U.S. Cannabinoids Market Size and Research 2026 to 2035

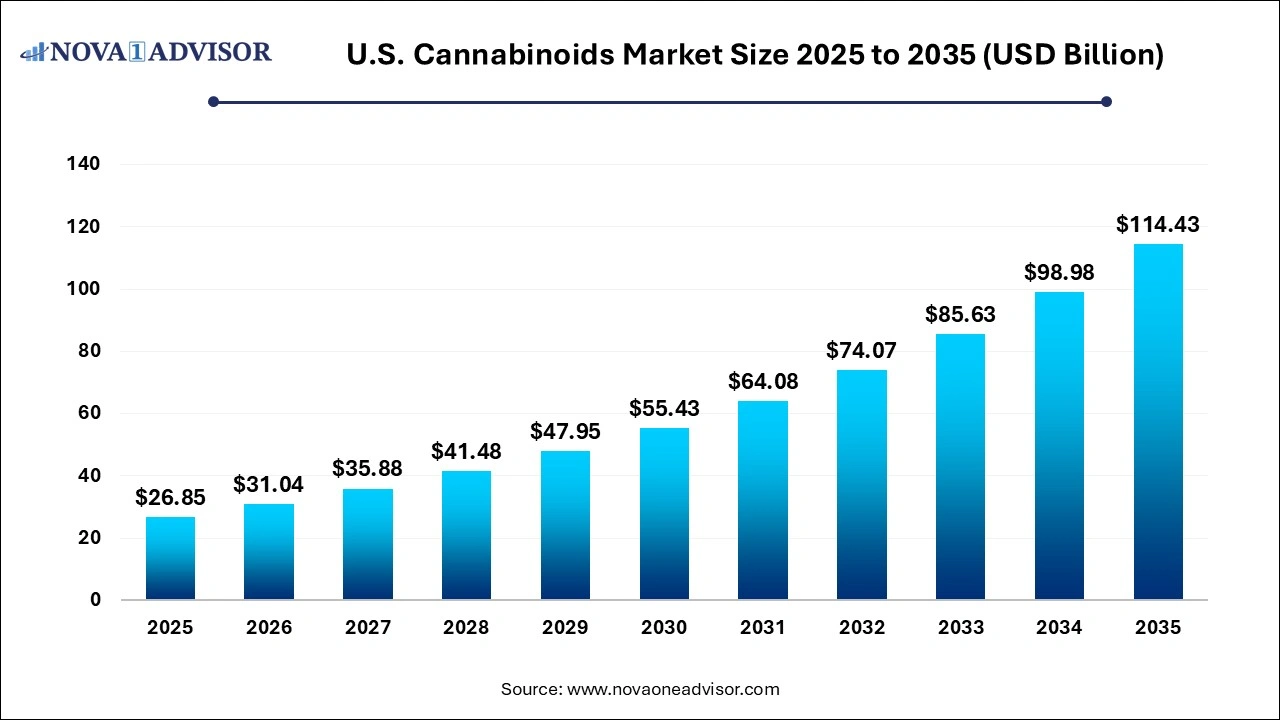

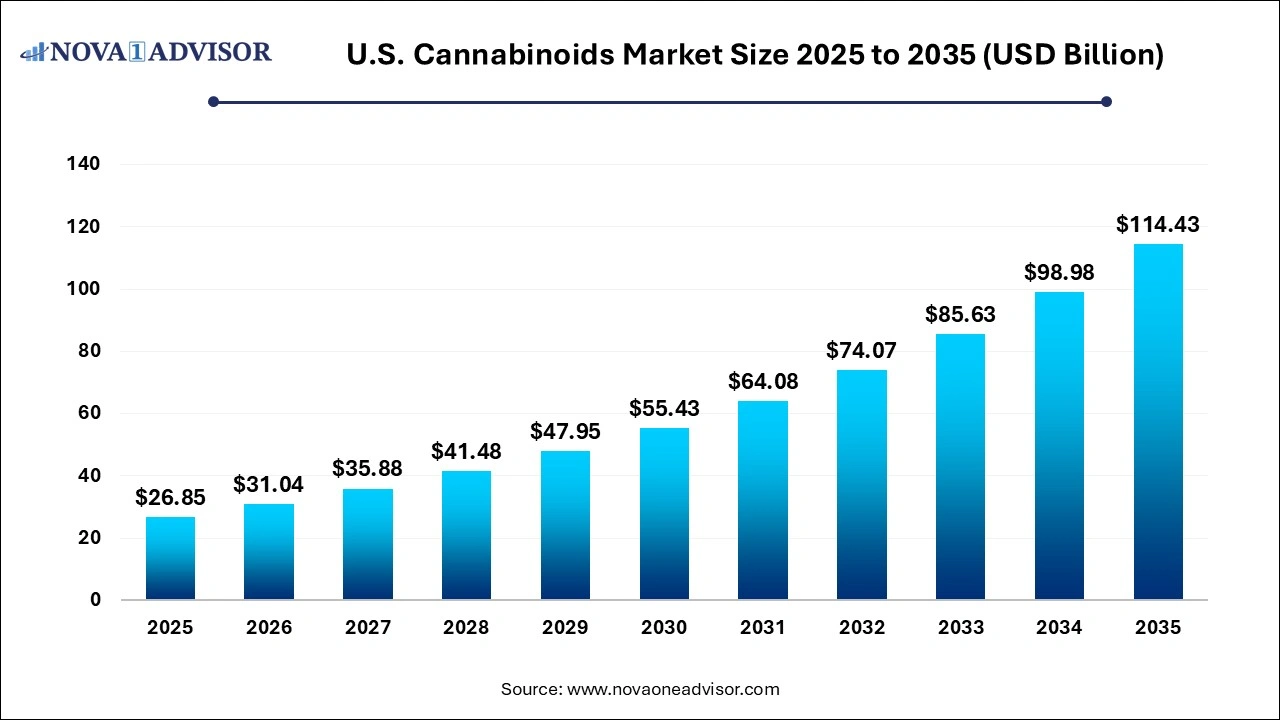

The U.S. cannabinoids market size was exhibited at USD 26.85 billion in 2025 and is projected to hit around USD 114.43 billion by 2035, growing at a CAGR of 15.6% during the forecast period .

Key Takeaways:

- The cannabidiol (CBD) segment held the largest revenue share in the U.S. cannabinoids market in 2025 with a share of 26.7% and is anticipated to witness a steady CAGR over the forecast period.

- The THCV segment is expected to showcase the fastest CAGR over the forecast period.

- The neurological disorders segment captured the largest revenue share of 22.1% in the U.S. cannabinoids market in 2025 and is projected to exhibit a lucrative CAGR throughout the forecast period.

- The pain management segment is expected to showcase the fastest CAGR over the forecast period.

U.S. Cannabinoids Market Overview

The U.S. cannabinoids market is rapidly evolving into one of the most dynamic sectors within the broader healthcare, wellness, and nutraceutical industries. Driven by regulatory shifts, increasing consumer awareness, and a growing body of scientific validation, cannabinoids are emerging as powerful bioactive compounds with therapeutic, functional, and commercial potential. From over-the-counter CBD products to pharmaceutical-grade THC derivatives, the market is rich with opportunity, albeit entangled with regulatory complexities and public perception issues.

Cannabinoids are naturally occurring compounds found in the cannabis plant. While tetrahydrocannabinol (THC) and cannabidiol (CBD) are the most recognized, dozens of minor cannabinoids like cannabigerol (CBG), cannabinol (CBN), and tetrahydrocannabivarin (THCV) are gaining traction due to their diverse health benefits. These compounds are used across multiple applications including pain management, inflammation treatment, neurological disorders, cancer support therapies, and general wellness products.

The U.S. market has witnessed a proliferation of cannabinoid-based products—ranging from oils and capsules to beverages, edibles, topicals, and pharmaceutical-grade formulations. The 2018 Farm Bill, which legalized hemp-derived cannabinoids (containing less than 0.3% THC), created a regulatory framework for widespread production and commercialization, especially of CBD. Meanwhile, state-level legalization of cannabis for medical or recreational use has opened additional pathways for THC-based products.

From a consumer perspective, the demand is being propelled by shifting attitudes toward natural health alternatives, increased incidence of chronic and lifestyle diseases, and broader societal acceptance of cannabis-related products. However, despite the growth trajectory, the market remains subject to legal, scientific, and logistical hurdles that shape the strategies of key players. In this context, innovation, education, and compliance are emerging as central pillars for success.

Major Trends in the U.S. Cannabinoids Market

-

Emergence of Minor Cannabinoids: CBG, CBN, CBC, and THCV are gaining recognition for their targeted health benefits, prompting formulation expansion beyond THC and CBD.

-

Pharmaceutical Advancement: Cannabinoids are increasingly integrated into clinical pipelines for treating epilepsy, multiple sclerosis, pain, and inflammatory diseases.

-

Functional Consumer Products: Cannabinoids are now infused in beverages, snacks, skincare, and pet care items, often promoted for stress relief, sleep aid, or anti-aging.

-

Growth in Personalized Cannabinoid Therapies: Companies are leveraging genetic profiling and AI to tailor cannabinoid use to individual physiology and health goals.

-

Regulatory Ambiguity and Enforcement Crackdowns: The FDA’s lack of clear guidance on CBD in food and supplements continues to create compliance challenges for brands.

-

Vertical Integration Among Producers: To maintain quality control and cost efficiency, many companies are adopting seed-to-sale models encompassing cultivation, extraction, formulation, and distribution.

-

Rising Demand for Organic and Clean-Label Products: Consumers are showing preference for organically grown, solvent-free, and non-GMO cannabinoid formulations.

-

Academic and Clinical Research Expansion: Universities and private institutions are accelerating studies on the safety, efficacy, and novel uses of both major and minor cannabinoids.

Report Scope of The U.S. Cannabinoids Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 31.04 Billion |

| Market Size by 2035 |

USD 114.43 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 15.6% |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| Segments Covered |

Product type, application |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Mile High Labs; Global Cannabinoids; GenCanna; CBD Inc.; Precision Plant Molecules; Rhizo Sciences; LaurelCrest; Fresh Bros Hemp Company; BulKanna; High Purity Natural Products; Zero Point Extraction, LLC |

Market Driver: Expanding Therapeutic Applications of Cannabinoids

One of the most significant drivers of the U.S. cannabinoids market is the expansion of therapeutic applications, especially in chronic disease management and neurological conditions. Cannabinoids are being recognized for their anti-inflammatory, analgesic, anti-anxiety, anti-seizure, and neuroprotective properties. CBD, for instance, has gained FDA approval under the brand name Epidiolex for treating severe childhood epilepsy syndromes, marking a major milestone in medical validation.

Beyond epilepsy, ongoing clinical trials are exploring the potential of cannabinoids in treating multiple sclerosis, Parkinson’s disease, Alzheimer’s, PTSD, and chemotherapy-induced nausea. The opioid crisis has further highlighted the need for non-addictive pain management alternatives an area where cannabinoids show great promise. As scientific validation continues to mount, clinicians and patients alike are increasingly open to cannabinoid-based treatments, expanding the market’s medical credibility and consumer base.

Market Restraint: Regulatory Uncertainty and Inconsistent Legal Frameworks

Despite remarkable commercial interest, the U.S. cannabinoids market remains constrained by regulatory fragmentation and legal ambiguity. At the federal level, the DEA still classifies marijuana as a Schedule I substance, making THC-rich products federally illegal outside of FDA-approved drugs. Even hemp-derived CBD while technically legalized by the 2018 Farm Bill—lacks formal FDA approval for use in dietary supplements or food and beverage products.

This inconsistency creates confusion for manufacturers, retailers, and consumers. Some states have enacted strict rules for product labeling, marketing, and THC thresholds, while others operate in a legal gray area. The lack of harmonized regulations also discourages institutional investment and limits expansion into mainstream retail and healthcare channels. Until a comprehensive federal framework is enacted, market participants must navigate a patchwork of policies that hamper scalability and increase compliance risk.

Market Opportunity: Growth of Minor Cannabinoids in Targeted Wellness Products

An emerging opportunity lies in the commercialization of minor cannabinoids such as CBG, CBC, CBN, and THCV, which are increasingly being used in targeted health and wellness formulations. Unlike THC and CBD, these cannabinoids are often non-psychoactive and may offer more precise therapeutic effects. For example, CBG is being studied for its potential in treating glaucoma and inflammatory bowel disease, while CBN is gaining popularity for sleep enhancement and neuroprotective benefits.

As consumer awareness grows, wellness brands are creating product lines focused on these specific compounds—often with branding that aligns with sleep, focus, immunity, or pain relief. The opportunity is further amplified by advancements in biosynthesis and synthetic biology, which allow for cost-effective production of these rare cannabinoids at scale. Companies that invest early in R&D, formulation, and clinical validation of minor cannabinoids stand to differentiate themselves in a crowded market and capture high-value niches.

Segmental Analysis

By Product Type

Cannabidiol (CBD) continues to dominate the U.S. cannabinoids market, accounting for the highest revenue share across multiple product categories. CBD’s non-psychoactive nature, wide therapeutic appeal, and legal status under the 2018 Farm Bill have made it a staple in everything from supplements and skincare to beverages and pet care products. Its versatility allows companies to market CBD as a solution for anxiety, pain, inflammation, and sleep disorders. The proliferation of CBD-infused consumer goods in mass retail channels such as CVS, Walgreens, and Amazon has contributed significantly to its dominance.

However, cannabigerol (CBG) is emerging as the fastest-growing cannabinoid, as scientific literature uncovers its antibacterial, anti-inflammatory, and neuroprotective properties. CBG is being marketed in premium supplements, topicals, and even oral health products. While its natural abundance in cannabis plants is low, advances in biosynthesis and genetic modification are making CBG more commercially viable. Early movers in this space—such as biotech startups and craft wellness brands—are creating high-margin niches for CBG-enriched formulas targeted at immune health, skin conditions, and mood regulation. Its rapid adoption points to a future where minor cannabinoids compete head-to-head with CBD in specialized markets.

By Application

Pain management remains the leading application segment within the U.S. cannabinoids market. Both THC and CBD have demonstrated efficacy in alleviating acute and chronic pain by interacting with the body’s endocannabinoid system. Medical cannabis is widely used for arthritis, back pain, fibromyalgia, and nerve damage. Patients seeking alternatives to opioids are turning to cannabinoid-based therapies for long-term pain relief without the risk of addiction. Clinics and dispensaries often recommend high-THC or balanced THC:CBD ratios for pain relief, while CBD topicals and tinctures are available over the counter for general use.

Meanwhile, neurological disorders represent the fastest-growing application, bolstered by increased research, FDA approvals, and anecdotal success stories. CBD’s success in treating epilepsy has encouraged studies into its impact on Parkinson’s disease, Huntington’s disease, Alzheimer’s, and multiple sclerosis. Cannabinoids offer neuroprotective properties and anti-inflammatory effects that may slow disease progression or alleviate symptoms. Innovations in delivery methods such as transdermal patches and nasal sprays are improving bioavailability and precision dosing, enhancing therapeutic impact. With a surge in aging populations and unmet needs in neurodegenerative disease management, this segment holds immense promise.

Country-Level Analysis: United States

In the U.S., state-level legalization continues to define market dynamics. As of 2025, over 20 states have legalized recreational cannabis, and more than 35 permit medical cannabis use. This patchwork landscape has created diverse operating environments across the country. States like California, Colorado, and Oregon have mature markets with robust retail ecosystems, while newcomers such as New York and Virginia are developing regulatory frameworks aimed at equity and social justice.

Federal policy, though lagging, is showing signs of evolution. The 2024 reintroduction of the SAFE Banking Act in Congress and bipartisan support for cannabis research legislation are gradually laying the groundwork for more stable and scalable industry infrastructure. At the same time, the U.S. Food and Drug Administration (FDA) continues to evaluate the safety of cannabinoids in supplements and foods—an eventual ruling could have far-reaching implications for national retailers and manufacturers.

On the consumer front, public sentiment is overwhelmingly favorable. A 2023 Gallup poll indicated that over 68% of Americans support cannabis legalization, with strong support across generational lines. Wellness-focused demographics are embracing cannabinoids as daily supplements, while patients and healthcare professionals are warming to their medical applications. With large-scale brands entering the space and clinical pipelines expanding, the U.S. cannabinoid industry is poised for exponential growth—pending regulatory alignment.

Some of the prominent players in the U.S. cannabinoids market include:

- Mile High Labs International

- Global Cannabinoids

- GenCanna

- CBD INC

- Precision Plant Molecules

- Rhizo Sciences

- LaurelCrest

- Fresh Bros Hemp Company

- BulKanna

- High Purity Natural Products

- Zero Point Extraction

Recent Developments

-

April 2024 – Cronos Group Launches CBG-infused Sleep Product: Cronos introduced a CBG-dominant sleep tincture under its U.S. wellness brand, citing rising consumer interest in minor cannabinoids for targeted effects.

-

March 2024 – Charlotte’s Web Announces Clinical Trial with Johns Hopkins: Charlotte’s Web initiated a collaboration with Johns Hopkins Medicine to investigate the cognitive effects of full-spectrum CBD in aging adults, enhancing the credibility of its product line.

-

February 2024 – GW Pharmaceuticals Expands Epilepsy Drug Portfolio: GW Pharmaceuticals (a subsidiary of Jazz Pharma) announced Phase II trial results for a new cannabinoid compound targeting Dravet syndrome, following the success of Epidiolex.

-

January 2024 – Acreage Holdings Unveils THCV Product Line: Acreage released a new line of products featuring tetrahydrocannabivarin (THCV), marketed for appetite suppression and cognitive stimulation, targeting the wellness-conscious demographic.

-

December 2023 – FDA Issues Warning Letters to CBD Companies: The FDA sent cease-and-desist letters to five companies marketing unapproved CBD products with therapeutic claims, reinforcing the need for compliance and clinical evidence.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. cannabinoids market

Product Type

- Tetrahydrocannabinol (THC)

- Cannabidiol (CBD)

- Cannabigerol (CBG)

- Cannabichromene (CBC)

- Cannabinol (CBN)

- Tetrahydrocannabivarin (THCV)

- Cannabigerolic Acid (CBGA)

- Others

Application

- Inflammation

- Pain Management

- Neurological Disorders

- Cancer

- Others