U.S. Additive Manufacturing Market Size and Research 2026 to 2035

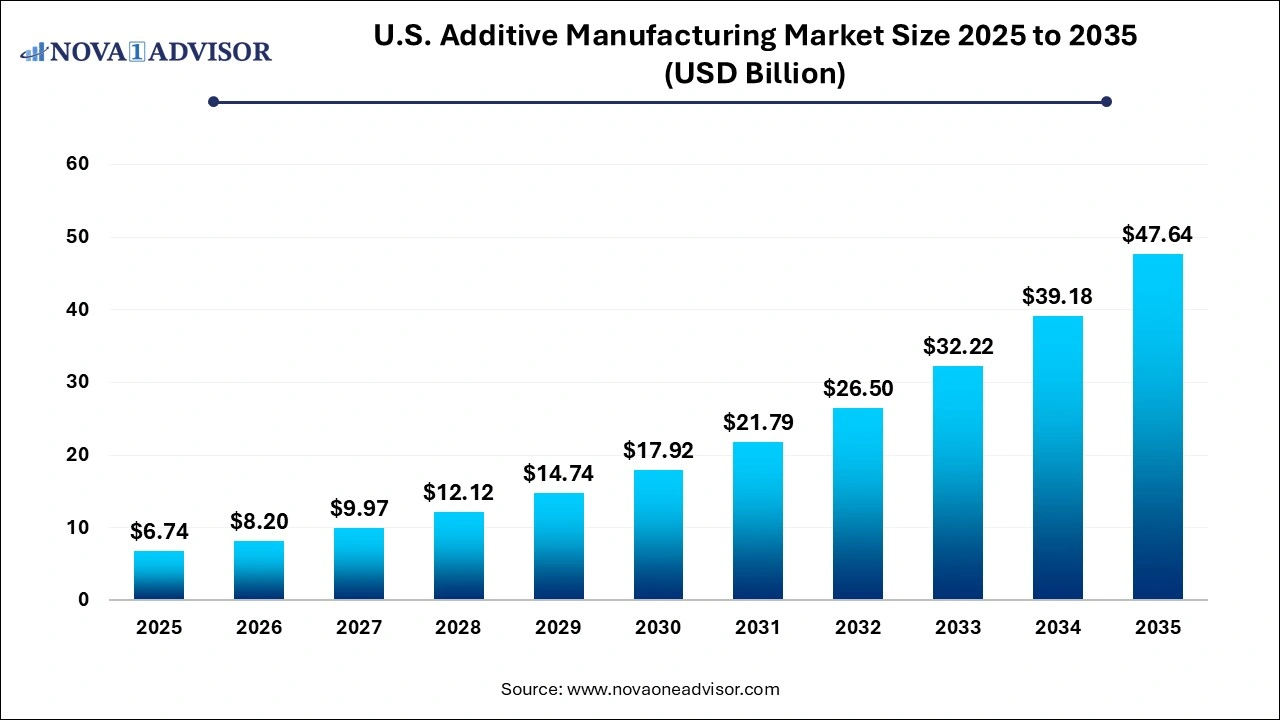

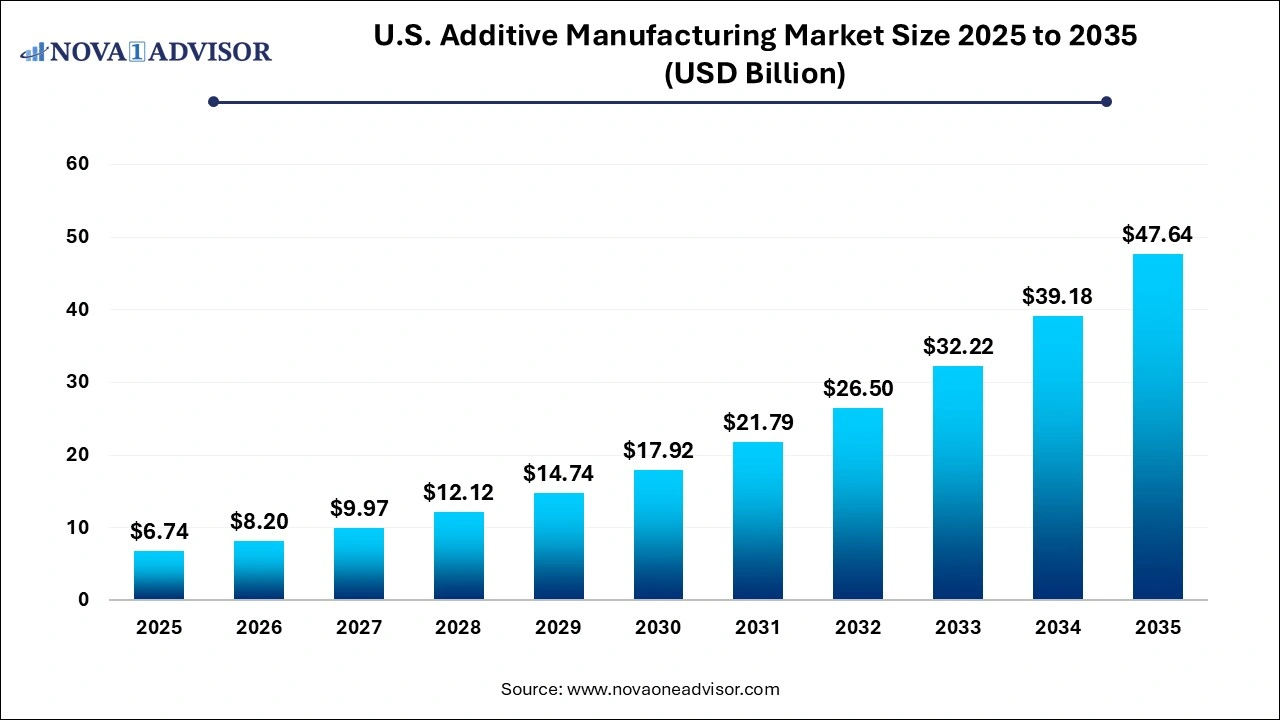

The U.S. additive manufacturing market size was exhibited at USD 6.74 billion in 2025 and is projected to hit around USD 47.64 billion by 2035, growing at a CAGR of 21.6% during the forecast period 2026 to 2035.

U.S. Additive Manufacturing Market Key Takeaways:

- The hardware segment led the market and accounted for a revenue share of more than 65.0% in 2025.

- The industrial printer section led the market and accounted for more than 69% revenue share in 2025.

- Stereolithography segment accounted for the largest share of more than 11.3% in 2025.

- FDM also accounts for a considerable revenue share of nearly 10.2% in 2025.

- The design software segment accounted for the largest share of 34.4% in 2025.

- The scanning software segment is projected to grow at the highest CAGR of 21.8% from 2026 to 2035.

- The prototyping segment led the market and accounted for a revenue share of more than 52.8% in 2025

- Thus, the functional application segment is expected to register a CAGR of 21.8% from 2026 to 2035.

- The segment is also expected to register the highest CAGR of 26.4% from 2026 to 2035.

U.S. Additive Manufacturing Market Overview

The U.S. additive manufacturing (AM) market often synonymous with 3D printing continues to evolve as one of the most transformative sectors in advanced manufacturing. The technology enables the creation of components by adding material layer by layer, offering advantages in customization, material savings, design complexity, and supply chain agility. From its roots in rapid prototyping, additive manufacturing has matured into a viable production solution for industries ranging from aerospace to healthcare.

The U.S. has historically been a leader in the global additive manufacturing landscape, supported by a robust R&D infrastructure, high rates of technological adoption, and strong institutional investment. In recent years, additive manufacturing has moved from research labs and niche prototyping applications into production environments, reshaping how companies approach tooling, part design, inventory, and maintenance. The COVID-19 pandemic acted as a catalyst, spotlighting the technology’s utility in producing medical equipment and fixing supply chain bottlenecks.

Government initiatives such as the AM Forward program and the Defense Production Act have also prioritized the use of additive manufacturing to strengthen national resilience, particularly in defense and energy sectors. As sustainability and localized manufacturing gain importance, AM is increasingly seen as a key enabler of lightweighting, waste reduction, and decentralized production—further propelling its market growth in the U.S.

Major Trends in the U.S. Additive Manufacturing Market

-

Shift Toward End-Part Production: Additive manufacturing is now being used not just for prototyping but for final-use, mission-critical parts in aerospace, automotive, and medical sectors.

-

Metal Additive Manufacturing Expansion: Demand for metal-based 3D printing is rising, particularly for high-performance alloys in jet engine parts, implants, and tooling inserts.

-

Advances in Multi-Material Printing: Innovations now allow for composite, ceramic, and hybrid material printing, enhancing functional integration.

-

Integration of AI and Machine Learning: Smart printers that self-correct based on AI-driven feedback loops are increasing production reliability and precision.

-

Growth in Software Ecosystem: The rise of simulation, inspection, and design software tailored to AM is making the design-to-print process more seamless and accurate.

-

Decentralized, On-Demand Manufacturing Models: Businesses and even defense contractors are deploying AM in field environments to print parts as needed, reducing warehousing needs.

Report Scope of U.S. Additive Manufacturing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 8.20 Billion |

| Market Size by 2035 |

USD 47.64 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 21.6% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Component, Printer Type, Technology, Software, Application, Vertical, Material |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

EnvisionTEC, Inc.; 3D Systems, Inc.; GE Additive; Autodesk Inc.; Made In Space; Prodways Americas; Solidscape, Inc.; Sciaky, Inc.; 3D Printer Works; Airwolf 3D Printers; AON3D; Ultimaker BV |

Key Market Driver: Customization and Design Freedom in Manufacturing

A major driver of the U.S. additive manufacturing market is its unmatched ability to enable mass customization and design complexity, which traditional manufacturing methods struggle to accommodate. AM allows for the direct fabrication of parts with complex geometries internal lattices, organic shapes, and topology-optimized forms without the need for tooling. This feature is revolutionizing industries where lightweighting, precision, and strength are critical.

For example, the aerospace industry uses AM to produce fuel nozzles with internal cooling channels that reduce weight and improve engine efficiency. In healthcare, patient-specific implants and prosthetics tailored to individual anatomies are produced using AM. These applications not only reduce lead times but also improve end-product performance. The freedom to iterate rapidly and produce functional, customized parts is particularly beneficial in the prototyping and low-volume production phases, enabling faster time-to-market and innovation cycles.

Key Market Restraint: High Initial Cost and Certification Barriers

Despite its advantages, the adoption of additive manufacturing in the U.S. faces hurdles related to high upfront costs and certification complexities. Industrial-grade 3D printers, particularly those using metal and high-performance polymers, can require capital investments ranging from hundreds of thousands to several million dollars. This cost barrier limits adoption among small and mid-sized enterprises.

Moreover, in highly regulated industries such as aerospace, medical, and automotive, the certification of AM parts remains a time-consuming and rigorous process. Parts must meet exacting standards of repeatability, strength, and material integrity. The lack of standardized quality assurance procedures and the limited availability of AM-specific material databases further complicate the certification process, discouraging broader industrial adoption.

Key Market Opportunity: Integration into Digital and Distributed Supply Chains

A key opportunity lies in embedding additive manufacturing into digital and distributed supply chain frameworks. As companies shift toward Industry 4.0, the ability to manufacture components near the point of use whether at field bases, hospitals, or distributed warehouses becomes increasingly valuable. Additive manufacturing is ideal for this decentralized model because it eliminates the need for large inventories or complex shipping networks.

For instance, the U.S. military has deployed mobile AM units in operational zones to produce spare parts for vehicles and equipment, dramatically reducing downtime. Similarly, logistics providers are exploring "print hubs" that store digital blueprints instead of physical parts, ready to print on demand. As AM software and printer capabilities become more cloud-integrated, digital inventory management will revolutionize logistics, enabling companies to respond faster to market demands and reduce total cost of ownership.

U.S. Additive Manufacturing Market By Component Insights

Hardware components dominated the U.S. additive manufacturing market, as printers represent the backbone of the AM ecosystem. Industrial 3D printers capable of working with polymers, metals, and composites are being deployed across sectors including aerospace, dental, automotive, and energy. Continued innovation in laser sintering, multi-laser systems, and hybrid manufacturing (additive + subtractive) is reinforcing hardware demand. Manufacturers such as 3D Systems and Stratasys are rolling out new machines with enhanced throughput, precision, and scalability for factory settings.

Services are the fastest-growing segment, propelled by demand from firms that prefer to outsource AM functions. Contract manufacturers and service bureaus offer design support, prototyping, small-batch production, and finishing operations. This model is attractive to companies hesitant to invest in in-house printers due to cost or scale constraints. Leading service providers also offer industry-specific expertise and quality assurance, making them an essential part of the AM supply chain.

U.S. Additive Manufacturing Market By Printer Type Insights

Industrial 3D printers account for the majority of market share, given their ability to produce high-precision, end-use parts with materials like titanium, Inconel, and carbon fiber composites. These printers are used in automotive prototyping, aerospace engine parts, and surgical guides. Manufacturers such as EOS, GE Additive, and HP have introduced systems focused on high-volume production and factory automation.

Desktop 3D printers are growing rapidly, especially in educational, dental, and fashion applications. Their affordability and compact footprint make them ideal for SMEs and labs. Innovations in resin-based and FDM desktop printers now enable hobbyists, design studios, and academic institutions to develop functional prototypes, molds, and intricate models at low cost.

U.S. Additive Manufacturing Market By Technology Insights

Fused deposition modeling (FDM) remains the most widely used technology, particularly for entry-level prototyping and plastic part production. Its cost-effectiveness, material availability, and simplicity of use make it dominant in both desktop and industrial setups.

Direct metal laser sintering (DMLS) is the fastest-growing technology, especially in aerospace, medical, and defense sectors. DMLS enables the fabrication of intricate metal parts with high strength and precision, reducing reliance on complex multi-step machining processes. This technology is being adopted for lightweight turbine parts, patient-specific implants, and high-performance tools, all of which require advanced geometries and robust materials.

U.S. Additive Manufacturing Market By Software Insights

Design software dominates this segment, as it forms the first step in the AM process. Software suites like AutoCAD, SOLIDWORKS, and Fusion 360 allow engineers to create digital blueprints with precision and simulate mechanical performance before printing.

Inspection software is growing quickly, driven by the need for post-print validation, metrology, and compliance. With complex geometries and novel materials, quality assurance becomes critical. Tools like CT scanning and AI-driven image analysis are now used to inspect printed components for internal defects, especially in mission-critical applications like aerospace and implants.

U.S. Additive Manufacturing Market By Application Insights

Prototyping continues to dominate the market, with AM dramatically shortening the product development cycle. Companies across all sectors from automotive to consumer electronics use 3D printing to iterate quickly, test form and function, and reduce pre-production tooling costs. The ability to produce near-final parts in hours rather than weeks is reshaping R&D.

Functional parts represent the fastest-growing application, reflecting the shift of AM into production environments. End-use parts such as aerospace brackets, medical implants, or automotive intake manifolds are increasingly manufactured using AM. With improvements in printer resolution, material strength, and repeatability, AM is becoming a production tool for low-to-medium volume, high-complexity parts.

U.S. Additive Manufacturing Market By Vertical Insights

The aerospace and defense sector dominates industrial additive manufacturing, with companies like Lockheed Martin, Boeing, and Northrop Grumman using AM to produce lightweight structural components, brackets, and complex ductwork. The ability to consolidate parts, reduce weight, and perform in high-stress environments makes AM indispensable.

Healthcare is the fastest-growing vertical, driven by patient-specific implants, dental applications, and surgical guides. Titanium implants, customized hearing aids, and prosthetics are increasingly being printed with superior accuracy and shorter lead times. Regulatory advancements and materials innovation are further accelerating AM adoption in the medical sector.

U.S. Additive Manufacturing Market By Material Insights

Polymers continue to be the most commonly used material, especially for prototyping and plastic part production. ABS, PLA, and nylon are popular due to their ease of printing, cost-efficiency, and sufficient strength for many applications.

Metals are the fastest-growing material segment, particularly for high-value parts in aerospace, orthopedics, and tooling. Titanium, aluminum, stainless steel, and Inconel are being printed using laser powder bed fusion technologies, replacing traditional casting and machining in many high-performance applications.

Country-Level Analysis: United States

The U.S. is at the forefront of the global additive manufacturing revolution, driven by its strong ecosystem of industrial users, research institutions, defense agencies, and startups. Federal initiatives like AM Forward and NIST’s efforts on AM standardization are reinforcing national leadership. Defense and aerospace remain the largest consumers, but healthcare and automotive are quickly catching up.

Universities such as MIT, Georgia Tech, and Penn State are hubs for AM innovation, while cities like Austin, Pittsburgh, and Detroit are evolving into additive manufacturing clusters. The U.S. market also benefits from a thriving VC ecosystem that funds AM startups focused on new materials, software, and on-demand manufacturing platforms.

Some of the prominent players in the U.S. additive manufacturing market include:

Recent Developments

-

GE Additive (March 2025) announced advancements in its metal binder jetting platform, enabling faster production of aerospace turbine components and fuel system parts.

-

Stratasys (February 2025) launched the F770 printer targeting mid-volume industrial applications with a build capacity ideal for automotive and tooling industries.

-

Carbon (January 2025) introduced a new material platform for dental applications, expanding its footprint in chairside manufacturing.

-

Markforged (December 2024) unveiled an AI-enhanced software suite that optimizes print parameters in real time based on structural load analysis.

-

Desktop Metal (November 2024) secured a multi-year contract with a U.S. Department of Defense unit to supply metal AM systems for deployable field repair missions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. additive manufacturing market

By Component

- Hardware

- Software

- Services

By Printer Type

- Desktop 3D Printer

- Industrial 3D Printer

By Technology

- Stereolithography

- Fuse Deposition Modelling (FDM)

- Selective Laser Sintering (SLS)

- Direct Metal Laser Sintering (DMLS)

- Polyjet Printing

- Inkjet printing

- Electron Beam Melting (EBM)

- Laser Metal Deposition

- Digital Light Processing

- Laminated Object Manufacturing

- Others

By Software

- Design Software

- Inspection Software

- Printer Software

- Scanning Software

By Application

- Prototyping

- Tooling

- Functional Parts

By Vertical

- Industrial Additive Manufacturing

-

- Automotive

- Aerospace & Defense

- Healthcare

- Consumer Electronics

- Power & Energy

- Others

- Desktop Additive Manufacturing

-

- Educational Purpose

- Fashion & Jewelry

- Objects

- Dental

- Food

- Others

By Material