U.S. Battery Energy Storage System Market Size and Forecast 2025 to 2034

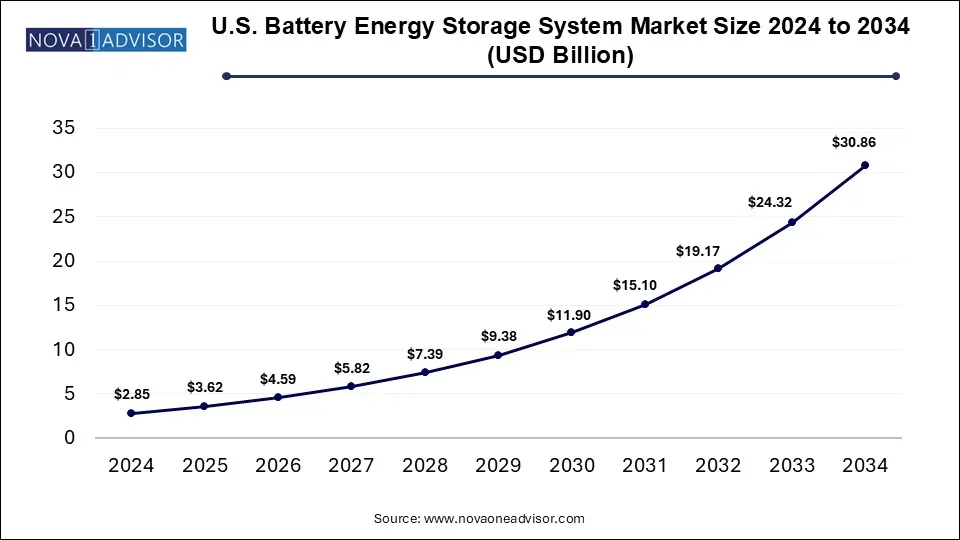

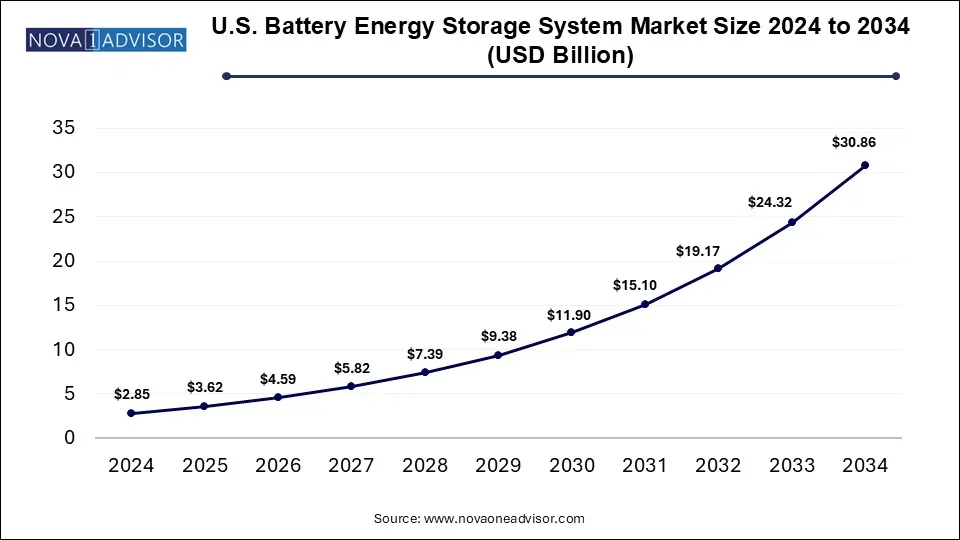

The U.S. battery energy storage system market size was valued at USD 2.85 billion in 2024 and is anticipated to reach around USD 30.86 billion by 2034, growing at a CAGR of 26.9% from 2025 to 2034. The growth of the U.S. battery energy storage system market is driven by increased renewable energy integration, reduced costs of battery technologies, and focus on grid modernization. Government initiatives for energy independence and enhancing security are expanding the market potential.

U.S. Battery Energy Storage System Market Key Takeaways

- Based on product, the lithium-ion battery segment accounted for a revenue of 55% in 2024.

- The lead acid battery product segment occupied a significant revenue share of 19% in 2024.

- The flywheel battery product segment is expected to witness a significant CAGR of 34.4% over the forecast period.

- Based on application, the grid storage segment accounted for the largest revenue share of more than 45% in 2024.

- The telecom segment was valued at USD 24.62 million in 2024.

- The UPS application segment is anticipated to witness a CAGR of 31.4% from 2025 to 2034.

- The others segment is expected to witness a significant CAGR of 29.5% over the forecast period.

The U.S. Battery Energy Storage System (BESS) market is at the epicenter of the country’s clean energy transformation. As the United States accelerates its decarbonization strategy, the integration of renewable energy sources—particularly solar and wind—into the power grid necessitates robust, scalable, and efficient energy storage solutions. Battery Energy Storage Systems play a critical role in enhancing grid stability, providing backup power, managing demand fluctuations, and enabling the large-scale deployment of intermittent renewable resources.

The past decade has witnessed a paradigm shift in energy generation, with utility companies, commercial enterprises, and even residential users increasingly investing in energy storage infrastructure. In response, the BESS market in the U.S. has evolved from a niche sector into a multi-billion-dollar industry. Lithium-ion batteries, in particular, have emerged as the workhorse of this revolution due to their high energy density, scalability, and declining cost trajectory.

Federal and state-level policy support—ranging from tax incentives to storage mandates and clean energy targets—has further bolstered market adoption. For instance, the Inflation Reduction Act (IRA) of 2022 introduced standalone storage tax credits, providing a significant financial incentive for developers to invest in battery systems independent of solar or wind assets. This policy change alone has stimulated a new wave of project development across the country.

Additionally, the U.S. Department of Energy’s Long Duration Storage Shot initiative aims to reduce costs by 90% for grid-scale storage lasting more than 10 hours by 2030, reflecting the government’s commitment to energy resilience and innovation. As the grid becomes more digitized, distributed, and decarbonized, battery energy storage systems are poised to become indispensable to the country’s energy future.

Major Trends in the Market

-

Surging demand for renewable integration: Utilities are rapidly deploying BESS to manage intermittency in solar and wind generation.

-

Declining lithium-ion battery costs: Economies of scale, improved supply chains, and technological advancements are making lithium-ion systems more affordable.

-

Hybrid power plant development: Increasing installation of co-located solar + storage and wind + storage facilities to maximize value and grid contribution.

-

Emergence of Virtual Power Plants (VPPs): Aggregated BESS units are being digitally connected to operate as flexible grid assets.

-

Focus on long-duration storage technologies: Investments are growing in alternatives to lithium-ion, such as flow batteries and compressed air storage, to support multi-day resilience.

-

Vehicle-to-grid (V2G) innovation: Electric vehicles are being piloted as mobile BESS assets capable of supplying power back to the grid.

-

Resilience planning post-natural disasters: Battery storage is being adopted in wildfire-prone or hurricane-affected regions as backup for critical infrastructure.

Artificial intelligence integration in the U.S. battery energy storage systems can potentially enhance their performance and efficiency by optimizing battery usage in real-time by analyzing energy consumption patterns, further preventing over-exertion or overheating. Researchers are implementing AI tools for enhancing battery materials and designs. AI-powered battery energy storage systems can assist in grid stabilization by absorbing excess power during periods of high renewable energy generation and deploy as required. AI-based Battery Management Systems (BMS) can offer meticulous estimations of state-of-charge (SoC) and state-of-health (SoH), leading to improved battery energy management.

For instance, in January 2025, Enfinity Global Inc., a leading renewable energy company, declared the expansion of its battery energy storage systems (BESS) portfolio with two new projects expected to commence construction in the second and fourth quarters of 2025 in Texas. The projects will have a total power capacity of 425 MW and are being deployed with company’s dedication towards innovative energy solutions to meet the growing load demands in AI and manufacturing.

U.S. Battery Energy Storage System Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 3.62 Billion |

| Market Size by 2034 |

USD 30.86 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 26.9% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Application, Product |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

General Electric; Hitachi Ltd.; GS YuasaBeckett Energy Systems; Exide Technologies; Samsung SDI; Enersys; AES Energy Storage; Imergy Power Systems Inc.; Altair Nanotechnologies Inc. |

Key Market Driver: Decentralization of the Power Grid and Renewable Penetration

One of the most significant drivers propelling the U.S. Battery Energy Storage System market is the decentralization of the electric grid, combined with rising renewable energy penetration. Traditional centralized power systems are giving way to more distributed models where energy is generated closer to the point of use such as in homes, businesses, or community solar installations. However, renewable energy sources like solar and wind are inherently variable and unpredictable.

Battery energy storage provides a critical buffer by absorbing excess generation during peak production periods and releasing it during demand surges or low-output intervals. In California, for instance, battery installations in 2024 exceeded 5 GW in capacity, helping to mitigate peak demand pressures during record summer heatwaves. The proliferation of microgrids and net-zero buildings is also driving demand for onsite storage solutions, creating a cascading impact across residential, commercial, and utility-scale segments.

Moreover, with over 50% of the U.S. grid’s new capacity additions expected to come from renewables through 2034, the need for stable, flexible, and intelligent storage systems will only intensify. This transition not only supports carbon reduction goals but also builds resilience against outages, thereby amplifying the role of BESS in the national energy portfolio.

Key Market Restraint: Supply Chain and Critical Mineral Dependence

Despite the booming growth, a key restraint facing the U.S. battery energy storage market is its heavy reliance on imported raw materials and a complex global supply chain. Lithium, cobalt, nickel, and graphite—critical components of most battery chemistries—are largely sourced from overseas, with processing often dominated by China. This concentration poses geopolitical, economic, and environmental risks.

For example, fluctuations in lithium carbonate prices over the past two years have led to unpredictable swings in project costs. Additionally, ethical concerns over cobalt mining in countries like the Democratic Republic of Congo (DRC) have prompted scrutiny from both regulators and consumers. These supply chain bottlenecks not only threaten cost stability but also delay project timelines.

To counteract this, the U.S. government is promoting domestic mining and processing initiatives through the Department of Energy’s Battery Materials Initiative. However, building a self-sufficient supply chain is a long-term endeavor and does not alleviate short-term dependencies, making the market vulnerable to material shortages and price volatility.

Key Market Opportunity: Electrification of Transportation and Grid Synergies

An unprecedented opportunity lies in the convergence of electric vehicle (EV) adoption and stationary battery energy storage systems. As EV sales in the U.S. continue to soar—crossing 1.2 million units in 2024—the number of high-capacity lithium-ion batteries entering circulation is increasing dramatically. These EV batteries, at the end of their vehicular life, can be repurposed for grid storage, giving rise to the second-life battery market.

Furthermore, bidirectional charging infrastructure and vehicle-to-grid (V2G) capabilities allow EVs to not only consume energy but also act as mobile storage units that support grid reliability. Pilot programs in states like California, New York, and Texas are already demonstrating how EV fleets can provide ancillary services like frequency regulation and demand response.

The electrification of public transport systems, school buses, and delivery fleets provides a parallel opportunity to integrate large-scale battery storage infrastructure into depots, terminals, and commercial hubs. With supportive regulatory policies, utilities and private developers alike can harness transportation-linked BESS assets as grid stabilizers and backup sources, unlocking new revenue streams and performance metrics.

U.S. Battery Energy Storage System Market Report Segmentation Insights

Product Insights

Based on product, the lithium-ion battery segment accounted for a revenue of 55% in 2024. Their widespread adoption is fueled by favorable energy density, cycle life, response time, and declining manufacturing costs. Lithium-ion chemistries — particularly lithium iron phosphate (LFP) are widely preferred for both grid storage and EV-related applications. Utility-scale projects in California and Nevada have consistently favored lithium-ion solutions, with companies like Tesla and Fluence deploying massive installations in the hundreds of megawatts.

In addition to performance benefits, strong supply chain ecosystems and battery management system (BMS) innovations have enhanced the safety and reliability of lithium-ion technologies. With the IRA extending tax credits to standalone battery installations, the economic case for lithium-ion has further strengthened across commercial and residential markets.

Flywheel batteries, while currently niche, represent the fastest-growing product segment. These mechanical energy storage systems offer unparalleled power density and response speed, making them ideal for applications requiring rapid charge-discharge cycles, such as frequency regulation, UPS backup, and voltage stabilization. Recent technological advancements in magnetic bearings, rotor materials, and vacuum containment have improved the energy efficiency and lifecycle of flywheel systems. Their ability to operate in extreme conditions and minimal maintenance requirements are making them attractive for critical infrastructure and data centers.

Application Insights

Based on application, the grid storage segment accounted for the largest revenue share of more than 45% in 2024. driven by increasing renewable energy installations and grid modernization programs. Utility-scale storage installations have surged as system operators aim to reduce reliance on peaker plants, improve frequency regulation, and store solar/wind power for nighttime or overcast periods. In states like California, Texas, and Arizona, grid-connected battery farms have become key components of renewable integration strategies.

The grid storage segment is also benefiting from capacity auctions, frequency control markets, and demand-side participation programs that incentivize storage deployment. Advanced analytics and AI integration have further optimized load balancing and dispatch, making BESS an economical choice for utilities.

Transportation, on the other hand, is the fastest-growing application segment. The explosive rise in electric vehicle sales, including passenger cars, buses, and commercial fleets, is creating a parallel market for onboard and depot-based battery storage systems. Moreover, the federal government’s push for a national EV charging network, combined with private investments from automakers like Tesla and Ford, is catalyzing the demand for high-capacity storage installations that can support ultra-fast charging stations and manage peak loads efficiently

Country-Level Analysis

The United States has solidified its position as a global leader in battery energy storage system deployment, accounting for a substantial portion of new installations worldwide. Key states driving this momentum include California, Texas, Arizona, and New York. California alone represented nearly 40% of U.S. grid-scale storage additions in 2023, with over 10 GW of operational and planned projects aimed at supporting its 100% clean energy goals by 2045.

Texas, driven by a deregulated energy market and a booming renewable pipeline, has witnessed a surge in merchant storage deployments that monetize arbitrage opportunities and ancillary services. Meanwhile, New York’s aggressive climate legislation and storage targets (6 GW by 2030) are fueling investments in distributed and community-based BESS projects.

The federal government is also playing an active role. The U.S. Department of Energy is funding large-scale storage demonstrations through programs such as the Energy Storage Grand Challenge, while the Federal Energy Regulatory Commission (FERC) has enacted policies to enable fair compensation for storage in wholesale markets (notably FERC Order 841). These actions have created a favorable policy environment for investors, developers, and utilities alike.

U.S. Battery Energy Storage System Market Top Key Companies:

- General Electric

- Hitachi Ltd.

- GS YuasaBeckett Energy Systems

- Exide Technologies

- Samsung SDI

- Enersys

- AES Energy Storage

- Imergy Power Systems Inc.

- Altair Nanotechnologies Inc.

Recent Developments

- In July 2025, JinkoSolar Holding Co., Ltd., successfully commissioned 21.6 MWh Energy Storage Systems for Distributed Energy Infrastructure (DEI), further advancing reliable, clean and dispatchable energy in Massachusetts through the state's Solar Massachusetts Renewable Target (SMART) program.

- In May 2025, Georgia Power announced advancements in projects in Bibb, Lowndes, Floyd and Cherokee counties located across Georgia with the construction now underway on 765-megawatts (MW) of new battery energy storage systems (BESS) which was authorized by the Georgia Public Service Commission (PSC) through the Integrated Resource Plan (IRP) process.

- In May 2025, CVE North America (CVE), began construction of its solar and battery energy storage system (BESS), featuring a 7 megawatt (MW) solar array paired with a 13.6 megawatt-hour (MWh) BESS at its Riverhead Project in New York State.

- In March 2025, Jupiter Power LLC, successfully secured $286 million in project financing to fund the construction of two standalone battery energy storage systems (BESS) — Tibbits in Michigan, and Tidwell Prairie in Texas with a combined capacity of 300 MW/800 MWh (megawatt hours).

U.S. Battery Energy Storage System Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Battery Energy Storage System market.

By Application

- Transportation

- Grid Storage

- UPS

- Telecom

- Others

By Product

- Flywheel Battery

- Lead Acid Battery

- Lithium-ion Battery

- Others