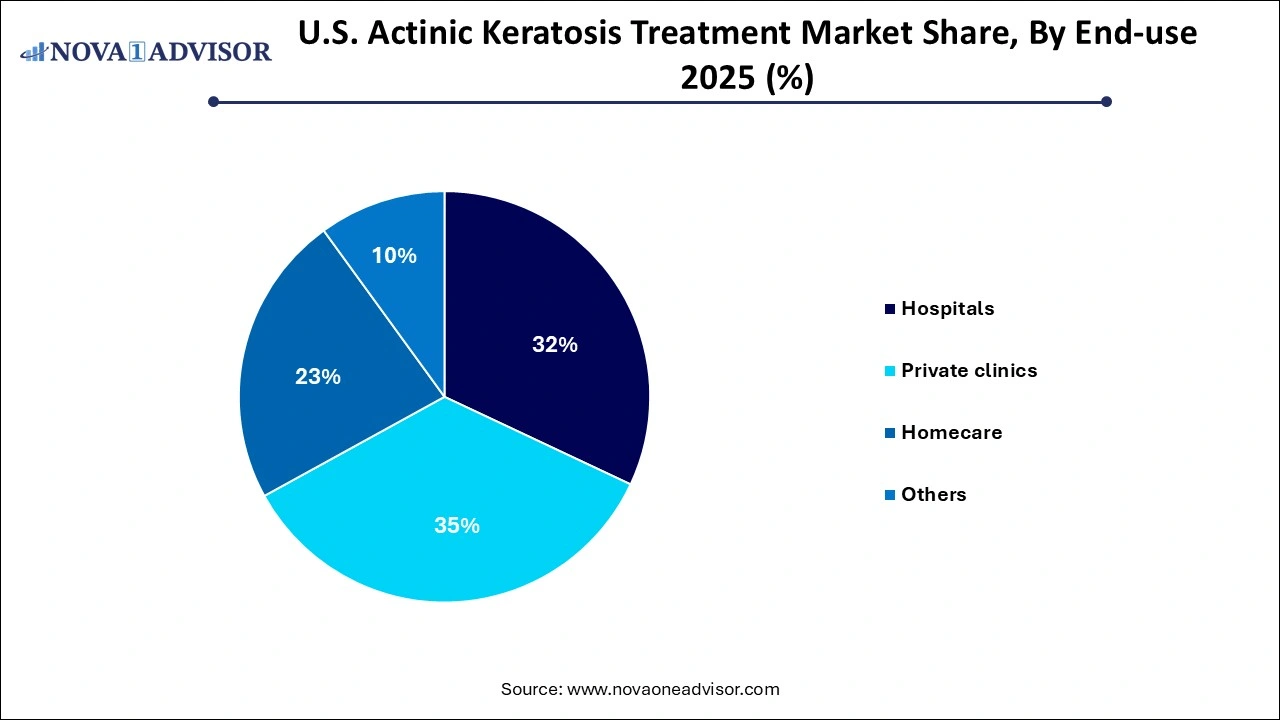

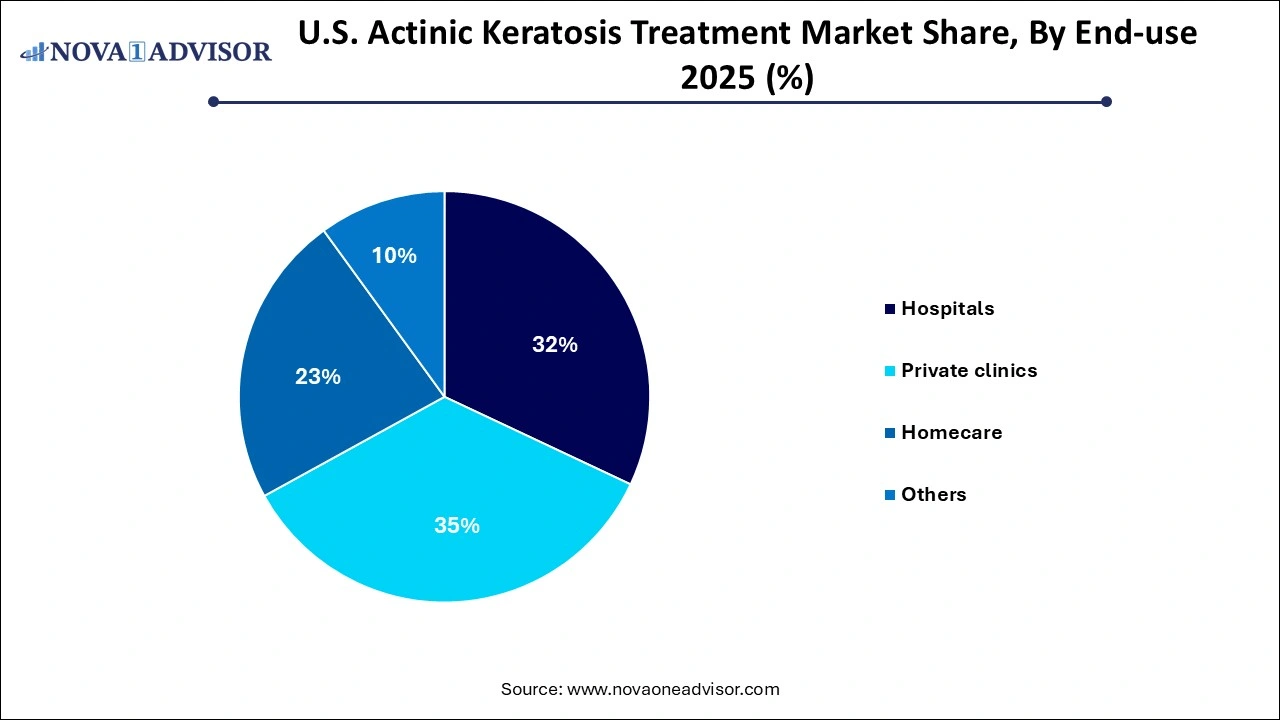

By End-use Insights

Hospitals accounted for the largest share of the end-use segment due to their ability to manage complex or widespread AK cases. They are the primary centers for surgical interventions, photodynamic therapy, and clinical trials of emerging drugs. The presence of multidisciplinary teams ensures comprehensive care, including biopsy and histopathological confirmation in cases with high progression risk. Moreover, Medicare and private insurance coverage for in-hospital AK treatments encourages patient access.

Homecare is expected to be the fastest-growing end-use segment. With the advent of user-friendly topical therapies and the increasing availability of dermatologist consultations via telemedicine, patients are increasingly managing early-stage AK at home. Particularly among the elderly, the ability to self-administer treatments like 5-fluorouracil and Diclofenac without frequent clinic visits is a major convenience. Pharmaceutical companies are capitalizing on this trend by developing formulations with easy application systems and reduced irritation potential, enabling safe home-based use.

Homecare is expected to be the fastest-growing end-use segment. With the advent of user-friendly topical therapies and the increasing availability of dermatologist consultations via telemedicine, patients are increasingly managing early-stage AK at home. Particularly among the elderly, the ability to self-administer treatments like 5-fluorouracil and Diclofenac without frequent clinic visits is a major convenience. Pharmaceutical companies are capitalizing on this trend by developing formulations with easy application systems and reduced irritation potential, enabling safe home-based use.

Country-Level Insights United States

In the U.S., actinic keratosis has one of the highest prevalence rates among skin disorders. The country’s extensive sunbelt regions spanning California, Texas, Arizona, and Florida report the highest AK incidence due to year-round UV exposure. Awareness campaigns, insurance coverage for dermatological consultations, and a strong network of dermatologists contribute to early diagnosis and treatment.

The U.S. Food and Drug Administration (FDA) plays a critical role in regulating new therapies, ensuring product safety and efficacy. Recent expansions in product indications and streamlined approval pathways for dermatological treatments have further encouraged innovation. Moreover, the U.S. healthcare system’s integration of dermatological services with oncology and primary care clinics is facilitating holistic AK management, especially in aging populations.

Key Companies & Market Share Insights

Key players are adopting new product development, merger & acquisition, and partnership strategies to increase their market share. Market players such as Bausch Health Companies, Inc., LEO Pharma A/S, Almirall, S.A., Biofrontera AG, and others are actively involved in the development of therapeutics for actinic keratosis. For instance, in June 2020, Sun Pharmaceutical Industries Ltd. presented the results of its two specialty medicines ODOMZO and LEVULAN KERASTICK + BLU-U from its skincare portfolio. The data analysis provides insights for using BLU-U+ LEVULAN KERASTICK to treat moderate actinic keratosis. Some prominent players in the U.S. actinic keratosis treatment market include:

U.S. Actinic Keratosis Treatment Market Top Key Companies:

U.S. Actinic Keratosis Treatment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Actinic Keratosis Treatment market.

By Therapy

- Topical/Drugs

- Surgery

- Photodynamic Therapy

By Drug Class

- Nucleoside metabolic inhibitors

- Nonsteroidal anti-inflammatory drugs

- Immune response modifiers

- Photoenhancers

- Others

By Product

- 5-fluorouracil

- Carac

- Fluoroplex

- Actikerall

- Tolak

- Others

- Diclofenac

- Solaraze

- Voltaren

- Pennsaid

- Others

- Imiquimod

- Tirbanibulin

- Capecitabine

- Xeloda

- Others

- Aminolevulinic acid

- Porfimer sodium

- Others

- Gemzar

- Clolar

- Vidaza

- Metvix

- Others

By End-use

- Hospitals

- Private clinics

- Homecare

- Others

Homecare is expected to be the fastest-growing end-use segment. With the advent of user-friendly topical therapies and the increasing availability of dermatologist consultations via telemedicine, patients are increasingly managing early-stage AK at home. Particularly among the elderly, the ability to self-administer treatments like 5-fluorouracil and Diclofenac without frequent clinic visits is a major convenience. Pharmaceutical companies are capitalizing on this trend by developing formulations with easy application systems and reduced irritation potential, enabling safe home-based use.

Homecare is expected to be the fastest-growing end-use segment. With the advent of user-friendly topical therapies and the increasing availability of dermatologist consultations via telemedicine, patients are increasingly managing early-stage AK at home. Particularly among the elderly, the ability to self-administer treatments like 5-fluorouracil and Diclofenac without frequent clinic visits is a major convenience. Pharmaceutical companies are capitalizing on this trend by developing formulations with easy application systems and reduced irritation potential, enabling safe home-based use.