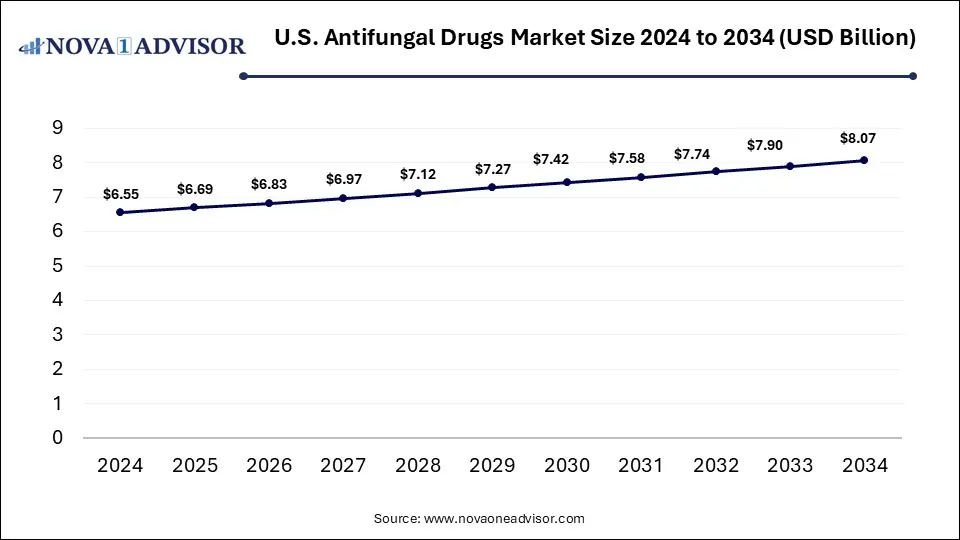

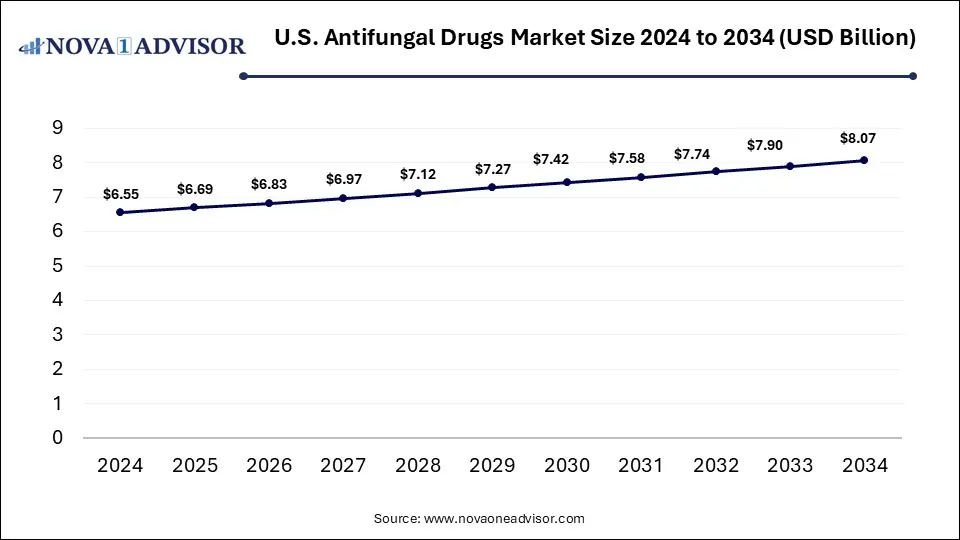

U.S. Antifungal Drugs Market Size and Growth 2025 to 2034

The U.S. antifungal drugs market size is calculated at USD 6.55 billion in 2024, grows to USD 6.69 billion in 2025, and is projected to reach around USD 8.07 billion by 2034, growing at a CAGR of 2.11% from 2025 to 2034. The growth of the U.S. antifungal drugs market is driven by increasing fungal infection cases, demand for safe and effective therapies, rising awareness, and expedited regulatory pathways.

U.S. Antifungal Drugs Market Key Takeaways

- By drug class, the azoles segment dominated the market with the largest share in 2024.

- By drug class, the echinocandins segment is expected to show the fastest growth over the forecast period.

- By indication, the candidiasis segment held the largest market share in 2024.

- By indication, the aspergillosis segment is expected to register fastest growth during the forecast period.

- By dosage form, the oral drugs segment captured the largest market share in 2024.

- By dosage form, the ointments segment is expected to show the fastest growth during the forecast period.

- By distribution channel, the hospital pharmacies segment generated the highest market revenue share in 2024.

- By distribution channel, the retail pharmacies segment is expected to register the fastest CAGR over the forecast period.

What Drives the Growth of the U.S. Antifungal Drugs Market?

Antifungal drugs refer to medications used for treating fungal infections affecting different parts of the body, including the skin, nails, and also internal organs. The increasing prevalence of various types of fungal infections, well-developed healthcare infrastructure, access to advanced diagnostic services, and increased awareness among healthcare providers and patients regarding early detection and treatment of fungal infections are the factors driving the growth of the U.S. antifungal drugs market. Biomarker-based stratification and pharmacogenomics are facilitating the development of personalized treatment strategies such as tailored selection of drug and dosage, based on individual patient needs.

What Are the Key Trends in the U.S. Antifungal Drugs Market in 2024?

- In June 2024, Elion Therapeutics, a biotechnology company focused on reshaping the treatment of life-threatening invasive fungal infections (IFIs), secured $81 million in a Series B funding round led by Deerfield Management and the AMR Action Fund. The funding will support the advancement in of SF001 which is a next-generation polyene antifungal developed for reduced toxicity.

- In March 2024, Astellas Pharma US, Inc., was granted the orphan drug designation and pediatric exclusivity for its CRESEMBA® (isavuconazonium sulfate) for the treatment of invasive aspergillosis (IA) and invasive mucormycosis (IM) in pediatric patients by the U.S. FDA.

What Impact Can AI Have on the U.S. Antifungal Drugs Market?

Artificial intelligence (AI) algorithms such as machine learning and deep learning can be applied for analyzing vast chemical libraries and biological data to identify novel antifungal molecules as well as to predict the activity and efficacy of potential drug candidates, further expediting drug discovery. AI models like generative adversarial networks (GANs) can be applied for generating new molecular structures with ideal properties, leading to creation of novel and more effective antifungal agents.

Molecular dynamics simulations can be used for replicating the interactions between potential drugs and their targets, assisting them for optimizing drug binding and efficacy. Additionally, AI-powered tools can be applied for imaging analysis, development of personalized treatment strategies and in antimicrobial susceptibility testing.

Report Scope of U.S. Antifungal Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 6.69 Billion |

| Market Size by 2034 |

USD 6.69 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 2.11% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Drug Class, By Indication, By Dosage Form, By Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Abbott, Astellas Pharma, Inc., Bayer AG, Enzon Pharmaceuticals, Inc., Glenmark, GSK plc, Merck & Co., Inc., Novartis AG, Pfizer, Inc., Sanofi |

Market Dynamics

Drivers

Rising Cases of Fungal Infections

The rising incidences of fungal infections, both systemic like apsergillosis, candidiasis and mucormycosis as well as superficial like athlete’s foot, nail infections and ringworms across the U.S. is a major driver for the market. There is a significant rise in immunocompromised population due to individuals undergoing organ transplantation, chemotherapy or those with HIV/ AIDS which makes susceptible to fungal infections. Furthermore, surge in hospital-acquired fungal infections, especially among critically ill patients, emergence of new virulent fungal pathogens, and increased public awareness are the factors driving the demand for safe and effective antifungal therapies.

Restraints

Antifungal Resistance and High Treatment Costs

Fungi can potentially develop tolerance to antifungal drugs over time due to increased use, usually in agriculture and prophylactic purposes. This leads to emergence of drug-resistant fungal strains which can make it harder to treat infections and may to more severe outcomes. Overuse or misuse of antifungal drugs as well as global spread of these resistant strains can exacerbate resistance.

The high costs associated with R&D development of novel and targeted antifungal therapies and manufacturing complexity can potentially increase the cost of these drugs. Prolonged treatment durations for chronic and recurrent fungal infections like onychomycosis as well as increased preventive use for extended periods to prevent infections in certain patient populations can potentially lead to increased healthcare costs in the long run, further restricting their access to patients with inadequate insurance coverage and limited financial resources. Furthermore, stringent regulations for antifungal drugs and side effects like liver damage (hepatotoxicity) and kidney damage (nephrotoxicity) can restrain the market growth.

- For instance, in February 2023, Biocon Pharma recalled 3,665 bottles of antifungal medication from the U.S. market due to “failed degradation specifications”, as per the U.S. Food and Drug Administration (USFDA).

Opportunities

Improvements in Antifungal Therapies

Pharmaceutical companies are developing novel antifungal therapies such as innovative lipid formulations and second-generation triazoles, leading to expansion of treatment options, addressing limitations in spectrum of activity, and improved patient safety and adherence. A major opportunity lies in addressing antifungal resistance in stains such as Candida auris, azole-resistant Aspergillus fumigatus, and other emerging resistant strains. Advancements in diagnostic technologies such as lateral flow immunoassays, nucleic acid amplification tests and point-of-care diagnostic testing are facilitating early diagnosis, leading to targeted approach for treating fungal infections. Additionally, expansion of antifungal drug use in prophylactic and empiric therapy is contributing to the market growth.

U.S. Antifungal Drugs Market By Segmental Insights

What Made Azoles the Dominant Segment in the Market in 2024?

By drug class, the azoles segment accounted for the highest market revenue share in 2024. Popular azole drugs such as fluconazole, isavuconazole, posaconazole and voriconazole are widely used against a wide range of fungal infections, due to their broad-spectrum efficacy, both superficially and systematically. Healthcare providers (HCPs) often prefer azoles due to their well-established clinical safety profiles and predictable pharmacokinetics. The rising incidences of fungal infections like aspergillosis and candidiasis are driving the demand for azole-based therapies. The availability of azoles in different formulations such as oral, intravenous and topical forms, makes them suitable for both hospital and outpatient settings. Furthermore, increased prophylactic use, ongoing R&D activities, and the rise in number of immunocompromised population in the U.S. are boosting the market dominance of this segment.

By drug class, the echinocandins segment is expected to register the fastest growth during the forecast period. Echinocandins like anidulafungin, caspofungin, and rezafungin are commonly suggested first-line therapy drugs for invasive candidiasis such as candidemia, especially in immunocompromised and critically ill patients. The rise in hospital-acquired infections, fungicidal activity of these drugs against most Candida species, favorable safety profile, effectiveness against azole-resistant strains and biofilm inhibition properties are the factors expanding the market growth of this segment.

How the Candidiasis Segment Dominated the Market in 2024?

By indication, the candidiasis segment dominated the market with the largest share in 2024. The widespread occurrence of candidiasis, including systemic candidiasis and invasive candidiasis, particularly among hospitalized and immunocompromised patients is creating the demand for effective and safe antifungal drugs. In the U.S., millions of women suffer from vulvovaginal candidiasis (vaginal yeast infection), with a significant number experiencing recurring episodes. The emergence of drug-resistant Candida strains such as Candida auris and fluconazole-resistant Candida glabrata are contributing to continuous research and development for new and potential antifungal drug candidates. Recent approvals by the FDA for drugs like REZZAYO (rezafungin for injection) indicated for the treatment of candidemia and invasive candidiasis in adults, and BREXAFEMME (ibrexafungerp tablets) for treating vulvovaginal candidiasis (VVC) are expanding the market potential.

By indication, the aspergillosis segment is expected to register fastest growth during the forecast period. Aspergillosis comprises of various range of diseases caused by the Aspergillus mold, including invasive aspergillosis, chronic pulmonary aspergillosis, allergic bronchopulmonary aspergillosis, and aspergilloma (fungus ball). The high mortality and morbidity of invasive aspergillosis, rising number of immunocompromised population, and emergence of azole-resistant Aspergillus fumigatus strains are creating the need for alternative drug classes or new antifungal drugs with novel mechanism of action to treat these indications. Improvements in diagnostic technologies such as beta-D-glucan assays, galactomannan antigen tests and PCR-based techniques are enabling early and accurate diagnosis of aspergillosis, allowing timely commencement of antifungal therapy and greater patient outcomes.

Why Did the Oral Drugs Segment Dominate the Market in 2024?

By dosage form, the oral drugs segment dominated the market with the largest share in 2024. Oral drug formulations are the most widely used medications for fungal treatments due to convenience of self-medication for patients at home and reduced need for hospital visits or intravenous infusions, further making them highly suitable for inpatient step-down units (SDUs) and in outpatient treatment settings. The broad spectrum activity for treating various fungal infections, increased patient adherence to treatment regimens, cost-effectiveness of oral drugs, availability of generics, and improved access to these formulations through retail pharmacies and online platforms like telemedicine and online pharmacy apps are driving the market dominance of this segment.

By dosage form, the ointments segment is expected to expand rapidly during the predicted timeframe. The rising incidences of localized skin fungal infections such as athlete’s foot (tinea pedis), jock itch (tinea curis), ringworm (tinea corporis), cutaneous candidiasis and onychomycosis (fungal nail infection) are driving the demand for targeted treatments such as ointments to treat these superficial infections. The over-the-counter availability of topical antifungal formulations, minimized systemic effects, growing consumer preference towards non-invasive treatments, and convenience of application enabling self-medication for early treatment are the factors fuelling the market expansion. Pharmaceutical companies are focused on expanding their product pipelines of topical antifungal medications to strengthen their market presence.

What Drives the Dominance of the Hospital Pharmacies Segment in 2024?

By distribution channel, the hospital pharmacies segment accounted for the biggest market revenue share in 2024. Hospital pharmacies play a critical role in providing treatments for severe and invasive fungal infections such as invasive aspergillosis, candidemia, cryptococcosis, and mucormycosis. Hospitals regularly treat immunocompromised patients, critically ill patients in ICUs and patients with prolonged hospital stays, which makes them highly susceptible to nosocomial infections, further driving the demand for antifungal therapies in hospital settings. Several potent systemic antifungals medications given through intravenous formulations such as echinocandins like caspofungin and micafungin, and polyenes like amphotericin B formulations are available through hospital pharmacies which are well-equipped for handling and dispensing these complex IV medications. Hospital pharmacies implement and manage Antifungal Stewardship Programs (AFSPs) which help in combating antifungal resistance and optimize expenses.

By distribution channel, the retail pharmacies segment is anticipated to show the fastest growth over the forecast period. Retail pharmacies are primary providers of antifungal medications to treat superficial and less severe systemic fungal infections. The availability of over-the-counter (OTC) antifungal medications, rising consumer preference towards self-treatment of mild fungal infections, and increasing prevalence of these common infections leading to high volume sales of OTC antifungal products are the factors boosting the market growth of this segment. Furthermore, widespread network of retail pharmacies such as independent pharmacies, chain pharmacies, supermarket pharmacies and mass merchandisers with pharmacies across the U.S. are improving consumer access to prescription or OTC antifungal drugs.

Country-level Analysis

The U.S. antifungal drugs market is experiencing significant growth, driven by factors such as focus on addressing unmet medical needs such as for rare and orphan fungal diseases, expansion into women’s health through innovations specifically targeting recurrent vulvovaginal candidiasis (RVCC), and improved access and availability of OTC and prescription antifungal drugs. Integration of digital health platforms such as remote monitoring systems, telemedicine consultations, and online pharmacies are improving patient adherence to antifungal treatments, optimizing resource allocation, and enhancing access to antifungal drugs, leading to enhanced patient-centered care.

The Food and Drug Administration (FDA) has established pathways such as the Limited Population Pathway for Antibacterial and Antifungal Drugs (LPAD) (section 506(h) of the FD&C Act) for simplifying drug approvals for limited and distinct patient populations with unmet medical needs. Initiatives by the U.S. government such as the Generating Antibiotic Incentives Now (GAIN) Act offers incentives like extended market exclusivity for drugs designated as Qualified Infectious Disease Products (QIDPs), especially for drugs targeting antibiotic resistance and serious fungal infections.

Some of the Prominent Players in the U.S. Antifungal Drugs Market

- Abbott

- Astellas Pharma, Inc.

- Bayer AG

- Enzon Pharmaceuticals, Inc.

- Glenmark

- GSK plc

- Merck & Co., Inc.

- Novartis AG

- Pfizer, Inc.

- Sanofi

U.S. Antifungal Drugs Market Recent Developments

- In April 2024, Anivive Lifesciences presented a breakthrough research, based on the development of the world’s first systemic antifungal vaccine at the World Vaccine Congress.

- In January 2024, Vanda Pharmaceuticals Inc., received the U.S. Food and Drug Administration’s (FDA’s) approval for the Investigational New Drug Application (IND) for evaluating a topical antifungal candidate, VTR-297 for the treatment of onychomycosis.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. antifungal drugs market.

By Drug Class

- Allylamines

- Azoles

- Echinocandins

- Polyenes

- Others

By Indication

- Aspergillosis

- Candidiasis

- Dermatophytosis

- Others

By Dosage Form

- Ointments

- Oral Drugs

- Powders

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others