U.S. Artificial Ventilation And Anesthesia Masks Market Size and Trends

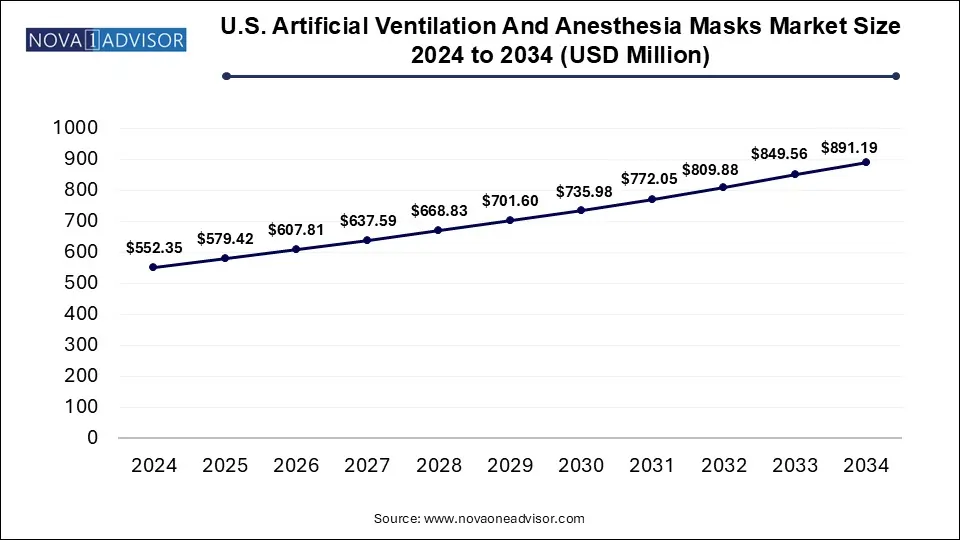

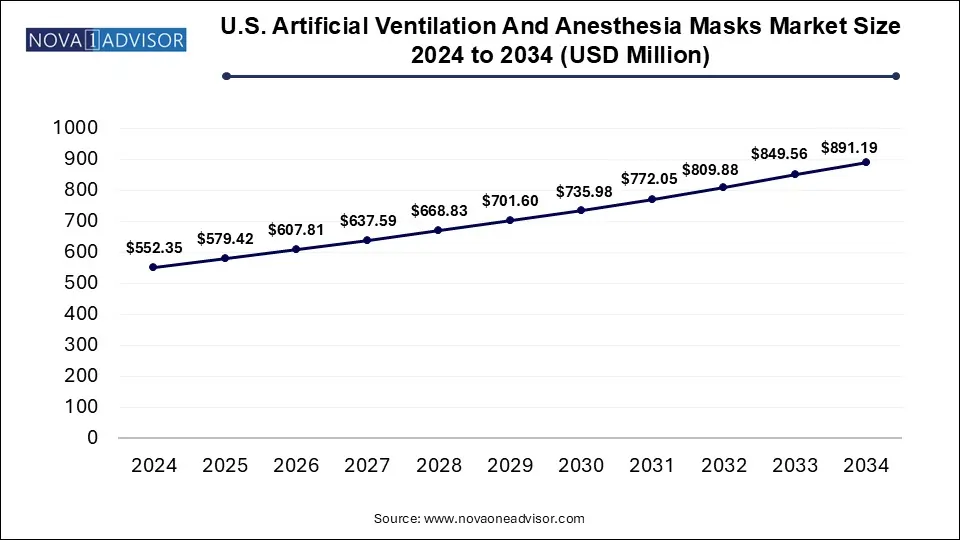

The U.S. artificial ventilation and anesthesia masks market size was exhibited at USD 552.35 million in 2024 and is projected to hit around USD 891.19 million by 2034, growing at a CAGR of 4.9% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, disposable masks represented the highest revenue contribution, capturing 68% of the overall market.

- The operating rooms segment emerged as the leading application area in 2024, accounting for 30% of the total market share.

Market Overview

The U.S. artificial ventilation and anesthesia masks market has witnessed notable expansion in recent years, driven by increasing surgical procedures, the rising prevalence of respiratory diseases, and a surge in demand for emergency care. These masks are essential components in both elective and emergency medical procedures, ensuring that patients receive adequate oxygen or anesthetic agents during operations or in critical care settings.

The growing geriatric population in the United States highly susceptible to chronic obstructive pulmonary diseases (COPD), sleep apnea, and other respiratory ailments has intensified the use of mechanical ventilation and anesthesia. According to the CDC, over 16 million Americans suffer from COPD, and many more remain undiagnosed. This population requires long-term ventilation support or perioperative respiratory assistance, propelling the demand for high-performance masks.

Furthermore, the COVID-19 pandemic emphasized the significance of respiratory equipment, especially ventilation-related apparatus, bringing artificial ventilation masks into mainstream healthcare focus. This sudden demand spike also exposed critical gaps in healthcare supply chains, prompting institutions to adopt more robust and disposable options, catalyzing innovation in mask materials and design.

Major Trends in the Market

-

Shift Toward Disposable Masks: Hospitals and ambulatory surgical centers are increasingly favoring disposable masks to reduce the risk of cross-contamination.

-

Home Care Expansion: Rising use of ventilators in home care settings is promoting the need for patient-friendly, lightweight, and easy-to-fit masks.

-

Customization and Ergonomics: Manufacturers are emphasizing ergonomic designs and custom-fit options to improve patient comfort and compliance.

-

Integration with Smart Monitoring Systems: Integration of masks with real-time monitoring and AI-powered ventilators is being explored.

-

Eco-conscious Manufacturing: There is growing interest in biodegradable materials and recyclable mask components.

-

Rise of ASCs (Ambulatory Surgical Centers): The proliferation of ASCs has led to increased consumption of single-use anesthesia masks.

Report Scope of U.S. Artificial Ventilation And Anesthesia Masks Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 579.42 Million |

| Market Size by 2034 |

USD 891.19 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 4.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Mask Type, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Medtronic; BD (Becton, Dickinson and Company); ResMed; Vyaire Medical, Inc.; Thermo Fisher Scientific Inc.; Drägerwerk AG & Co. KGaA; Koninklijke Philips N.V.; Nihon Kohden Corporation; Hamilton Medical; Ambu A/S; Cardinal Health |

Market Driver

Rising Surgical Volume and ICU Admissions

One of the primary drivers of the market is the increasing number of surgical procedures in the U.S., including both inpatient and outpatient operations. Anesthesia masks are indispensable for administering anesthetics during these procedures. According to the American Society of Anesthesiologists, over 40 million anesthetics are administered annually in the U.S. Moreover, with higher ICU admissions for both elective and emergency reasons, the use of artificial ventilation has surged. The aging U.S. population, combined with a rise in obesity, heart disease, and lung infections, has created a consistent need for ventilatory support and anesthesia during complex surgeries.

Market Restraint

Cost Pressure and Reimbursement Challenges

Despite technological advancements, cost containment remains a significant issue for healthcare providers. While reusable masks promise long-term savings, their maintenance and sterilization impose overheads. Conversely, the recurring costs of disposable masks can strain hospital budgets, particularly in facilities with high surgical throughput. Additionally, inconsistent or limited reimbursement for ventilatory support in home care settings can deter adoption, especially among low-income or uninsured patients. These financial constraints can hinder procurement, particularly among small clinics and independent surgery centers.

Market Opportunity

Advancements in Patient-Centric Mask Design for Home Care Use

The increasing shift of healthcare services to home environments opens new avenues for mask manufacturers. Ventilation masks used in home care must combine clinical efficacy with ease of use. Lightweight construction, soft materials to avoid pressure sores, noise reduction features, and compatibility with portable ventilators are now in demand. Companies that innovate in this domain particularly by offering subscription-based mask replacement models or integrating smart features stand to benefit. The aging U.S. population, coupled with growing preference for home-based care, makes this an especially ripe opportunity.

Segmental Analysis

By Mask Type

Disposable masks dominated the U.S. market due to infection control protocols and operational ease.

Disposable anesthesia and ventilation masks have become the default choice across hospitals and ASCs in the U.S. owing to their one-time-use nature, which effectively reduces the risk of infection transmission—an imperative in critical care environments. The pandemic further accelerated this shift, prompting many institutions to replace reusable systems with disposables to streamline workflows and minimize sterilization needs. These masks are often made from lightweight polymers and are compatible with a variety of ventilators and anesthesia systems, making them versatile and cost-effective in high-turnover settings.

On the other hand, reusable masks are projected to grow at the fastest rate, particularly in home healthcare settings and specialty hospitals. Despite the higher upfront cost, these masks offer economic advantages over time and reduce medical waste. Technological advancements such as autoclavable silicone masks and those with interchangeable filters have improved durability and safety. Innovations like anti-fog properties and transparent body materials to improve visibility are gaining traction, particularly for pediatric and geriatric patient groups where observation during ventilation is crucial.

By Application

Operating rooms held the largest market share due to routine use during surgical procedures.

The use of anesthesia masks in operating rooms is standard practice, covering a range of procedures from minor outpatient surgeries to complex inpatient operations. Hospitals continue to invest heavily in advanced anesthesia systems integrated with high-quality masks that ensure precise gas delivery and minimal leakage. Surgeons and anesthesiologists often prefer disposable, pre-lubricated masks for their convenience and comfort, which also enhances compliance and procedural speed.

The fastest-growing segment is the home care setting, where patients with chronic respiratory diseases are increasingly using ventilators at home. This shift is fueled by rising healthcare costs, patient preference for familiar environments, and improved access to telemedicine. Customized masks designed for prolonged wear, reduced skin breakdown, and ease of cleaning are in high demand. Manufacturers offering direct-to-consumer channels and telehealth-compatible devices are gaining a competitive edge. Government programs like Medicare and Medicaid are also expanding reimbursement for home-based ventilation, further propelling this segment.

Country-Level Analysis: United States

The United States presents a unique and highly receptive market for artificial ventilation and anesthesia masks due to its advanced healthcare infrastructure and well-established surgical networks. With over 6,000 hospitals and a rapidly expanding network of ambulatory surgical centers (ASCs), demand remains robust across public and private settings.

Moreover, the home healthcare segment in the U.S. is witnessing significant traction. According to the National Association for Home Care & Hospice (NAHC), over 12 million Americans receive some form of home health care annually. A significant proportion of this population requires respiratory support, fueling demand for user-friendly, non-invasive ventilation solutions.

Notably, states such as California, Texas, and Florida report the highest surgical volume, and are thus major consumers of both disposable and reusable masks. The Northeast and Midwest regions, with higher aging populations and a dense hospital network, contribute significantly to ICU-based ventilatory care. The rapid expansion of ASCs in suburban and rural areas is democratizing access to surgical care and thereby expanding the use of anesthesia masks across demographics.

Some of The Prominent Players in The U.S. Artificial Ventilation And Anesthesia Masks Market Include:

- Medtronic

- BD (Becton, Dickinson and Company)

- ResMed

- Vyaire Medical, Inc.

- Thermo Fisher Scientific Inc.

- Drägerwerk AG & Co. KGaA

- Koninklijke Philips N.V.

- Nihon Kohden Corporation

- Hamilton Medical

- Ambu A/S

- Cardinal Health

Recent Developments

- Medline Industries, a major player in the U.S. medical supply industry, announced in March 2025 the expansion of its disposable mask manufacturing plant in Georgia to address growing demand in hospitals and ASCs.

- In February 2025, Teleflex Incorporated launched a next-generation anesthesia mask with integrated oxygen delivery monitoring sensors, aimed at outpatient and emergency settings.

- Ambu Inc., known for its innovative disposable medical devices, revealed in January 2025 a strategic partnership with several ASCs across the Midwest to supply anesthesia and ventilation masks as part of a bundled care model.

- GE HealthCare, though primarily a ventilator manufacturer, announced in December 2024 that it is investing in a new product line of AI-integrated ventilation masks to work seamlessly with its existing respiratory systems.

- Intersurgical Inc., a specialist in respiratory care, launched a new range of eco-friendly disposable masks in November 2024, aiming to cater to environmentally conscious healthcare providers.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Artificial Ventilation And Anesthesia Masks Market.

By Mask Type

- Disposable Masks

- Reusable Masks

By Application

- Operating Rooms

- ICU

- Emergency Rooms

- Home Care

- ASCs