U.S. Bioanalytical Testing Services Market Size and Research

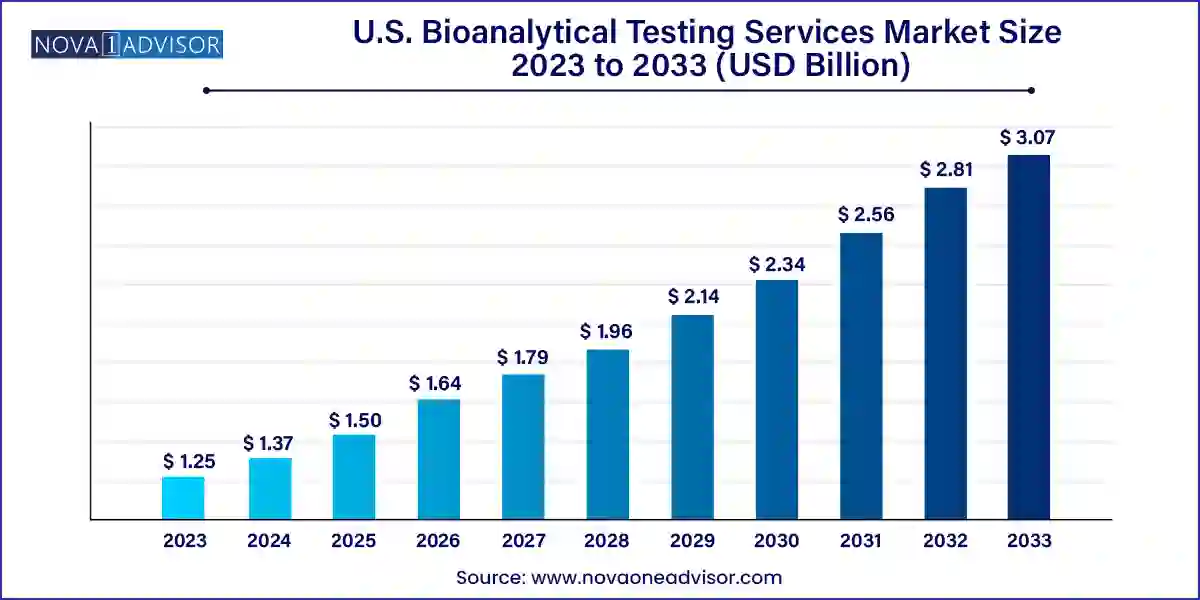

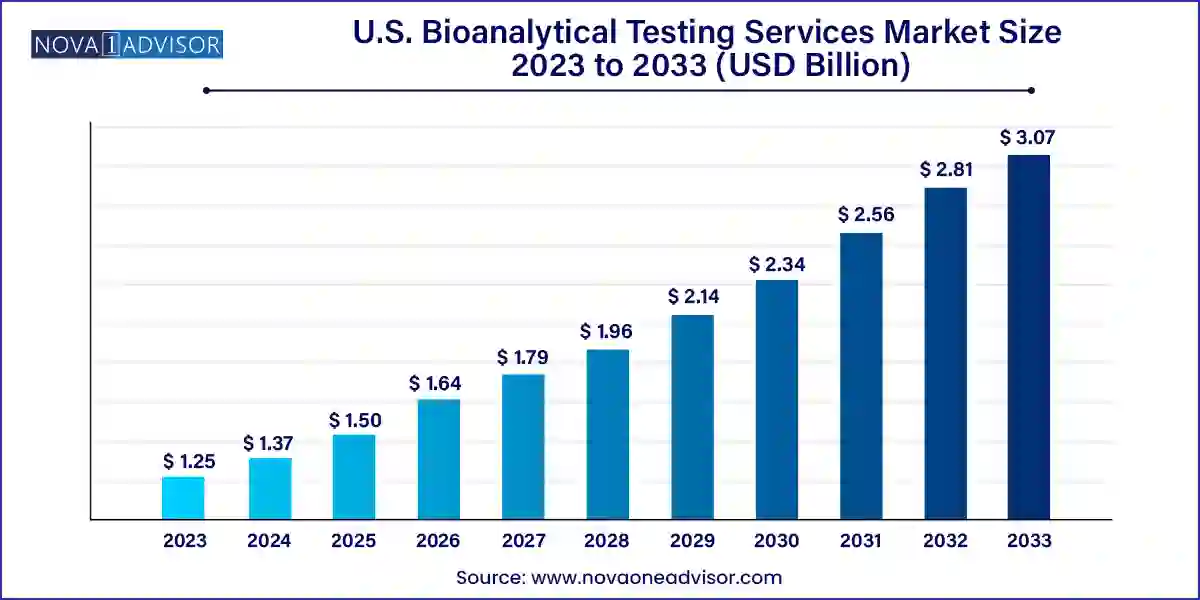

The U.S. bioanalytical testing services market size was exhibited at USD 1.25 billion in 2023 and is projected to hit around USD 3.07 billion by 2033, growing at a CAGR of 9.4% during the forecast period 2024 to 2033.

U.S. Bioanalytical Testing Services Market Key Takeaways:

- The sample analysis workflow segment held the leading revenue share of 45.8% in 2023.

- The sample preparation workflow segment is anticipated to advance at the fastest CAGR of 9.7% during the projection period.

- The bioavailability segment emerged with the largest share of 18.9% in 2023.

- Meanwhile, the bioequivalence segment is projected to advance at the fastest CAGR of 9.8% in the coming years.

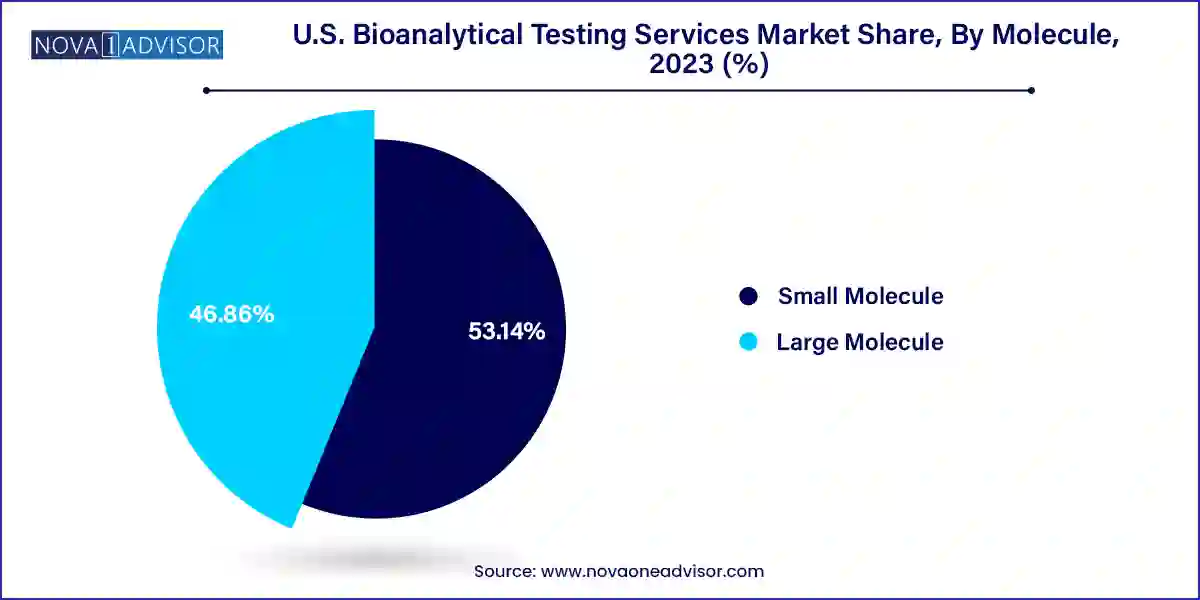

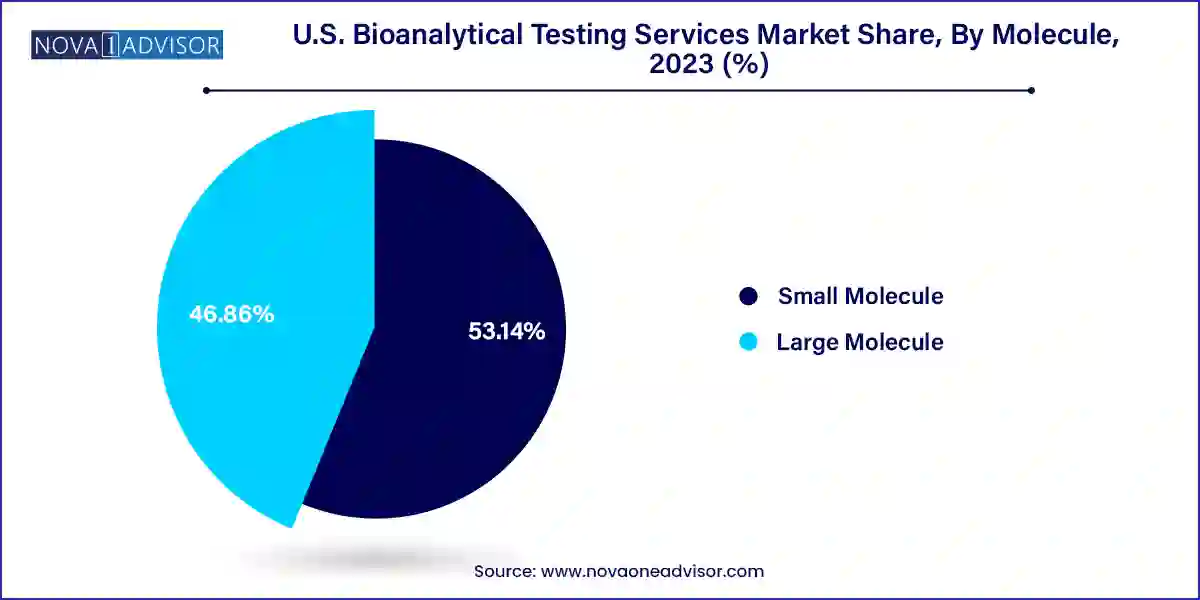

- The small molecule segment emerged with a dominant revenue share of 53.14% in 2023.

- The large molecule segment is projected to advance at the fastest CAGR of 9.9% during the projected timeframe.

Market Overview

The U.S. bioanalytical testing services market forms a foundational component of the country’s biopharmaceutical and clinical research ecosystem. Bioanalytical testing involves the quantitative measurement of drugs, metabolites, biological molecules, and biomarkers in biological matrices such as blood, serum, plasma, urine, and tissue samples. These services are indispensable across the drug development continuum from preclinical studies and clinical trials to post-marketing surveillance.

The market is characterized by its strong alignment with the broader pharmaceutical, biotechnology, and life sciences industries. Given the U.S.'s position as the global leader in drug innovation, the demand for high-quality, compliant, and rapid bioanalytical testing services continues to rise. Stringent regulatory standards set by the U.S. Food and Drug Administration (FDA), National Institutes of Health (NIH), and Good Laboratory Practice (GLP) guidelines ensure high levels of quality and reproducibility in bioanalytical workflows.

Bioanalytical testing services in the U.S. are provided by a mix of global contract research organizations (CROs), specialized bioanalytical labs, academic centers, and in-house pharma labs. Outsourcing of bioanalytical testing has increased significantly over the past decade due to the need for cost efficiency, faster turnaround, and access to niche technical expertise.

From small molecule quantification using LC-MS/MS to complex large molecule analysis using immunoassays and anti-drug antibody (ADA) testing, the breadth and depth of services available in the U.S. market are unparalleled. The nation’s advanced technological infrastructure, rich pool of scientific talent, and a favorable innovation environment make it an epicenter for bioanalytical services.

Major Trends in the Market

-

Shift Toward Large Molecule Testing: Rising demand for biologics, biosimilars, and gene therapies is propelling investment in immunoassays, ADA, and LC-MS-based protein analysis.

-

Integrated PK/PD and Biomarker Platforms: Growing use of platforms that simultaneously assess pharmacokinetics, pharmacodynamics, and biomarker endpoints in one workflow.

-

Rise of Decentralized and Virtual Trials: Remote sample collection, mobile phlebotomy, and digital monitoring are reshaping clinical research workflows and requiring agile bioanalytical support.

-

Expansion of Automation in Sample Preparation: Laboratories are adopting robotic sample prep systems for protein precipitation and SPE to reduce variability and enhance throughput.

-

Adoption of Hybrid Assays: Blending mass spectrometry with ligand-binding assays to improve sensitivity and specificity for complex biologics.

-

Outsourcing Surge by Small Biotech Firms: Early-stage biotechs with limited in-house capabilities are increasingly outsourcing bioanalytical services to CROs.

-

Advanced Data Analytics and Reporting: AI and cloud platforms are streamlining data interpretation, regulatory compliance, and client access to real-time results.

-

Focus on FDA-Ready Validation Protocols: Labs are designing assays and workflows that align closely with regulatory expectations for faster IND and NDA approval cycles.

Report Scope of U.S. Bioanalytical Testing Services Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.37 Billion |

| Market Size by 2033 |

USD 3.07 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Molecule, Test, Workflow |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Charles River Laboratories; ICON plc; Intertek Group plc; IQVIA Inc.; Labcorp Drug Development; Medpace; Pace Analytical Services, LLC; SGS Société Générale de Surveillance SA; Syneos Health; Thermo Fisher Scientific Inc. (PPD, Inc.) |

Market Driver: Expanding Biopharma Pipeline in the U.S.

A key driver of the U.S. bioanalytical testing services market is the continually expanding biopharmaceutical pipeline, particularly in oncology, autoimmune, rare, and infectious diseases. The U.S. leads globally in the number of investigational new drug (IND) applications and clinical trial initiations, with more than 7,000 drugs currently in development as of 2024. With increasing R&D activity comes heightened demand for robust and validated bioanalytical methodologies.

Every new therapeutic candidate—whether it is a small molecule, monoclonal antibody, gene therapy, or RNA-based treatment—requires intensive analytical validation to support safety, efficacy, and dosage optimization. Early-phase clinical trials depend on accurate pharmacokinetics (PK), pharmacodynamics (PD), and biomarker analysis, while later phases require large-scale sample processing and compliance-driven data management.

Companies like Pfizer, Moderna, Gilead, and emerging biotechs across innovation hubs like Boston, San Francisco, and Raleigh-Durham are driving this demand. To meet growing and complex analytical needs, bioanalytical CROs are investing in high-throughput instrumentation, GLP-certified facilities, and domain-specific expertise, propelling market growth.

Market Restraint: High Cost of Technological Infrastructure and Talent Acquisition

One of the main restraints in the U.S. bioanalytical testing services market is the high cost associated with advanced instrumentation and skilled labor. Maintaining cutting-edge analytical capabilities requires significant investment in mass spectrometers, robotic sample handlers, data management systems, and cleanroom infrastructure. Instruments like triple quadrupole LC-MS/MS, Orbitrap mass analyzers, and automated SPE systems represent capital-intensive assets.

Furthermore, recruiting and retaining qualified bioanalytical scientists, especially those experienced in GLP-compliant environments and biologics testing, remains a challenge. Talent shortages can lead to bottlenecks in sample turnaround time, especially during peak clinical development phases. Additionally, smaller CROs may struggle to scale operations or expand service portfolios due to these cost constraints, thereby limiting competitiveness and regional coverage.

Market Opportunity: Expansion of Advanced Large Molecule Testing Capabilities

A major opportunity lies in the expansion of large molecule bioanalytical testing capabilities, particularly in response to the boom in monoclonal antibodies, antibody-drug conjugates (ADCs), vaccines, and gene therapies. Unlike small molecules, large biologics require tailored methodologies, such as ligand-binding assays (LBAs), hybrid LC-MS/MS, immunogenicity (ADA), and neutralizing antibody (NAb) testing.

In the U.S., the rapid development and approval of novel biologics including mRNA vaccines, bispecific antibodies, and cell-based therapeutics—has pushed CROs and testing labs to build specialized services in this space. Companies that offer comprehensive support for ADA, cytokine profiling, immunogenicity risk assessment, and advanced LC-MS workflows for intact proteins are poised to gain a significant competitive advantage.

There is also increasing demand for personalized assay development, biomarker-enabled dose selection, and automation-friendly workflows. CROs that invest in biologics-focused infrastructure and hybrid analytical methods will be well-positioned to serve evolving sponsor needs.

U.S. Bioanalytical Testing Services Market By Workflow Insights

Sample analysis dominates the bioanalytical testing workflow due to its centrality in quantifying drug levels and assessing biomarkers. Techniques such as mass spectrometry, ligand-binding assays, and electrophoresis provide precise and reproducible data across therapeutic areas. LC-MS/MS remains the gold standard in small molecule testing, while LBAs and hybrid assays are vital in large molecule analysis. Mass spectrometry, in particular, offers unparalleled sensitivity and specificity, allowing labs to detect trace levels of drugs and metabolites in complex matrices.

However, sample preparation is the fastest-growing workflow segment, especially as labs seek to enhance throughput, reproducibility, and contamination control. Processes such as protein precipitation, liquid-liquid extraction (LLE), and solid-phase extraction (SPE) are being automated using robotic platforms. This ensures consistency across large sample sets, minimizes human error, and enables high-volume processing. As decentralized and real-world clinical studies grow in popularity, robust and standardized sample preparation protocols will become increasingly essential for maintaining data quality.

U.S. Bioanalytical Testing Services Market By Test Insights

Pharmacokinetic (PK) testing remains the dominant segment in the U.S. bioanalytical services market. PK testing determines the absorption, distribution, metabolism, and excretion (ADME) of drug candidates in biological systems and is essential in defining optimal dosing strategies. It is a core requirement for IND, NDA, and BLA submissions to the FDA. High-throughput PK assays using LC-MS/MS and immunoassays are routinely deployed in early- and late-phase trials, especially in oncology and CNS drugs.

In contrast, ADME testing, particularly in-vitro ADME, is the fastest-growing sub-segment. As more drug developers seek to de-risk candidate selection early in the pipeline, in-vitro ADME assessments are increasingly used to predict metabolic stability, drug-drug interactions, and permeability profiles. The rise of predictive modeling, human-based test systems (e.g., hepatocyte assays), and microfluidic platforms is contributing to the expansion of this segment. The need to reduce late-stage failures is making ADME a more critical part of the early development process.

U.S. Bioanalytical Testing Services Market By Molecule Insights

Small molecules currently dominate the U.S. bioanalytical testing market, owing to their long-standing use in pharmaceutical development and established analytical protocols. LC-MS/MS, chromatographic techniques, and other validated small molecule platforms are widely used to assess drug levels, metabolites, and pharmacokinetic properties. The high volume of generics, fixed-dose combinations, and repurposed drugs also contributes to the dominance of small molecule testing. Regulatory familiarity and lower testing complexity further reinforce their continued leadership in the analytical landscape.

However, the large molecule segment is witnessing the fastest growth, driven by the increasing approval and development of biologics and biosimilars. Sub-segments such as LC-MS studies and immunoassays are particularly important in measuring protein-based drugs and biological markers. Anti-drug antibody (ADA) testing and PK studies tailored to large molecules are becoming standard for immunotherapies and vaccines. As biopharma innovation shifts toward more complex modalities, demand for accurate, reproducible, and regulatory-compliant large molecule assays will continue to surge.

Country-Level Analysis

The United States is not just the largest market for bioanalytical testing services it is also the most technologically advanced and heavily regulated. The U.S. hosts a high concentration of clinical trials, CROs, academic medical centers, and pharmaceutical manufacturing facilities. Key hubs include Boston/Cambridge, San Diego, San Francisco Bay Area, and Research Triangle Park, all of which boast strong biopharma clusters and world-class testing infrastructure.

The U.S. FDA plays a pivotal role in shaping bioanalytical practices by continuously updating guidance on bioequivalence, PK/PD, biomarker qualification, and method validation. Regulatory expectations drive innovation and standardization in assay design, quality assurance, and digital reporting. Additionally, the increasing adoption of virtual trials and mobile health platforms is creating demand for geographically distributed bioanalytical support. Companies that can provide agile, compliant, and high-throughput testing solutions are well-positioned for long-term success in this dynamic market.

Some of the prominent players in the U.S. bioanalytical testing services market include:

- Charles River Laboratories

- ICON plc

- Intertek Group plc

- IQVIA Inc.

- Labcorp Drug Development

- Medpace

- Pace Analytical Services, LLC

- SGS Société Générale de Surveillance SA

- Syneos Health

- Thermo Fisher Scientific Inc. (PPD, Inc.)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. bioanalytical testing services market

Molecule

- Small Molecule

- Large Molecule

-

- LC-MS Studies

- Immunoassays

- PK

- ADA

- Others

Test

- PK

- PD

- Bioavailability

- Bioequivalence

- Others

Workflow

-

- Protein Precipitation

- Liquid-Liquid Extraction

- Solid Phase Extraction

-

- Hyphenated technique

- Chromatographic technique

- Electrophoresis

- Ligand Binding Assay

- Mass Spectrometry

- Nuclear Magnetic Resonance