U.S. Cell Therapy Raw Materials Market Size and Growth 2026 to 2035

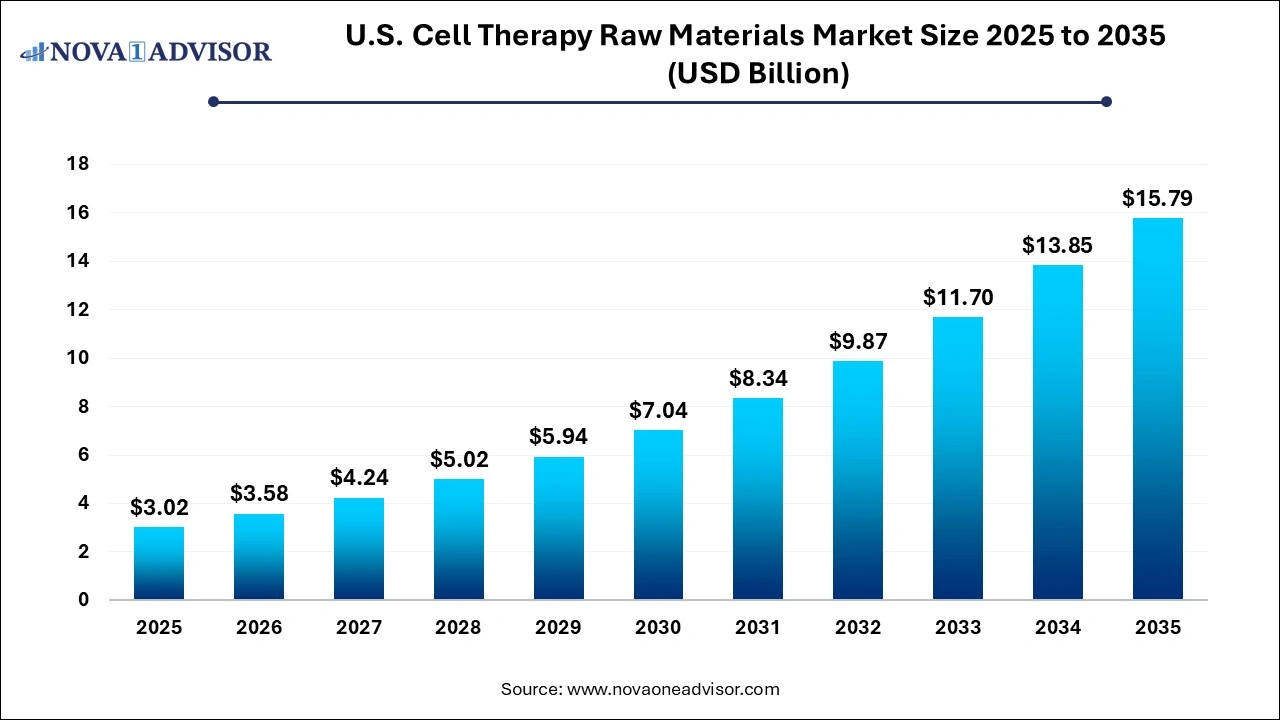

The U.S. cell therapy raw materials market was valued at USD 3.02 billion in 2025 and is projected to hit around USD 15.79 billion by 2035, growing at a CAGR of 17.99% during the forecast period 2026 to 2035. The growth of the market is attributed to the rising demand for cell-based therapy and increasing investments in cell therapy R&D.

U.S. Cell Therapy Raw Materials Market Key Takeaways

- By product, the cell culture supplements segment dominated the market in 2025.

- By product, media segment is expected to grow at the fastest rate between 2026 to 2035.

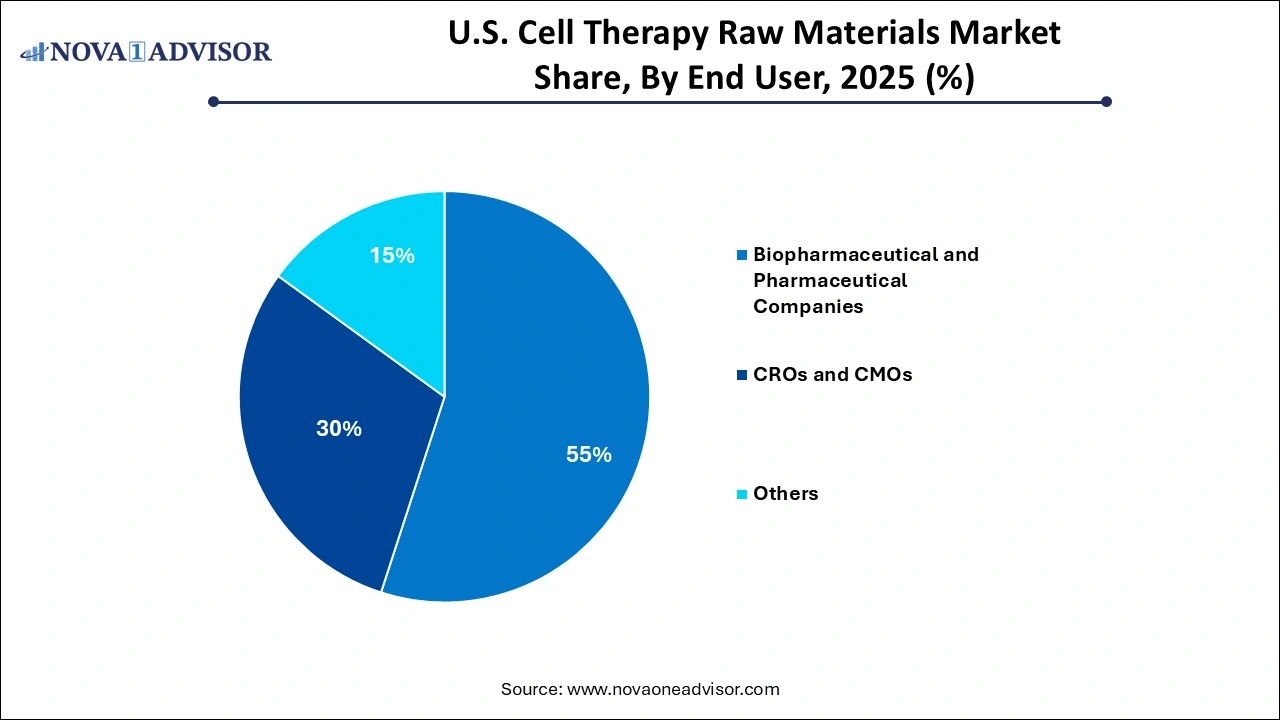

- By end use, the biopharmaceutical & pharmaceutical companies segment held the largest share of the market in 2025.

- By end use, the CMOs & CROs segment is expected to expand at the highest CAGR over the forecast period.

AI Impact on the U.S. Cell Therapy Raw Materials Market

AI is significantly impacting the U.S. cell therapy raw materials market by enhancing efficiency, quality control, and scalability across the value chain. Machine learning algorithms are being used to optimize cell culture conditions, predict batch outcomes, and reduce variability in raw material performance. AI-driven analytics also support faster development of customized media formulations and help ensure regulatory compliance through advanced data tracking and documentation. As a result, manufacturers can accelerate timelines, improve product consistency, and reduce costs.

U.S. Cell Therapy Raw Materials Market Overview

The U.S. cell therapy raw materials market encompasses all the materials used to manufacture cell therapies, including reagents, media, growth factors, and other consumables. This market is experiencing significant growth, driven by the increasing number of cell therapy products in development and commercialization. Essential materials such as culture media, growth factors, and enzymes play a critical role in the manufacturing process of cell therapy, requiring high purity and consistency. Market players are investing heavily in advanced formulations and scalable production to meet the rising demand. Additionally, strict regulatory standards are pushing suppliers to ensure quality and safety in raw material supply chains.

- For instance, the FDA’s Current Good Manufacturing Practice (cGMP) regulations, outlined in 21 CFR Parts 210, 211, and 600–680, apply to the manufacturing of biologics and their raw materials. These mandates ensure consistent product quality through robust Chemistry, Manufacturing, and Controls (CMC) practices.

What are the Major Trends in the U.S. Cell Therapy Raw Materials Market?

- Therapeutic Demand & Clinical Activity: The increasing pipeline of cell- and gene-based therapies, alongside a surge in clinical trials in the U.S., is fueling demand for high-quality, GMP-grade raw materials such as media, supplements, and viral vectors.

- Scaling Infrastructure & Localization: Leading suppliers, including Thermo Fisher, Danaher, and RoosterBio, are investing heavily in domestic biomanufacturing capabilities to enhance supply-chain resilience, improve turnaround times, and meet stringent regulatory requirements.

- Technological Innovation Across Bioprocessing: Adoption of advanced bioprocess technologies, like closed systems, single-use consumables, automated bioreactors, and cryopreservation, aims to minimize contamination, boost efficiency, and lower production costs.

- Regulatory Heightening Standards & Strippling Global Dependency: The FDA’s evolving guidance (e.g., for use of human/animal-derived materials) and geopolitical tensions are prompting U.S. stakeholders to reduce reliance on foreign suppliers and meet higher domestic standards for quality, traceability, and compliance.

Report Scope of U.S. Cell Therapy Raw Materials Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 3.58 Billion |

| Market Size by 2035 |

USD 15.79 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 17.99% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, By End Use |

| Market Analysis (Terms Used) |

Value (USDMillion/Billion) or (Volume/Units) |

| Key Companies Profiled |

Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), Danaher Corporation (via Cytiva), Sartorius Stedim Biotech, Stemcell Technologies, Charles River Laboratories, Grifols, S.A., RoosterBio, Inc., ACROBiosystems, PromoCell GmbH, Actylis, GeminiBio, Akron Biotech, AllCells |

U.S. Cell Therapy Raw Materials Market Dynamics

Drivers

Increasing Investments in R&D

The U.S. cell therapy raw materials market is significantly driven by rising investments in research and development. These investments fuel the discovery of novel cell therapies and enhance existing ones, thereby increasing the demand for specialized raw materials. As more companies and research institutions allocate resources to cell therapy, the need for high-quality materials such as growth factors, media, and reagents grows. This increased demand drives market expansion, encouraging innovation and the development of advanced materials. Furthermore, these investments lead to the expansion of manufacturing capabilities, creating a robust ecosystem that supports market growth. Ultimately, the continuous influx of capital into R&D is a primary catalyst for the sustained growth of the market.

- In August 2024, Centers for Medicare & Medicaid Services (CMS) awarded the American Institutes for Research (AIR) a $28 million federal contract to help implement the Cell and Gene Therapy (CGT) Access Model. This program aims to increase access to cutting-edge cell and gene therapy treatments for Medicaid recipients, starting with therapies for sickle cell disease, and to explore outcomes-based payment agreements to improve both health outcomes and equity.

Increasing Number of Clinical Trials

The increasing number of clinical trials is another major factor driving the growth of the market. As more cell therapies progress through clinical trials, the demand for raw materials such as cells, growth factors, and other reagents increases substantially. Each phase of a clinical trial requires a larger volume of materials. The success of these trials often leads to commercialization, which significantly increases the need for raw materials to support manufacturing and distribution. Moreover, the complexity and stringent requirements of clinical trials necessitate high-quality raw materials, encouraging market innovation.

According to the American Society of Gene & Cell Therapy (ASGCT), there were more than 4,000 gene, cell, and RNA therapies in development. This indicated significant increases in the number of therapies across all three phases of development in the clinical pipeline, with notable growth of 11% in Phase I programs.

Restraint

High Costs and Regulatory Hurdles

Several factors restrain the growth of the U.S. cell therapy raw materials market. The high costs of raw materials, including specialized reagents and cell culture media, pose a significant challenge, especially for smaller companies and research institutions. Supply chain challenges, such as disruptions in the availability of critical components and logistical issues, can lead to delays and increased costs. Furthermore, stringent regulatory hurdles, including complex approval processes and quality control standards, add to the operational burdens and expenses. These regulatory requirements can slow down the development and commercialization of cell therapies, indirectly impacting the demand for raw materials.

Opportunities

Development of Novel Materials and Technological Advancements

A major future opportunity for U.S. cell therapy raw materials market lies in the development of novel materials and advancements in manufacturing techniques. Innovation in materials science leads to the creation of more efficient and cost-effective raw materials, such as improved cell culture media and advanced biomaterials. Advancements in manufacturing techniques, including automation and closed-system processing, enhance the scalability and reproducibility of cell therapy production. These improvements reduce costs, improve product quality, and increase the efficiency of manufacturing processes. Furthermore, the development of new materials opens doors for novel cell therapy applications and expands the market's scope.

Financing for Start-Up Cell Therapy Companies

Financing for start-up cell therapy companies enables expansion in research, clinical trials, and manufacturing capabilities. With increased funding, companies invest in high-quality raw materials such as culture media, cytokines, and gene editing reagents to support scalable and compliant production. This rising demand encourages suppliers to enhance their product offerings and expand GMP-certified facilities. As a result, capital inflows directly stimulate innovation and capacity across the raw materials supply chain.

U.S. Cell Therapy Raw Materials Market Segmental Insights

By Product Insights

Why Did the Cell Culture Supplements Segment Dominate the U.S. Cell Therapy Raw Materials Market in 2025?

The cell culture supplements segment dominated the market while holding the largest share in 2025. The dominance of cell cultural supplements stems from their critical role in supporting cell growth, viability, and functionality during manufacturing. These supplements, such as growth factors, cytokines, amino acids, and serum components, are essential for optimizing cell expansion and maintaining consistency across batches. As more cell therapies progressed into clinical and commercial stages, the demand for high-quality, GMP-grade supplements surged to meet strict regulatory and performance standards. Additionally, the shift toward chemically defined and animal-free supplements further boosted innovation and adoption, supporting the long-term growth of the market.

The media segment is expected to expand at the fastest CAGR over the projection period due to its central role in cell cultivation and expansion, which are critical for both research and large-scale therapeutic manufacturing. As cell therapies advance into late-stage clinical trials and commercialization, there is increasing demand for customized, serum-free, and chemically defined media that ensure consistency, safety, and regulatory compliance. Moreover, media tailored for specific cell types, like T cells, stem cells, and CAR-T cells Therapy, is enabling higher yields and better therapeutic outcomes. Continuous innovation and partnerships between media developers and therapy manufacturers are further driving this segment’s growth trajectory.

By End Use Insights

What Made Biopharmaceutical & Pharmaceutical Companies the Dominant Segment in the Market in 2025?

The biopharmaceutical & pharmaceutical companies segment led the market with the largest share of the market in 2025. This is primarily due to their extensive investment in R&D, clinical trials, and commercialization of cell-based therapies. These companies are leading the development of advanced therapies like CAR-T cells, stem cell treatments, and gene-modified cell products, which require high volumes of reliable, GMP-compliant raw materials. Their strong financial capacity enables them to secure long-term supply contracts, invest in scalable manufacturing, and collaborate with raw material suppliers for tailored solutions.

The CMOs & CROs segment is expected to grow at the fastest CAGR in the upcoming period. The growth of the segment is driven by the increasing trend of outsourcing among biotech and pharmaceutical companies. As the complexity and cost of developing cell therapies rise, many developers are turning to CMOs and CROs for specialized services, including raw material sourcing, process development, and regulatory support. These organizations offer scalable infrastructure, technical expertise, and compliance with GMP standards, making them ideal partners for accelerating clinical and commercial production. The growing pipeline of cell therapies and the need for flexible, cost-effective solutions are fueling this segment’s rapid expansion.

Why the U.S. is at the Forefront of the Global Cell Therapy Raw Materials Landscape?

1. Strong Biopharmaceutical and Biotech Ecosystem

The U.S. is home to a large number of leading biopharma and biotech companies actively developing cell therapies, which creates sustained demand for high-quality raw materials. These firms also drive innovation by partnering with suppliers to develop specialized materials tailored for advanced therapies.

2. High Volume of Clinical Trials and FDA Approvals

A significant portion of global cell therapy clinical trials take place in the U.S., supported by the FDA’s evolving regulatory guidance for advanced therapies. This clinical activity boosts demand for GMP-compliant raw materials and encourages rapid commercialization.

3. Presence of Major Raw Material Suppliers

Top global players like Thermo Fisher Scientific, Danaher (Cytiva), and MilliporeSigma (Merck KGaA) have major operations or headquarters in the U.S. Their proximity enables faster delivery, better customer support, and accelerated R&D collaboration with therapy developers.

4. Advanced Manufacturing Infrastructure

The U.S. has invested heavily in advanced biomanufacturing facilities and single-use technology platforms that support scalable, high-quality production of raw materials. This infrastructure ensures that both clinical and commercial-scale production can be achieved efficiently.

5. Government Support and Funding Initiatives

U.S. agencies like the NIH, BARDA, and ARPA-H provide substantial funding for regenerative medicine and cell therapy research. These investments not only support therapy developers but also strengthen the raw materials supply chain through innovation grants and partnerships.

- In 2024, ATCC, the leading biological materials management and standards organization, has received a five-year, $87 million award from BARDA (part of the U.S. Department of Health and Human Services) to advance the development of next-generation medical countermeasures (MCMs). The funding will support efforts to protect Americans against public health threats, including coronaviruses and other emerging pathogens.

6. Strong Regulatory Framework

The FDA offers clear and evolving guidelines for raw materials used in cell therapy, ensuring consistency, safety, and traceability. This regulatory clarity encourages global companies to align their products with U.S. standards, making the U.S. a reference market.

7. Academic and Research Collaboration

Top U.S. universities and research institutions actively collaborate with industry players to advance raw material development. These collaborations help translate scientific discovery into scalable, commercial-grade materials more quickly than in other regions.

Exploring the Statewide Opportunities

Massachusetts (Boston–Cambridge)

This region is one of the nation’s premier life sciences clusters, housing over 1,000 biopharmaceutical companies involved in cell and gene therapy development, accounting for approximately 20% of the global gene therapy pipeline. This concentration drives strong local demand for raw materials and encourages supplier–developer collaborations.

California (San Francisco Bay Area & San Diego)

California, particularly the Bay Area and San Diego, hosts leading gene therapy developers and enjoys heavy venture capital support. The state's focus on innovation and R&D has led to significant growth in investment in the past few years, that indirectly boosts raw materials consumption.

North Carolina (Research Triangle Park)

Known for its attractive operating costs and strong talent pool, Research Triangle Park has become a magnet for over 20 cell and gene therapy companies, like AveXis and Precision BioSciences, building regional raw material demand via manufacturing and clinical initiatives

Texas (Houston)

Houston’s ecosystem, anchored by institutions like MD Anderson Cancer Center, supports active CAR T therapy development and sizable clinical trial efforts, fostering demand for local quality control and raw material supply. This regional activity is strengthening Houston’s role in the raw materials value chain.

Maryland (DNA Valley / D.C. area)

Nicknamed "DNA Valley," Maryland boasts a dense concentration of biotech firms and federal R&D infrastructure, like the NIH in Bethesda, making it a strong regional hub for advanced cell therapy innovation and raw material sourcing. Examples include companies like RoosterBio, which actively operate in Frederick, MD.

Ohio (Cleveland–Akron–Columbus)

Ohio stands out as a long-standing regenerative medicine center. Institutions like Case Western, Cleveland Clinic, and a network of regenerative medicine startups anchor the state's biotech presence. With deep expertise in mesenchymal stem cell research and clinical activities, Ohio drives regional raw materials demand.

U.S. Cell Therapy Raw Materials Market Value Chain Analysis

1. Source Material Procurement & Primary Cell Collection

This is the starting point of the value chain, involving the ethical and regulated sourcing of human tissues and cells (e.g., T cells, NK cells, stem cells), which are critical for cell therapy development.

Key Activities:

- Collection of peripheral blood, bone marrow, cord blood, adipose tissue

- Ethical donor screening and tissue banking

- GMP-compliant primary cell isolation

2. Production of Growth Media, Reagents, & Cytokines

Raw materials such as media, sera, growth factors, cytokines, and buffers are vital for cell proliferation, differentiation, and maintenance during manufacturing.

Key Activities:

- Manufacturing of chemically defined and xeno-free culture media

- GMP-grade cytokine and growth factor production

- Lot-to-lot quality consistency and sterility assurance

3. Cell Engineering & Gene Modification Reagents

This step involves providing tools and reagents for gene editing or modification of cells, often using viral vectors or non-viral technologies.

Key Activities:

- Vector construction and gene insertion reagents

- Transfection tools and electroporation kits

- CRISPR components and safety-enhancing agents

4. Contract Manufacturing & GMP Processing (CDMOs)

GMP-compliant scale-up and production are often outsourced to specialized facilities that can meet regulatory, sterility, and traceability standards.

Key Activities:

- Cell expansion and final product formulation

- GMP-compliant manufacturing under FDA/EMA guidelines

- Quality control and batch release testing

5. Quality Control, Testing, and Regulatory Compliance

Ensures that raw materials and final products meet strict safety, sterility, potency, and compliance standards set by regulatory authorities like the FDA.

Key Activities:

- Lot release testing for sterility, identity, purity, and potency

- Regulatory document support and data compilation

- Analytical and bioassay development

6. Packaging, Storage & Cold Chain Logistics

Because of their sensitivity, cell therapy materials and reagents must be packaged and stored under ultra-low temperature conditions with secure, validated logistics.

Key Activities:

- Cryopreservation and secure vialing

- GMP-compliant storage (-80°C to cryogenic)

- Cold chain logistics with traceability

7. End Users & Clinical Deployment

The final materials are delivered to pharmaceutical companies, academic institutions, and clinical centers developing or administering cell-based therapies.

Competitive Landscape

1. Thermo Fisher Scientific: Provides a wide range of high-quality cell culture media, reagents, and growth factors essential for research, clinical, and commercial-scale cell therapy production.

2. Merck KGaA (MilliporeSigma): Supplies chemically defined media, supplements, and testing services, supporting scalable and regulatory-compliant cell therapy manufacturing.

3. Danaher Corporation (via Cytiva): Delivers GMP-grade raw materials, single-use systems, and automated solutions to streamline cell therapy workflows.

4. Sartorius Stedim Biotech: Offers advanced bioprocessing tools including bioreactors and filtration systems tailored for high-efficiency cell therapy production.

5. Stemcell Technologies: Specializes in serum-free, animal-free cell culture media and tools that support stem cell research and therapeutic development.

6. Charles River Laboratories: Provides critical raw materials, safety testing, and quality control services across the preclinical and clinical development stages.

7. Grifols, S.A.: Contributes plasma-derived products and biologics used as foundational inputs in regenerative medicine and cell therapy.

8. RoosterBio, Inc.: Supplies high-volume human mesenchymal stem cells (hMSCs) and ready-to-use media systems for scalable manufacturing.

9. ACROBiosystems: Produces recombinant proteins, assay kits, and GMP-grade reagents for cell therapy development and quality control.

10. PromoCell GmbH: Offers primary human cells and customized culture media systems tailored to therapeutic cell expansion.

11. Actylis: Delivers specialty ingredients and excipients that meet regulatory and process-specific needs for cell and gene therapies.

12. GeminiBio: Provides GMP-grade bioprocess liquids and reagents with a focus on quality assurance and local manufacturing.

13. Akron Biotech: Manufactures cGMP-compliant plasmid DNA and critical raw materials for advanced therapy production.

14. AllCells: Supplies ethically sourced RUO and GMP-compliant human primary cells for research and clinical applications in cell therapy.

These companies are actively expanding through strategic acquisitions, partnerships with biotech firms, and investments in local cGMP manufacturing facilities to enhance production capacity and ensure supply chain resilience. A key strategy involves developing high-quality, customizable, and regulatory-compliant raw materials, such as animal-origin-free and chemically defined media, to meet the specific needs of advanced therapies like CAR-T and stem cell treatments. In addition, players are integrating digital tools for quality control and traceability, aligning with FDA and cGMP standards to strengthen their market presence and support the evolving demands of clinical and commercial-scale therapy developers.

- In April 2024, Thermo Fisher announced the expansion of its cell therapy manufacturing capabilities with a new commercial manufacturing site in Plainville, Massachusetts. This facility supports the development and production of viral vectors and cell therapies, addressing the growing demand for advanced biologics. The expansion is part of Thermo Fisher’s broader investment strategy to support end-to-end cell and gene therapy solutions, including raw materials, development, and commercial-scale production.

U.S. Cell Therapy Raw Materials Market Recent Development

- In January 2023, Kite, a Gilead Company, announced the expansion of its global cell therapy supply chain operations in Frederick, Maryland, with a new, centralized raw materials warehouse that will serve Kite’s global manufacturing network. This facility complements Kite’s sites in Maryland, California, and the Netherlands, creating the world’s largest dedicated in-house cell therapy manufacturing network covering process development, vector production, clinical trials, and commercial manufacturing.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. cell therapy raw materials market.

By Product

- Media

- Sera

- Cell Culture Supplements

- Antibodies

- Reagents & Buffers

- Others

By End Use

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Others