U.S. Aromatherapy Market Size and Research

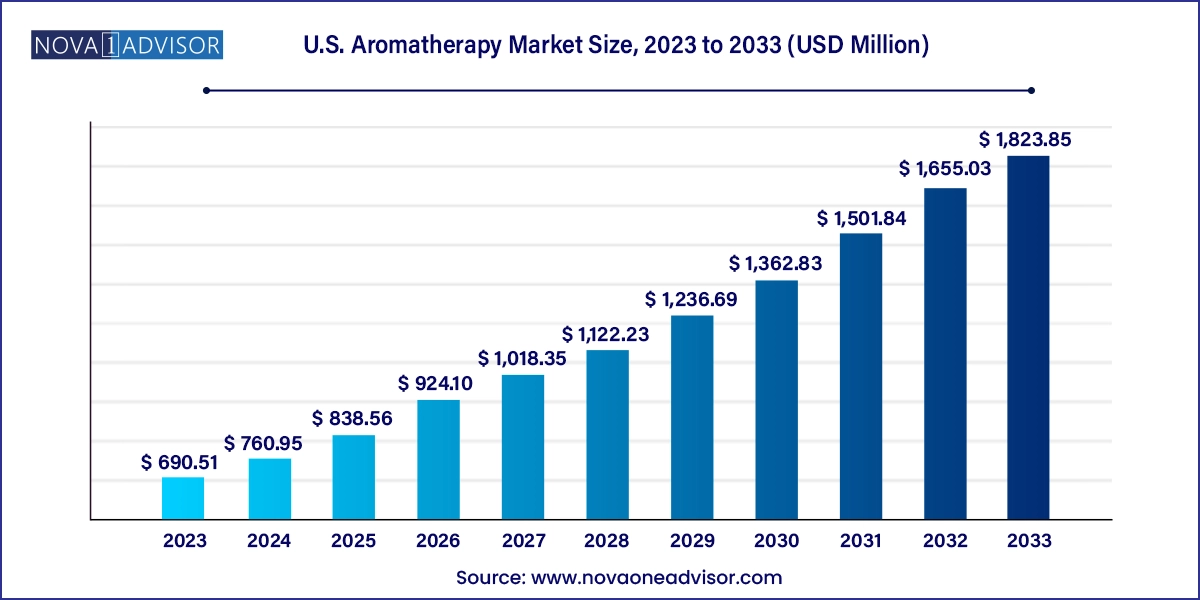

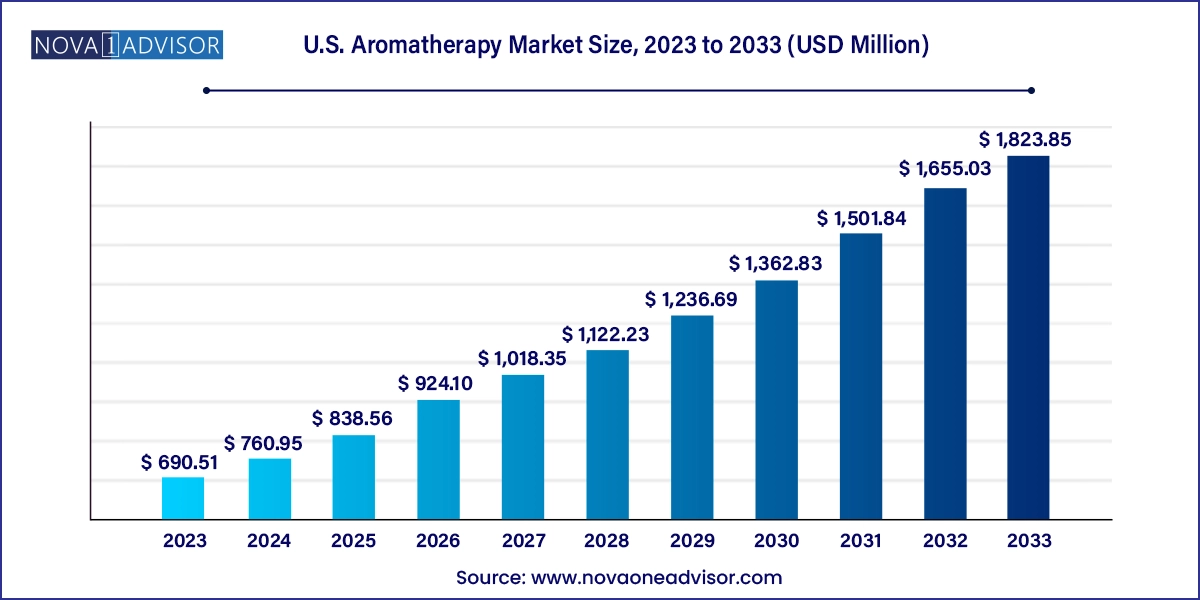

The U.S. aromatherapy market size was exhibited at USD 690.51 million in 2023 and is projected to hit around USD 1,823.85 million by 2033, growing at a CAGR of 10.2% during the forecast period 2024 to 2033.

U.S. Aromatherapy Market Key Takeaways:

- The consumables segment held the largest share of 78.3% in 2023 and is expected to grow at a CAGR of 10.7% over the forecast period.

- In terms of mode of delivery, the topical application segment dominated the market in 2023

- Aerial diffusion, on the other hand, is expected to exhibit a lucrative CAGR over the forecast period

- In terms of application, the relaxation segment dominated the market in 2023

- In terms of distribution channel, the direct-to-consumer (DTC) sales segment dominated the market in 2023.

- The home use segment dominated the U.S. market in 2023 with a market share of 40.5% and is estimated to be the fastest-growing segment in the coming years.

Market Overview

The U.S. aromatherapy market has emerged as a prominent segment within the broader wellness and alternative medicine landscape. Aromatherapy involves the use of essential oils and aromatic plant extracts to enhance physical and psychological well-being. In recent years, growing consumer inclination toward natural remedies, stress management, and holistic health has significantly driven market demand. As more individuals turn away from synthetic chemicals and conventional pharmaceuticals for everyday wellness solutions, aromatherapy has become a favored choice among American households and wellness professionals.

A wide range of essential oils, from lavender and eucalyptus to peppermint and tea tree, are utilized for purposes ranging from relaxation and skin care to respiratory support and pain relief. Equipment such as diffusers, nebulizers, and heat-based dispensers have also gained popularity, further boosting the accessibility of aromatherapy in home and clinical settings. The market is also fueled by increasing penetration of wellness centers, spas, yoga studios, and online health platforms. Additionally, the integration of aromatherapy into conventional health and beauty products by major personal care brands underscores its mainstream acceptance in the United States.

Major Trends in the Market

-

Rising popularity of essential oil blends targeting specific health conditions

-

Increasing use of aromatherapy in spas and luxury wellness resorts

-

Growing adoption of ultrasonic diffusers for home and workplace relaxation

-

Expansion of e-commerce platforms offering direct-to-consumer sales of essential oils

-

Development of certified organic and sustainably sourced aromatherapy products

-

Integration of aromatherapy into dermatological and cosmetic formulations

-

Increased use of aromatherapy in mental wellness and emotional balance therapies

-

Technological innovation in equipment design, including smart diffusers with app control

Report Scope of U.S. Aromatherapy Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 760.95 Million |

| Market Size by 2033 |

USD 1,823.85 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 10.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Mode of Delivery, Application, Distribution Channel, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Edens Garden; doTERRA International; Frontier Natural Products Co-op; Mountain Rose Herbs; Young Living Essential Oils; Rocky Mountain Oils, LLC; Plant Therapy Essential Oils; FLORIHANA; Biolandes; Falcon Essential Oils. |

Key Market Driver: Growing Demand for Natural Stress Relief Solutions

One of the most prominent drivers of the U.S. aromatherapy market is the increasing demand for natural solutions to combat stress, anxiety, and fatigue. The modern lifestyle, characterized by long working hours, digital overload, and urban living, has elevated stress levels across demographics. As a result, consumers are increasingly turning to aromatherapy as a complementary wellness tool to manage emotional and psychological well-being.

Essential oils such as lavender, chamomile, and bergamot are scientifically associated with calming effects. They are now widely used in homes, offices, therapy centers, and even hospitals. Their ability to induce relaxation, improve sleep quality, and enhance mood without the side effects of synthetic drugs is a key factor in their popularity. The COVID-19 pandemic further accentuated this trend, as lockdowns and uncertainty spurred demand for in-home relaxation and wellness products.

Key Market Restraint: Regulatory and Quality Assurance Challenges

Despite its strong growth trajectory, the U.S. aromatherapy market is restrained by regulatory and quality control challenges. Unlike pharmaceuticals, essential oils and aromatherapy products are often marketed as dietary supplements or cosmetics, which subjects them to less rigorous oversight by the FDA. This regulatory gap allows variability in product quality, purity, and labeling.

As a result, concerns regarding adulteration, contamination, and false therapeutic claims have surfaced. Inconsistent standards among manufacturers can lead to reduced efficacy or even adverse effects, affecting consumer trust. The absence of standardized testing and certification frameworks remains a key hurdle for brands aiming to build long-term credibility and market share.

Key Market Opportunity: Integration with Clinical and Holistic Healthcare

A growing opportunity in the U.S. aromatherapy market lies in its integration with mainstream and holistic healthcare systems. Increasing clinical interest in the therapeutic potential of essential oils has led to their gradual adoption in hospitals, rehabilitation centers, and mental health practices. For instance, lavender oil is often used to calm preoperative anxiety, while peppermint oil is employed for nausea management in oncology settings.

Additionally, naturopaths, chiropractors, and integrative health practitioners are incorporating aromatherapy into treatment plans for conditions such as insomnia, migraines, and muscle tension. As clinical research continues to explore and validate these applications, the medical and scientific endorsement of aromatherapy could lead to expanded insurance coverage, institutional usage, and broader patient acceptance.

U.S. Aromatherapy Market By Product Insights

Consumables dominated the U.S. aromatherapy market, accounting for a significant share due to their wide applicability and repeat purchase cycle. Essential oils, both as singles and blends, are core products in this segment. Among single essential oils, herbaceous variants like lavender and eucalyptus are frequently used for relaxation and respiratory support. Citrus oils such as lemon and orange are preferred for mood enhancement, while woody and spicy oils like sandalwood and cinnamon are utilized in spiritual and meditative contexts.

In contrast, equipment is the fastest-growing product category, driven by the rising use of ultrasonic and nebulizing diffusers. Ultrasonic diffusers, in particular, are favored for their silent operation, aesthetic appeal, and dual functionality as humidifiers. These devices are increasingly integrated into home decor and wellness routines. Smart diffusers that sync with mobile apps and allow customization of scent schedules are attracting a younger, tech-savvy demographic.

U.S. Aromatherapy Market By Mode Of Delivery Insights

Aerial diffusion remained the dominant mode of delivery, facilitated by the widespread use of diffusers in homes, offices, and wellness spaces. This method allows for ambient fragrance dispersion, mood enhancement, and relaxation, making it suitable for group settings and continuous use. Diffusion also minimizes the risk of skin sensitivity or allergic reactions associated with direct application.

Topical application is rapidly gaining ground, especially among users seeking targeted therapeutic effects. Carrier oils combined with essential oils are commonly applied for localized pain relief, skincare routines, or massage therapy. Products such as roll-ons, balms, and massage oils offer convenient application formats. Dermatologists and spa professionals increasingly recommend topical aromatherapy for treating skin conditions, scar healing, and muscle relaxation.

U.S. Aromatherapy Market By Application Insights

Relaxation emerged as the leading application segment, reflecting the consumer emphasis on stress reduction and emotional wellness. Products aimed at creating a calming environment, improving sleep, and alleviating anxiety dominate retail and online platforms. Essential oils like chamomile, ylang-ylang, and frankincense are frequently marketed under this category.

Pain management is witnessing the fastest growth, especially among aging populations and individuals seeking alternatives to NSAIDs or opioids. Oils such as peppermint, eucalyptus, and ginger have analgesic and anti-inflammatory properties. These are used in massage oils, creams, and bath soaks for relief from arthritis, muscle soreness, and chronic pain conditions.

U.S. Aromatherapy Market By Distribution Channel Insights

Direct-to-consumer (D2C) retail and e-commerce platforms collectively dominate the distribution landscape. Online marketplaces such as Amazon, along with branded e-commerce websites, have revolutionized product accessibility. The availability of reviews, subscription options, and DIY usage guides further encourages customer engagement.

B2B distribution is growing steadily, fueled by increased aromatherapy adoption in spas, wellness centers, hotels, and healthcare institutions. These bulk purchases often involve custom blends and private labeling, contributing significantly to brand revenue streams. Partnerships with wellness chains and retail franchises offer a scalable route for brand expansion.

U.S. Aromatherapy Market By End-use Insights

Home use is the most prevalent end-use segment, as consumers increasingly incorporate aromatherapy into daily self-care rituals. Portable diffusers, starter kits, and value packs are designed specifically for domestic users seeking accessible wellness solutions. Social media platforms and lifestyle influencers play a significant role in promoting home aromatherapy.

Spa and wellness centers represent the fastest-growing end-use, reflecting a premiumization trend in wellness services. Aromatherapy is now a core offering in luxury spas, often combined with massage therapy and hydrotherapy. The emphasis on sensory experiences, customization, and therapeutic benefits has led to increased demand for high-quality oils and professional-grade equipment.

Country-Level Analysis

The United States presents a mature and highly diversified market for aromatherapy. Urban centers like Los Angeles, New York, and Miami lead in consumer adoption, driven by strong wellness cultures, high disposable incomes, and exposure to holistic lifestyles. The influence of yoga studios, alternative therapy practitioners, and clean beauty brands is particularly notable in these cities.

The midwestern and southern states are also witnessing growing interest, particularly in the context of pain relief and respiratory support. The integration of aromatherapy in nursing homes, rehabilitation centers, and community clinics across these regions suggests expanding usage across age groups and care settings. Regulatory shifts and industry collaborations are also influencing growth. For example, several U.S. states are pushing for clearer labeling and third-party testing to ensure consumer safety and product integrity.

Some of the prominent players in the U.S. aromatherapy market include:

- Edens Garden

- doTERRA International

- Frontier Natural Products Co-op

- Mountain Rose Herbs

- Young Living Essential Oils

- Rocky Mountain Oils

- Plant Therapy Essential Oils.

Recent Developments

-

March 2025: doTERRA announced the launch of a new "Mind & Mood" essential oil blend designed to support emotional balance, available via its D2C platform.

-

January 2025: Young Living opened a new aromatherapy experience center in Austin, Texas, offering immersive workshops and guided product education.

-

November 2024: Plant Therapy introduced a smart ultrasonic diffuser with mobile app control and voice assistant compatibility.

-

October 2024: Aura Cacia collaborated with a national spa chain to offer signature essential oil blends across 100+ spa locations.

-

August 2024: NOW Foods launched a certified organic line of single and blended essential oils with a focus on sustainable sourcing and eco-friendly packaging.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. aromatherapy market

Product

-

-

-

- Herbaceous

- Woody

- Spicy

- Floral

- Citrus

- Earthy

- Camphoraceous

- Others

-

- Ultrasonic

- Nebulizing

- Evaporative

- Heat

Mode of Delivery

- Topical Application

- Aerial Diffusion

- Direct Inhalation

Application

- Relaxation

- Skin & Hair care

- Pain Management

- Cold & Cough

- Insomnia

- Scar management

- Others

Distribution Channel

End-use

- Home use

- Spa & Wellness Centers

- Hospitals & Clinics

- Others