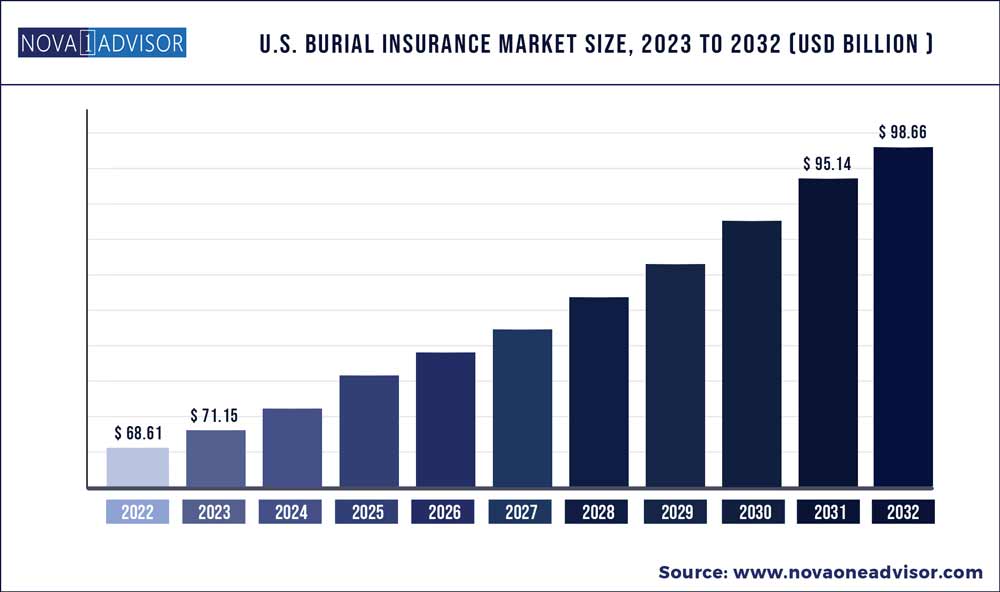

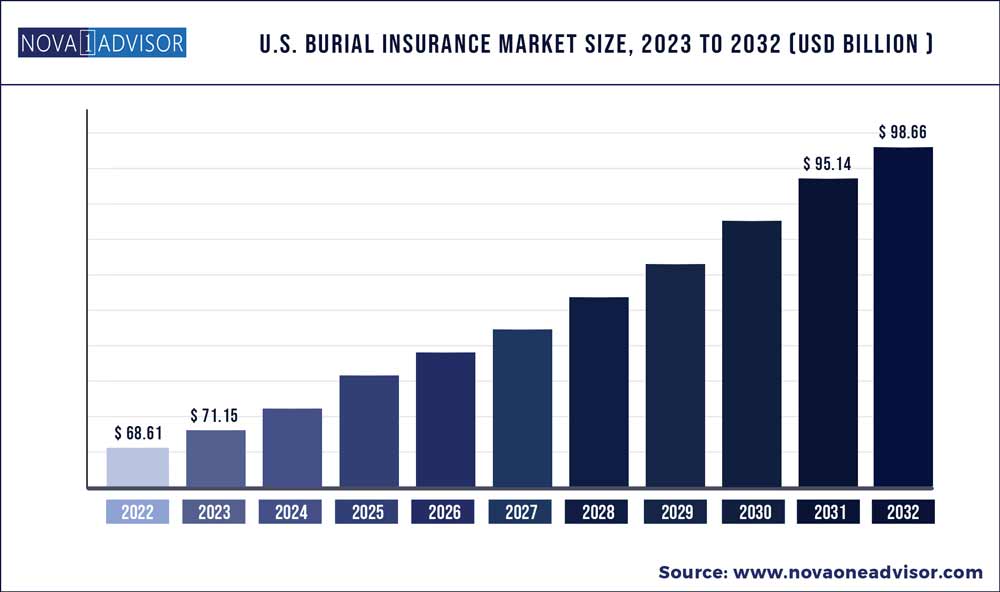

The U.S. burial insurance market size was estimated at USD 68.61 billion in 2022 and is expected to surpass around USD 98.66 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 3.7% during the forecast period 2023 to 2032.

Market Overview

The U.S. burial insurance market, also referred to as final expense insurance, has gained considerable prominence in recent years as a vital financial planning tool for older adults. Burial insurance is a type of whole life insurance policy designed to cover end-of-life expenses, including funeral costs, medical bills, and outstanding debts. It provides a modest death benefit, typically ranging between $5,000 and $25,000, ensuring that families are not financially burdened after a loved one’s passing.

This market thrives on a growing aging population, cultural values surrounding dignity in death, rising funeral costs, and increased financial literacy among older demographics. Funeral expenses in the U.S. often exceed $10,000, with costs varying widely by location and services rendered. As many retirees live on fixed incomes, they seek financial products that are affordable, easy to qualify for, and provide peace of mind to their families—making burial insurance a preferred choice.

In contrast to traditional life insurance, burial policies often feature simplified underwriting processes, with some offering no medical exam and guaranteed acceptance. These policies appeal to seniors with health issues who may be ineligible for larger term or whole life policies. Insurers have adapted to this demand with customizable plans, low premium options, and bundled services such as grief counseling and funeral planning.

Digitalization has further impacted the burial insurance landscape, enabling streamlined application processes, policy comparisons, and customer support through online platforms. As life expectancy increases and more seniors prioritize legacy planning, the burial insurance market in the U.S. is poised for sustained growth.

Major Trends in the Market

-

Growing Demand Among Seniors Without Traditional Life Insurance: Older adults who missed buying life insurance earlier in life are turning to burial insurance as a low-cost alternative.

-

Digital Policy Applications and Approvals: Online enrollment and instant underwriting decisions are simplifying the customer experience and reducing barriers to entry.

-

Bundled Funeral Services with Insurance Policies: Many insurers now collaborate with funeral homes to offer pre-arranged services, enhancing convenience for policyholders.

-

Personalized Plans Based on Health and Lifestyle: Insurers are offering tailored policies based on minor health disclosures, allowing greater customization and fairness.

-

Expansion of Guaranteed Acceptance Policies: These plans are being heavily marketed to individuals with serious pre-existing conditions.

-

Use of AI and Chatbots in Customer Service: Automation tools are helping streamline interactions, especially among elderly customers seeking assistance.

-

Education-Based Marketing Approaches: Companies are increasingly using webinars, workshops, and social media campaigns to educate consumers on burial insurance options.

U.S. Burial Insurance Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 71.15 Billion |

| Market Size by 2032 |

USD 98.66 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 3.7% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Coverage type, Age of End-user, State |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Aetna Inc.; Mutual of Omaha; Royal Neighbors of America; Allianz Life; Gerber Life Insurance; Baltimore Life; Foresters Life Insurance and Annuity Company (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’); Globe Life Inc. (Globe Life and Accident Insurance Company); Fidelity Life Association; Colonial Penn |

Market Driver – Increasing Funeral Costs in the United States

A primary driver of the U.S. burial insurance market is the rising cost of funerals and related end-of-life expenses. According to the National Funeral Directors Association (NFDA), the median cost of a funeral with a viewing and burial exceeded $8,000 in 2023, with some services surpassing $12,000 depending on the state and provider. These costs include embalming, casket purchase, funeral home charges, transport, gravesite, headstones, and administrative fees.

This financial burden can place undue stress on grieving families, particularly when no pre-arranged financial provision exists. Burial insurance serves as a financial safety net, offering a predetermined payout to cover these expenses without resorting to loans or credit cards. Seniors are increasingly aware of this burden and are turning to burial insurance as a means of shielding their families from unexpected costs. For middle- and low-income households, in particular, this form of insurance offers dignity, peace of mind, and a sense of preparedness.

Market Restraint – Limited Awareness and Misconceptions Among Consumers

Despite its benefits, the U.S. burial insurance market is often hindered by a lack of awareness and persistent misconceptions. Many older Americans either remain unaware of burial insurance products or confuse them with more complex life insurance options. Additionally, misinformation—such as the belief that burial insurance is unnecessary if a person already has savings—can prevent potential customers from exploring the product.

Furthermore, aggressive or unclear marketing tactics in the past have eroded consumer trust. Some individuals worry about scams or deceptive sales pitches targeting the elderly, particularly through unsolicited calls or mailers. This restraint calls for ethical, transparent marketing practices and broader public education initiatives to clarify policy terms, benefits, and suitability.

Market Opportunity – Digital Expansion and Insurtech Innovation

A notable opportunity in the burial insurance market lies in leveraging digital platforms and insurtech innovations to reach untapped segments. The digital shift has already begun reshaping how policies are researched, purchased, and serviced. Elderly consumers and their caregivers are becoming more comfortable with online financial tools, creating room for insurers to streamline their operations and expand outreach through digital-first approaches.

Online quote generators, video consultations, and automated underwriting are making burial insurance more accessible. Insurers that provide real-time application processing, multilingual support, and integration with financial planning apps stand to gain a competitive edge. Moreover, collaborations with fintech startups can help insurers deliver more personalized and user-friendly insurance experiences to older adults and their families.

Segmental Analysis

By Coverage Type

Level death benefit policies dominated the market, largely due to their affordability, transparency, and fixed premium structures. These plans offer full death benefits from the moment the policy becomes active, provided the applicant meets medical underwriting standards. Level benefit policies appeal to healthier seniors in their 50s and early 60s who want immediate coverage without waiting periods. Many customers prefer the predictability and clarity these plans offer—there’s no ambiguity about payout eligibility or premium increases over time.

Guaranteed acceptance policies are the fastest-growing coverage type, driven by their inclusivity and appeal to high-risk individuals. These policies require no medical exam or health questions and are issued with minimal underwriting. Although they typically include a graded death benefit for the first two years, their accessibility is unparalleled. Seniors with chronic illnesses, past surgeries, or multiple medications find guaranteed acceptance policies to be their only viable option. The emotional security of leaving something behind for loved ones—even a modest benefit—makes this product segment highly attractive, especially among those over 70.

By Age of End-user

Individuals over 60 constitute the largest share of the market, as this group often begins actively planning for end-of-life expenses. At this age, individuals start retiring, reassessing financial plans, and exploring ways to minimize burdens on their families. Many in this demographic are healthy enough to qualify for level death benefit policies while still being motivated to secure coverage due to concerns over rising healthcare and funeral costs. Insurers often design marketing materials and product bundles to appeal specifically to this group.

The over 70 age group is the fastest-growing segment, fueled by increased longevity and the need for late-life financial solutions. While traditional term life insurance may be unavailable or prohibitively expensive, burial insurance offers a viable alternative even at this age. Insurers have started offering smaller coverage amounts with flexible payment plans to cater to this audience. As life expectancy rises and more seniors remain active into their 70s and 80s, the demand for final expense planning tools like burial insurance is expanding significantly.

Country-Level Analysis – United States

The U.S. burial insurance market is geographically diverse, reflecting demographic, economic, and cultural variations across states. States with larger elderly populations, such as Florida, California, and Texas, represent significant markets due to higher demand for final expense planning. Florida, in particular, with its large retiree community, sees robust uptake of burial insurance products, supported by an extensive network of retirement communities and estate planning advisors.

New York and Pennsylvania also show strong market activity, with a focus on multicultural, multilingual marketing given their diverse populations. In southern and midwestern states like Georgia, Illinois, and Ohio, burial insurance is often promoted as part of community-based financial literacy programs, particularly among African-American and low-income households. Nationwide carriers tailor their policy offerings based on state-specific regulations, premium affordability, and customer outreach practices. The national push for equitable access to financial products has also led to broader availability in rural and underserved regions, supported by digital platforms and mobile agents.

Some of the prominent players in the U.S. Burial Insurance Market include:

- Aetna Inc.

- Mutual of Omaha

- Transamerica

- Royal Neighbors of America

- Prosperity Life Group

- American International Group, Inc.

- Allianz Life

- Gerber Life Insurance

- Baltimore Life

- Foresters Life Insurance and Annuity Company (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’)

- AARP/New York Life

- Globe Life Inc. (Globe Life and Accident Insurance Company)

- Colonial Penn

Recent Developments

-

March 2025 – Mutual of Omaha launched a new guaranteed acceptance burial insurance plan with higher coverage thresholds (up to $40,000) targeting seniors aged 70–85, with simplified mobile application procedures.

-

February 2025 – Globe Life announced enhancements to its online portal for burial insurance, allowing real-time underwriting and paperless policy issuance for agents and direct buyers.

-

January 2025 – AARP, in partnership with New York Life, expanded its final expense offerings for members over 80, incorporating additional grief support and digital legacy tools.

-

November 2024 – Colonial Penn introduced educational webinars aimed at reducing misconceptions about guaranteed issue life insurance and explaining burial insurance benefits to older adults.

-

October 2024 – Ethos Life, an insurtech company, integrated an AI-powered chatbot to assist elderly users in comparing burial insurance plans, marking a significant step in senior-friendly digital transformation.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Burial Insurance market.

By Coverage Type

- Level Death Benefit

- Guaranteed Acceptance

- Modified or Graded Death Benefit

By Age of End-user

- Over 50

- Over 60

- Over 70

- Over 80

By State

- California

- Texas

- Florida

- New York

- Pennsylvania

- Illinois

- Ohio

- Georgia

- Rest of the U.S