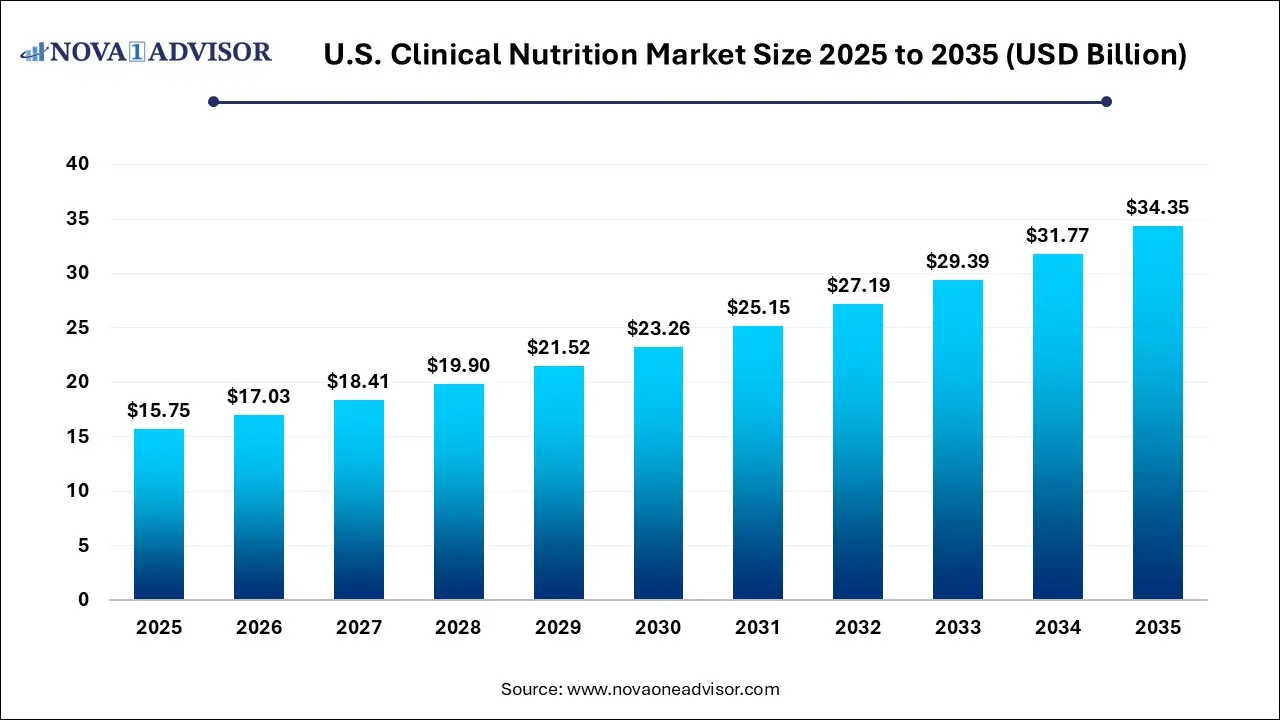

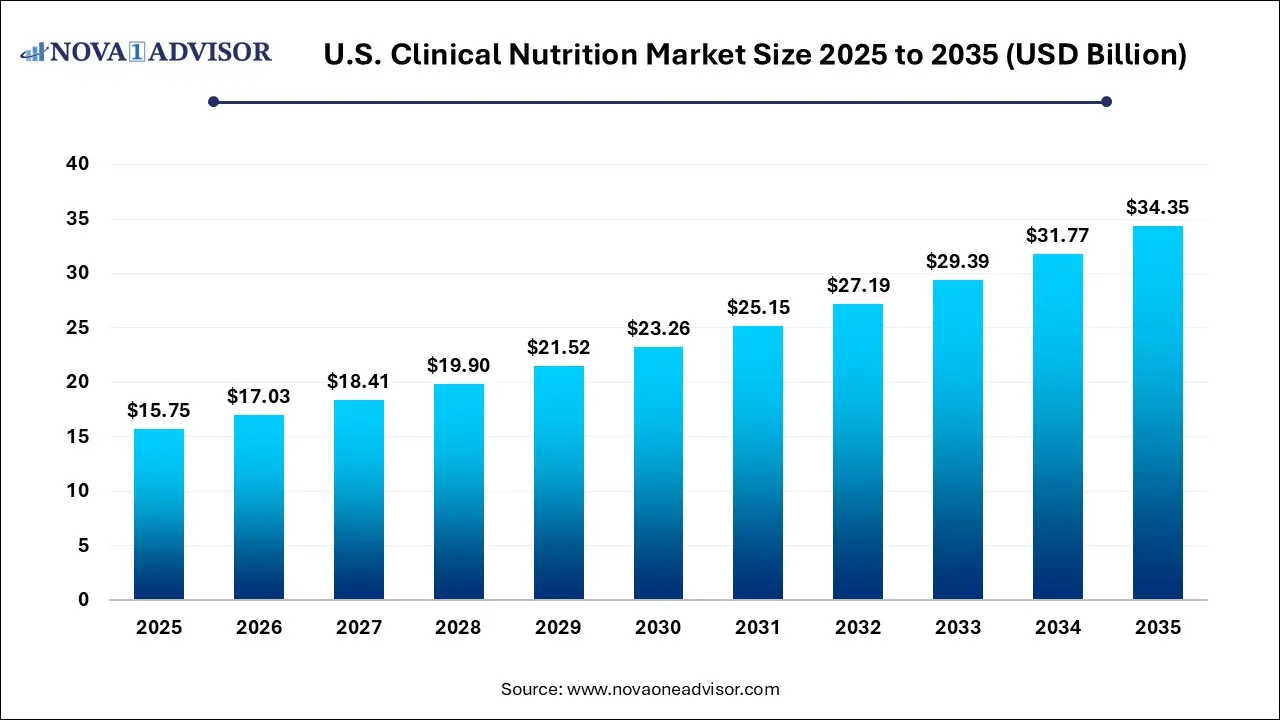

U.S. Clinical Nutrition Market Size and Growth 2026 to 2035

The U.S. clinical nutrition market size was exhibited at USD 15.75 billion in 2025 and is projected to hit around USD 34.35 billion by 2035, growing at a CAGR of 8.11% during the forecast period 2026 to 2035.

Key Pointers:

- The Centers for Disease Control and Prevention, in 2025, over 40.7 million people, or 8.9% of the U.S. population were diagnosed with diabetes.

- U.S. clinical nutrition market from infant nutrition segment was more than USD 7 billion in 2025

- The pediatric consumer segment is anticipated to reach USD 16 billion by 2035.

- The metabolic disorders application segment is anticipated to cross USD 9.5 billion by 2035.

- The retail stores distribution channel segment is expected to surpass USD 14 billion by 2035.

Market Overview

The U.S. clinical nutrition market involves the development and use of specialized nutrition products and therapies to manage diseases and conditions resulting from malnutrition or other medical issues. These products, which can be administered orally, enterally (via feeding tube), or parenterally (intravenously), provide essential macro and micronutrients to patients unable to meet their dietary needs through conventional food intake. A key benefit of clinical nutrition is its ability to improve patient outcomes by accelerating recovery from illness or surgery, strengthening the immune system, and managing symptoms of chronic diseases such as cancer, diabetes, and gastrointestinal disorders.

Market Outlook

- Market Growth Overview: The U.S. clinical nutrition market is expected to grow significantly between 2025 and 2034, driven by the high incidence of diabetes, metabolic disorders, gastrointestinal issues, the rising aging population, and product innovations.

- Sustainability Trends: Sustainability trends involve eco-friendly packaging, personalized and efficient nutrition, and the rising use of plant-based ingredients.

- Major Investors: Major investors in the market include Abbott Laboratories, Nestlé Health Science, Danone, Fresenius Kabi, and Baxter International.

Artificial Intelligence: The Next Growth Catalyst in U.S. Clinical Nutrition

AI is significantly impacting the U.S. clinical nutrition industry by enabling highly personalized nutrition plans, improving the efficiency and accuracy of nutritional assessments, and offering scalable patient monitoring and coaching solutions. By analyzing vast datasets, including patient genetics, medical history, and real-time data from wearables, AI algorithms can identify unique dietary needs and predict the risk of nutrition-related conditions like diabetes and obesity, which is superior to traditional one-size-fits-all approaches.

U.S. Clinical Nutrition Market Highlights (2025)

- By Product: The infant nutrition segment led the U.S. clinical nutrition market in 2025, driven by high demand for milk-based and specialized infant formulas.

- By Product: The soy-based infant nutrition segment emerged as the fastest-growing product category in 2025 due to rising lactose intolerance and preference for plant-based alternatives.

- By Consumer: The pediatric segment dominated the market in 2025, supported by strong consumption of infant and child-specific clinical nutrition products.

- By Consumer: The adult segment registered the fastest growth in 2025 owing to increasing prevalence of chronic diseases and higher demand for therapeutic nutrition.

- By Application: The metabolic disorders segment accounted for the largest market share in 2025, driven by the growing burden of diabetes and obesity-related conditions.

- By Application : The cancer segment witnessed the fastest growth in 2025 as clinical nutrition became an integral part of oncology care.

- By Distribution Channel: The pharmacies & drug stores segment led the market in 2025 due to widespread accessibility and consumer trust.

- By Distribution Channel: The online channels segment grew at the fastest pace in 2025, supported by expanding e-commerce platforms and rising digital adoption.

Report Scope of the U.S. Clinical Nutrition Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 17.03 Billion |

| Market Size by 2035 |

USD 34.35 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.11% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Consumer, Application, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Abbott Laboratories (Abbott Nutrition), Mead Johnson (Reckitt Benckiser) , Baxter International Inc. , Fresenius Kabi, B Braun Melsungen AG , Nestle Health Science , Hero Nutritionals Inc., Perrigo, , Pfizer, Inc., Danone |

Segmental Analysis:

By Product

In 2025, infant nutrition remained the dominant segment in the U.S. clinical nutrition market. This is largely due to the increasing preference for formula feeding, rising awareness among parents regarding proper infant growth and development, and the availability of a variety of milk-based and specialized formulas. Among infant nutrition products, milk-based formulas continue to hold the largest share, reflecting longstanding consumer trust and extensive distribution networks.

The soy-based infant nutrition segment has been the fastest-growing product category. This growth is attributed to a rising number of infants with lactose intolerance or milk protein allergies and a shift among parents toward plant-based nutrition options for their children.

The amino acids segment in parenteral nutrition is experiencing the fastest growth due to increased hospitalizations, rising prevalence of chronic illnesses, and the need for intravenous nutrition for patients unable to consume food orally or enterally.

By Consumer

The pediatric segment has dominated the clinical nutrition market, primarily driven by the strong demand for infant formulas and specialized nutrition for children with health conditions or dietary restrictions. The adult segment has shown the fastest growth due to increasing awareness of disease-specific nutrition, a rising elderly population, and growing demand for nutritional support in chronic conditions such as cancer, diabetes, and metabolic disorders.

By Application

Among applications, metabolic disorders have dominated the market, reflecting the growing prevalence of conditions such as diabetes, obesity, and other metabolic syndromes. Nutritional interventions are crucial for managing these diseases, boosting segment growth.

The cancer application segment is the fastest-growing due to the increasing number of cancer patients requiring clinical nutrition support to maintain strength, manage treatment side effects, and improve quality of life.

By Distribution Channel

The pharmacies & drug stores channel has dominated the market because of easy accessibility, professional guidance, and strong trust among consumers seeking clinical nutrition products. Online channels are the fastest-growing distribution segment, driven by convenience, a wider variety of product availability, competitive pricing, and increased e-commerce adoption among all age groups.

Value Chain Analysis of the U.S. Clinical Nutrition Market

- Research & Development (R&D) and Ingredient Sourcing

This foundational stage involves scientific research into nutritional requirements for various medical conditions and the sourcing of high-quality, specialized ingredients like proteins, amino acids, and lipids.

Key Players: Nestlé Health Science, Abbott Laboratories, Danone (Nutricia), Mead Johnson (Reckitt Benckiser), Ajinomoto Co., Inc., BASF SE, and Cargill Incorporated.

- Manufacturing and Production

Raw ingredients are transformed into finished clinical nutrition products, such as oral supplements, enteral feeding formulas, and parenteral solutions, while adhering to stringent government regulations (e.g., FDA requirements).

Key Players: Abbott Laboratories, Fresenius Kabi, Baxter International Inc., B. Braun Melsungen AG, Danone (Nutricia), Perrigo Company plc.

- Distribution and Logistics

Products are moved from manufacturing facilities to various healthcare settings and retail channels, including hospitals, clinics, and pharmacies. Efficient logistics are crucial to ensure product availability and minimize supply chain disruptions, particularly for critical care products.

Key Players: Baxter International Inc., Fresenius Kabi, Abbott Laboratories, and B. Braun Melsungen AG.

U.S. Clinical Nutrition Market Companies

- Abbott Laboratories (Abbott Nutrition) holds a significant share of the U.S. clinical nutrition market with a broad portfolio of products aimed at various age groups and medical conditions, including popular brands like Ensure and PediaSure.

- Mead Johnson (Reckitt Benckiser) contributes to the market primarily through its specialized pediatric nutrition offerings, such as Enfamil, which are widely used for infant and toddler nutrition.

- Baxter International Inc. plays a vital role by providing essential products for parenteral nutrition, which involves feeding patients intravenously when they cannot tolerate food through the digestive system.

- Fresenius Kabi is a major contributor in both enteral (tube feeding) and parenteral nutrition within the U.S. clinical setting.

- B. Braun Melsungen AG focuses heavily on infusion therapy and clinical nutrition, offering a comprehensive line of products for delivering nutrients directly into a patient's bloodstream.

- Nestlé Health Science significantly impacts the U.S. market by providing science-based nutritional solutions for all ages, including specialized medical foods and functional nutrition products.

- Hero Nutritionals Inc. primarily operates within the consumer health sector with its line of gummy vitamins and supplements, such as Yummi Bears, which focus on general wellness rather than acute clinical nutrition in a medical setting.

Segments Covered in the Report

This report forecasts the volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor has segmented the U.S. clinical nutrition market.

By Product

- Infant Nutrition

- Milk Based

- Soy Based

- Organic Formulas

- Others

- Enteral Nutrition

- Standard Composition

- Disease Specific Composition

- Parenteral Nutrition

- Amino Acids

- Fats

- Carbohydrates

- Others

By Consumer

By Application

- Cancer

- Metabolic Disorders

- Neurological Diseases

- Gastrointestinal Disorders

- Others

By Distribution Channel

- Retail Stores

- Pharmacies & Drug Stores

- Online Channels

- Others