U.S. Banking Solutions For Healthcare Payers And Providers Market Size and Growth

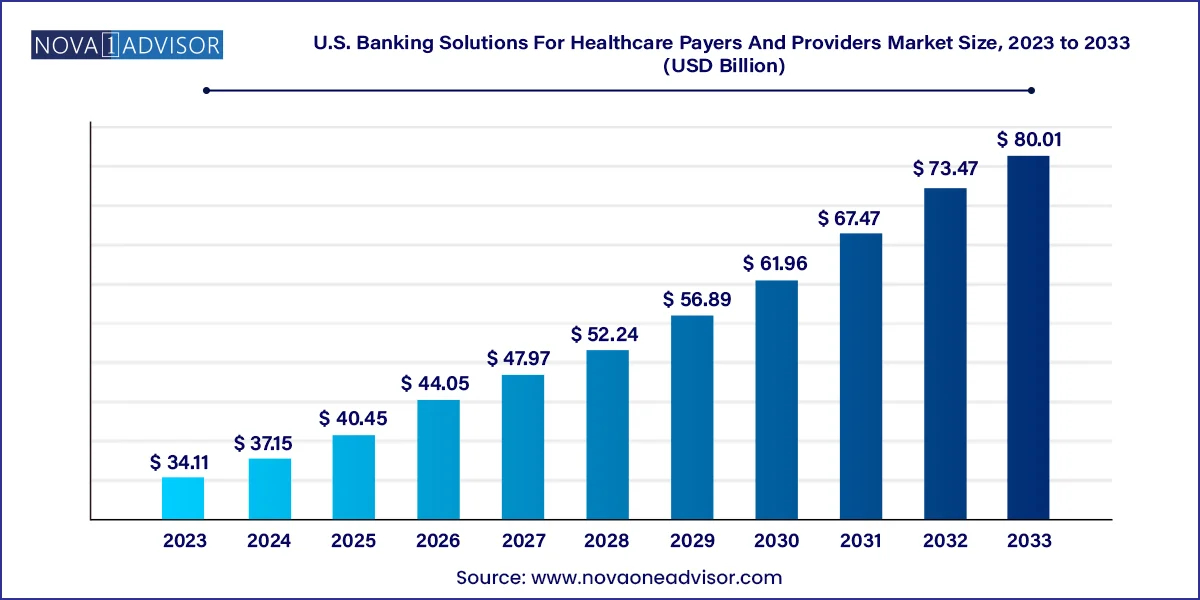

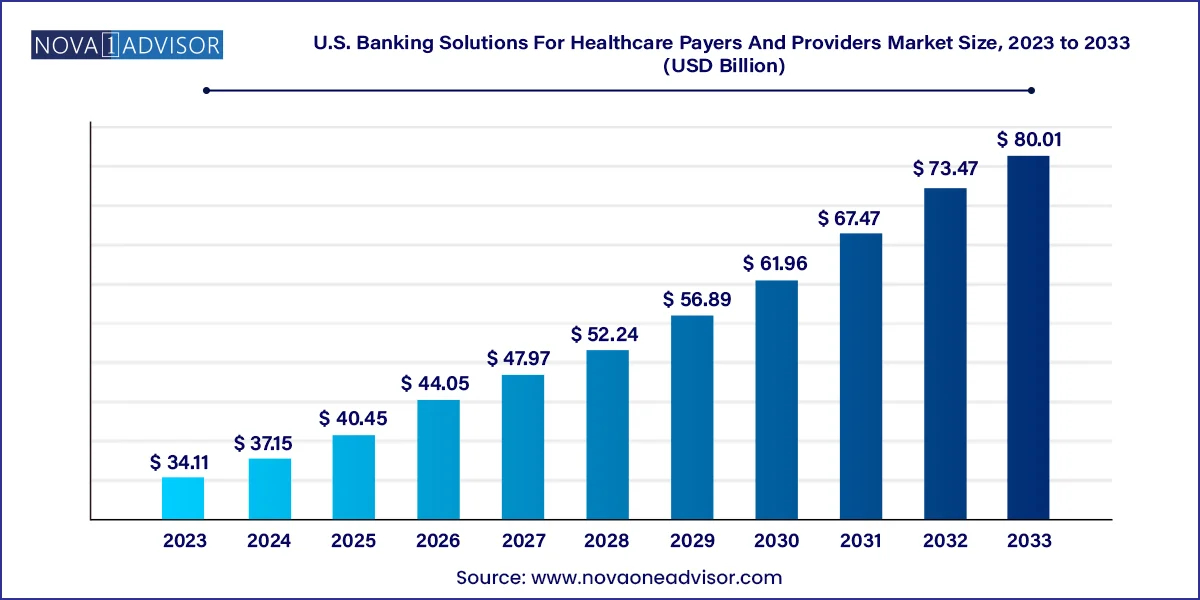

The U.S. banking solutions for healthcare payers and providers market size was valued at USD 34.11 billion in 2023 and is anticipated to reach around USD 80.01 billion by 2033, growing at a CAGR of 8.9% from 2024 to 2033.

U.S. Banking Solutions For Healthcare Payers And Providers Market Key Takeaways

- The services segment dominated the market and accounted for the largest share of 73.18% in 2023 and is anticipated to witness fastest growth over the forecast period.

- The software and hardware devices segment is expected to grow significantly over the forecast period.

- The financial management segment dominated the market growth in 2023, with a share of 44.13%.

- The analytics segment is anticipated to showcase the fastest growth from 2024 to 2033.

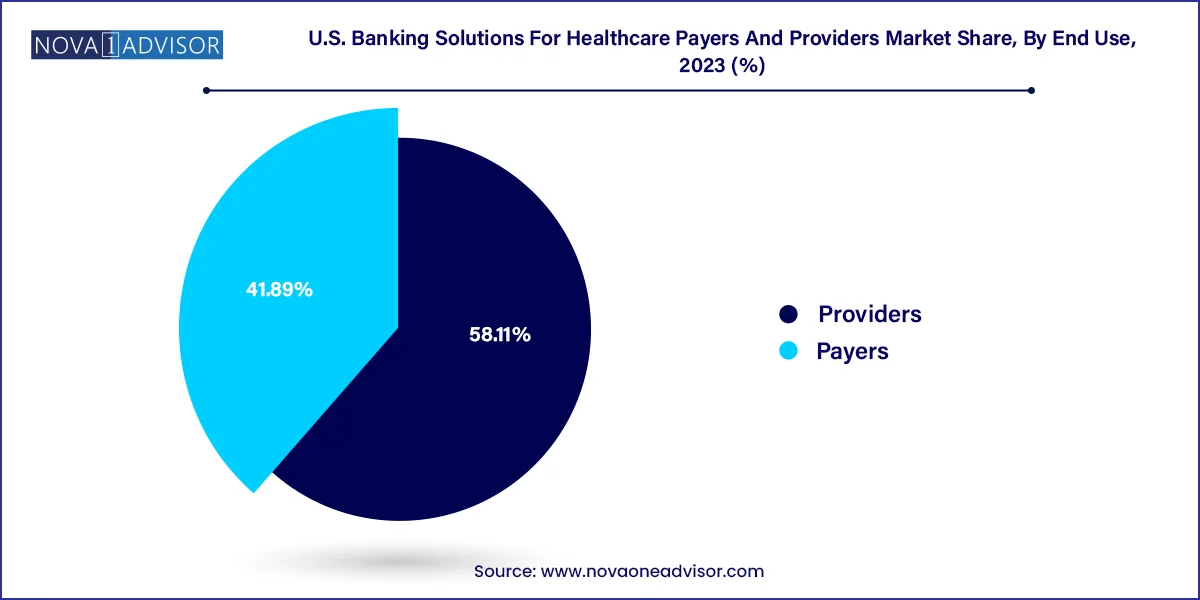

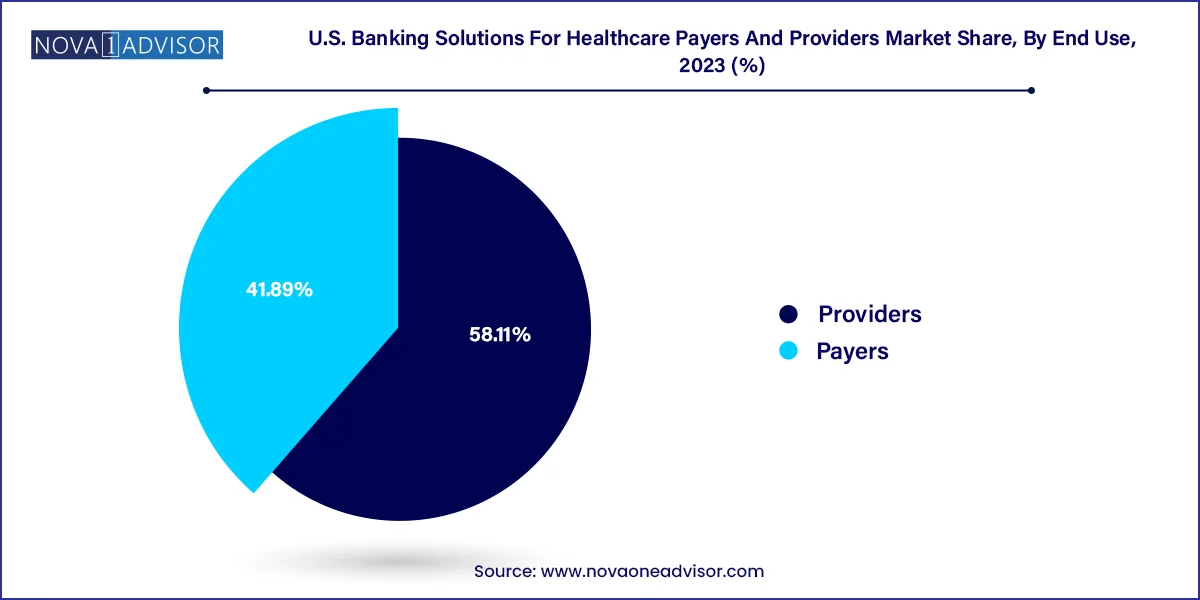

- The providers segment dominated the market with a market share of 58.11% in 2023.

- The payers segment is anticipated to witness fastest growth from 2024 to 2033.

Market Overview

The U.S. banking solutions market for healthcare payers and providers is evolving rapidly in response to the growing complexities of healthcare financing, regulatory reforms, and the digital transformation of financial services. As healthcare systems grapple with rising costs, delayed reimbursements, and revenue cycle inefficiencies, financial institutions are increasingly stepping in to offer specialized banking and financial services tailored for healthcare organizations. This intersection of healthcare and banking represents a unique convergence of industries, where tailored financial solutions enable more efficient, secure, and strategic management of funds across provider and payer landscapes.

Healthcare payers (such as insurance companies and government-sponsored health plans) and providers (hospitals, clinics, and physician groups) face a common set of financial challenges cash flow uncertainty, billing and claims delays, administrative overhead, and the rising burden of patient financing. As a result, demand is rising for robust banking services that include credit and financing solutions, liquidity management, integrated revenue cycle services, treasury and cash flow management tools, and advanced analytics.

Leading U.S. banks and fintech firms are addressing these needs by developing industry-specific platforms that go beyond traditional banking. These platforms often integrate with electronic health records (EHRs), patient management systems, and billing software to streamline workflows. The emergence of healthcare-specific fintech partnerships, blockchain-driven revenue cycle automation, and AI-powered financial planning tools further underscore the strategic importance of banking innovations in this vertical.

With the U.S. healthcare expenditure exceeding $4.5 trillion annually and administrative costs constituting a significant share of that spending, the financial optimization of healthcare operations has become both a necessity and a growth opportunity. As regulations like the No Surprises Act and price transparency laws take effect, the pressure on payers and providers to adopt efficient financial practices supported by modern banking tools continues to mount.

Major Trends in the Market

-

Rise of Embedded Finance in Healthcare: Banking functionalities such as credit scoring, payment processing, and financing are increasingly being embedded within healthcare management software.

-

Digital-First Banking Platforms for Providers: Hospitals and clinics are shifting to digital treasury and receivables platforms that automate receivables, manage payables, and reconcile claims.

-

Expansion of Patient Financial Engagement Tools: Banks are offering platforms that help providers extend flexible payment plans to patients, improving collections and satisfaction.

-

Use of Artificial Intelligence in Revenue Cycle Banking: AI algorithms are being deployed to forecast cash flows, automate denial management, and streamline payor reimbursements.

-

Increased Collaboration Between Banks and Health Fintechs: Strategic partnerships are forming between traditional banks and digital health startups to build healthcare-centric financial ecosystems.

-

Blockchain-Based Payment Settlements: Emerging technologies like blockchain are being piloted for real-time provider-payer transactions and audit-proof settlement systems.

-

Compliance-Driven Financial Innovation: Banks are launching compliance-ready financial solutions aligned with HIPAA, HITECH, and price transparency mandates.

U.S. Banking Solutions For Healthcare Payers And Providers Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 37.15 Billion |

| Market Size by 2033 |

USD 80.01 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.9% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Solution, application, end use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

PNC Bank; Bank of America; JP Morgan Chase; US Bank; Wells Fargo; KeyBank; Fifth Third Bank; Truist Bank; Citizens Bank; Regions Bank; Comerica Bank; M&T Bank; Commerce Bancshares, Inc. |

Key Market Driver

Growing Complexity of Healthcare Revenue Cycles and Need for Financial Modernization

One of the most significant drivers in the U.S. market is the increasing complexity of healthcare revenue cycles and the urgent need for financial modernization among both payers and providers. The traditional revenue cycle in healthcare is riddled with inefficiencies—from claims submission and adjudication to reimbursement and patient billing. These inefficiencies not only delay revenue realization but also contribute to administrative costs, which account for approximately 25% of total U.S. healthcare spending.

Modern banking solutions offer a remedy by automating cash flows, integrating directly into EHRs and billing systems, and providing real-time analytics that help healthcare organizations forecast revenues, manage operating costs, and ensure compliance. For instance, providers are now using treasury management platforms with auto-reconciliation features to reduce manual processing of thousands of payer transactions daily. Likewise, payers leverage bank-supported analytics platforms to predict fraud, optimize claims processing, and facilitate faster fund disbursement.

As value-based care models proliferate and patient out-of-pocket expenses rise, the pressure on financial efficiency intensifies. Banks that can offer tailored, tech-integrated financial solutions are well-positioned to thrive in this growing ecosystem.

Key Market Restraint

High Cost of Integration and Resistance to Change

Despite the clear benefits, the adoption of advanced banking solutions in the healthcare domain is often hindered by the high cost of integration and organizational resistance to change. Many healthcare providers, especially smaller clinics and community hospitals, operate on tight margins and are wary of investing in new banking technologies that require upfront capital, employee training, and process overhauls.

Additionally, healthcare systems often rely on legacy IT infrastructure that lacks compatibility with modern financial platforms. The complexity of integrating banking solutions with health information systems (HIS), billing software, and patient engagement platforms can lead to costly delays and operational disruptions. Moreover, decision-makers in healthcare organizations may be hesitant to overhaul financial workflows that, despite being inefficient, are familiar and deeply entrenched.

This resistance is compounded by concerns over cybersecurity and compliance, especially when introducing third-party banking systems into health environments governed by strict regulations such as HIPAA. As a result, adoption may be slower than expected, especially in smaller healthcare settings.

Key Market Opportunity

Expansion of Banking Services for Patient Financing and Cost Transparency

A major growth opportunity lies in the development of patient-centric financial tools that help healthcare providers manage the growing burden of patient billing and financing. With high-deductible health plans becoming more common, patients are bearing a larger share of healthcare costs, making patient collections a critical issue for providers. According to industry surveys, nearly two-thirds of providers cite patient collections as a top financial concern.

Banks are uniquely positioned to bridge this gap by offering point-of-care financing, pre-service price estimates, and easy-to-use patient billing platforms. For instance, a healthcare provider can partner with a bank to offer zero-interest payment plans that are integrated into the appointment scheduling and billing systems. These offerings not only improve collections but also enhance the patient experience, particularly in an era where financial stress can lead to care avoidance.

There is also potential for banks to develop solutions aligned with new government mandates on cost transparency. Tools that integrate banking and billing functions with real-time cost estimation could help patients make informed decisions, fostering trust while ensuring providers maintain financial viability.

U.S. Banking Solutions For Healthcare Payers And Providers Market Solution Insights

Services segment dominated the market and continues to be the primary contributor to revenue generation. Banking services including treasury management, fund disbursement, credit facilities, fraud detection, and payment processing are critical for both payers and providers. These services enable healthcare entities to manage large volumes of transactions efficiently, especially in complex payer ecosystems where reimbursements span multiple stages. Banks such as JPMorgan Chase, Wells Fargo, and U.S. Bank offer specialized healthcare divisions providing such services. For example, JPMorgan’s InstaMed platform offers comprehensive payment and billing services tailored for healthcare, streamlining both provider and patient interactions.

Meanwhile, software and hardware segment is the fastest-growing, driven by the digital transformation of healthcare financial management. Software solutions include platforms for integrated revenue cycle banking, fraud analytics, digital invoicing, and real-time fund tracking. Hardware components, while smaller in market size, include secure banking terminals and point-of-service equipment used in healthcare settings. Cloud-based financial platforms, open banking APIs, and mobile applications for transaction management are expanding rapidly, especially as remote healthcare and digital health solutions scale.

U.S. Banking Solutions For Healthcare Payers And Providers Market Application Insights

Financial management emerged as the leading application segment, supporting critical functions such as liquidity management, revenue forecasting, and expense control for providers and payers. Hospitals and insurers increasingly rely on banking partners to optimize financial operations through centralized cash flow platforms. These platforms consolidate payer reimbursements, automate accounts receivable, and help identify payment trends to reduce errors. The demand is especially strong among large hospital networks, where managing multi-million-dollar receivables daily requires precision and automation that traditional processes cannot offer.

Analytics is the fastest-growing application area due to the rising need for data-driven decision-making in healthcare finance. Advanced analytics tools help track and forecast reimbursement timelines, detect financial leakage, and predict patient payment behaviors. AI-powered analytics are being integrated with banking platforms to help CFOs and revenue cycle managers make informed, strategic decisions. These tools are also being used by payers to identify potential fraud and optimize claims processing cycles, thus enhancing operational efficiency and reducing risk.

U.S. Banking Solutions For Healthcare Payers And Providers Market End Use Insights

Providers held the largest market share due to their operational dependency on diverse banking solutions. Hospitals, clinics, ambulatory surgery centers, and other providers require daily financial support for billing, payroll, procurement, reimbursements, and patient financing. Given the high volume of transactions, frequent payment delays, and regulatory requirements, providers are investing in specialized banking partnerships to stabilize financial operations. Banks often offer these clients dedicated relationship managers and customized digital banking platforms, particularly those with multi-site or system-wide footprints.

Payers segment is witnessing faster growth, propelled by their increasing use of fintech-enabled solutions to manage claims, settlements, and compliance. Health insurers, third-party administrators (TPAs), and government health programs like Medicaid and Medicare are turning to advanced banking platforms to streamline fund disbursements and manage large-scale transactions securely. The rise in data interoperability requirements, combined with growing enrollment in private and public health plans, is compelling payers to adopt more agile, secure, and integrated financial solutions.

Country-Level Analysis

The U.S. represents the most mature and advanced market for banking solutions tailored to healthcare payers and providers. A confluence of factors including high healthcare spending, regulatory complexity, and a push toward digitization has catalyzed the development of sophisticated financial products and platforms. Leading U.S. banks have established dedicated healthcare verticals offering services such as healthcare treasury management, patient financing programs, insurance claim reconciliation, and payment automation tools.

Furthermore, federal and state-level regulatory mandates have heightened the need for compliance-centric financial tools. Laws such as the 21st Century Cures Act and the Transparency in Coverage Rule are creating opportunities for banks to offer real-time cost estimation and automated billing integration. Fintech firms, in collaboration with banks, are also introducing AI and blockchain to support real-time payments and fraud prevention, addressing growing concerns around financial security.

Cities like New York, Chicago, and San Francisco are leading in innovation, with numerous healthcare startups partnering with financial institutions. Additionally, rural and underserved areas are beginning to adopt mobile-first financial solutions, enabling providers to better manage their finances and enhance patient engagement.

U.S. Banking Solutions For Healthcare Payers And Providers Market Top Key Companies:

- PNC Bank

- Bank of America

- JP Morgan Chase

- US Bank

- Wells Fargo

- KeyBank

- Fifth Third Bank

- Truist Bank

- Citizens Bank

- Regions Bank

- Comerica Bank

- M&T Bank

- Commerce Bancshares, Inc.

U.S. Banking Solutions For Healthcare Payers And Providers Market Recent Developments

-

In February 2025, JPMorgan Chase’s InstaMed division launched a new patient financing feature integrated into its healthcare payment platform, enabling flexible payment plans directly through EHR systems.

-

Bank of America, in December 2024, announced a strategic partnership with a major U.S. hospital network to deploy AI-powered revenue cycle management tools that connect directly to the bank’s treasury services.

-

In October 2024, Wells Fargo Healthcare Group introduced a blockchain pilot for real-time payer-provider settlements, aimed at reducing fraud and administrative costs across large-scale insurance claims.

-

U.S. Bank partnered with Change Healthcare in September 2024 to launch a digital invoicing and remittance platform designed for multi-site hospital systems.

U.S. Banking Solutions For Healthcare Payers And Providers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Banking Solutions For Healthcare Payers And Providers market.

By Solution

- Services

- Software and Hardware

By Application Area

- Credit & Financing

- Financial Management

- Analytics

- Others

By End Use