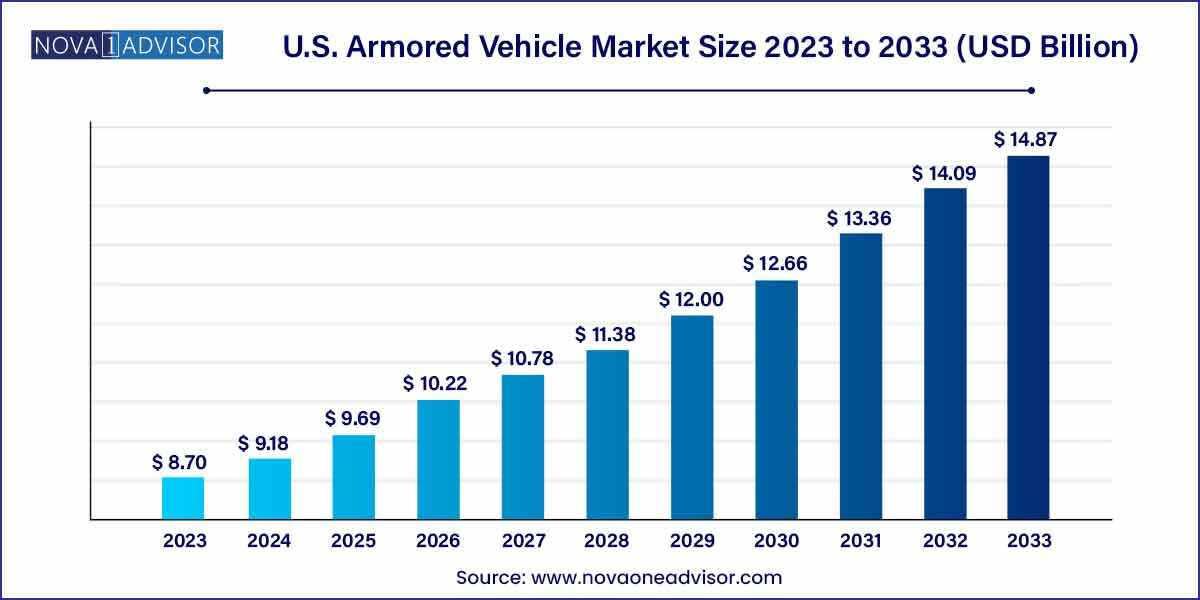

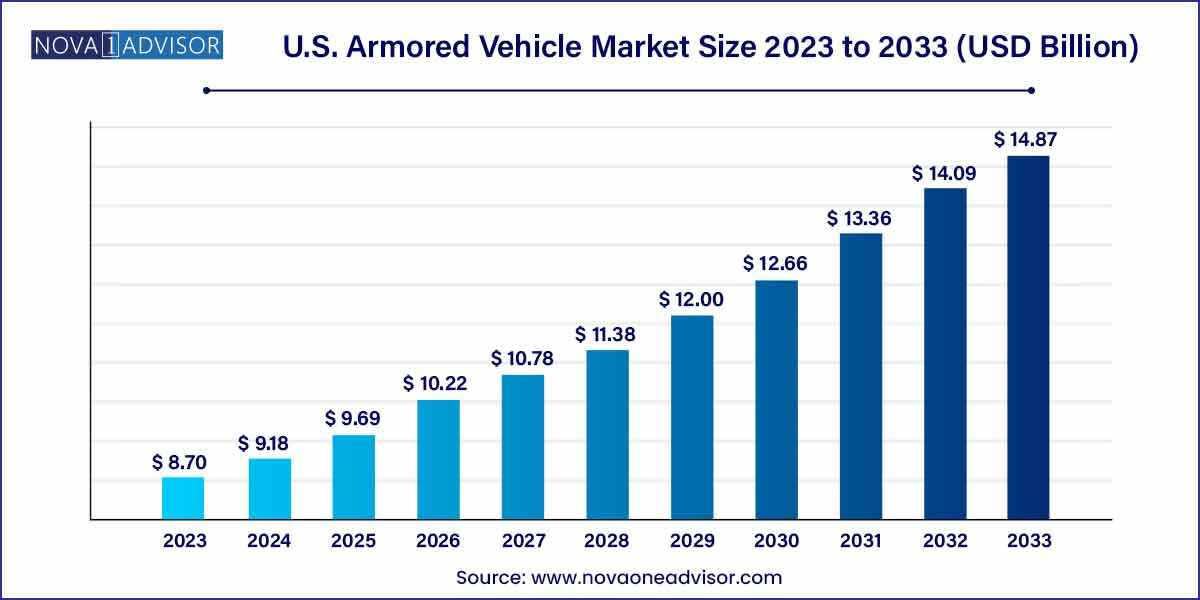

The U.S. armored vehicle market size was estimated at USD 8.70 billion in 2023 and is projected to hit around USD 14.87 billion by 2033, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

Key Takeaways:

- The engines segment held the significant revenue share of over 20% in 2023

- The navigation systems segment is estimated to grow significantly over the forecast period.

- The combat vehicles segment led the market in 2023, accounting for over 35% share of the revenue.

- The cash in transit vehicles segment is predicted to foresee significant growth in the forecast period.

- The conventional armored vehicles segment led the market in 2023, accounting for over 96% share of the revenue.

- The electric armored vehicles segment is expected to showcase significant growth over the forecast period.

- The wheeled segment led the market in 2023, accounting for over 82% of revenue.

- The tracked segment will witness significant growth in the coming years.

- The manned armored vehicles segment led the market in 2023, accounting for over 86% of the revenue.

- The unmanned armored vehicles segment will witness significant growth in the coming years.

- The OEM segment led the market in 2023, accounting for over 83% of the revenue.

- The retrofit segment will witness significant growth in the coming years.

Market Overview

The U.S. armored vehicle market serves as a critical component of national defense, law enforcement, and specialized civilian security sectors. As the largest defense spender globally, the United States invests heavily in the modernization, procurement, and development of next-generation armored systems across all military branches and federal agencies.

The market includes a wide range of vehicles, from Main Battle Tanks (MBTs) and Infantry Fighting Vehicles (IFVs) to Mine-Resistant Ambush Protected (MRAP) vehicles, Armored Personnel Carriers (APCs), and Light Protected Vehicles (LPVs). In addition to their use in combat, armored vehicles are increasingly employed in domestic law enforcement, border patrol, VIP protection, and the secure transportation of valuables.

Several factors drive this market's evolution: an emphasis on modern warfare tactics, growing threats from cyber-physical hybrid warfare, and the integration of unmanned systems and electric mobility solutions. The U.S. is currently engaged in programs such as the Optionally Manned Fighting Vehicle (OMFV) and Mobile Protected Firepower (MPF), indicating a decisive move toward modular, tech-forward, and agile combat platforms.

Private sector innovation also plays a vital role, with defense contractors and startups contributing to rapid prototyping, simulation-based testing, and performance enhancement in armored platforms.

Major Trends in the Market

-

Shift Toward Modular and Multi-role Platforms: Vehicles designed for modular payloads and interchangeable roles are being favored for operational flexibility.

-

Rise of Electric and Hybrid Propulsion: Growing interest in electric drive systems to reduce acoustic and thermal signatures and enhance fuel efficiency.

-

Integration of Advanced Defensive Systems: Use of Active Protection Systems (APS), counter-IED technologies, and autonomous sensing solutions.

-

Adoption of Unmanned and Remotely Operated Vehicles: Integration of AI and remote-control systems for high-risk missions.

-

Retrofit Modernization Initiatives: Extension of service life through technology upgrades of legacy platforms.

-

Public-Private R&D Collaborations: Government partnering with tech firms and defense startups for agile innovation.

-

Expansion of Civilian Armored Applications: Law enforcement agencies, SWAT teams, and private security firms increasing adoption of tactical armored vehicles.

U.S. Armored Vehicle Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 9.18 Billion |

| Market Size by 2033 |

USD 14.87 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.5 % |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, Vehicle Type, Mobility, Mode of Operation, Point of Sale, and System |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

BAE Systems; BMW AG; Benz Group AG; Elbit Systems Ltd.; Ford Motor Company; General Dynamics Corporation; INKAS Armored Vehicle Manufacturing; International Armored Group; Iveco Group N. V; Krauss-Maffei Wegmann GmbH & Co. (KMW); Lenco Industries, Inc.; Lockheed Martin Corporation; Navistar, Inc.; Oshkosh Defense, LLC; Rheinmetall AG; STAT, Inc.; Textron, Inc.; Thales Group |

Market Driver: Modernization of Armed Forces and Tactical Capabilities

The strongest driver for the U.S. armored vehicle market is the ongoing modernization programs across the U.S. Army, Marine Corps, and special forces units. As global conflicts become increasingly asymmetric and technologically sophisticated, the Department of Defense (DoD) is focusing on replacing legacy armored fleets with more advanced, survivable, and networked platforms.

Programs like the Next-Generation Combat Vehicle (NGCV) aim to replace aging Bradley IFVs with new vehicles equipped with enhanced mobility, autonomous features, and integrated C4ISR systems. Simultaneously, the U.S. military is upgrading its Stryker and Abrams M1 tanks with better fire control, ballistic protection, and electric drives to meet modern battlefield requirements.

This modernization wave is not limited to combat vehicles; support vehicles such as repair/recovery and command/control vehicles are also undergoing upgrades to enable real-time data exchange and adaptive mission response capabilities.

Market Restraint: Budgetary Constraints and Procurement Delays

A significant restraint in the market is the complex and often delayed procurement process, combined with periodic budgetary fluctuations. While the U.S. defense budget is substantial, funding allocations must be spread across multiple priorities including cyber defense, naval fleet expansion, and personnel costs.

Procurement for large-scale armored vehicle programs often involves years of testing, legislative approvals, and re-evaluation—leading to extended development cycles. For example, the OMFV program has experienced multiple delays due to shifting technical specifications and vendor disagreements.

Additionally, rising costs of next-generation materials, software integration, and testing create financial pressures, particularly when balancing innovation with unit affordability. In some cases, these challenges result in scope reductions, batch cancellations, or retrofit preference over new acquisitions.

Market Opportunity: Unmanned Armored Systems and Autonomous Mobility

One of the most promising opportunities lies in the field of Unmanned Armored Ground Vehicles (UGVs) and autonomous mobility systems. As warfare becomes increasingly digitized, autonomous systems are gaining ground in high-risk operations such as surveillance, logistics in combat zones, and reconnaissance under fire.

U.S. defense agencies are actively testing unmanned platforms such as the Robotic Combat Vehicle (RCV) Light and Medium variants, designed to operate independently or in tandem with manned vehicles. These vehicles reduce soldier exposure, increase operational range, and support real-time situational awareness.

The integration of LiDAR, neural navigation, and swarm AI with armored vehicles is redefining the battlefield. This market segment is also attractive for commercial defense contractors and technology firms entering the defense robotics space, offering lucrative partnership opportunities.

Segmental Analysis

By Product

Combat vehicles dominate the U.S. armored vehicle market due to their central role in frontline engagements, tactical mobility, and force projection. This category includes Main Battle Tanks, IFVs, APCs, and MRAPs. Platforms like the Abrams M1A2, Stryker A1 IFV, and JLTV (Joint Light Tactical Vehicle) are among the most deployed. Combat vehicles represent a core investment area in the U.S. defense strategy due to their deterrence and rapid deployment capabilities.

Unmanned armored ground vehicles and law enforcement vehicles are the fastest-growing sub-segments. Unmanned systems are being tested for high-risk missions, while domestic police forces are increasingly procuring armored SUVs and tactical vehicles for riot control, hostage rescue, and counter-terrorism. The rise in urban unrest and mass event security needs has created a secondary, fast-growing market within civilian law enforcement and private defense firms.

By Vehicle Type

Conventional armored vehicles dominate, particularly due to the current reliance on diesel-powered engines in heavy-duty combat and tactical vehicles. Vehicles like the M1A2 Abrams and Bradley remain diesel-reliant due to the high power demands in combat situations and the existing fuel infrastructure within the military.

Electric armored vehicles are the fastest-growing segment, fueled by the military's push toward silent mobility, energy efficiency, and heat signature reduction. The U.S. Army has initiated exploratory projects on hybrid-electric tanks and infantry carriers, and companies like GM Defense are prototyping all-electric utility armored platforms suitable for both logistics and special operations.

By Mobility

Wheeled vehicles dominate due to their versatility, lighter weight, and better suitability for rapid deployment and urban missions. Platforms like the JLTV, Stryker, and MRAP are preferred for counterinsurgency operations and quick maneuverability across paved and semi-urban terrains.

Tracked vehicles remain vital for heavy-duty battlefield applications and are seeing innovation in suspension systems and reduced ground pressure features. These vehicles, although slower, provide higher protection and off-road mobility in rugged or hostile terrain, making them indispensable in traditional warfare simulations.

By Mode of Operation

Manned armored vehicles currently dominate the operational mode segment, reflecting the traditional structure of combat deployment and field operation. Despite technological advancements, human-in-the-loop systems remain crucial for tactical decisions, navigation, and compliance with rules of engagement.

Unmanned armored vehicles are the fastest-growing, especially in reconnaissance, logistics, and autonomous supply chain delivery. Integration with drone systems, AI route planning, and smart obstacle detection is making these vehicles critical for future operations. They are increasingly deployed in experimental formations and may eventually become standard in U.S. military doctrine.

By Point of Sale

OEM sales dominate the U.S. market, driven by consistent demand for newly designed platforms with modern combat capability, customized for the needs of the U.S. Department of Defense and allied contractors. Major OEMs such as General Dynamics, BAE Systems, and Oshkosh Defense secure multi-year contracts to produce new platforms at scale.

Retrofit services are growing rapidly, as the government seeks to extend the lifespan of existing fleets by integrating modern electronics, defensive systems, and propulsion upgrades. Retrofitting is especially cost-effective during fiscal constraints and is essential for maintaining readiness while awaiting next-gen platforms.

By System

Ballistic armor and drive systems dominate due to their fundamental importance in providing survivability and mobility. Innovations in composite armor, reactive armor, and underbody blast protection are critical areas of investment. Drive systems are increasingly integrated with electronic control units and hybrid transmission technologies.

Fire control systems and navigation systems are among the fastest-growing segments, with smart targeting, autonomous tracking, and geospatial awareness becoming central to next-generation combat effectiveness. Real-time battlefield data sharing, AI-powered targeting, and GPS-denied navigation technologies are drawing significant R&D funding.

Country-Level Analysis

In the United States, the armored vehicle market is driven by federal defense budgets, military modernization initiatives, and homeland security considerations. U.S. Army and Marine Corps programs such as the OMFV, AMPV (Armored Multi-Purpose Vehicle), and JLTV upgrades are central to military capability enhancement.

At the same time, law enforcement agencies at the federal and state levels are increasing their investment in tactical armored vehicles, driven by the need to respond to civil unrest, natural disasters, and terrorist threats. Agencies such as the FBI, DEA, and U.S. Marshals regularly procure armored SUVs and MRAP variants for tactical operations.

The U.S. also plays a pivotal role as an exporter of armored vehicles, supplying allies through Foreign Military Sales (FMS) programs. American-made vehicles are operational in NATO deployments, UN peacekeeping missions, and strategic regional alliances, reflecting the country’s dominance in global armored mobility.

Key Companies & Market Share Insights

The major players are aiming to expand their market presence, seeking opportunities in both domestic and international markets. They establish partnerships, joint ventures, or subsidiaries in untapped regional markets to serve local customers with improved channel reach and enhance their market position. They continue to invest heavily in innovation, which enables them to stay at the forefront of the market. For instance, in May 2023, the Richmond Police Department introduced its new armored vehicle. This new vehicle, the Pit-Bull VX Special Edition, was created by Alpine Armoring, Inc., a company headquartered in Chantilly, Virginia. The acquisition of this vehicle focused on enhancing the safety of both police officers and innocent members of the community during emergency responses to various tragic and unfortunate events occurring across THE COUNTRY.

Key U.S. Armored Vehicles Companies:

- BAE Systems

- BMW AG

- Mercedes-Benz Group AG

- Elbit Systems Ltd.

- Ford Motor Company

- General Dynamics Corporation

- INKAS Armored Vehicle Manufacturing

- International Armored Group

- Iveco Group N. V

- Krauss-Maffei Wegmann GmbH & Co. (KMW)

- Lenco Industries, Inc.

- Lockheed Martin Corporation

- Navistar, Inc.

- Oshkosh Defense, LLC

- Rheinmetall AG

- STAT, Inc.

- Textron, Inc.

- Thales Group.

Recent Developments

-

April 2025 – General Dynamics Land Systems unveiled its latest autonomous prototype for the Robotic Combat Vehicle at the Army Global Force Symposium.

-

March 2025 – GM Defense delivered its first batch of hybrid-electric infantry support vehicles to U.S. Army units in Fort Hood, Texas, as part of a pilot electrification project.

-

February 2025 – Oshkosh Defense received a $1.2 billion contract modification for producing enhanced JLTV variants equipped with new communications and fire control systems.

-

January 2025 – BAE Systems initiated live testing of its new CV90 variant with integrated AI-supported threat detection in collaboration with DARPA.

-

December 2024 – Textron Systems announced a partnership with a Silicon Valley AI firm to develop autonomous navigation software for unmanned armored platforms.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Armored Vehicle market.

By Product

- Combat Vehicles

- Armored Personnel Carrier (APC)

- Infantry Fighting Vehicles (IFV)

- Light Protected Vehicles (LPV)

- Main Battle Tanks (MBT)

- Mine-resistant Ambush Protected (MRAP)

- Tactical Vehicle

- Others

- Combat Support Vehicles

- Armored Supply Trucks

- Armored Command & Control Vehicles

- Repair & Recovery Vehicles

- Unmanned Armored Ground Vehicles

- Cash in Transit Vehicles

- Law Enforcement Vehicles

- Others

By Vehicle Type

- Electric Armored Vehicles

- Conventional Armored Vehicles

By Mobility

By Mode of Operation

- Manned Armored Vehicles

- Unmanned Armored Vehicles

By Point of Sale

By System

- Engines

- Drive Systems

- Ballistic Armor

- Fire Control Systems (FCS)

- Navigation Systems

- Others