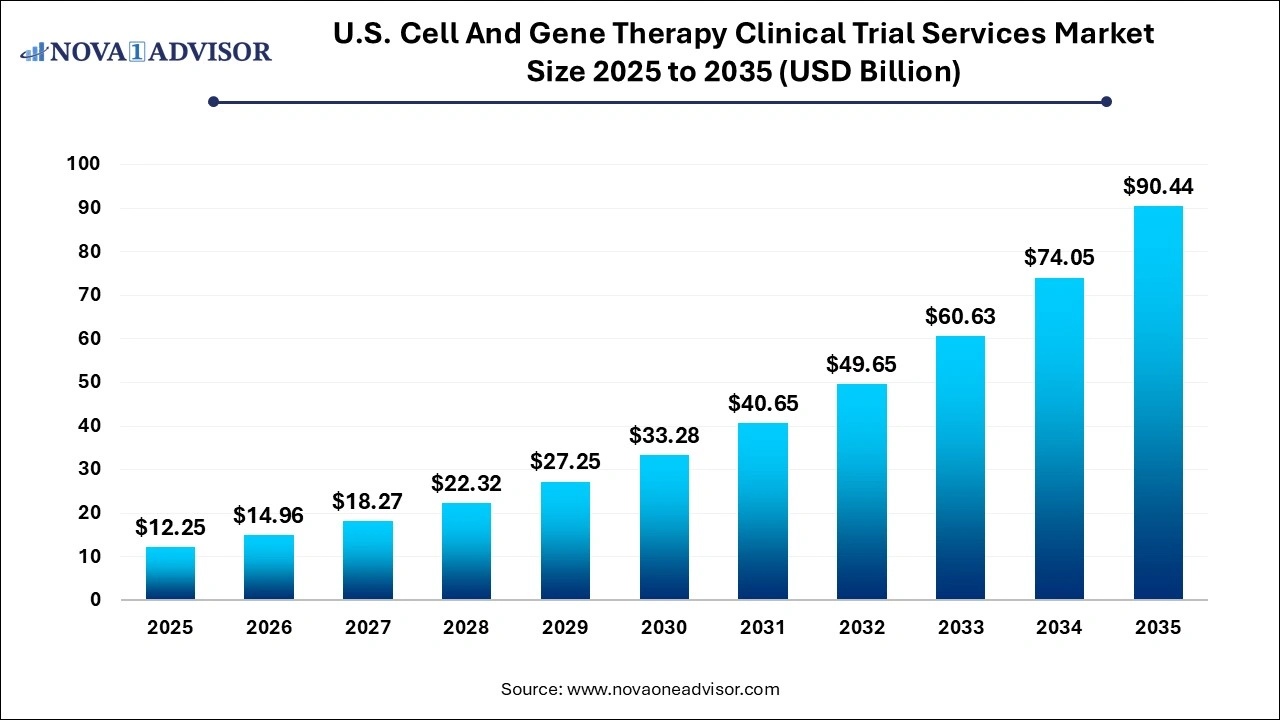

U.S. Cell And Gene Therapy Clinical Trial Services Market Size and Growth 2026 to 2035

The U.S. cell and gene therapy clinical trial services market size was valued at USD 12.25 billion in 2024 and is projected to surpass around USD 90.44 billion by 2035, registering a CAGR of 22.13% over the forecast period of 2025 to 2034.

Key Takeaways:

- The regulatory services segment held the largest revenue share of 22% in 2025.

- The supply and logistic services segment is anticipated to register a considerable CAGR of 23.3% over the forecast period.

- The phase II segment held the largest revenue share of 49% in 2025.

- The phase I segment is anticipated to register the fastest CAGR of 23.2% during the forecast period.

- The oncology segment held the largest revenue share of 57% in 2025.

- The central nervous system (CNS) disorders segment is anticipated to register the fastest CAGR of 24.7% during the forecast period.

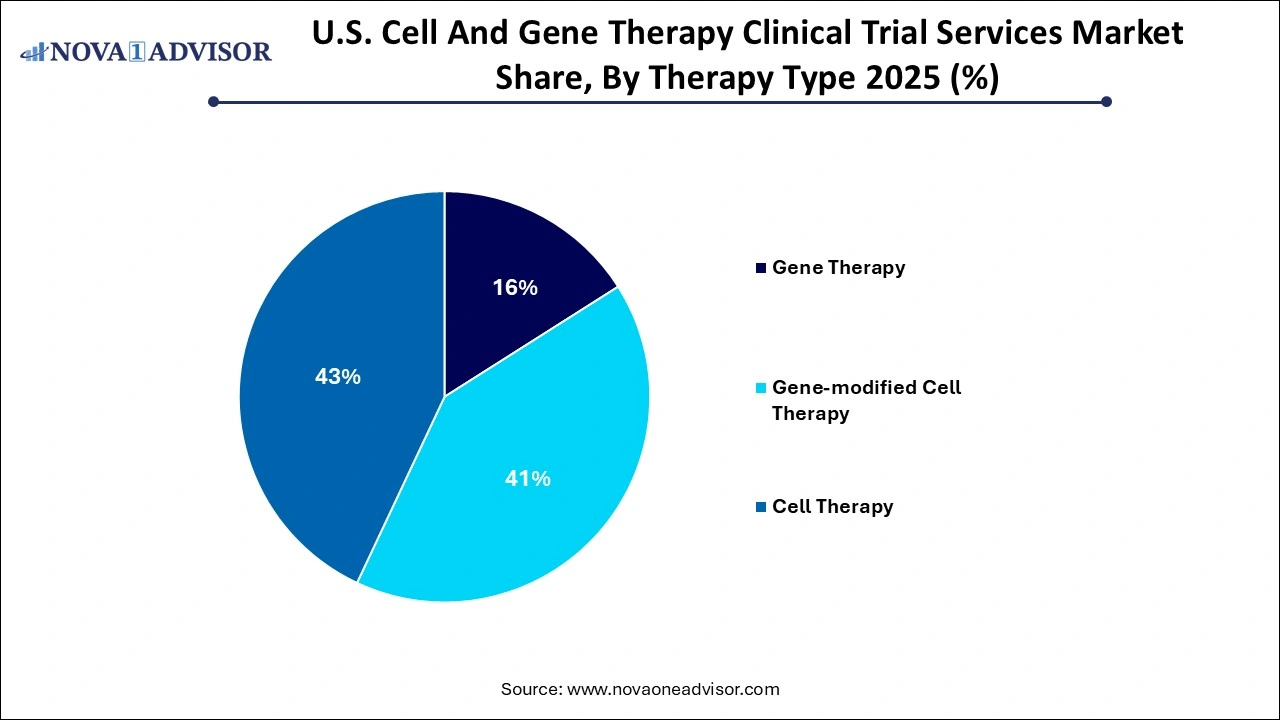

- The cell therapy segment held the largest revenue share of 43% in 2025.

- The gene-modified cell therapy segment is expected to register the fastest CAGR of 23.6% during the forecast period.

U.S. Cell And Gene Therapy Clinical Trial Services Market Overview

The U.S. cell and gene therapy (CGT) clinical trial services market represents a dynamic and rapidly expanding segment of the clinical research ecosystem. Fueled by breakthroughs in personalized medicine, regenerative therapy, and immuno-oncology, the demand for comprehensive and specialized services to support cell and gene therapy clinical trials has soared in recent years.

These therapies hold transformative potential in treating complex and previously untreatable diseases, including rare genetic disorders, cancers, neurodegenerative diseases, and cardiovascular conditions. However, the complexity of CGT trials—ranging from logistics of living cell materials to unique regulatory pathways and patient recruitment hurdles—requires specialized clinical trial support.

The U.S. remains the epicenter of global CGT research, backed by a strong pharmaceutical and biotech pipeline, top-tier academic medical centers, and progressive regulatory frameworks. The FDA’s RMAT (Regenerative Medicine Advanced Therapy) designation has further accelerated approvals and incentivized innovation.

The clinical trial services market in this domain spans from site identification and patient recruitment to laboratory analytics, logistics, and manufacturing support. Contract research organizations (CROs), biotech sponsors, academic institutions, and clinical trial networks form the key players within this evolving ecosystem.

U.S. Cell And Gene Therapy Clinical Trial Services Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 14.96 Billion |

| Market Size by 2035 |

USD 90.44 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 22.13% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Service, Phase, Therapeutic Areas, Therapy Type |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Novartis AG; Takeda Pharmaceutical Company Limited.; Gilead Sciences, Inc.; Amgen Inc.; bluebird bio, Inc.; Regeneron Pharmaceuticals Inc.; CRISPR Therapeutics; Pfizer; Biocair; Modality Solutions LLC; BioLife Solutions, Inc.; Marken; Yourway; Almac Group; Catalent, Inc; Quick International Courier (QuickStat (Kuehne + Nagel Company) |

Key Driver: Expanding CGT Pipeline and Accelerated Regulatory Designations

A critical driver of the U.S. CGT clinical trial services market is the expansion of the therapeutic pipeline and regulatory incentives accelerating trial timelines. According to FDA data, the number of investigational new drug (IND) applications for CGT products has risen sharply, with over 2,000 active CGT clinical trials globally, many of which are U.S.-based.

Designations such as Orphan Drug, Breakthrough Therapy, Fast Track, and RMAT status have significantly reduced development timelines for eligible therapies. This creates an urgent demand for agile and specialized clinical trial support, particularly in site activation, patient identification, regulatory navigation, and manufacturing coordination.

Examples include the rise of CAR-T cell therapy trials for hematological malignancies, where patient enrollment, cell extraction, and lab processing must occur within tight windows, supported by end-to-end clinical trial services. The momentum from biotech funding, venture capital investment, and pharma partnerships sustains this driver over the long term.

Key Restraint: Complex Logistics and High Operational Costs

The most significant restraint limiting wider scalability of CGT clinical trials is the high cost and complexity of operational logistics. Unlike traditional drugs, cell and gene therapies often involve autologous treatments (where cells are derived from the patient), cryopreserved materials, or genetically modified vectors, all of which require stringent handling and regulatory compliance.

Cold chain logistics, time-sensitive transportation, coordination between sites and manufacturing units, and the need for GMP-compliant facilities drive up trial costs significantly. Moreover, the scarcity of eligible patients, especially in rare disease trials, further complicates the process of patient recruitment and trial site selection.

These challenges require substantial investment in infrastructure, supply chain integration, and specialized personnel barriers that smaller biotech firms often struggle to overcome, leading to reliance on experienced CROs and service vendors.

Market Opportunity: Rise of Decentralized and Technology-driven CGT Trials

A key opportunity lies in the emergence of decentralized, hybrid, and digitally enabled clinical trial models, particularly suited for rare disease and geographically dispersed patient populations. Given the logistical burdens of site visits and the fragile health of CGT trial participants, the industry is embracing solutions that allow remote monitoring, e-consent, virtual site support, and wearable data collection.

Additionally, AI-driven platforms are being employed for patient identification, protocol design, and site optimization, helping accelerate trial timelines and improve precision in candidate selection. Companies offering integrated solutions that combine logistics with digital patient engagement and real-world data capture are well-positioned to benefit from this evolution.

Technologies such as blockchain for chain-of-custody tracking, machine learning in biomarker analysis, and cloud-based trial management systems are actively transforming the landscape of CGT clinical trials in the U.S.

Segmental Insights:

By Service Insights

Laboratory Services Dominate the Market

Laboratory services constitute the largest segment in the CGT clinical trial services market. These services include biomarkers testing, genomic analysis, pharmacokinetics (PK), and pharmacodynamics (PD) profiling, which are essential to CGT development.

The personalized nature of cell and gene therapies demands deep analytical support ranging from patient-specific genotyping to viral vector characterization and potency assays. Many trials require centralized labs equipped to handle biological materials under GxP standards, making this a high-value service segment.

Supply and Logistics Services are the Fastest-growing

Supply and logistic services are the fastest-growing due to the unique handling requirements of CGT materials. Sub-segments such as cryogenic transportation, comparator sourcing, packaging, and real-time tracking systems have seen rapid investment.

Manufacturing services particularly for viral vectors and cell processing are often integrated with logistics, offering end-to-end chain-of-identity and chain-of-custody assurance. With the rising volume of CGT trials, sponsors increasingly outsource these specialized logistics to CROs or CDMOs offering dedicated CGT platforms.

By Phase Insights

Phase II Trials Dominate the Market

Phase II trials dominate the CGT clinical landscape in the U.S., reflecting the growing maturity of the pipeline. This phase is critical for dose finding, safety validation, and preliminary efficacy, especially in oncology and rare disease indications.

Given the small, carefully selected patient populations and the need for biomarker-based monitoring, Phase II trials demand specialized trial coordination, site engagement, and regulatory navigation.

Phase I is the Fastest-growing Segment

Phase I trials are growing fastest, driven by the influx of new CGT IND filings and first-in-human studies. These trials are increasingly conducted at academic medical centers or early-phase research hospitals with experience in novel biologicals and stringent safety protocols.

CROs are developing phase-specific service offerings, including healthy volunteer recruitment, specialized toxicology labs, and cell processing units embedded within trial sites.

By Therapeutic Areas Insights

Oncology Dominates the Market

Oncology is the dominant therapeutic area for CGT clinical trials, with a heavy focus on CAR-T, TCR-T, and gene editing therapies for hematologic and solid tumors. Services such as tumor antigen analysis, patient lymphocyte collection, and adaptive trial designs are essential in this segment.

The FDA has already approved several oncology-focused CGTs, including Yescarta and Kymriah, setting the precedent for continued growth and investment in cancer-focused trials. Many large and mid-sized CROs have dedicated oncology trial units tailored to gene and cell therapies.

CNS Disorders Are the Fastest-growing Therapeutic Area

Central Nervous System (CNS) disorders, including spinal muscular atrophy (SMA), ALS, and Parkinson’s disease, represent the fastest-growing area for CGT trials. Many of these conditions are monogenic, making them ideal candidates for gene therapy approaches.

Service providers must navigate challenges such as neurological biomarker development, patient retention, and long-term safety tracking, which are complex and expensive but also critical for therapeutic validation.

By Therapy Type Insights

Gene-modified Cell Therapy (CAR-T) Dominates the Market

Gene-modified cell therapies, particularly CAR-T cell therapies, dominate the U.S. clinical trial services market. These therapies require extensive patient-specific cell collection, ex vivo modification, and reinfusion protocols, demanding precise trial coordination, chain-of-identity, and regulatory compliance.

CROs providing CAR-T trial support must integrate manufacturing logistics, immunophenotyping labs, patient monitoring tools, and pharmacovigilance systems into one seamless workflow. Leading cancer centers across the U.S. are central hubs for such trials.

Gene Therapy is the Fastest-growing Subsegment

Gene therapy trials especially those utilizing AAV or lentiviral vectors—are growing rapidly, driven by approvals like Zolgensma and ongoing studies in hemophilia, retinal disease, and inherited metabolic disorders.

These therapies are one-time interventions requiring long-term follow-up services, real-world evidence collection, and post-marketing surveillance, providing long-term growth opportunities for clinical trial service providers.

Country-level Insights

The U.S. is the global leader in CGT clinical trials, accounting for over 50% of global CGT trial activity, supported by regulatory innovation, venture capital funding, and robust infrastructure. The FDA’s Office of Tissues and Advanced Therapies (OTAT) facilitates fast-track reviews, encouraging innovation.

Leading academic centers like MD Anderson, Memorial Sloan Kettering, Mayo Clinic, and University of Pennsylvania serve as CGT trial hubs, offering specialized protocols, GMP cell labs, and translational research support. Meanwhile, CROs are expanding CGT-specific services, often through M&A or partnerships.

In addition, private biotechs and large pharmas are outsourcing more to trial service firms with CGT experience, fostering an ecosystem that supports efficient trial conduct from IND filing through Phase IV.

U.S. Cell And Gene Therapy Clinical Trial Services Market Key Companies & Share Insights

The key players focus on expanding their facilities, product/service launches, collaborations, partnerships, and mergers and acquisitions. These are the key strategic initiatives influencing the industry dynamics. For instance, in January 2022, AmerisourceBergen and TrakCel launched the integrated platform to enhance access to prescribed cell & gene therapies, delivering complete visibility during the treatment. The two platforms are TrakCel’s advanced therapy orchestration platform, OCELLOS, and Fusion, a customer relationship management & patient support platform. Some prominent players in the U.S. cell and gene therapy clinical trial services market (Amalgamation of service providers by sponsor companies and logistic providers) are:

Key Cell And Gene Therapy (CGT) Supply and Logistic Providers Companies:

- Biocair

- Modality Solutions LLC

- BioLife Solutions, Inc.

- Marken

- Yourway

- Almac Group

- Catalent, Inc

- Quick International Courier (QuickStat (Kuehne + Nagel Company)

Recent Developments

-

April 2025 – Parexel announced the opening of a new CGT-focused clinical trial unit in Boston to support early-phase oncology trials.

-

March 2025 – IQVIA launched an AI-powered platform for CGT patient recruitment using genomic databases and social listening tools.

-

February 2025 – ICON plc completed a partnership with a leading biomanufacturing firm to offer integrated CGT trial and manufacturing support.

-

January 2025 – Medpace expanded its Cincinnati-based facility to include dedicated cold chain and CGT storage capabilities.

-

December 2024 – PPD (Thermo Fisher Scientific) reported a 35% increase in CGT trial volume year-over-year, fueled by rare disease sponsors and orphan drug studies.

U.S. Cell And Gene Therapy Clinical Trial Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Cell And Gene Therapy Clinical Trial Services market.

By Service

- Site Identification

- Patient Recruitment

- Laboratory Services

- Regulatory Services

- Supply And Logistic Services

- Logistics & Distribution

- Storage & Retention

- Packaging, Labeling, And Blinding

- Manufacturing

- Comparator Sourcing

- Regulatory and customs support

- Other Services

- Others

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Therapeutic Areas

- Oncology

- Central Nervous System (CNS) Disorders

- Cardiovascular Diseases

- Infectious Diseases

- Musculoskeletal

- Others

By Therapy Type

- Gene Therapy

- Gene-modified Cell Therapy

- CAR T-cell therapies

- CAR-NK Cell Therapy

- TCR-T Cell Therapy

- Others

- Cell Therapy