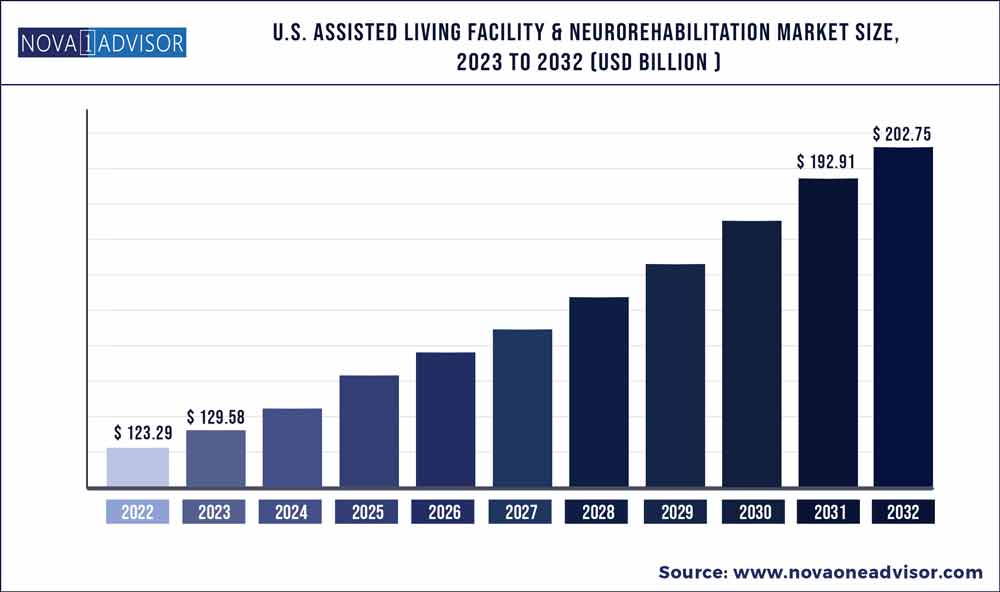

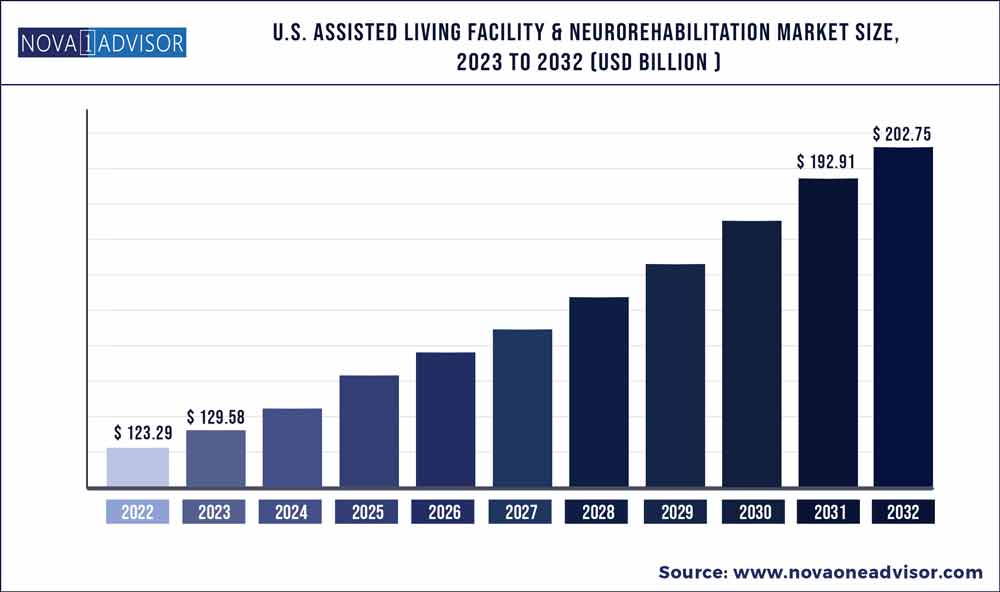

The U.S. assisted living facility and neurorehabilitation market size was exhibited at USD 123.29 billion in 2022 and is projected to hit around USD 202.75 billion by 2032, growing at a CAGR of 5.1% during the forecast period 2023 to 2032.

Key Takeaways:

- Women held a revenue share of around 76.0% in 2022 in the market

- The more than 85 years age segment accounted for the largest share of around 58.0% in 2022 in the market

- Increasing regulations on ALFs to ensure proper care and coordinated services could restrain the growth of the market. In the U.S., state-level regulation is enforced for licensing and certification and may vary in different states

- Strategic initiatives undertaken by various market players are expected to keep growth prospects upbeat in the following years

- Rising incidence of TBI drives the market for neurorehabilitation facilities. These patients are often discharged from ALFs based on the duration of treatment

- Competition in the market is very high and strict regulations and licensing are expected to pose barriers for new entrants.

U.S. Assisted Living Facility & Neurorehabilitation Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 129.58 Billion |

| Market Size by 2032 |

USD 202.75 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 5.1% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Gender, Age, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Centre For Neuro Skills; Mary Lee Foundation; NeuroRestorative; The MENTOR Network; Pate Rehabilitation; ResCare, Inc.; Texas NeuroRehab Center; Texas Rehabilitation and Habilitation Specialists, LLC; Moody Neurorehabilitation Institute |

Individuals residing in Assisted Living Facilities (ALFs), largely senior citizens, seek companionship, security, and assistance with daily activities. An increasing number of Traumatic Brain Injury (TBI) survivors seeking neurorehabilitation and residential care and growing geriatric population are the key factors driving the market for assisted living facility and neurorehabilitation. According to the UN estimates, in the U.S., 1 out 5 will be aged 65 years and above by 2050. The U.S. has a significantly high geriatric population, as advancements in medicine and technology have increased life expectancy.

About 7 out of every 10 people in assisted living facilities depend on their personal wealth or their families to pay for their services. To make such a facility more affordable for low-income individuals, several states are making changes to the regulations of Medicaid applicable to any assisted living facility. An assisted living facility does not abide by federal regulations, therefore, cannot claim Medicare reimbursement. This is the major restraining factor as the cost is one of the primary factors potential tenants take into consideration while forming their decisions. However, this scenario is anticipated to improve as almost 40 states either provide or are planning to partially reimburse these services through Medicaid.

Increased life expectancy, growing income from the senior population, and the desire to live in senior housing communities for better healthcare and quality of life are expected to fuel the market for the assisted living facility and neurorehabilitation over the forecast period. Adults suffering from various mental illnesses require prolonged assistance to sustain in mainstream society. In the U.S., mental illness was considered to be the most expensive disorder. This is expected to render exponential growth in the assisted living facility and neurorehabilitation industry. Many assisted living facilities offer special treatment for the survivors of Traumatic Brain Injury (TBI).

Gender Insights

Women held a revenue share of around 76.0% in 2022 in the market for assisted living facility and neurorehabilitation. Women will also emerge as the fastest-growing segment over the course of the forecast period. On the basis of gender, the market for assisted living facility and neurorehabilitation is segmented into women and men. An assisted living facility is a long-term senior care facility that provides personal care support services, such as social and recreational activities, housekeeping, meals, exercise, and wellness services. The greater life expectancy of women, higher rates of disability and chronic health problems, and lower-income compared to men are some of the major factors behind the dominance of this gender group in any assisted living facility.

Age Insights

The more than 85 years age segment accounted for the largest share of around 58.0% in 2022 in the market for assisted living facility and neurorehabilitation. The segment is also predicted to register the fastest growth rate over the forecast period. On the basis of age, the U.S. Assisted Living Facility and neurorehabilitation market is segmented into more than 85 years, 75 to 84 years, 65 to 74 years, and less than 65 years. According to the data published by the U.S. Department of Health and Human Services in April 2018, the age group of 65 and above increased by 35.0% from 2006 to 51.2 million in 2016 and is projected to reach 99.0 million by 2060.

The population aged 85 years and above is projected to increase from 6.4 million in 2016 to 14.6 million by 2040. The growing geriatric population base demands for more assisted living facility and neurorehabilitation in the region. This is likely to increase the demand for professional caregivers and new assisted living facility offering neurorehabilitation. According to Aging.com, seniors in the U.S. will need about two million housing facilities by 2040 to provide adequate living space for those in need of care.

The concept of continuing care retirement communities has been gaining traction among seniors with stable financial means. Such a facility is known to cater to tenants as young as 50 years of age. The idea behind these communities is that “seniors” do not have to relocate when additional care is needed as time passes. As a result, the less than 65 years segment in the market for assisted living facility and neurorehabilitation is likely to receive a moderate boost over the forecast period.

Country Insights

North America is the largest regional segment for neurorehabilitation devices. The North American market will reach 1.3 billion in 2024. The drivers for the growth of this market are the increasing incidence rate of neurological diseases, the increasing geriatric population, and sophisticated and equipped healthcare infrastructure in comparison with the other regions. The US and Canada are the major contributors to the North American neurorehab devices market. More than 130,000 people die each year in the US due to stroke and it is the leading cause of disability. Also, more than 400,000 Canadians are suffering from long-term stroke disability.

Europe is the second largest market for neurorehabilitation devices after North America. In Europe, stroke is one of the leading causes of deaths. Around 8.2 million people are affected every year according to The European Brain Council. The Europeans have the highest risk of developing multiple sclerosis with almost 0.5 million people suffering from it. According to The European Council Study conducted in 2011, brain disorders, including neurological diseases, resulted in financial burden on the European economy. The major contributors in this region are UK and Germany.

The majority of the key players such as Bioness, Inc., Ekso Bionics Holdings, Inc., Medtronic PLC (US), Bionik Laboratories, Kinova Robotics, and NINET (Canada) are established in North America. The adoption rate for these treatments is expected to witness growth in North America, as the treatments are covered under the medical insurance plans as well as the average out-of-pocket expenses are high in this region.

Asia Pacific market is likely to witness more growth opportunities. This market is estimated to grow at the highest CAGR of around 17% during the forecast period. Although there are no monopolized key players at present, however, increasing the patient base with neurological disorders and improving healthcare infrastructure will create a wide scope for the companies to enter this lucrative market.

Japan has emerged to be an important market for neurorehabilitation devices due to quick acceptance of new technologies mainly because of increasing aging population. Japanese population is ageing faster than any other country in the world. According to 2014 estimates, 26% of Japanese population was of age 65 years or older. Furthermore, stroke is the leading cause of disability in Japan. Therefore, Japanese neurorehabilitation devices market is likely to witness fastest growth in Asia Pacific.

Furthermore, one of the major growth factors for the Asian market is the rising awareness coupled with constantly improving healthcare infrastructure. Owing to the promising market potential, companies are taking up strategic initiatives to expand their operations in this region. For instance, Switzerland-based Hocoma AG has entered the Indian market by associating with Apollo Hospitals to provide neurorehabilitation services to the patient base in India.

Some of the prominent players in the U.S. Assisted Living Facility & Neurorehabilitation Market include:

- Centre For Neuro Skills

- Mary Lee Foundation

- NeuroRestorative

- The MENTOR Network

- Pate Rehabilitation

- ResCare, Inc.

- Texas NeuroRehab Center

- Texas Rehabilitation and Habilitation Specialists, LLC

- Moody Neurorehabilitation Institute

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Assisted Living Facility & Neurorehabilitation market.

By Gender

By Age

- More than 85 years

- 75-84 years

- 65-74 years

- Less than 65 years

By Country

- West

- South

- Midwest

- Northeast