U.S. Clinical Trials Market Size and Trends 2026 to 2035

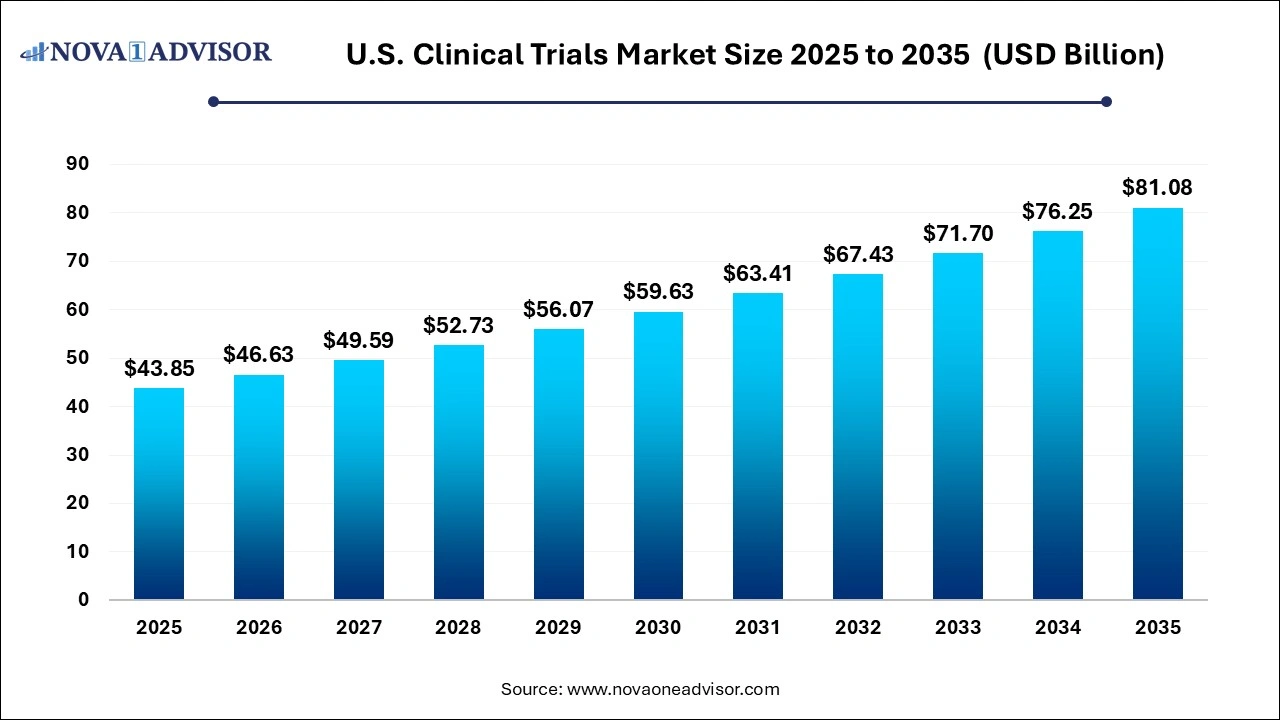

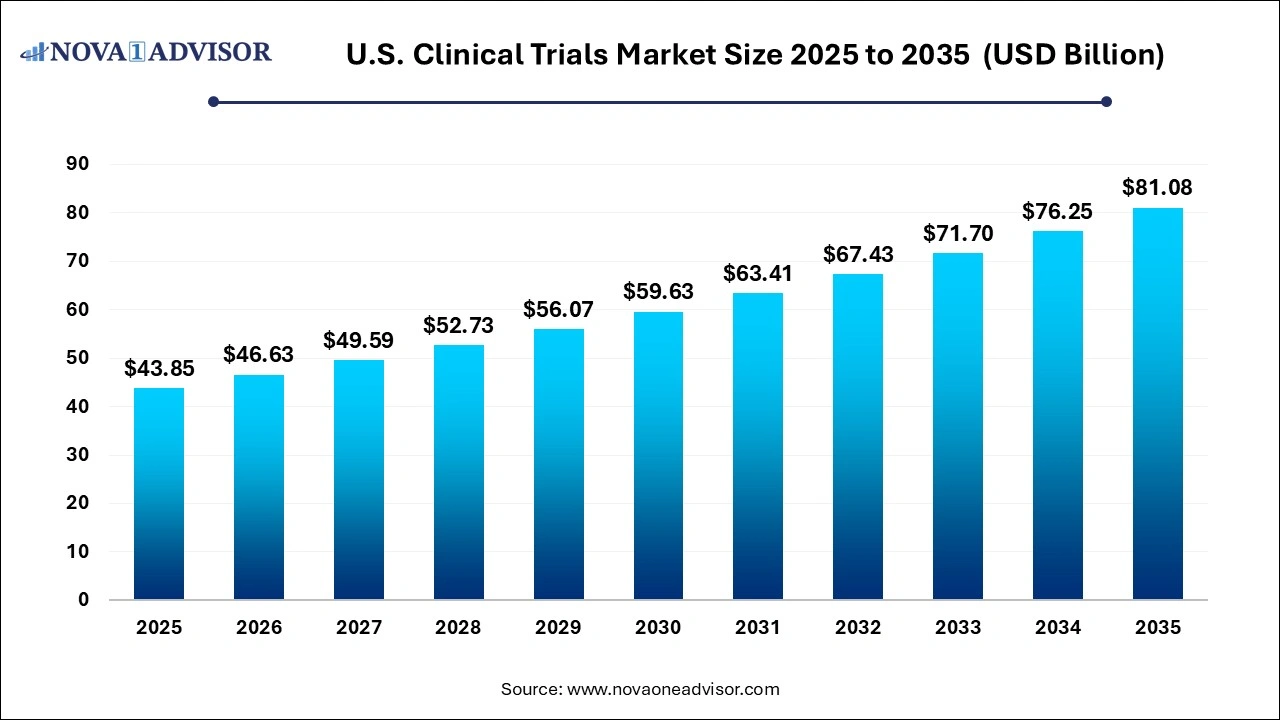

The U.S. clinical trials market size was valued at USD 43.85 billion in 2025 and is projected to surpass around USD 81.08 billion by 2035, registering a CAGR of 6.34% over the forecast period of 2026 to 2035.

Key Takeaways:

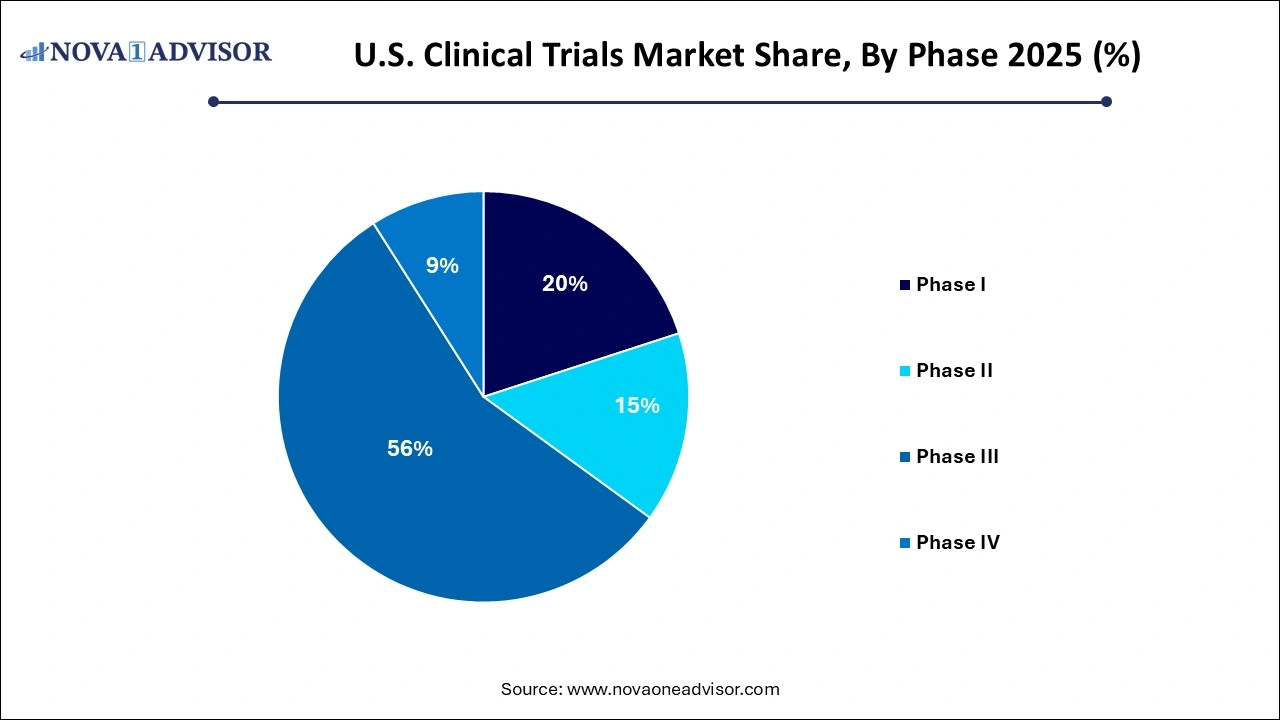

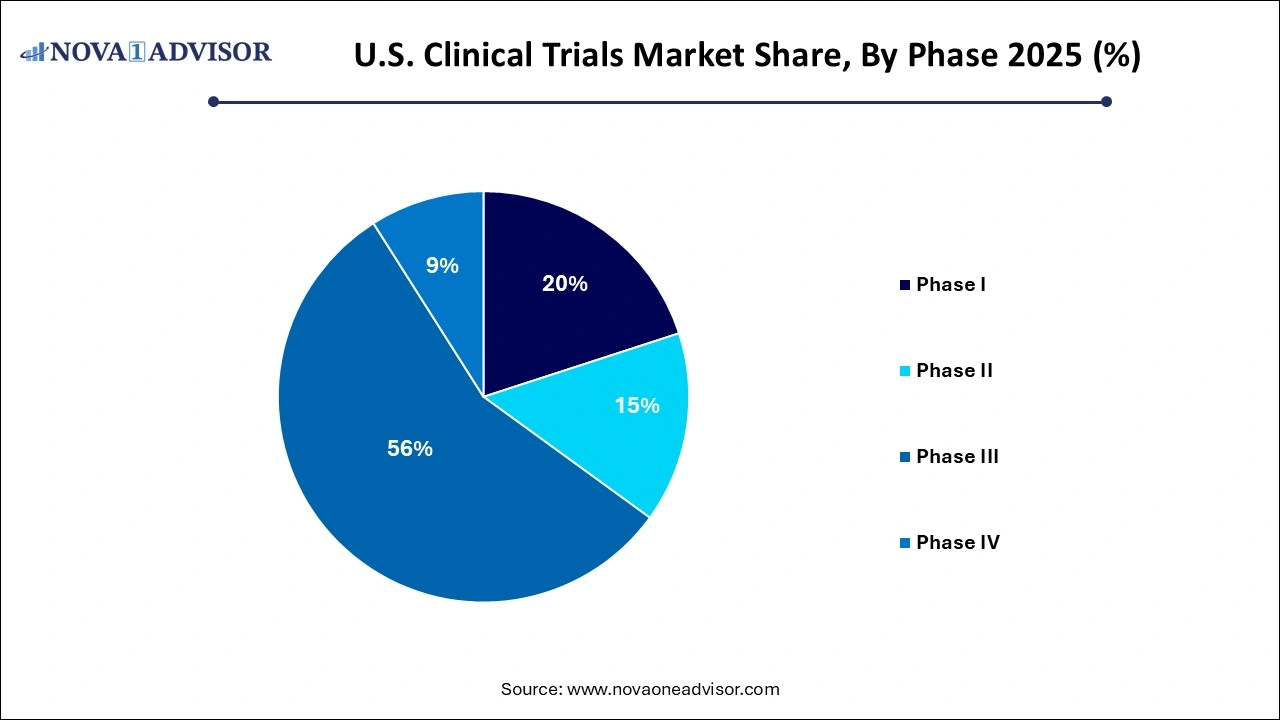

- In 2025, phase III clinical trials commanded the largest portion of the market, representing 55% of the overall share.

- Phase I clinical studies are expected to experience the highest compound annual growth rate (CAGR) of 7.2% throughout the forecast period.

- Interventional study designs held the top spot in 2025, comprising 48.9% of the market share. This segment is also projected to exhibit the second-highest growth rate over the coming years.

- The expanded access category in U.S. clinical trials is forecasted to rise at a CAGR of 5.7% during the projected timeline.

- Oncology emerged as the leading therapeutic area in 2025, contributing 27% of the market revenue. It is also expected to witness the most robust growth rate in the forecast period.

- The autoimmune disease segment is anticipated to become the second most rewarding market area, with a projected CAGR of 5.6%.

U.S. Clinical Trials Market Overview

The U.S. clinical trials market stands as a cornerstone of global pharmaceutical and biotechnology development. Characterized by its robust regulatory infrastructure, extensive R&D investment, and an increasing number of chronic disease incidences, the United States represents one of the most mature and complex markets for clinical trials. It is a region marked by scientific excellence, significant healthcare spending, and a thriving life sciences ecosystem, all of which contribute to the increasing volume and complexity of clinical studies conducted annually.

Clinical trials in the U.S. are vital to the approval and commercialization of new drugs, biologics, medical devices, and diagnostics. They serve as the bridge between laboratory innovation and real-world application, ensuring safety, efficacy, and patient outcomes. The U.S. Food and Drug Administration (FDA) plays a crucial role in overseeing this process, upholding the highest standards in trial design, patient safety, and ethical guidelines.

Driven by an aging population, rising incidence of non-communicable diseases (NCDs), advancements in precision medicine, and the adoption of decentralized trial models, the U.S. clinical trials market has experienced considerable evolution. From academic institutions to private research organizations, a wide array of stakeholders including Contract Research Organizations (CROs), pharmaceutical firms, biotech companies, and digital health start-ups are deeply engaged in driving innovation and value within this ecosystem.

In terms of economic scale, the clinical trials industry in the U.S. contributes significantly to national GDP, supports tens of thousands of high-skilled jobs, and continuously attracts domestic and international investments. Clinical trial sites in the U.S. benefit from diverse patient populations, advanced medical infrastructure, and access to cutting-edge digital technologies. These factors together form a fertile environment for clinical research and contribute to the U.S.'s leadership position in the global clinical trial landscape.

Major Trends in the U.S. Clinical Trials Market

-

Decentralized Clinical Trials (DCTs): With the rise of remote technologies, the DCT model is gaining ground, enabling broader patient participation and real-time data collection through wearable devices and telemedicine platforms.

-

Real-World Evidence (RWE) Integration: Pharmaceutical sponsors are increasingly leveraging real-world data (RWD) and real-world evidence to supplement clinical findings and accelerate approvals.

-

Patient-Centric Trial Models: There’s a growing emphasis on patient recruitment and retention strategies that prioritize convenience, transparency, and engagement, including mobile apps and e-consent systems.

-

Artificial Intelligence in Trial Design: AI is being deployed to optimize protocol development, identify patient cohorts, and enhance predictive analytics in trial outcomes.

-

Growth in Precision Medicine Trials: Trials targeting genetic and biomarker-specific populations are becoming more common, especially in oncology and rare diseases.

-

Outsourcing to CROs: Pharmaceutical and biotech companies continue to rely on Contract Research Organizations for faster, cost-efficient, and globally compliant trial execution.

-

Focus on Diversity and Inclusion: Regulatory agencies and sponsors are pushing for ethnically diverse patient populations to improve the generalizability of clinical data.

-

Blockchain for Data Integrity: Though still nascent, blockchain technology is being explored to ensure secure, tamper-proof documentation of clinical data.

U.S. Clinical Trials Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 46.63 Billion |

| Market Size by 2035 |

USD 81.08 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.34% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Phase, Study Design, Indication |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Parexel International Corp.: IQVIA Holdings Inc.; LabCorp; Thermo Fisher Scientific (Pharmaceutical Product Development); Charles River Laboratory; ICON plc; Wuxi AppTec; Eli Lilly and Company; SGS SA; Novo Nordisk A/S; Clinipace; Syneos Health Inc.; Pfizer Inc. |

Segments Insights

By Phase Insights

Phase III dominated the U.S. clinical trials market in terms of revenue and scale. This phase involves large patient groups and is essential for confirming the efficacy of new drugs or interventions, often involving multiple sites and stakeholders. Phase III trials receive the bulk of sponsor investment because they provide critical data required for regulatory approval. Their complexity and cost are significant, often making up over 40% of a drug’s clinical development budget. For instance, the development of novel oncology drugs often hinges on expansive Phase III trials to compare new therapies against standard-of-care treatments.

However, Phase I is anticipated to be the fastest-growing segment due to increasing demand for early-stage trials in rare and orphan diseases. With the rise of biotechnology and personalized medicine, many biotech startups are initiating early-phase trials to evaluate pharmacokinetics, dosage tolerability, and safety profiles. Moreover, the emergence of human micro-dosing studies and first-in-human (FIH) trials conducted under streamlined protocols is driving growth. These early trials also offer an avenue for strategic partnerships and licensing deals with larger pharma companies, thereby fueling segment expansion.

However, Phase I is anticipated to be the fastest-growing segment due to increasing demand for early-stage trials in rare and orphan diseases. With the rise of biotechnology and personalized medicine, many biotech startups are initiating early-phase trials to evaluate pharmacokinetics, dosage tolerability, and safety profiles. Moreover, the emergence of human micro-dosing studies and first-in-human (FIH) trials conducted under streamlined protocols is driving growth. These early trials also offer an avenue for strategic partnerships and licensing deals with larger pharma companies, thereby fueling segment expansion.

By Study Design Insights

Interventional studies continue to dominate the U.S. clinical trials landscape. These studies, which involve assigning patients to specific treatment arms, are preferred by sponsors seeking rigorous data on safety and efficacy. Most FDA approvals are based on interventional trials, making them a foundational element of regulatory submissions. The structured design, randomization, and controlled environments ensure that results are statistically significant. A typical example is a randomized controlled trial (RCT) assessing the efficacy of a new cardiovascular drug, where patients are randomly assigned a new treatment or a placebo.

Expanded Access studies are expected to grow the fastest, driven by increasing public awareness and regulatory support for compassionate use protocols. Patients with life-threatening conditions who do not qualify for clinical trials can now access investigational therapies through expanded access programs. The FDA’s guidance on expanded access and initiatives such as the Right to Try Act (2018) have led to a surge in such studies. Especially in oncology and rare diseases, expanded access programs offer ethical and economic value while generating supplementary real-world evidence.

By Indication Insights

Oncology has emerged as the dominant therapeutic area in U.S. clinical trials. The high prevalence of cancer, combined with the urgency to discover novel treatments like checkpoint inhibitors, CAR-T therapies, and gene-modified vaccines, has made oncology a top priority for clinical research. Solid tumor research, particularly in breast, lung, and prostate cancers, leads the charge. Meanwhile, blood cancers like leukemia and lymphoma attract considerable R&D investment due to advancements in targeted and cellular therapies. Companies like Bristol-Myers Squibb and Merck are heavily active in this domain, with multiple oncology trials underway.

CNS conditions are projected to be the fastest-growing indication due to the growing burden of neurodegenerative disorders such as Parkinson’s disease, Alzheimer’s, and ALS. These diseases represent areas of high unmet clinical need, and recent scientific breakthroughs in neurobiology and genetics have accelerated drug development. For example, trials investigating novel treatments for Huntington’s disease and brain injury-related cognitive decline are expanding. Furthermore, the use of biomarkers, neuroimaging, and digital cognitive assessments is enhancing the quality of clinical data in CNS trials, making the segment highly dynamic.

Country-Level Insights United States

The U.S. boasts a comprehensive network of over 14,000 clinical trial sites, making it one of the most trial-intensive countries globally. Regions like California, Massachusetts, and Texas serve as clinical research hubs due to their high concentration of academic medical centers, biopharmaceutical companies, and contract research organizations. California alone hosts over 2,000 active clinical trials at any given time, led by institutions like Stanford University and UCLA.

In 2024, the FDA launched new guidelines for decentralized trial models, significantly improving trial accessibility for rural and underserved populations across the U.S. Moreover, the U.S. government’s support for public-private partnerships—such as the Accelerating COVID-19 Therapeutic Interventions and Vaccines (ACTIV) initiative—has paved the way for similar collaborations in oncology, rare diseases, and pediatrics. This policy and infrastructure support enhances the operational scalability of trials and ensures continuous innovation across the country.

U.S. Clinical Trials Market Top Key Companies:

U.S. Clinical Trials Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Clinical Trials market.

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional Studies

- Observational Studies

- Expanded Access Studies

By Indication

- Autoimmune/Inflammation

- Rheumatoid Arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Oncology

- Blood Cancer

- Solid Tumors

- Other

- CNS Conditions

- Epilepsy

- Parkinson’s Disease (PD)

- Huntington’s Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

However, Phase I is anticipated to be the fastest-growing segment due to increasing demand for early-stage trials in rare and orphan diseases. With the rise of biotechnology and

However, Phase I is anticipated to be the fastest-growing segment due to increasing demand for early-stage trials in rare and orphan diseases. With the rise of biotechnology and