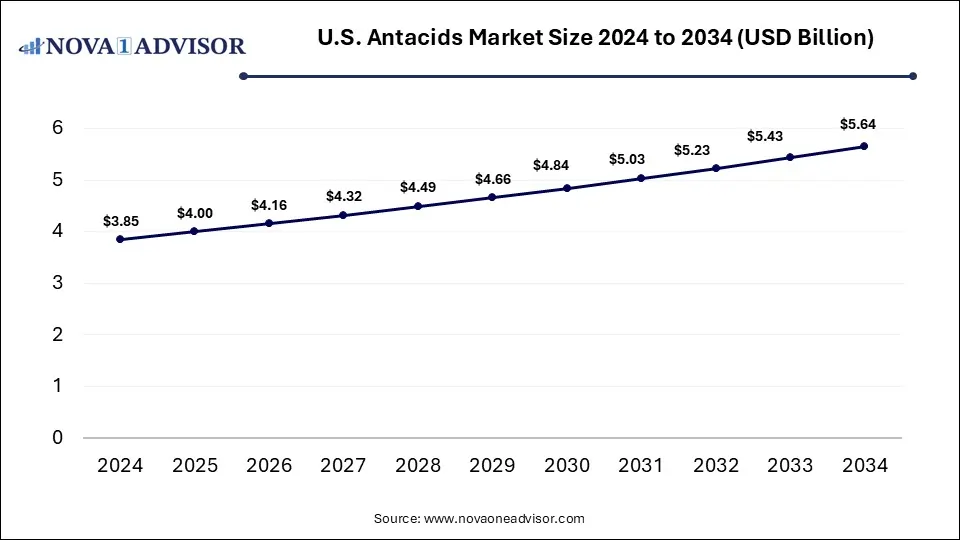

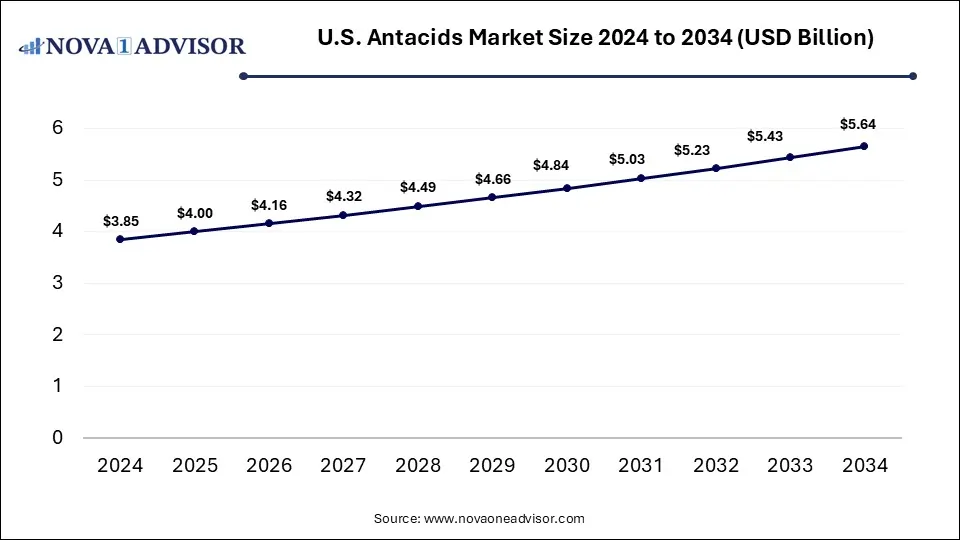

U.S. Antacids Market Size and Growth 2025 to 2034

The U.S. antacids market size is calculated at USD 3.85 billion in 2024, grow to USD 4.0 billion in 2025, and is projected to reach around USD 5.64 billion by 2034, grow at a CAGR of 3.9% from 2025 to 2034. The market is expanding due to rising cases of acid reflux and GERD linked to a sedentary lifestyle and poor dietary habits. Additionally, an aging population and the widespread availability of over-the-counter medication contribute to increasing demand.

Key Takeaways

- By type, the liquid segment held a significant market share in 2024.

- By end use, the retail pharmacy segment grew at a lucrative rate in the market in 2024.

Which Factors are Driving the Growth of the U.S. Antacids Market?

The antacids market encompasses the production and sale of medications that neutralize stomach acid to treat conditions like heartburn, indigestion, and acid reflux. It includes OTC and prescription products in various forms, driven by rising digestive disorders and lifestyle-related issues. The growth of the U.S. antacids market is primarily driven by the rising incidence of gastrointestinal disorders such as reflux, GERD, and indigestion, largely linked to unhealthy eating habits, obesity, and stress. Increased awareness of digestive health and the easy availability of over-the-counter antacid products also support market expansion. Additionally, a growing elderly population, who are more prone to such conditions, and innovation in fast-acting formulations are further demand across the country, boosting overall market growth.

- For Instance, As per a CDC report released in September 2024, obesity affected 40.3% of U.S. adults between August 2021 and August 2023. The condition was most common among individuals aged 40–59 and those with lower educational attainment. Additionally, 9.4% of adults were found to have severe obesity, with women experiencing higher rates than men across all age categories.

What are the emerging trends in the U.S. Antacids Market for 2024?

- In August 2024, Haleon launched a new 3-in-1 variant of ENO, India’s leading OTC antacid brand. This formulation combines ENO with natural ingredients like cumin, carom seeds, and black salt to provide quick and effective relief from acidity, indigestion, and gastric discomfort.

- In July 2024, the U.S. FDA approved vonoprazan (Voquezna), a new treatment for gastroesophageal reflux disease (GERD). This medication is intended for daily use to help relieve heartburn symptoms in adults affected by GERD.

What Impact does AI have on the U.S. Antacids Market?

Artificial intelligence is significantly influencing the U.S. antacids market by streamlining research and development processes. AI algorithms analyze extensive datasets from clinical trials and consumer feedback to identify new active ingredients and optimize formulations, enhancing efficacy and minimizing side effects. This accelerates product development cycles, enabling faster market entry for innovative antacid products. Additionally, AI-driven insights into consumer preferences and purchasing behaviors assist companies in tailoring marketing strategies and improving supply chain efficiency, thereby boosting competitiveness and market growth.

Report Scope of U.S. Antacids Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.0 Billion |

| Market Size by 2034 |

USD 5.64 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 3.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Haleon Group of Companies., Bayer AG, Boehringer Ingelheim International GmbH, Dr. Reddy’s Laboratories Ltd., Sanofi, Reckitt Benckiser Group plc, Sun Pharmaceuticals Ltd., Takeda Pharmaceutical Company Limited, Pfizer Inc., Procter & Gamble |

Market Dynamics

Driver

Increasing Prevalence of Gastrointestinal Disorders

A growing number of Americans are suffering from digestive health issues due to modern lifestyle, including irregular eating patterns, low physical activity, and high-fat diets. This shift has led to a consistent rise in demand for antacids, which offer quick relief from symptoms like bloating, acidity, and discomfort. As these disorders become more common across various age groups, especially adults, the need for effective and easily accessible antacid solutions continues to drive the market growth.

Restraint

Growing Concern Over the Long-term Side Effects

Rising awareness about the potential health risks associated with prolonged use of antacids limits their widespread adoption. Concerns over complications such as bone adoption. Concerns over complications such as bone fracture, vitamin B12 deficiency, and digestive imbalances have led healthcare professionals and consumers to reassess frequent or long-term usage. This growing caution is prompting a shift towards safer or more natural remedies, which in turn is restricting the growth potential of the U.S. antacids market.

Opportunity

Rising Demand for Natural and Herbal-based Products

The rising popularity of herbal and natural remedies is creating new growth avenues in the U.S. antacids market. Consumers are now more inclined toward products made from organic and plant-derived ingredients due to safety concerns linked to traditional medications. This shift in preference is driving companies to develop gentler, naturally formulated antacids, catering to a health-conscious population and opening an opportunity for brands to stand out with a cleaner, side-effect-free solution in a competitive market.

- For Instance, In March 2024, Haleon launched “ENO Chewy Bites” in the U.S., offering flavored, chewable antacids that cater to the growing demand for natural and convenient digestive relief. This reflects the market shift toward safer, plant-based alternatives.

Segmental Insights

How will the Liquid Segment Dominate the U.S. Antacids Market in 2024?

In 2024, the liquid segment dominated the market due to its fast-acting relief and ease of consumption. Liquid antacids are often preferred for quickly neutralized stomach acid, especially during severe heartburn or indigestion episodes. Their suitability for children, older adults, and individuals who struggle with swallowing pills adds to their appeal. Additionally, the availability of flavored and ready-to-drink options has further overtaken traditional tablets or capsules.

How will the Retail Pharmacy Segment Dominate the U.S. Antacids Market in 2024?

In 2024, the retail pharmacy segment witnessed strong growth in the market due to the ease of product availability and increased consumers reliance on nearby availability and increased consumer reliance on nearby drugstores for quick relief options. The growing preference for self-care, along with expanded shelf space for digestive health products, attracted more walk-in buyers. Retail pharmacies also benefited from personalized customer support and promotions, making them a trusted and convenient source for purchasing antacids without visiting a healthcare provider.

Regional Insights

How is the U.S. approaching the U.S. Antacids Market in 2024?

In 2024, the U.S. antacids market adopted a multifaceted approach to address rising digestive health issues. The prevalence of gastrointestinal disorders, such as GERD and indigestion, increased due to lifestyle factors like stress, poor diet, and obesity. To meet consumer demand for quick relief, manufacturers focused on over-the-counter formulations in various forms, including chewable, liquids, and fast-dissolving tablets. Additionally, there was a notable shift towards natural and combination products, aligning with the growing preference for holistic health solutions. This strategy emphasized innovation and consumer trust in self-care remedies.

Top Companies in the U.S. Antacids Market

- Haleon Group of Companies.

- Bayer AG

- Boehringer Ingelheim International GmbH

- Dr. Reddy’s Laboratories Ltd.

- Sanofi

- Reckitt Benckiser Group plc

- Sun Pharmaceuticals Ltd.

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- Procter & Gamble

Recent Developments in the U.S. Antacids Market

- In January 2025, UK-based healthcare company Haleon announced a $54 million investment to upgrade its R&D center in Northside Richmond, Virginia. The renovation is expected to be completed within the year, aiming to strengthen the company’s research capabilities and support future innovation efforts across its product range.

- In March 2024, Lil’ Drug Store Products (LDSP) partnered with Procter & Gamble to expand the distribution of Rolaids, a well-known heartburn relief brand. Through this collaboration, Rolaids products will now be made widely available across travel and convenience retail locations throughout the U.S., enhancing accessibility for consumers on the go.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Antacids Market.

By Type

By End-use

- Hospital Pharmacy

- Retail Pharmacy

- Others