U.S. Behavioral Health EHR Market Size and Growth

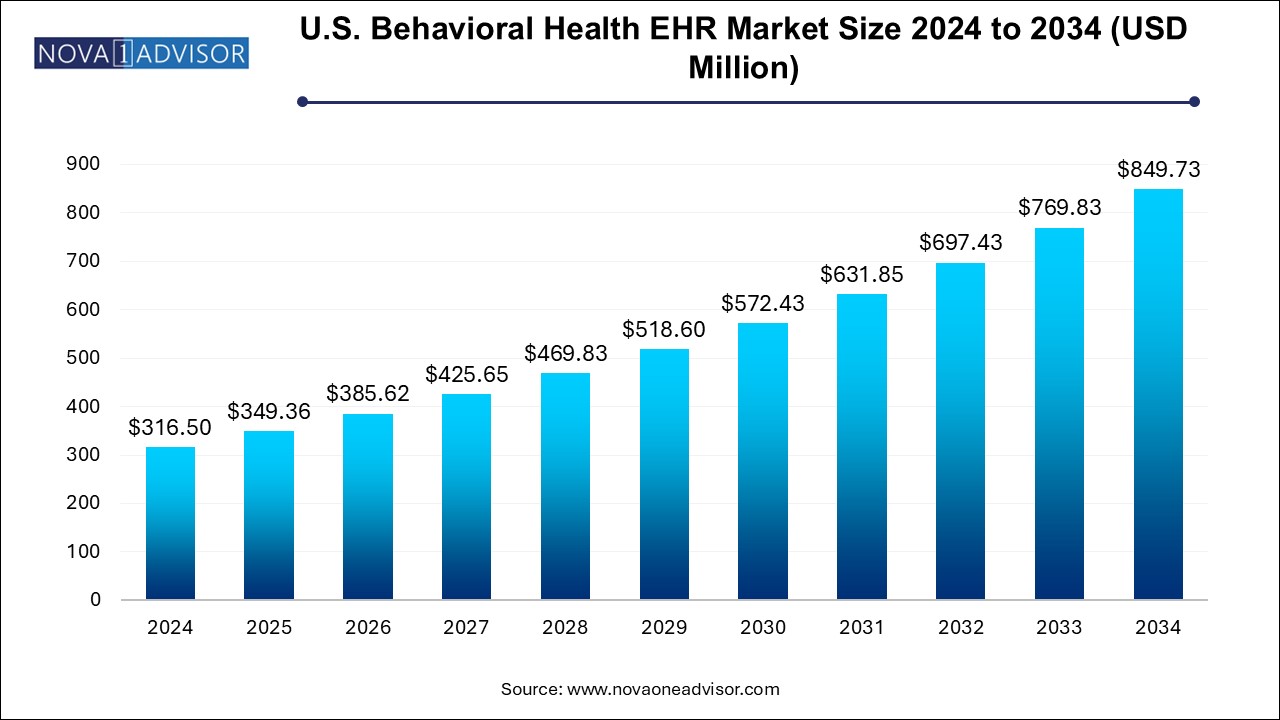

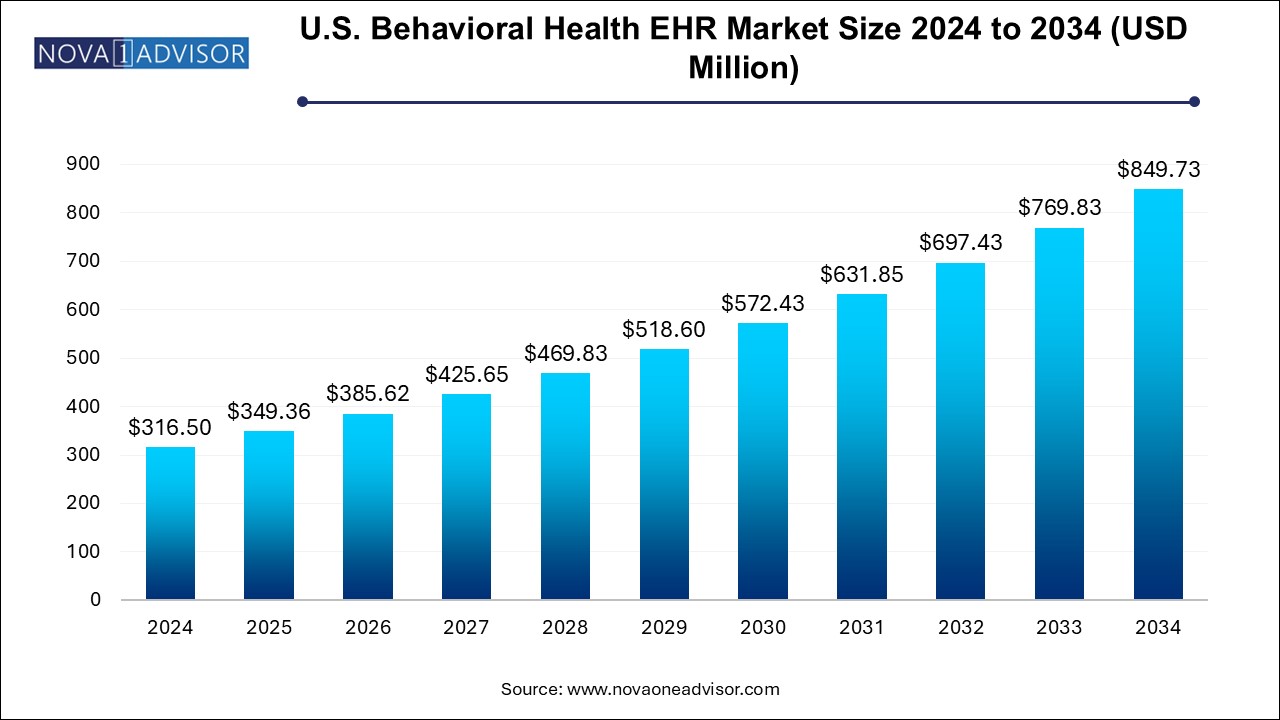

The U.S. behavioral health EHR market size was exhibited at USD 316.5 million in 2024 and is projected to hit around USD 849.73 million by 2034, growing at a CAGR of 10.38% during the forecast period 2025 to 2034.

U.S. Behavioral Health EHR Market Key Takeaways:

- Based on product, the web/cloud-based EHR segment held the largest revenue share of over 84.0% in 2024.

- Based on end use, the private segment held the largest revenue share in 2024 and is anticipated to grow fastest from 2025 to 2034.

Market Overview

The U.S. Behavioral Health Electronic Health Records (EHR) Market represents a rapidly evolving segment of the health information technology landscape, shaped by a growing national focus on mental health, substance abuse treatment, and integrated care delivery. Behavioral health EHRs are specialized digital platforms tailored to the needs of mental health providers, therapists, counselors, and psychiatric facilities, supporting documentation, care coordination, compliance, and billing in an increasingly regulated and value-driven healthcare environment.

Unlike general-purpose EHRs, behavioral health systems are designed with features that address the unique workflow challenges associated with mental health care—such as longitudinal therapy notes, group session documentation, complex privacy requirements (42 CFR Part 2), and interoperability with primary care and social services systems. As the demand for mental and behavioral health services surges in the U.S.—fueled by rising anxiety, depression, opioid addiction, and suicide rates—health IT vendors and policymakers are prioritizing digital infrastructure to support a more connected and data-driven mental health ecosystem.

Federal incentives, including those provided under the HITECH Act, Medicaid EHR Incentive Program, and more recently, SAMHSA’s support for Certified Behavioral Health Clinics (CCBHCs), are boosting EHR adoption among behavioral health providers who were previously under-digitized. Additionally, the shift toward value-based reimbursement, telebehavioral health, and population health management has made behavioral health EHRs not just a regulatory requirement, but a clinical and operational necessity. The U.S. market is expected to see steady and sustained growth through 2034, as behavioral health becomes fully integrated into national healthcare reform efforts.

Major Trends in the Market

-

Rapid Growth of Cloud-Based Behavioral Health EHR Systems Among Private Practices

-

Integration of Behavioral Health and Primary Care Data Through Interoperable EHR Platforms

-

Increased Demand for Telehealth-Ready EHR Features in Response to Virtual Mental Health Visits

-

Specialized EHR Modules for Substance Use Disorder (SUD) Treatment and Medication-Assisted Therapy (MAT)

-

Rising Use of AI-Powered Clinical Decision Support Tools for Psychiatric Diagnoses

-

Compliance-Driven Demand for Advanced Documentation, Billing, and e-Prescription Features

-

Widespread Adoption of Mobile EHR Applications for Community and Field-Based Mental Health Providers

-

Value-Based Reimbursement Driving Analytics and Outcome Reporting Tools Integration

-

Expansion of Behavioral Health IT Funding Under Federal Programs (e.g., SAMHSA, HRSA)

-

M&A Activity Among EHR Vendors to Consolidate Capabilities and Expand Market Reach

Report Scope of U.S. Behavioral Health EHR Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 349.36 Million |

| Market Size by 2034 |

USD 849.73 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 10.38% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Core Solutions, Inc.; Meditab; Holmusk; Netsmart Technologies, Inc.; Qualtrics; Welligent; Valant; TherapyNotes, LLC.; NextStep Solutions; Cerner Corporation (Oracle); TheraNest; ICANotes; Streamline Healthcare Solutions; Practice Fusion, Inc.; Opus Behavioral Health Inc. |

Market Driver: Expanding Demand for Behavioral Health Services in the U.S.

A major driver accelerating the U.S. behavioral health EHR market is the unprecedented rise in demand for mental health and substance abuse services across the country. The COVID-19 pandemic and its aftermath catalyzed a mental health crisis, with the CDC reporting substantial increases in depression, anxiety, and substance use—especially among adolescents, frontline workers, and underserved populations. The National Institute of Mental Health (NIMH) estimates that nearly 1 in 5 U.S. adults lives with a mental illness, with conditions ranging from anxiety and PTSD to bipolar disorder and schizophrenia.

This surge in behavioral health cases has created immense pressure on outpatient clinics, community health centers, school-based mental health programs, and inpatient psychiatric facilities. EHRs customized for behavioral health providers enable better care coordination, regulatory compliance, and outcomes monitoring, particularly in an environment increasingly focused on integrated care and social determinants of health. With Medicaid expansion and parity laws extending mental health coverage, behavioral health EHRs are vital tools for scaling care delivery and ensuring continuity.

Market Restraint: Limited IT Budgets Among Small Behavioral Health Providers

One of the key restraints in this market is the limited IT budgets and resource constraints faced by many small and mid-sized behavioral health providers, particularly in rural areas. Historically, behavioral health practices have lagged in EHR adoption compared to general medical practices, partly because earlier federal incentive programs excluded mental health-focused clinicians such as psychologists, licensed social workers, and addiction counselors.

Although newer funding initiatives are narrowing this gap, many behavioral health agencies—especially non-profits and solo practitioners—struggle with the high upfront cost of EHR implementation, ongoing licensing fees, training expenses, and workflow disruptions. Additionally, integrating behavioral health EHRs with legacy systems or larger health system platforms can be technically complex and financially burdensome. These challenges can delay digital transformation in smaller organizations and slow the pace of market adoption despite growing need.

Market Opportunity: Growing Embrace of Integrated Behavioral Health and Primary Care

A compelling opportunity for growth lies in the integration of behavioral health services within primary care and broader health system networks, a trend gaining traction across the U.S. as part of whole-person care models. Behavioral health conditions often co-occur with chronic physical illnesses, making coordinated treatment essential. For example, depression is common among patients with diabetes and heart disease, and untreated mental health issues can exacerbate physical conditions.

This integration necessitates interoperable behavioral health EHRs that can exchange data with general medical EHRs, enabling collaborative treatment plans, medication reconciliation, and shared care notes. Vendors that offer HL7, FHIR-compatible, and ONC-certified EHR platforms are in high demand. The push toward behavioral-medical integration is also supported by payers and accountable care organizations (ACOs), which seek to improve outcomes while controlling costs. Behavioral health EHRs that support this model—through clinical dashboards, shared analytics, and bidirectional data flow—are poised to see strong adoption in coming years.

U.S. Behavioral Health EHR Market By Product Insights

Based on product, the web/cloud-based EHR segment held the largest revenue share of over 84.0% in 2024 and scalability. Cloud-based solutions are especially attractive for outpatient practices, community mental health centers, and mobile behavioral health teams that require anytime, anywhere access to patient records. These systems reduce the burden of IT infrastructure maintenance, offer subscription-based pricing, and allow automatic updates, making them ideal for smaller organizations with limited internal tech resources.

In addition, cloud-based EHRs are better suited for telebehavioral health integration, which has surged since the pandemic. Many leading vendors now offer native video conferencing, patient portals, and secure messaging, all hosted on HIPAA-compliant cloud servers. These capabilities support hybrid care models, helping mental health providers maintain continuity of care with remote patients. Cloud platforms also facilitate faster innovation and updates in response to changing compliance and billing standards, contributing to their dominance in the U.S. market.

On the other hand, on-premise EHR systems, while still in use by large hospital systems or government facilities, are witnessing slower growth. These systems offer greater control over data and customization but require higher capital investment, dedicated IT staff, and longer implementation timelines. For behavioral health settings that prioritize data sovereignty or operate within tightly controlled networks—such as correctional health services or VA psychiatric facilities—on-premise systems may still hold value. However, over the forecast period, many of these users are expected to migrate to hybrid or fully cloud-based deployments.

U.S. Behavioral Health EHR Market By End-use Insights

Based on end use, The Private behavioral health providers, including outpatient clinics, group practices, and telehealth startups, currently represent the largest share of EHR adoption in the U.S. Their need for billing automation, clinical documentation, appointment scheduling, and patient engagement tools drives consistent investment in EHR platforms. Many private providers now operate multi-location networks, necessitating centralized record-keeping and analytics across state lines. Additionally, private-sector agility enables faster adoption of cloud platforms, AI-powered insights, and digital therapeutics integration.

Meanwhile, government-owned behavioral health facilities—including publicly funded community mental health centers, veterans’ services, and state-run psychiatric hospitals—are emerging as the fastest-growing segment. Federal grants, SAMHSA block funding, and Medicaid waivers are accelerating the modernization of IT systems in these institutions. Government entities are also prioritizing EHRs that support population health reporting, compliance tracking, and inter-agency data sharing. The recent push for Certified Community Behavioral Health Clinics (CCBHCs) is a catalyst for widespread EHR adoption in this segment, particularly when paired with outcome-based reimbursement models.

Country-Level Analysis

Behavioral Health Digitalization Accelerates Nationwide

Across the United States, the behavioral health EHR market is witnessing a nationwide push toward digital transformation, with strong federal backing and private investment. While urban and suburban areas have seen higher EHR penetration, rural states are catching up, driven by the expansion of telehealth networks and health IT grants. States such as California, New York, and Massachusetts lead in terms of behavioral health IT maturity, often housing multi-facility systems with integrated behavioral and physical health services.

The Medicaid program, administered state-by-state, is a major funding source for behavioral health services. States with expanded Medicaid populations (e.g., Oregon, Washington, and Michigan) are seeing higher demand for EHRs capable of tracking outcomes, managing reimbursements, and supporting compliance. The 2021 American Rescue Plan Act included funding for behavioral health modernization, while the Bipartisan Safer Communities Act (2022) committed billions toward youth mental health infrastructure, including EHR support.

Innovations are also emerging from non-traditional healthcare settings. School-based health programs, correctional facilities, and addiction recovery centers are adopting EHRs tailored to their specific workflow needs. Vendors that offer customizable modules for these environments are gaining traction. As the nation continues to prioritize behavioral health as a public health imperative, EHR adoption is likely to become universal across care settings, paving the way for a truly connected behavioral health infrastructure.

Some of the prominent players in the U.S. behavioral health EHR market include:

- Core Solutions, Inc.

- Meditab

- Holmusk

- Netsmart Technologies, Inc.

- Qualtrics

- Welligent

- Valant

- TherapyNotes, LLC.

- NextStep Solutions

- Cerner Corporation (Oracle)

- TheraNest

- ICANotes

- Streamline Healthcare Solutions

- Practice Fusion, Inc.

- Opus Behavioral Health Inc.

U.S. Behavioral Health EHR Market Recent Developments

-

March 2025: Kipu Health, a leading behavioral health EHR provider, launched a new AI-driven decision support feature for substance use disorder treatment, enabling real-time care plan optimization and compliance tracking.

-

February 2025: Valant Medical Solutions announced a strategic integration with Zoom for Healthcare, allowing clinicians to launch teletherapy sessions directly from the EHR and auto-document appointment metadata.

-

January 2025: Netsmart Technologies partnered with the National Council for Mental Wellbeing to expand EHR access and analytics capabilities to more Certified Community Behavioral Health Clinics (CCBHCs).

-

December 2024: TheraNest, a Therapy Brands company, introduced a new patient engagement suite featuring automated appointment reminders, digital intake forms, and secure client messaging for mental health practices.

-

November 2024: Cerner Corporation (Oracle Health) launched a specialized behavioral health module to support VA hospitals and state-run psychiatric facilities, emphasizing structured documentation and real-time care coordination.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. behavioral health EHR market

By Product

- Web/ cloud-based EHR

- On-premise EHR

By End-use