U.S. Biosimulation Market Size and Forecast 2025 to 2034

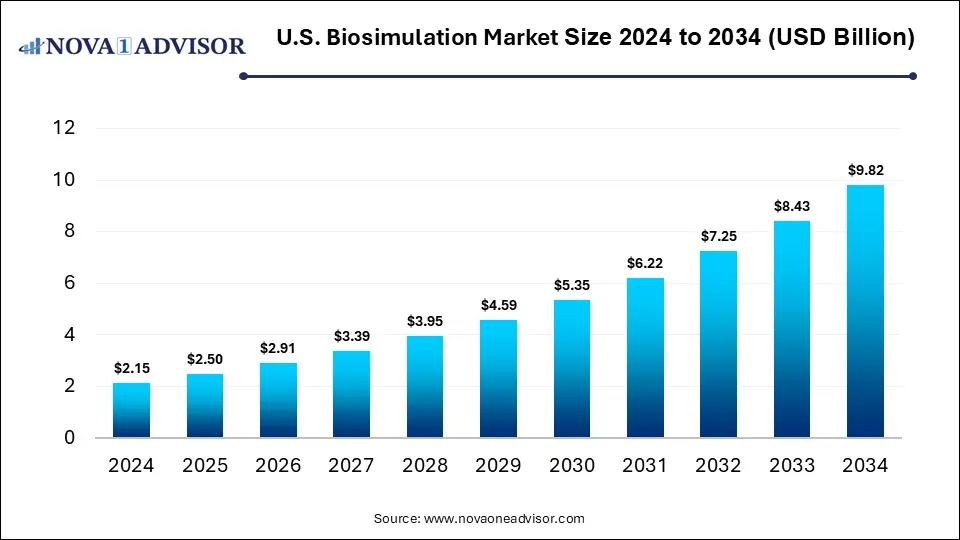

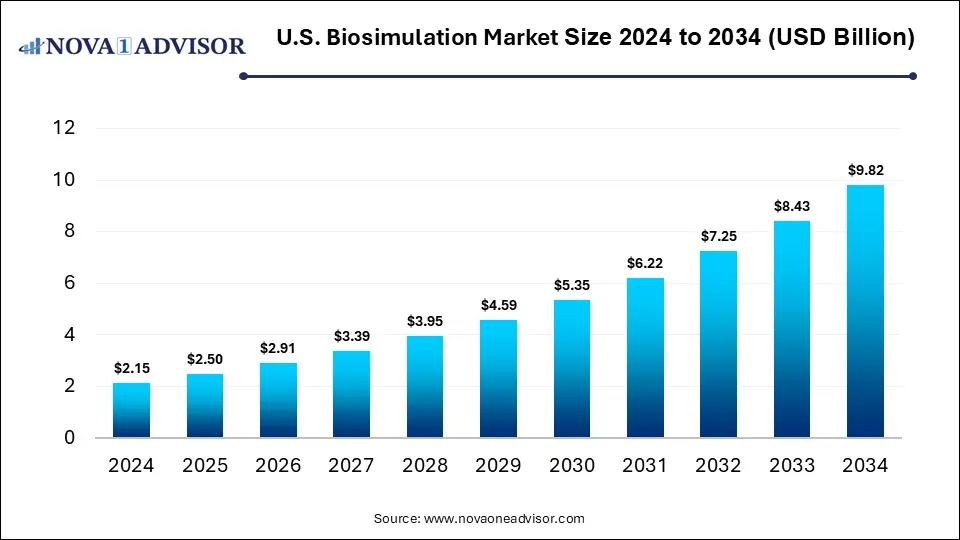

The U.S. biosimulation market size was estimated at USD 2.15 billion in 2024 and is expected to reach USD 9.82 billion by 2034, expanding at a CAGR of 16.4% during the forecast period of 2025 to 2034. The growth of the market is driven by increasing demand for cost-effective drug development and regulatory support for model-informed drug design. Moreover, advancements in AI-powered simulation technologies further contribute to market growth.

Key Takeaways

- By offering, the software segment dominated the market in 2024.

- By offering, the services segment is expected to expand at the highest CAGR in the coming years.

- By application, the drug discovery & development segment led the market in 2024.

- By application, the disease modeling segment is expected to grow at the fastest rate during the projection period.

- By therapeutic area, the oncology segment dominated the market in 2024.

- By therapeutic area, the infectious diseases segment is likely to expand at a significant rate in the upcoming period.

- By deployment model, the cloud-based segment held the largest share of the market in 2024.

- By deployment model, the hybrid model segment is expected to grow at a rapid pace between 2025 and 2034.

- By pricing model, the license-based model segment led the market in 2024.

- By pricing model, the subscription-based model segment is expected to register highest CAGR throughout the forecast period.

- By end use, the life science companies segment contributed the largest market share in 2024.

- By end use, the academic & research institutes segment is expected to expand at the fastest CAGR over the forecast period.

Impact of AI on the U.S. Biosimulation Market

AI is profoundly transforming the U.S. biosimulation market by enhancing the accuracy and speed of simulations used in drug development and disease modeling. By integrating machine learning algorithms, AI helps analyze vast datasets to predict drug behavior, optimize dosing, and identify potential safety issues earlier in the development process. This leads to more efficient and cost-effective research, reducing the reliance on costly clinical trials. Additionally, AI-driven biosimulation enables personalized medicine by creating patient-specific models, improving treatment outcomes. As a result, AI is accelerating innovation and adoption within the biosimulation industry.

- In October 2024, PumasAI launched AskPumas and DeepPumas, the first AI-driven biosimulation tools aimed at transforming pharmacometrics, clinical pharmacology, and data science. These solutions enhance predictive accuracy and streamline workflows, enabling faster, more efficient drug development.

Market Overview

The U.S. biosimulation market refers to the use of advanced computational models and simulation tools to predict biological responses and drug interactions, supporting decision-making in drug discovery, development, and regulatory submissions. Biosimulation offers significant advantages across applications such as optimizing clinical trial designs, reducing R&D costs, predicting drug efficacy and toxicity, and enhancing personalized medicine through patient-specific modeling. These tools help streamline the drug development process by minimizing trial-and-error experimentation and accelerating time-to-market. The market is experiencing significant growth due to the increasing adoption of model-informed drug development (MIDD), rising demand for precision medicine, and growing regulatory support from agencies like the FDA. As the need for efficient and cost-effective drug development continues to rise, biosimulation is becoming a critical component of modern pharmaceutical and biotech strategies.

What are the Major Trends in the U.S. Biosimulation Market?

- Integration of Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being increasingly embedded into biosimulation platforms to enhance predictive accuracy, automate data analysis, and accelerate decision-making in drug development. These technologies are helping researchers simulate complex biological systems more efficiently.

- Shift Toward Cloud-Based and Hybrid Deployment Models: Cloud-based and hybrid solutions are gaining traction due to their scalability, remote accessibility, and lower infrastructure costs. This trend supports more collaborative research environments and faster simulation execution.

- Expansion of Strategic Collaborations and Outsourcing: Pharmaceutical companies are partnering with biosimulation service providers and academic institutions to access specialized expertise and speed up R&D. This trend is driving growth in the services segment and expanding innovation capacity.

Report Scope of U.S. Biosimulation Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.50 Billion |

| Market Size by 2034 |

USD 9.82 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 16.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Offering, Application, Therapeutic Area, Deployment Model, Pricing Model, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Adoption of Model-Informed Drug Development (MIDD)

The rising adoption of model-informed drug development (MIDD) is a key factor driving the growth of the U.S. biosimulation market, as it encourages the integration of predictive modeling and simulation throughout the drug development lifecycle. Supported by the FDA, MIDD helps pharmaceutical companies make more informed decisions about dose selection, trial design, and patient stratification, ultimately improving the efficiency and success rates of clinical trials. By reducing reliance on traditional trial-and-error methods, MIDD significantly lowers development costs and accelerates time-to-market. This regulatory backing has led to greater industry confidence and investment in biosimulation tools. As MIDD becomes a standard part of regulatory strategy, demand for advanced simulation technologies continues to rise across the U.S. market.

Rising Demand for Precision Medicine & Biological Therapies

The rising demand for precision medicine and biological therapies is significantly driving the growth of the market by increasing the need for patient-specific modeling and complex biological system simulations. Precision medicine requires tailored treatment strategies based on individual genetic, environmental, and lifestyle factors, which biosimulation tools can effectively support through virtual trials and predictive modeling. Similarly, biological therapies such as monoclonal antibodies, gene therapies, and cell-based treatments involve intricate mechanisms that benefit from advanced biosimulation to optimize dosing, predict immune responses, and assess safety. These applications reduce trial failures and enhance therapeutic effectiveness, making biosimulation a vital part of modern R&D. As the healthcare industry shifts toward more personalized and complex treatment approaches, biosimulation becomes increasingly essential.

- In January 2023, Cellworks Group Inc. launched its Precision Drug Development business units to accelerate drug development and revive unapproved therapies using predictive biosimulation. Leveraging its Computational Biology Model (CBM), the units aim to streamline clinical trials by predicting patient responses and optimizing trial enrollment, reducing both time and cost.

Restraints

High Initial Investments

High initial investments are a major barrier, particularly for small and mid-sized pharmaceutical and biotech companies. Implementing advanced biosimulation tools often requires significant spending on software licenses, high-performance computing infrastructure, and specialized personnel. These upfront costs can be prohibitive, limiting access to biosimulation technologies for organizations with constrained R&D budgets. As a result, the market's growth potential is partially hindered by the financial barriers to adoption, despite the long-term cost-saving benefits biosimulation can offer.

Regulatory Heterogeneity and Lack of Standardization

Regulatory heterogeneity and lack of standardization create uncertainty around the acceptance and validation of simulation results. While agencies like the FDA are increasingly supportive of MIDD, there is still no universally accepted framework or consistent guidelines for the use of biosimulation across all therapeutic areas and stages of drug development. This inconsistency makes it challenging for companies to align their simulation approaches with regulatory expectations, leading to hesitation in fully adopting these tools. Additionally, the lack of standardized data formats, modeling protocols, and validation criteria hampers collaboration and comparability across organizations. As a result, these regulatory and technical gaps slow down broader implementation and trust in biosimulation methodologies.

Opportunities

Technological Advancements and Development of Digital Twin Patient Modeling

Technological advancements and the development of digital twin patient modeling are creating immense opportunities in the U.S. biosimulation market by enabling more precise, personalized, and predictive healthcare solutions. Digital twins, virtual replicas of individual patients, allow researchers to simulate disease progression, drug response, and treatment outcomes in a patient-specific manner, greatly enhancing the accuracy and effectiveness of therapy development. These innovations are especially valuable in complex therapeutic areas like oncology, neurology, and rare diseases, where individual variability plays a critical role. Coupled with advances in AI, ML, and high-performance computing, digital twin technology is expanding the capabilities of biosimulation far beyond traditional applications.

Integration with Clinical Trials

The integration of biosimulation with clinical trials is creating significant opportunities in the market by improving trial design, optimizing dosing strategies, and reducing the likelihood of failure in later phases. Through virtual trials and in silico modeling, researchers can simulate patient responses and outcomes before actual trials begin, enabling better-informed decisions and more targeted participant selection. This not only reduces costs and timelines but also enhances the safety and efficiency of clinical development. As regulatory bodies increasingly recognize the value of model-informed approaches, the integration of biosimulation into clinical trial planning is becoming more common. This shift is unlocking new potential for innovation, accelerating drug development, and expanding the role of biosimulation in the pharmaceutical industry.

Segment Outlook

Offering Insights

Why Did the Software Segment Dominate the U.S. Biosimulation Market in 2024?

The software segment dominated the market with the largest share in 2024 due to its critical role in streamlining and accelerating the drug development process. Advanced software solutions, such as PK/PD modeling, PBPK simulations, and molecular modeling, enable researchers to predict drug behavior, efficacy, and toxicity with greater accuracy, significantly reducing the need for costly and time-consuming physical trials. The widespread adoption of these tools by pharmaceutical and biotechnology companies is further fueled by increasing regulatory acceptance of model-informed drug development (MIDD) approaches. Additionally, continuous advancements in AI and machine learning have enhanced the predictive capabilities of biosimulation software, making it indispensable in early-stage research and clinical decision-making.

- In August 2024, Certara, Inc. launched Phoenix 8.5, the latest version of its industry-standard PK/PD and toxicokinetic modeling and simulation software. Used by over 75 of the top 100 pharma companies and 11 regulatory agencies, including the FDA and PMDA, Phoenix supports the evaluation of life-saving drug candidates. Version 8.5 is now offered as a hosted solution for improved performance and reduced total cost of ownership.

The services segment is expected to expand at the highest CAGR throughout the projection period due to the increasing outsourcing of biosimulation tasks by pharmaceutical and biotech companies seeking cost-effective and specialized expertise. As drug development becomes more complex, many organizations prefer to rely on contract research organizations (CROs) and consultants for simulation modeling, regulatory support, and data analysis. This demand is further fueled by the need for flexible, on-demand services such as implementation, training, and technical support, especially among small and mid-sized firms lacking in-house capabilities. Additionally, as biosimulation tools evolve rapidly, external service providers are better positioned to offer up-to-date knowledge and customized solutions, driving faster adoption across the industry.

U.S. Biosimulation Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Software |

1.29 |

1.51 |

1.76 |

2.06 |

2.42 |

2.82 |

3.31 |

3.86 |

4.52 |

5.29 |

6.19 |

| Services |

0.86 |

0.99 |

1.15 |

1.33 |

1.53 |

1.77 |

2.04 |

2.36 |

2.73 |

3.14 |

3.63 |

Application Insights

How Does the Drug Discovery & Development Segment Lead the Market in 2024?

The drug discovery & development segment led the U.S. biosimulation market in 2024 due to its critical role in reducing the time, cost, and risk associated with bringing new drugs to market. Biosimulation tools are widely used in this phase to model drug interactions, optimize dosing strategies, and predict clinical outcomes, allowing for more informed decision-making before entering costly human trials. The growing adoption of model-informed drug development (MIDD) practices, supported by the FDA, has further strengthened the use of biosimulation in early-stage research. Additionally, pharmaceutical companies are increasingly leveraging biosimulation to streamline pipeline development and improve success rates, making it an indispensable part of modern R&D strategies.

The disease modeling segment is expected to grow at the fastest rate over the forecast period. The growth of the segment is attributed to the increasing demand for deeper insights into complex and poorly understood diseases such as neurological disorders, rare diseases, and cancers. Biosimulation enables researchers to replicate disease progression, study pathophysiological mechanisms, and simulate therapeutic responses in virtual environments, enhancing precision in treatment design. The rise of personalized medicine and digital twin technologies is further accelerating this trend, as disease models are essential for patient-specific simulations. Additionally, academic and industry collaborations are expanding the use of disease modeling in early research stages, paving the way for more targeted and effective therapies. This growing emphasis on understanding disease biology is driving the segment’s rapid expansion.

U.S. Biosimulation Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Drug Discovery & Development |

1.25 |

1.43 |

1.65 |

1.9 |

2.2 |

2.53 |

2.91 |

3.35 |

3.86 |

4.44 |

5.11 |

| Disease Modeling |

0.6 |

0.7 |

0.81 |

0.94 |

1.09 |

1.26 |

1.47 |

1.7 |

1.97 |

2.28 |

2.65 |

| Other (Precision Medicine, Toxicology) |

0.3 |

0.37 |

0.45 |

0.55 |

0.66 |

0.8 |

0.97 |

1.17 |

1.42 |

1.71 |

2.06 |

Therapeutic Area Insights

What Made Oncology the Dominant Segment in the U.S. Biosimulation Market?

The oncology segment dominated the market with a major share in 2024. This is mainly due to the high prevalence of cancer and the urgent need for more effective, targeted therapies. Biosimulation plays a crucial role in oncology by enabling researchers to model tumor growth, drug-tumor interactions, and patient-specific responses, which are critical for designing personalized treatment strategies. The complexity and high failure rates of oncology drug development have made simulation tools indispensable in optimizing trial design and predicting outcomes. Additionally, strong investment from both public and private sectors in cancer research, coupled with regulatory support for model-informed approaches, has further driven the adoption of biosimulation in this therapeutic area.

The infectious diseases segment is likely to expand at a significant rate in the upcoming period, owing to rising concerns over emerging pathogens, antibiotic resistance, and global health threats. Biosimulation is increasingly used to model disease transmission, predict drug efficacy, and accelerate vaccine and antiviral development, particularly in response to pandemics like COVID-19. The ability to simulate various outbreak scenarios and treatment strategies in silico has proven invaluable for public health planning and rapid therapeutic response. Additionally, government and institutional funding for infectious disease research is increasing, encouraging greater adoption of advanced modeling tools.

U.S. Biosimulation Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Oncology |

0.82 |

0.96 |

1.12 |

1.31 |

1.53 |

1.79 |

2.1 |

2.45 |

2.87 |

3.35 |

3.93 |

| Cardiovascular Disease |

0.39 |

0.45 |

0.52 |

0.6 |

0.7 |

0.8 |

0.93 |

1.08 |

1.25 |

1.44 |

1.67 |

| Infectious Disease |

0.34 |

0.39 |

0.45 |

0.52 |

0.6 |

0.69 |

0.79 |

0.91 |

1.04 |

1.2 |

1.37 |

| Neurological Disorders |

0.32 |

0.38 |

0.45 |

0.53 |

0.62 |

0.74 |

0.87 |

1.02 |

1.2 |

1.42 |

1.67 |

| Others |

0.28 |

0.32 |

0.37 |

0.43 |

0.5 |

0.57 |

0.66 |

0.76 |

0.89 |

1.02 |

1.18 |

Deployment Model Insights

How Does the Cloud-Based Segment Lead the Market in 2024?

The cloud-based segment led the U.S. biosimulation market while holding the largest share in 2024 due to its flexibility, scalability, and cost-effectiveness compared to on-premise solutions. Cloud deployment allows researchers and pharmaceutical companies to access high-performance computing resources and biosimulation tools from anywhere, facilitating collaboration and faster data processing. It also reduces the need for expensive infrastructure and IT maintenance, making it especially attractive to small and mid-sized organizations. As biosimulation software becomes more complex and data-intensive, the cloud offers the computational power needed to run large-scale simulations efficiently. The growing adoption of remote and hybrid work models further accelerated the shift toward cloud-based platforms.

The hybrid model segment is expected to expand at a rapid pace throughout the forecast period. This is primarily because of its ability to combine the security and control of on-premise systems with the scalability and accessibility of cloud-based solutions. This flexible approach allows pharmaceutical and biotech companies to manage sensitive data locally while leveraging cloud infrastructure for high-performance simulations and collaborative research.

As regulatory requirements around data privacy tighten, many organizations prefer hybrid models to maintain compliance without sacrificing computational efficiency. Additionally, the growing complexity of biosimulation tasks demands adaptable deployment options that can evolve with organizational needs. This balance of performance, security, and flexibility is driving rapid adoption of hybrid deployment models.

U.S. Biosimulation Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Cloud-based |

0.95 |

1.13 |

1.35 |

1.61 |

1.93 |

2.3 |

2.74 |

3.26 |

3.88 |

4.62 |

5.5 |

| On-premise |

0.73 |

0.82 |

0.92 |

1.03 |

1.15 |

1.28 |

1.43 |

1.59 |

1.77 |

1.96 |

2.16 |

| Hybrid Model |

0.47 |

0.55 |

0.64 |

0.75 |

0.87 |

1.01 |

1.18 |

1.37 |

1.6 |

1.85 |

2.16 |

Pricing Model Insights

Why Did the License-Based Segment Lead the U.S. Biosimulation Market in 2024?

The license-based model segment led the market in 2024 due to its widespread adoption among large pharmaceutical and biotechnology companies that prefer long-term, full-access solutions. Licensed software typically offers advanced features, customization options, and robust support, making it ideal for organizations with ongoing and complex biosimulation needs. Additionally, many leading vendors have traditionally focused on license-based models, which are perceived as more secure and stable for enterprise-level deployments. This model also allows for better control over software updates and usage, aligning with the regulatory and operational requirements of large R&D teams. As a result, license-based solutions remained the preferred choice for high-volume users in 2024.

The subscription-based model segment is expected to register highest CAGR throughout the projection period due to its affordability, flexibility, and accessibility, especially for small and mid-sized organizations. This pricing model allows companies to access advanced biosimulation tools without the high upfront costs associated with license-based solutions, making it ideal for project-based or short-term use. Subscription models often include regular updates, cloud access, and technical support, which enhances usability and keeps users aligned with the latest technological advancements. As more companies seek scalable and cost-efficient deployment options, particularly in fast-paced R&D environments, subscription-based offerings are becoming increasingly attractive.

U.S. Biosimulation Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| License-based Model |

0.75 |

0.84 |

0.94 |

1.05 |

1.18 |

1.31 |

1.45 |

1.61 |

1.78 |

1.96 |

2.16 |

| Subscription-based Model |

0.6 |

0.72 |

0.86 |

1.03 |

1.23 |

1.47 |

1.75 |

2.09 |

2.49 |

2.97 |

3.53 |

| Service-based Model |

0.54 |

0.62 |

0.72 |

0.84 |

0.97 |

1.12 |

1.32 |

1.51 |

1.76 |

2.03 |

2.36 |

| Pay Per Use Model |

0.26 |

0.32 |

0.39 |

0.47 |

0.57 |

0.69 |

0.83 |

1.01 |

1.22 |

1.47 |

1.77 |

End Use Insights

How Does Life Science Companies Hold the Largest Share of the Market in 2024?

The life science companies segment held the largest share of the U.S. biosimulation market in 2024. This is primarily due to their extensive involvement in drug discovery, development, and clinical research activities where biosimulation plays a critical role. These companies invest heavily in advanced simulation tools to reduce R&D costs, shorten development timelines, and improve the success rates of new therapies.

Their focus on innovation and precision medicine drives the demand for sophisticated modeling and simulation software. Additionally, strong regulatory support for model-informed drug development encourages life science firms to adopt biosimulation extensively to meet compliance requirements. This combination of high usage and strategic importance solidifies their dominant position in the market.

The academic & research institutes segment is expected to expand at the fastest CAGR in the upcoming period due to increasing investments in biomedical research and the growing emphasis on translational science and personalized medicine. These institutions are adopting biosimulation tools to better understand disease mechanisms, develop novel therapies, and train the next generation of scientists. The availability of more affordable, cloud-based, and subscription pricing models is also enabling wider access to advanced simulation software in academia. Furthermore, collaborations between academia and industry are expanding, driving demand for biosimulation to support innovative research projects. This growing focus on cutting-edge research and education is fueling the growth of this segment.

U.S. Biosimulation Market Value Chain Analysis

1. Research & Development (R&D) and Data Generation

This stage involves gathering biological, pharmacological, and clinical data necessary for creating biosimulation models. Pharmaceutical companies, academic institutions, and CROs (Contract Research Organizations) generate large datasets through lab research, preclinical studies, and early-phase trials, which serve as the foundation for simulation models. The quality and depth of this data are critical, as they directly impact the accuracy of predictive modeling.

2. Software Development & Tool Design

Specialized biosimulation software is developed to analyze and model complex biological systems. This includes platforms for molecular modeling, PBPK/PKPD simulation, toxicity prediction, and trial simulation. Developers integrate advanced technologies like AI and machine learning to enhance functionality, speed, and usability, ensuring that tools are capable of handling large, complex datasets for varied therapeutic applications.

3. Service Provision (Consulting, Implementation & Support)

At this stage, biosimulation companies and service providers offer contract research, consulting, training, and support services to help clients integrate simulation tools into their drug development workflows. These services are essential for companies that lack in-house expertise or infrastructure, enabling broader market adoption and efficient use of biosimulation technologies.

4. End Use Application (Drug Discovery, Clinical Trials, Regulatory Submissions)

Biosimulation tools are applied in real-world scenarios such as drug discovery, lead optimization, dosing strategy design, and clinical trial simulation. They also play a growing role in regulatory submissions, with agencies like the FDA supporting model-informed drug development (MIDD). This application stage directly contributes to reducing R&D costs, minimizing trial failures, and accelerating product approvals.

5. Regulatory & Market Access

Regulatory review and acceptance of biosimulation data is a critical final step in the value chain. Agencies evaluate simulation outcomes to support drug approval decisions, particularly in areas like dose justification, safety prediction, and trial design.

Key Players Operating in the Market

1. Certara

Certara is a leading provider of biosimulation software and services, widely recognized for its PBPK modeling and Model-Informed Drug Development (MIDD) solutions. Its platforms like Phoenix and Simcyp are extensively used in regulatory submissions and clinical trial optimization across the U.S. pharmaceutical industry.

2. Dassault Systèmes

Through its BIOVIA brand, Dassault Systèmes delivers advanced biosimulation, molecular modeling, and informatics tools tailored for life sciences research. The company’s solutions support collaborative R&D, enabling pharmaceutical companies to accelerate drug discovery and streamline regulatory workflows.

3. Advanced Chemistry Development (ACD/Labs)

ACD/Labs provides specialized software for molecular characterization, cheminformatics, and physicochemical property prediction. Its tools aid biosimulation workflows by improving data quality and enabling accurate modeling of drug behavior in silico.

4. Simulations Plus

Simulations Plus offers powerful simulation tools for ADMET prediction, pharmacokinetics (PK), and pharmacodynamics (PD) modeling. Its widely used platforms like GastroPlus and DDDPlus support early-stage drug screening and clinical trial design across U.S. research institutions and biopharma companies.

5. Schrödinger, Inc.

Schrödinger specializes in molecular-level simulation software used in computational drug design and discovery. Its physics-based modeling tools and collaborative platforms like LiveDesign enhance the speed and precision of small molecule research in the U.S. biosimulation market.

6. Chemical Computing Group ULC

This company develops the Molecular Operating Environment (MOE), a versatile platform for molecular modeling, bioinformatics, and cheminformatics. MOE is used by U.S. researchers to conduct protein-ligand simulations, QSAR studies, and drug design workflows.

7. Physiomics Plc

Physiomics offers oncology-focused biosimulation services, including Virtual Tumor technology, which helps optimize cancer treatment strategies. The company supports U.S. biopharma firms by providing predictive modeling solutions for dosing regimens and clinical trial planning.

8. Rosa & Co. LLC

The company is known for its PhysioPD™ platform, which builds quantitative systems pharmacology (QSP) models to simulate disease progression and treatment effects. It works closely with U.S. pharmaceutical companies to reduce R&D risks and guide clinical development decisions.

9. BioSimulation Consulting Inc.

BioSimulation Consulting Inc. provides specialized modeling and simulation services, including PK/PD analysis, trial simulation, and model validation. Its tailored consulting helps U.S. clients integrate biosimulation into regulatory and research strategies effectively.

10. Genedata AG

Genedata offers a range of software platforms that support high-throughput data analysis and modeling for biosimulation. Its tools are used by U.S. biopharma companies to manage complex datasets and optimize experimental design in early drug discovery.

11. Instem Group of Companies

Instem delivers software solutions for preclinical and clinical data analysis, including modeling and simulation tools. The company helps U.S. organizations align biosimulation with regulatory requirements, particularly in toxicology and safety assessment.

12. PPD, Inc.

PPD, a global contract research organization, integrates biosimulation into its clinical trial services to enhance protocol design and dose optimization. Its modeling capabilities support more efficient drug development for U.S. pharmaceutical clients.

13. Yokogawa Insilico Biotechnology GmbH

A subsidiary of Yokogawa, Insilico Biotechnology provides cell-based modeling and simulation solutions for bioprocess optimization and systems biology. Its U.S. presence supports pharma and biotech firms in improving biologics manufacturing and cell therapy development.

14. In Silico Biosciences, Inc.

Focused on PBPK and systems pharmacology modeling, In Silico Biosciences brings specialized simulation tools that streamline drug development workflows. Its niche expertise supports highly targeted applications in pharmacokinetic prediction and translational modelling.

Recent Developments

- In June 2025, Simulations Plus, Inc. released ADMET Predictor® 13, its advanced ML-based platform for molecule design and optimization in drug discovery. The new version features enhanced HT-PBPK simulations, upgraded AI-driven drug design, and next-gen ADMET models for improved predictive accuracy. With expanded automation, Python support, and enterprise-ready deployment, it streamlines decision-making for data-centric R&D teams.

- In April 2025, Certara, Inc. launched Non-Animal Navigator, a solution designed to help biopharma companies align with the FDA’s Roadmap to Reduce Animal Testing in preclinical safety studies. This innovation enables faster development, lower costs, and stronger predictive insights.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. biosimulation market.

By Offering

-

- Molecular Modeling & Simulation Software

- Clinical Trial Design Software

- PK/PD Modeling and Simulation Software

- Pbpk Modeling and Simulation Software

- Toxicity Prediction Software

- Other Software

-

- Contract Services

- Consulting

- Other (Implementation, Training, & Support)

By Application

- Drug Discovery & Development

- Disease Modeling

- Other (Precision Medicine, Toxicology)

By Therapeutic Area

- Oncology

- Cardiovascular Disease

- Infectious Disease

- Neurological Disorders

- Others

By Deployment

- Cloud-based

- On-premise

- Hybrid Model

By Pricing Model

- License-based Model

- Subscription-based Model

- Service-based Model

- Pay Per Use Model

By End-use

- Life Sciences Companies

- Academic Research Institutions

- Others (CROs/CDMOs, Regulatory Authorities)