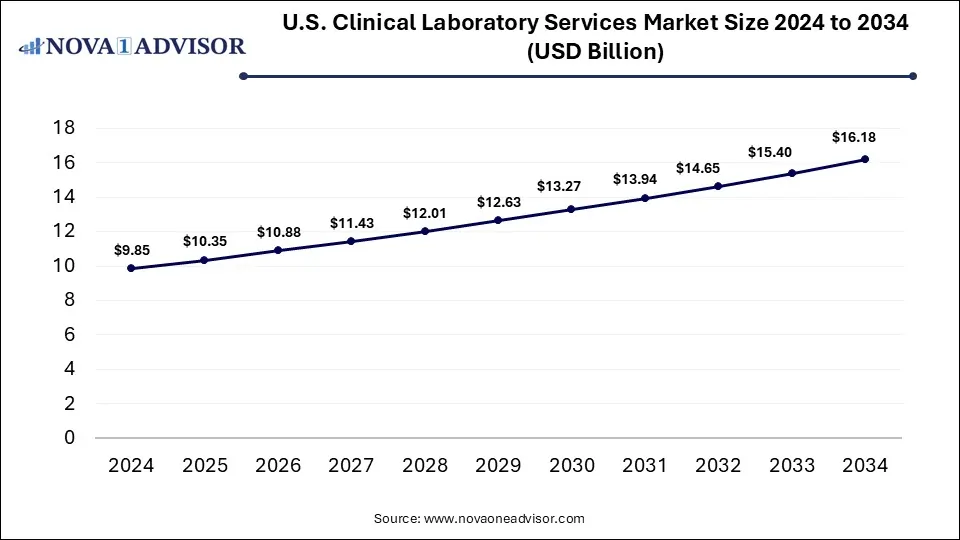

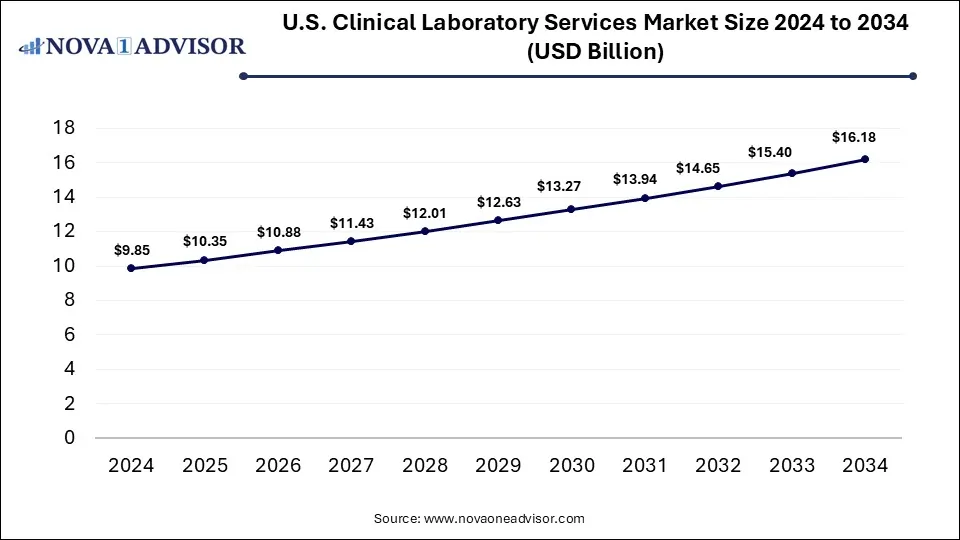

U.S. Clinical Laboratory Services Market Size and Forecast 2025 to 2034

The U.S. clinical laboratory services market size is calculated at USD 9.85 billion in 2024, grows to USD 10.35 billion in 2025, and is projected to reach around USD 16.18 billion by 2034, expanding at a CAGR of 5.09% from 2025 to 2034. The U.S. clinical laboratory services market growth is driven by the rising chronic disease burden, increasing demand for diagnostic procedures and screening tests, and focus on preventive healthcare.

U.S. Clinical Laboratory Services Market Key Takeaways

- By test type, the clinical chemistry segment dominated the market with the largest share in 2024.

- By test type, the cytology testing segment is expected to show the fastest growth over the forecast period.

- By application, the bioanalytical & lab chemistry services segment held the largest market share in 2024.

- By application, the toxicology testing services segment is expected to register fastest growth during the forecast period.

- By service provider, the hospital-based laboratories segment captured the largest market revenue share in 2024.

- By service provider, the stand-alone laboratories segment is expected to show the fastest growth during the forecast period.

What Drives the U.S. Clinical Laboratory Services Market Growth?

Clinical laboratory services refer to broad range of medical testing services executed on patient samples for aiding in the diagnosis, treatment, and management of diseases. These services involve the analysis of different bodily fluids and tissues, such as blood, urine, and tissue samples, by utilizing different techniques.

The well-established healthcare infrastructure, expanding applications of laboratory tests, growing demand for laboratory services in the geriatric population, increasing emphasis on public health monitoring for detection and management of infectious disease outbreaks, ongoing clinical trials, and focus personalized treatment plans are the factors driving the growth of the U.S. clinical laboratory services market. Government support through laws like the Affordable Care Act (ACA) is expanding access to healthcare services, including diagnostic testing offered by clinical laboratories to millions of previously uninsured Americans.

What Are the Key Trends in the U.S. Clinical Laboratory Services Market in 2025?

- In May 2025, Celerion, a globally leading company in early clinical research and bioanalytical services, launched the upgraded version of its Labnotes, which is a state-of-the-art bioanalytical electronic laboratory notebook software designed for boosting data handling and analysis capabilities for sponsors.

- In April 2025, Labcorp, a globally leading provider of innovative and comprehensive laboratory services, nationally rolled out its pTau-217/Beta Amyloid 42 Ratio blood test, which is a first-of-its-kind immunoassay developed for aiding in the diagnosis of Alzheimer’s disease, further expanding Labcorp's leading blood-based biomarker portfolio for Alzheimer's disease and dementia.

How Will AI Integration Impact the U.S. Clinical Laboratory Services Market?

The integration of artificial intelligence (AI) in clinical laboratory services in the U.S. is expected to enhance the accuracy, efficiency, and diagnostic capabilities for laboratory workflows.

AI-powered systems can assist in laboratory operations such as automating routine tasks like sample preparation and pipetting leading to reduced human error and helping lab personnel to focus on more complex tasks as well as generation of standardized lab test results, further streamlining data entry process into the Laboratory Information System (LIS). AI algorithms can be applied for analyzing medical images, for identification of potential biomarkers, and for predicting disease outcomes, further enabling early and accurate disease diagnosis for development of tailored treatment strategies for patients.

The creation of AI-enabled data-sharing networks and repositories for uploading and storing laboratory data, can enable collaborations across various laboratories and accelerate research operations. Furthermore, AI can be applied for optimizing staffing levels, in inventory management and for quality control purposes.

Report Scope of U.S. Clinical Laboratory Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 10.35 Billion |

| Market Size by 2034 |

USD 16.18 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.09% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Test Type, By Service Provider, By Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

ARUP Laboratories, Charles River Laboratories International, Inc., Eurofins Scientific SE, Fresenius Medical Care, Laboratory Corporation of America Holdings (LabCorp), Mayo Clinic Laboratories, NeoGenomics Laboratories, OPKO Health, Inc., Siemens Medical Solutions USA, Inc., Sonic Healthcare, SYNLAB International GmbH, QIAGEN NV, Quest Diagnostics Incorporated, Unilabs |

Market Dynamics

Drivers

Increased Frequency of Diagnostic Testing

The rising incidences of chronic diseases like cancer, cardiovascular disorders and diabetes as well as infectious diseases and autoimmune disorders across the U.S., especially in the aging populations which drives the need for both routine and specialized diagnostic procedures and clinical testing services, for diagnosis and monitoring of these disease conditions. Older people require health check-ups and diagnostic tests related to organ function, bone health, cognitive decline, among others on a frequent basis, which drives the demand for clinical laboratory services. Additionally, growing emphasis on preventive healthcare and early detection of diseases is driving the demand for diagnostic testing services, further expanding the market potential.

Restraints

Scarcity of Expertise

The shortage of skilled professionals such as laboratory technicians and technologists in the clinical laboratory services sector across the U.S. is a significant restraint for the market. Furthermore, the rising demand for diagnostic tests, early workforce retirements, and limited number of training programs are worsening the market conditions, in addition to a shortage of skilled workforce.

Opportunities

Advancements in Laboratory Technologies

The rising innovations in diagnostic technologies such as the integration of AI and machine learning models, molecular diagnostics, genetic testing is creating the demand for specialized lab equipment and services, further leading to the development of more advanced and personalized diagnostic approaches. The increased adoption of automated testing platforms and digital pathology solutions is enhancing the efficiency of laboratory workflows with decreased turnaround times for test results. Improvements in laboratory technologies such as biochips, companion diagnostics, and microarrays, aiding in early disease diagnosis and tailoring treatments, are creating opportunities for market expansion.

Segmental Insights

What Made Clinical Chemistry the Dominant Market Segment in 2024?

By test type, the clinical chemistry segment accounted for the highest market revenue share in 2024. Clinical chemistry tests are conducted to analyze the chemical composition of bodily fluids for various applications like diagnosing and monitoring disease progression, for assessing organ function, and to guide treatment decisions and patient management. The rising prevalence of chronic diseases such as cardiovascular disease, diabetes and liver disorders as well as the increasing emphasis on routine health checkups and preventative testing for early detection of disease conditions are driving the demand for clinical chemistry testing services. Clinical chemistry tests act as a foundation for various other expanding laboratory testing services in fields like hematology, genetics and microbiology, which indirectly contribute to the market growth of this segment.

By test type, the cytology testing segment is expected to grow at the fastest CAGR during the forecast period. Cytology testing involves the study of cells with diverse applications, particularly for the diagnosis and monitoring of several diseases as well as for assessment of inflammatory conditions and monitoring of treatment responses. Cytology is widely used in cancer diagnosis and screening such as for early detection in areas like the lungs (sputum cytology) and the cervix (Pap smears), for diagnosing various cancers through cerebrospinal fluid analysis, fine needle aspiration (FNA), and pleural fluid analysis, as well as for monitoring disease progression and treatment effectiveness in cancer patients.

The market growth is driven by the increasing prevalence of chronic and infectious diseases as well as autoimmune disorders, focus on preventive healthcare, demand for personalized treatments, rising trend of co-testing with HPV, and supportive government initiatives. Telecytology is gaining popularity due to advancements in digital pathology and whole slide imaging, which is enabling remote diagnosis and expanding access to specialized expertise. Additionally, enhanced diagnostic accuracy of cytology testing through molecular testing techniques and liquid-based cytology (LBC) as well as improvements in brush technologies like soft-brush heads and nylon bristles are streamlining sample collection processes.

U.S. Clinical Laboratory Services Market Size By Test Type, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Genetic Testing |

1.77 |

1.88 |

2 |

2.12 |

2.25 |

2.39 |

2.53 |

2.69 |

2.85 |

3.03 |

3.22 |

| Clinical Chemistry |

1.96 |

2.06 |

2.16 |

2.23 |

2.33 |

2.44 |

2.57 |

2.67 |

2.79 |

2.91 |

3.04 |

| Medical Microbiology Testing |

1.18 |

1.24 |

1.3 |

1.37 |

1.44 |

1.51 |

1.58 |

1.66 |

1.74 |

1.83 |

1.92 |

| Hematology Testing |

1.18 |

1.24 |

1.3 |

1.37 |

1.44 |

1.51 |

1.58 |

1.66 |

1.74 |

1.83 |

1.92 |

| Immunology Testing |

0.99 |

1.04 |

1.1 |

1.16 |

1.22 |

1.29 |

1.36 |

1.43 |

1.51 |

1.59 |

1.68 |

| Cytology Testing |

0.79 |

0.83 |

0.87 |

0.92 |

0.97 |

1.02 |

1.07 |

1.13 |

1.19 |

1.25 |

1.31 |

| Drug of Abuse Testing |

0.99 |

1.02 |

1.06 |

1.11 |

1.15 |

1.19 |

1.24 |

1.29 |

1.34 |

1.39 |

1.44 |

| Other Esoteric Tests |

0.99 |

1.04 |

1.09 |

1.15 |

1.21 |

1.28 |

1.34 |

1.41 |

1.49 |

1.57 |

1.65 |

How Bioanalytical & Lab Chemistry Services Segment Dominated the Market in 2024?

By application, the bioanalytical & lab chemistry services segment dominated the market with the largest share in 2024. The demand for bioanalytical and lab chemistry services is rising due to factors such as the increasing prevalence of chronic diseases such as cancer and diabetes, aging population, growing emphasis on early disease detection, and rising demand for personalized treatment strategies.

The increased adoption of advanced technologies such as high-throughput screening, chromatography techniques and mass spectrometry as well as improvements in laboratory automation and molecular diagnostics are expanding the segment’s market potential. Furthermore, the increased use of bioanalytical services for drug discovery and development such as in clinical trials for pharmacokinetic and toxicological evaluations as well as the rising outsourcing trend for bioanalytical testing by pharmaceutical and biotechnology companies are driving the market expansion.

By application, the toxicology testing services segment is expected to show the fastest growth over the forecast period. The rising incidences of substance abuse and increasing addiction rates are creating a huge demand for toxicology testing services for detection drug use and monitoring treatment response. Mandates imposed by the government for drug testing in various settings such as legal issues and workplaces are contributing to the market growth. Moreover, innovations in toxicology testing techniques, increased use of toxicology testing in R&D activities for assessing the safety and efficacy of new drug compounds, as well as the need for therapeutic drug monitoring in patients are the factors expanding the segment’s market potential.

U.S. Clinical Laboratory Services Market Size By Application, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Bioanalytical & Lab Chemistry Services |

2.17 |

2.26 |

2.36 |

2.46 |

2.58 |

2.72 |

2.83 |

2.94 |

3.08 |

3.23 |

3.38 |

| Cell & Gene Therapy Related Services |

1.18 |

1.26 |

1.35 |

1.44 |

1.53 |

1.63 |

1.74 |

1.86 |

1.98 |

2.11 |

2.24 |

| Drug Discovery & Development Related Services |

1.77 |

1.87 |

1.98 |

2.09 |

2.2 |

2.32 |

2.45 |

2.59 |

2.73 |

2.88 |

3.04 |

| Preclinical & Clinical Trial Related Services |

1.97 |

2.06 |

2.15 |

2.25 |

2.35 |

2.45 |

2.56 |

2.67 |

2.79 |

2.91 |

3.04 |

| Toxicology Testing Services |

1.48 |

1.55 |

1.62 |

1.69 |

1.77 |

1.85 |

1.94 |

2.03 |

2.12 |

2.22 |

2.32 |

| Other Clinical Laboratory Services |

1.28 |

1.35 |

1.42 |

1.5 |

1.58 |

1.66 |

1.75 |

1.85 |

1.95 |

2.05 |

2.16 |

Why Did the Hospital-based Laboratories Segment Dominate the Market in 2024?

By service provider, the hospital-based laboratories segment held the biggest market share in 2024. Hospital-based laboratories offer comprehensive diagnostic testing services across wide range of fields, including clinical chemistry, hematology, immunology, microbiology, molecular diagnostics, among others for both inpatients and outpatients. The segment’s market dominance is driven by the rising demand for early disease diagnosis and personalized approaches, increasing rates of chronic and infectious diseases, growing number of hospitals incorporating laboratories in directly in their facilities, supportive government initiatives, and favorable reimbursement policies. The increasing use of laboratory instruments interfaced with Laboratory Information Systems (LIS) is streamlining integration of test results into the patient’s electronic health record (EHR).

By service provider, the stand-alone laboratories segment is expected to show the fastest CAGR during the predicted timeframe. Stand-alone laboratories such as national reference laboratories are equipped with advanced instruments and offer services such as handling of complex, high volume and esoteric tests like molecular diagnostics and genetic testing, which are usually not available at small labs and hospital-based laboratories. These laboratories leverage centralized hubs and sophisticated logistics networks, which allows them to process tests at lower costs, further offering them the advantage of competitive pricing compared to hospital-based labs.

Additionally, factors such as the rising trend of at-home and direct-to-consumer (DTC) testing, increased emphasis on outreach testing programs, employer screenings, strategic collaborations, and wellness contracts are contributing to the market growth.

U.S. Clinical Laboratory Services Market Size By Service Provider, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Clinic-Based Laboratories |

2.46 |

2.6 |

2.74 |

2.89 |

3.05 |

3.22 |

3.4 |

3.58 |

3.78 |

3.99 |

4.21 |

| Hospital-Based Laboratories |

3.94 |

4.12 |

4.32 |

4.52 |

4.73 |

4.96 |

5.19 |

5.43 |

5.68 |

5.95 |

6.23 |

| Stand-Alone Laboratories |

3.45 |

3.63 |

3.82 |

4.02 |

4.23 |

4.45 |

4.68 |

4.93 |

5.19 |

5.46 |

5.74 |

Country-Level Analysis

U.S. is a leading contributor to the clinical laboratory services market. The emergence of telehealth platforms is enabling access to clinical laboratory services such as remote sample collection and diagnostic services, further facilitating remote results reporting.

The increasing collaborations among hospitals and major reference laboratories is improving access to wide range of tests. Major market players in the U.S. are expanding their geographical reach with the launch of new laboratories.

- For instance, in May 2025, Labcorp launched its new diagnostic laboratory in Chantilly, Virginia. The new facility offers expanded services, including cytology and histology.

The U.S. government regulates and oversees clinical laboratory services through its primary regulatory framework, the Clinical Laboratory Improvement Amendments (CLIA), which are established quality standards developed for all laboratory testing of human samples, to ensure the accuracy, safety and reliability of laboratory testing for patient care. The Centers for Medicare & Medicaid Services (CMS) administer CLIA, issues laboratory certificates, conducts inspections, collects fees, and ensures compliance for clinical laboratories. The Laboratory Response Network (LRN) initiative led by the Centers for Disease Control and Prevention (CDC) focuses on identification and responding to potential biological and chemical threats, which involves several public health, hospital, and other types of laboratories.

Value Chain Analysis

Diagnostic Information Services

These services refer to a broad range of medical tests, imaging scans, and procedures utilized for identification illnesses and for determining their severity, which enables accurate diagnosis, treatment planning and management of diseases, playing an important role in both patient care and preventive medicine.

Key Players:

- BioReference Health, LLC

- Quest Diagnostics

- LabCorp

2. Patient Support and Services

These services comprise of specimen collection, interpretation of results, and communication with patients and their healthcare providers.

Key Players:

- ARUP Laboratories

- NeoGenomics Laboratories

3. R&D

Research and development focuses on enhancing the accuracy, efficiency, and speed of clinical trials, as well as improving data interpretation and decision-making, further leading to faster and more reliable clinical R&D workflows.

Key Players:

- Abbott Laboratories,

- Charles River Laboratories

- IQVIA

- Thermo Fisher Scientific

Some of the Prominent Players in the U.S. Clinical Laboratory Services Market

- ARUP Laboratories

- Charles River Laboratories International, Inc.

- Eurofins Scientific SE

- Fresenius Medical Care

- Laboratory Corporation of America Holdings (LabCorp)

- Mayo Clinic Laboratories

- NeoGenomics Laboratories

- OPKO Health, Inc.

- Siemens Medical Solutions USA, Inc.

- Sonic Healthcare

- SYNLAB International GmbH

- QIAGEN NV

- Quest Diagnostics Incorporated

- Unilabs

Recent Developments in the U.S. Clinical Laboratory Services Market

- In April 2025, Scientist.com launched an innovative tool, Clinical Labs Navigator, which is developed for transforming the sourcing, management and execution of clinical trial services, further streamlining clinical procurement, reducing costs and accelerating study timelines.

- In March 2025, IQVIA Laboratories, a globally leading drug discovery and development laboratory services organization, launched its Site Lab Navigator, which is an advanced toolkit designed for automating and streamlining lab workflows for clinical trial sponsors and investigator sites.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Clinical Laboratory Services Market.

By Test Type

- Genetic Testing

- Clinical Chemistry

-

- Routine Chemistry Testing

- Therapeutic Drug Monitoring Testing

- Endocrinology Chemistry Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology Testing

-

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuse Testing

- Other Esoteric Tests

By Service Provider

- Clinic-Based Laboratories

- Hospital-Based Laboratories

- Stand-Alone Laboratories

By Application

- Bioanalytical & Lab Chemistry Services

- Cell & Gene Therapy Related Services

- Drug Discovery & Development Related Services

- Preclinical & Clinical Trial Related Services

- Toxicology Testing Services

- Other Clinical Laboratory Services