U.S. Child Care Market Size and Trends

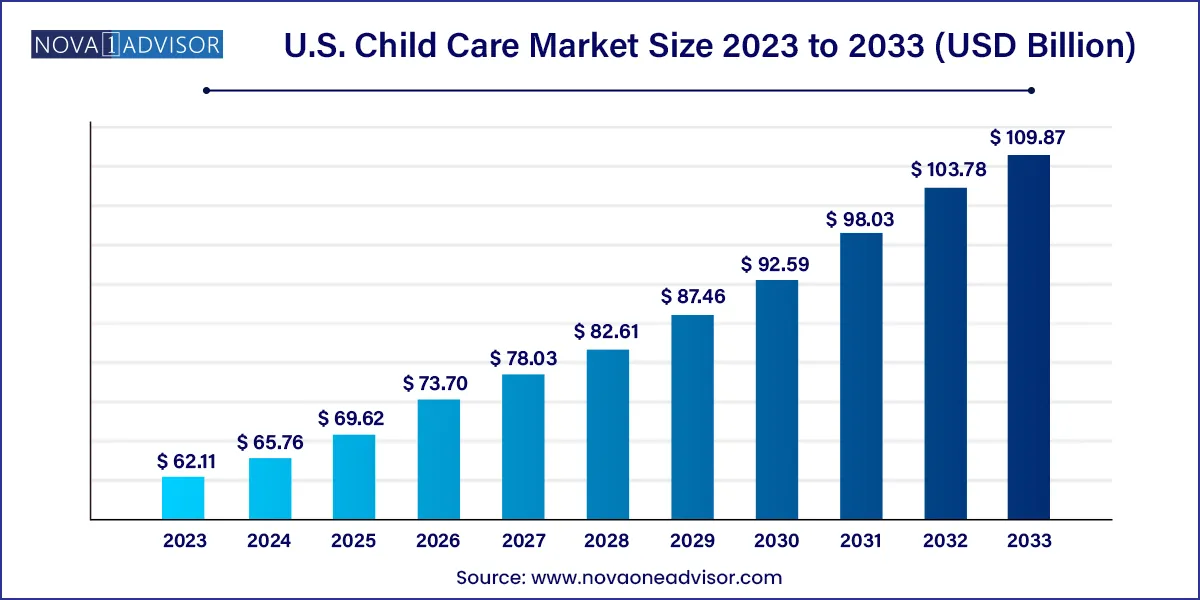

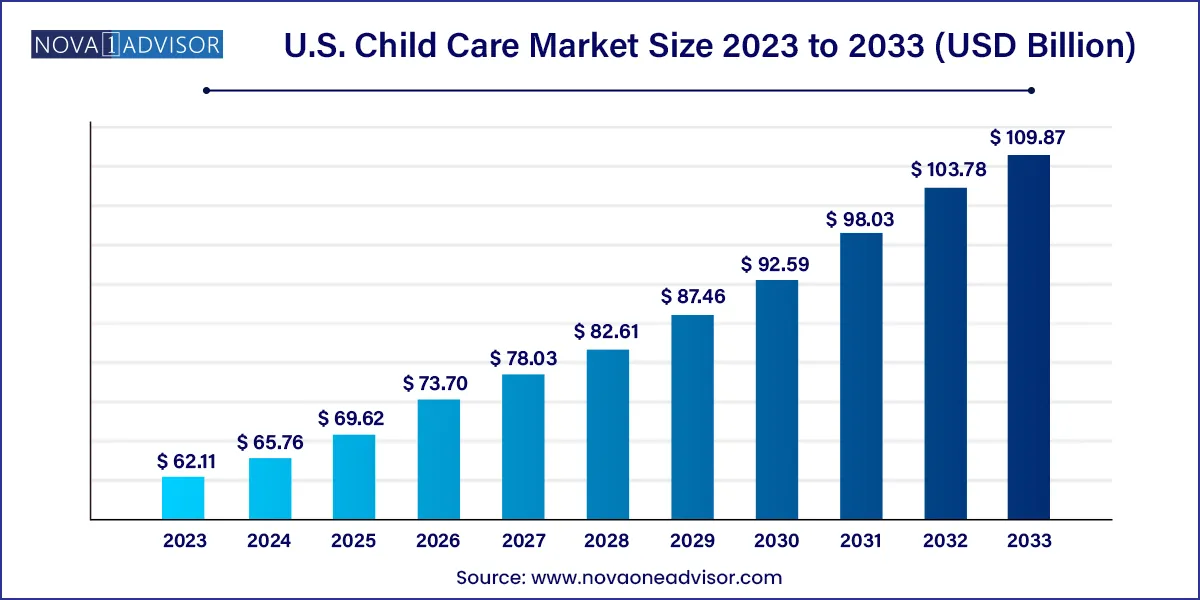

The U.S. child care market size was valued at USD 62.11 billion in 2023 and is projected to surpass around USD 109.87 billion by 2033, registering a CAGR of 5.87% over the forecast period of 2024 to 2033.

U.S. Child Care Market Key Takeaways:

- The school-aged children segment dominated the market in 2023 with a revenue share of 41.37%.

- The infants segment is anticipated to grow at the fastest CAGR during the forecast period.

- The organized care facilities segment held the dominant revenue share of 71.89% in 2023 and is expected to grow at the fastest CAGR during the forecast period.

- The home-based settings are expected to witness lucrative growth during the forecast period.

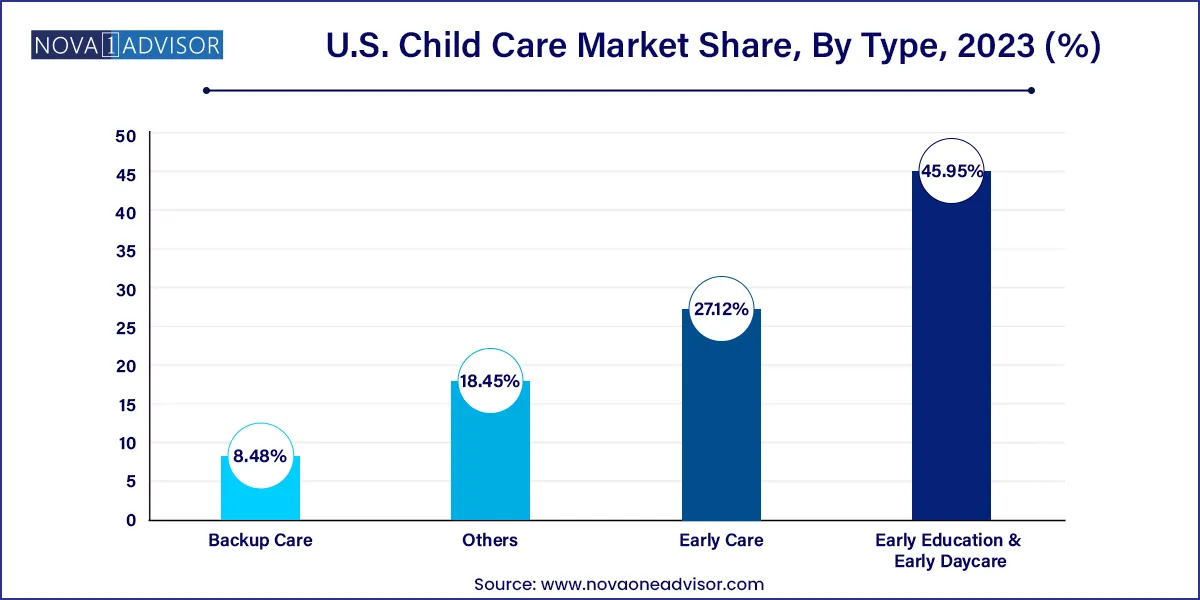

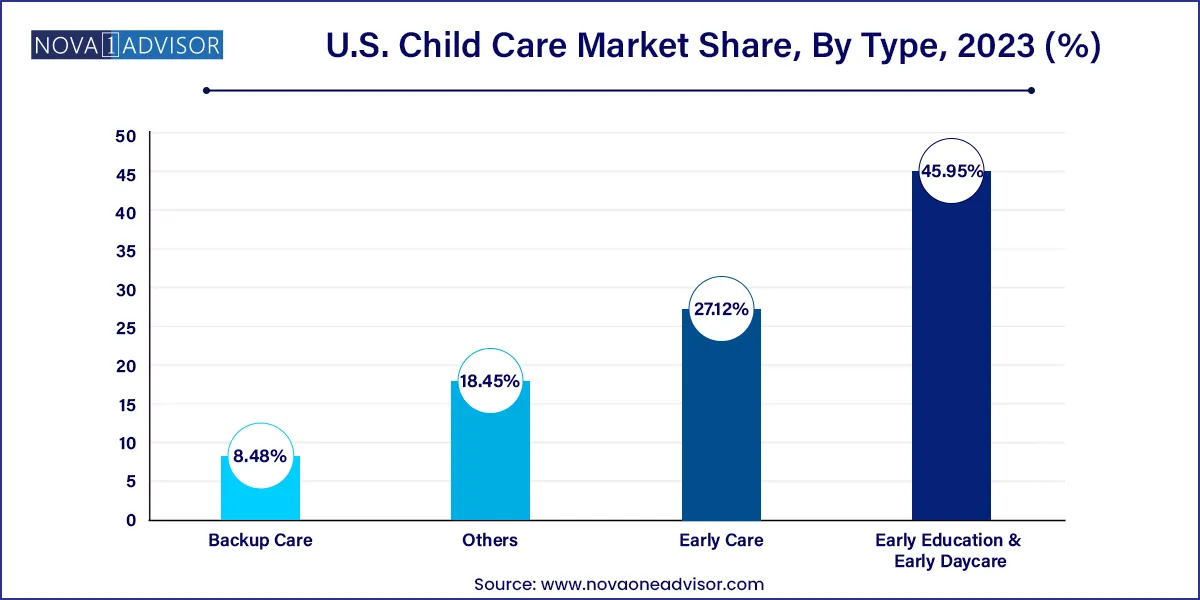

- The early education & early daycare segment dominated the market in 2023 with the largest revenue share of 45.95% and is expected to grow the fastest from 2024 to 2033.

- In 2023, Texas held the largest market share of 45.74%.

U.S. Child Care Market Growth

The market growth is driven by the increased demand due to more parents returning to offices, advancements in learning technologies, and government funding, specifically for single and working mothers.

The demand for early care and education in states such as Massachusetts is increasing due to the growth in skilled service areas, such as business & health, indicating the need for quality and accessible child care & early education. Therefore, ensuring that skilled workers with young children can continue participating in the labor force is important. It also facilitates parents to pursue higher education degrees and specialized training, which is essential to maintain a competitive employment market.

Child care services are a growing necessity in states such as New Jersey as more parents join the workforce. Public funding and support are necessary for these services, as they are essential for the economy to thrive and for children to reach their potential. Therefore, accessible and affordable early education programs are needed to meet this growing demand. According to a Rutgers University report, the demand for childcare is expected to grow in every county in New Jersey, specifically Ocean, Somerset, Morris, and Burlington counties. They are expected to experience a surge in the population of young children between 2019 and 2034.

U.S. Child Care Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 65.76 Billion |

| Market Size by 2033 |

USD 109.87 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.87% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, age group, delivery type, states, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Bright Horizons Family Solutions; KinderCare Learning Centers LLC.; Learning Care Group, Inc.; Spring Education Group; Cadence Education; The Learning Experience; Childcare Network; Kids 'R' Kids; Primrose Schools; Goddard Systems; BrightPath Kids; Winnie, Inc.; New Horizon Academy; Care.com; NeighborSchools, Inc.; SitterTree., LLC |

U.S. Child Care Market By Age Group Insights

The school-aged children segment dominated the market in 2023 with a revenue share of 41.37%. Population growth, urbanization, and demographic shifts influence demand for services in communities across the U.S. As communities grow and evolve, there is an increasing need for service providers to accommodate the needs of school-aged children and their families.

Moreover, many parents of school-aged children require child care before and after school due to their work schedules. The programs that offer before- and after-school care provide a solution for parents who need supervision and engagement for their children during these hours. Child care programs for school-aged children focus on providing engaging learning and recreational experiences that support children's development and help them thrive outside of school.

The infants segment is anticipated to grow at the fastest CAGR during the forecast period. The growing demand for infant care is due to a rise in labor participation. According to a survey by Move.org., in September 2023, infant care is estimated to be more expensive than older kids. Furthermore,the rise in the number of home-based centers, revenue limitations for providers, low teacher compensation, social & economic factors such as poverty, and a shortage of licensed child care options for infants & toddlers are expected to drive the segment growth.

U.S. Child Care Market By Delivery Type Insights

The organized care facilities segment held the dominant revenue share of 71.89% in 2023 and is expected to grow at the fastest CAGR during the forecast period. This growth of the segment is driven by the increasing number of working parents, technological advancements, and funding for quality early education.

In addition, organizations that facilitate daycare are collaborating to provide large-scale daycare services. For instance, South Carolina First Steps 4K has collaborated with private non-profit and for-profit organizations, faith-based institutions, independent schools, and other eligible providers to expand 4-year-old kindergarten programs in the 2023-2024 school year. The program is expected to prioritize developmental and learning support for children to prepare them for school, incorporating research-based practices, ongoing assessment, and parenting education.

The home-based settings are expected to witness lucrative growth during the forecast period. These settings are highly recommended for families with younger children or irregular schedules. Around 7 million children under 5 receive care in a home-based setting, offering benefits such as personalized care, lower costs, and a home-like environment. This is expected to fuel segment growth during the forecast period.

U.S. Child Care Market By Type Insights

The early education & early daycare segment dominated the market in 2023 with the largest revenue share of 45.95% and is expected to grow the fastest from 2024 to 2033. The demand for services is driven by several factors, including the increasing number of working parents who require care for their young children and growing recognition of the importance of early childhood education in supporting children's development.

In addition, various state-level institutions are undertaking the initiative to develop early education and care systems. For instance, in November 2023, the American College of Education (ACE) announced a strategic alliance with Learning Care Group, Inc. The alliance aims to initiate an educational pathway for early childhood professionals through three-course packs as part of the company expansion of professional development and educational training.

Furthermore, early care segment is expected to have substantial growth over the forecast period. It is emerging as an essential aspect for parents and the government since it provides a safe and nurturing environment for them to grow & learn. High-quality early care can have long-lasting positive effects on children's cognitive, social, and emotional development, and can even lead to better outcomes in adulthood.

U.S. Child Care Market By State Insights

In 2023, Texas held the largest market share of 45.74%. The primary factor driving the market growth in Texas includes stringent regulation and licensing processes in services. Child care centers and facilities in Texas are regulated and licensed by the Texas Department of Family and Protective Services (DFPS) through the Child Care Licensing (CCL) Division. The CCL ensures that child-placing agencies and operations meet the minimum standards set by the state.

There is an increase in dual-income households, where both parents work outside the home. As a result, there is a greater need for reliable and affordable options for children of working parents, including infants, toddlers, preschoolers, and school-aged children. In addition, Texas has its own set of policies and regulations governing child care facilities, licensing requirements, and health and safety standards. These state-level policies influence the operation and oversight of providers and contribute to the overall quality and accessibility of services in Texas.

On the other hand, South Carolina is expected to grow at the fastest growth rate during the forecast period. The growing need for ensuring the health and well-being of children are factors driving South Carolina's child care system. The state focuses on ensuring that providers meet health & safety standards and provides resources for families to find safe options. The DSS works to increase the quality of care for all children in the state.

U.S. Child Care Market By Regional Insights

Southeast U.S. dominated the market with a revenue share of 28.52% in 2023. It is expected to grow at the fastest CAGR from 2024 to 2030. The Southeast region is experiencing significant population growth, driven by factors such as migration from other parts of the country, natural population increase, and economic opportunities. As the population grows, the demand for these services increases, particularly in urban and suburban areas.

Economic conditions vary across the Southeast region, with some states experiencing robust economic growth while others face challenges such as poverty and unemployment. Economic factors influence families' ability to afford services and impact the demand for subsidized care programs and financial assistance. Collaboration among community organizations, nonprofits, and government agencies is essential for addressing the diverse needs of children and families in the Southeast region. Community partnerships can help expand access to services, provide support for low-income families, and promote early childhood development initiatives.

On the other hand, the Midwest U.S. is expected to witness substantial growth from 2024 to 2030. The growing initiatives and increased investments by the government are expected to boost the growth of the region. In addition, State and local governments utilized State and Local Fiscal Recovery Funds (SLFRF) from the American Rescue Plan Act (ARPA) to support working families and close the care gap, enabling the country's economic recovery. For instance, in September 2023, Franklin County, Ohio launched the Franklin County RISE program, which allocates USD 22.5 million to improve child care support in the county. This includes early learning scholarships of up to USD 10,000 for eligible families, rental assistance for child care workers, and incentive payments for licensed providers.

U.S. Child Care Market Recent Developments

- In December 2023, Goddard Systems partnered with Staples, Inc. to open the Childhood Education Center in Framingham. This center aims to provide care and education to approximately 200 children aged from 6 weeks to 6 years old.

- In November 2023, the American College of Education (ACE) announced a strategic alliance with Learning Care Group, Inc. The alliance aims to initiate an educational pathway for early childhood professionals through three-course packs as part of Learning Care Group, Inc.’s expansion of professional development and educational training.

- In March 023, Bright Horizons Family Solutions opened two new Bright Space for children at the Newton Police Department Headquarters, Newton, Massachusetts. The program aims to promote healing, offer nurturing & stimulating activities, and provide an enriching and stable environment for children in the care centers.

- In February 2023, Cadence Education acquired the Montessori Teacher Education Institute (MTEI) and the Suzuki School in Atlanta, Georgia. The acquisition aims to strengthen and boost the growth of Cadence Education’s presence in the Southeast, with the addition of three new campus locations in the Northside Drive, Ponce City Market, and Buckhead neighborhoods of Atlanta to its portfolio.

U.S. Child Care Market Top Key Companies

- Bright Horizons Family Solutions

- KinderCare Learning Centers LLC.

- Learning Care Group, Inc.

- Spring Education Group

- Cadence Education

- The Learning Experience

- Childcare Network

- Kids 'R' Kids

- Primrose Schools

- Goddard Systems

- BrightPath Kids

- Winnie, Inc.

- New Horizon Academy

- Care.com

- NeighborSchools, Inc.

- SitterTree., LLC

U.S. Child Care Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Child Care market.

By Type

- Early Care

- Early Education & Early Daycare

- Backup Care

- Others

By Delivery Type

- Organized Care Facilities

- Home-based Settings

By Age Group

- Infants

- Toddlers

- Preschoolers

- School-aged Children

By State

- Massachusetts

- New Jersey

- Connecticut

- Texas

- South Carolina

- Georgia

By Regional

- Northeast

- Southeast

- Southwest

- Midwest

- West