U.S. Aesthetic Surgery Procedures Market Size and Research

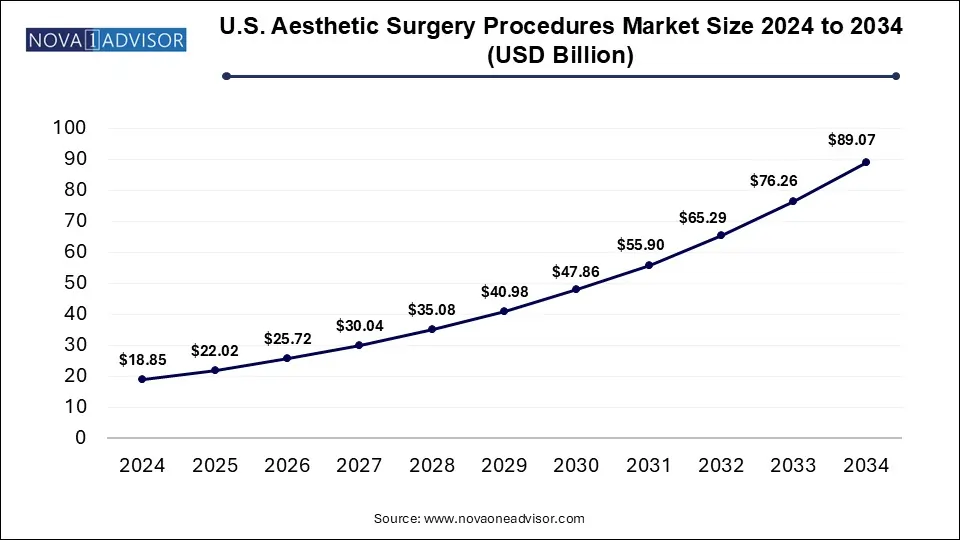

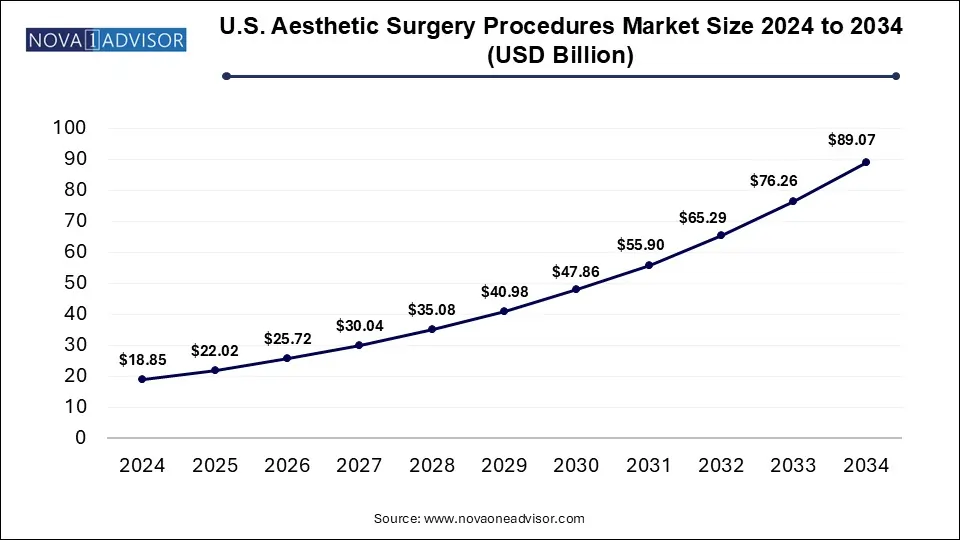

The U.S. Aesthetic Surgery Procedures Market size was exhibited at USD 18.85 billion in 2024 and is projected to hit around USD 89.07 billion by 2034, growing at a CAGR of 16.8% during the forecast period 2025 to 2034. The growth of the U.S. aesthetic surgery procedures market is driven by rising disposable incomes, demand for aesthetic procedures, advancements in cosmetic procedures and increased adoption of glucagon-like peptide-1 (GLP-1) agonists.

U.S. Aesthetic Surgery Procedures Market Key Takeaways

- By procedure type, the body and extremities segment dominated the market with the largest share in 2024.

- By procedure type, the face & head segment is expected to show the fastest growth over the forecast period.

- By end-use, the cosmetic surgery clinics segment held the largest market share in 2024.

- By end-use, the hospitals segment is expected to register fastest growth during the forecast period.

How is the U.S. Aesthetic Surgery Procedures Market Expanding?

Aesthetic surgery procedures are a type of planned surgery devoted to improve an individual’s physical appearance. These elective procedures are focused on enhancing or reshaping the features of a person’s body to boost confidence and self-esteem through aesthetic improvement. Breast augmentation, eyelid surgery, liposuction, tummy tucks and rhinoplasty are the most common surgical procedures. Advancements in surgical procedures, increasing consumer demand for aesthetic enhancements, rising disposable incomes and evolving social acumen regarding beauty are expanding the U.S. aesthetic surgery procedures market.

What Are the Key Trends in the U.S. Aesthetic Surgery Procedures Market in 2025?

- In April 2025, led by renowned board-certified plastic surgeon Dr. Haven J. Barlow, Chesapeake Plastic Surgery, announced the launch of its newly redesigned website for enhancing patient experience and showcasing its extensive range of services for cosmetic and reconstructive procedures.

- In March 2025, Tiger Aesthetics Medical, a division of Pennsylvania-based tissue engineering company Tiger Biosciences, revealed plans for building a new $50 million facility in Franklin, Wisconsin for supporting its breast implant business. The company had acquired Sientra, a California-based breast implant business last year which included a manufacturing facility in Franklin.

How is AI Benefitting the U.S. Aesthetic Surgery Procedures Market?

Artificial intelligence (AI) is being deployed in aesthetic surgery for analyzing patient data such as medical history and images for predicting potential treatment outcomes, mitigating associated risks and tailoring procedures for ideal results. AI-powered 3D modelling can be applied for examining CT scans in preoperative planning to provide better understanding of anatomical variations and to optimize surgical approaches for surgeons. Integration of AI with robotic surgery systems can potentially enhance dexterity and precision of complex aesthetic surgery procedures. Virtual simulations of treatment outcomes can be created with AI, further allowing patients to visualize results before surgical procedure.

AI integration with Augmented Reality (AR) technology can offer surgeons with real-time guidance and improve decision-making abilities during procedures. Development of AI tools such as DermGPT is assisting dermatologists by providing access to dermatology information, improving efficiency of clinical tasks and enhancing patient care.

- For instance, in April 2025, Bliss Aesthetics, an AI-powered platform for cosmetic enhancement, secured $17.5 million in a seed funding round led by Shine Capital. The funding will be used for expanding provider base of Bliss platform through their patient-to-physician app.

Report Scope of U.S. Aesthetic Surgery Procedure Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 22.02 Billion |

| Market Size by 2034 |

USD 89.07 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 16.8% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Procedures and End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

New York Plastic Surgical Group, PC; Westlake Dermatology; Piedmont Plastic Surgery & Dermatology; SKINovative of Gilbert-Medical Spa; Nazarian Plastic Surgery; Schweiger Dermatology Group.; Tiger Aesthetics Medical, LLC; persimmon.life; Cutera, Inc.; Cynosure Lutronic |

Market Dynamics

Drivers

Increasing Demand for Aesthetic Enhancements and Cosmetic Procedures

Rising desire among individuals across U.S. for enhancing their appearance to boost self-confidence and address concerns such as aging, body image and cosmetic blemishes are driving the demand for aesthetic surgical procedures. Increased influence of social media platforms such as Instagram and Snapchat displaying filtered images and idealized bodies, celebrity trends and targeted advertisements for cosmetic procedures are driving the adoption of these procedures.

Restraints

High Costs and Risks Associated with Procedures

Although aesthetic enhancement procedures are elective, they are really expensive and not covered by insurance policies making them inaccessible to a large population. Furthermore, inherent risks and complications associated with cosmetic surgical procedures such as adverse anaesthetic reactions, excess bleeding, scarring, infections, blood clot, nerve damage and dissatisfaction associated with aesthetic results can potentially limit their adoption among individuals.

Opportunities

Continuous Advancements and Reduced Social Stigma

Ongoing progress in instrumentation, surgical techniques and imaging modalities are enabling safe, precise and predictable outcomes of aesthetic surgical procedures. Focus on regenerative medicine such as using platelet-rich plasma (PRP), stem cells and fat grafting for natural tissue regeneration and accelerated healing through these organic solutions is creating significant opportunity for market growth. Development of innovative and minimally invasive surgical procedures for aesthetic enhancement are leading to smaller incisions, reduced downtime and quick recovery are attracting a wider patient base.

Increased celebrity influence, impact of social media and open discussions regarding these procedures are leading to reduced stigma and increased normalization in the public. This is driving the adoption of aesthetic surgical procedures across broader demographics.

Segmental Analysis

What Made Body and Extremities the Dominant Segment in 2024?

By procedure type, the body and extremities segment accounted for the largest market share in 2024. According to the Center for Disease Control and Prevention (CDC), about 4 in 10 adults (40%) are suffering from obesity in the U.S. Rising obesity rates, increased awareness on weight loss among obese individuals and growing emphasis on body sculpting are the factors boosting the market growth of this segment. Proven efficacy and success rates of weight loss medications such as Ozempic and Wegovy are significantly driving the demand for body contouring procedures. Innovations in surgical techniques and energy-based devices such as advanced liposuction technologies and skin tightening devices are enhancing the safety and efficacy of body and extremity procedures with reduced downtime. Expansion of body contouring procedures such as chest sculpting, liposuction and gynecomastia reduction into male demographics is creating opportunities for market expansion.

By procedure type, the face & head segment is expected to register the fastest growth during the forecast period. Increased demand and acceptance of face and head aesthetic procedures across broad range of demographics, especially among millennials and Generation Z in U.S. are contributing to the market growth. Rising social media influence such as the selfie culture and growing trend of remote work are increasing awareness of facial appearance on video calls which drives the market growth of this segment. Patients are seeking combination surgery approaches for addressing several concerns in a single surgery.

Why Did the Cosmetic Surgery Clinics Segment Dominate the Market in 2024?

By end-use, the cosmetic surgery clinics segment dominated the market with the biggest share in 2024. Cosmetic surgery clinics are designed specifically and are well-equipped with advanced instruments and experienced surgeons for aesthetic procedures offering natural looking results and patient satisfaction. Increased social acceptance, aging demographics seeking anti-aging treatments, rising interest of men, improvements in devices and techniques for cosmetic surgery and social media platforms are fuelling the market dominance of this segment. Focus of cosmetic surgery clinics on expansion of service offerings by launching innovative procedures and improving geographical reach through new clinics spread across the U.S. are bolstering the segment’s market growth.

By end-use, the hospitals segment is expected to show the fastest growth over the forecast period. The market growth of this segment is driven by increase in number of surgical and non-surgical aesthetic procedures, rising preference towards minimally invasive procedures, increasing disposable incomes and wider acceptance of aesthetic enhancement procedures. High demand for facial and body aesthetic enhancement procedures such as body contouring and facelifts as well as increased emphasis on personalized aesthetics integrated with combination therapies are expansion the market. Hospitals are actively adopting advanced technologies and offer expert opinions from board-certified surgeons which leads to improved patient safety and satisfaction.

Country-Level Analysis: United States

U.S. is a leading provider of aesthetic surgery procedures. Non-surgical aesthetic enhancements such as skin tightening procedures and injectables such as Botox and Hyaluronic acid fillers are gaining traction. Innovative aesthetic devices such as ultrasound, laser technology and cryolipolysis are widely being used. Focus on minimally invasive techniques, personalized treatment approaches as well as preventative aesthetic medicine are driving the market growth. Rise in male cosmetic surgery procedures such as blepharoplasty, facial contouring and hair restoration are expanding the market.

Increased penetration of digital technologies and emergence of telemedicine platforms is facilitating online consultations, remote patient monitoring and virtual reality planning. Digital marketing strategies such as website optimization, search engine optimization (SEO), social media marketing and Pay-Per-Click (PPC) advertising are being deployed by aesthetic enhancement service providers in the U.S. Sustainable practices such as environment friendly cosmetic products and procedures using natural fillers are becoming popular.

Some of The Prominent Players in The U.S. Aesthetic Surgery Procedures Market Include:

- Allergan

- Cutera, Inc.

- Cynosure

- Long Island Plastic Surgical Group

- Nazarian Plastic Surgery

- Nova Aesthetics

- Piedmont Plastic Surgery & Dermatology

- Sientra (Tiger Aesthetics Medical, LLC)

- SKINovative of Gilbert

- Westlake Dermatology & Cosmetic Surgery

Recent Developments

- In April 2025, Martin Plastic Surgery, announced the launch of its long-awaited physician-led Aesthetic Center in Las Cruces, New Mexico. The new center opened to patients in March 2025 will offer a full spectrum pf aesthetic care.

- In January 2025, Cytrellis Biosystems, Inc., a leading novel medical aesthetics solutions company, launched its updated next-generation skin removal treatment, ellacor 2.0 which is the first-ever and only minimally invasive in-office solution designed for treating wrinkles, removing skin and rejuvenating skin.

- In October 2024, Morales Plastic Surgery, led by well-known plastic surgeon Dr. Rolando Morales, launched its breakthrough in body contouring, the Corset Contour procedure designed for delivering a more defined and hourglass-shaped waistline for women seeking dramatic and natural enhancements to their midsection.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Aesthetic Surgery Procedures Market.

By Procedure

-

- Breast Augmentation

- Breast Implant Removal

- Breast Lift (Mastopexy)

- Breast Reduction

- Others

-

- Eyelid Surgery

- Rhinoplasty

- Lip Enhancement

- Fat Grafting-Face

- Others

-

- Abdominoplasty

- Buttock Augmentation-Implants and Fat Transfer

- Buttock Lift

- Liposuction

- Vaginal Rejuvenation

- Others

By End-use

- Cosmetic Surgery Clinics

- Hospitals