U.S. Antibody Drug Conjugates Market Size and Forecast 2025 to 2034

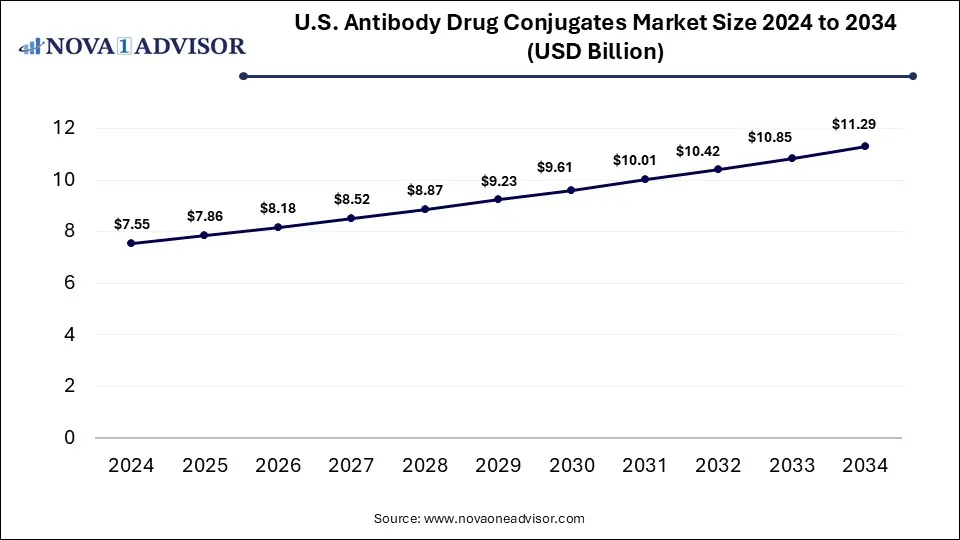

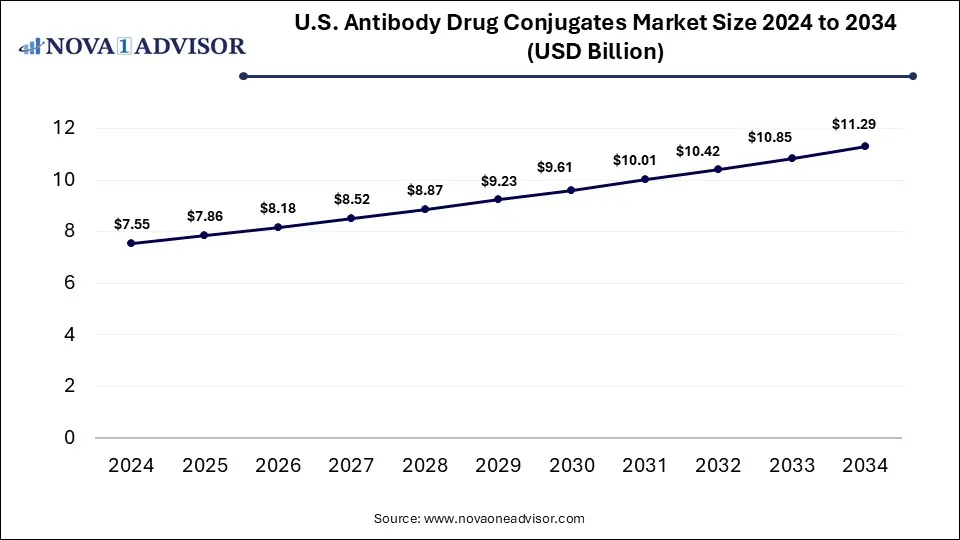

The U.S. antibody drug conjugates market size is calculated at USD 7.55 billion in 2024, grows to USD 7.86 billion in 2025, and is projected to reach around USD 11.29 billion by 2034, growing at a CAGR of 4.11% from 2025 to 2034. The growth of the U.S. antibody drug conjugates (ADCs) market is driven by the rising demand for targeted therapies, increasing cancer prevalence, innovations in ADC technologies, and focus on addressing unmet medical needs.

U.S. Antibody Drug Conjugates Market Key Takeaways

- By application, the breast cancer segment accounted for the highest market revenue share in 2024.

- By application, the urothelial cancer & bladder cancer segment is expected to grow at a notable rate during the predicted timeframe.

- By product, the Kadcyla segment held a significant share in the market in 2024.

- By product, the Enhertu segment is expected to show notable growth over the forecast period.

- By target, the HER2 segment holds a significant market revenue share in 2024.

- By target, the CD22 segment is expected to register significant CAGR during the forecast period.

- By technology, the cleavable linker technology segment captured a significant share in the market in 2024.

- By technology, the payload technology segment is expected to grow at a notable rate during the forecast period.

What Drives the Growth of the U.S. Antibody Drug Conjugates Market?

Antibody-drug conjugates (ADCs) refer to a class of targeted cancer therapies which combine together the accuracy of monoclonal antibodies with the potency of cytotoxic drugs, acting like guided missiles for directly delivering a toxic payload to cancer cells. Several advantages of ADCs such as targeted delivery with reduced impact on healthy cells, enhanced potency and their ability to overcome resistance developed to other treatments are driving their development and adoption for cancer treatments.

The rising investments by major biopharmaceutical organizations, smaller biotech companies and emerging startups in ADC research and development for discovering and developing novel and targeted therapies are contributing to the market growth. The increasing number of strategic collaborations, mergers and acquisitions, and licensing agreements among companies, research organizations and academic institutions for seeking expertise, expediting clinical development processes and to expand their product pipelines are expanding the market potential.

What Are the Key Trends in the U.S. Antibody Drug Conjugates Market in 2025?

In June 2025, Simtra BioPharma Solutions formed a strategic alliance with MilliporeSigma to offer drug substance, drug manufacturing services. The five-year agreement aims at providing assistance to companies in the biopharmaceutical industry looking for solutions related to antibody-drug conjugates (ADCs) and bioconjugates, which also include linker and payload manufacturing, drug product formulation development, and fill/finish services. (Source: https://www.pharmtech.com/)

In June 2025, NextCure, Inc., a clinical-stage biopharmaceutical company, formed a strategic partnership with Simcere Zaiming, an oncology-focused biopharmaceutical company, for developing SIM0505, which is a novel antibody-drug conjugate (ADC) designed for targeting CDH6 (cadherin-6 or K-cadherin) to treat solid tumors. (Source: https://www.globenewswire.com/)

How is AI Influencing the U.S. Antibody Drug Conjugates Market?

Artificial intelligence (AI) integration in the development and application of antibody-drug conjugates (ADCs) can potentially lead more effective, safer, and personalized cancer therapies. AI algorithms can be applied for various applications to ADC design and discovery such as for predicting efficacy of ADCs, for optimizing linker designs, as well as identifying new protein targets for ADCs. Deep learning models can be used for used for designing novel antibodies and optimizing the design of existing ones to enhance their therapeutic potential. Analysis of patient data with AI algorithms can help in identification of biomarkers predicting response to specific ADCs, leading to more effective and targeted treatments.

Report Scope of U.S. Antibody Drug Conjugates Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.86 Billion |

| Market Size by 2034 |

USD 11.29 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Application, Product, Target, Technology |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

ADC Therapeutics SA, Astellas Pharma, Inc., AstraZeneca, Daiichi Sankyo Company Ltd., F. Hoffmann-La Roche Ltd., Gilead Sciences, Inc., GlaxoSmithKline Plc, Pfizer, Inc., Seagen, Inc., Takeda Pharmaceutical Company Ltd. |

Market Dynamics

Drivers

Rising Burden of Cancer Disease

The rising burden of cancer disease of various types with high mortality and morbidity rates across the U.S. is boosting the demand for novel treatment options such as ADCs looked upon as a potentially effective strategy. According to the National Cancer Institute (NCI), approximately 2,041,910 new cases of cancer will be identified and about 618,120 people will succumb to the illness in the U.S. in 2025. The increased awareness among oncologists and patients regarding the potential of ADCs for cancer care and management are driving their adoption. (Source: https://www.cancer.gov/ )

Restraints

High Development and Manufacturing Costs

The complex processes involved with the development of ADCs such as conjugating an antibody, finding a suitable linker, and a cytotoxic payload, requires specific raw materials and specialized manufacturing facilities with highly skilled professionals. This complexity of ADC manufacturing processes requires heavy investments which can potentially delay the development and commercialization timelines, further limiting market entry for smaller biotech companies. Additionally, the high attrition rates in clinical trials due to the lengthy and complex nature of developing an ADC, can lead to significant financial losses for the companies and delay the time-to-market for potential new therapies.

Opportunities

Progress in ADC Technology and Expanding Applications

The ongoing advancements in ADC technologies with focus on improving conjugation strategies and the synthesis of more effective cytotoxic agents, leading to development of more potent and safer ADCs. Improvements in linker technology used for connecting the antibody and the cytotoxic payload are enhancing the stability of ADCs in bloodstream, further enabling targeted drug release at the tumor site with improved efficiency and decreased toxicity. Development of techniques such as site-specific conjugation allowing precise attachment of the payload to the antibody are leading more reliable ADCs with controlled drug-to-antibody ratios (DAR). ‘

Additionally, the proven efficacy of ADCs for providing targeted and effective treatments for several cancers as well as expanding applications of ADCs beyond oncology in other therapeutic areas such as autoimmune disorders and infectious diseases are creating new opportunities for market growth.

Segmental Insights

By Application Insights

By application, the breast cancer segment dominated the market with the largest market share in 2024. According to the National Breast Cancer Foundation, breast cancer is most common cancer in American women and 1 in 8 women, or about 13% of the U.S. female population develops breast cancer in their lifetime. The rising adoption of ADCs for treating breast cancer by both patients and healthcare providers (HCPs) due to their effectiveness and targeted nature are contributing to the market growth. The well-established healthcare infrastructure with access to advanced diagnostic tools, increased emphasis on early detection, rise in number of breast cancer clinical trials for investigating ADCs, and launch of biosimilars such as Uivira are the factors driving the market dominance of this segment. (Source: https://www.nationalbreastcancer.org/)

By application, the urothelial cancer & bladder cancer segment is expected to grow at a notable rate during the forecast period. The high unmet needs in standard treatments like chemotherapy and immune checkpoint inhibitors for advanced and metastatic urothelial carcinomas, leading to limited long-term survival of patients and repeated relapses are driving the demand for novel and more effective therapies such as antibody drug conjugates. The rising prevalence of bladder cancer in the aging population and increased smoking rates in the U.S. are contributing to the growth of ADCs market. Additionally, the approval of ADCs like enfortumab vedotin, in combination with pembrolizumab for locally advanced or metastatic urothelial cancer (la/mUC) by the FDA are encouraging research and development efforts in this area.

By Product Insights

By product, the Kadcyla segment held a significant market share in 2024. Kadcyla (ado-trastuzumab emtansine) which is an ADC combining HER2-targeting antibody trastuzumab with cytotoxic agent DM1 is widely used in cancer care. The established efficacy and safety profile of Kadcyla in clinical trials for reducing tumor size and for improving progression-free survival of HER2-positive breast cancer patients as well as expanding applications of the drug for various disease indications are contributing to the market dominance of this segment.

By product, the Enhertu segment is expected to show notable growth over the forecast period. The strong performance of Enhertu in clinical trials for treating HER2-positive breast cancer due to its high drug-to-antibody ratio (DAR) enabling greater delivery of cytotoxic agent payload delivered to cancer cells is driving the market growth. The well-established efficacy of Enhertu has enabled its use in the second-line treatment of HER2-positive breast cancer. Furthermore, increased investigation activities of the drug across multiple clinical trial sites for other types of cancer such as HER2-positive gastric cancer and other solid tumors are contributing to the market expansion of this segment.

By Target Insights

By target, the HER2 segment holds a significant market revenue share in 2024. The rising incidences of HER2-positive cancers, especially in case of breast cancer are creating the demand for effective therapies like ADCs due to their proven clinical efficacy and well-established safety profile, compared to traditional therapies. The development of patient-friendly dosing regimens and their inclusion in treatment guidelines are driving the adoption of ADCs for treating HER2 cancers. The rise in R&D activities, increased strategic collaborations and focus on development of targeted therapies are driving the market growth.

By target, the CD22 segment is expected to register significant CAGR over the projected timeframe. The high efficacy with reduced side effects of CD22-targeted ADCs for treating some types of leukemia are driving the adoption by healthcare professionals and patients. The rising cancer burden, improvements in ADC technology, increased regulatory approvals, surging investments in R&D activities and increase awareness are the factors anticipated to drive the market expansion of this segment in the upcoming years.

By Technology Insights

By technology, the cleavable linker technology segment captured a significant market revenue share in 2024. Cleavable linkers offer several advantages such as extended blood circulation time and specific payload release in target tissues, further enabling more effective patient outcomes with less probability of off-target toxicity. Advancements in ADC technology such as payload design, antibody engineering, and improved linker technologies are facilitating the development of next-generation ADCs with enhanced safety and efficacy. Furthermore, increased ADC adoption in clinical settings, favorable reimbursement policies, and expedited development and commercialization of novel ADC candidates with increasing partnerships are the factors driving the market growth.

By technology, the payload technology segment is expected to grow at a notable rate during the predicted timeframe. The increasing emphasis on development of novel and highly potent payloads such as topoisomerase I inhibitors and DNA-damaging agents, leading to improved potency and widespread applications across several cancer types are driving the segment’s market growth. Innovations in ADC technology such as enhanced linker-payload combinations are improving patient outcomes and mitigating side effects.

Country-Level Analysis

The U.S. antibody drug conjugates market is experiencing significant growth, driven by the factors such as advanced healthcare infrastructure, robust R&D capabilities, rise in number of clinical trials for ADCs and availability of latest diagnostic tools. The rising approvals for ADCs, continuous innovations in ADC designs, increasing emphasis on precision medicine and surge in collaboration activities are contributing to the market expansion.

The increased support of the U.S. Food and Drug Administration (FDA) such as breakthrough therapy and orphan drug designations for ADCs are encouraging their development. Guidance on clinical pharmacology considerations for ADCs issued by the FDA are enhancing the understanding of their drug properties, dosing strategies as well as drug-drug interactions for researchers and companies developing ADCs.

Some of the Prominent Players in the U.S. Antibody Drug Conjugates Market

- ADC Therapeutics SA

- Astellas Pharma, Inc.

- AstraZeneca

- Daiichi Sankyo Company Ltd.

- F. Hoffmann-La Roche Ltd.

- Gilead Sciences, Inc.

- GlaxoSmithKline Plc

- Pfizer, Inc.

- Seagen, Inc.

- Takeda Pharmaceutical Company Ltd.

U.S. Antibody Drug Conjugates Market Recent Developments

- In April 2025, Synthetic Design Lab, a company dedicated to next-generation antibody-drug conjugate (ADC) development and advancing its novel SYNTHBODY therapeutic platform against a range of cancer indications, became public by securing $20 million in a seed financing round. The SYNTHBODY platform will enhance targeted payload delivery ≥10x in comparison to current ADCs. (Source: https://www.businesswire.com/ )

- In March 2025, Callio Therapeutics, a biotechnology company dedicated to develop multi-payload antibody-drug conjugates (ADCs) for improving cancer therapy, launched itself with closing of a $187.0 million Series A financing round led by Frazier Life Sciences. The financing will be used for achieving clinical proof-of-concept for its HER2-targeted dual-payload ADC and a second undisclosed ADC program. (Source: https://www.prnewswire.com/)

- In September 2024, MilliporeSigma, the U.S. and Canada Life Science business of Merck KGaA, introduced its first single-use reactor, the Mobius ADC Reactor which is designed specifically for accelerating antibody drug conjugate manufacturing. (Source: https://www.businesswire.com/ )

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Antibody Drug Conjugates Market.

By Application

- Blood Cancer

- Leukemia

- Lymphoma

- Multiple Myeloma

- Breast Cancer

- Urothelial Cancer & Bladder Cancer

- Other Cancer

By Product

- Kadcyla

- Enhertu

- Adcetris

- Padcev

- Trodelvy

- Polivy

- Others

By Target

By Technology

-

- Cleavable Linker

- Non-cleavable Linker

- Linkerless

-

- VC

- Sulfo-SPDB

- VA

- Hydrazone

- Others

-

- MMAE

- MMAF

- DM4

- Camptothecin

- Others