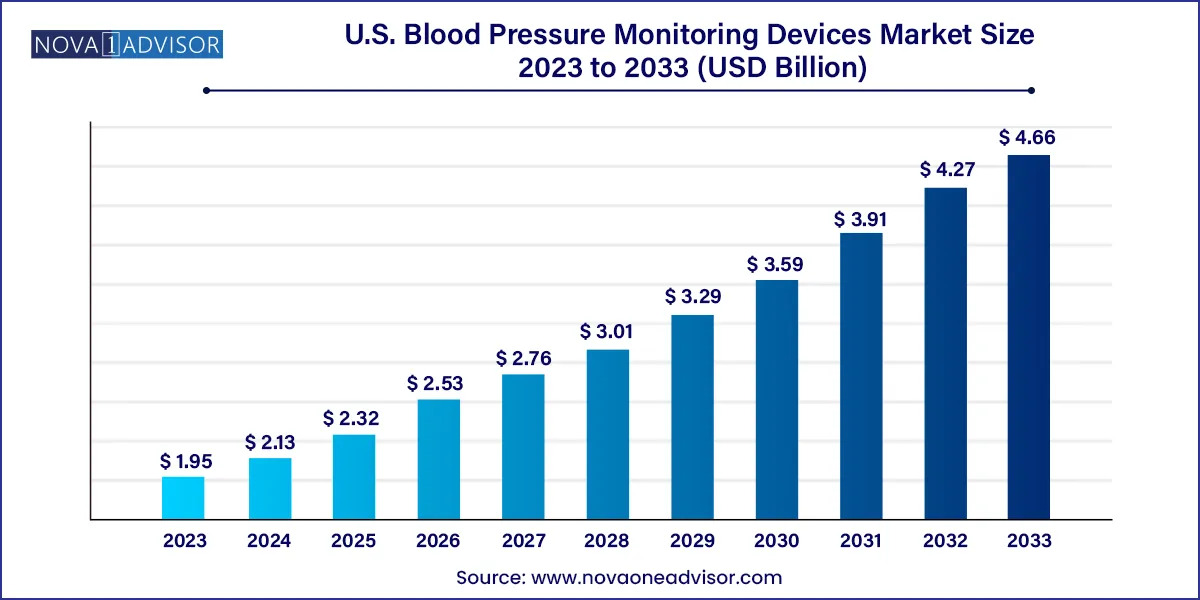

The U.S. blood pressure monitoring devices market size was estimated at USD 1.95 billion in 2023 and is expected to be worth around USD 4.66 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 9.1% during the forecast period 2024 to 2033.

U.S. Blood Pressure Monitoring Devices Market Key Takeaways

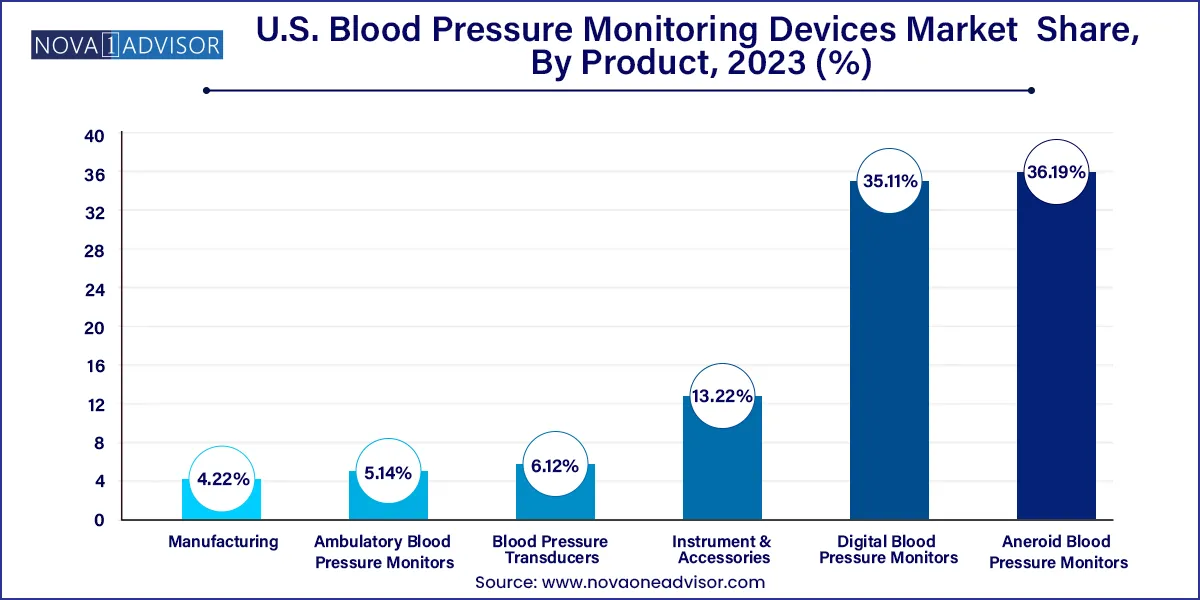

- In 2023, aneroid blood pressure monitors dominated the market with a 36.19% share.

- The digital blood pressure monitors segment is projected to grow at the fastest CAGR of 11.5% from 2024 to 2033.

- In the US, hospitals and clinics have been the dominant end-users of blood pressure monitors, accounting for around 65.19% of the market share in 2023.

- The other hand, the homecare segment is expected to grow at the fastest CAGR of 10.9% from 2024 to 2033.

Market Overview

The U.S. blood pressure monitoring devices market is experiencing robust growth due to the increasing prevalence of hypertension, the aging population, the rise in remote patient monitoring, and the growing emphasis on preventive healthcare. Blood pressure monitoring devices are fundamental tools in both clinical and home settings, enabling early detection of cardiovascular conditions, guiding treatment interventions, and supporting chronic disease management.

With approximately 47% of U.S. adults diagnosed with high blood pressure according to data from the Centers for Disease Control and Prevention (CDC) the need for accessible and accurate blood pressure measurement solutions has never been more pronounced. Moreover, public health awareness campaigns, evolving insurance reimbursement policies, and a shift toward patient-driven health management are expanding the market's scope.

Technological advancements are reshaping the landscape, with digital monitors, Bluetooth-enabled cuffs, wearable blood pressure sensors, and smartphone-integrated devices gaining popularity. In clinical environments, advanced ambulatory monitors and blood pressure transducers are providing more comprehensive cardiovascular data. As the healthcare industry embraces value-based care and remote patient monitoring programs, the demand for home-based, connected BP devices is rising rapidly.

This evolving environment is creating opportunities for innovation in design, functionality, and data integration while intensifying competition among device manufacturers, digital health firms, and health IT solution providers. With chronic conditions accounting for a significant share of national health expenditures, blood pressure monitoring devices are expected to play a crucial role in reducing hospital admissions, supporting long-term care, and improving population health outcomes.

Major Trends in the Market

-

Surge in At-Home Monitoring Devices: Self-monitoring is becoming the norm, especially for elderly and hypertensive populations.

-

Bluetooth and IoT-Enabled Devices: Integration with smartphones, fitness trackers, and cloud platforms is fueling growth in connected BP devices.

-

Rise of Wearable BP Technologies: Wristband and smartwatch-based monitors are emerging as alternatives to traditional cuffs.

-

Growing Demand for Ambulatory BP Monitoring (ABPM): These devices offer 24-hour monitoring and are increasingly used in diagnostics and research.

-

Focus on Data Analytics and AI: BP data is being combined with machine learning to identify cardiovascular risks and predict adverse events.

-

Partnerships with Telemedicine Platforms: BP monitor manufacturers are collaborating with digital health providers for RPM (remote patient monitoring) integration.

-

FDA Clearances and Fast-Track Innovations: Regulatory support for home-use and mobile devices has boosted product availability.

-

Device Miniaturization and Portability: Compact, travel-friendly BP monitors are being developed for lifestyle-conscious consumers.

-

Increased Availability in Retail and Pharmacy Chains: Devices are now widely distributed through outlets like CVS, Walgreens, and Walmart.

-

Bundling with Chronic Care Management Programs: Hospitals and insurers are incorporating BP monitors in chronic disease kits.

U.S. Blood Pressure Monitoring Devices Market Report Scope

| Report Attribute |

Details

|

| Market Size in 2024 |

USD 2.13 Billion |

| Market Size by 2033 |

USD 4.66 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.1% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

American Diagnostics Corporation; SunTech Medical, Inc ; GE Healthcare, A&D Medical Inc; Kaz Inc.; GF Health Products Inc. Spacelabs Healthcare Inc.; OMRON Healthcare, Inc. Welch Allyn; Briggs Healthcare; Spacelabs Healthcare |

Market Driver: Growing Prevalence of Hypertension and Cardiovascular Disease

A key driver propelling the U.S. blood pressure monitoring devices market is the alarming rise in hypertension and related cardiovascular conditions. The CDC reports that nearly half of adults in the U.S. suffer from high blood pressure, with only 24% having the condition under control. This represents a massive burden on the healthcare system and creates an ongoing demand for monitoring and intervention tools.

Hypertension is a silent risk factor, often going undetected until serious complications arise. Blood pressure monitors—especially those used in the home setting—serve as a critical first line of defense in catching early warning signs and prompting timely medical attention. The rising incidence of obesity, sedentary lifestyles, poor dietary habits, and stress are all contributing factors to the condition’s prevalence.

As national initiatives like "Million Hearts 2027" gain momentum, the integration of home-based blood pressure monitoring with physician supervision is being promoted. Furthermore, physicians are increasingly relying on longitudinal data from ambulatory or digital monitors to make more accurate diagnoses and adjust treatment protocols. The demand for dependable and user-friendly monitoring devices is therefore being driven by both medical necessity and health system priorities.

Market Restraint: Accuracy Concerns in Home Monitoring and Wearables

One of the major restraints faced by the market is the concern over the accuracy and consistency of readings in home-use and wearable blood pressure monitors. While consumer-grade devices offer convenience, many lack proper calibration and may not adhere to standardized measurement protocols. Inaccurate readings can lead to underdiagnosis or overtreatment, undermining clinical decision-making.

Moreover, wrist and finger monitors though portable often deliver less reliable data compared to upper-arm cuff-based devices. Variability in readings due to user error, improper cuff placement, or device calibration issues continues to challenge the reliability of self-monitoring. Regulatory bodies like the FDA are tightening scrutiny around validation standards, yet many devices available over-the-counter bypass rigorous clinical evaluation.

Healthcare providers often express skepticism about basing treatment solely on patient-reported home readings unless the device is clinically validated and data is shared via a secure, integrated platform. Addressing these issues through education, product design, and improved standardization is essential for ensuring continued growth in the consumer segment of the market.

Market Opportunity: Integration with Telehealth and Remote Patient Monitoring Programs

A compelling growth opportunity exists in the integration of blood pressure monitoring devices with telehealth platforms and remote patient monitoring (RPM) systems. The COVID-19 pandemic accelerated the adoption of virtual care, and blood pressure monitors have become essential peripherals in chronic care and virtual cardiovascular evaluations.

In 2024, Medicare expanded coverage for RPM services, including reimbursement for BP readings transmitted from a patient’s home. This policy shift has encouraged primary care practices, cardiology groups, and managed care organizations to deploy Bluetooth-enabled BP monitors as part of chronic disease management bundles.

Digital health startups are partnering with device manufacturers to embed blood pressure data into EHRs, dashboards, and mobile applications. AI-driven insights from continuous BP monitoring are being explored to predict heart failure, stroke, and medication non-adherence. As the U.S. healthcare system increasingly embraces preventive and personalized care models, integrating smart BP monitors into the clinical continuum presents a significant opportunity for providers, payers, and manufacturers alike.

U.S. Blood Pressure Monitoring Devices Market By Product Insights

Digital blood pressure monitors dominate the market, driven by their user-friendly interfaces, ease of access, and wide availability in both clinical and home settings. These devices often come with automatic inflation, memory storage, and multi-user tracking, making them ideal for patient engagement. Digital monitors are now the standard in both primary care and outpatient environments. Innovations like voice-assistance for elderly users, cloud connectivity, and integration with digital health platforms have further boosted their appeal.

Ambulatory blood pressure monitors (ABPMs) are the fastest-growing segment, particularly among cardiologists and hypertension specialists. These devices provide a 24-hour reading of a patient’s BP profile, capturing nocturnal hypertension, white-coat syndrome, and other anomalies that standard readings miss. As ABPM becomes a recommended standard for accurate diagnosis, their clinical use in managing borderline hypertension and validating therapeutic efficacy is expanding. Their increasing role in research and clinical trials also adds to demand in academic and specialist healthcare institutions.

U.S. Blood Pressure Monitoring Devices Market By End-user Insights

Hospitals and clinics are the leading end-users, relying on blood pressure monitoring devices as part of routine patient assessments, pre-surgical screenings, and chronic disease follow-ups. In these settings, both automated digital devices and advanced transducers are used, particularly in operating rooms, ICUs, and cardiology departments. Many hospitals are also investing in devices that can integrate with electronic medical records, allowing for real-time data access and documentation.

Homecare is the fastest-growing end-use segment, fueled by the rise in self-monitoring, virtual care, and aging-in-place trends. With chronic disease management shifting to the home setting, patients and caregivers are increasingly using home BP monitors to manage conditions such as hypertension, diabetes, and heart failure. The ability to sync readings with apps, generate trend reports, and share data with clinicians makes home BP devices indispensable in modern care pathways. Retail availability, smartphone compatibility, and insurance coverage are accelerating this trend across urban and rural households in the U.S.

Country-Level Analysis

The United States represents the largest and most mature market for blood pressure monitoring devices globally, driven by an advanced healthcare infrastructure, high disease burden, and tech-savvy consumer base. The U.S. is home to major industry players, regulatory institutions like the FDA, and healthcare systems that are increasingly focused on chronic disease prevention and management.

The U.S. government, through initiatives like Healthy People 2030 and CDC-funded community health programs, actively promotes hypertension control. Payers including Medicare, Medicaid, and commercial insurers are increasingly covering home monitoring devices under chronic care management plans.

Telehealth integration, consumer demand for wellness tools, and clinical protocols focused on cardiovascular risk mitigation continue to fuel the adoption of BP monitors across all care settings. As digital health infrastructure matures and RPM becomes a core component of U.S. healthcare delivery, the domestic BP monitoring market is expected to evolve into a more interconnected, intelligent, and outcome-driven ecosystem.

U.S. Blood Pressure Monitoring Devices Market Recent Developments

-

March 2025: Omron Healthcare launched its new HeartGuide 2.0, a smartwatch-style wearable BP monitor with continuous tracking and arrhythmia alerts, targeting remote cardiac monitoring users.

-

February 2025: Withings partnered with CVS Health to distribute its FDA-cleared BPM Connect Pro smart BP monitors as part of CVS’s chronic care remote monitoring kits.

-

January 2025: Welch Allyn (Hillrom/Baxter) expanded its Spot Vital Signs line with Bluetooth-enabled BP cuffs that sync directly with EHR platforms like Epic and Cerner.

-

December 2024: iHealth Labs received CMS approval for reimbursement of its iHealth Clear BP Monitor under Medicare’s remote patient monitoring program.

-

November 2024: A&D Medical introduced a multi-user blood pressure monitor with secure cloud access designed for assisted living and multi-patient home settings.

U.S. Blood Pressure Monitoring Devices Market Top Key Companies:

- American Diagnostics Corporation

- SunTech Medical, Inc

- GE Healthcare

- A&D Medical Inc

- Kaz Inc.

- GF Health Products Inc.

- Spacelabs Healthcare Inc.

- OMRON Healthcare, Inc.

- Welch Allyn

- Briggs Healthcare

- Spacelabs Healthcare

U.S. Blood Pressure Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Blood Pressure Monitoring Devices market.

By Aneroid Blood Pressure Monitors

- Digital Blood Pressure Monitors

- Ambulatory Blood Pressure Monitors

- Manufacturing

- Blood Pressure Transducers

- Instrument & Accessories

By End-user

- Hospitals & Clinics

- Ambulatory Surgical Centre

- Homecare