U.S. Cleanroom Technology In Healthcare Market Size and Growth

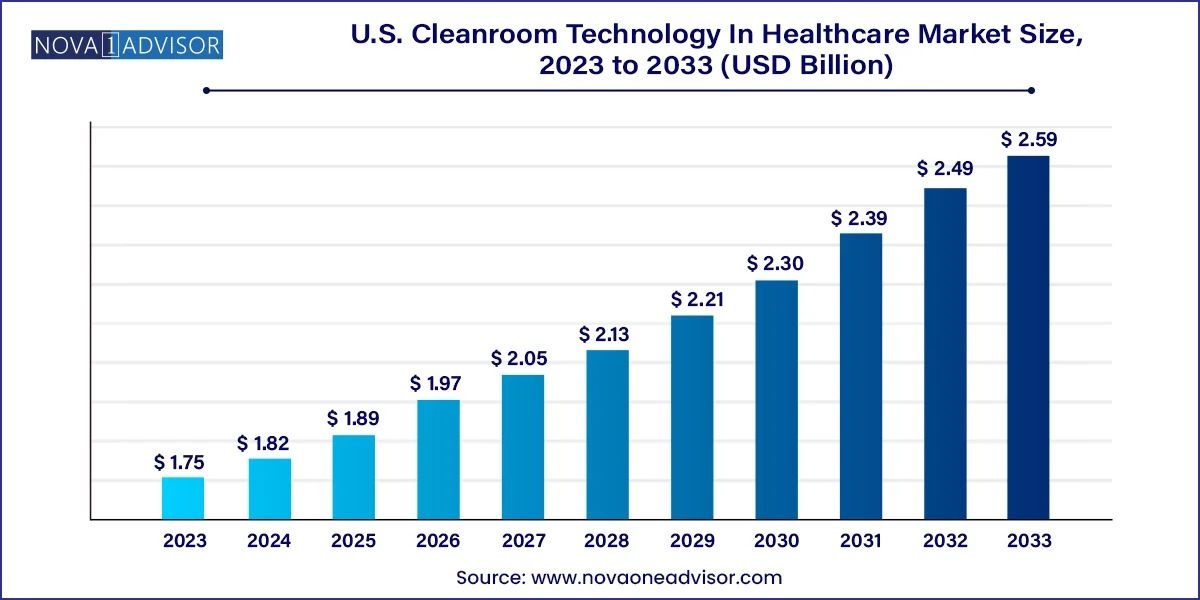

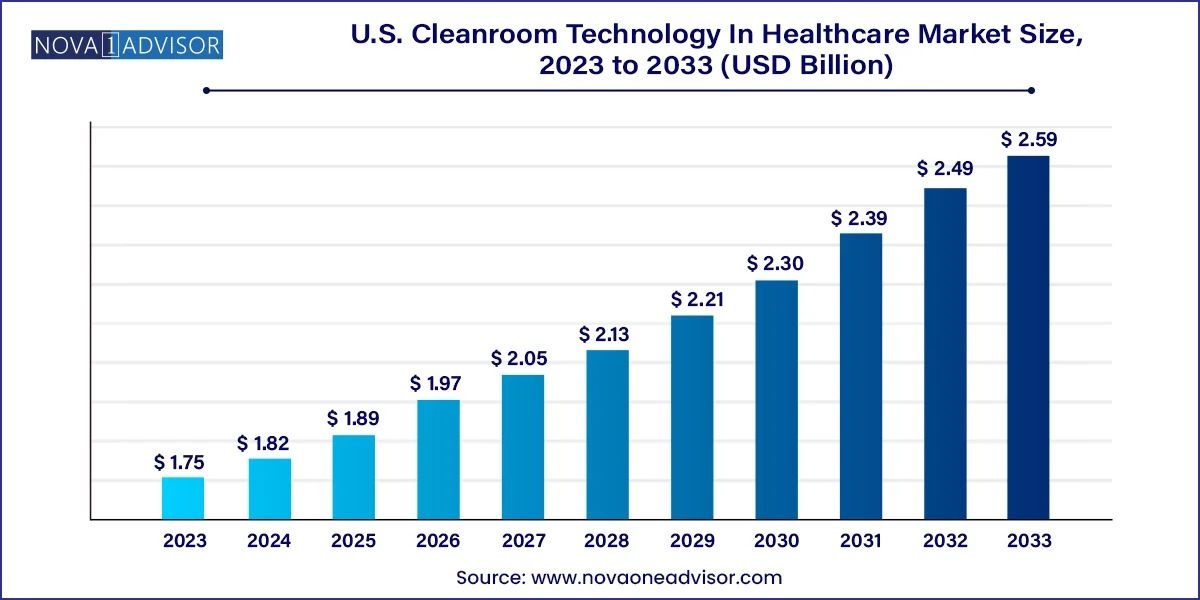

The U.S. cleanroom technology in healthcare market size was exhibited at USD 1.75 billion in 2023 and is projected to hit around USD 2.59 billion by 2033, growing at a CAGR of 3.99% during the forecast period 2024 to 2033.

U.S. Cleanroom Equipment In Healthcare Market Key Takeaways:

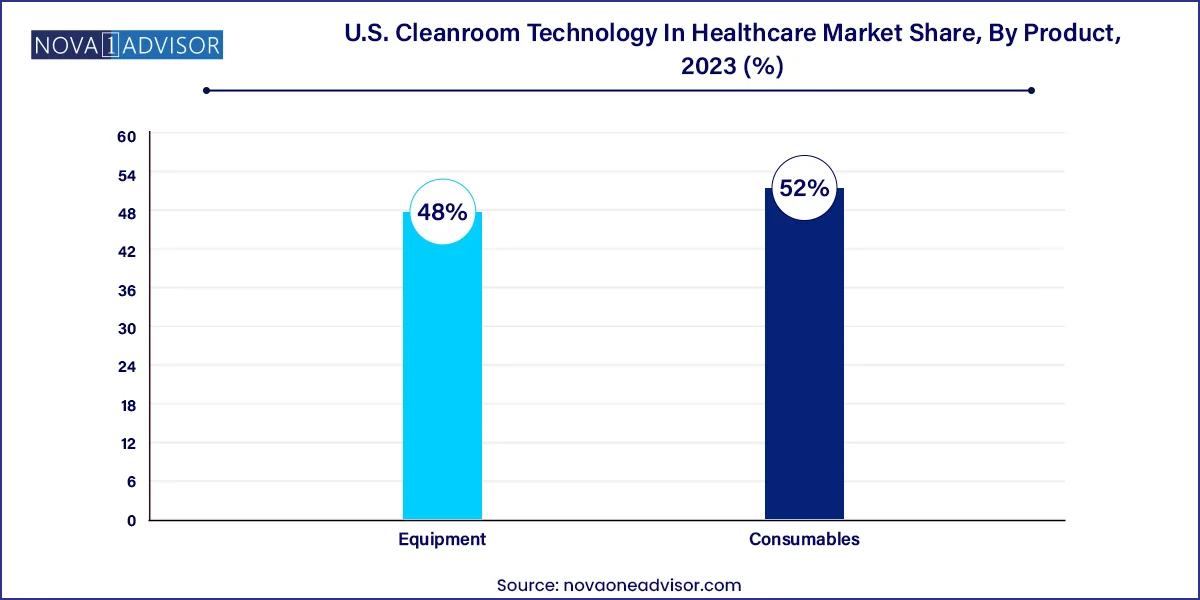

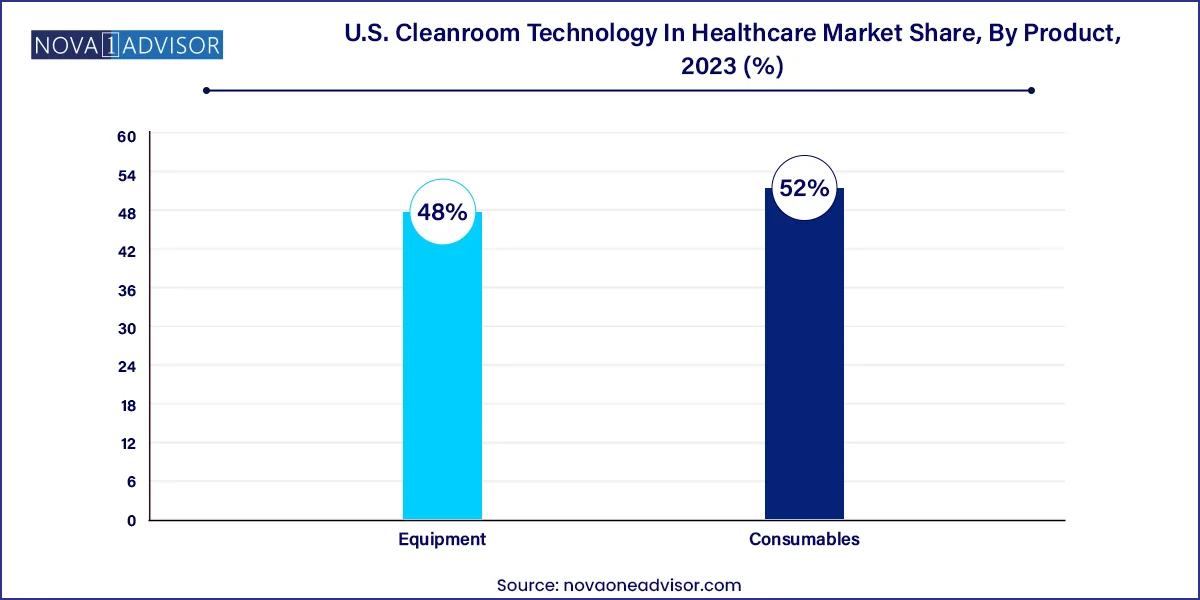

- Consumables dominated the market and accounted for a revenue share of over 52.0% in 2023.

- The equipment sector is anticipated to register the fastest CAGR from 2024 to 2033.

- Pharmaceutical industry accounted for the largest revenue share in 2023.

- The biotechnology industry is expected to register the fastest CAGR from 2024 to 2033.

Market Overview

The U.S. cleanroom technology market in healthcare is a critical component of the nation's life sciences and healthcare ecosystem. This market encompasses a wide array of products and systems designed to create controlled environments with minimal contamination essential for applications in pharmaceuticals, biotechnology, medical device manufacturing, and hospital operations. In recent years, the importance of contamination-free environments has been magnified due to heightened awareness of infection control, regulatory compliance, and the rapid advancement of biopharmaceutical innovation.

Cleanroom technologies enable healthcare stakeholders to meet the stringent safety and quality standards established by the U.S. Food and Drug Administration (FDA), Centers for Disease Control and Prevention (CDC), and other regulatory authorities. These environments are indispensable in ensuring the aseptic production of injectable drugs, sterile packaging of medical devices, and safe handling of diagnostic samples. Moreover, the COVID-19 pandemic created unprecedented demand for cleanroom infrastructure, especially in vaccine production, diagnostic labs, and PPE manufacturing, leaving a lasting impact on facility design and equipment procurement strategies.

The market consists of two major components cleanroom equipment and cleanroom consumables each serving a pivotal role in sustaining a contamination-free healthcare environment. With the healthcare landscape evolving rapidly, factors like the emergence of cell and gene therapies, increasing investments in biologics, and stringent post-market surveillance are driving sustained demand for cleanroom solutions. The U.S., as a global leader in healthcare innovation and manufacturing, is poised to remain a high-potential market for cleanroom technology providers.

Major Trends in the Market

-

Increased adoption of modular cleanrooms and prefabricated units to support flexible manufacturing and rapid scalability.

-

Integration of IoT-enabled HVAC and air filtration systems for real-time monitoring and predictive maintenance.

-

Rising focus on energy-efficient cleanroom designs to align with sustainability goals in healthcare manufacturing.

-

High demand for disposable consumables, such as gloves and wipes, driven by infection control protocols post-COVID-19.

-

Growing emphasis on cleanroom validation and compliance services to meet evolving FDA cGMP guidelines.

-

Adoption of automation and robotics within cleanrooms, especially in pharmaceutical filling and packaging environments.

-

Expansion of biologics and personalized medicine manufacturing, creating demand for high-grade ISO class cleanrooms.

-

Use of antimicrobial fabrics and nano-coatings in cleanroom apparel for improved contamination resistance.

Report Scope of U.S. Cleanroom Equipment In Healthcare Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.82 Billion |

| Market Size by 2033 |

USD 2.59 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.99% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Terra Universal. Inc.; Clean Air Technology, Inc.; Kimberley-Clark Corporation; DuPont; Labconco; Clean Room Depot; ICLEAN Technologies; Abtech; Berkshire Corporation; Texwipe; Micronova Manufacturing |

Market Driver: Growth of Biopharmaceutical and Personalized Medicine Industry

A key driver for the U.S. cleanroom technology market in healthcare is the booming biopharmaceutical and personalized medicine industry. The United States is home to the world’s largest biotech and pharma clusters, with companies investing billions into the development of biologics, monoclonal antibodies, cell therapies, and gene therapies. These advanced therapeutics require precise environmental control due to their high sensitivity to contamination and temperature variation.

For instance, the production of CAR-T cell therapies involves multiple cleanroom stages from cell extraction and modification to final packaging. Each of these steps mandates a contamination-free space supported by HEPA filters, laminar airflow systems, and specialized apparel. The growing pipeline of these therapies necessitates specialized cleanroom infrastructure that can accommodate complex workflows while ensuring sterility. As new therapeutic platforms enter commercialization, manufacturers are scaling their cleanroom footprints, spurring demand for both new equipment and consumables.

Market Restraint: High Capital Investment and Maintenance Costs

While cleanrooms are indispensable in healthcare settings, their high capital and operational costs present a significant market restraint. Establishing a cleanroom, particularly one that meets ISO Class 5 or Class 6 standards, involves significant financial investment. Costs associated with advanced HVAC systems, air pressure balancing, filtration, continuous monitoring, and automated access controls can be prohibitive especially for smaller contract manufacturing organizations (CMOs) or hospital labs.

Moreover, maintaining cleanrooms involves rigorous daily cleaning, filter replacements, air quality audits, and ongoing validation adding to operational expenditure. The complexity and cost can deter smaller players or slow adoption in facilities with limited budgets. Additionally, the need for skilled personnel to manage cleanroom compliance adds another layer of cost and complexity, which can hinder rapid expansion or refurbishment of cleanroom spaces across the U.S. healthcare sector.

Market Opportunity: Digital and Smart Cleanroom Integration

One of the most promising opportunities in the market lies in the digitization and smart integration of cleanroom systems, transforming them into intelligent environments. The rise of smart HVAC systems equipped with sensors and connected to cloud-based platforms allows facilities to monitor temperature, humidity, particulate count, and airflow in real time. This capability enables predictive maintenance and proactive responses to contamination risks.

Healthcare manufacturers are increasingly integrating IoT-enabled systems and AI-based software to automate compliance documentation and environmental control. For example, smart filters can signal replacement requirements before performance degrades, while AI algorithms can predict contamination risks based on historical data. These systems reduce manual oversight and improve process reliability, offering a strong value proposition. Vendors focusing on digital transformation of cleanroom ecosystems are well-positioned to tap into this expanding opportunity in the U.S. healthcare industry.

U.S. Cleanroom Equipment In Healthcare Market By Product Insights

Equipment dominated the U.S. cleanroom technology in healthcare market, owing to its fundamental role in establishing and maintaining cleanroom infrastructure. HVAC systems, in particular, represent a significant share of cleanroom investments, as they regulate airflow, pressure, and temperature key variables for achieving ISO-certified environments. Hospitals and biopharmaceutical manufacturers heavily rely on air filtration systems and laminar flow units to prevent airborne contaminants during drug preparation, sterile compounding, and surgical operations. Air showers and diffusers are common in high-traffic zones to reduce particle ingress, especially in aseptic packaging lines and diagnostic labs.

Consumables are the fastest-growing product segment, driven by their recurring nature and essential role in routine contamination control. Gloves, disinfectants, and cleaning wipes are consumed daily across cleanroom environments, making them indispensable in both pharmaceutical manufacturing and hospital sterile zones. With the heightened focus on hygiene and personnel protection following the COVID-19 pandemic, the demand for single-use gowns, masks, and wipes has surged. Facilities now stock large volumes of consumables to ensure continuous operations without risking regulatory non-compliance. Additionally, the rise of antimicrobial consumables with enhanced performance is driving innovation within this segment.

U.S. Cleanroom Equipment In Healthcare Market By End-use Insights

The pharmaceutical industry led the end-use segment, as it encompasses a broad range of drug manufacturing processes that require contamination-free environments. From oral solid dosage forms to injectable biologics, each step in pharmaceutical production involves strict cleanroom protocols to avoid product contamination, cross-contamination, or microbial growth. The U.S. pharmaceutical sector, which includes both innovator and generic drug manufacturers, mandates FDA-approved cleanroom practices. Major pharma firms like Pfizer and Moderna have significantly expanded their cleanroom footprints in recent years to meet growing vaccine and biologics demand.

The biotechnology industry is the fastest-growing end-use segment, fueled by the expanding pipeline of biologics and cell-based therapies. Biotech firms require advanced cleanroom environments to facilitate aseptic cell cultures, protein purification, and biosample handling. Given the sensitivity of biologic products to environmental factors, even minor deviations can lead to batch failures, making robust cleanroom protocols crucial. Biotech companies often invest in flexible cleanroom modules to accommodate changing research and manufacturing needs. The growth in clinical trial activity and biologics outsourcing is further driving biotech cleanroom demand.

Country-Level Analysis

As the sole focus of this market, the United States represents a mature yet rapidly evolving cleanroom technology market in the healthcare domain. The U.S. leads globally in pharmaceutical and biotechnology innovation, accounting for a large share of new molecular entity (NME) approvals annually. This vibrant innovation ecosystem drives constant investment in cleanroom infrastructure, especially across regions like the San Francisco Bay Area, Boston, and North Carolina’s Research Triangle.

U.S.-based contract development and manufacturing organizations (CDMOs) and contract research organizations (CROs) are key contributors to cleanroom demand. With drug sponsors increasingly outsourcing development, these third-party vendors are scaling their cleanroom capabilities to meet client needs. Hospitals, especially large academic medical centers, have also begun modernizing their sterile compounding facilities in response to updated USP <797> and <800> regulations, which emphasize contamination control in hazardous drug handling. Collectively, these factors position the U.S. as a high-opportunity market for both cleanroom equipment and consumables vendors.

Some of the prominent players in the U.S. cleanroom technology in healthcare market include:

- Terra Universal. Inc.

- Clean Air Technology, Inc.

- Kimberley-Clark Corporation

- DuPont

- Labconco

- Clean Room Depot

- ICLEAN Technologies

- Abtech

- Berkshire Corporation

- Texwipe

- Micronova Manufacturing

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. cleanroom technology in healthcare market

Product

-

- Heating Ventilation and Air Conditioning System (HVAC)

- Cleanroom air filters

- Air shower and diffuser

- Laminar air flow unit

- Others

-

- Gloves

- Wipes

- Disinfectants

- Apparels

- Cleaning Products

End-use

- Pharmaceutical industry

- Medical device industry

- Biotechnology industry

- Hospitals and diagnostic centers